Market Overview

The Global

Fraud Detection and Prevention Market size is projected to reach

USD 39.7 billion in 2025 and grow at a compound annual growth rate of

19.4% from there until 2034 to reach a value of

USD 195.7 billion.

Fraud detection and prevention covers the combination of methods, together with technological tools and criminal prevention strategies, which help identify fraud before it creates financial loss. The process begins with watching for transaction signs of being fraudulent and ends with the use of

artificial intelligence (AI) and machine learning (ML) tools to identify atypical patterns.

The main objective focuses on securing money from dishonest activities, which include identity theft, payment fraud, and financial scams that target individuals, businesses, and financial institutions. The systems act as identity verification tools that detect anomalous behaviors, thus preventing harmful transactions from processing.

The requirement for fraud detection, together with prevention strategies, has developed at a rapid pace throughout the last few years. The growth of digital payment systems, mobile banking platforms, and online financial services is responsible for this upward trend. Online activity expansion has triggered fraudsters to discover innovative ways of deceiving computer systems and digital users. Organizations across private and public institutions dedicate large funding toward solutions that automate the detection and interception of fraudulent activities during real-time operations.

The four sectors, which include banking, insurance, e-commerce, and government, serve as major consumers of these technologies due to their large work with data security as well as money management requirements.

Several upcoming patterns are driving the development of fraud detection and prevention methods. AI and ML serve as one of the primary drivers in the fraud detection field. Such tools enable computer systems to learn from their data, which results in improved abilities to discover novel types of fraud in operation. The adoption of biometric security technologies, representing facial and fingerprint recognition methods, rises as an emerging trend for verifying user identities.

The broad adoption of multi-factor authentication requires several different methods of verification for users to gain system access. Cloud-based systems have become prevalent because these solutions enable faster development of updates and seamless connection between different systems.

The detection and prevention of fraud have undergone significant changes because of major worldwide events that occurred in recent times. The pandemic lockdown forced users toward digital payments, leading to increased cyberspace fraud attempts. The public’s online behavior and rising anxiety allowed criminal groups to start their operations through scams, fake support services, and phishing attempts. The rapid increase in fraudulent activities pushed companies to develop advanced security systems because their existing tactics proved insufficient against evolving threats.

The frequency of synthetic identity fraud has grown because criminals integrate genuine information with fictional details to produce entirely new false identity profiles. These fraud methods are hidden from detection since they follow no recognized fraud patterns. The combination of AI-generated realistic fake documents creates a challenge for older fraud detection systems to remain effective because AI provides ongoing support to these fraud tactics. Companies direct their efforts toward verification systems and behavioral assessments instead of maintaining their dependency on stationary identification factors such as names or addresses.

The battle against fraud demands teamwork between human operators and technical solutions, and government oversight to ensure its progress. Business organizations and government agencies must develop closer collaboration efforts to exchange information, which helps prevent early fraud detection. Employees need proper training as well as customer education about associated risks to combat fraud effectively. The constant evolution of fraudulent techniques forces businesses to remain active in their threat detection and menu rapid system adjustments to deprive criminals of their new tactics to exploit system vulnerabilities.

