Market Overview

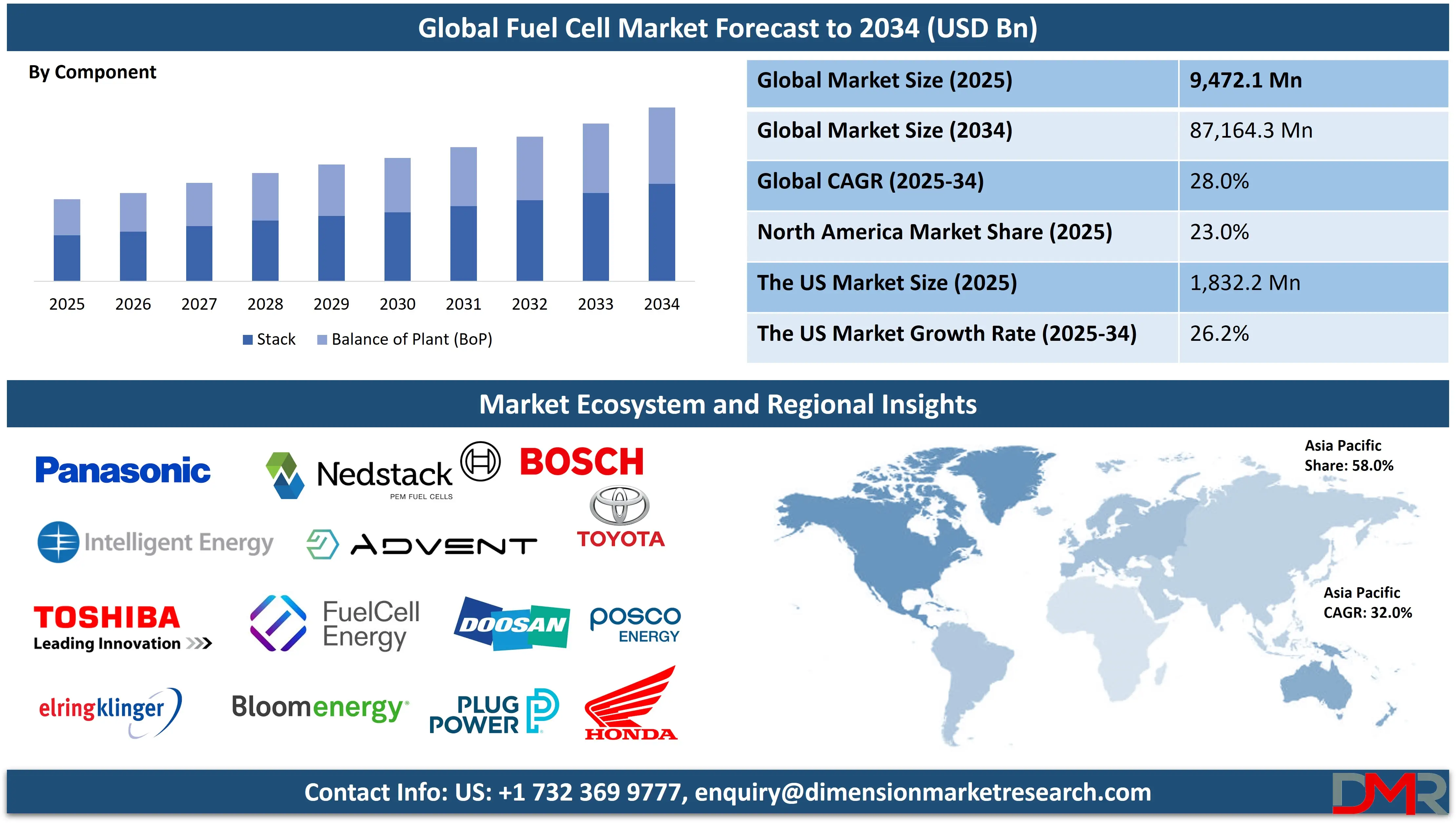

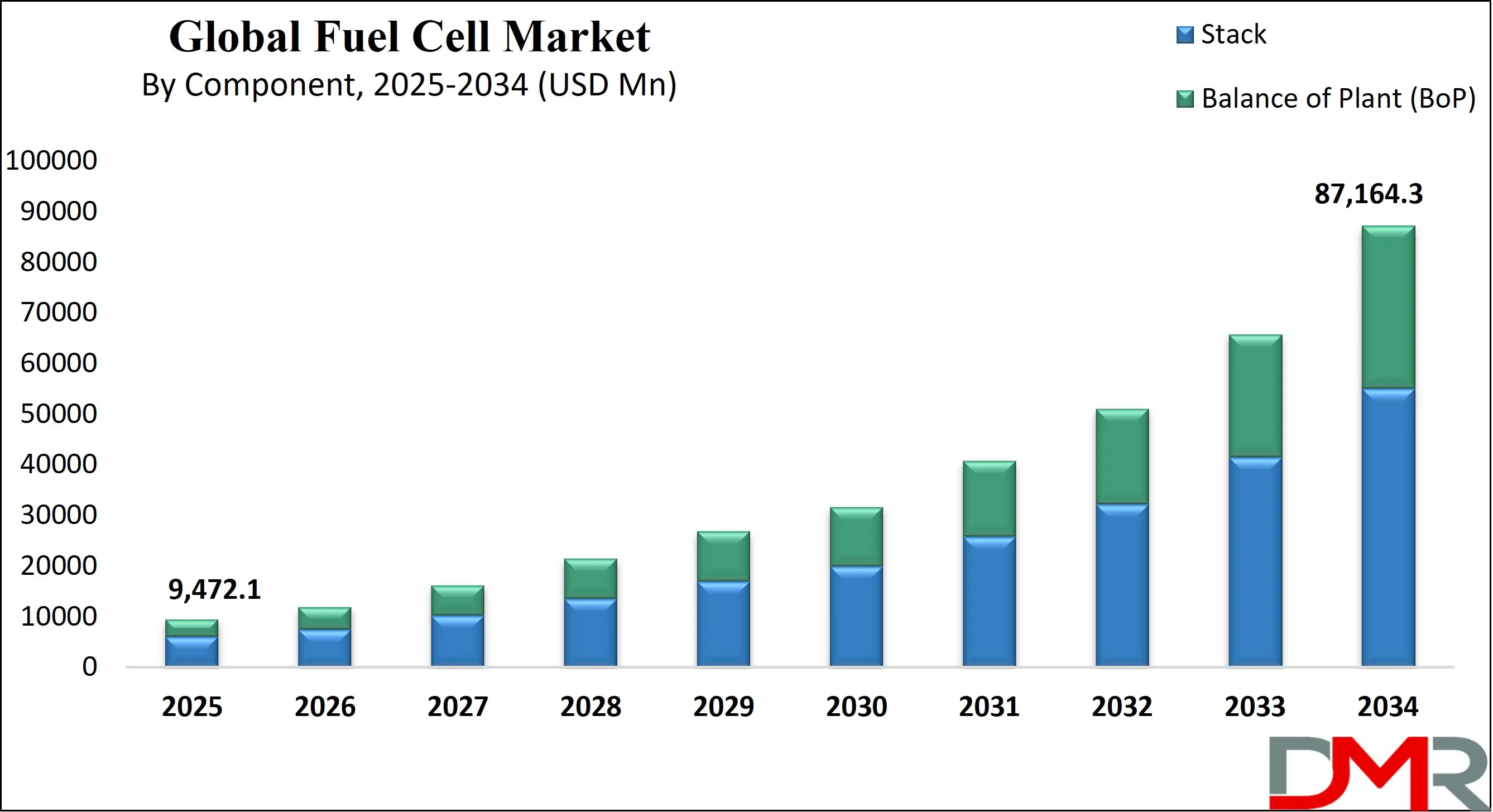

The Global Fuel Cell Market is projected to reach USD 9,472.1 million in 2025 and grow at a compound annual growth rate of 28.0% from there until 2034 to reach a value of USD 87,164.3 million.

The global fuel cell market is entering a transformative growth phase due to increasing climate policy stringency, rising energy security concerns, and the global transition toward hydrogen-based energy systems. Fuel cells, which convert chemical energy into electricity through an electrochemical reaction, offer an efficient, zero-emission alternative to combustion engines and traditional grid-based power. As of 2023, global fuel cell capacity exceeded 3 GW, driven primarily by stationary and transport deployments in Asia, North America, and Europe. According to data from the International Energy Agency (IEA), the number of fuel cell electric vehicles (FCEVs) has grown exponentially, with more than 70,000 units globally, led by South Korea, the U.S., and Japan.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Key technology types include proton exchange membrane fuel cells (PEMFC), which dominate the mobility and backup power sectors, and solid oxide fuel cells (SOFC), widely used for stationary distributed generation. The technology is increasingly integrated across sectors from heavy-duty trucks and city buses to data centers, ports, and residential energy systems. Notably, the versatility of fuel cells in combined heat and power (CHP) applications enhances their appeal in both commercial and residential buildings.

The most promising opportunities lie in the hydrogen economy's expansion. Initiatives like the U.S. Department of Energy’s Hydrogen Shot, the EU’s Hydrogen Strategy, and Japan’s Basic Hydrogen Strategy are unlocking investments in low-cost green hydrogen, electrolyzer capacity, and refueling infrastructure. These efforts are crucial for scaling hydrogen-fueled fuel cells, particularly for hard-to-decarbonize sectors like aviation, steelmaking, and maritime logistics.

Nonetheless, several restraints impede wider adoption. High upfront costs due to precious metal catalysts (e.g., platinum), limited hydrogen refueling infrastructure outside key markets, and efficiency losses in hydrogen production remain key challenges. Additionally, concerns around hydrogen storage, transport, and safety pose engineering and regulatory hurdles. The lack of standardization across international hydrogen certification frameworks also impedes cross-border fuel cell deployment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite these barriers, the growth prospects for the fuel cell market remain robust. The IEA projects a significant ramp-up of low-emission hydrogen production by 2030, which will directly benefit fuel cell markets. Countries like China and India are also initiating pilot projects and public-private partnerships to deploy fuel cell-powered buses and trucks. Innovations in catalyst development, durability, and heat management are helping reduce lifecycle costs, improve efficiency, and broaden fuel cell adoption.

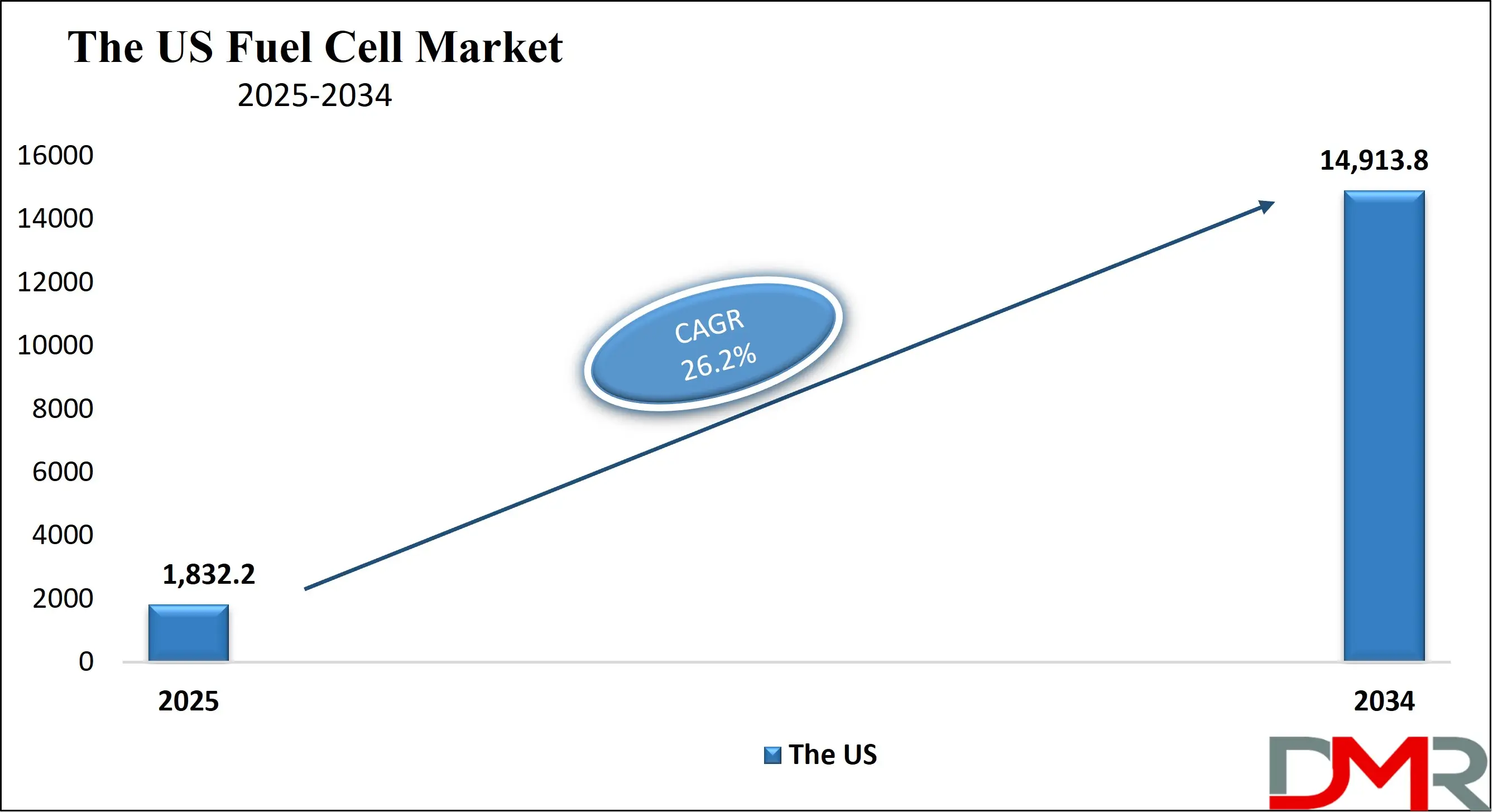

The US Fuel Cell Market

The US Fuel Cell Market is projected to reach USD 1,832.2 million in 2025 at a compound annual growth rate of 26.2% over its forecast period.

The United States is one of the most mature and innovative fuel cell markets globally, with over 1,300 MW of fuel cell stationary power installed as of 2023, per the U.S. Department of Energy (DOE). The U.S. leads in R&D investment, early-stage deployment, and commercial vehicle applications, particularly in California, where robust policies and infrastructure support fuel cell vehicle adoption. California alone accounts for over 60 retail hydrogen refueling stations and more than 14,000 registered FCEVs, according to the California Energy Commission.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. market is heavily supported by federal funding through the DOE’s Hydrogen and Fuel Cell Technologies Office (HFTO) and the Infrastructure Investment and Jobs Act (IIJA). The recent Inflation Reduction Act (IRA) introduces the 45V clean hydrogen tax credit up to USD 3/kg of low-carbon hydrogen which will significantly lower the operational costs of fuel cell systems reliant on green hydrogen. The Hydrogen Shot initiative, launched in 2021, aims to cut the cost of clean hydrogen by 80% to USD 1/kg within a decade.

The demographic and infrastructure advantage in the U.S. includes expansive industrial zones, long-haul trucking routes, and aging energy grids creating ideal conditions for deploying stationary fuel cells and hydrogen mobility solutions. The U.S. military’s deployment of fuel cells in forward-operating bases and off-grid systems further diversifies its use cases, especially as a reliable portable generator solution in remote and disaster-affected areas. Major players like Plug Power, Bloom Energy, and Cummins have established large-scale manufacturing and deployment projects in multiple states.

However, infrastructure gaps remain a constraint. Hydrogen fueling stations are largely limited to California, and interstate infrastructure is underdeveloped. The high cost of electrolyzers and hydrogen transportation continues to pose technical and financial challenges. Nevertheless, DOE’s Hydrogen Hubs (H2Hubs) initiative is addressing these gaps by developing regional hydrogen production and distribution clusters in locations such as the Gulf Coast, Appalachian Basin, and Midwest.

Looking ahead, the U.S. fuel cell market is set to benefit from growing federal incentives, utility sector interest, and private-sector investments in clean logistics and power. With comprehensive policy support and technological leadership, the U.S. is poised to remain a global leader. As hydrogen technologies expand, synergies are emerging with other clean energy sectors including aviation fuel, biofuel, and sustainable marine fuel, which are increasingly being integrated into multi-modal decarbonization strategies.

The Europe Fuel Cell Market

The European Fuel Cell Market is estimated to be valued at USD 1,420.8 million in 2025 and is further anticipated to reach USD 8,848.5 million by 2034 at a CAGR of 24.0%.

Europe is rapidly emerging as a key fuel cell market, propelled by strong climate policy, green industrial strategies, and a growing hydrogen economy. The European Union’s (EU) Hydrogen Strategy and Fit for 55 package underscore the region’s commitment to reducing emissions by 55% by 2030 and achieving climate neutrality by 2050. These frameworks prioritize renewable hydrogen and fuel cell technologies across transportation, industry, and energy systems.

Germany leads the charge, supported by the National Hydrogen Strategy (2020) and €9 billion in public funding, while France, the Netherlands, and Spain have launched similar national hydrogen roadmaps. The European Commission-backed “Hydrogen Valley” projects are demonstrating integrated production, storage, and use of hydrogen with applications in fuel cell buses, trains, and heat generation. As per the European Fuel Cell and Hydrogen Observatory (FCHO), over 600 MW of stationary fuel cell capacity has been installed in the EU, primarily using PEMFC and SOFC systems for combined heat and power (CHP) applications in urban areas.

The EU’s demographic and economic profile dense urban populations, industrial clusters, and high energy costs makes it an ideal environment for fuel cells. Additionally, the strong demand for energy resilience and grid decentralization aligns well with the distributed nature of stationary fuel cell systems. European OEMs such as Alstom and Siemens are integrating fuel cells into trains and heavy-duty vehicles, while companies like Bosch and ElringKlinger are investing in fuel cell stack manufacturing.

Europe’s transport sector presents key growth opportunities. Fuel cell electric buses are already in service in Germany, the UK, and France, supported by the Clean Vehicles Directive, which mandates a minimum quota of zero-emission buses in public fleets. The Alstom Coradia iLint, the world’s first fuel cell-powered passenger train, is operational in Germany and Italy, showcasing the feasibility of replacing diesel rail networks with hydrogen-based propulsion.

Overall, Europe’s fuel cell market is forecasted to grow significantly over the next decade, with strong backing from the European Investment Bank (EIB), Horizon Europe research funding, and the Important Projects of Common European Interest (IPCEI). By aligning industrial policy, climate targets, and infrastructure planning, Europe is positioned to be a global leader in fuel cell innovation and deployment.

The Japan Fuel Cell Market

The Japan Fuel Cell Market is projected to be valued at USD 568.3 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3,719.4 million in 2034 at a CAGR of 27.0%.

Japan remains a global frontrunner in fuel cell technology, reflecting decades of sustained investment, industrial policy, and public-private coordination. The Japanese government’s Basic Hydrogen Strategy, launched in 2017, targets a full-fledged hydrogen society by mid-century. It aims to reduce hydrogen production costs to ¥30/Nm³ (~USD 2.30/kg) by 2030 and boost domestic demand in transport, power, and residential sectors.

Residential fuel cells (ENE-FARM) are the cornerstone of Japan’s domestic strategy. Over 420,000 systems have been installed as of 2024, supported by subsidies from the Ministry of Economy, Trade and Industry (METI). These systems generate both electricity and hot water using natural gas or hydrogen, helping households reduce CO₂ emissions by up to 50%. Given Japan’s limited landmass and high building density, these compact, decentralized units are ideal for space-constrained urban settings.

In mobility, Japan has pioneered the commercialization of fuel cell electric vehicles (FCEVs), particularly through Toyota (Mirai) and Honda (Clarity Fuel Cell). Japan boasts one of the world’s most developed hydrogen refueling infrastructures, with more than 160 stations in operation, concentrated around Tokyo, Osaka, and Nagoya. METI’s Strategic Roadmap for Hydrogen and Fuel Cells targets 800,000 FCEVs and 320 hydrogen stations by 2030.

Fuel cells are also being deployed in industrial backup systems, shipping, and port decarbonization projects. The Fukushima Hydrogen Energy Research Field (FH2R), one of the world’s largest green hydrogen production facilities, uses solar power to generate hydrogen for local use, including fuel cell-powered buses for the 2020 Tokyo Olympics.

Japan’s demographic structure an aging, urban population and high energy import dependence creates a strategic imperative for resilient, decentralized, and clean energy technologies like fuel cells. Moreover, the country’s susceptibility to natural disasters such as earthquakes and typhoons elevates the need for off-grid and backup power systems, a niche where fuel cells excel due to their autonomy, silent operation, and quick ramp-up time.

However, Japan faces challenges in scaling green hydrogen production domestically due to its limited renewable energy potential. To address this, Japan has signed international hydrogen supply chain agreements with Australia, Brunei, and the Middle East, including liquefied hydrogen shipping infrastructure development.

Global Fuel Cell Market: Key Takeaways

- Global Market Size Insights: The Global Fuel Cell Market size is estimated to have a value of USD 9,472.1 million in 2025 and is expected to reach USD 87,164.3 million by the end of 2034.

- The US Market Size Insights: The US Fuel Cell Market is projected to be valued at USD 1,832.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 14,913.8 million in 2034 at a CAGR of 26.2%.

