Market Overview

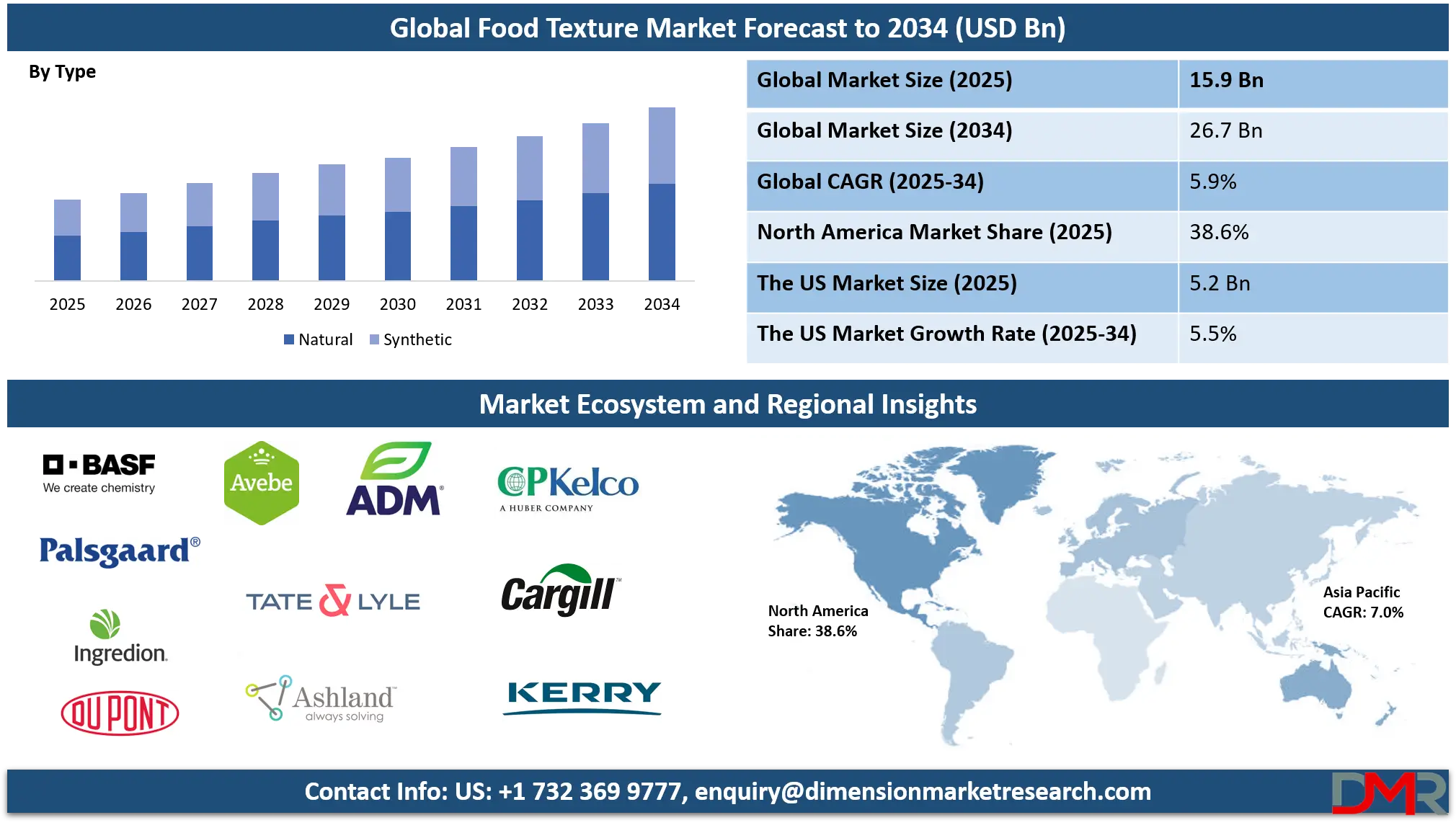

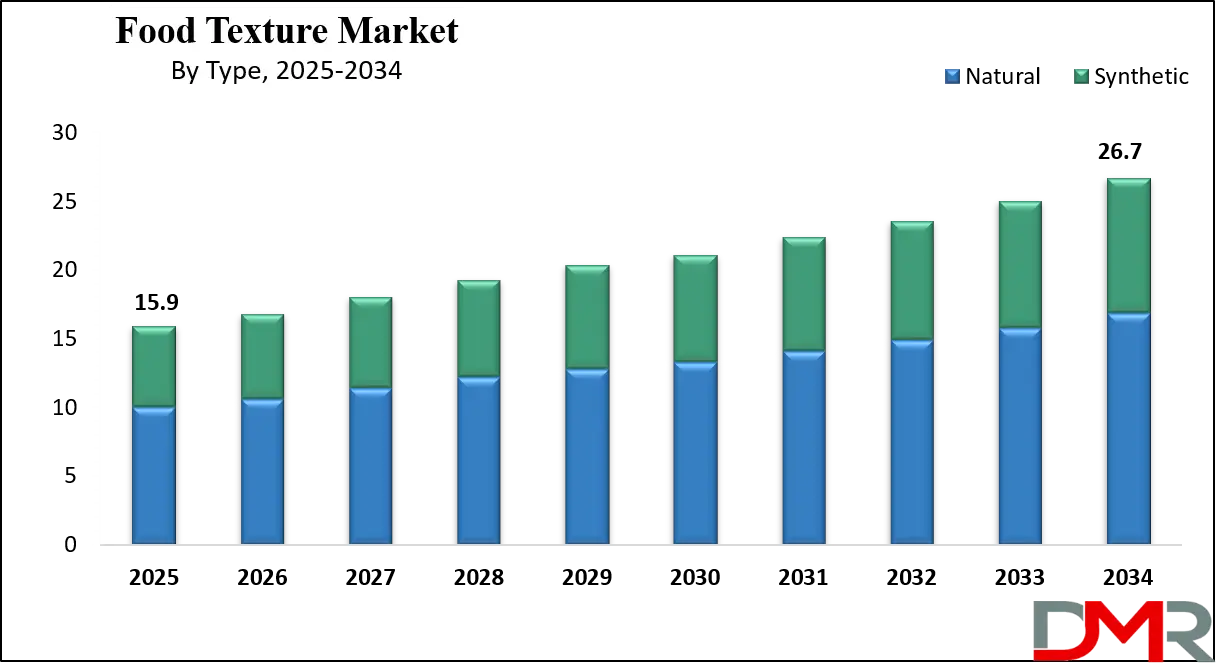

The Global Food Texture Market is projected to reach USD 15.9 billion in 2025 and grow at a compound annual growth rate of (CAGR ) 5.9% from there until 2034 to reach a value of USD 26.7billion.

