Market Overview

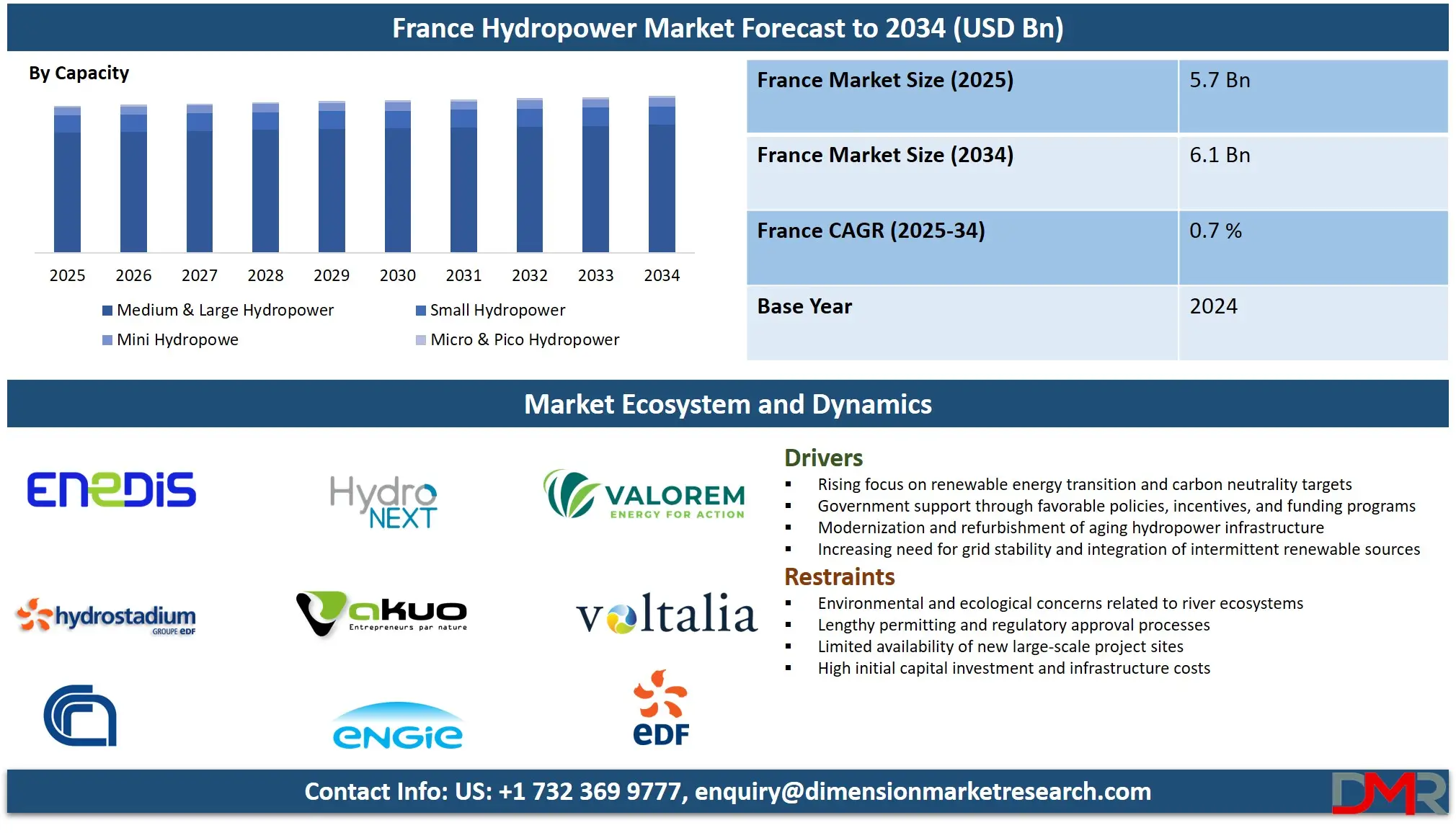

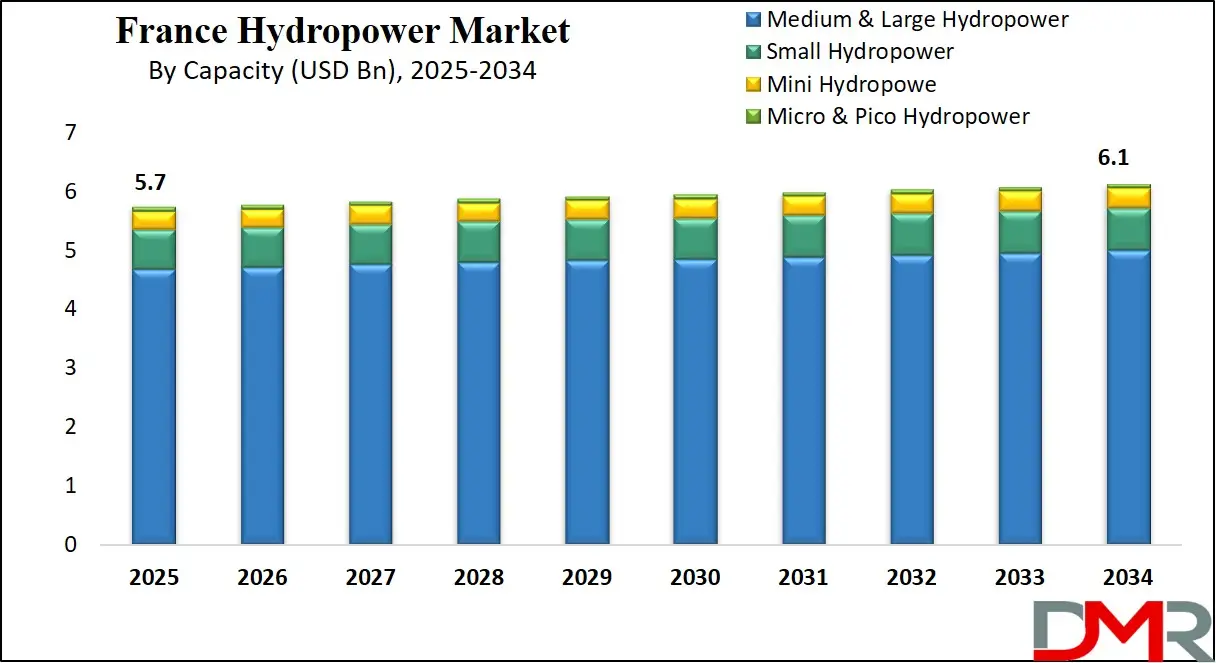

The France Hydropower Market size is projected to reach USD 5.7 billion in 2025 and grow at a compound annual growth rate of 0.7% from there until 2034 to reach a value of USD 6.1 billion.

Hydropower is a form of renewable energy that uses the movement of water typically from rivers, dams, or reservoirs to generate electricity. Water flows through turbines that spin and convert kinetic energy into electrical energy. In France, hydropower has long been a vital part of the country’s energy system, offering a clean, domestic source of electricity. It also plays a key role in balancing the national grid, especially during peak demand periods or when other renewable sources like solar and wind fluctuate due to weather.

Hydropower continues to see steady demand in France due to its reliability and ability to produce power on demand. Unlike wind or solar, which depend on weather conditions, hydropower can be adjusted more easily to meet electricity needs. This makes it especially valuable during energy shortages or high consumption periods. Moreover, the growing push to reduce fossil fuel use and meet climate targets has led to a renewed focus on strengthening existing hydropower facilities rather than building new ones, due to limited new construction opportunities in a mature market.

Recent years have seen increased attention to optimizing and modernizing France’s hydropower assets. Many older plants have undergone upgrades to improve efficiency, safety, and environmental performance. Technological improvements have allowed existing plants to operate with better water flow control, reduced ecological impact, and longer equipment life. Digital monitoring and automation have also helped operators manage operations more effectively. This trend of modernization reflects a broader European strategy focused on upgrading existing clean energy infrastructure.

Environmental concerns remain important in the development and management of hydropower. River ecosystems, fish migration, and water availability are carefully studied before any major project or renovation begins. In recent years, public awareness and regulatory scrutiny have increased, leading to a greater emphasis on sustainable practices. Some projects have incorporated fish ladders, improved flow systems, and sediment management plans to reduce their environmental footprint. This balance between clean energy and ecosystem protection is central to how hydropower evolves in France.

Several important events have shaped the hydropower landscape in France. The government has set policies aimed at maintaining hydropower’s role in the energy mix while aligning with EU decarbonization goals. Ongoing droughts and changing rainfall patterns have also raised concerns about the long-term availability of water for energy production. These climate challenges are pushing researchers and utilities to improve forecasting, storage methods, and adapt infrastructure to new weather patterns.

Looking ahead, France is expected to continue relying on hydropower as a backbone of its renewable energy strategy. While there may be limited potential for building entirely new large dams, there is growing interest in small-scale hydro, pumped storage, and hybrid systems that combine hydropower with solar or wind. Hydropower's ability to support grid stability and its low-carbon footprint make it a strategic resource as France works to meet its energy transition goals. Its future depends on smart policies, ongoing innovation, and careful resource management.

France Hydropower Market: Key Takeaways

- Market Growth: The France Hydropower Market size is expected to grow by USD 0.3 billion, at a CAGR of 0.7%, during the forecasted period of 2026 to 2034.

- By Capacity: TheMedium & Large Hydropower segment is anticipated to get the majority share of the France Hydropower Market in 2025.

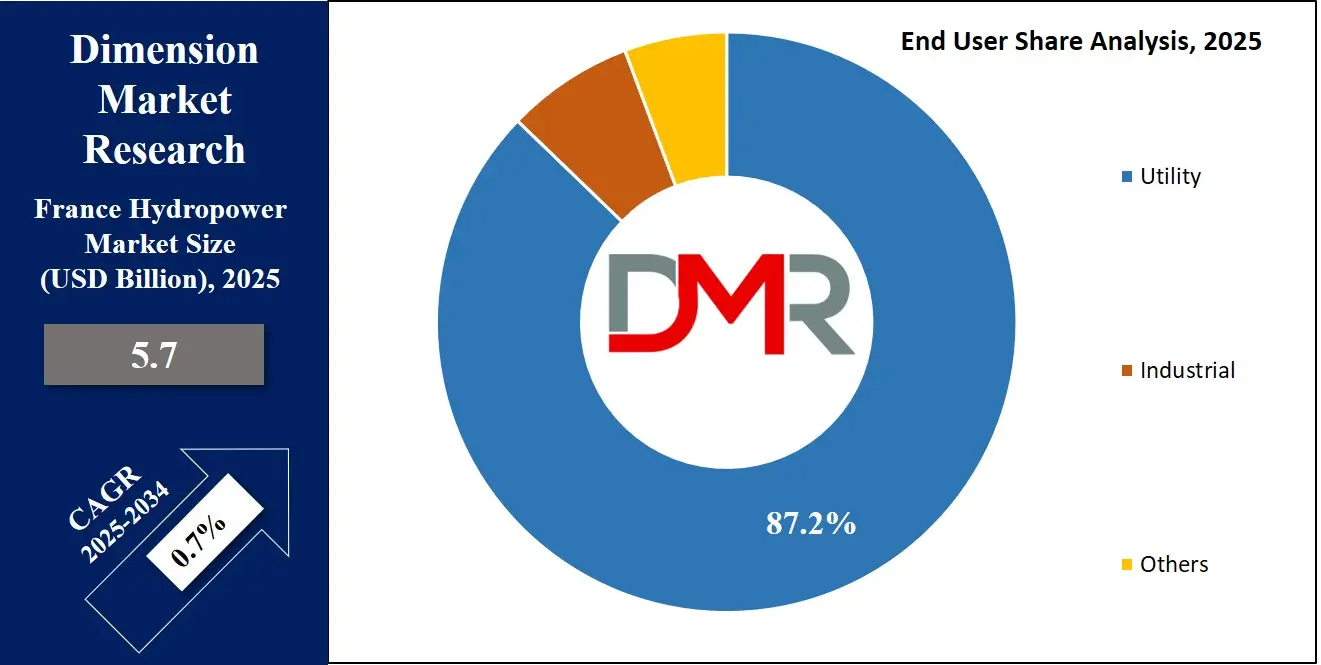

- By End User: The Utility segment is expected to get the largest revenue share in 2025 in the France Hydropower Market.

- Use Cases: Some of the use cases of Hydropower include grid stability support, peak load management, and more.

France Hydropower Market: Use Cases

- Grid Stability Support: France’s hydropower plants provide quick-response energy that helps balance supply and demand on the national grid. This makes hydropower essential during sudden demand spikes or when solar and wind output drops. Its flexibility ensures smoother electricity flow across regions.

- Peak Load Management: Hydropower is often used during peak consumption hours, reducing strain on the power system. By storing water and releasing it when needed, it helps meet high electricity demand without relying on fossil fuels. This supports cleaner energy usage during busy times.

- Energy Storage via Pumped Hydropower: Pumped storage systems move water between reservoirs at different heights, acting like a giant battery. These systems store excess energy and release it when needed, helping to integrate more variable renewables like wind and solar into the grid.

- Support for Remote and Mountain Regions: In mountainous parts of France, small and mini hydropower systems provide local power solutions. These systems reduce reliance on long-distance energy transmission and support rural electrification and development with reliable, low-emission electricity.

Stats & Facts

- According to Enedis and the Syndicat des énergies renouvelables (SER), France’s total renewable electricity capacity reached 76.7 GW by the end of 2024—an annual gain of more than 6.7 GW. Solar contributed the largest share of new capacity (+4,961 MW), followed by onshore wind (+1,091 MW) and offshore wind (+665 MW), signaling continued diversification of renewable sources.

- Solar photovoltaic capacity rose to 24,333 MW as of December 2024, reflecting an increase of 3,137 MW over the previous year, according to Agence ORE and Enedis. It generated 24.8 TWh of electricity—up 10.3% year-over-year—and accounted for 5.7% of national electricity consumption, with output peaking in the summer months due to seasonal irradiation.

- Based on the Panorama de l’électricité renouvelable by RTE and the Syndicat des énergies renouvelables (SER), onshore wind reached a capacity of 22,875 MW, but production declined by 12.6% year-on-year to 42.8 TWh in 2024. Despite this drop, it still covered 9.6% of metropolitan electricity consumption, reflecting variability in wind conditions across regions.

- Offshore wind energy marked a significant milestone in 2024 by producing 4 TWh—up 111.2% from the previous year—thanks to the ramp-up of the Saint-Brieuc, Fécamp, and Saint-Nazaire projects now totaling 1,508 MW, as reported by Agence ORE and RTE. This growing segment contributed 0.9% to national electricity consumption, with expansion ongoing.

- Hydropower remained the dominant renewable electricity source in France, with a consistent capacity of 25,716 MW generating 69.8 TWh in 2024, according to data from Enedis and the Syndicat des énergies renouvelables (SER). The 27.3% year-on-year increase was driven by favourable hydrological conditions, allowing hydropower to cover 15.8% of metropolitan electricity demand.

- As per data from Agence ORE and RTE, the renewable sector covered 33.9% of electricity consumption in metropolitan France by the end of 2024. In contrast, renewables contributed 27.8% of total national electricity production, highlighting the role of imports and generation-export balance in the broader national grid dynamics.

- Bioenergy, including energy recovery from waste, maintained a steady but limited role with 2,272 MW of installed capacity producing 8.5 TWh in 2024—a 1.5% year-on-year increase. According to the Syndicat des énergies renouvelables (SER) and Agence ORE, this source met 1.9% of national electricity consumption, complementing France’s broader renewable energy mix.

Market Dynamic

Driving Factors in the France Hydropower Market

Modernization and Efficiency Upgrades

One of the key growth drivers for the France hydropower market is the ongoing modernization of existing facilities. Many of France’s hydropower plants were built decades ago and are now being upgraded with advanced turbines, automation systems, and digital controls. These improvements allow plants to produce more electricity from the same volume of water, reducing waste and increasing reliability.

Modernization also helps meet stricter environmental and safety standards, ensuring long-term operation under current regulations. With limited opportunities to build new large dams due to environmental and spatial constraints, enhancing the efficiency of current infrastructure is a practical and sustainable growth path. These upgrades are often supported by government programs, funding schemes, and policy incentives aimed at boosting clean energy output without expanding physical footprints.

Rising Need for Flexible Renewable Energy

Another major growth driver is the increasing demand for flexible, dispatchable renewable energy to support the national grid. As France adds more solar and wind power to its energy mix, the role of hydropower becomes more critical due to its ability to adjust output quickly and maintain grid stability. Unlike intermittent renewables, hydropower can be turned on or off as needed, making it ideal for balancing fluctuations in energy supply and demand.

This flexibility is especially valuable during extreme weather events, seasonal power demand spikes, or drops in wind and solar generation. With energy security and climate goals becoming top priorities, hydropower’s adaptability and reliability are key to maintaining a stable and resilient energy system. As a result, investments are expected to increase in both conventional and pumped storage hydro technologies.

Restraints in the France Hydropower Market

Environmental and Regulatory Constraints

One of the main restraints in the France hydropower market is the increasing pressure from environmental regulations and public concerns about ecological impacts. Hydropower projects, especially large dams, can disrupt river ecosystems, affect fish migration, alter natural water flow, and impact biodiversity. As environmental awareness grows, stricter rules are being enforced to protect aquatic life and maintain river health.

Gaining approvals for new projects or even for modernizing old ones can be time-consuming and expensive due to lengthy environmental assessments and consultations. Additionally, some regions face public resistance to new infrastructure, especially where rivers have already been heavily developed. These regulatory and ecological considerations significantly limit the potential for expanding large-scale hydropower, forcing a stronger focus on sustainable operations and impact mitigation.

Geographical and Climatic Limitations

France’s geography presents another key limitation, as most of the country's high-potential hydropower sites have already been developed. This leaves little room for new large-scale installations, especially in flatter or urbanized areas where water flow is insufficient or infrastructure expansion is impractical. Moreover, climate change is increasingly affecting water availability across different regions.

Irregular rainfall, more frequent droughts, and shifting snowfall patterns are leading to less predictable river flows, reducing the reliability of hydropower generation. These climatic uncertainties make it harder to plan long-term production and impact the consistency of energy output. As water becomes a more contested resource for drinking, agriculture, and energy, balancing priorities will become even more challenging for future hydropower development in France.

Opportunities in the France Hydropower Market

Development of Small and Micro Hydropower Projects

One of the key opportunities in the France hydropower market lies in expanding small and micro hydropower installations. These systems require less infrastructure, have lower environmental impact, and are suitable for decentralized energy production in rural or mountainous regions. With growing interest in local, clean energy solutions, small-scale hydropower can provide reliable electricity to remote areas and reduce dependence on the national grid.

These projects also support regional economic development by creating jobs and encouraging local investment. Technological advancements have made these systems more efficient and easier to maintain, making them increasingly attractive. Government incentives and EU funding programs aimed at rural energy development are further opening up this segment. As a result, small and micro hydro offers a sustainable growth path in areas where large-scale projects are no longer feasible.

Integration with Hybrid Renewable Systems and Storage

Another major opportunity is the integration of hydropower with other renewable energy sources and energy storage solutions. Combining hydropower with solar or wind in hybrid systems allows for a more balanced and stable electricity supply, especially as variable renewables expand across France. Hydropower can act as a backup source when solar or wind output drops, and pumped storage facilities can store excess energy for later use.

This synergy improves overall system resilience and helps meet energy demand more efficiently. Additionally, hybrid projects can reduce pressure on the grid and lower the need for fossil fuel-based backup power. Technological progress in smart grids and digital controls makes it easier to coordinate these mixed systems. Such integration supports France’s goal of a flexible, low-carbon energy system and opens new investment opportunities for utilities and innovators.

Trends in the France Hydropower Market

Digitalization and Smart Control Adoption

In recent years, France’s hydropower sector has increasingly embraced digital technologies to boost efficiency and reliability. Advanced sensors, data analytics, and AI-powered monitoring systems are becoming standard tools for condition-based maintenance and predictive diagnostics . By analyzing real-time data, plant operators can detect wear or deviations early, schedule maintenance more effectively, and reduce unplanned downtime.

Additionally, digital twins and performance analytics platforms help simulate operations under different conditions, optimizing water usage and turbine output . This trend towards smart hydropower supports smoother integration with the broader grid while extending the useful life of existing assets.

Growth of Pumped Storage and Hybrid Systems

Another key trend is the expansion of pumped storage solutions and hybrid hydropower arrangements across France. Pumped storage facilities, which move water between upper and lower reservoirs, are gaining attention as a means to store surplus energy from intermittent renewables like wind and solar .

Trials in Europe including French sites have shown that pairing hydropower with battery storage enhances grid responsiveness and improves frequency control . As France pursues a cleaner and more flexible energy mix, hybrid setups combining hydro, storage, and digital grid coordination are being promoted through EU innovation projects and national policies.

Research Scope and Analysis

By Capacity Analysis

Medium & large hydropower will be leading in 2025 with a share of 81.6%, driven by its stable output, grid-balancing capabilities, and role as a base-load renewable energy source in France. These large-scale facilities are well-established and located across strategic river basins, offering high-capacity generation that supports both regional and national electricity demand. Their ability to deliver consistent power during peak and off-peak periods makes them central to France’s clean energy transition.

This segment is also benefiting from modernization efforts, where digital upgrades and improved turbine technologies are enhancing overall performance and operational efficiency. As solar and wind sources grow, the role of large hydropower in balancing intermittent energy becomes even more crucial. With rising focus on decarbonization and energy security, medium and large hydropower will continue to anchor the country’s renewable power system.

Mini hydropower, having significant growth over the forecast period, is expected to gain traction due to its ability to provide localized, low-impact energy solutions. These smaller plants are ideal for remote or rural areas, supporting community-based electricity generation without the need for massive infrastructure. Mini hydro systems are also faster to develop, face fewer regulatory barriers, and have lower environmental footprints compared to large dams. Their scalability and ability to integrate with other renewables like solar make them suitable for distributed energy models.

As France promotes energy decentralization and aims to reduce emissions from all sectors, mini hydropower will find wider application in agricultural regions, mountainous zones, and near industrial clusters seeking clean and stable power. This segment’s flexibility and alignment with sustainable development goals will drive its long-term expansion.

By Component Analysis

Electromechanical equipment will be leading in 2025 with a share of 39.2%, playing a core role in ensuring the operational strength and efficiency of France’s hydropower plants. This component segment includes turbines, generators, control systems, and hydraulic mechanisms that directly convert water flow into electricity. Upgrading these systems improves performance, extends plant life, and enhances responsiveness to grid demands.

As France focuses on boosting output from existing installations rather than building new dams, investments in modern and high-efficiency electromechanical units are accelerating. These upgrades also support real-time data monitoring and remote operations, reducing downtime and improving energy reliability. With digitalization reshaping plant operations and flexible power supply becoming a priority, advanced electromechanical systems are emerging as critical for optimizing plant productivity and cost-effectively meeting clean energy targets.

Civil construction, having significant growth over the forecast period, is gaining momentum due to rising renovation and infrastructure maintenance projects across France’s hydropower fleet. This component includes the building and strengthening of dams, canals, spillways, and supporting structures that ensure safe and continuous water flow to turbines. As aging infrastructure faces climate-related stress and higher safety standards, there is a growing need to reinforce foundations, repair concrete works, and implement erosion control.

Expansion of small-scale and pumped storage hydropower systems also requires new civil layouts tailored for specific terrains. Furthermore, better flood control and environmental integration in plant design have increased the demand for smart and sustainable construction methods. These activities are not just supporting power generation but also contributing to job creation and regional development linked to renewable infrastructure upgrades.

By End User Analysis

Utility segment will be leading in 2025 with a share of 87.2%, driven by its central role in generating and distributing large-scale hydropower across France. Utilities manage most of the country’s major hydro facilities, ensuring a stable supply of clean electricity to millions of homes and businesses. These operators focus on long-term planning, grid integration, and system reliability, which aligns perfectly with the characteristics of hydropower—predictable, dispatchable, and renewable.

Their involvement in modernization projects, digital monitoring, and grid-balancing strategies further supports the growth of hydropower as a key pillar in the national energy mix. With policy support for carbon neutrality and increased renewable targets, utility companies are accelerating investments in both conventional and pumped storage hydro, reinforcing their leadership in the sector and ensuring that hydropower remains vital to France’s low-carbon energy goals.

Industrial segment, having significant growth over the forecast period, is gaining attention as more industries seek reliable and sustainable power sources to meet energy and emissions goals. Hydropower offers a clean, steady electricity supply that can lower operational costs over time and help reduce dependency on fossil fuels. Energy-intensive sectors such as manufacturing, mining, and food processing are beginning to explore direct supply agreements or invest in nearby hydro installations to meet their power needs.

This shift is also influenced by regulatory pressures and sustainability reporting standards, which push companies to use more green energy. Additionally, industries located in river-accessible areas or near existing hydropower plants find it practical to tap into this source for stable and localized energy. As industrial decarbonization becomes a national priority, hydropower is emerging as a strong alternative for industrial energy resilience.

The France Hydropower Market Report is segmented on the basis of the following:

By Capacity

- Micro & Pico Hydropower

- Mini Hydropower

- Small Hydropower

- Medium & Large Hydropower

By Component

- Electromechanical Equipment

- Electric & Power Infrastructure

- Civil Construction

- Others

By End User

- Utility

- Industrial

- Others

Competitive Landscape

The hydropower market in France is made up of a mix of long-established operators and newer players, all working within a mature and well-regulated energy system. Most of the capacity is managed by large national producers, but smaller regional firms also contribute, especially in the small and micro hydropower segments. Competition in this market mainly revolves around securing long-term concessions, upgrading existing plants, and offering reliable grid support.

Since opportunities for building new large dams are limited, companies focus on modernizing older facilities, improving efficiency, and meeting environmental rules. Government policies and auction-based contracts also shape the market, encouraging fair competition while ensuring stable electricity supply. Overall, the landscape is stable but evolving with innovation and sustainability in focus

Some of the prominent players in the France Hydropower are:

- EDF (Électricité de France)

- Engie

- CNR (Compagnie Nationale du Rhône)

- SHEM (Société Hydro-Électrique du Midi)

- Voltalia

- Akuo Energy

- Hydrostadium

- UNITe

- Valorem

- Hydronext

- Quadran Energies Libres

- GEG Energies Renouvelables

- Hydrocop

- Enedis

- Statkraft France

- Hydrea

- Neoen

- Enercoop

- Energie des Hauts de France

- H3C Energies

- Other Key Players

Recent Developments

- In April 2025, French energy firm EDF will invest in a 120 MW hydropower project in Tamatave, Madagascar, aiming to supply electricity to around 2 million households by 2030. The €500 million project is expected to generate 750 GWh annually. EDF Renewables will take a 37.5% stake in the CGHV consortium, leading the project, alongside Axian (37.5%) and Africa50 (25%). As of end-2023, hydropower made up 22% of Madagascar’s installed capacity and accounted for 43% of its electricity generation.

- In December 2024, Saudi Arabia and France agreed to strengthen their energy partnership, focusing on hydrogen and low-emission electricity. Following a meeting between their energy ministers, both countries reaffirmed their commitment to clean energy and climate goals under the Paris Agreement. Building on a 2023 memorandum, the collaboration includes a roadmap for hydrogen, covering technology, business, and policy coordination. The two nations aim to jointly promote hydrogen production, transport, and use across industries, mobility, and power generation to support a sustainable energy future.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.7 Bn |

| Forecast Value (2034) |

USD 6.1 Bn |

| CAGR (2025–2034) |

0.7% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Capacity (Micro & Pico Hydropower, Mini Hydropower, Small Hydropower, and Medium & Large Hydropower), By Component (Electromechanical Equipment, Electric & Power Infrastructure, Civil Construction, and Others), By End User (Utility, Industrial, and Others) |

| Regional Coverage |

France |

| Prominent Players |

EDF (Électricité de France), Engie, CNR (Compagnie Nationale du Rhône), SHEM (Société Hydro-Électrique du Midi), Voltalia, Akuo Energy, Hydrostadium, UNITe, Valorem, Hydronext, Quadran Energies Libres, GEG Energies Renouvelables, Hydrocop, Enedis, Statkraft France, Hydrea, Neoen, Enercoop, Energie des Hauts de France, H3C Energies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The France Hydropower Market size is expected to reach a value of USD 5.7 billion in 2025 and is expected to reach USD 6.1 billion by the end of 2034.

Some of the major key players in the France Hydropower Market are EDF (Électricité de France), Engie, CNR (Compagnie Nationale du Rhône), SHEM (Société Hydro-Électrique du Midi), and others

The market is growing at a CAGR of 0.7 percent over the forecasted period.