Freight forwarding market is witnessing rapid expansion due to increasing global trade activity and technological innovations. Furthermore, its growth is further supported by global supply chain complexity necessitating sophisticated logistic solutions aimed at timely cargo delivery across borders.

Technology like AI, machine learning and blockchain is revolutionizing freight forwarding operations by improving efficiency, transparency and real-time shipment tracking capabilities. Freight forwarders using these cutting-edge techniques are increasingly capable of responding more swiftly and flexibly to market fluctuations and changing consumer needs essential skills in today's fast-moving ecommerce environment.

Environmental sustainability has also become a critical element of freight forwarding services, with market leaders investing heavily in green logistics solutions not only to comply with stringent global regulations but also meet rising environmental consciousness among their client base. Sustainable practices have become a source of competitive differentiation that attract clients dedicated to decreasing their ecological footprints.

Although these opportunities exist, the market faces potential drawbacks such as volatile fuel costs, geopolitical instability and international trade disputes that threaten cost structures and operational efficiencies. Forward thinking companies that use technology to refine service offerings while optimizing cost efficiencies while managing regulatory complexity should find success in today's dynamic marketplace.

Key Takeaways

- The Global Freight Forwarding Market is projected to grow from USD 229.8 billion in 2025 to USD 356.2 billion by 2034, at a CAGR of 4.8%.

- Rail Freight Forwarding led the Mode of Transport segment in 2025 with a 26.2% share, favored for its cost-efficiency and lower environmental impact.

- B2B transactions dominated the Customer Type segment in 2025, reflecting the critical role of freight forwarders in managing complex global trade logistics.

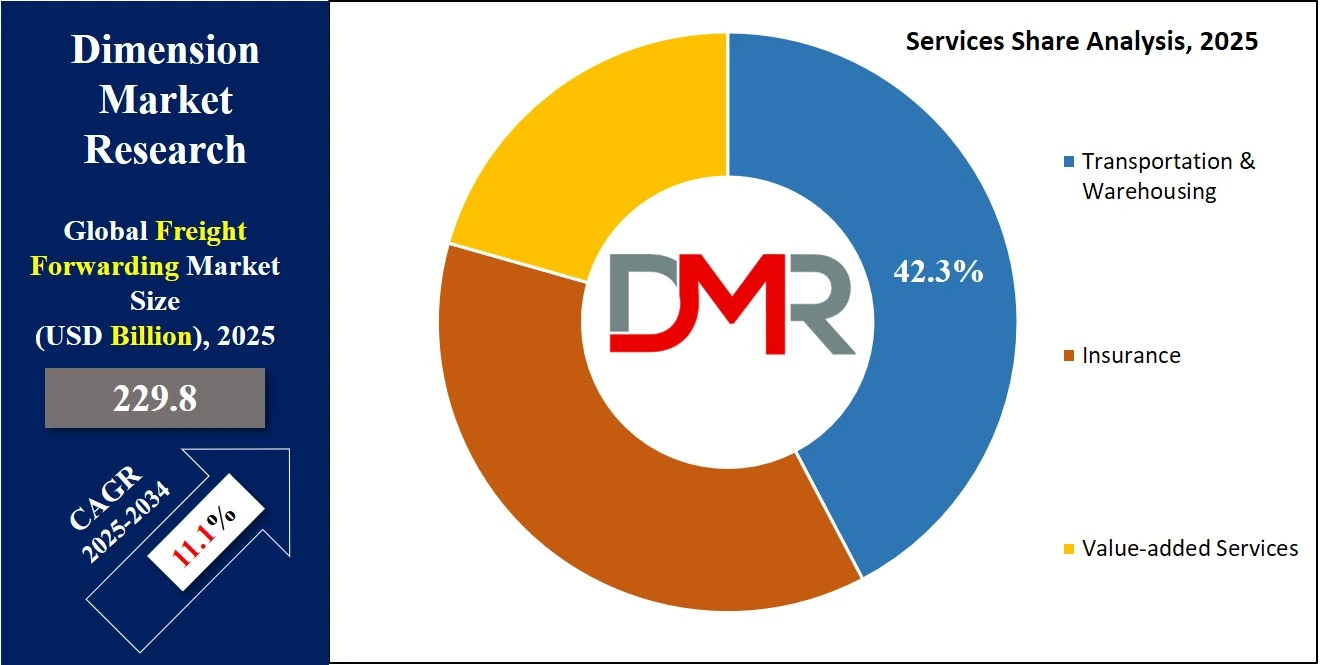

- Transportation & Warehousing accounted for 43.23% of the Services revenue in 2025, underscoring its vital role in supporting efficient global supply chains.