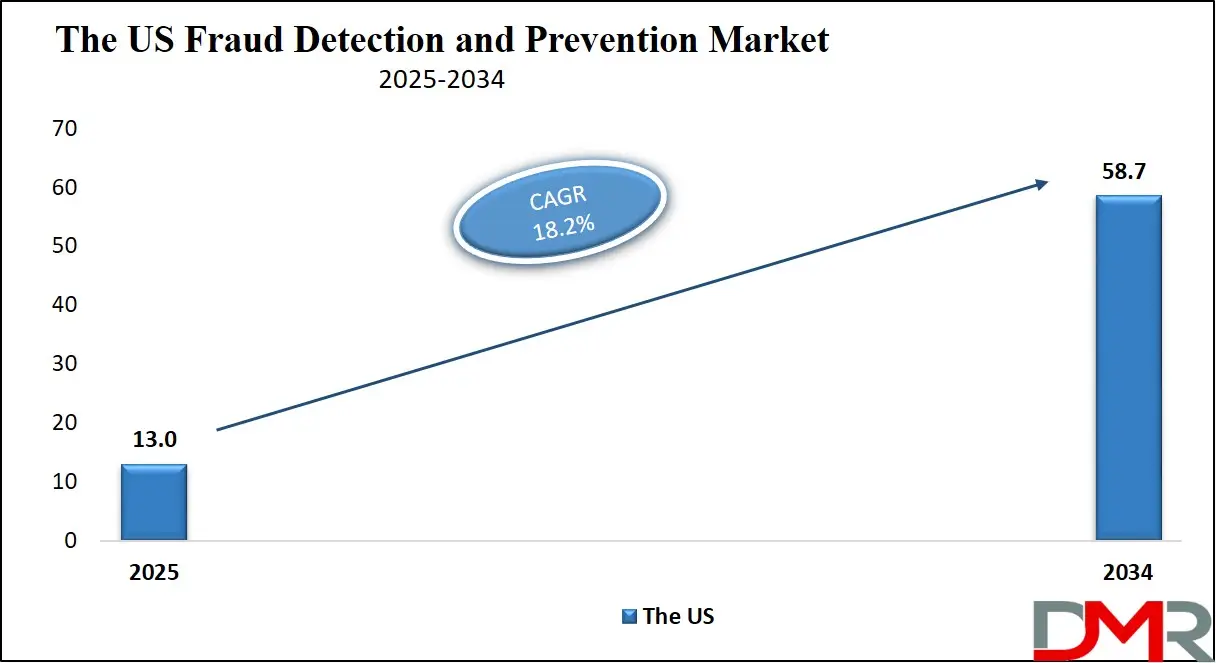

The US Fraud Detection and Prevention Market

The US Fraud Detection and Prevention Market size is projected to reach USD 13.0 billion in 2025 at a compound annual growth rate of 18.2% over its forecast period.

The US maintains authority in global fraud protection markets because its financial infrastructure operates advanced systems and processes a large volume of digital transactions before others. US-based institutions allocate substantial resources to AI, machine learning, and real-time analytics systems to battle growing fraud threats effectively. The nation maintains several important fraud solution development companies and cybersecurity organizations, which contribute to ongoing advances in this field.

The SEC and FINCEN, along with other regulatory bodies, create market demand for enhanced fraud controls through their pressure on organizations. The increase of synthetic identity fraud and data breaches, along with mobile payment scams, makes fraud prevention critical while creating a prosperous growth environment for the industry in the United States.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Fraud Detection and Prevention Market

Europe Fraud Detection and Prevention Market size is projected to reach

USD 9.7 billion in 2025 at a compound annual growth rate of

17.9% over its forecast period.

The fraud detection and prevention market in Europe maintains its strong position due to strong regulatory mandates from GDPR and PSD2, which enforce better security practices in financial services. As digital banking, along with e-commerce and mobile payments, expands, the analysis of fraud prevention technologies has received major investment in the region. Multiple European nations use AI together with

machine learning and behavioral analytics to fight increasing instances of fraud that threaten banking and insurance sectors and online retail services.

Businesses require affordable solutions for data protection and cross-border transaction management that follow regulatory requirements. The growing specialization of fraud continues to drive market growth in fraud detection because European nations pay close attention to security and compliance standards.

Japan Fraud Detection and Prevention Market

Japan Fraud Detection and Prevention Market size is projected to reach USD 6.2 billion in 2025 at a compound annual growth rate of 19.9% over its forecast period.

In Japan, the fraud detection and prevention market functions strongly because of its advanced technology infrastructure and strict regulatory requirements. The developing digital banking sector, with expanding e-commerce and mobile payment systems, requires enhanced fraud protection tactics to protect users' interests.

Japanese financial institutions direct funds toward advanced technologies such as artificial intelligence, machine learning,

biometric technology, and biometric authentication to combat fraud automatically in real time. The country's rigorous data protection and privacy laws drive the production of powerful security systems because of their regulatory benefits. The global fraud detection market will remain under Japanese leadership because of their dedication to innovation and regulatory compliance as fraud tactics become more advanced.

Fraud Detection and Prevention Market: Key Takeaways

- Market Growth: The Fraud Detection and Prevention Market size is expected to grow by 149.1 billion, at a CAGR of 19.4%, during the forecasted period of 2026 to 2034.

- By Component: The solution segment is anticipated to get the majority share of the Fraud Detection and Prevention Market in 2025.

