Market Overview

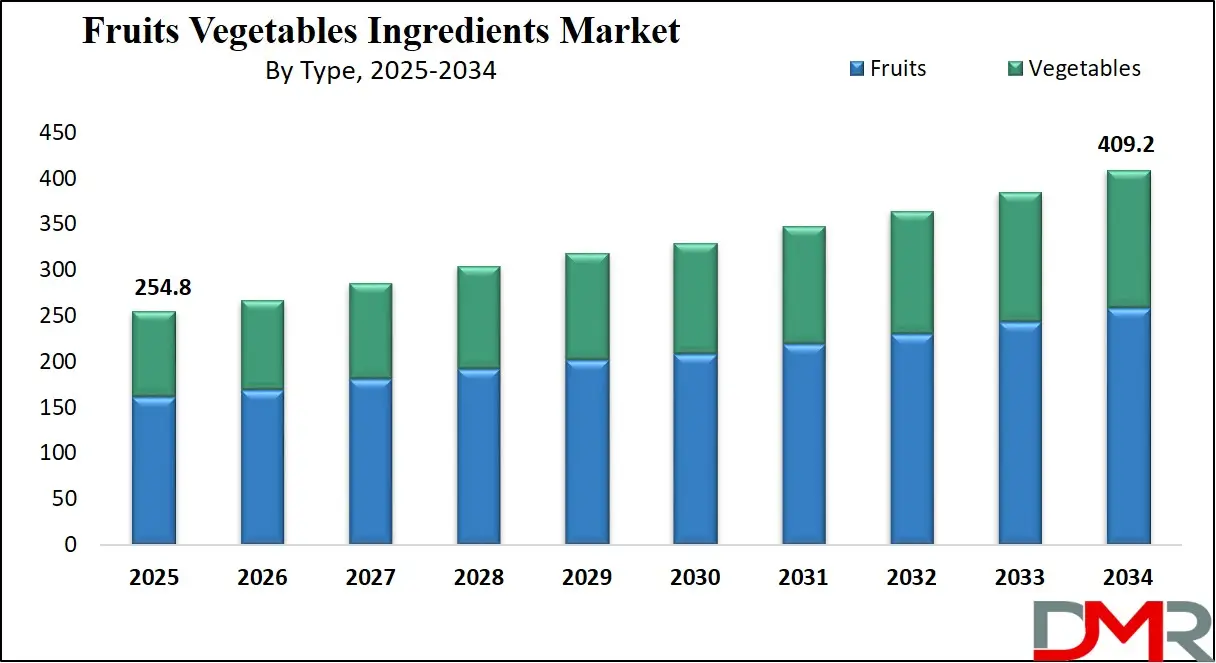

The Global Fruits and Vegetables Ingredients Market is projected to reach

USD 254.8 billion in 2025 and grow at a compound annual growth rate of

5.4% from there until 2034 to reach a value of

USD 409.2 billion.

The fruits and vegetables ingredients market is growing strongly globally, fueled by increasing consumer demand for natural, clean-label, and plant-based foods. With processed food and drinks companies reformulating their products with healthier, high-nutrient ingredients, fruit and vegetable derivatives are in greater demand for use in juices, dairy, snacks, bakery, and even savory products. Market participants are increasing product ranges with new formats such as purees, powders, and NFC (Not From Concentrate) juices to meet changing tastes and functional food trends.

A strong trend is the growing use of organic and minimally processed ingredients. Consumers are placing a higher value on transparency and nutritional quality, which is leading producers to invest in traceable, sustainable ingredients. Technology advancements in drying, concentration, and preservation continue to enhance ingredient shelf life and quality without sacrificing taste or nutritional integrity. Such technologies are aiding the creation of long-lasting, clean-label, and additive-free final products.

Although it offers promising growth, the market has limitations such as seasonal availability of raw materials, volatile commodity prices, and tight food safety requirements that could restrain scalability. Besides, the relatively high price of organic products inhibits penetration in price-sensitive geographies, compromising wider adoption. The Asia-Pacific region is also expected to grow at the quickest rate owing to urbanization, increased health awareness, and expansion in the middle-class population. Generally, the market possesses tremendous growth prospects, particularly in the functional foods and personalized nutrition categories.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

