Frozen food items are foods that are subjected to low temperatures to preserve them for a long duration. The preservation process involves storing food below the freezing point of water to prevent microbial growth & enzymatic activity, which leads to its decay. These are convenient foods that can be stored in the freezer for a long time, and they can be consumed by reheating them in an oven or microwave.

It removes the requirement for planning and preparation of a meal and becomes a convenient option for consumers. It is available in a variety of sizes, flavors, and styles in supermarkets to cater to a wide range of evolving tastes. This convenience and the appeal of ready-to-eat meals directly tie into the Frozen Pizza and other related categories like dairy products and bakery products.

The frozen food market research is driven by the increasing popularity of shelf-stable foods among global consumers, & the adoption of these foods by many services, hotels & resorts, & quick-service restaurants. There is also an increase in impulse purchasing due to the rising demand for convenient and processed food.

Urbanization, increased disposable incomes, and the popularity of Western foods are some of the primary factors that support the market growth significantly. These foods are rapidly adopted among consumers as they offer customization according to individual tastes. Related trends in the healthy snacks and plant-based meat continue to grow as health-conscious consumers opt for plant-based frozen food products.

Key Takeaways

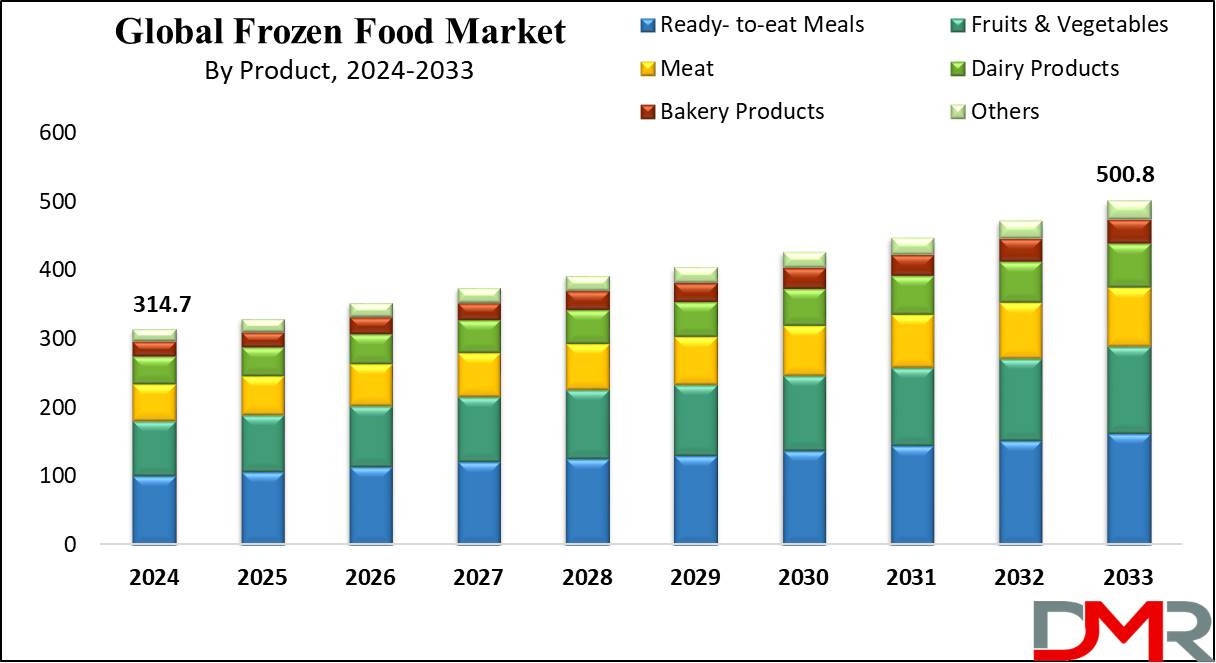

- Market size: The Global Frozen Food Market size is estimated to grow by 171.2 billion, at a CAGR of 5.3 % during the forecasted period of 2025 to 2033

- Market Definition: Frozen foods are premade foods assembled, cooked, and frozen to preserve their freshness and flavors.