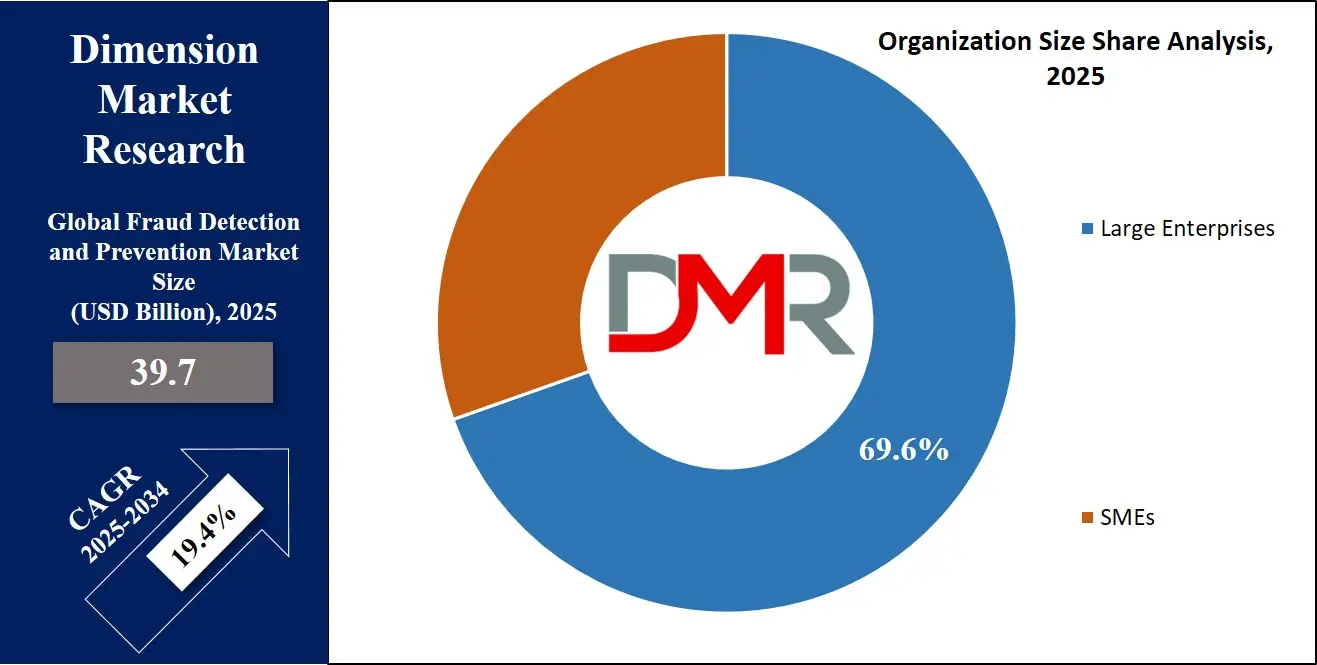

- By Organization Size: The large enterprise segment is expected to get the largest revenue share in 2025 in the Fraud Detection and Prevention Market.