- In 2025, Healthcare led the Application segment of Freight Forwarding, necessitating stringent compliance and specialized handling due to its critical nature.

- North America held a dominant 34.5% share of the global freight forwarding market in 2025, supported by advanced logistics and key industry players.

Use Cases

- E-Commerce Logistics: Optimize shipments using advanced tracking and automated warehousing for faster deliveries at reduced costs.

- Sustainable Supply Chains: Implement eco-friendly solutions like biofuel transport and route optimization in order to lower environmental impact and maximize supply chains' sustainability.

- Pharmaceutical Compliance: Provide safe, secure, temperature-controlled transportation services that comply with industry requirements through real-time IoT monitoring for pharmaceuticals.

- Disaster Relief Logistics: Coordinate rapid-response logistics so essential supplies can reach disaster-struck areas quickly.

- Global Expansion Support: Provide international logistics management support to companies expanding operations internationally while adhering to compliance rules and minimizing disruptions.

Driving Factors

Global Trade Growth Fuelled by Increased Freight Forwarding Efficiency

Globalization of trade serves as an influential driver in the freight forwarding market. With international trade volumes expected to expand by 3-6% annually over the coming decade--projections indicate annual increases--international freight forwarders must provide efficient and reliable services that can navigate cross-border regulations, customs requirements and logistical obstacles successfully in order to remain relevant in this growing marketplace.

Companies within this sector must therefore increase operational capabilities as volume grows in order to remain viable competitors on an international scale. This in turn leads to market expansion and further advancement.

E-Commerce Expansion: Meeting Global Logistics Demands

Parallel to the globalization of trade, the meteoric rise of e-commerce has significantly shaped the freight forwarding market. The global e-commerce sector, expected to surpass $4.2 trillion in sales in recent years, demands rapid, reliable, and efficient logistics solutions to meet consumer expectations for swift delivery times and seamless service.

This surge in online shopping increases the volume of international and last-mile deliveries, necessitating robust global logistics networks. Freight forwarders have responded by integrating advanced technological solutions such as real-time tracking and automated logistics, further driving market growth by improving delivery efficiency and customer satisfaction.

Infrastructure Development: Strengthening Freight Movement

Infrastructure investments such as ports, railways and airports play a vital role in supporting the efficiency of freight forwarding markets. Better infrastructure allows for seamless transitions across multimodal transport services and reduces bottlenecks to speed up moving goods worldwide networks.

When governments or private investors upgrade and expand transport facilities their capacity increases to handle increased trade or e-commerce shipments - not only directly satisfying needs of freight forwarders themselves but indirectly also creating opportunities to offer more streamlined yet cost-effective services to clients.

Growth Opportunities

Digitizing Freight Forwarding Processes: Harnessing Technology to Gain Market Leadership

2023 is set to bring major advances for the global freight forwarding market by way of the digitization of operations. Companies investing in digital platforms that improve operational transparency and efficiency are not simply a fad but an imperative.

By adopting technologies like AI, IoT, and blockchain into their processes, freight forwarders can streamline processes while decreasing errors, while improving decision-making abilities - an advantage which ultimately allows them to better respond to customer demands while managing complex logistic networks efficiently and remaining competitive within technology-driven marketplaces.

Sustainable Logistics Solutions: Pioneer of Green Freight Forwarding

Implementation of sustainable logistics solutions is another area ripe for expansion. As global awareness and regulatory pressure regarding environmental impact rises, demand is on the rise for eco-friendly freight forwarding services that reduce ecological impact footprint.

Companies taking this seriously are exploring biofuel-powered transport, carbon offset programs, and efficient route planning as ways to lower ecological impact footprint. Adopting green practices not only meet customer and regulator expectations but also position these firms as leaders within an ever-evolving sector where sustainability becomes an invaluable differentiator.

Last-Mile Delivery Solutions to Meet Increased Demand: Optimizing E-commerce Fulfilment

With the growth of e-commerce, freight forwarders must focus on last mile delivery optimization as a key strategy in 2023. Consumer expectations have grown for faster deliveries due to online shopping; therefore freight forwarders must devise efficient last-mile solutions backed up with local distribution centers and technology that ensure timely deliveries if they hope for sustained growth in this space. Last-mile optimization not only enhances customer experience and drives operational efficiencies; it is therefore key component for long-term business expansion in 2023.