- Product size segment: In terms of product, Ready-to-eat Meals are expected to dominate with the largest revenue share of 45.3 % in 2024.

- Freezing Technology segment analysis: Based on the freeing technology, Blast Freezing is anticipated to lead the market with the largest revenue share by the end of 2024.

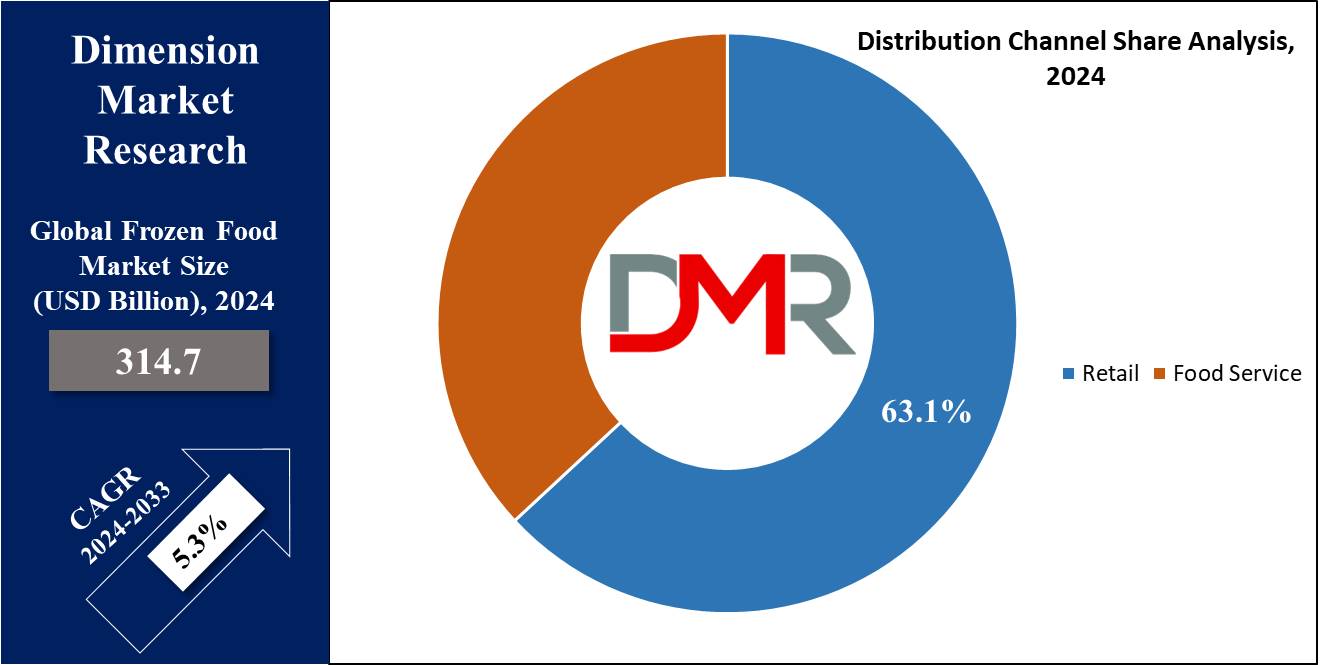

- Distribution Channel Analysis: Retail as a distribution channel is projected to dominate the market with the largest share of 63.1%.

- Regional Analysis: Europe is expected to dominate the frozen food market with a revenue share of 34.1% in 2024.

Use Cases

- Emergency Food: Frozen foods serve as a backup plan for emergency times when there is a shortage of food ingredients or when unexpected guests arrive. The rise in Cold Chain & Logistics has enabled more efficient and faster delivery of frozen goods.

- Kids' Meal: It is popular among parents as a meal option for children, as it is easy to cook just by heating it in the oven.

- Quick Meal Option: These are quick and convenient frozen meal options, particularly for busy individuals or families with limited time to prepare meals from scratch.

- Lunch Option: It is a suitable lunch option for students, office workers, or anyone looking for a simple yet satisfying meal during the day, supported by growth in the Ready to Drink Premixes Market for beverages that pair with these meals.

Market Dynamic

Drivers

Rising demand for ready-to-eat foods

The growing popularity of ready-to-eat foods is fueling the growth of frozen food products as they are time-saving and easy to cook compared to preparing food. Packaged edible food attracts a majority of consumers, including different age groups from children to elders, which leads to an increase in the demand for frozen food.

There is a high consumption of these foods due to the increasing population and busy lifestyles of consumers. The popularity of the frozen pizza market and the bakery product market demonstrates the increasing preference for these types of meals.

Ice cream is experiencing high demand due to its convenience, flavor & taste, particularly in warm places. These foods are safer to eat and reduce the possibility of contamination as they are stored at very low temperatures, which is driving the growth of this market. The food safety testing market and food pathogen testing market are essential for maintaining consumer confidence in frozen foods.

Fast food and bakery goods like cakes & pastries are continuously gaining popularity as consumer spending increases on these food items. This corresponds with the broader Food Additives Market as manufacturers focus on improving the taste and preservation of these products.

Restrains

Increasing demand for fresh and natural food

Consumers are becoming health-conscious as they prefer fresh & natural foods, & reducing the consumption of processed and convenient foods, which obstructs the growth of the frozen food market. Organic and natural frozen meals are highly nutritional and are made with fewer additives, therefore restraining the demand for frozen foods.

Research Scope and Analysis

By Product

Ready-to-eat is expected to dominate the frozen food market with the largest revenue share of 45.3% in 2024, due to its popularity among working-class consumers as they don’t have enough time to cook.

Frozen ready meals offer a variety of options like international cuisines, vegetarian and vegan choices, and healthier alternatives, which fulfill the demands of diverse dietary preferences of consumers.

Food service companies are continuously introducing new products in the ready-to-eat market as it is essential to add different types of vegetables and cheese to increase their nutritional value. The quality and shelf life of ready-to-eat meals are continuously increasing due to the advancement of food and packaging technology, which are attractive to consumers looking for convenient food options.

Fruit & vegetables are forecasted to experience the fastest growth attributed to the rising focus on health which leads adoption of frozen vegetables and fruits that do not need washing, peeling, or chopping. Increasing cases of bloated stomach and diarrhea from contaminated food further drive the growth of this segment.

By Freezing Technology

Blast Freezing is predicted to dominate the frozen food market with the largest market share by the end of 2024. These are popular for their ability to cool food items and preserve their nutritional value and freshness.

Strict government regulation towards food safety and storage increases the use of blast freezing to maintain the temperature continuously which further drives its adoption and increases the growth of this segment. The demand for blast freezing is also due to affordability, efficiency, production capacities, and lower operational costs as compared to other.

Belt Freezing is expected to experience growth due to its automation capabilities and faster processing rates, which make it an attractive choice for large-scale food production. These freezing systems can handle a large range of food products like meat, seafood, fruit, and vegetables ,which are beneficial for different food services that are looking for single freezing solutions for different products.

Individual quick freezing (IQF) allows for single use of food items, maintaining their shape, texture, and quality. It also reduces the wastage of food items by allowing consumers to use only the required amount of frozen food.

By Distribution Channel

Retail is predicted to lead the Frozen food market, and capture the largest revenue share of 63.1% in 2024, which includes supermarkets & hypermarkets, convenience stores, online, and others that serve frozen fast food.

The increased demand for fast food due to the availability of these stores is an important factor in driving the growth of this segment. Distribution of frozen food items has increased in recent times due to the rise of supermarkets & hypermarkets in local areas, which contributes to the growth of this segment.

Further, these stores often have freezer boxes, so consumers can inspect and purchase frozen food products, hence driving the growth of this segment. Online channels are predicted to grow shortly as they offer comfort and variety, allowing consumers to browse and purchase frozen pizzas from their homes, contributing to the market’s expansion.

These channels offer a wide range of vegan and plant-based items and gluten-free frozen food, which attract a broader range of consumers who are looking for healthy items.

The Global Frozen Food Market Report is segmented based on the following

By Product

- Ready-to-eat Meals

- Fruits & Vegetables

- Meat

- Dairy Products

- Bakery Products

- Others

By Freezing Technology

- Blast Freezing

- Belt Freezing

- Individual Quick Freezing

By Distribution Channel

- Retail

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

- Food Service

Regional Analysis

Europe is expected to dominate the frozen food market with the largest revenue share of 34.1% by the end of 2024 due to an increase in the standard of living and a growing preference for convenience food among consumers.

They are the biggest consumer of frozen food due to their longer shelf life & immense popularity. Demand for ready-to-eat foods, increasing population, and associated disposable income of consumers are the main factors driving the demand for frozen food in this region.

This region is continuously showing growth in the consumption of frozen food items due to its superior taste and quality. They are the biggest consumer of frozen food due to their longer shelf life and immense popularity.

Consumers in the European region are now focusing on products having high nutritional content fewer trans fats, adoption of whole multigrain wheat, & few preservatives, which is anticipated to boost the growth of this market.

Countries like China & India are showing a surge in the distribution of prepared and partially cooked frozen foods, which contribute to the growth of the global frozen food market due to the busy lifestyles of consumers in these regions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Major market participants commonly employ strategies such as introducing new products and expanding through investments. Manufacturers and suppliers are focusing on logistical improvements and strengthening distribution channels as part of their business growth strategies.

These initiatives are improving the product adoption rates among global consumers. The Frozen food market is fragmented due to many participants, and it is anticipated that there will be moderate to intense competition among the companies.

Some of the major key players in the frozen food Market are Unilever PLC, Nestlé S.A., General Mills, Inc., and Nomad Foods Ltd. Food service companies are encouraged to create products with longer shelf life by growing frozen food consumption. Companies allocate resources toward R&D to introduce high-quality frozen food products.

Some of the prominent players in the global frozen food market are

- Unilever PLC

- Nestlé S.A.

- General Mills, Inc.

- Nomad Foods Ltd.

- Tyson Foods Inc.

- Conagra Brands Inc.

- Wawona Frozen Foods

- Bellisio Parent, LLC

- The Kellogg Company

- The Kraft Heinz Company

- Others

Recent Development

- In February 2024, Twin City Foods, Inc. and Smith Frozen Foods, Inc., two prominent frozen food companies, announced a partnership that aims to align resources and strengths to better serve customer needs and respond to market demands, all while providing support to local farmers.

- In July 2023, Conagra Brands, Inc. uncovered more than 50 new products across their frozen, grocery, and snacks divisions which offer a diverse range of flavors and pricing options within its frozen meal lineup, spanning different brands and entrees.

- In August 2022, The Kraft Heinz Company, under its Oscar Mayer brand, launched Cold Dog, a flavored frozen treat, as part of its major market expansion efforts.

- In June 2022, Conagra Brands, Inc., introduced over 50 new products, including multi-serve frozen meals, across its brands like Healthy Choice, Marie Callender's, Banquet, Frontera, and others, aiming to meet customer demands.

- In April 2022, Conagra Brands, Inc., rolled out carbon-free certified carbon-neutral single-serve frozen meals to diversify its product range and take further steps towards environmental conservation.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 314.7 Bn |

| Forecast Value (2033) |

USD 500.8 Bn |

| CAGR (2024-2033) |

5.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Ready- to-eat Meals, Fruits & Vegetables, Meat, Dairy Products, Bakery Products, and Others ), By Freezing Technology (Blast Freezing, Belt Freezing, and Individual Quick Freezing ), By Distribution Channel (Retail, and Food Service) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Unilever PLC, Nestlé S.A., General Mills, Inc, Nomad Foods Ltd., Tyson Foods Inc., Conagra Brands Inc., Wawona Frozen Foods, Bellisio Parent, LLC, The Kellogg Company, The Kraft Heinz Company, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |