Market Overview

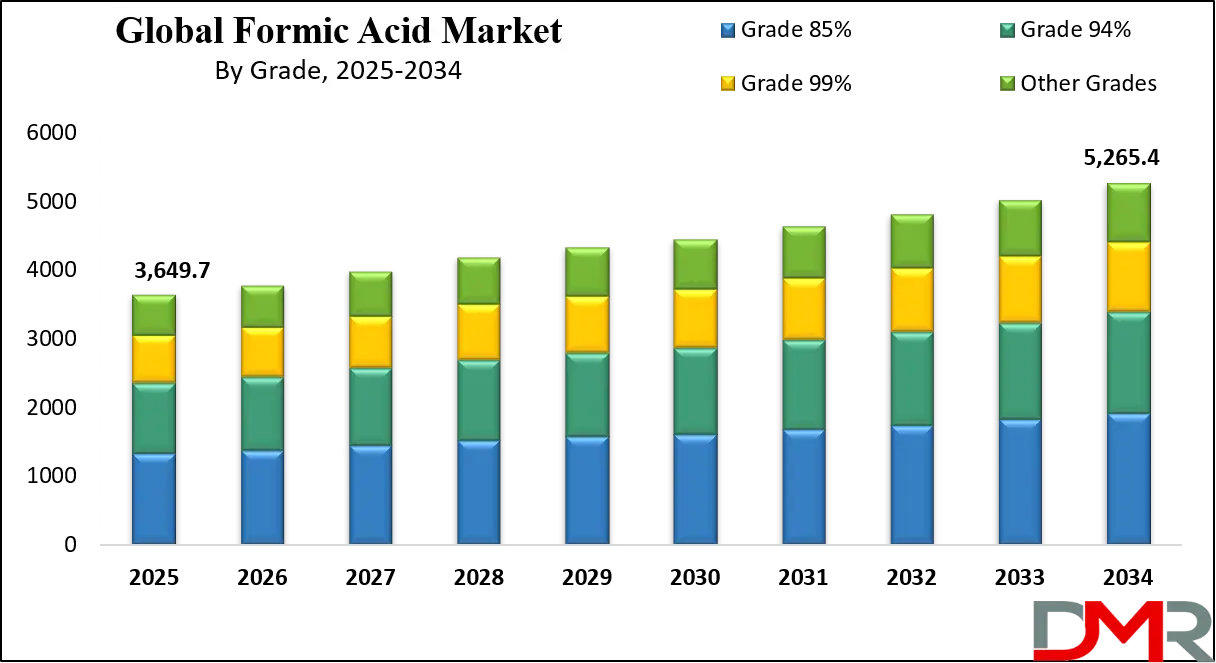

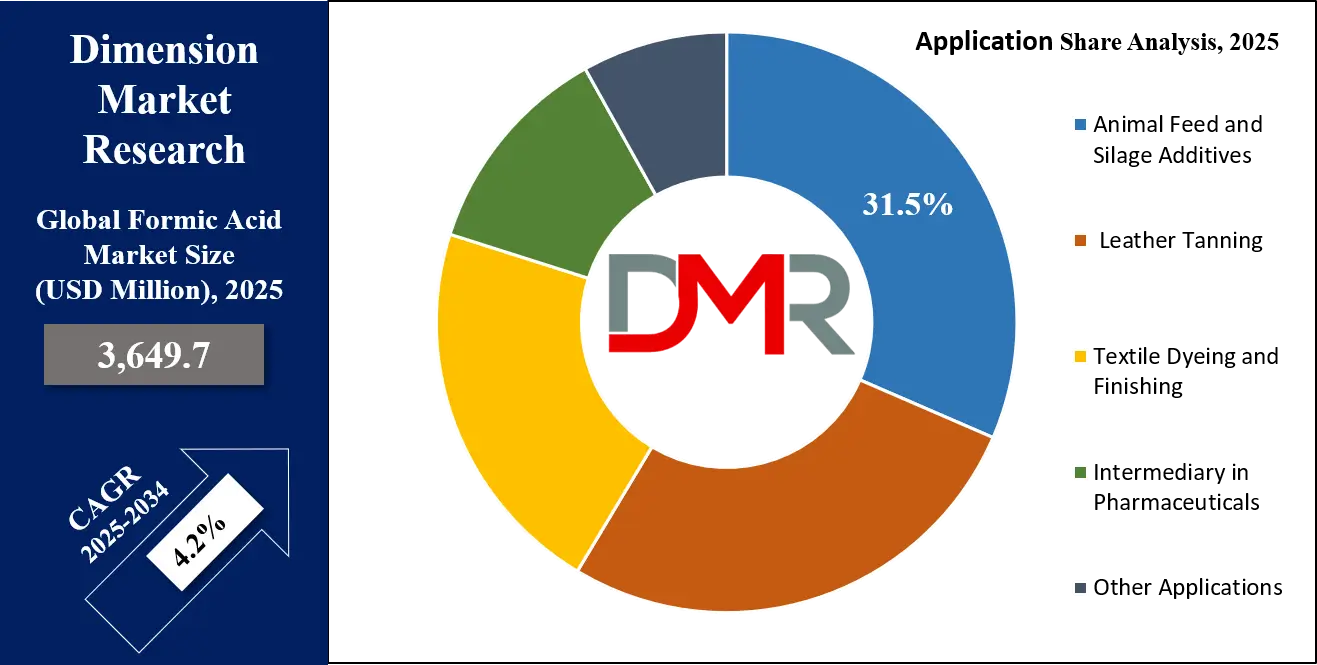

The Global Formic Acid Market size is expected to be valued at USD 3,649.7 million in 2025, and it is further anticipated to reach a market value of USD 5,265.4 million by 2034 at a CAGR of 4.2%.

Formic acid market expansion continues at an accelerated rate because it serves multiple industries within agriculture, chemicals, pharmaceuticals, and textiles. Numerous production chains depend on formic acid as both an acidulant and preservative and as a chemical intermediate in their procedures. The market shows strong growth because of the expanding use of bio-based formic acid. The market expansion is primarily driven by environmental regulations, together with consumer demand for sustainable and eco-friendly chemical production processes that replace traditional methods. More industries are selecting bio-based formic acid because it functions as a sustainable replacement for fuel-derived industrial chemicals.

Formic acid consumption by the agriculture industry for silage preservation continues to increase because of expanding animal feed additive requirements, leading to market growth. The ability of formic acid to control bacterial growth in farm feed contributes to improved agricultural productivity, specifically in dairy and meat production operations. Formic acid maintains significant industrial relevance in textile operations because manufacturers extensively use it for textile dyeing and finishing applications. This chemical shows increasing market potential across developing economic regions because the global textile industry keeps growing.

Despite positive growth potential, the formic acid market confronts various market obstacles. Market development is restricted by unstable costs from raw materials and production expense requirements, which particularly impact synthetic formic acid manufacturing. Formic acid market operations face disabilities through regulatory standards that classify the substance as a dangerous material except when properly managed. Market growth potential faces constraints because alternative preservative acids and chemicals are increasing their presence in the market.

The economic limitations cannot dampen the positive development expectations for the formic acid market sector. The formic acid market will profit from extended benefits due to rising corporate demand for dual approaches to production and raw material sourcing, including biological methods. Overall market development remains positive because new production technologies and global trends toward sustainable agriculture will support the market expansion.

The US Formic Acid Market

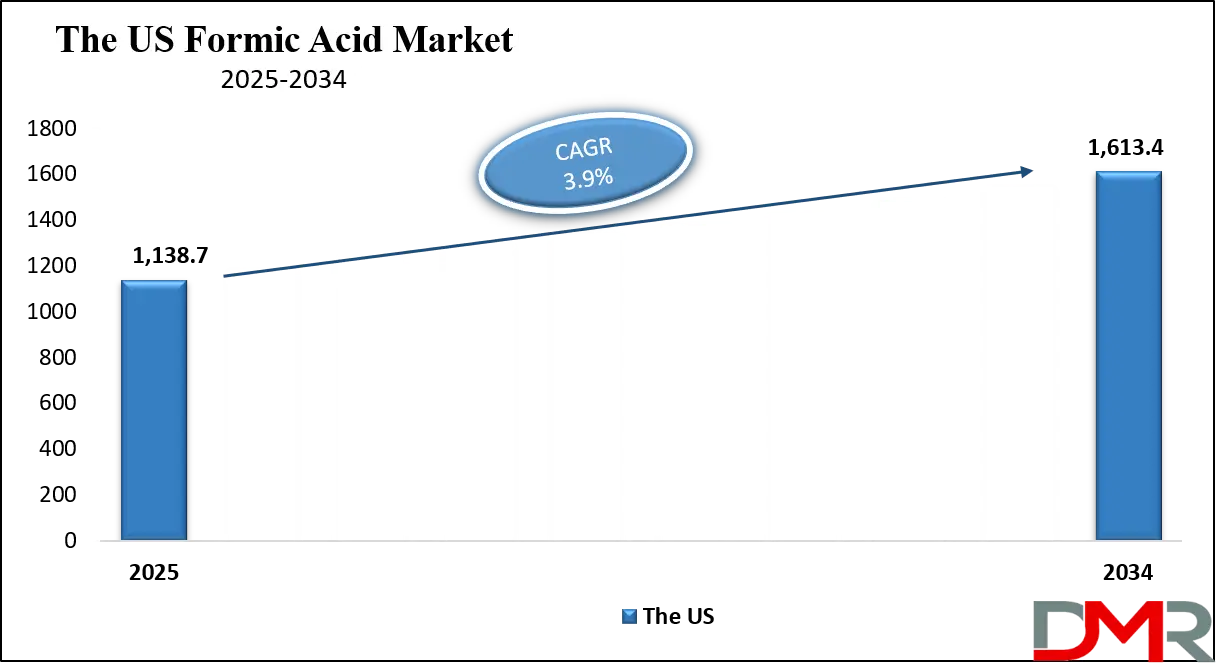

The US Formic Acid Market is estimated to be valued at USD 1,138.7 million in 2025, and projections suggest it will grow to USD 1,613.4 million by 2034, at a steady CAGR of 3.9%.

The US formic acid market depends largely on agricultural needs because farmers require the product to preserve silage and use it as an animal feed additive. The U.S. ranks among the top countries globally with its substantial livestock industry because this sector substantially increases formic acid use for livestock feed preservation, according to the U.S. Department of Agriculture. Formic acid helps preserve nutrients and stops bacterial growth in livestock feed components, including silage, so it becomes a major beneficial additive for feed preservation. The U.S. Environmental Protection Agency conducts strict regulation of formic acid usage to guarantee safety and optimal results within agricultural applications, thus enhancing overall market demand.

Within the chemical sector, formic acid finds essential application for developing formates and producing rubber and plastic materials. Industrial chemicals made through formic acid production continuously require the use of the U.S. chemical industry, which stands as one of the world's top chemical manufacturers. The U.S. government operates research programs for sustainable formic acid production through funding from organizations, including the Department of Energy and the U.S. Environmental Protection Agency and driven by the increasing demand for bio-based chemicals. Important progress has been made in bio-based formic acid development, and this product will function as a primary growth driver according to industry expectations.