Key Trends

Automated Warehousing's Rising Tide: Revolutionizing Inventory Management

Automated warehousing will have a dramatic impact on the global freight forwarding market in 2023, revolutionizing inventory management processes using robotics, AI and automation technologies such as robotics to streamline warehouse operations while increasing accuracy while decreasing labor costs and processing goods more quickly without errors; increasing overall efficiency while providing swift shipping for online commerce sectors like e-commerce.

As this demand surges further along, automated warehousing stands poised to become standard among forward thinking freight forwarders providing operational excellence and competitive advantage to their business models.

Focus on Cybersecurity: Protecting Digital Frontier

With digitizing freight forwarding processes comes an increased emphasis on cybersecurity; companies have invested in safe platforms and technologies to protect sensitive client and shipment data against rising cyberthreats, thus upholding operational integrity as well as maintaining client trust while complying with global data protection regulations. Robust cybersecurity measures will remain integral parts of freight forwarding services ensuring safe service delivery in an ever-evolving global landscape.

Integrating IoT Solutions for Supply Chain Transparency

2023 will see another transformative trend: IoT adoption within freight forwarding sector. Tracking systems enabled by IoT technologies significantly enhance supply chain visibility and operational efficiencies by providing real-time data about shipment location, condition and progress for informed decision-making and proactive logistics network management. Adopting IoT not only enhances service quality but also advances how freight forwarding companies manage complex global supply chains.

Restraining Factors

High Operational Costs Are Constraining Freight Forwarder Profit Margins

One of the major obstacles confronting freight forwarding companies today is rising operational costs that limit profit margins and operational flexibility. Rising fuel prices due to geopolitical tensions or global economic conditions directly affect transport services, while labor costs continue to escalate with rising demands for skilled workers and tightened regulations around fair wages.

Maintenance and upgrade expenses associated with fleets and technology also represent significant financial strain. All these elements make cost management increasingly complex for freight forwarders; as a result they must seek more cost-efficient operational methods to preserve competitiveness and profitability.

Lack of Infrastructure in Developing Regions Impede Market Expansion

Lack of infrastructure in developing regions is another significant impediment to growth. Emerging markets that play an integral part in expanding global trade networks suffer from underdeveloped transportation facilities like ports, railways and roads that impede the efficiency and reliability of freight forwarding services, thus restricting market penetration and growth within those areas. Furthermore, such lack of adequate infrastructure impacts local operations and international supply chains by creating bottlenecks that lower overall market efficiency.

Research Scope and Analysis

Mode of Transport Analysis

Rail Freight Forwarding was the clear market leader in 2023 when it came to Mode of Transport Freight Forwarding services, boasting more than 26.2% share. This dominance can be attributed to rail freight's cost-efficiency and reliability when transporting bulky items over longer distances; industries such as automotive, mining and agriculture often prefer it due to its capacity and lower environmental impact compared to road transport options.

Ocean Freight Forwarding claimed an impressive market share due to its ability to handle massive volumes at lower costs - an essential feature of international trade that remains essential today for industries like electronics manufacturing and consumer goods that rely heavily on import/export activities across continents.

Air Freight Forwarding also found itself with a notable share in the market, being valued for its speed and reliability, making air freight an indispensable option when handling high-value, time-sensitive items such as pharmaceuticals, perishable foodstuffs or high-tech components. Although more costly than alternatives like freight forwarding services like sea or land shipping options, global supply chain complexities require rapid deliveries that meet requirements such as those found within industries like eCommerce or automotive sales channels.

Road Freight Forwarding remains an invaluable and versatile form of cargo transportation, offering flexibility and last mile connectivity that other modes cannot. Road freight plays an invaluable role within integrated logistics solutions, helping transport goods to final locations where other modes cannot. Road freight plays an especially crucial part in regions with extensive roads infrastructure supporting industries that demand timely localized delivery services.

Customer Type Analysis

In 2023, B2B held a dominant market position in the Customer Type segment of the Freight Forwarding market, reflecting its critical role in global trade and logistics. Businesses engaging in B2B transactions typically require moving large volumes of goods with complex supply chain management needs and logistical demands; freight forwarders with extensive networks and operational capacities proved vital in managing and streamlining these processes efficiently for this segment.

Especially prevalent are B2B interactions in industries like manufacturing, wholesale goods distribution and industrial products manufacturing where supply chain coordination plays an integral part in operations driving demand for robust freight forwarding solutions from freight forwarders.

As the B2C market experiences unprecedented growth with the exponential expansion of e-commerce, its B2C segment is steadily growing at an astounding rate. Consumers increasingly expect fast, reliable, and transparent shipping services when making online purchases - placing immense demands on freight forwarding companies to provide these services at reasonable cost with maximum transparency for an optimal consumer experience.

Although smaller in scale than B2B markets, B2C markets drive significant innovation within them such as advanced tracking systems development or integration of IT solutions that improve delivery efficiency or customer service.

Services Anlaysis

Transportation & Warehousing held an impressive market position within the Services segment of Freight Forwarding market in 2023, accounting for 43.23% market share in terms of Services revenue. This segment's leadership can be attributed mainly to its essential function in supporting global supply chains with efficient goods flow. Transportation & Warehousing services play a vital role in making sure freight reaches its destinations reliably, safely, and efficiently, satisfying a diverse clientele from perishable goods industries to industrial equipment manufacturers. Utilization of advanced logistics technologies has only further reinforced these services' efficiency and dependability.

Insurance services have grown increasingly important with an awareness of risk management becoming an essential element in international trade. Businesses are more cognizant of potential losses from damaged goods, lost shipments or logistical failures and thus invest more heavily in comprehensive freight forwarder policies with comprehensive protection plans to mitigate financial risk when transporting delicate or valuable cargo over vast distances. This trend can only continue as companies face greater potential liabilities for their transport of delicate cargo that must travel far distances for delivery or payment purposes.

Value-added Services also serve an integral purpose, comprising of such offerings as custom packaging, inventory management and supply chain consulting. These offerings aim to improve customer satisfaction and operational efficiencies; meeting needs that standard freight services don't cover. As companies seek ways to streamline operations and cut costs more effectively, their demand for these customized solutions grows; fueling growth of this segment within the freight forwarding market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Application Analysis

Healthcare was the clear market leader within Freight Forwarding in 2023, occupying more than

19.2% of its Application segment and accounting for 19.2% market share in terms of applications. This dominance can be largely attributed to its critical nature in pharmaceutical and medical supply transport which must adhere to stringent compliance with regulatory standards as well as special handling/storage solutions for handling. Furthermore, global health challenges have intensified this segment's expansion; with increased emphasis placed on efficient global distribution networks for healthcare products worldwide.

Food & Beverage occupies a considerable share of the market due to global food supply chains and rising perishable goods demand, placing considerable reliance on freight forwarders for maintaining product integrity via controlled logistics solutions, guaranteeing fresh food products reach consumers safely.

Oil & Gas industry remains under immense global pressures towards sustainability, yet still relies on freight forwarding services for transport of bulky equipment and hazardous materials. Furthermore, this segment requires highly specialized logistic services capable of meeting its unique safety and compliance regulations.

Industrial and Manufacturing businesses rely heavily on freight forwarding services to coordinate the distribution of machinery, components and raw materials across production stages and markets - helping ensure continued operations as well as expansion into new regions.

Freight forwarding services provide retailers with a powerful asset for meeting the dynamic consumer markets around the globe, especially since e-commerce growth requires efficient yet flexible logistics solutions.

The "Others" industry sector encompasses various sectors like automotive, electronics and textiles that rely heavily on freight forwarding services to satisfy specific demands while supporting overall market expansion. Each of these industries relies heavily on efficient, timely and secure freight forwarding solutions to satisfy their specialized requirements, reflecting freight forwarding's indispensable role in global trade while meeting diverse demands from multiple markets around the globe.

The Freight Forwarding Market Report is segmented based on the following:

By Mode of Transport

- Rail Freight Forwarding

- Ocean Freight Forwarding

- Air Freight Forwarding

- Road Freight Forwarding

By Customer Type

By Services

- Transportation & Warehousing

- Insurance

- Value-added Services

By Application

- Healthcare

- Food & Beverage

- Oil & Gas

- Industrial and Manufacturing

- Retail

- Others

Regional Analysis

North America is currently the dominant region, accounting for 34.5% of global trade. This dominance can be attributed to advanced logistics and transportation infrastructure combined with key industry players who facilitate efficient domestic and international trading operations. The U.S. leads in this region using technologies like AI and IoT to enhance logistic processes and connectivity - vital tools when supporting large volumes of goods moved both within its continent as well as across it.

European freight forwarders continue to lead in adopting sustainable practices that appeal to an eco-conscious market base, serving as an invaluable hub between Asia and North America for trade. Europe enjoys highly developed transportation networks as well as green logistics solutions prevalent throughout its countries such as Germany and Netherlands - contributing significantly towards an ever more green-conscious global trade economy.