The global food texture market is experiencing significant growth, driven by increasing consumer demand for processed and convenience foods that offer appealing sensory attributes. Advancements in food processing technologies and the rising popularity of plant-based diets are further propelling the market. Key trends include the development of clean-label products, the use of natural and organic texturizing agents, and the incorporation of innovative ingredients to enhance mouthfeel and stability.

Opportunities in the market are abundant, particularly in emerging economies where urbanization and changing lifestyles are leading to higher consumption of ready-to-eat meals and snacks. The growing awareness of

health and wellness among consumers is also encouraging manufacturers to develop products with improved nutritional profiles without compromising texture. Additionally, the expansion of e-commerce platforms is facilitating greater access to a variety of textured food products.

However, the market faces certain restraints, such as stringent regulatory frameworks governing food additives and the high cost of natural texturizing agents. Challenges also arise from the need to balance texture enhancement with nutritional value, as well as from consumer skepticism towards synthetic ingredients. Supply chain disruptions and fluctuating raw material prices can further impact market stability.

Statistically, the market is witnessing a steady increase in the adoption of texturizing agents across various food applications, including dairy, bakery, confectionery, and meat products. The demand for hydrocolloids, starches, and emulsifiers is particularly notable, reflecting their versatility and effectiveness in improving product quality. Regional markets such as Asia-Pacific and Latin America are showing robust growth, attributed to rising disposable incomes and evolving dietary preferences.

Looking ahead, the global food texture market is poised for continued expansion. Innovations in ingredient sourcing, such as the use of alternative proteins and sustainable raw materials, are expected to open new avenues for product development. Collaborations between food scientists and technologists will likely lead to breakthroughs in texture modification techniques, catering to the diverse and dynamic preferences of consumers worldwide.

The US Food Texture Market

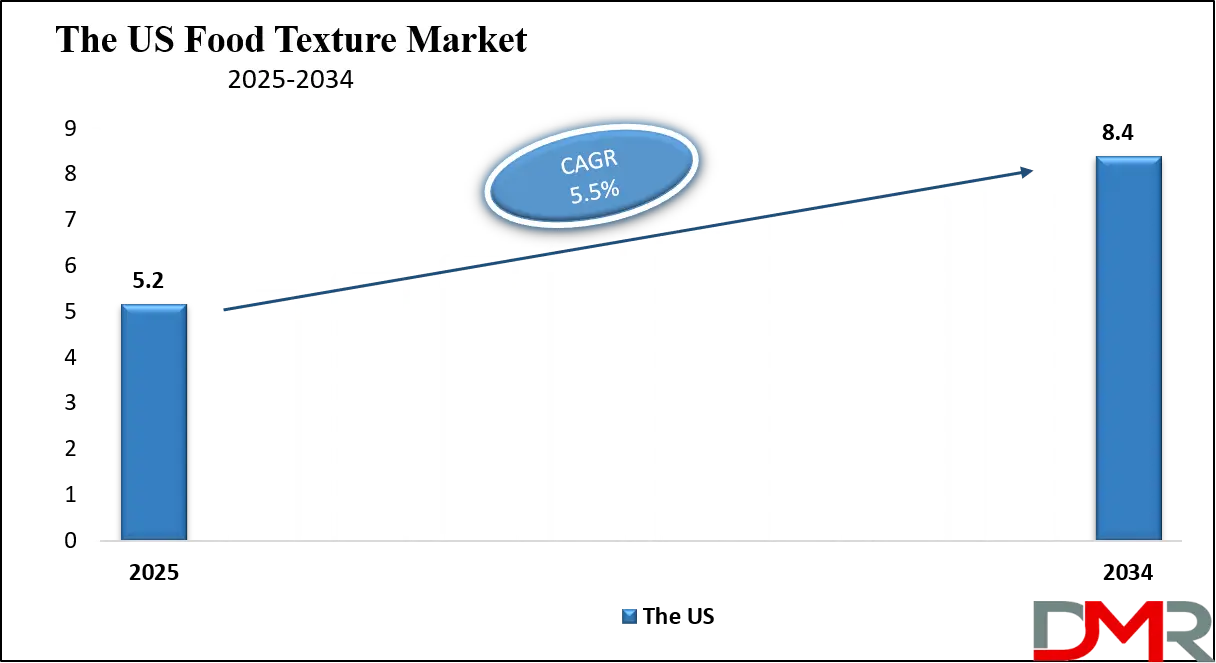

The US Food Texture Market is projected to reach USD 5.2 billion in 2025 at a compound annual growth rate of 5.5% over its forecast period.

The U.S. food texture market is supported by a highly developed food manufacturing sector, diverse consumer base, and growing interest in health-forward eating. Food texture has emerged as a defining quality, often influencing consumer repurchase behavior in products ranging from snacks to dairy. With an expanding focus on sensory satisfaction, U.S. manufacturers are leveraging emulsifiers, thickeners, and stabilizers to enhance mouthfeel, bite, and product consistency across food categories.

According to government data, the U.S. agricultural and food sector contributes significantly to the economy, supporting over 20 million jobs and fostering innovation across the food value chain. Demographically, a blend of aging baby boomers, multicultural millennials, and health-conscious Gen Z consumers are driving varied texture demands from smooth and easy-to-swallow foods to bold, crunchy snacking options.

The U.S. population is also more inclined toward label transparency, prompting brands to reformulate with clean-label, plant-based, and allergen-free texturizing ingredients. The regulatory environment, overseen by national agencies, encourages safety and transparency, while also opening doors for novel food ingredients that support sensory enhancement. Manufacturers are also focused on texture-enhanced products for specific groups, such as seniors, children, and individuals with dysphagia.