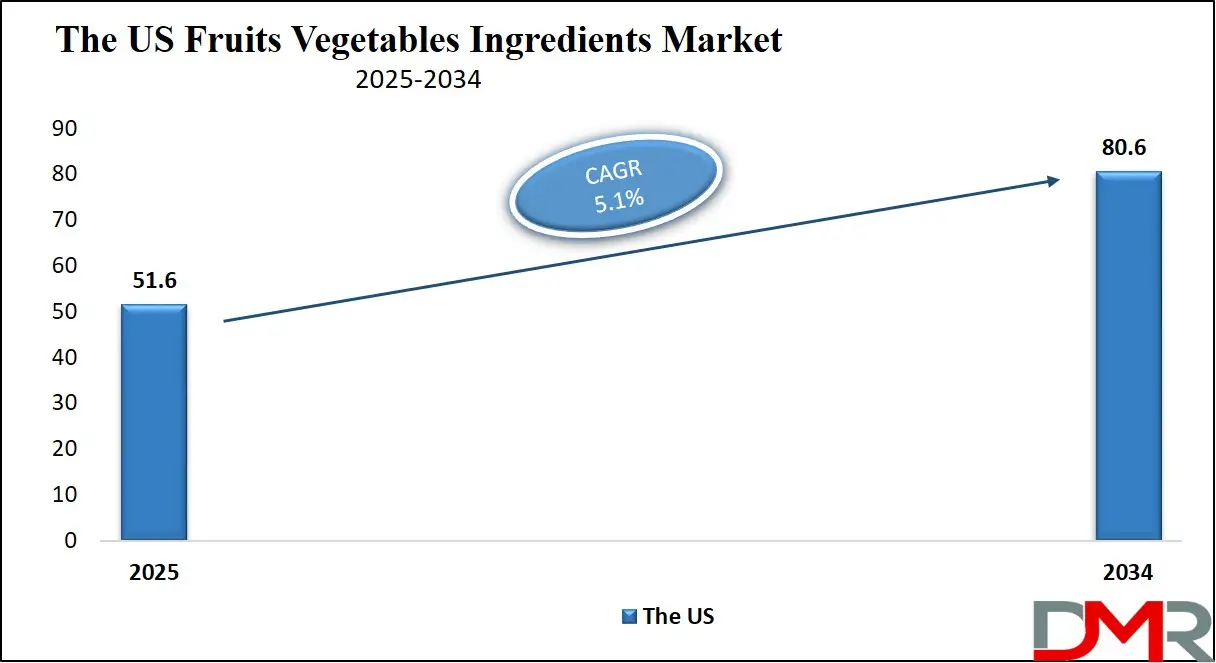

The US Fruits and Vegetables Ingredients Market

The US Fruits and Vegetables Ingredients Market is projected to reach

USD 51.6 billion in 2025, which is further projected to reach

USD 80.6 billion at a compound annual growth rate of

5.1% over its forecast period.

The U.S. fruits and vegetables ingredients market is an old but rapidly changing market, influenced by increasing health consciousness, natural additives demand, and the popularity of clean-label foods. With a high preventive health focus, U.S. consumers are looking for more food and beverage products enriched with actual fruit and vegetable content. The solution is to turn to purees, juices, and powders, which manufacturers are using in increasing numbers of applications, from fortified dairy foods and snacks to nutritional supplements and baked goods.

The population strength of the U.S. is its vast millennial and Gen Z base, which is extremely health-oriented, experimental, and wellness-driven. This age group prefers minimally processed, non-GMO, organic, and plant-based products, which makes them a profitable target for natural ingredient manufacturers. Moreover, the growing multicultural population has fragmented dietary choices, increasing the demand for exotic fruit and vegetable derivatives in fusion and ethnic foods.

Advanced processing capabilities in food industries, the imposition of stricter standards of food quality, and its focus on sustainable agriculture are backing the growth of the industry. Rich disposable incomes by consumers and pervasive networks of distributors continue to further power market expansion for retail, online, and foodservice platforms. Through increasing investments in organic production farming, sustainability strategies, and novel forms of ingredients, the United States market has strong prospects of registering sustained expansion. It is a bellwether for international trends and continues to be one of the leading regions for R&D and product launches in this category.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Fruits and Vegetables Ingredients Market

The European Fruits and Vegetables Ingredients Market is expected to achieve a market size of

USD 55.04 billion by 2025. This figure is projected to grow at a compound annual growth rate

(CAGR) of 4.5%, reaching

USD 81.93 billion by the end of the forecast period.

The European fruits and vegetables ingredients market is experiencing substantial growth, driven by shifting consumer preferences toward healthier, natural food products. Europe, with its diverse food culture and high demand for plant-based products, is witnessing an increasing shift toward clean-label, organic, and nutrient-rich ingredients in various food applications. The market is supported by growing consumer awareness about the benefits of fruits and vegetables, such as their antioxidants, vitamins, and fiber content, which are essential for maintaining health and wellness.

Demographically, Europe has a well-developed food and beverage industry, with significant contributions from countries like Germany, France, Italy, and the UK. The region’s aging population, especially in countries like Germany and Italy, is a key driver of the demand for functional foods, including fruit and vegetable ingredients. This demographic group is more inclined to choose foods that promote heart health, immune support, and overall vitality, contributing to the growing demand for these ingredients.

In addition, Europe’s focus on sustainability and environmental impact further propels the market. With strict regulations on food safety and the environment, consumers and manufacturers are increasingly looking for fruits and vegetables that are ethically sourced, organic, and free from harmful chemicals. As a result, Europe is becoming a leader in innovation, with a robust supply chain for fresh, frozen, and processed fruit and vegetable ingredients that cater to both traditional and emerging food sectors, including beverages, snacks, and dairy.

The Japan Fruits and Vegetables Ingredients Market

The Japan Fruits and Vegetables Ingredients Market is projected to reach USD 12.74 billion in 2025, which is further projected to reach USD 19.76 billion at a compound annual growth rate of 4.9% over its forecast period.

Japan’s fruits and vegetables ingredients market is characterized by a robust demand for high-quality, functional food products. Driven by a growing consumer focus on health, nutrition, and wellness, Japanese consumers are increasingly turning to products containing natural ingredients, particularly fruits and vegetables known for their health benefits. The market is heavily influenced by the rising popularity of plant-based diets, which has led to the widespread use of fruits and vegetables in juices, snacks, and dairy alternatives.

Japan benefits from strong agricultural production, particularly in fruits like citrus, apples, and grapes, as well as vegetables such as sweet potatoes and leafy greens. These ingredients are processed into a variety of forms, including purees, concentrates, and powders, to meet the demand for both fresh and processed food products. Japan's advanced food processing technology also plays a vital role in delivering high-quality fruit and vegetable ingredients that retain their nutritional content.

Demographically, Japan’s aging population significantly impacts the demand for functional foods. Older consumers prioritize foods that promote heart health, digestive health, and immune support, boosting the need for fruits and vegetables with added nutritional benefits. Additionally, Japan’s trend towards convenience foods, including ready-to-eat meals, has fueled the use of fruits and vegetables in packaged foods. With a strong focus on health and innovation, Japan continues to be a leader in the development of specialized ingredients, including fermented vegetable products and functional fruit-based beverages, which further contribute to the market’s growth.

Global Fruits and Vegetables Ingredients Market: Key Takeaways

- Global Market Share Insights: The Global Fruits and Vegetables Ingredients Market size is estimated to have a value of USD 254.8 billion in 2025 and is expected to reach USD 409.2 billion by the end of 2034.

- The US Market Share Insights: The US Fruits and Vegetables Ingredients Market is projected to be valued at USD 51.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 80.6 billion in 2034 at a CAGR of 5.1%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Fruits and Vegetables Ingredients Market with a share of about 45.4% in 2025.

- Key Players Insights: Some of the major key players in the Global Fruits and Vegetables Ingredients Market are Archer Daniels Midland Company (ADM), Ingredion Incorporated, Kerry Group plc, Olam International, Sensient Technologies Corporation, Symrise AG, Dohler Group, SunOpta Inc., AGRANA Beteiligungs-AG, Diana Food (a part of Symrise), and many others.

- Global Market Growth Rate Insights: The market is growing at a CAGR of 5.4 percent over the forecasted period of 2025.

Global Fruits and Vegetables Ingredients Market: Use Cases

- Functional Beverages: Fruit concentrates and vegetable purees have become increasingly popular ingredients used to craft low-sugar, nutrient-rich beverages. These ingredients help improve flavor and color naturally while meeting clean-label requirements, supporting immunity, wellness, and immunity trends among health-minded consumers seeking functional hydration options.

- Infant Nutrition: Fruit and vegetable powders can add both taste and nutrition to baby food, with their easy digestibility and natural sweetness providing safe solutions that meet parent demand for clean-label and allergen-free solutions for infant feeding solutions.

- Bakery & Confectionery: Fruits in the form of purees, pastes, or pieces enrich bakery and confectionery items by adding natural sweetness, vibrant color, and moist texture. They replace artificial ingredients and align with the rising demand for indulgent yet health-focused baked goods.

- Plant-Based Meat Alternatives: These ingredients add color, protein, bulkiness, and sustainability in plant-based meat formulations while supporting sustainability efforts, clean label initiatives, and growing vegan consumer segments.

- Ready-to-Eat Meals: Dried and paste forms of fruits and vegetables add taste, nutrition, shelf stability, and natural color and functional benefits without preservatives - satisfying consumer demands for convenience without compromising health or quality.

Global Fruits and Vegetables Ingredients Market: Stats & Facts

- FAO (Food and Agriculture Organization): Global fruit production reached approximately 887 million metric tons in 2023, while vegetable production exceeded 1.1 billion metric tons, highlighting the vast raw material base for the ingredients market.

- USDA (U.S. Department of Agriculture): In 2023, the U.S. exported over $6.4 billion worth of processed fruits and vegetables, including juices, purees, and dried items, indicating strong international demand for value-added produce derivatives.

- WHO (World Health Organization): Only 1 in 3 adults globally meet the recommended daily intake of fruits and vegetables, which has led to rising interest in fortified food products that incorporate concentrated ingredients for better nutrition.

- EUROSTAT (European Union Statistics Office): The European Union processed over 70 million metric tons of fruits and vegetables in 2022 for use in beverages, confectionery, and baby food, making it one of the largest processing hubs globally.

- Nutritional Outlook (Industry Magazine): In 2024, plant-based and clean-label product launches containing fruit and vegetable ingredients grew by 18% year-over-year, reflecting innovation in health-driven food and beverage segments.

- FDA (U.S. Food and Drug Administration): New labeling regulations around added sugars and ingredient transparency in the U.S. are encouraging manufacturers to substitute synthetic additives with real fruit and vegetable derivatives.

- India Ministry of Food Processing Industries: India’s fruit and vegetable processing capacity grew by 23% between 2020 and 2023, spurred by government incentives and export demand for purees, powders, and IQF (Individually Quick Frozen) formats.

- CNBC: Consumer preference surveys in 2023 revealed that over 65% of U.S. shoppers now look for “real fruit” or “vegetable-based” claims when purchasing snacks, juices, or packaged meals.

- The Guardian: The rise in flexitarian diets has significantly boosted demand for vegetable-based fillers and natural flavor enhancers in processed foods, especially in the U.K., where plant-forward innovation has become mainstream in food retail.