The United States benefits from its state-of-the-art manufacturing capabilities through technological advances that support the bulk production of formic acid. North America functions as one of the top suppliers of formic acid for international markets that primarily focus on Latin America and Asia-Pacific. The United States industry, taking on renewable energy and environmentally sustainable chemical creation, continues to generate new growth opportunities for formic acid in energy storage and green chemical fields.

The European Formic Acid Market

The European Formic Acid Market size is estimated to be valued at USD 642.4 million in 2025, and projections suggest it will grow to USD 847.2 million by 2034, at a steady CAGR of 3.3%.

The European market stands among the global market leaders for formic acid products because users primarily deploy the substance within agriculture and textile operations. European Union environmental policies drive organizations to use formic acid as a safer, sustainable process alternative throughout manufacturing operations. Silage conservation, along with animal feed additives in Germany, France, and the Netherlands, the major farming nations use formic acid as a primary agricultural processing agent. Formic acid demand has increased due to the EU Farm to Fork Strategy because it provides nature-based methods for feed preservation.

The textile industry depends heavily on formic acid since this chemical performs vital processes for dyeing and finishing materials. Formic acid serves as a main chemical ingredient in Italian textile industries alongside Spanish and Turkish manufacturers for its role in stabilizing dyeing reactions while improving fabric finishing results. European textile and fashion manufacturers adopting sustainable processes, together with growing customer demand for sustainable products, drive the market expansion of formic acid.

ECHA maintains executive authority over formic acid regulations to protect its safe use across European industries. Bioriented chemical investment and renewable production methods for formic acid continue to strengthen European dominance in the regional market of formic acid. Extended environmental sustainability efforts, along with rising needs for sustainable chemical solutions, will support the expansion of Europe's formic acid market throughout the coming years.

The Japan Formic Acid Market

It is expected that the Japan Formic Acid Market will be valued at USD 218.98 million in 2025 and is likely to grow to USD 307.6 million by 2034, registering a CAGR of 3.8%.

The primary markets consuming formic acid in Japan include the agricultural sectors, together with the pharmaceutical field, as well as the textile industry. Agriculture represents a major sector of Japan since livestock farming plays a central role in this field. The Ministry of Agriculture, Forestry, and Fisheries (MAFF) promotes formic acid applications for silage preservation together with animal feed additives since it enhances livestock welfare and production capabilities. Japan relies on formic acid as a crucial element for its agricultural supply chain because of its high-quality standards in food safety and agricultural productivity goals.

The successful implementation of manufacturing technology in the textile industry results in increased demand for formic acid, specifically for dyeing and finishing applications. Approximately, formic acid maintains the integrity of dyeing processes in Japanese textile manufacturing, where the country's innovation continues to build its global reputation for textile quality. The Japanese focus on sustainability has created increased emphasis on manufacturing bio-based formic acid through sustainable methods. Japan actively supports eco-friendly chemical production technologies through the Japan External Trade Organization (JETRO) and its government organizations that promote sustainable practices in the chemical industry.

Through government backing of renewable energy technology development, Japanese companies create new prospects to utilize formic acid as an energy storage solution. Japan maintains growth potential for formic acid because the country advances sustainability through well-established infrastructure and continuous investments in technology development, while managing material import dependence. The growing environmental solution needs to make Japan a leading player in the global formic acid industry forecast.

Global Formic Acid Market: Key Takeaways

- Global Market Size Insights: The Global Formic Acid Market size is estimated to have a value of USD 3,649.7 million in 2025 and is expected to reach USD 5,265.4 million by the end of 2034.

- The US Market Size Insights: The US Formic Acid Market is projected to be valued at USD 1,138.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,613.4 million in 2034 at a CAGR of 3.9%.

- Regional Analysis: North America is expected to have the largest market share in the Global Formic Acid Market with a share of about 37.10% in 2025.

- Key Players: Some of the major key players in the Global Formic Acid Market are BASF SE, Eastman Chemical, Perstorp AB, Huntsman Corporation, Shandong Jinmao, LANXESS AG, Dow Chemical, Celanese, Beijing Huanxin Hengtai, GNFC, Chongqing Chuandong, Chang Chun Group, and many others.

- The Global Market Growth Rate Insights: The market is growing at a CAGR of 4.2 percent over the forecasted period of 2025.

Global Formic Acid Market: Use Cases

- Animal Feed and Silage Additives: The preservation of silage takes advantage of formic acid, which enhances its preservation properties through better nutritional values while also preventing microbial contamination. The overall feed quality improves significantly because of this process, which directly benefits livestock health and productivity.

- Leather Tanning: Formic acid functions as a tanning agent in leather processing to control pH through its application as a tanning agent in the leather tanning process. The resulting material possesses higher strength levels while displaying better texture and durability, thus making formic acid a top selection for premium leather manufacturing.

- Textile Dyeing and Finishing: Formic acid preserves pH stability in textile dyeing operations that produce finished products. The application of formic acid creates uniform dye absorption patterns in textiles along with durable dye substances while simultaneously improving fabric texture through finishing operations, thus making it crucial for textile production.

- Intermediary in Pharmaceuticals: Formic acid functions as an essential intermediary component in pharmaceutical manufacturing for creating different vital pharmaceutical substances. The pharmaceutical industry becomes more efficient through formic acid-generated control of reaction rates that optimize chemical processes during drug production.

- Food Preservation: The dairy and meat industry depends on formic acid as a food preservative, which protects various food products. Food preservation depends on formic acid because the substance inhibits microorganisms while lengthening the product shelf life and protecting nutritional content, which makes it vital for food industry preservation needs.

Global Formic Acid Market: Stats & Facts

U.S. Department of Agriculture (USDA)

- Livestock Production: The U.S. has over 94 million cattle and 75 million pigs, creating a significant demand for formic acid in feed preservation and silage additives.

- Silage Demand: Silage preservation is a critical part of livestock farming, with 40% of U.S. corn production used in silage, a key market for formic acid.

European Commission

- Farm to Fork Strategy: The EU aims to make 25% of its agricultural land organic by 2030, increasing demand for sustainable additives like formic acid for feed preservation.

- Agriculture and Silage: In 2020, approximately 5.5 million tons of silage were produced in the EU, creating a steady demand for preservatives, including formic acid.

European Chemicals Agency (ECHA)

- Formic Acid Registration: Formic acid has been registered under REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) as a substance with industrial use in Europe.

- Safety Guidelines: ECHA's guidelines regulate the safe use of formic acid, which helps maintain demand for the product while ensuring compliance with health and safety standards.

U.S. Environmental Protection Agency (EPA)

- Regulation of Formic Acid: The EPA has identified formic acid as an agricultural pesticide and regulates its safe use, which influences market growth in agricultural sectors.

- Approval for Agricultural Use: Formic acid is approved for use in animal feed in the U.S., aligning with growing livestock farming practices.

Food and Agriculture Organization (FAO)

- Global Agricultural Use: The FAO reports that over 90 million tons of silage are produced annually globally, with significant contributions from the U.S., China, and Europe. This drives global formic acid consumption.

- Food Safety: FAO advocates for the use of formic acid in food preservation to prevent bacterial growth and improve shelf life.

Japan Ministry of Agriculture, Forestry, and Fisheries (MAFF)

- Animal Feed in Japan: MAFF estimates that around 50% of animal feed in Japan is preserved with additives like formic acid to ensure quality.

- Silage in Livestock Farms: MAFF reports that silage production in Japan supports a growing demand for formic acid in livestock farming, particularly in Hokkaido, where dairy farming is prevalent.

U.S. Department of Energy (DOE)

- Bio-Based Chemical Support: The DOE funds projects to enhance bio-based chemical production, including bio-based formic acid. The U.S. has seen a rise in bio-based formic acid production through its Bioenergy Technologies Office.

- Sustainable Energy Research: The DOE has earmarked grants for developing renewable energy storage systems, some of which incorporate formic acid as a key component in energy storage technologies.

United Nations Environment Programme (UNEP)

- Green Chemistry Initiatives: UNEP's work in promoting sustainable chemistry has supported the development of bio-based formic acid. The push for eco-friendly chemicals globally has increased formic acid's appeal in several industries.

China Ministry of Agriculture (MOA)

- Silage Use in China: MOA reports that silage production in China has increased by 6% annually, significantly boosting the demand for formic acid as a feed preservative.

- Livestock and Feed Additives: China’s livestock sector consumes a large volume of formic acid due to its widespread use in animal feed and silage.

European Food Safety Authority (EFSA)

- Safety of Food Additives: EFSA recognizes formic acid as a safe preservative in food products, which has led to its widespread use in the food and beverage industry in Europe.

The Japanese External Trade Organization (JETRO)

- Chemical Market Trends: JETRO reports that Japan's chemical industry, including formic acid production, has grown by 2-3% annually over the last decade, supported by government policies promoting industrial innovation and sustainability.

- Bio-Based Chemical Investment: JETRO has noted that Japan is increasingly investing in bio-based formic acid production to meet domestic and international demand for sustainable chemicals.

India Ministry of Chemicals and Fertilizers

- Formic Acid Use in Agriculture: India’s growing agricultural sector has seen a rise in formic acid consumption, particularly in feed additives and crop protection. The Ministry of Chemicals and Fertilizers is exploring domestic production to meet rising demand.

- Australian Government Department of Agriculture, Water and the Environment (DAWE)

- Livestock and Feed Preservation: DAWE reports that Australia’s cattle industry consumes a large proportion of formic acid used for feed preservation. This aligns with the country's strong agricultural export sector.

Brazil Ministry of Agriculture

- Agricultural Growth: Brazil’s agricultural sector, which is the world’s largest exporter of soybeans, increasingly uses formic acid for silage preservation. The government has supported sustainable agriculture programs, which encourage the use of effective preservatives like formic acid.

United Kingdom Department for Environment, Food & Rural Affairs (DEFRA)

- Agriculture and Chemical Use: DEFRA promotes the use of formic acid in agriculture, particularly in the preservation of silage for dairy farms, where its use has grown by over 5% in the last five years.

China National Chemical Corporation (ChemChina)

- Chemical Industry Production: ChemChina reports that formic acid is increasingly used in the production of industrial chemicals, which supports its growing demand in manufacturing and agriculture.

U.S. Food and Drug Administration (FDA)

- Food Additive Approval: The FDA has approved the use of formic acid as a preservative in food products, including cheeses and meats, further driving demand within the food industry.

- Regulation of Additives: FDA guidelines ensure the safe use of formic acid in food products, which promotes market growth in the U.S.

World Health Organization (WHO)

- Food Safety Guidelines: WHO includes formic acid in its list of safe food preservatives, which has contributed to its increased use in global food safety measures.

- Use in Dairy and Meat: WHO reports that formic acid is frequently used in the preservation of dairy and meat products, extending shelf life and preventing bacterial growth.