Overall, the U.S. food texture market is positioned for sustained growth. Emerging trends like plant-based innovation, convenience food demand, and personalized nutrition are creating ample room for texturizing agents to add value. With a strong infrastructure for product development and consumer feedback, U.S. companies continue to lead in sensory innovation and texture engineering.

The Europe Food Texture Market

The Europe Food Texture Market is estimated to be valued at USD 2.7 billion in 2025 and is further anticipated to reach USD 4.1 billion by 2034 at a CAGR of 4.5%.

The Europe food texture market benefits from a rich culinary tradition, heightened consumer awareness, and stringent quality standards that encourage the use of safe, sustainable, and premium ingredients. European consumers are especially attuned to food mouthfeel and are more likely to reject products with inconsistent, unappealing, or artificial textures. This has led food manufacturers to adopt natural texturizing agents such as starches, gums, and proteins that enhance sensory appeal while meeting clean-label demands.

Across the continent, the food and beverage sector remains a key economic driver, employing millions and contributing to exports and innovation. The demographic composition, including an aging population and a growing segment of health-conscious consumers, is influencing product formulation trends. There is a heightened preference for foods that are not only healthy and functional but also provide a pleasing tactile experience, such as smooth yogurts, airy baked goods, and velvety plant-based milks.

European regulations play a pivotal role in shaping this market. Strict oversight of food additives, particularly those used to modify texture, ensures consumer trust and safety. This has catalyzed innovation in the development of natural and sustainable alternatives to synthetic emulsifiers and stabilizers.

In recent years, the demand for specialty diets, including vegan, gluten-free, and keto, has driven the need for texture-enhancing agents that compensate for removed ingredients. Food producers are also exploring advanced processing technologies to manipulate microstructure and texture in novel ways. Europe's market is positioned to grow steadily, supported by evolving dietary patterns, sustainability goals, and product premiumization trends.

The Japan Food Texture Market

The Japan Food Texture Market is projected to be valued at USD 954 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.3 billion in 2034 at a CAGR of 4.0%.

Japan’s food texture market is unique due to the country’s cultural emphasis on mouthfeel, or “shokkan,” which plays a crucial role in food satisfaction and culinary presentation. Unlike Western markets where taste often dominates, Japanese consumers value a multisensory eating experience, where texture enhances perceived freshness, authenticity, and overall enjoyment. This cultural mindset has led to widespread use of texture modifiers in traditional and modern foods.

The aging population, which accounts for nearly 30% of Japan’s total demographic, has significantly influenced food innovation. Foods designed for easier mastication and swallowing are in high demand, prompting use of thickening agents and texture-softening solutions in prepared meals, beverages, and healthcare nutrition. Texture-modified diets have become an integral part of elderly care, especially for those with dysphagia or limited chewing ability.

Younger generations, on the other hand, are gravitating toward international cuisines, driving the development of fusion foods with innovative textures. The nation’s advanced food processing sector is actively integrating technologies such as microencapsulation, aeration, and gelling systems to customize food textures across a variety of categories.

Government support for food industry modernization, export promotion, and healthy aging policies is further stimulating growth. Regulatory authorities closely monitor food safety and innovation, ensuring that both synthetic and natural texturizers meet stringent safety criteria.

In a society where textural nuances define culinary preference, Japan continues to lead in consumer-driven texture innovation. The market outlook remains strong, bolstered by technological excellence, a health-aware demographic, and a deeply rooted appreciation for food aesthetics and sensory complexity.

Global Food Texture Market: Key Takeaways

- Global Market Size Insights: The Global Food Texture Market size is estimated to have a value of USD 15.9 billion in 2025 and is expected to reach USD 26.7 billion by the end of 2034.

- The US Market Size Insights: The US Food Texture Market is projected to be valued at USD 5.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.4 billion in 2034 at a CAGR of 5.5

- Regional Insights: North America is expected to have the largest market share in the Global Food Texture Market with a share of about 38.6% in 2025.

- Key Players: Some of the major key players in the Global Food Texture Market are Archer Daniels Midland Company (ADM), Cargill Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Kerry Group plc, DuPont de Nemours Inc., CP Kelco (Huber Company), Ashland Global Holdings Inc, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.9% over the forecasted period of 2025.

Global Food Texture Market: Use Cases

- Plant-Based Meat Alternatives: Texturizing agents replicate the fibrous, juicy bite of real meat in plant-based burgers and sausages. Hydrocolloids, starches, and proteins are used to enhance chewiness, making these meat substitutes more appealing to flexitarians and vegans seeking authentic sensory satisfaction.

- Low-Fat and Non-Dairy Dairy Products: In reduced-fat yogurts and vegan cheeses, texture enhancers like guar gum, pectin, and carrageenan recreate creaminess lost from fat removal. These agents improve viscosity, stability, and mouth-coating perception, delivering indulgent texture without compromising on health goals.

- Gluten-Free Bakery Items: Texturizing ingredients such as xanthan gum and tapioca starch are key in mimicking gluten’s elasticity in breads, cookies, and pastries. These agents ensure better crumb structure, elasticity, and moistness in gluten-free baked goods, enhancing consumer acceptance.

- Sauces and Condiments: Thickeners and emulsifiers ensure smooth, stable textures in ketchup, mayonnaise, and salad dressings. They prevent phase separation and provide spoonable or pourable consistencies, meeting consumer expectations for texture in both shelf-stable and refrigerated products.

- Nutritional and Functional Beverages: Protein shakes and fortified drinks use stabilizers and texturizers to suspend particles, prevent sedimentation, and ensure uniform mouthfeel. These ingredients also help control viscosity and improve drinkability, especially in high-protein or fiber-enriched formulations.

Global Food Texture Market: Stats & Facts

United Nations Food and Agriculture Organization (FAO)

- Approximately 1.3 billion tons of food are wasted globally each year, with texture degradation being a significant contributor to consumer rejection.

- Over 2 billion people worldwide consume insects as part of their diet, highlighting the importance of texture in alternative protein sources.

U.S. Department of Agriculture (USDA)

- The U.S. food processing industry contributes approximately $750 billion annually to the economy, with texture-enhancing ingredients playing a crucial role in product development.

- Plant-based protein consumption in the U.S. increased by 28% from 2019 to 2021, driving demand for texture-modifying ingredients in meat alternatives.

European Food Safety Authority (EFSA)

- The EFSA has implemented stringent guidelines on food additives, leading to a 20% increase in demand for natural texturizers like pectin and carrageenan in Europe.

- The functional food sector in Europe is growing at an annual rate of 8%, with texture being a key factor in product acceptance.

World Health Organization (WHO)

- Obesity rates have tripled worldwide since 1975, prompting manufacturers to develop low-fat and low-sugar products with texture-enhancing ingredients to maintain consumer appeal.

- Dysphagia, a condition affecting swallowing, impacts approximately 15 million Americans, increasing the need for texture-modified foods.

Food Standards Australia New Zealand (FSANZ)

- Natural hydrocolloids are increasingly used in food products to meet consumer demand for clean-label ingredients, with a 15% annual growth in their application.

- The use of guar gum and xanthan gum has risen by 12% annually in Australia and New Zealand, driven by their effectiveness in texture modification.

Ministry of Agriculture, Forestry and Fisheries (MAFF) – Japan

- Japan's aging population, with 28% aged 65 and over, has led to a 10% annual increase in demand for texture-modified foods suitable for elderly consumers.

- The Japanese market for easy-to-swallow foods is growing at a rate of 7% per year, emphasizing the importance of texture in product development.

Health Canada

- Health Canada's regulations have led to a 25% reduction in the use of synthetic texturizers over the past five years, with a shift towards natural alternatives.

- The demand for plant-based dairy alternatives in Canada has increased by 30%, necessitating the use of texture-enhancing ingredients to meet consumer expectations.

Food and Drug Administration (FDA) – USA

- The FDA has approved over 3,000 food additives, including various texturizers, to ensure safety and consistency in food products.

- Labeling regulations require manufacturers to disclose the use of certain texturizers, influencing consumer choices and driving demand for transparent ingredient sourcing.

European Commission

- The "Farm to Fork" strategy aims to reduce the environmental impact of food production, encouraging the use of sustainable texturizers derived from plant sources.

- Research funding for sustainable food processing technologies, including texture modification, has increased by €1.5 billion under the Horizon Europe program.

Food Industry Asia (FIA)

- In Southeast Asia, the demand for convenience foods with enhanced textures is growing at a rate of 6% annually, driven by urbanization and changing lifestyles.

- Consumer surveys indicate that 70% of Southeast Asian consumers consider texture an important factor in food satisfaction.

Global Food Texture Market: Market Dynamic

Driving Factors in the Global Food Texture Market

Expansion of Plant-Based and Vegan Food Products

The booming plant-based and vegan food market has significantly contributed to the growth of the food texture sector. These alternative products must replicate the sensory characteristics especially texture of traditional meat, dairy, and egg-based items. Texture plays a pivotal role in consumer acceptance of plant-based burgers, milk, yogurt, cheese, and egg substitutes, as it impacts mouthfeel, chewability, creaminess, and spreadability.

Unlike animal-based products that naturally deliver specific textures, plant-based formulations require strategic use of gums, fibers, proteins, and starches to emulate similar properties. For example, methylcellulose is widely used in plant-based meats to create a cohesive bite and juiciness when cooked. Similarly, pectin and carrageenan help mimic the creaminess in plant-based yogurts and milk.

The rise in flexitarian diets has driven a massive increase in demand for such alternatives, especially in North America, Europe, and parts of Asia, where food innovation ecosystems are robust. Moreover, major food brands and startups alike are heavily investing in R&D to continuously refine the texture of plant-based offerings to align with consumer expectations.

The competitive landscape of this market is increasingly influenced by how close an alternative product can mimic the textural fidelity of its conventional counterpart. As the plant-based movement moves from niche to mainstream, demand for texture-modifying ingredients will only intensify, driving significant market expansion.

Advancements in Food Processing Technologies

Technological innovations in food processing have emerged as a crucial driver for the food texture market. Techniques such as high-pressure processing (HPP), cold extrusion, 3D food printing, microfluidization, and enzymatic hydrolysis enable manufacturers to modify or retain textural properties with greater precision, consistency, and customization. These advancements allow for the controlled manipulation of ingredient interactions, structural build-up, and moisture retention key determinants of texture in finished products.

For example, HPP enhances the texture of ready-to-eat meals and deli products while maintaining freshness and safety without using synthetic preservatives. Cold extrusion has become essential in the formulation of textured vegetable protein (TVP), especially for plant-based meat products that need to simulate fibrousness and chew. Microencapsulation and nanotechnology are also being deployed to engineer textures in functional foods, ensuring prolonged shelf-life while preserving mouthfeel.

In bakery and confectionery, aeration and lamination technologies are pushing the boundaries of crunch, flakiness, and elasticity. These methods not only improve consumer experience but also extend the functional application of texture enhancers in low-sugar, low-fat, and high-protein formulations. Moreover, advancements in texture analysis tools and digital food design are helping formulators develop data-driven strategies for sensory optimization. As technology bridges the gap between formulation challenges and consumer demand, it paves the way for sophisticated and scalable innovations in the food texture landscape.

Restraints in the Global Food Texture Market

High Cost of Natural and Functional Texturizers

Despite the rising preference for clean label and plant-based texture enhancers, their high production and procurement costs pose a considerable barrier to market expansion. Natural texturizers such as inulin, locust bean gum, pectin, and carrageenan often require complex extraction and refinement processes, making them significantly more expensive than synthetic alternatives.

Additionally, price volatility due to seasonal crop yields, supply chain disruptions, and climate variability further adds to cost unpredictability. These price pressures are especially impactful for small and medium-sized food manufacturers, which may find it economically challenging to switch to premium natural ingredients without compromising profit margins.

Furthermore, functional texturizers that also provide health benefits such as prebiotic fibers or protein-based emulsifiers are costlier due to multi-stage processing and regulatory compliance requirements. The growing demand for organic certification, traceability, and non-GMO verification further adds to supplier costs, which are ultimately transferred to manufacturers and consumers. In developing economies, cost sensitivity limits the adoption of high-end texture enhancers, stalling market penetration.

This cost-related restraint forces many companies to continue using conventional or synthetic additives to remain competitive on price, despite consumer trends favoring natural ingredients. Thus, while clean label texture agents are desirable, their high cost remains a formidable obstacle, creating a gap between market demand and feasible product formulation across various segments.