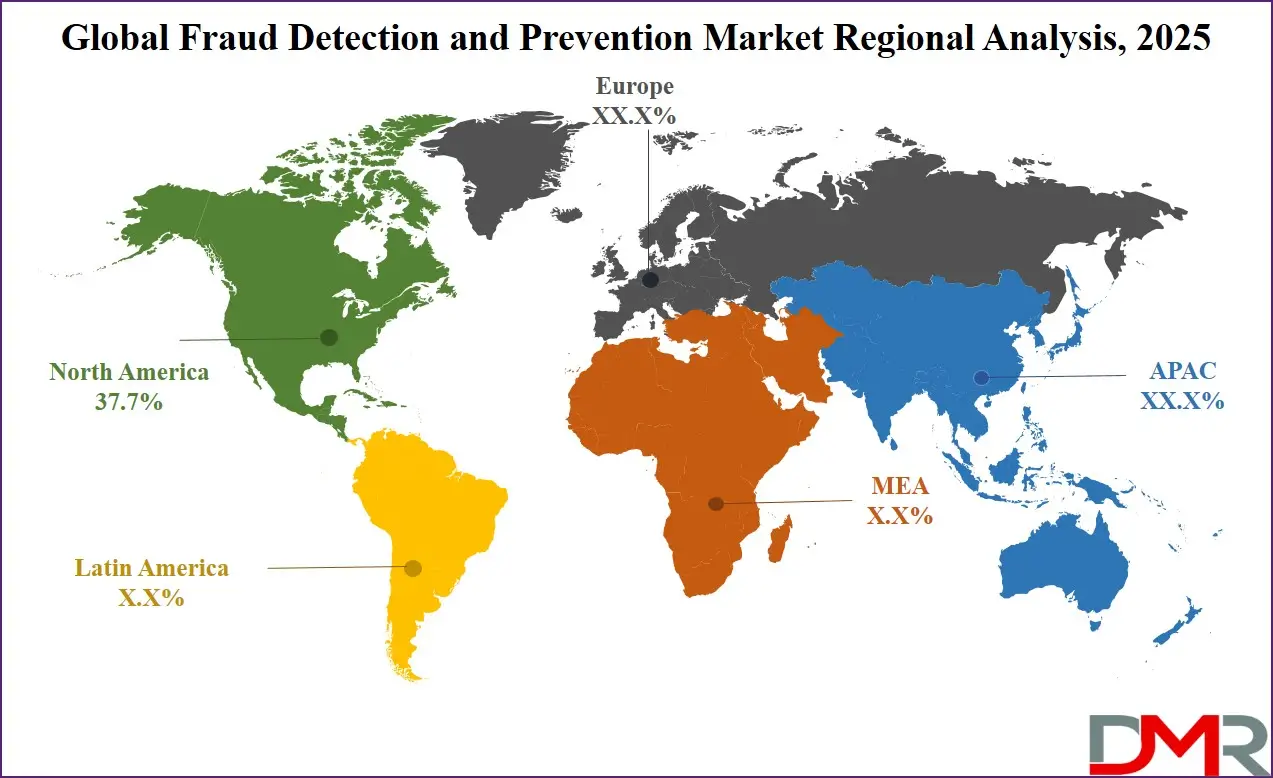

- Regional Insight: North America is expected to hold a 37.7% share of revenue in the Global Fraud Detection and Prevention Market in 2025.

- Use Cases: Some of the use cases of Fraud Detection and Prevention include synthetic identity detection, account takeover prevention, and more.

Fraud Detection and Prevention Market: Use Cases

- Online Transaction Monitoring: Online banking systems, along with digital payment services, use real-time fraud detection software for transaction monitoring, which automatically flags out-of-the-ordinary purchase patterns, large transfers, and multiple logins across unusual geographical areas to block fraud before it happens.

- Synthetic Identity Detection: Financial institutions deploy AI tools to discover synthetic identities by assessing personal details that include Social Security numbers combined with email activities and application records for spotting dubious profiles made from genuine and artificial information to carry out fraudulent activities.

- Account Takeover Prevention: Running fraud prevention tools prevents unauthorized access to user accounts through automated monitoring of login activities and device identification and geographic location data, which stops phishing exploits and the stealing of user credentials.

- Insurance Claim Fraud Detection: Insurance organizations use fraud detection technologies that analyze historical claims together with documentation styles and customer actions to identify suspicious claim activities, allowing additional review while lowering insurance payouts through decreased cases of insurance fraud.

Stats & Facts

- According to Alloy, over 50% of financial institutions—including banks, fintechs, and credit unions—reported an increase in business fraud, while more than two-thirds noted a rise in consumer fraud, signaling a broad surge in criminal activity across both commercial and individual segments.

- NICE Actimize highlights that synthetic identity fraud skyrocketed 37% year-over-year, driven by criminals using AI to craft realistic yet fake personas that infiltrate financial systems undetected and operate like legitimate customers.

- In a single year, Alloy reports that 35% of institutions experienced over 1,000 fraud attempts, while an alarming 10% faced more than 10,000, revealing how fraud is not just persistent but increasingly high-volume and industrialized in scale.

- Based on data from NICE Actimize, elder financial abuse rose by 9.7% in 2024, with 171,233 suspicious activity reports filed, as scammers exploited trust, digital inexperience, and emotional manipulation to steal from vulnerable seniors.

- According to Alloy, 39% of all Suspicious Activity Reports (SARs) filed were attributed to fraud, and 25% of financial organizations admitted to losing $1 million or more to fraud, while consumer-reported losses exceeded a staggering $10 billion.

- NICE Actimize reports that SAR filings surged by 51.8% from 2020 to 2024, peaking in 2023 before seeing a marginal 0.2% decline in 2024, underscoring the evolving nature of financial crime rather than its abatement.

- Fraudsters are accelerating the use of automated cyberattacks; NICE Actimize notes a 12.4% increase in cyber event-related SARs as attackers exploit security gaps and breach systems faster than institutions can respond.

- According to Alloy, the use of knowledge-based authentication rose from 37% to 50% in one year, even though fraudsters have repeatedly managed to bypass such mechanisms, showing the challenge of staying ahead of evolving fraud tactics.

- Mobile payment fraud increased 16%, while branch-based fraud declined 2.3%, NICE Actimize observes, clearly illustrating the shift of fraud from physical to digital channels as consumer behavior evolves and criminals follow suit.

- Driven by market instability, NICE Actimize notes a sharp rise in asset-backed loan fraud, with bad actors faking incomes, forging documents, and draining funds from lenders facing economic pressure and oversight fatigue.

- According to Alloy, financial institutions are responding to the fraud surge by ramping up investment in third-party fraud prevention tools—over 50% have increased spending, and 75% have adopted Identity Risk Solutions to mitigate threats.

- Advances in generative AI are expected to cost banks $40 billion in fraud losses by 2027, according to Alloy, as bad actors refine their tactics using increasingly powerful and adaptive AI tools that overwhelm traditional defenses.

Market Dynamic

Driving Factors in the Fraud Detection and Prevention Market

Surge in Digital Transactions and Online Services

Digital banking and e-commerce, alongside mobile payments and online financial services, comprise a considerable opportunity for fraud because they have grown rapidly over time. Digital transformation has expanded the number of avenues available for fraudsters because more people conduct their financial activities through digital platforms.