Global Fruits and Vegetables Ingredients Market: Market Dynamics

Driving Factors in the Global Fruits and Vegetables Ingredients Market

Rising Demand for Processed and Convenience Foods

Rising Demand for Processed and Convenience Foods. One of the main drivers of the global fruits and vegetable ingredients market growth is consumer interest in processed and convenience foods. As urbanization and lifestyles in emerging economies like India, Brazil, and Southeast Asia become busier, there has been an evident move towards easy-to-prepare food products without compromising nutritional content.

Fruit and vegetable ingredients play an essential role in this market due to their long shelf life, ease of storage, and capacity to preserve flavor and nutrients during processing. Food products containing tomato paste, carrot puree, onion powder, and apple chunks are commonly included in ready-to-eat meals, snacks, soups, and sauces. Global food chains and quick service restaurants (QSRs) rely heavily on preprocessed fruits and vegetables to maintain consistency and speed during meal preparation.

Manufacturers are expanding their capacities for producing IQF (Individually Quick Frozen), spray-dried, and aseptic fruit and vegetable ingredients to meet rising industrial demands. Vacuum sealing and retort pouch innovations are helping this trend by increasing consumer convenience. As demand for convenient, shelf-stable food products increases, so too will their market for fruits and vegetable ingredients, both retail and institutional consumption will boost it considerably.

Expansion of Plant-Based and Vegan Diets

A factor fueling the growth of the fruits and vegetable ingredients market is an increase in plant-based and vegan dietary trends. As more consumers become aware of the health, ethical, and environmental impacts associated with animal-based diets, consumers across demographics are gravitating toward plant-forward options when making food decisions.

Produce such as fruits and vegetables is key in crafting plant-based alternatives that provide texture, flavor, color, and nutrition. Ingredients such as beetroot powder for coloring plant-based meat, pea fiber for structure, or sweet potato puree to add creamy texture are increasingly being utilized in non-dairy yogurts, meat alternatives, and vegan desserts. Dietary shifts are not exclusive to Western nations; regions like the Middle East and Asia-Pacific are experiencing cultural transformation as traditional diets become updated with fruit- and vegetable-based formulations.

Major food companies are responding by diversifying their portfolios with plant-based product offerings, while start-ups have emerged with niche offerings featuring specific vegetables or fruit ingredients. Sustainability-conscious consumers are encouraging brands to source ingredients locally and lower their carbon footprints, further driving interest in fruits and vegetables. As plant-based eating becomes mainstream, fruit and vegetable ingredients will continue to become functional foundational elements worldwide.

Restraints in the Global Fruits and Vegetables Ingredients Market

Supply Chain Vulnerabilities and Seasonality Challenges

A major hindrance in the fruits and vegetable ingredients market is their inherent supply chain volatility due to seasonal availability and climate factors. As opposed to synthetic additives that can be produced year-round, fruits and vegetables must often be harvested during specific seasons, and any disruptions, such as drought, floods, or pests, can significantly lower yield and price. Manufacturers reliant on consistent ingredient availability for large-scale production face the risk of variability, further complicating matters by sourcing fruits and vegetables globally through customs regulations, logistics requirements, and cold chain constraints.

Minor delays or temperature variations during transport can significantly diminish ingredient quality, leading to financial losses and product rejections. As fresh produce perishes quickly, processors must act within an extremely limited window to protect its nutritional and sensory attributes. Companies focused on natural ingredients can face unique obstacles that impede year-round production, limit product diversity, and drive up costs through cold storage requirements or inventory management systems.

Lack of integrated supply networks in developing countries compounds this issue, with inconsistent quality and traceability hurting consumer trust, particularly when markets place high food safety expectations on products like rice. Without investments in agriculture resilience and logistics infrastructure, supply chain fragility will continue to impede growth.

High Processing Costs and Margin Pressures

One key barrier limiting market potential is the high costs associated with turning fruits and vegetables into usable ingredients. Producing fruit and vegetable ingredients requires sophisticated machinery as well as considerable energy inputs for cleaning, peeling, grinding, pasteurization, drying, and packaging. Freeze-drying or high-pressure processing technologies, while superior in their preservation of nutrients, tend to be considerably more costly than their conventional alternatives, thus restricting their adoption to premium product segments.

Natural ingredients require stringent quality controls to meet safety standards, increasing operational costs and thus making products with natural ingredients more expensive than their synthetic alternatives. Cost-sensitive markets face substantial barriers to the mass adoption of their technologies due to cost considerations. Small and medium-scale producers face additional difficulty scaling due to capital investment restrictions, and margin pressures increase when raw material costs increase due to poor harvests or geopolitical disruptions.

Additionally, global inflation and fluctuating energy costs have an exponential effect on operational expenses. Retailers, particularly in the private label segment, frequently push for lower prices that force ingredient suppliers to operate within thin profit margins. Without subsidies, collaborative sourcing models, or cost-cutting technologies to combat production and processing costs effectively, high production and processing costs will remain an obstacle to market growth for years to come.

Opportunities in the Global Fruits and Vegetables Ingredients Market

Technological Innovations in Processing and Preservation

One of the most promising growth opportunities lies in technological innovations in processing and preservation technology that are significantly improving fruit and vegetable ingredients' quality, shelf life, and versatility. Techniques such as freeze-drying, vacuum evaporation, high-pressure processing (HPP), and cold pasteurization are becoming more commonly employed to preserve nutritional value, enhance taste, and meet clean-label standards.