Asia Pacific is widely acknowledged to be one of the fastest-growing regions, driven by economic expansion in China, India and Southeast Asian nations. Asia Pacific's surge is propelled by rising industrialization levels, an expanding e-commerce industry and significant investments into infrastructure development - creating an ideal setting for the freight forwarding market to flourish, making Asia Pacific an area worth targeting for market conquest in future market expansion plans.

Middle East & Africa present promising growth potential due to investments made into infrastructural developments and logistics capabilities, particularly within Saudi Arabia and UAE. Such investments aim to transform this region into an effective logistic nexus between Eastern and Western hemispheres.

Latin America, though smaller in market share, has experienced growth driven by improved trade policies and investments in transport infrastructure - particularly Brazil and Mexico. Over time, Latin America is gradually overcoming logistic inefficiencies which hampered its potential growth into an established player within global freight forwarding market.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In 2023, the global freight forwarding market has seen considerable influence and leadership from key players, each contributing unique strengths to the industry's evolution and responding adeptly to emerging challenges and opportunities.

DHL Global Forwarding and Kuehne + Nagel International AG remain market leaders due to their comprehensive service offerings and expansive global networks that help boost operational efficiencies while improving customer service capabilities.

DB Schenker, DSV Panalpina A/S and Expeditors International have held key positions throughout 2018, capitalizing on their expertise with advanced technologies like AI and blockchain to optimize tracking, logistics management and transparency - not only increasing service delivery quality but also strengthening competitive advantages in an increasingly swift-and-accurate market.

UPS Supply Chain Solutions and CEVA Logistics stand out as leaders in sustainable logistics strategies that reflect global shifts towards environmental consciousness. Both organizations have invested in eco-friendly practices and technologies, making them attractive options to clients prioritizing green logistics solutions.

Nippon Express Co. and Hellmann Worldwide Logistics have used their regional expertise and flexible service models to gain entry to emerging markets in Asia and Africa where industry is expanding quickly while demand increases rapidly for advanced logistic solutions.

Sinotrans India Private Limited and MGF (Manitoulin Global Forwarding) stand out for their expansion strategies and sector-specific logistics expertise; meeting both regional needs as well as industry demands.

Some of the prominent players in the Global Freight Forwarding Market are:

- Bolloré Logistics

- DB Schenker

- Nippon Express Co.

- UPS Supply Chain Solutions

- DHL Global Forwarding

- CEVA Logistics

- Hellmann Worldwide Logistics

- Kuehne + Nagel International AG

- Sinotrans India Private Limited

- MGF (Manitoulin Global Forwarding)

- Imerco

- Dachser

- DSV Panalpina A/S

- Expeditors International

Recent developments

- March 2024, Lisbon-based Cargofive raises €2.5 million to continue accelerating digital transformation in freight forwarding. Cargofive, headquartered in Lisbon, has successfully secured €2.5 million in funding to advance its initiatives aimed at digitalizing the freight forwarding industry.

- November 2022, GoFreight raises $23M to become the “Shopify of freight forwarding.” GoFreight has raised $23 million to further its mission of revolutionizing the freight forwarding sector by emulating Shopify's user-friendly platform model.

- January 2024, NIPPON EXPRESS HOLDINGS takes a minority stake in Wiz Freight, a leading digital forwarding services provider in India. NIPPON EXPRESS HOLDINGS has acquired a minority stake in Wiz Freight, marking a strategic expansion into the rapidly growing Indian market.

- March 13, 2024, DP World, a global leader in supply chain solutions, announces that it is expanding its freight forwarding operations across the Americas as part of its global strategy to build a comprehensive end-to-end supply chain network.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 229.8 Bn |

| Forecast Value (2034) |

USD 356.2 Bn |

| CAGR (2025-2034) |

4.8% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2034 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Mode of Transport(Rail Freight Forwarding, Ocean Freight Forwarding, Air Freight Forwarding, Road Freight Forwarding), By Customer Type(B2B, B2C), By Services(Transportation & Warehousing, Insurance, Value-added Services), By Application(Healthcare, Food & Beverage, Oil & Gas, Industrial and Manufacturing, Retail, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Bolloré Logistics, DB Schenker, Nippon Express Co., UPS Supply Chain Solutions, DHL Global Forwarding, CEVA Logistics, Hellmann Worldwide Logistics, Kuehne + Nagel International AG, Sinotrans India Private Limited, MGF (Manitoulin Global Forwarding), Imerco, Dachser, DSV Panalpina A/S, Expeditors International |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |