Market Overview

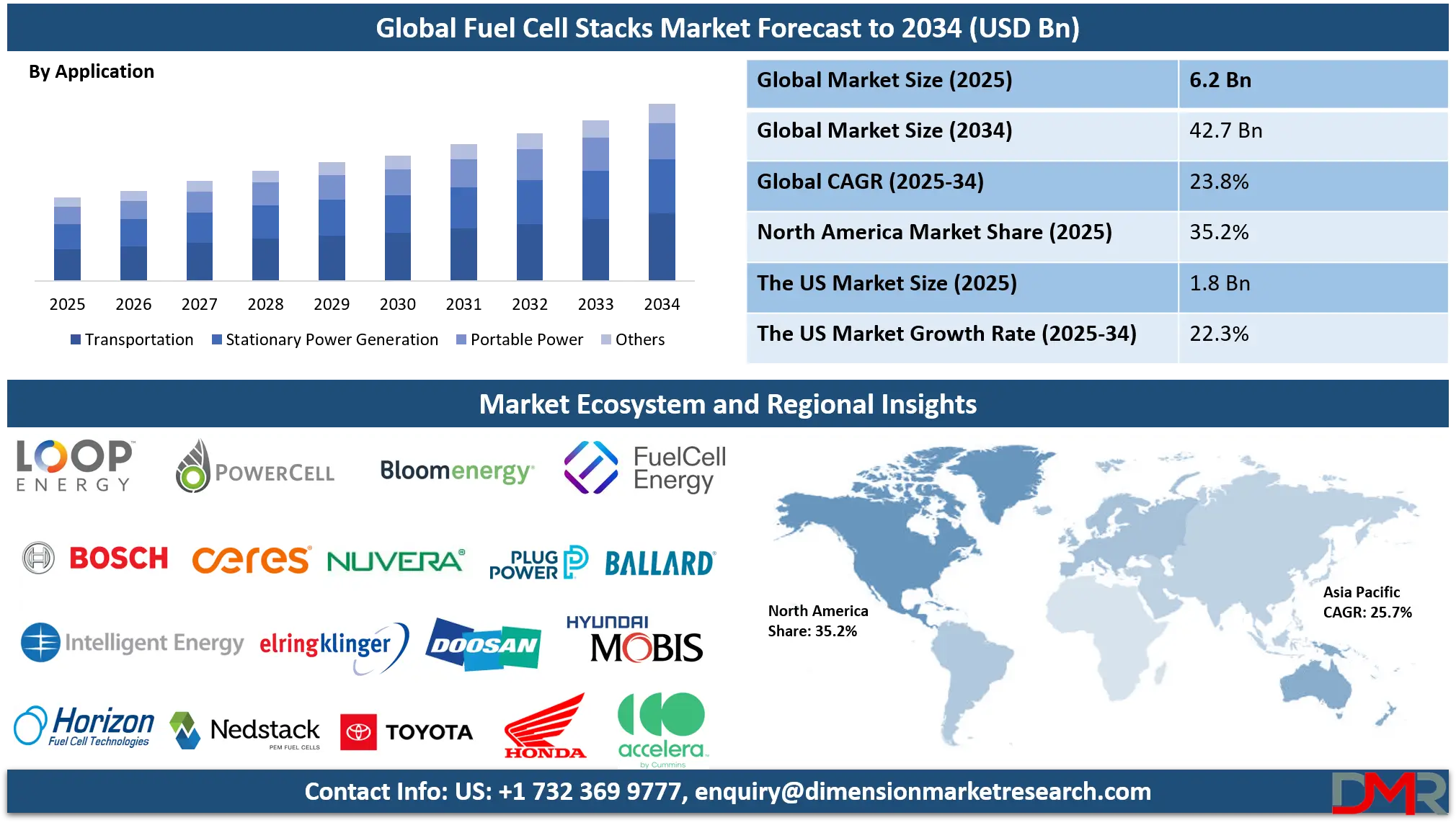

The Global Fuel Cell Stacks Market is forecast to reach USD 6.2 billion in 2025 and is poised for robust expansion at a CAGR of 23.8% between 2025 and 2034, driven by the accelerating adoption of clean energy technologies. By 2034, the market is expected to achieve a substantial valuation of USD 42.7 billion, reflecting growing demand across transportation, stationary power generation, and industrial applications.

This transformative growth is catalyzed by the urgent global imperative to achieve net-zero carbon emissions, the rapid maturation of the green hydrogen value chain, and the critical need for dispatchable, clean power sources beyond intermittent renewables.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fuel cell stacks, the electrochemical heart of fuel cell systems, represent a cornerstone technology for deep decarbonization. They enable high-efficiency conversion of hydrogen and other fuels into electricity, with water and heat as primary by-products. Their application is expanding beyond niche markets into mainstream heavy-duty mobility, large-scale stationary power, and energy-intensive industrial processes. The technology directly addresses the trilemma of energy security, affordability, and sustainability, offering a pathway to reduce reliance on fossil fuels and enhance grid stability.

Technological breakthroughs are occurring across the stack value chain. Innovations include ultra-thin, reinforced membranes for higher durability, platinum group metal (PGM)-free catalysts using iron-nitrogen-carbon compounds, 3D-printed titanium bipolar plates with optimized flow fields, and advanced sealing materials capable of withstanding extreme thermal cycling. Furthermore, the integration of digital twin technology for real-time performance simulation and embedded fiber-optic sensors for internal condition monitoring is revolutionizing stack management, predictive maintenance, and lifespan optimization.

Unprecedented government support worldwide is a primary accelerant. Initiatives like the U.S. Inflation Reduction Act (IRA) with its clean hydrogen production tax credit (PTC), the European Union's Carbon Border Adjustment Mechanism (CBAM) and Hydrogen Bank, and Japan's Green Transformation (GX) Basic Policy are creating robust, long-term demand signals. These policies de-risk investments and foster public-private partnerships.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

However, significant hurdles persist, including persistent high capex for green hydrogen production, material scarcity concerns for critical minerals, standardization gaps in fueling protocols, and the need for a skilled workforce for manufacturing and maintenance. Nevertheless, the synergistic alignment of policy tailwinds, corporate decarbonization mandates, and continuous technological leaps solidifies the fuel cell stack's position as an indispensable pillar of the future global energy architecture through 2034.

The US Fuel Cell Stacks Market

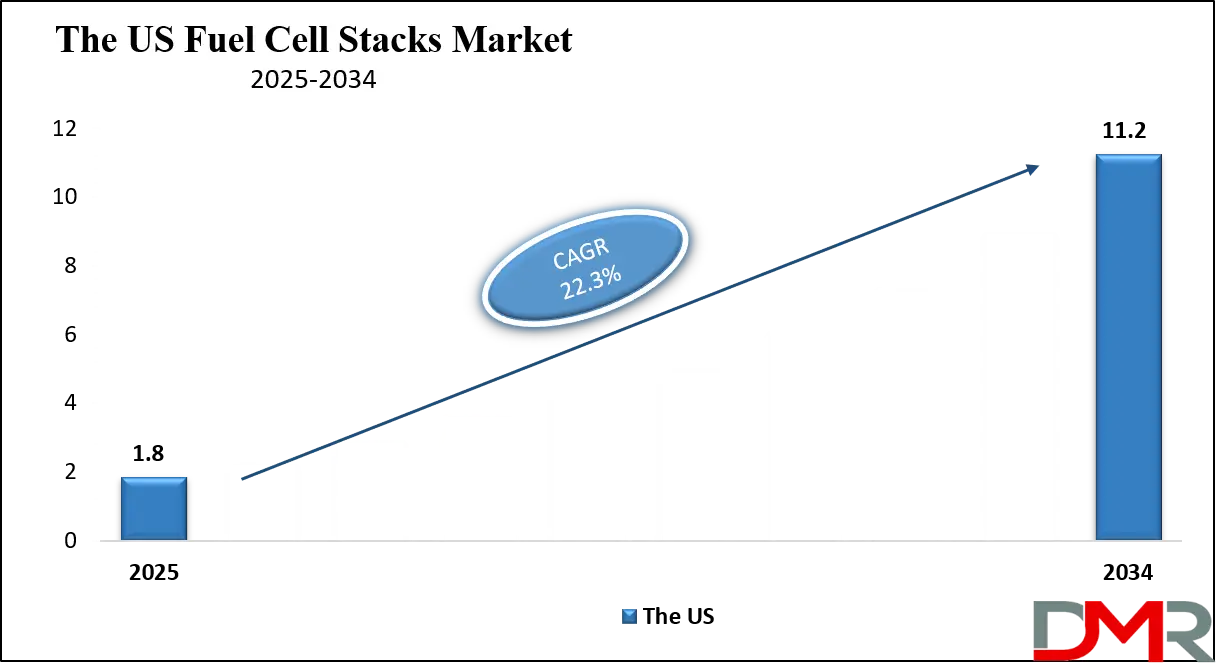

The U.S. Fuel Cell Stacks Market is projected to reach USD 1.8 billion in 2025 and grow at a robust CAGR of 22.3%, reaching USD 11.2 billion by 2034. The United States is a global powerhouse in fuel cell innovation and early commercialization, driven by a potent mix of technology leadership, substantial federal funding, and a diverse industrial base eager to adopt clean technologies.

The U.S. Department of Energy (DOE)'s Hydrogen Shot goal of USD 1 per 1 kg of clean hydrogen within a decade is a game-changer, directly improving the economics of all fuel cell applications. The Infrastructure Investment and Jobs Act (IIJA) allocates USD 8 billion for Regional Clean Hydrogen Hubs (H2Hubs), creating geographically distributed demand centers for fuel cell stacks in transportation, industry, and power generation. Furthermore, the Inflation Reduction Act (IRA) provides a production tax credit of up to USD 3/kg for clean hydrogen, making green hydrogen-fueled systems economically viable much sooner.

Domestically, the market is segmented into high-growth verticals. The material handling equipment sector, led by companies like Plug Power, represents a mature, high-volume market for PEMFC stacks in forklifts. The heavy-duty transportation segment is poised for explosive growth, with major demonstrations and pilot fleets for fuel cell trucks by Nikola, Hyzon, and Toyota.

Data center backup power is emerging as a critical, high-value application, with companies like Microsoft and Amazon testing multi-megawatt fuel cell systems for grid-independent, zero-emission uptime. The U.S. also boasts a leading position in SOFC technology for distributed generation, with Bloom Energy securing major contracts with utilities and corporations. Strong venture capital investment and a culture of entrepreneurship continue to spawn innovative startups focused on next-generation stack materials and manufacturing processes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Fuel Cell Stacks Market

The Europe Fuel Cell Stacks Market is projected to be valued at approximately USD 1.3 billion in 2025 and is projected to reach around USD 7.9 billion by 2034, growing at a CAGR of about 21.5% from 2025 to 2034. Europe's market is characterized by a top-down, regulation-driven approach within the framework of the European Green Deal, creating one of the world's most certain and ambitious demand environments for clean hydrogen and fuel cells.

The EU's Fit for 55 package and REPowerEU plan set binding targets, including the production of 10 million tonnes of domestic renewable hydrogen and 10 million tonnes of imports by 2030. This "hydrogen backbone" is supported by the IPCEI Hy2Tech and Hy2Use initiatives, which funnel state aid into integrated projects across the value chain, from stack component manufacturing to end-use application deployment. The European Hydrogen Bank aims to bridge the cost gap between renewable and fossil hydrogen through auctions, further stimulating the market.

National strategies are highly active. Germany's National Hydrogen Strategy and massive investments are making it a European leader, particularly in heavy-duty trucking (with players like Daimler Truck) and industrial applications. The United Kingdom is advancing through its Hydrogen Strategy and support for projects like the HyNet industrial cluster. France is focusing on green hydrogen for industry and heavy mobility, while the Nordic countries leverage their abundant renewable electricity to become green hydrogen exporters and early adopters of fuel cells in maritime and aviation.

Europe's industrial giants are pivotal. Cummins (through its European operations and Accelera brand) and Volvo Group (via the cellcentric joint venture with Daimler Truck) are central to the commercial vehicle stack ecosystem. This cohesive, pan-European strategy, backed by strong manufacturing and engineering prowess, ensures the region remains a global leader in both technology development and market deployment.

The Japan Fuel Cell Stacks Market

The Japan Fuel Cell Stacks Market is anticipated to be valued at approximately USD 900.1 million in 2025 and is expected to attain nearly USD 580.0 million by 2034, expanding at a leading CAGR of about 23.1% during the forecast period. Japan's pursuit of a "hydrogen society" is a decades-long, national strategic priority born from resource scarcity and a commitment to technological sovereignty, making its market uniquely focused and advanced.