These technologies enable manufacturers to produce ingredients that not only retain the vibrant colors and flavors found in fresh produce but are also shelf-stable, which contributes to product appeal. Freeze-dried fruits are often found in premium cereals, snacks, and smoothies, while aseptic fruit purees are used frequently in baby food and beverage manufacturing. Encapsulation techniques enable the incorporation of fruit or vegetable nutrients into bakery and confectionery products without altering their structure or taste.

Innovations have also expanded to the development of customized blends, where multiple fruits and vegetables are combined for multipurpose benefits like immunity and digestive health. Smart packaging and improved logistics further facilitate the distribution of these high-quality ingredients globally. As food safety regulations become stricter, these innovations ensure compliance while opening up expansion into new product formats. As food brands strive to meet evolving consumer preferences, technology-driven ingredient processing will serve as an accelerator of market expansion.

Penetration into Emerging Economies with Urbanizing Lifestyles

Another exciting prospect for growth for the global fruits and vegetable ingredients market lies within emerging economies in Asia-Pacific, Latin America, and parts of Africa. These economies hold great promise as sources of fresh ingredients. These regions are experiencing rapid urbanization, rising middle-class populations, and growing disposable incomes--factors which generate demand for packaged, processed, and ready-to-eat food products. As consumers in these markets become more health-minded and inclined towards Western-style diets, demand for nutritious yet convenient and shelf-stable food solutions is on the rise.

This environment fosters fruit and vegetable ingredients to be utilized in beverages, infant nutrition products, dairy alternatives, and culinary applications. Government initiatives promoting healthier eating habits and the increased awareness of lifestyle diseases like diabetes and obesity have incentivized manufacturers to incorporate fruit and vegetable derivatives in local food products. Additionally, organized retail and e-commerce platforms are making products more readily accessible to rural and semi-urban populations.

Local players and global giants alike are turning to local farms and co-packers to secure supply chains more affordably and meet demand more cost-effectively. India, Brazil, and Vietnam all offer ideal climates and agricultural diversity that make an abundant and varied raw material base available to companies looking for expansion opportunities. Strategic market entry and education-driven marketing techniques can generate substantial revenue streams in emerging economies, making these an excellent area for expansion.

Trends in the Global Fruits and Vegetables Ingredients Market

Surge in Clean-Label and Natural Ingredient Preferences

A significant trend driving global fruits and vegetable ingredients markets is an increased interest in clean-label and natural ingredient products. Consumers are becoming more conscious about what goes into their food, pushing food and beverage companies to prioritize natural, minimally processed ingredients in their offerings. Fruit and vegetable derivatives like purees, concentrates, powders, and fibers are increasingly being utilized as alternatives to synthetic colors, flavors, and sweeteners. Due to increasing public concern around transparency, brands are actively labeling real fruit or vegetable content in products to improve product appeal.

Clean-label trends have created an increase in demand for non-GMO, gluten-free, and allergen-free product formulations in developed economies such as the U.S., Canada, Germany, and Britain. Concerns surrounding food safety have led companies to source ingredients from certified suppliers who follow sustainable supply chains. These market shifts are not limited to premium brands; even value brands are increasingly including natural ingredients to maintain consumer trust and loyalty.

Social media influencers and digital food influencers are also supporting this movement by advocating natural foods as part of a holistic wellness lifestyle. As this trend strengthens, fruit and vegetable ingredients will likely expand across multiple food segments, including snacks, dairy, functional beverages, baby food, and plant-based alternatives--reinventing formulation strategies within the industry.

Rising Integration in Functional and Fortified Foods

The food industry is experiencing a dramatic transformation, as an emphasis is being placed on health and functionality, making functional and fortified foods an increasingly prevalent trend. Consumers are now looking beyond basic nutrition for products that offer additional health benefits, including immunity support, digestive health improvements, cognitive enhancement, and skin health enhancement. Fruits and vegetables play an integral role in this trend due to their abundant supply of antioxidants, vitamins, and fiber. Vegetable powders such as beetroot, kale, and spinach are now being added to snacks, cereals, and smoothies for their functional properties. Meanwhile, fruit concentrates high in vitamin C, such as acerola or citrus, are being utilized to provide immunity-enhancing beverages.

The COVID-19 pandemic served to accelerate this trend as health-oriented consumption became the priority. Manufacturers responded by investing in R&D efforts that enhance bioavailability and functional efficacy for ingredients they develop. Consumer preference for natural fortification over synthetic alternatives has fuelled this trend, while sports nutrition brands are capitalizing on it by adding freeze-dried fruit or vegetable extracts into energy bars and recovery drinks. As personalized nutrition becomes mainstream, fruit and vegetable ingredients will increasingly provide targeted health benefits, opening new avenues of innovation across functional food and beverage categories globally.

Global Fruits and Vegetables Ingredients Market: Research Scope and Analysis

By Type Analysis

The fruits segment is projected to dominate the fruits and vegetables ingredients market due to its wide range of applications and consumer appeal. Fruits can be used in producing juices, smoothies, desserts, yogurts, flavored water beverages, jams, baby food items, and confectionery items; their natural sweetness, appealing flavors, vibrant colors, and health benefits make them suitable for inclusion into many food and beverage products. Berry, mangoes, apples, and citrus fruits make especially great choices.