The digital transformation has led to an intense market need for real-time fraud prevention tools compatible with various digital platforms. Organizations face an imperative to implement platform security measures that do not disrupt user interactions. The growing number of digital-first consumers who pay without contact grew alongside remote onboarding processes, which force financial institutions to strengthen their fraud protection systems. Digital infrastructure has identified fraud detection as an essential building block because this blockchain-enabled pattern exists as a permanent global force.

Increasing Sophistication of Cybercrime and Fraud Tactics

Hackers use artificial intelligence along with automation,

DeepFake AI, and social engineering practices to conduct their digital attacks, which target both system breaches and user deception. Fraudsters currently use progressively advanced methods in synthetic identity fraud, account takeovers, and phishing attacks, which make them difficult to detect.

The evolution of fraudulent methods requires organizations to adopt improved detection systems built on behavior assessment methods, machine learning, and predictive analytics capabilities. The growing complexity of cybercriminal practices leads organizations to urgently seek new-generation fraud prevention technologies that operate quickly and intelligently.

These modern technologies have driven financial organizations, together with government departments and e-commerce operators, to take proactive measures to defend against potential cyber threats. The essential demand for proactive detection and layered security measures drives market expansion in fraud prevention throughout all industrial sectors.

Restraints in the Fraud Detection and Prevention Market

High Implementation Costs and Technical Complexity

The adoption of fraud detection tools faces significant challenges because installation and maintenance expenses prove to be very costly. Organizations struggle to implement sophisticated fraud detection systems because such technology demands major expenditures for both technological infrastructure and expert personnel. The management of complex or expensive fraud detection systems proves difficult, mainly for businesses with average to small scales.

The integration process with existing infrastructure often becomes complex because it takes a long time and needs constant system updates for effectiveness. Many organizations encounter problems when they try to train their employees or keep specialized internal expertise within their organizations. The market faces a restriction in expansion because limited financial means and technological complexity slow down widespread adoption, particularly in areas with scarce resources.

Privacy Concerns and Regulatory Compliance Issues

Fraud detection systems achieve their mission by using massive quantities of personal data, which they process to detect anomalous behaviors. Strict privacy regulations, including GDPR, along with additional regional laws, create substantial worries regarding user data safety because of the possible disclosure that emerges from AI-based fraud prevention systems. Organizations need to establish fair measures to achieve maximum fraud protection without violating individual rights, yet this achievement remains challenging to accomplish.

When sensitive data is improperly managed, it generates three major consequences: legal penalties and problems, and destruction of corporate reputation, together with customer trust loss. Individual countries have distinct compliance standards that create challenges for worldwide businesses when trying to deploy universal fraud prevention methods. The deployment delays and enhanced regulatory requirements function as a major market expansion barrier because of these challenges.

Opportunities in the Fraud Detection and Prevention Market

Growing Adoption of AI and Machine Learning Technologies

The integration of artificial intelligence (AI) with machine learning (ML) technologies creates a major opportunity for the fraud detection and prevention market. Systems leverage these technologies to study historical information while recognizing advanced fraud methods at the same time, they develop new ways to prevent emerging threats. The development of fraud techniques exceeds the capacity of rule-based systems, while AI tools provide immediate anomaly detection that proves accurate and reduces false alarms.

Financial institutions, e-commerce companies, and government agencies use AI to enhance their fraud detection programs in a parallel fashion. Automated response systems, along with enhanced prediction modeling, will perform as a leading market expansion factor for the future. Solution providers will find growing revenue opportunities when more organizations start adopting this technology as it becomes more mature.

Expansion into Emerging Markets and Underserved Sectors

Companies that provide fraud detection solutions should focus on the substantial growth potential available in Asia, alongside Africa and Latin America. The rising adoption of digital technologies across emerging regions due to mobile banking, together with fintech innovation, along with internet connectivity, leads to increased fraud risks. These areas contain numerous businesses that sustain their security through flawed, antiquated procedures and have not established formal fraud management programs.

Local organizations require practical and cost-efficient fraud prevention solutions that match their specific needs, so the market demand is strong. The digitization of healthcare, retail, and education sectors creates new opportunities for fraud solution providers because such sectors have become more susceptible to fraudulent practices. These underdeveloped markets will emerge as the main growth areas for the industry as awareness rises, together with regulatory requirements.

Trends in the Fraud Detection and Prevention Market

Rise of AI-Driven Deepfake and Voice Cloning Fraud

The growing trend in modern fraud involves AI techniques such as deepfakes as well as voice cloning for deceiving institutions and individuals. Scammers possess advanced capabilities to duplicate someone's voice and produce phony video footage that can deceive victims through obtaining unauthorized access.