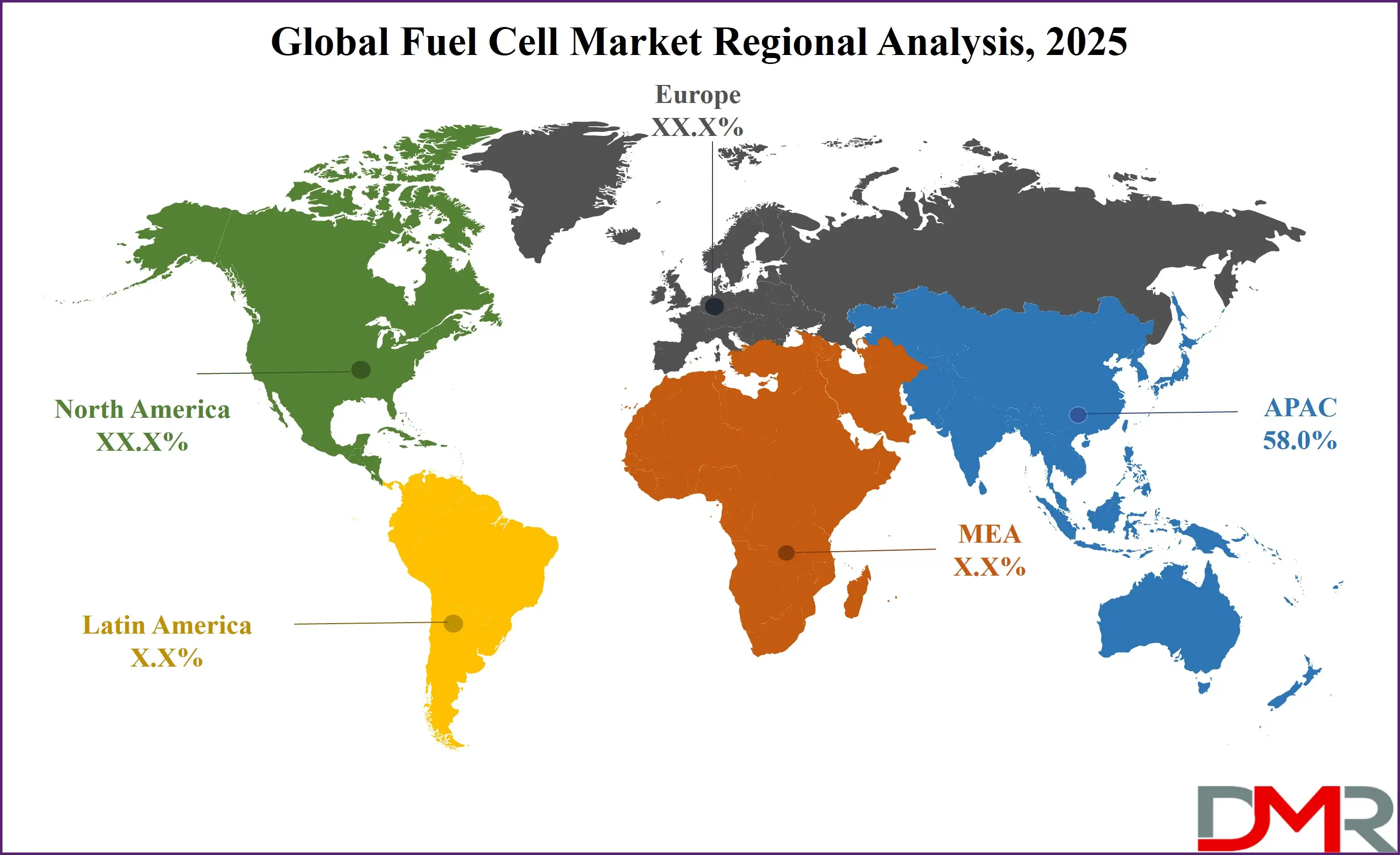

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Fuel Cell Market with a share of about 58.0% in 2025.

- Key Players: Some of the major key players in the Global Fuel Cell Market are Ballard Power Systems, Plug Power Inc., Bloom Energy Corporation, Doosan Fuel Cell Co., Ltd., FuelCell Energy, Inc., Hydrogenics, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 28.0 percent over the forecasted period of 2025.

Global Fuel Cell Market: Use Cases

- Fuel Cell Electric Vehicles (FCEVs): FCEVs such as the Toyota Mirai and Hyundai Xcient use hydrogen fuel cells to provide long-range, zero-emission transport. These vehicles recharge in 3–5 minutes and are suitable for public buses, intercity logistics, and fleet services. Countries with ZEV mandates, like the U.S. and Germany, are promoting FCEVs to decarbonize transport where batteries face range or weight limitations.

- Backup Power for Data Centers and Hospitals: Fuel cells provide continuous, emissions-free power for data centers, hospitals, and telecom towers, where grid reliability is critical. Companies like Microsoft and Apple are testing hydrogen fuel cell generators as alternatives to diesel gensets. Their modularity, scalability, and low noise make them ideal for urban and off-grid locations requiring consistent, resilient energy.

- Commercial and Institutional CHP Systems: In Japan and South Korea, residential and institutional combined heat and power (CHP) systems use fuel cells (like ENE-FARM) to generate electricity and hot water. Universities, hotels, and government buildings install SOFC systems to cut energy costs and reduce emissions, particularly in regions with high energy tariffs or decarbonization incentives.

- Hydrogen-Powered Marine Vessels and Ports: Europe and Japan have developed hydrogen fuel cell-powered ferries, port equipment, and auxiliary marine engines. The EU-funded FLAGSHIPS and Japan’s e5 Project aim to decarbonize short-sea shipping and reduce air pollution in port cities. Fuel cells offer silent operation and zero emissions ideal for regulated emissions zones and coastal environments.

- Defense and Aerospace Applications: The U.S. military and aerospace agencies deploy fuel cells in unmanned systems, field equipment, and submarines. Their silent operation, low heat signature, and long runtime are advantages in stealth and tactical environments. NASA and the Department of Defense are funding next-gen fuel cells for extreme environments, including lunar missions and forward-operating bases..t

Global Fuel Cell Market: Stats & Facts

International Energy Agency (IEA)

The IEA is a major source of global hydrogen and fuel cell data. According to their latest reports:

- Global hydrogen demand reached 97 million tonnes (Mt) in 2023, reflecting a 2.5% increase from 2022.

- Hydrogen use in new applications such as transportation, industry feedstocks, and seasonal energy storage grew by 40% year-on-year. However, these emerging segments still account for less than 1% of total global hydrogen consumption.

- As of late 2022, there were approximately 70,200 fuel cell electric vehicles (FCEVs) operating globally, a sharp contrast to the over 26 million plug-in electric vehicles (PEVs) in circulation.

- The U.S., EU, and Japan collectively hosted the majority of the world's hydrogen refueling infrastructure and FCEV deployments.

- Over the past 12 months, 19 new national hydrogen strategies were launched, bringing the global total to 60 strategies, covering countries that produce 84% of global energy-related CO₂ emissions.

- Planned global electrolyzer capacity needed to produce green hydrogen grew from 3.2 GW to 8.2 GW expected by 2030, with 57% of that capacity located in Europe.

U.S. Department of Energy (DOE)

The DOE has supported the growth of the U.S. fuel cell industry through funding, pilot projects, and deployment programs:

- The U.S. currently has over 500 megawatts (MW) of stationary fuel cell power capacity installed across more than 40 states.

- Over 35,000 fuel cell forklifts are in commercial operation, and these have undergone more than 20 million hydrogen refuelings.

- In California alone, fuel cell buses have provided transportation to over 20 million passengers, showcasing the viability of clean public transit.

- During the American Recovery and Reinvestment Act (ARRA) of 2009, the DOE funded the deployment of 1,330 fuel cell units, including backup power systems and forklifts.

- Commercial stationary fuel cells exhibit average electrical efficiencies of about 45% lower heating value (LHV) and maintain capacity factors near 89.2%, with availability rates of 97–98%, indicating high reliability.

- As of 2016, average installed costs for stationary fuel cell systems with incentives were USD 7,616 per kilowatt, significantly above the DOE target of USD 1,500/kW.

- For FY2024, the DOE’s Fuel Cell Technologies subprogram has a USD 30 million budget, with objectives that include fuel cells reaching 68% peak efficiency and 80,000 hours of durability.

- A major future DOE goal is the mass production of 20,000 fuel cell stacks per year for use in heavy-duty trucks by 2030.

Ministry of Economy, Trade and Industry (METI), Japan

Japan has been a pioneer in residential and automotive fuel cell technology. Key statistics include:

- By September 2022, more than 450,000 residential fuel cell systems (ENE-FARM) had been installed in Japanese households.

- As early as June 2021, installations had already exceeded 400,000 units, reflecting strong government support and subsidy programs.

- Each ENE-FARM unit is capable of reducing household CO₂ emissions by approximately 38% annually, equivalent to the absorption of around 2,460 square meters of forest.

- These residential systems meet around 70% of a home’s electricity demand, and simultaneously provide hot water.

- Japan plans to deploy 100,000 ENE-FARM units in a single capacity auction under its current fiscal stimulus framework.

- Initial deployment was slower, with only 60,000 units installed by 2015, but accelerated rapidly afterward.

European Union (EU), European Commission & Joint Research Centre (JRC)

Europe’s hydrogen ambitions are clearly defined in the REPowerEU and Fit-for-55 packages. Data from the EU and affiliated agencies includes:

- Under REPowerEU, the EU aims to produce 10 million tonnes of renewable hydrogen domestically and import another 10 million tonnes by 2030.

- To meet this hydrogen demand, the EU would require around 140 GW of electrolyzer capacity by 2030.

- As of 2023, Europe had over 600 MW of installed stationary fuel cell capacity, including fuel cells used for combined heat and power (CHP).

- In 2020, EU electrolyzers produced only 30 tonnes per day of hydrogen, while carbon capture-supported hydrogen production yielded 40 tonnes per day, together covering only a tiny fraction (less than 1%) of total hydrogen needs.

- The Fuel Cells and Hydrogen Joint Undertaking (FCH JU) facilitated over €1 billion in R&D investment between 2008 and 2021.

- Despite growing interest, the EU had only 16 MW of large-scale (>200 kW) stationary fuel cell systems in operation as of 2017. Deployment potential remains high, especially in data centers (up to 1.4 GW) and CHP applications (up to 5.6 GW).

Global Fuel Cell Market: Market Dynamic

Driving Factors in the Global Fuel Cell Market

Decarbonization Imperatives and Energy Security Demands

Fuel cells are positioned at the intersection of climate action and geopolitical energy shifts. With global targets of net-zero emissions by 2050 gaining urgency, fuel cells powered by green hydrogen offer a near-zero-carbon alternative across power, mobility, and industrial sectors. Nations are prioritizing diversification from fossil fuels amid Russia–Ukraine conflict-driven energy crises, making fuel cells essential to distributed, clean, and resilient energy systems. Industrial fuel cell applications ranging from refineries and chemical plants to cement and steel are vital to reducing emissions in hard-to-abate sectors.

As a grid-independent power source, fuel cells offer black-start capabilities, enhancing energy security for critical infrastructure. Moreover, climate-linked financial regulations and ESG frameworks now pressure corporations to decarbonize value chains. Many are investing in on-site fuel cell cogeneration or microgrids to meet Scope 1 and 2 emission targets. These macroeconomic and regulatory forces are creating a structural growth runway for stationary and mobile fuel cell markets globally.

Advancements in Electrolyzer and Fuel Cell Stack Technologies

Rapid innovation in fuel cell components and manufacturing is drastically improving system performance, lifespan, and economics. Recent advances in catalyst optimization, bipolar plate coatings, and membrane durability have extended PEM fuel cell lifetimes beyond 20,000 hours for mobility and 80,000 hours for stationary systems. The use of platinum group metal-free catalysts and ceramic oxides is also reducing cost and supply chain exposure. On the production side, automation and roll-to-roll manufacturing are scaling up multi-gigawatt stack factories in the U.S., Europe, and Asia.

Companies like Plug Power, Bosch, and Ballard are accelerating stack integration into scalable modules for varied power classes. Meanwhile, solid oxide fuel cells (SOFCs) are gaining traction in combined heat and power (CHP) and off-grid industrial applications due to their high-temperature efficiency (>60%). These technological leaps are critical in closing the gap between fuel cells and incumbent powertrain technologies in cost, reliability, and scalability, thus driving broader adoption across sectors.

Restraints in the Global Fuel Cell Market

High Hydrogen Production and Fuel Cell System Costs

Despite declining trends, fuel cells remain significantly more expensive than conventional power systems or battery-based alternatives. The levelized cost of hydrogen (LCOH) from electrolysis is still around USD 4–USD 6/kg in most regions, while target levels for competitive parity are under USD 2/kg. This impacts the fuel cost for mobility and stationary applications, making TCO uncompetitive in many cases. Additionally, fuel cell stacks, especially PEM types, rely on expensive materials like platinum-group metals (PGMs), while SOFCs face challenges with ceramics and interconnects.

Although innovations are reducing material intensity and increasing lifespan, system costs especially for smaller installations are prohibitive without subsidies or mandates. Balance of plant (BOP), cooling, and power electronics further inflate capital expenditure. Until economies of scale, domestic electrolyzer manufacturing, and hydrogen logistics infrastructure mature, affordability remains a key barrier across most segments.

Underdeveloped Hydrogen Refueling and Logistics Infrastructure

A major bottleneck to fuel cell market growth is the lack of widespread hydrogen refueling, transport, and storage infrastructure. As of 2024, there are fewer than 2,000 hydrogen refueling stations globally, concentrated in Japan, Germany, South Korea, and select U.S. states. This limited network constrains FCEV adoption outside pilot corridors. For stationary systems, hydrogen delivery via tube trailers or on-site generation remains logistically complex and costly. Pipelines are still regionally constrained (e.g., the U.S. Gulf Coast, parts of Germany), and large-scale hydrogen liquefaction or compression facilities are under development but years away from maturity.

Even where infrastructure exists, station downtime and inconsistent fuel purity can disrupt operations. Moreover, hydrogen lacks a unified regulatory framework for safety, permitting, and metering across many jurisdictions, slowing project approvals. These infrastructure gaps significantly limit scalability and investor confidence in fuel cell rollout across commercial and industrial use cases.

Opportunities in the Global Fuel Cell Market

Fuel Cell Microgrids and Off-Grid Applications in Developing Markets

Emerging markets with unreliable grids and high diesel dependency offer immense potential for distributed fuel cell adoption. Countries in Southeast Asia, Sub-Saharan Africa, and Latin America are increasingly seeking off-grid and hybrid microgrid solutions to power rural telecom towers, remote clinics, and water treatment facilities. Fuel cells provide a low-maintenance, silent, and zero-emission alternative to diesel gensets, particularly when paired with solar PV and battery storage. Government-led energy access programs and international climate finance (e.g., the Green Climate Fund) can catalyze commercial deployment in these regions.

Additionally, multilateral development banks are exploring results-based financing and concessional loans for green hydrogen production that would enable localized fuel cell energy hubs. With declining fuel cell costs and falling hydrogen production prices via electrolysis, especially in renewables-rich regions, these applications represent untapped, socially transformative opportunities. Local manufacturing, assembly, and training initiatives further enhance job creation and capacity building, aligning with just energy transition goals.

Maritime, Aerospace, and Defense Applications as Emerging Frontiers

Specialty sectors like marine transport, aviation, and defense represent high-value future markets for fuel cell integration. The International Maritime Organization (IMO) mandates a 50% CO₂ reduction from 2008 levels by 2050, pushing shipbuilders to explore zero-emission alternatives like hydrogen fuel cells. Companies such as ABB and Ballard are testing megawatt-scale maritime stacks, with initial deployments in ferries and cruise vessels. In aviation, both small aircraft (e.g., ZeroAvia, Universal Hydrogen) and large OEMs like Airbus are developing hydrogen propulsion based on fuel cell-electric and hybrid systems, targeting commercial operation by the 2030s.

Defense agencies in the U.S., Israel, and Europe are also deploying fuel cells for silent, long-endurance unmanned vehicles (UAVs), field generators, and mobile command posts due to their stealth, portability, and fuel flexibility. These frontier applications, while niche today, hold multibillion-dollar potential as performance metrics improve and regulatory timelines tighten, creating new commercial beachheads for next-generation fuel cell technologies.

Trends in the Global Fuel Cell Market

Accelerated Government Hydrogen Policies and National Strategies

The proliferation of hydrogen-centric policies across major economies is significantly shaping fuel cell market momentum. As of 2024, over 60 countries have adopted national hydrogen strategies, covering more than 80% of global energy-related CO₂ emissions. These policies prioritize decarbonization and energy security through clean hydrogen and fuel cell deployment in sectors like heavy transport, industrial processing, and backup power. Japan, the EU, South Korea, and the U.S. are investing billions in hydrogen valleys, gigafactories, and refueling corridors.

These initiatives ensure long-term investment certainty and create demand-pull for proton exchange membrane (PEM) and solid oxide fuel cells (SOFCs). Policy instruments such as tax credits, procurement mandates, green hydrogen incentives, and carbon pricing are increasingly integrated. For instance, the U.S. Inflation Reduction Act and Bipartisan Infrastructure Law allocate over USD 13 billion to hydrogen and fuel cells. Similarly, the EU’s REPowerEU aims for 10 million tonnes of domestic green hydrogen by 2030, underpinned by electrolyzer and fuel cell rollouts. Such sweeping policies foster industrial-scale manufacturing, lower costs, and catalyze ecosystem-wide growth.

Rise of Fuel Cell Integration in Transportation and Material Handling

The transport sector is emerging as a transformative arena for fuel cell deployment, with adoption expanding across light-duty vehicles, heavy-duty trucks, buses, trains, maritime, and aviation. In 2023, over 70,000 fuel cell electric vehicles (FCEVs) were operational globally, with Toyota, Hyundai, and Honda leading deployments. The technology offers long-range, fast refueling, and higher payload efficiency over batteries in long-haul and fleet use cases. Simultaneously, forklifts, especially in logistics hubs like Amazon and Walmart warehouses, are leveraging PEM fuel cells for uninterrupted operation and indoor air quality.

Fuel cells are also gaining traction in passenger rail (Alstom’s Coradia iLint in Germany), hydrogen-powered ferries in Norway, and even aircraft development (ZeroAvia, Airbus’s ZEROe). Key drivers include zero-emission mandates, diesel bans, corporate sustainability goals, and Total Cost of Ownership (TCO) benefits over batteries in high-duty cycles. With hydrogen refueling infrastructure expanding in the U.S., Japan, and Germany, mobility-based applications are evolving from pilot to pre-commercial stages, signaling a rapid scale-up trend through 2030.

Global Fuel Cell Market: Research Scope and Analysis

By Component Analysis

The fuel cell stack is projected to dominate the market by component because it is the core energy-generating unit where the actual electrochemical reaction between fuel (typically hydrogen) and oxygen takes place. This stack is composed of multiple individual fuel cells layered together to produce the desired power output. It contributes more than 60% of the total system cost, making it the most valuable and technically intensive component in any fuel cell system. As performance, durability, and efficiency improvements are mainly driven by advances in stack materials and design, the stack commands the largest R&D and commercial attention.

Manufacturers are heavily investing in next-generation membrane electrode assemblies (MEA), bipolar plates, and catalyst technologies that are integrated specifically in the stack. For example, developments in platinum-group-metal-free (PGM-free) catalysts, solid oxide membranes, and thin-film coatings all focus on stack enhancement to reduce cost and increase durability. Moreover, stack technology also directly influences scalability, especially for large stationary systems and heavy-duty vehicles, where higher power density and compactness are essential.

The growing deployment of fuel cell electric vehicles (FCEVs), forklifts, backup power units, and CHP systems further increases demand for highly efficient and modular stacks. Additionally, global efforts to reduce the cost per kilowatt of fuel cell systems to below USD 1,500/kW center around improvements in stack manufacturing and materials. With its pivotal role in system performance and cost reduction strategies, the stack component is naturally the largest and most dominant in the global fuel cell market across every application segment.

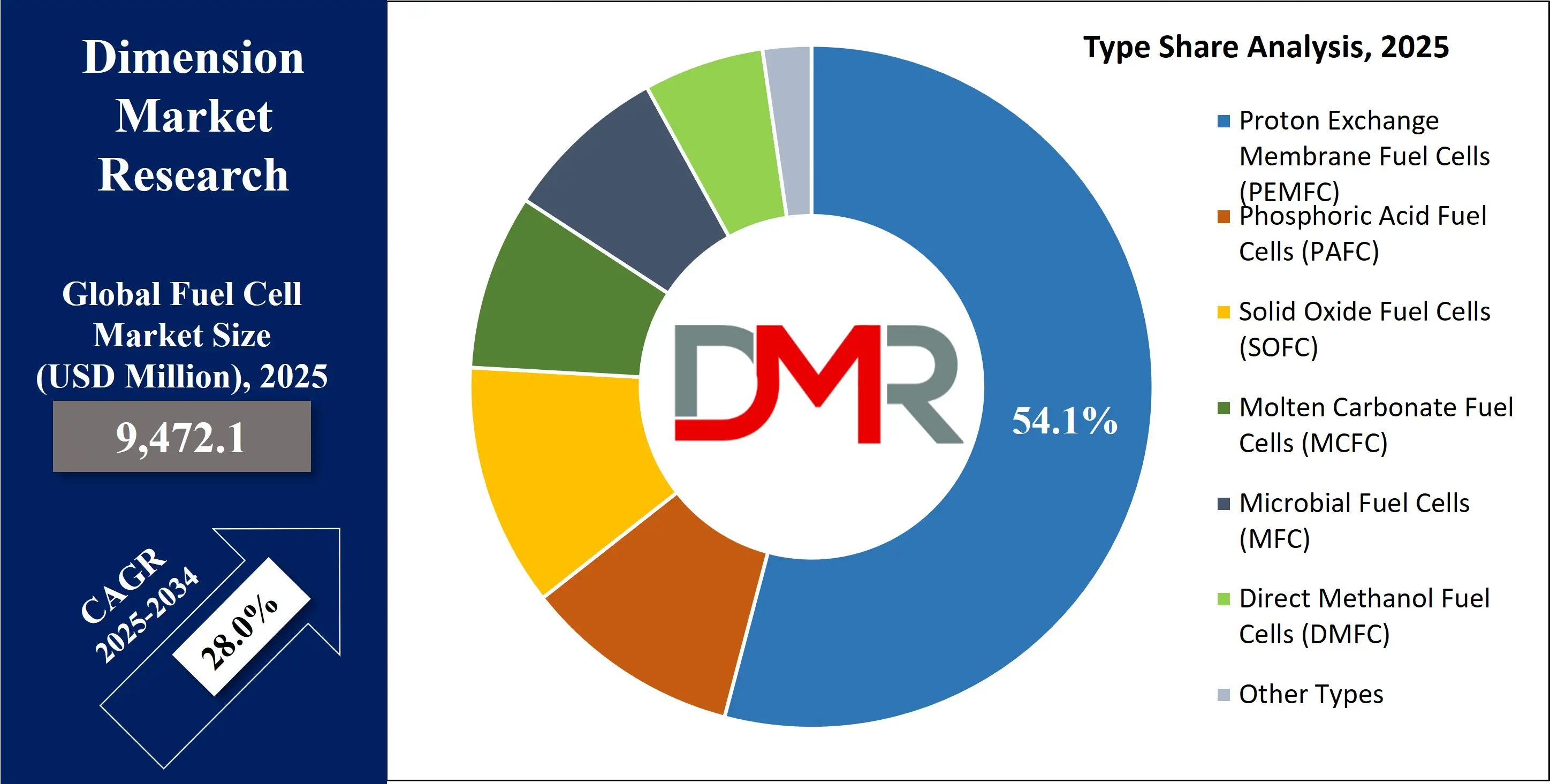

By Type Analysis

Proton Exchange Membrane Fuel Cells (PEMFCs) are anticipated to dominate the global fuel cell market due to their versatility, quick start-up time, low operating temperature (60–80°C), and high power density, which make them ideal for both mobile and stationary applications. PEMFCs are the primary choice for fuel cell electric vehicles (FCEVs), including cars, buses, and forklifts, due to their fast dynamic response, which supports the acceleration and deceleration cycles in transportation use cases.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Their compact size, lightweight design, and ability to operate efficiently at partial loads also make PEMFCs highly suited for portable power generation and residential/commercial backup power systems. The technology is extensively supported by automotive leaders such as Toyota (Mirai), Hyundai (NEXO), and Honda (Clarity), who have collectively deployed thousands of PEMFC-powered vehicles globally. Additionally, PEMFCs are the focus of several national hydrogen strategies, including the U.S. Department of Energy and Japan’s METI, which are funding R&D and commercialization efforts.

From a materials standpoint, continuous advancements in membrane electrode assemblies (MEA) and bipolar plate technologies are driving down costs while enhancing performance. Moreover, the PEMFC supply chain is relatively mature, with established manufacturing processes and component standardization, enabling quicker scaling compared to other fuel cell types like molten carbonate or phosphoric acid fuel cells.

Given its broad applicability across transport, portable, and backup power segments, and strong support from both public and private sectors, PEMFCs account for more than 65% of all fuel cell shipments globally and continue to be the technological backbone of market expansion.

By Fuel Type Analysis

Hydrogen is projected to be the most dominant fuel type in the fuel cell market due to its clean combustion profile, high energy density (120 MJ/kg), and growing availability from renewable sources. When used in a fuel cell, hydrogen produces only water and heat as by-products, making it a critical enabler for net-zero targets and air quality improvement efforts. The global shift toward decarbonization, particularly in transportation, industrial processes, and backup power, is accelerating hydrogen adoption.

Hydrogen fuel cells, especially PEMFCs, offer fast refueling times and long ranges, making them the fuel of choice for heavy-duty mobility applications such as buses, trucks, trains, and ships. Governments and agencies, including the U.S. DOE, Japan’s METI, and the European Commission, are investing heavily in green hydrogen production through electrolysis, ensuring future fuel supply is sustainable and domestically sourced. For instance, the EU plans to produce 10 million tonnes of green hydrogen by 2030 under its REPowerEU strategy.

In stationary applications, hydrogen offers excellent compatibility with distributed energy systems, microgrids, and backup power units. Unlike hydrocarbons, it does not release CO₂, NOx, or particulate matter upon oxidation. Additionally, hydrogen infrastructure, though still nascent, is expanding globally with public-private partnerships constructing hydrogen refueling stations and pipelines.

Hydrogen’s unique ability to bridge renewable energy intermittency, its potential for large-scale storage, and compatibility with both low- and high-temperature fuel cell technologies further cements its dominance. It is the cleanest, most future-proof fuel type and forms the backbone of most national hydrogen economy strategies.

By Application Analysis

The portable application segment is poised to dominate due to its growing relevance in both civilian and defense sectors. Portable fuel cells provide reliable, lightweight, and efficient off-grid power for electronics, military field operations, disaster relief, telecommunications, and remote monitoring systems. Their ability to function independently of traditional power grids, coupled with long operating durations and quick refueling, gives them a significant edge over traditional lithium-ion battery solutions in mission-critical and remote-use environments.

In military operations, fuel cells are increasingly being adopted for silent surveillance equipment, soldier-worn electronics, and unmanned vehicles, due to their low noise signature, reduced thermal emissions, and extended endurance. Organizations like the U.S. Army and DARPA have funded multiple portable fuel cell trials to replace conventional battery packs with higher energy-density alternatives.

In civilian contexts, portable fuel cells are used in consumer electronics, camping, disaster-prone areas, and medical equipment where extended runtime and grid independence are essential. PEMFCs and direct methanol fuel cells (DMFCs) dominate this segment due to their rapid responsiveness and low-temperature operation.

Growing outdoor and emergency response sectors, along with rising concerns over natural disasters and grid instability, have made reliable portable power more critical than ever. As demand increases for lightweight, clean, and dependable energy solutions for off-grid use, the fuel cell market for portable applications is expected to witness significant expansion. Continuous product miniaturization, modular design improvements, and enhanced fuel logistics are reinforcing the dominance of the portable application segment across global fuel cell deployments.

By End-User Analysis

The Commercial & Industrial (C&I) segment is expected to dominate the fuel cell end-user market due to its vast energy demands, pressure to decarbonize operations, and growing interest in energy resilience and reliability. Industrial users, especially in sectors like chemical manufacturing, data centers, pharmaceuticals, and food processing, are leveraging fuel cells for on-site power generation, combined heat and power (CHP), and backup energy, thereby reducing dependency on the grid and cutting carbon emissions.

Fuel cells offer high electrical efficiencies (up to 60%) and can achieve even greater overall efficiency (80–90%) in cogeneration setups. This makes them ideal for companies seeking cost-effective, uninterrupted, and clean energy, especially in regions with frequent outages or expensive peak tariffs. Commercial buildings, including hospitals, hotels, and universities, are also increasingly adopting fuel cells to power mission-critical infrastructure with minimal emissions and noise.

Additionally, regulatory drivers such as carbon pricing, emissions caps, and green building certifications are pushing industrial players to seek alternatives to diesel generators and fossil-fueled boilers. Fuel cells support corporate ESG goals while also qualifying for tax credits and incentive programs in the U.S., EU, Japan, and South Korea.

Furthermore, commercial installations are benefiting from long system lifespans and relatively low maintenance costs. As hydrogen infrastructure matures and green hydrogen becomes more accessible, commercial and industrial adoption is poised to accelerate further, establishing this segment as the cornerstone of the stationary fuel cell market expansion.

The Global Fuel Cell Market Report is segmented on the basis of the following

By Component

- Stack

- Cells

- Interconnects

- End Plates

- Sealants

- Other Stack Components

- Balance of Plant (BoP)

- Heat Transfer Components

- Power Electronics & Control Systems

- Instruments & Sensors

- Fuel Reformers / Desulfurizers

- Other BoP Components

By Type

- Proton Exchange Membrane Fuel Cells (PEMFC)

- Phosphoric Acid Fuel Cells (PAFC)

- Solid Oxide Fuel Cells (SOFC)

- Molten Carbonate Fuel Cells (MCFC)

- Microbial Fuel Cells (MFC)

- Direct Methanol Fuel Cells (DMFC)

- Other Types

By Fuel Type

- Hydrogen

- Methanol

- Ammonia

- Ethanol

- Hydrocarbons

- Other Fuel Types

By Application

- Portable

- Consumer electronics

- Military-grade portable units

- Stationary

- Data Centers

- Grid Support

- Combined Heat & Power (CHP) Systems

- Transportation

- Passenger Light-duty Fuel Cell Vehicles

- Fuel Cell Buses

- Fuel Cell Trucks

- Other Vehicles

By End-User

- Residential

- Commercial & Industrial

- Transportation

- Data Centers

- Military & Defense

- Utilities & Government/ Municipal Institutes

Global Fuel Cell Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is poised to dominate the global fuel cell market as it commands over 58.0% of the total revenue by the end of 2025, due to robust government policies, leading fuel cell vehicle (FCV) deployment, and large-scale investments in hydrogen infrastructure. Japan and South Korea were among the first countries to establish comprehensive hydrogen roadmaps. Japan’s Ministry of Economy, Trade and Industry (METI) supports mass commercialization of fuel cells through initiatives like the ENE-FARM program, which has led to the installation of over 400,000 residential fuel cells. Toyota, Honda, and Hyundai are global leaders in fuel cell electric vehicles (FCEVs), accounting for a significant portion of global FCV sales.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

China, meanwhile, is aggressively promoting hydrogen and fuel cell technologies as part of its dual-carbon goals. The Chinese government has declared hydrogen a strategic emerging industry and provides local subsidies, tax reliefs, and preferential policies for fuel cell stack manufacturing and commercial vehicle deployment. Provinces like Guangdong, Shandong, and Shanghai have developed regional hydrogen plans and fuel cell industrial parks.

Strong industrial capabilities, favorable policies, a skilled workforce, and massive public-private partnerships make Asia-Pacific the largest contributor to global fuel cell installations and shipments, both in transport and stationary applications.

Region with the Highest CAGR

Asia-Pacific registers the highest compound annual growth rate (CAGR) in the fuel cell market due to aggressive scale-up strategies, export-oriented manufacturing, and emerging demand in developing economies. While the region already leads in volume, countries like China and India are entering the next phase of commercialization, backed by strong policy frameworks and local manufacturing incentives.

In China, the fuel cell vehicle market is expected to surge following the 2022 policy shift that incentivizes FCVs in clusters across cities like Beijing and Shanghai. The Five-Year Plan prioritizes clean hydrogen production, fuel cell stack R&D, and supply chain development, all contributing to exponential growth.

India’s National Green Hydrogen Mission, launched in 2023, aims to produce 5 million metric tons of green hydrogen annually by 2030, with fuel cells identified as a key application area, particularly in transportation and distributed power.

This dynamic shift from early adoption to mass commercialization, especially in developing Asia, underpinned by infrastructure development and technology transfer, is driving the region’s fastest-growing CAGR in the global fuel cell landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Fuel Cell Market: Competitive Landscape

The global fuel cell market is moderately consolidated, with a mix of legacy players, innovative startups, and automotive giants. Ballard Power Systems (Canada) remains a leader in proton exchange membrane fuel cells (PEMFCs) for heavy-duty vehicles and buses. Plug Power (U.S.) is a key player in hydrogen-powered forklifts and on-site green hydrogen production. In Japan, Panasonic and Toshiba lead residential fuel cell deployment, especially with ENE-FARM units.

Automotive firms such as Toyota, Hyundai, and Honda dominate the FCEV segment, investing billions in fuel cell R&D, vehicle deployment, and infrastructure development. Toyota’s Mirai and Hyundai’s NEXO are among the most commercially successful FCVs globally. In the stationary space, Bloom Energy (U.S.) specializes in solid oxide fuel cells (SOFCs) for industrial and commercial power.

Strategic collaborations, such as Hyundai and Cummins, Bosch and PowerCell Sweden, and Nikola and Bosch, are accelerating joint technology development. Governments are actively funding pilot programs and infrastructure projects, particularly in the U.S., Japan, Germany, and China.

Startups like Hyzon Motors, Advent Technologies, and Blue World Technologies are innovating around next-gen membrane technologies, modular systems, and methanol-based fuel cells. The competitive landscape is increasingly dynamic, driven by green hydrogen integration and decarbonization targets across industries.

Some of the prominent players in the Global market are

- Ballard Power Systems

- Plug Power Inc.

- Bloom Energy Corporation

- Doosan Fuel Cell Co., Ltd.

- FuelCell Energy, Inc.

- Hydrogenics (a Cummins Inc. company)

- SFC Energy AG

- Ceres Power Holdings plc

- POSCO Energy

- Panasonic Corporation

- Toshiba Energy Systems & Solutions Corporation

- Toyota Motor Corporation

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- General Motors Company

- Robert Bosch GmbH

- Intelligent Energy Ltd.

- ElringKlinger AG

- Nedstack Fuel Cell Technology BV

- Advent Technologies Holdings, Inc.

- Other Key Players

Recent Developments in the Global Fuel Cell Market

April 2025

- GenH2 Joins Hydrogen Fuel Cell Partnership (H2FCP): GenH2, a U.S.-based developer of liquid hydrogen infrastructure solutions, joined the Hydrogen Fuel Cell Partnership to contribute toward accelerating hydrogen mobility and fueling station deployments. The partnership involves stakeholders from the public and private sectors, supporting California’s roadmap for fuel cell vehicle expansion.

- Rehlko–Toyota Collaboration Announced at ACT Expo: During the Advanced Clean Transportation (ACT) Expo 2025 in Las Vegas, Rehlko, a U.S. backup power systems provider, announced a strategic agreement with Toyota to use its hydrogen fuel cell modules in stationary generators. These generators are aimed at off-grid backup power markets, including telecom and disaster relief.

March 2025

- FuelCell Energy at CERAWeek 2025: FuelCell Energy participated in the global energy conference CERAWeek, presenting its latest advancements in solid oxide electrolyzers and clean distributed power generation. The company emphasized fuel cell applications for microgrids and low-carbon hydrogen production, particularly in Asia-Pacific and North America.

- FuelCell Energy–Diversified Energy–TESIAC Consortium Formation: FuelCell Energy, in partnership with Diversified Energy and TESIAC, formed a consortium to deploy up to 360 MW of fuel cell power systems across data centers in the Appalachian region of the United States. These systems will be powered by natural gas and coal mine methane, providing resilient, low-emission electricity to large-scale IT infrastructure.

February 2025

- SFC Energy Receives €4 Million Order from Indian Ministry of Defence: SFC Energy, a German fuel cell manufacturer, secured a €4 million order through its Indian partner FC TecNrgy to supply portable and stationary methanol-based fuel cells for defense and surveillance applications. These units will be deployed in remote, high-altitude, and grid-independent regions for military use.

December 2024

- SFC Energy Acquires Ballard’s Nordic Stationary Fuel Cell Business: SFC Energy completed its acquisition of Ballard Power Systems Europe's small-scale stationary fuel cell segment in the Nordic region. The deal included the transfer of technology, customer base, and related intellectual property, helping SFC expand its foothold in Europe’s decentralized energy market.

November 2024

- FuelCell Energy Announces Global Operational Restructuring: FuelCell Energy announced a strategic restructuring of its operations in the U.S., Germany, and Canada. The move was aimed at cost optimization and greater focus on core markets such as distributed generation, data center power, and utility-scale backup systems. The restructuring was projected to reduce corporate operational costs by 15%.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9,472.1 Mn |

| Forecast Value (2034) |

USD 87,164.3 Mn |

| CAGR (2025–2034) |

28.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1,832.2 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Stack, Balance of Plant), By Type (Proton Exchange Membrane Fuel Cells (PEMFC), Phosphoric Acid Fuel Cells (PAFC), Solid Oxide Fuel Cells (SOFC), Molten Carbonate Fuel Cells (MCFC), Microbial Fuel Cells (MFC), Direct Methanol Fuel Cells (DMFC), Other Types), By Fuel Type (Hydrogen, Methanol, Ammonia, Ethanol, Hydrocarbons, Other Fuel Types), By Application (Portable, Stationary, Transportation), By End-User (Residential, Commercial & Industrial, Transportation, Data Centers, Military & Defense, Utilities & Government/Municipal Institutes) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Ballard Power Systems, Plug Power Inc., Bloom Energy Corporation, Doosan Fuel Cell Co., Ltd., FuelCell Energy, Inc., Hydrogenics (a Cummins company), SFC Energy AG, Ceres Power Holdings plc, POSCO Energy, Panasonic Corporation, Toshiba Energy Systems & Solutions Corporation, Toyota Motor Corporation, Hyundai Motor Company, Honda Motor Co., Ltd., General Motors Company, Robert Bosch GmbH, Intelligent Energy Ltd., ElringKlinger AG, Nedstack Fuel Cell Technology BV, Advent Technologies Holdings, Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global fuel cell market?

▾ The Global Fuel Cell Market size is estimated to have a value of USD 9,472.1 million in 2025 and is expected to reach USD 87,164.3 million by the end of 2034.

What is the size of the US fuel cell market?

▾ The US Fuel Cell Market is projected to be valued at USD 1,832.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 14,913.8 million in 2034 at a CAGR of 26.2%.

Which region accounted for the largest Global Fuel Cell Market?

▾ Asia Pacific is expected to have the largest market share in the Global Fuel Cell Market with a share of about 58.0% in 2025.

Who are the key players in the Global Fuel Cell Market?

▾ Some of the major key players in the Global Fuel Cell Market are Ballard Power Systems, Plug Power Inc., Bloom Energy Corporation, Doosan Fuel Cell Co., Ltd., FuelCell Energy, Inc., Hydrogenics, and many others.

What is the growth rate in the Global Fuel Cell Market in 2025?

▾ The market is growing at a CAGR of 28.0 percent over the forecasted period of 2025.