Consumers increasingly favor natural and clean label ingredients, and fruit-derived ingredients perfectly satisfy this preference by providing flavor enhancement without synthetic additives. Furthermore, functional food and beverage trends promoting immunity, digestion, and antioxidant properties boost fruit ingredient demand; in particular, those from berries and citrus fruits, due to their rich vitamin C content and antioxidant benefits, are in high demand.

Fruit-based flavors such as tropical or berry blends have grown increasingly popular around the world, leading manufacturers to prioritize them over vegetable-based ones. Their marketing appeal and consumer familiarity cement their leading role in this segment, and processing-wise, they offer many ingredient formats (juices, concentrates, powders, and purees) easily adaptable across applications; further reinforcing their dominance.

By Nature Analysis

Conventional fruits and vegetable ingredients are anticipated to dominate the market due to their cost-effectiveness, scalability, and wide availability. Conventional farming techniques produce significantly larger crop volumes compared to organic ones, compared with food processors and manufacturers, providing consistent supplies of raw materials. With lower ingredient costs associated with conventional options, this makes conventional options a preferred choice when producing mass-market food and beverage items.

Furthermore, conventional agriculture's infrastructure - global supply chains, storage technologies, and distribution channels - is more advanced and efficient, enabling companies to procure ingredients year-round without major interruptions, essential for uninterrupted production cycles and product consistency.

Conventional ingredients remain popular with consumers in price-sensitive markets where affordability often outweighs organic certification. Furthermore, many conventional ingredients undergo quality and safety inspections that ensure compliance with food standards without incurring the premium associated with organic alternatives.

Organic ingredients have an increasingly growing market presence; however, their production remains limited due to limited capacity, higher costs, and certification challenges. Organic farming can also be labor-intensive and subject to yield fluctuations, which hinders its scalability and market penetration.

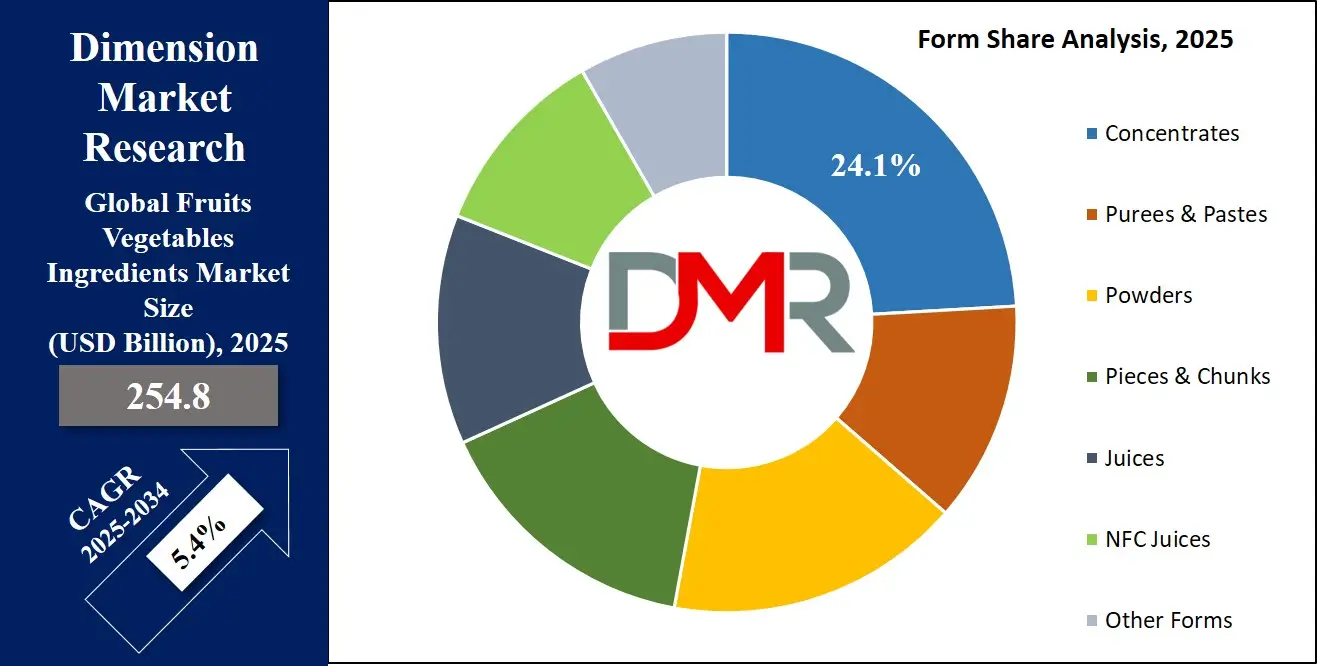

By Form Analysis

Conventional fruits and vegetable ingredients are anticipated to offer greater operational flexibility and commercial viability, meeting the diverse needs of food and beverage companies with various concentrations, powders, purees, pastes, and pastes processed on a large scale to meet food industry specifications. Their wide variety of forms ensures the conventional segment dominates global markets.

Concentrates are an ideal choice for manufacturers due to their long shelf life, easy storage, and cost-effectiveness, making them the go-to option for global companies looking to minimize logistical expenses. Concentrates are created by extracting water content from fruits and vegetables; their compact nature allows easier transportation, reduced packaging costs, and lowered storage requirements, making them a more practical solution than whole fruit or vegetables.

Concentrates offer several commercial advantages over fresh ingredients, including being readily available year-round without seasonal availability constraints that hamper fresh produce; this enables manufacturers to maintain continuous production schedules and meet market demand without disruption. Furthermore, due to reduced water content, products often boast longer shelf lives that reduce the risk of spoilage while expanding usability in food and beverage formulations.

Concentrates contain all of the flavor, nutrition, and color from their source fruits or vegetables while providing consistent, high-quality ingredients suitable for beverages, sauces, snacks, and processed food products. Their versatility increases even further through rehydration back into their original form for use in products, further broadening their application range and logistical advantages, cost effectiveness, and ease of use. These benefits cement their dominance on the market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

The beverages segment is poised to dominate the fruits and vegetable ingredients market due to rising global demand for fruit- and vegetable-based beverages, driven largely by increased health-conscious consumer interest in functional drinks with nutritional benefits, such as enhanced immunity, hydration, and antioxidant properties. As consumers increasingly opt for beverages made with natural ingredients with clean labels like fruits and vegetables are an ideal way to deliver flavor as well as health benefits without artificial additives or preservatives.

Fruit-based beverages such as juices, smoothies, and flavored waters are popular due to their delicious taste, refreshing properties, and versatility in flavor combinations. Citrus fruits, berries, and tropical fruits are frequently used as the basis of 100% natural juice production or blended varieties that offer health benefits like vitamins, minerals, or fiber content. Meanwhile, vegetable-based beverages have also seen a surge in popularity thanks to innovations like vegetable juices or plant-based milk alternatives (e.g., almond or oat milk), catering to growing interest for more plant-forward diets.

Beverages benefit from the variety of fruit and vegetable ingredient forms--juices, concentrates, powders, and purees--that give manufacturers greater flexibility in formulation and processing. Ready-to-drink (RTD) beverages' growing trend toward functional and wellness beverages has rendered fruit and vegetable ingredients highly lucrative within this segment.

Due to on-the-go consumption and an ever-increasing selection of healthy, non-alcoholic drink options, beverages have grown increasingly dominant within the market and cemented their position of leadership.

The Global Fruits and Vegetables Ingredients Market Report is segmented on the basis of the following:

By Type

- Fruits

-

Apple

-

Banana

-

Mango

-

Berries

-

Citrus Fruits

-

Pineapple

-

Grapes

- Other Fruits

-

Vegetables

-

Carrot

-

Potato

-

Tomato

-

Onion

-

Spinach

-

Peas

-

Broccoli

- Other Vegetables

By Nature

By Form

- Concentrates

- Purees & Pastes

- Powders

- Pieces & Chunks

- Juices

- NFC Juices

- Other Forms

By Application

- Beverages

-

Fruit Juices

-

Smoothies

-

Flavored Water

- Carbonated Soft Drinks

-

Bakery & Confectionery

-

Cakes

-

Pastries

-

Candies

- Fillings & Toppings

-

Dairy Products

-

Yogurt

-

Ice Cream

- Flavored Milk

-

Soups & Sauces

-

Snacks & RTE Products

-

Baby Food

- Other Application

Global Fruits and Vegetables Ingredients Market: Regional Analysis

Region with Highest Market Share

Asia-Pacific is projected to dominate the fruits and vegetable ingredients market as it holds 45.4% of market share by the end of 2025 due to several key factors, including its expansive agricultural base and rising demand for processed food products. Major producers of fruits and vegetables such as China and India boast robust supplies of raw materials that lower production costs for ingredient manufacturers; furthermore, an expanding middle class in countries such as China India Southeast Asia has created greater demand for natural, healthier foods which increases consumption of fruit- and vegetable-based ingredients used in processed foods snacks beverages and ready-to-eat products.

As awareness of the health benefits of fruits and vegetables and shifts toward plant-based diets increase, market growth increases exponentially across Asia-Pacific. Governments in various Asian-Pacific nations are working toward food security improvement that impacts agriculture and processing sectors positively; furthermore, urbanization, rising disposable income levels, as well as increased access to fruit- and vegetable-based products, ensure Asia-Pacific remains at the top of global markets.

Region with the Highest CAGR

North America is forecasted to experience the highest compound annual growth rate for the fruits and vegetable ingredients market due to several key drivers driving strong expansion in this region. Rising consumer preferences for organic and clean-label food options have driven significant demand for fruit and vegetable-based ingredients in beverages, snacks, dairy products, and packaged food products. As more consumers opt for healthier plant-based diet options, such as fruits and vegetables as ingredients, beverages, snacks, dairy products packaged food.

North American food manufacturers are investing heavily in innovation and developing fruit and vegetable-based products that meet the increasing demand for functional foods with added antioxidants, vitamins, and minerals. Furthermore, plant-based diets have grown in popularity over time due to environmental and ethical considerations as well. North America boasts advanced food processing infrastructure, large-scale production capabilities, as well as growing interest in functional beverages, driving increased fruit and vegetable demand further, and thus leading to an impressive compound annual growth rate in this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Fruits and Vegetables Ingredients Market: Competitive Landscape

The global fruits and vegetables ingredients market is highly competitive, with several key players leading the industry by focusing on product innovation, sustainability, and expansion strategies. Companies like Archer Daniels Midland (ADM), Ingredion Incorporated, and Kerry Group plc are prominent players, leveraging their vast supply chains, research and development capabilities, and global reach to maintain a competitive edge. These companies focus on offering a wide range of fruit and vegetable ingredients in various forms, including purees, concentrates, powders, and juices, catering to the diverse needs of food and beverage manufacturers.

Olam International and Dohler Group are also significant players, offering organic and conventional ingredient options, with a focus on quality and traceability. They maintain strong relationships with farmers and use advanced processing technologies to ensure high-quality product offerings. Sensient Technologies and Givaudan SA stand out for their expertise in flavor solutions, providing customized fruit and vegetable ingredients that meet specific consumer preferences and regional tastes.

Strategic acquisitions and partnerships are common in this market. For example, Naturex (now part of Givaudan) has strengthened its position through the acquisition of various ingredient firms. Additionally, companies are expanding into emerging markets like Asia-Pacific, where demand for processed fruit and vegetable ingredients is rising, securing long-term growth opportunities.

Some of the prominent players in the Global Fruits and Vegetables Ingredients Market are:

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Kerry Group plc

- Olam International

- Sensient Technologies Corporation

- Symrise AG

- Dohler Group

- SunOpta Inc.

- AGRANA Beteiligungs-AG

- Diana Food (a part of Symrise)

- SVZ International B.V.

- Givaudan SA

- Tate & Lyle PLC

- Tree Top Inc.

- Naturex (now part of Givaudan)

- Grunewald International

- SensoryEffects (a division of Balchem Corporation)

- Paradise Fruits Solutions GmbH & Co. KG

- Yaax International

- Milne Fruit Products Inc.

- Other Key Players

Recent Developments in the Global Fruits and Vegetables Ingredients Market

Investments

- April 2025: Olam Group revealed a USD 500.0 million equity investment into its Olam Food Ingredients division to fund strategic initiatives such as R&D for clean-label fruit and vegetable extracts, and to support a potential dual listing in Europe and Singapore, underpinning its drive toward sustainable nutrition and traceable supply chains

- June 2024: SunOpta committed US$ $26 million to expand its Modesto, California, plant-based beverage processing facility, adding 167,684 sq ft of production space and 17 new jobs to increase capacity for fruit and vegetable-based beverage ingredients while reducing nearly 800,000 freight miles annually.

Collaborations & Partnerships

- March 2025: Kerry Group joined The Consumer Goods Forum’s Collaboration for Healthier Lives Coalition, partnering with retailers, manufacturers, and NGOs to co-develop sustainable diet initiatives and accelerate the adoption of nutrient-dense fruit and vegetable ingredients across global supply chains.

- November 2024: Kerry Health and Nutrition Institute collaborated with over 100 industry experts to launch its “Ten Key Health and Nutrition Trends for 2025” report, highlighting clean-label flavors, regenerative sourcing, and functional fruit and vegetable extracts for wellness applications.

Expos & Conferences

- February 2025: FRUIT LOGISTICA 2025 convened in Berlin from February 5–7, attracting over 2,500 exhibitors and 66,000 professionals to showcase innovations in fresh produce and ingredient technologies, including sustainable fruit and vegetable ingredient solutions.

- February 2025: At the Consumer Analysts Group of New York (CAGNY) conference, Kerry outlined a strategic roadmap for ingredient innovation in response to global citrus shortages and sodium regulation, emphasizing rapid reformulation of fruit and vegetable-based formulations.

Mergers & Acquisitions

- April 2025: Döhler North America completed the acquisition of Premier Juices, enhancing its portfolio of natural fruit-based purees and concentrates to meet rising demand for tropical ingredient solutions in beverage and dairy segments.

- December 2024: Symrise secured approximately 90.2% of Probi’s outstanding capital through a public tender offer, expanding its footprint in probiotic ingredient applications and strengthening its clean-label digestive health portfolio.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 254.8 Bn |

| Forecast Value (2034) |

USD 409.2 Bn |

| CAGR (2025–2034) |

5.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 51.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Fruits, Vegetables), By Nature (Organic, Conventional), By Form (Concentrates, Purees & Pastes, Powders, Pieces & Chunks, Juices, NFC Juices, Other Forms), By Application (Beverages, Bakery & Confectionery, Dairy Products, Soups & Sauces, Snacks & RTE Products, Baby Food, Other Applications) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Archer Daniels Midland Company (ADM), Ingredion Incorporated, Kerry Group plc, Olam International, Sensient Technologies Corporation, Symrise AG, Dohler Group, SunOpta Inc., AGRANA Beteiligungs-AG, Diana Food (a part of Symrise), SVZ International B.V., Givaudan SA, Tate & Lyle PLC, Tree Top Inc., Naturex (now part of Givaudan), Grunewald International, SensoryEffects (a division of Balchem Corporation), Paradise Fruits Solutions GmbH & Co. KG, Yaax International, Milne Fruit Products Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|