A reporter showed how an AI voice generator replicated her voice to trick bank security systems because these technologies allow criminal actors to execute attacks with relative ease. The recent technological breakthrough creates a critical obstacle for standard fraud detection systems, which require complex, enhanced verification methods to fight AI-supported fraudulent operations.

Emphasis on Behavioral Analytics for Fraud Detection

Businesses are mainly using behavioral analytics to discover fraudulently conducted activities as one of the latest changes observed in the field. The analysis of behavioral patterns consisting of user habits, together with login information and device activities, now serves as an essential method for fraud detection. The dynamic nature of this detection method allows sophisticated fraud schemes to be identified, preventing them from escaping conventional static rule systems. Fraud preventive measures achieve better performance through user behavior baseline establishment, which enables quick detection of abnormal conduct for proper examination.

Research Scope and Analysis

By Component Analysis

The fraud detection and prevention market will experience dominant growth in 2025 due to solutions which will claim 68.4% of the market share. Various industries including finance and e-commerce have seen rising amounts of complex fraud which drives companies to buy enhanced fraud detection systems. Security systems which employ artificial intelligence along with machine learning capabilities and real-time detection systems block fraudulent actions effectively.

Organization automation in fraud detection shortens response times to threats which simultaneously reduces losses from financial crimes. New developments in digital transactions and fraudulent behavior patterns have generated additional market need for these solutions. Market growth drivers will increase since businesses focus on security and regulatory compliance, which leads them to adopt more robust fraud prevention systems.

The service segment will see substantial expansion throughout the forecast period for the fraud detection and prevention market. The services enable the proper installation and modification of fraud prevention systems as well as service maintenance to guarantee their optimal functioning. Advanced fraud detection technologies require expert support from companies to enable the successful implementation and optimization of these solutions.

Managed service providers enjoy rising consumer interest while consulting and training services gain prominence because organizations aim to anticipate and prevent fraud risks effectively. Service providers conduct regular assessments and provide updates that allow organizations to maintain compliance with changing regulations and current fraud trends. Enhanced security infrastructure depends on services that have emerged as an essential part for companies aiming to fight fraud at scale.

By Deployment Mode Analysis

The cloud deployment will lead the fraud detection and prevention market as it will hold the leading segment with a 64.4% share in 2025. Organizations find cloud solutions highly useful for fraud prevention because of their adaptable capabilities and ability to scale. Businesses can use advanced fraud prevention tools from cloud-based systems without making substantial investments in infrastructure, which enables and simplifies growth according to their changing requirements.

The solutions support immediate data processing and create direct connections between several platforms for better detection accuracy. Cloud deployment helps organizations improve teamwork and speed up their update cycles to help them detect and prevent newly emerging fraud strategies. The rising number of digital transactions, coupled with evolving fraud patterns, makes cloud-based fraud detection systems the preferred solution for businesses operating in different sectors.

Further, the adoption of the on-premises deployment mode will continue to expand rapidly during the predicted market period for fraud detection and prevention systems. Enterprises focusing on strict data protection regulations together with high security needs usually select on-premises solutions because they get total control over sensitive information and security infrastructure. Businesses maintain full control of their fraud detection system configuration through this deployment mode according to their organization's requirements.

The investment costs for on-premises systems are higher, together with maintenance demands, but organizations favored these solutions for their ability to control data storage while integrating well with existing systems. Some market segments continue to choose on-premises deployment as their preferred anti-fraud strategy because of data security issues and regulatory obligations, so the market demand for such solutions remains stable.

By Organization Size Analysis

The large enterprises in 2025 will dominate the fraud detection and prevention market by having a 69.6% market share, due to the extensive nature of big enterprises, making them targets for advanced fraud criminals because they need highly specialized protective platforms that work at large scales to defend their business operations.

Large enterprises need advanced fraud detection systems that use machine learning and artificial intelligence to monitor their abundant data and transactions and efficiently stop fraudulent transactions. The implementation of strict regulatory requirements has led such organizations to require solutions focused on compliance. Large enterprises invest significant resources in cybersecurity personnel to adopt leading-edge fraud prevention systems, which in turn power the development of new techniques and expand market capabilities.

SMEs will also display remarkable market expansion regarding fraud detection and prevention throughout the forecast period. Small to medium-sized enterprises that operate with minimal resources compared to large enterprises understand the fraud danger, and they acquire economical, scalable security solutions. Small and medium-sized enterprises turn to digital transaction protection tools because of highly sophisticated attacks and changing digital workflows.