U.S. Department of Commerce

- Export Growth: The Department of Commerce reports that the U.S. is one of the top exporters of formic acid, exporting significant quantities to Latin America, Europe, and Asia, which boosts its market growth.

- Industrial Manufacturing: The U.S. chemical industry is a major driver of formic acid demand, particularly in the production of formates, plastics, and rubber products.

United Nations Industrial Development Organization (UNIDO)

- Industrial Chemical Development: UNIDO’s support for green chemicals and sustainable industrial practices has encouraged the use of formic acid in various applications, including manufacturing and agriculture, where it contributes to environmental sustainability goals.

Global Formic Acid Market: Market Dynamic

Driving Factors in the Global Formic Acid Market

Rising Demand for Silage Preservation in Agriculture

The global formic acid market expands because agriculture needs this acid for silage preservation at an increasing rate. Livestock need silage because this fermented feed product is made from green foliage crops such as grass and corn and becomes vital sustenance when fresh grass cannot grow during prolonged, harsh winters.

Silage preservation using formic acid proves effective because the preservative impedes harmful microbial growth throughout fermentation, thereby retaining nutritive value in the feed. Global livestock production in emerging markets such as China, Brazil, and India has triggered increased demand for formic acid within the agricultural sector.

The U.S. Department of Agriculture (USDA) shows that North American silage production has expanded rapidly during recent years, thus making formic acid essential for feed preservation. The rapid adoption of formic acid has accelerated because it functions as an effective yet safer replacement for other preservatives. The global expansion of meat consumption, along with rising interest in agricultural efficiency and productivity levels, sustains the increasing demand for formic acid in this industry sector.

Expansion of the Textile and Leather Industry

The formic acid market receives substantial growth from the expanding textile and leather industries. Formic acid works primarily within textile production by creating ideal solution pH levels to achieve consistent dye absorption as well as fabric durability maintenance. The global textile industry expands quickly because major production takes place in China, India, and Bangladesh.

The market expansion of formic acid directly results from increasing customer needs for strong and durable textile materials. Formic acid serves a vital function within the leather tanning operations since it controls leather pH values throughout manufacturing processes to generate durable, soft products.

Formic acid demand rises in leather production because the industry maintains its continuous expansion within luxury items and automotive elements, and footwear production sectors. The market's expansion relies on the emerging market development of both textile and leather production, which will boost demand for formic acid to maintain market growth.

Restraints in the Global Formic Acid Market

Health and Safety Concerns

The global formic acid market faces its main limitation from the health risks, along with safety complications that occur when handling formic acid products. Formic acid represents a powerful acid that presents severe hazards to people during improper handling conditions. People who are exposed to formic acid for long periods will develop skin burns as well as respiratory problems and additional health complications. The medical risks of handling formic acid along with safety requirements have prompted strict approval procedures for its industrial applications, especially when used in agriculture and chemical manufacturing.

Formic acid maintains approval status for animal feed preservation together with food processing, but its correct handling necessitates both protective equipment and ventilation systems. The broadening use of formic acid in industries creates challenges for industries to meet the rigorous safety standards that authorities set. Market expansion can be delayed when companies face legal liabilities and a ruined reputation after experiencing accidents involving formic acid or exposure to it.

Volatility in Raw Material Prices

The formic acid market faces significant hurdles because methanol raw material prices undergo frequent fluctuations, as one of the essential materials needed to produce formic acid. The methanol market pricing undergoes constant swings when market conditions and supply-and-demand fluctuations, and geopolitical dynamics in the main production areas interact. Price and market performances of formic acid depend on how its production costs change when raw materials prices fluctuate.

The supply disruptions of methanol, which occur because of trade disputes or natural disasters, or political instability in major producing countries, result in high prices that drive up production expenses. Formic acid costs rise when production expenses increase, thus making it less competitive in comparison to other chemical alternatives. The price increase of raw materials creates barriers for smaller companies entering the market, thus reducing market competition alongside innovation potential. Methanol, together with other raw materials, forms the basis of the formic acid market, but its unpredictable pricing stability creates a major market obstacle.

Opportunities in the Global Formic Acid Market

Increasing Use of Formic Acid in Pharmaceutical Applications

A key growth opportunity in the global formic acid market lies in its increasing use in pharmaceutical applications. Formic acid is widely used as an intermediary in the production of various pharmaceutical compounds, including active pharmaceutical ingredients (APIs) used in the synthesis of antibiotics, antiviral agents, and other therapeutic drugs.

Its ability to act as a catalyst in chemical reactions makes it an invaluable component in the pharmaceutical manufacturing process. The global pharmaceutical industry is experiencing rapid growth, driven by an aging population, rising healthcare needs, and ongoing advancements in drug research and development. As the demand for high-quality pharmaceuticals increases, formic acid will continue to play a pivotal role in drug manufacturing.

Additionally, with the rising trend towards green chemistry and sustainable drug production methods, formic acid’s eco-friendly production process offers further potential for growth in this sector. As pharmaceutical companies increasingly seek efficient and sustainable ways to produce drugs, the use of formic acid as a key intermediary is likely to grow, presenting significant opportunities for the market.

Demand for Sustainable and Eco-Friendly Chemical Solutions

Formic acid market prospects strengthen as the global industry establishes new standards for environmentally friendly chemical alternatives. Global industry adoption of green chemistry principles triggered an increase in the market demand for environmentally friendly chemicals. The bio-based version of formic acid represents an environmentally safer and sustainable choice against conventional preservatives and solvents in the market.

The increasing focus on sustainability exists because of mounting governmental requirements, together with increasing consumer interest in environmentally friendly product choices. International governments across Europe and North America have established demanding environmental guidelines that stimulate industries across Europe to North America to utilize sustainable chemicals across the agricultural and manufacturing sectors.

The European Union’s Farm to Fork strategy promotes decreased agricultural chemical use so industries may adopt formic acid as a food preservative and animal feed additive. The adoption of sustainable production methods in the construction and automotive, and textile industries, coupled with these industries' expands the market demand for formic acid. The rising interest in sustainability works to make formic acid even more essential since it serves as a bio-based green chemical, thereby creating new avenues for market expansion.

Trends in the Global Formic Acid Market

Shift Towards Bio-Based Formic Acid

Bio-based production methods are gaining popularity in the global formic acid market to meet escalating customer needs for sustainable and environmentally friendly chemicals. Bio-based formic acid originates from renewable biomass, making it a promising substitute for commonly produced formic acid. The pursuit of environmentally sustainable alternatives to fossil-fuel chemistry by European and North American industries has sparked a powerful demand for bio-based formic acid.

Various national authorities have launched initiatives to endorse bio-based chemical use through financial support programs that benefit production companies transitioning toward sustainable practices. Such a transition produces lower carbon emissions, which supports global sustainability objectives. The agricultural sector heavily embraces bio-based formic acid because it functions as an essential feed supplement, along with being a silage preservative during production. The market demand for bio-based formic acid grows stronger due to rising efforts to minimize petrochemical usage in chemical production methods.

Increasing Use of Renewable Energy Storage Solutions

The formic acid market witnesses rising demand in renewable energy storage solutions as one of its primary market trends. Renewable energy technologies, made up of solar and wind systems, drive an increasing demand for effective solutions to store generated energy. Scientists investigate formic acid as an energy storage candidate because this chemical substance has the potential to conserve energy within formates until reprocessed into energy.

The energy storage application for formic acid is rapidly building interest among heavy industrial consumers, and it will function as an essential solution for managing power supply and demand over the upcoming decades. Research facilities and companies focus their investments on creating storage technologies based on formic acid as their main constituent.

Acidic organic compounds known as formic acid are currently under scientific investigation for their usage in future energy-powered flow battery and related storage systems. Essential factors behind the growing adoption of formic acid as an energy storage solution are both the rising adoption of green chemistry and societal demands for sustainable energy storage methods. Sustainable energy systems that incorporate formic acid as a primary component will drive a rapid increase in the market demand.

Global Formic Acid Market: Research Scope and Analysis

By Grade Analysis

Grade 85% formic acid is projected to be the dominant grade in the global formic acid market due to its balance between performance and cost-effectiveness. The demand for Grade 85% formic acid is rising since it provides superior performance at a lower cost. The 85% concentration meets the performance needs of multiple industries, therefore making it the standard grade for industrial applications across the world.

Widespread use of Grade 85% formic acid in agriculture stands as a primary reason behind its market dominance because it preserves silage in animal feed. The silage preservation application uses Grade 85% formic acid as a microbial inhibitor, which produces high-quality preserved feed while preventing nutrient deterioration. It efficiently inhibits fermentation spoilage while remaining cost-effective compared to premium formic acids, therefore making it a suitable choice for farmers preserving their feed at reasonable costs.

Grade 85% formic acid serves the leather and textile industries for tanning and dyeing purposes because its moderate acidity strength protects materials without causing excessive damage. Grade 85% formic acid serves industrial manufacturing because of its adaptable properties when purity requirements are not strict.

Production infrastructure availability combined with easy handling streams make Grade 85% formic acid a leading choice in the market. Industrial manufacturers select Grade 85% formic acid for bulk production because it combines economical aspects with convenient use. Grade 85% remains the most preferred formic acid choice in North America, together with Europe and Asia, because it is affordable and meets many different application requirements.

By Production Method Analysis

The method of oxalic acid production is projected to lead this segment in formic acid manufacturing through its efficient operational parameters and economic benefits. Natural sources, beginning with sugarcane bagasse and agricultural fragments, provide sustainable yet financially attractive ways to make formic acid through the catalyst oxalic acid. The industrial implementation of formic acid production starts with the catalytic reduction of oxalic acid because this established process enables efficient and low-cost manufacturing. This production method uses significantly less energy compared to both carbonylation of methanol and other accompanying methods for formic acid creation.

The shift toward sustainable chemical production methods supports the development of formic acid manufacturing from oxalic acid. The growing movement for environmental preservation has driven business enterprises to minimize their need for petrochemical-based raw materials.

The application of oxalic acid as a natural, renewable substance supports sustainability targets, which explains why many industries, including agriculture, favor it as an eco-friendly replacement. The production technique based on oxalic acid delivers higher yield and pure formic acid concentrations, which enable the chemical to meet the strict quality specifications of diverse industrial applications. Lower-cost formic acid production through this method becomes feasible for price-sensitive markets that include agriculture and animal feed.

The oxalic acid method leads the industry because it provides efficient operations, together with environmental sustainability and cost-effective manufacturing of high-quality industrial formic acid.

By Application

Animal feed and silage additives are projected to constitute a significant market segment for formic acid consumption because the substance plays an essential part in boosting livestock performance and maintaining feed quality. Formic acid functions as a prominent silage preservative for agricultural purposes because it protects the primary livestock feed known as silage, especially when regions face yearly shortages of fresh forage during cold seasons.

Formic acid applies a microbial-blocking mechanism to fermentation that maintains both the nutrition and safety quality of silage for continuous year-round feeding. The preservation ability of formic acid proves essential for dairy farms because it directly affects both milk production performance and animal health through improved food quality.

Formic acid dominates animal feed and silage additives because it effectively improves both the digestibility and nutritional content of feed ingredients. The fermentation process attains better results together with stable silage pH through formic acid application, which preserves nutrients and stops unwanted losses. The product generates superior-quality feed that promotes healthy livestock while lowering farming operations costs.

The rising global meat and dairy product consumption, particularly in emerging markets like China, Brazil, and India, creates a growing need for effective feed preservation methods that support a rising market demand for formic acid as an animal feed and silage application. The conservation properties of formic acid when preserving silage jointly with its productivity benefits for livestock establish it as the top choice for the agricultural sector, which amplifies its widespread use.

The Global Formic Acid Market Report is segmented on the basis of the following:

By Grade

- Grade 85%

- Grade 94%

- Grade 99%

- Other Grades

By Production Method

- Oxalic Acid

- Carbonylation of Methanol

By Application

- Animal Feed and Silage Additives

- Leather Tanning

- Textile Dyeing and Finishing

- Intermediary in Pharmaceuticals

- Other Applications

Global Formic Acid Market: Regional Analysis

Region with the Highest Market Share in the Global Formic Acid Market

North America is projected to dominate the global formic acid market as it holds 37.10% of the market share by the end of 2025. The global formic acid market receives most of its demand from North America because this region maintains a strong agricultural industry, combined with a wide range of industrial applications. Both the U.S. and Canada act as major culminating livestock producers through their extensive cattle and dairy operations, which need formic acid as feed protection and silage conservation additives.

The area's rising focus on sustainable feed preservation techniques and sustainable farming methods has created widespread acceptance of formic acid since it prevents fermentation spoilage effectively. North America benefits from its highly developed chemical manufacturing industry, together with its advanced production facilities and dependable supply of methanol feedstocks for formic acid production. The manufacturing structure enables higher efficiency through economical production methods.

A mix of strict safety and quality control standards within this geographic region guarantees safe usage for formic acid across food production and textile manufacturing, along with leather processing industries. The combination of robust industry infrastructure alongside powerful agricultural and industrial sector needs and helpful regulations keeps North America firmly at the top of the global formic acid market leadership.

Region with the Highest CAGR in the Global Formic Acid Market

The Asia-Pacific region will show the most rapid growth rate in the global formic acid market because emerging economies in China, India, and Southeast Asia experience fast industrial development and growing agricultural harvests, and expanding livestock production. Formic acid consumption in these regions remains intense within the sectors of agricultural preservation and animal feed enhancement because it protects silage and increases the nutritional value of animal feed.

Rising purchasing power, along with evolving diets, has resulted in a strong market pull for meat and dairy products that subsequently boosted livestock operations and thus increased the demand for feed additives, including formic acid. The chemical industry in Asia-Pacific grows rapidly due to the increasing speed of manufacturing hubs in China and India, implementing economical production methods for formic acid.

Formic acid demand increases because Asia-Pacific has started implementing sustainable agricultural methods and seeks out environmentally friendly chemical solutions, including formic acid. Formic acid market growth within the Asia-Pacific region is swiftly expanding because of sustained economic growth rates in the region, making it the fastest-expanding market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Formic Acid Market: Competitive Landscape

Key market players hold dominant positions throughout the global formic acid market because they produce and distribute this chemical across multiple international regions. Marketable companies use strategic moves, which include technological development and capability escalation, and product structural diversification, to maintain their market leadership. The three main companies in the formic acid sector, including BASF SE, Perstorp, and DuPont, dedicate significant funds to research and development for improved production efficiency alongside product sustainability and purity enhancements. Market leaders direct attention to bio-based formic acid because various industries demand sustainable chemical alternatives.

The Asia-Pacific region demonstrates particular significance because its demand for formic acid increases rapidly, so regional businesses become increasingly important. The rising industrial as well as agricultural requirements of China and India have prompted Jiangsu Sopo and Chongqing Chuandong Chemical to build new production facilities. The market position of these companies and their production capabilities increase through partnerships and through acquired assets from mergers and acquisitions.

Strengths in cost efficiency and regulatory compliance, along with sustainability, play a major role in transforming the market strategies of companies competing in the formic acid industry.

Some of the prominent players in the Global Formic Acid Market are:

- BASF SE

- Eastman Chemical Company

- Perstorp AB

- Huntsman Corporation

- Shandong Jinmao Technology Group Co., Ltd.

- LANXESS AG

- Dow Chemical Company

- Acetic Acid Company (Celanese Corporation)

- Beijing Huanxin Hengtai Technology Co., Ltd.

- Gujarat Narmada Valley Fertilizers & Chemicals (GNFC)

- Chongqing Chuandong Chemical Co., Ltd.

- Chang Chun Group

- Jiangsu SOPO Chemical Co., Ltd.

- Yunnan Tin Company Limited

- Hefei TNJ Chemical Industry Co., Ltd.

- Jiaxing Zhonghua Chemical Co., Ltd.

- Shandong Kaisheng New Materials Co., Ltd.

- Jiutai Energy Group

- Nantong Jinxing Chemical Co., Ltd.

- Zhongtai International Co., Ltd.

- Other Key Players

Recent Developments in the Global Formic Acid Market

April 2025

- BASF SE announced the launch of a new bio-based formic acid production unit in the United States, aiming to cater to the increasing demand for sustainable chemicals. The new facility will focus on producing formic acid using renewable raw materials and reducing CO₂ emissions in line with BASF’s sustainability goals. The company has committed to expanding its green chemistry initiatives across the globe.