Complex Regulatory Landscape Across Regions

The global food texture market faces considerable restraint due to the complex and often fragmented regulatory landscape governing the use of texture-modifying ingredients. Different countries and regions maintain distinct rules concerning additive approvals, labeling, permissible concentrations, and usage conditions. For example, an ingredient like carrageenan may be accepted in the EU but restricted or subject to debate in parts of North America or Asia.

These inconsistencies create hurdles for multinational food manufacturers, who must adapt formulations, packaging, and regulatory filings for each target market. Moreover, as consumer advocacy groups push for transparency and clean labels, governments are increasingly revising food additive guidelines, banning or limiting ingredients previously considered safe.

Such shifts require manufacturers to continuously monitor compliance, revise product lines, and often invest in costly reformulations. Small and medium enterprises, in particular, may lack the resources or technical expertise to navigate evolving regulatory requirements, delaying product launches or limiting geographic expansion.

Furthermore, new natural texturizers introduced in the market must undergo rigorous testing, safety assessments, and bureaucratic approval processes before commercialization, slowing innovation cycles. The absence of global harmonization in additive regulations not only adds operational complexity but also affects supply chain flexibility and ingredient sourcing. This regulatory friction hampers the fluid growth of the food texture market, especially for global brands aiming for scalability and cross-border market entry.

Opportunities in the Global Food Texture Market

Rising Geriatric and Dysphagia Population Worldwide

An expanding geriatric population globally presents a unique growth opportunity for the food texture market, particularly in the realm of texture-modified diets. As people age, physiological changes such as reduced saliva production, weakened chewing ability, and difficulty swallowing known as dysphagia become more prevalent. According to global health data, millions of elderly individuals require special dietary interventions that emphasize soft, puree-like, or thickened food consistencies.

These texture-adjusted foods not only improve swallowing safety but also ensure adequate nutrition and hydration. Food texture agents such as starches, gelatin, and gums are vital in creating modified consistencies without compromising nutritional density or palatability. Additionally, hospitals, senior living facilities, and home care services are witnessing rising demand for ready-to-consume texture-modified meals that cater to this demographic. Markets such as Japan, where over 28% of the population is aged 65 or above, are already pioneering innovations in “easy-to-eat” foods, establishing global precedents for product development.

Moreover, caregivers and healthcare professionals are increasingly recognizing the importance of appealing textures in maintaining elderly patients' appetite and emotional satisfaction. Government initiatives in elder nutrition and healthcare funding are further promoting innovation and investment in this segment. Hence, as aging becomes a global trend, the food texture market stands to benefit from its essential role in ensuring functional, nutritious, and emotionally fulfilling food solutions for elderly and dysphagic populations.

Growing Popularity of Convenience and Ready-to-Eat Foods

The accelerating pace of modern lifestyles, particularly in urban areas, has driven a significant increase in demand for convenience and ready-to-eat (RTE) food products an area where texture plays a critical role in consumer satisfaction. Consumers now seek fast yet fulfilling meals that replicate the quality and sensory appeal of freshly cooked dishes.

In this context, food texture enhancers are essential in maintaining product integrity during storage, transportation, and reheating. Textural stability ensures products like microwavable pastas, instant noodles, chilled desserts, and pre-cooked meats retain optimal bite, creaminess, or crispness over extended shelf lives. This growing demand is particularly strong in working populations, dual-income households, and student demographics across emerging economies in Asia-Pacific, Latin America, and the Middle East.

Furthermore, the convenience food category is expanding beyond traditional segments to include healthier options, such as low-carb meals, high-protein snacks, and fortified beverages all of which require customized texture solutions. Global players are capitalizing on this trend by launching new RTE products with enhanced textures supported by clean label claims.

As online food delivery and meal kit subscriptions surge post-pandemic, the relevance of texture has only grown. Ensuring consistent texture in RTE formats also boosts brand loyalty, as consumers associate mouthfeel with freshness and quality. Thus, the rising appetite for convenience foods presents fertile ground for food texture innovation.

Trends in the Global Food Texture Market

Rising Demand for Multi-Sensory Food Experiences

One of the most dominant trends driving the global food texture market is the increasing consumer preference for multi-sensory food experiences. Texture is no longer just a background component; it has become a defining attribute in product differentiation and consumer loyalty. From the crunch of snacks to the creaminess of dairy alternatives, consumers are associating textures with freshness, quality, and indulgence.

As food choices become more experiential, especially among millennials and Gen Z, brands are investing in creating a range of textures such as chewy, crispy, airy, smooth, and layered to elevate consumer satisfaction. Texture innovations are particularly prominent in premium food segments like artisanal baked goods, gourmet confectionery, and plant-based meat substitutes, where mouthfeel plays a crucial role in mimicking real meat or dairy.

This demand is also reshaping product development in emerging markets, where globalization of food trends is influencing local brands to incorporate diverse textural profiles. Additionally, texture-enhancing components such as starch derivatives, gums, and cellulose are increasingly tailored to provide multi-textural functionality in a single formulation.

This trend is expected to shape the formulation strategies of food processors and manufacturers, driving collaborations between R&D departments and texture ingredient suppliers. Ultimately, texture is becoming an experiential benchmark in the sensory evaluation of food, boosting its role in competitive positioning and brand perception globally.

Clean Label and Natural Texture Modifiers Are Gaining Ground

Another significant trend shaping the food texture market is the rapid transition towards clean label and natural ingredients. Consumers today are more ingredient-conscious and demand transparency in product labeling. This has prompted food manufacturers to replace synthetic texture enhancers with natural alternatives like pectin, agar, carrageenan, and starch-based gums.

The “clean label” trend goes beyond eliminating artificial additives it encompasses sustainability, traceability, and minimal processing, making plant-derived and non-GMO texture ingredients more favorable. The rising demand for organic, vegan, and allergen-free products further accelerates the need for cleaner texture solutions that maintain functionality without compromising consumer trust.

Regulatory pressures in regions like the EU and North America also compel manufacturers to limit or clearly declare the use of artificial thickeners, emulsifiers, and stabilizers. These changes in consumer expectations and policy frameworks have fueled innovations in fermentation-derived hydrocolloids, upcycled food waste derivatives (such as citrus peel pectin), and seaweed extracts, which offer functional textural benefits while meeting natural standards.

Additionally, ingredient companies are focusing on refining processing technologies that retain the structural integrity of natural modifiers, ensuring they perform as effectively as their synthetic counterparts. As a result, clean label solutions are not just a marketing advantage they are becoming the cornerstone of formulation strategies, reshaping the dynamics of ingredient sourcing, marketing, and consumer engagement in the global food texture market.

Global Food Texture Market: Research Scope and Analysis

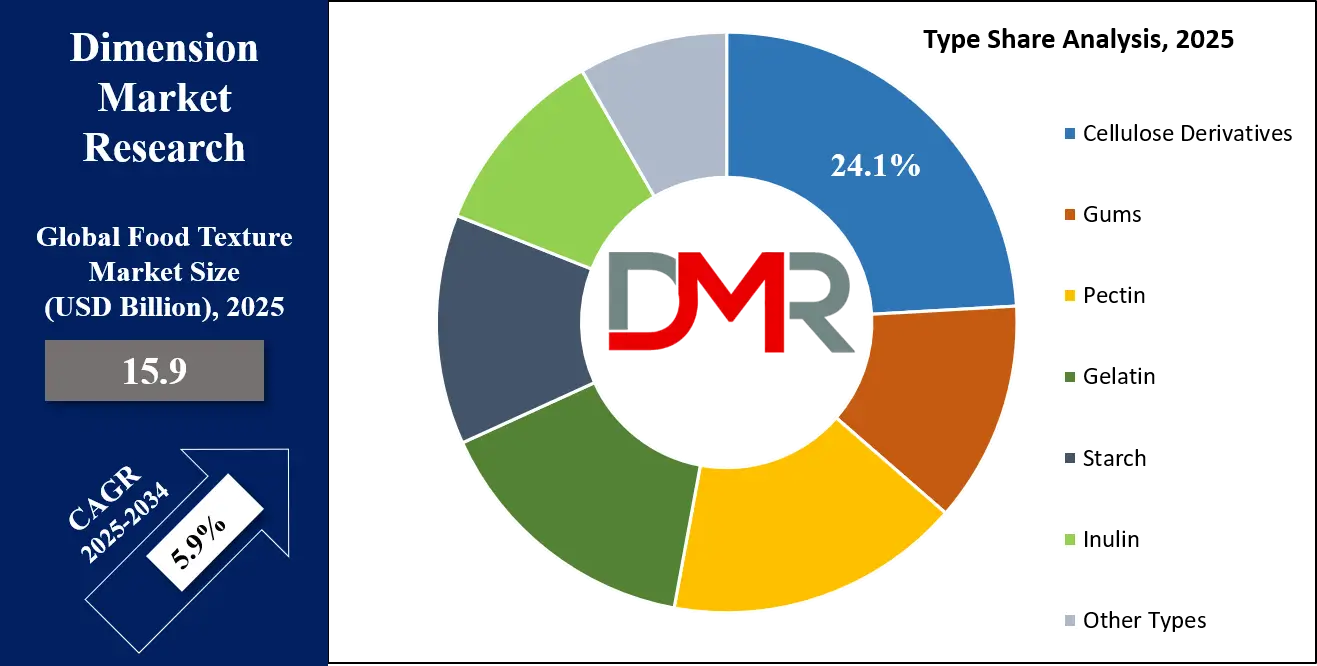

By Type Analysis

Cellulose derivatives is projected to hold a dominant position in the global food texture market due to their exceptional versatility, stability, and cost-effectiveness. These derivatives, including methylcellulose, carboxymethyl cellulose (CMC), hydroxypropyl methylcellulose (HPMC), and others, are widely utilized as thickeners, stabilizers, emulsifiers, and fat replacers. Their ability to function across a wide pH range and under thermal processing conditions makes them ideal for a variety of food applications. Notably, CMC is highly effective in enhancing mouthfeel and viscosity, making it suitable for bakery fillings, sauces, dairy-based beverages, and processed foods.

The dominance of cellulose derivatives is also tied to their plant-based origin, aligning with the rising consumer demand for sustainable and clean-label ingredients. Unlike synthetic texturizers, cellulose-based products are derived from renewable sources, making them more acceptable in natural and organic food formulations. Additionally, their excellent water-binding properties contribute to improved shelf-life, texture retention, and reduced syneresis in frozen and refrigerated products.

The cost-efficiency of cellulose derivatives further strengthens their market leadership. They deliver high functional performance at low usage levels, which is attractive for food manufacturers managing formulation budgets. As product developers increasingly seek multifunctional ingredients that optimize formulation complexity, cellulose derivatives meet these needs without compromising on quality or texture.

Moreover, regulatory approvals across major markets such as the U.S. (FDA GRAS status), Europe (EFSA), and Asia enhance their adoption. Their broad compatibility with other food ingredients also allows seamless integration into diverse product types. This widespread functional adaptability and clean-label appeal underpin the continued dominance of cellulose derivatives in the global food texture market.

By Source Analysis

Natural sources is expected to dominate the global food texture market primarily due to increasing consumer demand for clean-label, minimally processed, and plant-based food products. Natural texturizers, including starches, pectins, agar, guar gum, xanthan gum, and gelatin, are derived from renewable plant or animal sources and are often perceived as healthier and safer alternatives to synthetic ingredients. As consumers grow more health-conscious and ingredient-aware, there is a strong market shift favoring food products that utilize natural texture-enhancing components.

The clean-label trend is one of the major forces driving the preference for natural food texture solutions. Food and beverage companies are reformulating their products to align with label transparency demands, using recognizable and minimally processed ingredients. Natural texturizers help improve the consistency, stability, and mouthfeel of foods while maintaining alignment with consumer expectations for authenticity and natural origin. This has driven their widespread adoption across bakery, dairy, snacks, beverages, and ready meals.

Additionally, natural texturizers are often multifunctional, offering thickening, gelling, and emulsifying properties, which reduces the need for multiple additives in a single formulation. Their compatibility with a range of pH and temperature conditions supports their versatility across global cuisines and processing methods.

Regulatory favorability also plays a role in the dominance of natural sources. Many natural texturizers, like pectin and starch, are universally accepted and listed as safe by global food authorities. Their environmentally friendly sourcing also aligns with sustainability goals of modern food manufacturers. These factors, combined with growing vegan and allergen-free product lines, reinforce the stronghold of natural sources in the food texture market.

By Form Analysis

Dry form texturizers projected to dominate the global food texture market due to their superior shelf stability, ease of handling, and wide application versatility. Dry powders, granules, or flakes are preferred by manufacturers for their long shelf life, minimal risk of microbial contamination, and consistent functional performance. These properties are crucial in large-scale production environments, especially in regions with limited cold chain infrastructure or fluctuating climatic conditions.

From a logistical standpoint, dry texturizers are highly advantageous. They are lighter to transport, more economical to store, and less perishable compared to liquid or gel-based alternatives. This reduces overall manufacturing and distribution costs for food producers. Moreover, the ability to use dry texturizers in precise quantities allows for better batch control and consistency, especially in high-speed automated production lines where dosage accuracy is critical.

Dry form also offers greater formulation flexibility. Food manufacturers can easily blend dry texturizers with other dry ingredients like flour, sugar, or powdered flavors in baking mixes, seasonings, dairy powders, and instant foods. This makes them ideal for convenience products, which continue to experience growing demand globally. Dry texturizers also rehydrate quickly during processing, ensuring optimal dispersion and functional activity without clumping or performance loss.

In R&D settings, dry texturizers provide a broader experimentation base, as they are easier to sample, mix, and store. Their robust functional profile supports a range of functionalities including thickening, stabilizing, gelling, and emulsifying. The dominance of dry form texturizers is thus driven by their practical, economic, and performance advantages in both industrial and retail food processing applications.

By Functionality Analysis

Thickening functionality is poised to command the food texture market because it plays a fundamental role in modifying food viscosity, mouthfeel, and overall sensory experience across a wide range of product categories. Thickeners improve the consistency and stability of food systems by increasing the viscosity of liquid or semi-liquid products without altering their taste. This is particularly important in applications such as sauces, soups, gravies, dressings, dairy products, beverages, and desserts where texture significantly influences consumer acceptance and perception of quality.

A major reason for the dominance of thickening agents is their ability to enhance the palatability and appeal of low-fat, reduced-calorie, or plant-based formulations. With rising health-consciousness among consumers, many manufacturers are reformulating products to reduce fat or sugar content. Thickeners allow for these reductions while maintaining the creamy, full-bodied mouthfeel traditionally associated with fat or sugar, making them essential in modern food design.

Moreover, thickeners derived from both natural (e.g., starches, guar gum, xanthan gum) and synthetic sources are highly adaptable and cost-effective, offering a broad functionality spectrum. They can perform under a wide range of temperatures and pH conditions, supporting hot and cold processing across global cuisines and processing styles.

Additionally, thickeners contribute to extended product shelf-life by reducing syneresis (water separation), maintaining product integrity during storage. Their compatibility with other food additives and ease of integration into dry and liquid systems further solidify their widespread use. Collectively, these advantages make thickening functionality a dominant force in the global food texture market.

By Application Analysis

Bakery and confectionery products is projected to dominate the application segment of the food texture market due to their complex structural and sensory requirements that demand a wide range of texture-modifying ingredients. In this segment, food texture plays a critical role in defining product success whether it’s the softness of bread, the chewiness of cookies, the creaminess of fillings, or the snap of chocolate. Texture-enhancing agents are thus indispensable in achieving the desired mouthfeel, moisture retention, structural integrity, and visual appeal.

Bakery and confectionery items rely heavily on thickeners, emulsifiers, stabilizers, and gelling agents to maintain consistency and extend shelf life. For instance, hydrocolloids like guar gum, xanthan gum, and pectin are widely used in fillings, frostings, and dough systems to control viscosity and prevent syneresis. Meanwhile, emulsifiers such as lecithin improve the aeration, softness, and crumb structure in cakes and breads.

This segment also benefits from the global popularity of baked goods and sweets, which are widely consumed across demographics and regions. The constant innovation in gluten-free, vegan, and low-sugar bakery products has further increased the use of texturizers to replicate the sensory qualities of conventional formulations.

Furthermore, the surge in demand for frozen and ready-to-eat baked goods has led to increased usage of texture ingredients that retain softness, flexibility, and freshness during storage and reheating. All these factors functional complexity, mass consumption, and innovation in product offerings have reinforced the dominance of bakery and confectionery applications in the food texture market.

The Global Food Texture Market Report is segmented on the basis of the following:

By Type

- Cellulose Derivatives

- Gums

- Pectin

- Gelatin

- Starch

- Inulin

- Other Types

By Source

By Form

By Functionality

- Thickening

- Gelling

- Emulsifying

- Stabilizing

- Other Functionalities

By Application

- Bakery & Confectionery Products

- Dairy & Frozen Foods

- Meat & Poultry Products

- Beverages

- Snacks & Savory

- Sauces & Dressings

- Other Applications

Global Food Texture Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to command the global food texture market as it holds 38.6% of market share by the end of 2025, due to its highly developed food processing industry, high per capita consumption of processed foods, and strong emphasis on food innovation. The region boasts well-established infrastructure, advanced food technologies, and a consumer base that prioritizes convenience, premiumization, and clean-label attributes. In the United States and Canada, bakery, dairy, plant-based, and ready-to-eat segments are mature and widely consumed sectors where textural quality is a critical factor for product differentiation.

Consumers in North America also show heightened awareness of ingredient transparency and label claims, prompting food companies to invest heavily in natural and multifunctional texturizers. The region’s regulatory bodies, such as the FDA and Health Canada, provide clear guidelines for food additive approvals, encouraging innovation within safe boundaries.

Additionally, the high demand for gluten-free, vegan, keto, and protein-fortified products has boosted the adoption of thickening, gelling, and stabilizing agents. With major players headquartered in the U.S., including ADM, Cargill, and Ingredion, North America benefits from local supply chains and strong R&D capabilities, securing its position as the leading region in the global food texture market.

Region with the Highest CAGR

Asia Pacific is projected to record the highest CAGR in the global food texture market, driven by rapid urbanization, rising disposable incomes, and evolving dietary habits. As middle-class populations expand in countries like China, India, Indonesia, and Vietnam, the demand for processed, packaged, and convenience foods is surging—segments where texture is a key sensory attribute.

Local consumers are increasingly experimenting with Western-style bakery and dairy products while also preserving traditional textured foods such as noodles, mochi, and jellies. This dual culinary demand expands the scope for versatile texturizing agents. Furthermore, governments in the region are supporting domestic food manufacturing through infrastructure investment and quality regulations, encouraging the adoption of global standards in food processing.

The growth of the e-commerce sector and cold chain logistics has improved access to diverse product offerings, boosting the need for texturizers that enhance shelf-life and sensory quality. Combined with a youthful population and rising interest in health-forward diets, Asia Pacific’s dynamic food ecosystem makes it the fastest-growing market for food texture solutions globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Food Texture Market: Competitive Landscape

The global food texture market is moderately consolidated, with key players accounting for a significant share of the market through expansive product portfolios, global presence, and strong R&D capabilities. Leading companies such as Archer Daniels Midland Company (ADM), Cargill, Ingredion Incorporated, and Tate & Lyle PLC dominate due to their integrated supply chains and ability to deliver customized texture solutions across multiple food categories. These players offer a wide range of natural and functional texturizers including starches, gums, cellulose derivatives, and proteins that cater to clean-label, vegan, gluten-free, and reduced-fat product needs.

Strategic mergers, acquisitions, and partnerships are common, aimed at expanding geographic reach and innovating within high-growth segments such as plant-based and functional foods. For example, investments in biotechnological fermentation and sustainable sourcing have become central to gaining a competitive edge. Mid-sized and regional companies like CP Kelco, Palsgaard, and Nexira are also gaining traction by specializing in organic, non-GMO, or region-specific solutions.

Innovation is a key differentiator in this market, with companies increasingly focusing on textural mimicry in meat and dairy alternatives, texture-enhanced health foods, and responsive formulations based on consumer feedback and digital tools. Regulatory compliance, ingredient traceability, and environmental sustainability are shaping the long-term strategies of leading firms.

Some of the prominent players in the Global Food Texture Market are:

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Ingredion Incorporated

- Tate & Lyle PLC

- Kerry Group plc

- DuPont de Nemours, Inc.

- CP Kelco (Huber Company)

- Ashland Global Holdings Inc.

- DSM-Firmenich

- Palsgaard A/S

- BASF SE

- Fiberstar, Inc.

- Nexira

- Avebe

- TIC Gums (a part of Ingredion)

- Roquette Frères

- Jungbunzlauer Suisse AG

- Corbion N.V.

- Darling Ingredients Inc.

- Riken Vitamin Co., Ltd.

- Other Key Players

Recent Developments in Global Food Texture Market

- April 2025: Ingredion Incorporated announced the launch of a new range of clean-label, tapioca-based texture systems for dairy alternatives, targeting improved creaminess and mouthfeel while meeting growing demand for plant-based options in North America and Europe.

- February 2025: Cargill expanded its texturizer production line in Uberlândia, Brazil, investing over $10 million to meet regional demand for modified starches and sustainable food solutions amid Latin America's processed food growth.

- January 2025: CP Kelco unveiled a new citrus fiber ingredient at the Food Ingredients Asia (Fi Asia) Expo in Bangkok, designed for water-binding and texturizing in meat alternatives and low-fat sauces, emphasizing clean-label functionality.

- December 2024: Tate & Lyle PLC completed the acquisition of a 100% stake in Quantum Hi-Tech (China) Biological Co., Ltd., enhancing its portfolio of prebiotic fibers and texture enhancers, especially for functional snacks and beverages.

- October 2024: At the Food Ingredients Europe (Fi Europe) event in Frankfurt, Kerry Group showcased its latest textural innovation platform focusing on hybrid food solutions that combine plant proteins and hydrocolloids to mimic animal-based textures.

- August 2024: Nexira collaborated with Roquette on a joint R&D initiative to develop organic gum acacia-based stabilizers for natural soft drinks and reduced-sugar confectionery, aiming to reinforce European leadership in natural texture systems.

- July 2024: ADM launched a new application center in Singapore dedicated to texturizer research and sensory profiling to support APAC food manufacturers in developing novel texture experiences in noodles, desserts, and dairy products.

- May 2024: Ashland Global Holdings expanded its hydrocolloid facility in Texas, strengthening its supply of cellulose derivatives for texture enhancement in gluten-free baked goods and ready meals across the U.S. market.

- April 2024: Givaudan announced a partnership with Bühler Group to launch a Texture Innovation Lab in Switzerland, focusing on extrusion-based techniques to optimize texture in plant-based meat analogs and protein-rich snacks.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 15.9 Bn |

| Forecast Value (2034) |

USD 26.7 Bn |

| CAGR (2025–2034) |

5.9% |

| The US Market Size (2025) |

USD 5.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Cellulose Derivatives, Gums, Pectin, Gelatin, Starch, Inulin, Other Types),By Source (Natural, Synthetic), By Form (Dry, Liquid), By Functionality (Thickening, Gelling, Emulsifying, Stabilizing, Other Functionalities), By Application (Bakery & Confectionery Products, Dairy & Frozen Foods, Meat & Poultry Products, Beverages, Snacks & Savory, Sauces & Dressings, Other Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Archer Daniels Midland Company (ADM), Cargill Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Kerry Group plc, DuPont de Nemours Inc., CP Kelco (Huber Company), Ashland Global Holdings Inc., DSM-Firmenich, Palsgaard A/S, BASF SE, Fiberstar Inc., Nexira, Avebe, TIC Gums (a part of Ingredion), Roquette Frères, Jungbunzlauer Suisse AG, Corbion N.V., Darling Ingredients Inc., Riken Vitamin Co. Ltd., and other key players., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Food Texture Market size is estimated to have a value of USD 15.9 billion in 2025 and is expected to reach USD 26.7 billion by the end of 2034.

The US Food Texture Market is projected to be valued at USD 5.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.4 billion in 2034 at a CAGR of 5.5.

North America is expected to have the largest market share in the Global Food Texture Market with a share of about 38.6% in 2025.

Some of the major key players in the Global Food Texture Market are Archer Daniels Midland Company (ADM), Cargill Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Kerry Group plc, DuPont de Nemours Inc., CP Kelco (Huber Company), Ashland Global Holdings Inc, and many others.

The market is growing at a CAGR of 5.9 percent over the forecasted period of 2025.