These organizations now actively search for fraud prevention solutions that match their organizational requirements. Small and medium-sized enterprises choose cloud-based systems with affordable pricing, along with flexible features that skip the requirement for big infrastructure systems. SMEs continue making cybersecurity investments to combat growing fraud risks, which drives the market’s expanding size.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Area Analysis

Payment fraud will lead the market in 2025 by reaching a

31.3% market share because it strongly contributes to the expansion of the fraud detection and prevention space. The increase in digital payment activities leads to elevated payment fraud risk which has become a critical challenge for business organizations in all industries. The rise of sophisticated fraudsters aims at exploiting payment system weaknesses which they target in e-commerce and mobile payments.

The substantial investments made by organizations in exceptional fraud detection technologies such as machine learning and biometric verification and real-time transaction monitoring help minimize fraud incidents. Prevention of payment fraud protects businesses from harming both their customers and maintaining positive financial operations. Payment fraud has emerged as a pressing concern in the fraud detection market, thus driving organizations to seek effective adaptive solutions to address this growing threat.

Further, the billing category of fraud shows substantial growth in fraud detection applications across the prediction period. Online transaction growth, along with subscription-based services, created billing fraud that severely impacts consumers and businesses. Expected recipients often experience attacks on their billing systems through fraudulent payment transactions, which include charge manipulation and unauthorized payments alongside identity theft incidents.

The increasing instances of billing fraud lead businesses to adopt progressive fraud detection tools for managing their billing procedures. AI anomaly detection systems alongside secure payment gateways currently achieve widespread adoption to detect suspicious transactions and secure payment processes. Organizations are increasing their investment in proper detection tools because it ensures revenue protection along with customer trust.

By Industrial Vertical Analysis

The BFSI banking sector stands as the market leader in 2025 by controlling 34.9% of the total business. Institutions operating in this sector remain key targets for fraudulent activities so these organizations require top-level fraud detection solutions. The BFSI organizations experience continuous threats due to their large financial data while handling transactions through methods like identity theft payment fraud and money laundering.

These risks prompt BFSI organizations to put large resources into adopting sophisticated fraud detection technologies featuring machine learning alongside AI and biometric authentication. The increased strictness of regulatory standards compels BFSI institutions to implement advanced and compliance-suited fraud prevention systems. The market maintains continuous expansion because financial institutions and businesses consistently require protection for their customer information, along with their financial resources.

Further, the IT & Telecom industry has demonstrated substantial expansion within the fraud prevention field. The growing dependence on digital networks by consumers, along with businesses, has created greater opportunities for cyber threats, which include subscription fraud and account takeovers, along with service abuse. Telecom organizations remain at high risk because they manage substantial customer information alongside their large network of digital services.

Telecom companies now use integrated fraud detection solutions for the protection of network systems in addition to user security. Machine learning technologies coupled with AI systems to identify irregularities in activities that take place through computer networks and user interactions. Telecom and IT services are utilizing next-generation security solutions for transaction safety and user information protection as they extend their operations worldwide, which drives the industry forward.

The Fraud Detection and Prevention Market Report is segmented on the basis of the following:

By Component

- Solutions

- Fraud Analytics

- Authentication

- Governance, Risk, and Compliance (GRC)

- Services

- Professional Services

- Managed Services

By Deployment Mode

By Organization Size

By Application Area

- Payment Fraud

- Identity Theft

- Money Laundering

- Insurance Claim Fraud

- Billing Fraud

- Others

By Industry Vertical

- BFSI

- Retail and E-commerce

- Government and Public Sector

- Healthcare

- IT and Telecom

- Manufacturing

- Travel and Transportation

- Others

Regional Analysis

Leading Region in the Fraud Detection and Prevention Market

In the fraud detection and prevention market, the North America market will lead in 2025 controlling

37.7% of the market share. The combination of advanced digital infrastructure,, together with extensive e-commerce, along with financial services activities, transforms this region into one of the primary targets for criminal exploitation. From major companies to independent firms in North America, they are spending beneficially on state-of-the-art security systems for fraud detection to protect business operations.

The increase in digital payment usage and the rising frequency of cybercrime attacks drive businesses to adopt instant fraud prevention solutions. The regional regulatory standards obligate organizations to enhance their security measures. The rapid AI growth, along with machine learning development in fraud detection systems and strong cybersecurity awareness, has established North America as a foremost market for advanced fraud prevention technologies. The critical factors together drive the region to lead the worldwide market share.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Fraud Detection and Prevention Market

Asia Pacific is experiencing significant growth in the fraud detection and prevention market over the forecast period, driven by rapid digitalization and the rising adoption of online banking and mobile payments. With increasing cybercrime and fraud incidents, businesses in the region are investing in advanced fraud prevention solutions to protect customer data and financial transactions. The region’s expanding e-commerce sector, coupled with a growing focus on data security, is pushing demand for real-time fraud detection technologies, such as AI and machine learning. Additionally, evolving regulatory requirements are encouraging businesses to adopt more robust fraud prevention systems, ensuring the region's continued dominance in the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The rise in the levels of market competition exists in fraud detection and prevention due to mounting business requirements for security protection against growing threats. Various businesses use specialized tools like artificial intelligence systems combined with real-time monitoring features and behavior-based analytic capabilities to obtain an advantage over fraudsters. Forest competition intensifies due to higher digital transactions combined with rising online activity and the associated new risks.

The market features different vendors who either deliver end-to-end solutions combining identity verification with transaction monitoring and risk analysis capabilities or concentrate on individual segments ranging from mobile fraud protection to biometric security. The market accepts providers who have been established for a long time, along with newer companies experiencing rapid expansion. Technology in this field keeps advancing alongside evolving fraud methods to provide customers with improved features combined with speedier responses and adaptable integration.

Some of the prominent players in the Gobal Fraud Detection and Prevention are:

- IBM

- Oracle

- SAP

- FICO

- Experian

- SAS

- Equifax

- Microsoft

- Adobe

- Google Cloud

- Salesforce

- ServiceNow

- Zscaler

- Hawk AI

- Riskified

- Forter

- Fiserv

- Other Key Players

Recent Developments

- In April 2025, through their strategic alliance with DATASEERS® CSI released TruDetect and TruProtect, which represent AI-based AML compliance tools and fraud detection systems for customers. Financial institutions need to enhance operational efficiency because AML alerts generate thousands of false positives, which cost 70 minutes each to verify, as per Celent. Banks have placed advanced tools at the front of their priorities due to $12.5 billion in consumer fraud losses in 2024.

- In April 2025, Lynx Financial Crime Tech released the enhanced Daily Adaptive Models (DAMs) which serve as their advanced fraud detection product to help financial institutions fight advanced threats. Lynx’s mission to optimize real-time fraud prevention receives support from this platform update. DAMs provide a critical advantage through daily retraining and adaptation to new data which enables better fraud savings and reduces operational friction compared to traditional static machine learning models despite the surge in fraud cases along with daily losses exceeding £3 million per day as reported by UK Finance.

- In November 2024, Paisabazaar, India’s leading lending marketplace, has introduced a new Fraud Detection and Prevention System on its platform to boost trust and promote responsible lending. Using advanced machine learning and real-time data analytics, the system aims to detect and prevent fraudulent activities. This move addresses growing concerns in the lending sector, including financial risks and operational inefficiencies.

- In October 2024, The U.S. Department of the Treasury reported through its data and technology-based anti-fraud approaches that authorities prevented and recovered more than $4 billion throughout fiscal year 2024 (October 2023–September 2024) which showed substantial improvement over the $652.7 million recovered in 2023. Through meaningful advancements OPI in the Bureau of Fiscal Service instituted improved fraud prevention tools while increasing its support toward government agency customers who are existing as well as new to the system.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 39.7 Bn |

| Forecast Value (2034) |

USD 195.7 Bn |

| CAGR (2025–2034) |

19.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 13.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Deployment Mode (Cloud and On-Premises), By Organization Size (Large Enterprises and SME), By Application Area (Payment Fraud, Identity Theft, Money Laundering, Insurance Claim Fraud, Billing Fraud, Others), By Industry Vertical (BFSI, Retail and E-commerce, Government and Public Sector, Healthcare, IT and Telecom, Manufacturing, Travel and Transportation, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

IBM, Oracle, SAP, FICO, Experian, SAS, Equifax, Microsoft, Adobe, Google Cloud, Salesforce, ServiceNow, Zscaler, Hawk AI, Riskified, Forter, Fiserv, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Fraud Detection and Prevention Market?

▾ The Global Fraud Detection and Prevention Market size is expected to reach a value of USD 39.7 billion in 2025 and is expected to reach USD 195.7 billion by the end of 2034.

Which region accounted for the largest Global Fraud Detection and Prevention Market?

▾ North America is expected to have the largest market share in the Global Fraud Detection and Prevention Market, with a share of about 37.7% in 2025.

How big is the Fraud Detection and Prevention Market in the US?

▾ The Fraud Detection and Prevention Market in the US is expected to reach USD 13.0 billion in 2025.

Who are the key players in the Global Fraud Detection and Prevention Market?

▾ Some of the major key players in the Global Fraud Detection and Prevention Market are IBM, Microsoft, Google, and others

What is the growth rate in the Global Fraud Detection and Prevention Market?

▾ The market is growing at a CAGR of 19.4 percent over the forecasted period.