February 2025

- Perstorp unveiled a new high-efficiency formic acid production process. The updated process utilizes advanced catalytic technology to enhance output while reducing energy consumption. The company claims this new method could significantly lower production costs and reduce environmental impact, making formic acid more accessible to industries demanding both quality and sustainability.

December 2024

- China National Petroleum Corporation (CNPC) announced a partnership with Sinopec to jointly develop a large-scale formic acid production facility in the region. The project is expected to increase China's capacity for formic acid production by 20%, meeting the growing demand in the agriculture and chemical industries. The facility will use oxalic acid-based production methods for greater cost efficiency.

October 2024

- DuPont launched a new range of formic acid products designed specifically for the leather tanning industry. The new formulations are aimed at improving the quality of leather while reducing the environmental footprint of the tanning process. DuPont’s commitment to eco-friendly chemical solutions has been a significant driver behind this product innovation.

Investments in the Formic Acid Market

March 2025

- Jiangsu Sopo Chemical Co., Ltd. received a strategic investment of $50 million from a private equity firm to expand its formic acid production capacity in China. The investment will enable the company to increase its market share in the Asia-Pacific region, where the demand for formic acid is rapidly rising, especially for use in agricultural feed and silage.

January 2025

- Perstorp secured a $35 million investment from the European Investment Bank (EIB) to fund the construction of a new bio-based formic acid production plant in Sweden. The plant will help meet the increasing demand for sustainable chemicals in Europe, particularly for applications in agriculture and textiles. This investment also underscores Perstorp's commitment to transitioning to green chemistry.

Collaborations in the Formic Acid Market

February 2025

- BASF and FMC Corporation entered into a joint venture aimed at developing more efficient and eco-friendly production methods for formic acid. The collaboration will focus on integrating digital technologies to optimize production processes and reduce energy consumption. The strategic partnership aims to boost the supply of sustainable formic acid to the agricultural and chemical sectors globally.

November 2024

- Lanxess and Chongqing Chuandong Chemical signed a memorandum of understanding (MoU) to collaborate on the expansion of formic acid production in China. The collaboration will allow Lanxess to leverage Chongqing’s established manufacturing capabilities to meet the growing demand for formic acid in both domestic and international markets.

Expos and Conferences in the Formic Acid Market

May 2025

- The Global Chemical Expo (GCE) 2025, hosted in Frankfurt, Germany, will feature key discussions on the sustainable production of formic acid. Industry leaders from BASF, DuPont, and other major players will showcase the latest innovations in formic acid production technologies and discuss trends in sustainability and bio-based chemicals. The expo will provide insights into regulatory updates and market projections, with a focus on the chemical industry's shift toward green chemistry.

September 2024

- The International Conference on Agricultural and Food Chemistry in Tokyo, Japan, included a dedicated session on the use of formic acid as a feed preservative in livestock farming. Experts from across the globe gathered to discuss the latest research and advancements in the agricultural use of formic acid. The conference also highlighted innovations in bio-based formic acid production methods and their potential to revolutionize the agricultural feed industry.

Mergers and Acquisitions in the Formic Acid Market

April 2025

- Clariant AG announced the acquisition of Azelis Group's chemical distribution business in Europe, which included the distribution rights for formic acid in key European markets. The acquisition is expected to expand Clariant’s reach in the formic acid sector, particularly in industries such as agriculture, leather tanning, and textiles. This strategic acquisition aims to enhance Clariant's product portfolio and strengthen its position in the growing European market for sustainable chemicals.

January 2025

- SABIC acquired a 60% stake in Zhejiang Materials Industry Group (ZMC), a Chinese company specializing in the production of formic acid. The acquisition strengthens SABIC’s presence in the Asia-Pacific region, where formic acid demand is on the rise, particularly in agriculture and animal feed sectors. This merger allows SABIC to leverage ZMC's production capacity and distribution network to meet the growing demand for formic acid in China and other emerging markets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,649.7 Mn |

| Forecast Value (2034) |

USD 5,265.4 Mn |

| CAGR (2025–2034) |

4.2% |

| The US Market Size (2025) |

USD 1,138.7 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Types (Grade 85%, Grade 94%, Grade 99%, Others), By Production Method (Oxalic Acid, Carbonylation of Methanol), By Applications (Animal Feed and Silage Additives, Leather Tanning, Textile Dyeing and Finishing, Intermediary in Pharmaceuticals, Other Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BASF SE, Eastman Chemical, Perstorp AB, Huntsman Corporation, Shandong Jinmao, LANXESS AG, Dow Chemical, Celanese, Beijing Huanxin Hengtai, GNFC, Chongqing Chuandong, Chang Chun Group, Jiangsu SOPO, Yunnan Tin, Hefei TNJ, Jiaxing Zhonghua, Shandong Kaisheng, Jiutai Energy, Nantong Jinxing, Zhongtai International, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Formic Acid Market size is estimated to have a value of USD 3,649.7 million in 2025 and is expected to reach USD 5,265.4 million by the end of 2034.

The US Formic Acid Market is projected to be valued at USD 1,138.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,613.4 million in 2034 at a CAGR of 3.9%.

North America is expected to have the largest market share in the Global Formic Acid Market with a share of about 37.10% in 2025.

Some of the major key players in the Global Formic Acid Market are BASF SE, Eastman Chemical, Perstorp AB, Huntsman Corporation, Shandong Jinmao, LANXESS AG, Dow Chemical, Celanese, Beijing Huanxin Hengtai, GNFC, Chongqing Chuandong, Chang Chun Group, and many others.

The market is growing at a CAGR of 4.2 percent over the forecasted period of 2025.