The government's Basic Hydrogen Strategy, recently revised and accelerated, outlines comprehensive targets for hydrogen supply (3 million tonnes/year by 2030, 20 million by 2050) and cost reduction (30 yen/Nm³ by 2030, 20 yen/Nm³ by 2050). It supports the entire ecosystem, from overseas hydrogen sourcing (e.g., from Australia and Brunei) to downstream applications.

Japan dominates specific application niches. The ENE-FARM program for residential micro-CHP systems, primarily using PEMFC and SOFC stacks, has resulted in over 400,000 units installed, creating a massive, sustained demand for small-scale, high-durability stacks. In mobility, Toyota's Mirai and Honda's Clarity Fuel Cell have established Japan as a leader in passenger FCEVs. The focus is now expanding to commercial vehicles, buses, and forklifts. Japan's technological excellence in materials science (e.g., Toray's advanced carbon fiber for gas diffusion layers) and precision engineering enables continuous stack improvement in power density, cold-start capability, and longevity.

A distinctive feature is the keiretsu-style, cross-industry collaboration. Conglomerates like Toyota, Panasonic, Mitsubishi Heavy Industries, and ENEOS (an oil company transitioning to a hydrogen supplier) work in consortia to develop integrated solutions, from hydrogen production and distribution to vehicle manufacturing and stack production. This vertically coordinated approach, combined with societal acceptance and government steadfastness, positions Japan not just as an adopter but as a persistent innovator and exporter of fuel cell stack technology.

Global Fuel Cell Stacks Market: Key Takeaways

- Exponential Global Market Growth Trajectory: The Global Fuel Cell Stacks Market is poised for a near-sixfold expansion, from USD 6.2 billion in 2025 to USD 42.7 billion by 2034, underpinned by the structural shift from pilot projects to gigawatt-scale commercial deployment across multiple sectors.

- Unprecedented CAGR Fueled by Hydrogen Economy Realization: The remarkable 23.8% CAGR from 2025 to 2034 is directly correlated with the materialization of the hydrogen economy, where plummeting green hydrogen costs and proliferating infrastructure unlock fuel cell competitiveness in transportation, industry, and power.

- Robust and Diversified Growth in the United States: The U.S. market, growing at a 22.3% CAGR to USD 11.2 billion by 2034, benefits from a "whole-of-government" approach, world-leading R&D, and deep penetration across material handling, emerging heavy-duty transport, and premium backup power applications.

- North America Sustains Leadership Through Innovation and Policy: Commanding an estimated 35.2% global market share in 2025, North America's dominance is fortified by aggressive federal legislation (IRA, IIJA), a vibrant ecosystem of innovators, and first-mover commercial successes that set global benchmarks.

- Quantum Leaps in Stack Performance and Manufacturability: Breakthrough trends such as PGM-free catalysts, automated high-speed MEA assembly, AI-optimized flow field design, and sealless stack architectures are concurrently driving down cost curves while dramatically improving power density, durability, and reliability.

- Escalating Sectoral Diversification Beyond Mobility: While transportation remains the primary driver, accelerating demand from grid-forming stationary power, maritime and aviation decarbonization, and high-temperature industrial heat and power applications is broadening the market base and de-risking the long-term growth story.

Global Fuel Cell Stacks Market: Use Cases

- Long-Haul Fuel Cell Electric Trucks: Class 8 trucks equipped with high-power (300+ kW) PEMFC stacks achieve ranges exceeding 500 miles with refueling times under 15 minutes, directly competing with diesel on total cost of ownership for fleet operators on specific corridors.

- Megawatt-Scale Fuel Cell Power Plants for Grid Stability: Multi-MW installations of SOFC or PEMFC stacks, often co-located with green hydrogen storage, provide dispatchable, carbon-free baseload or peaking power, integrating with renewable-heavy grids to ensure stability and replace natural gas peaker plants.

- Fuel Cell-Powered Data Center campuses: Hyperscale data centers deploy containerized fuel cell systems (using PEMFC stacks) as primary or backup power, achieving 99.999%+ reliability with zero on-site NOx/SOx emissions and a significantly smaller physical footprint compared to diesel generators and battery banks.

- Auxiliary Power Units (APUs) for Shipping and Aviation: Fuel cell stacks provide clean, efficient onboard power for hotel loads in berthed ships ("cold ironing") and for aircraft systems on the ground and in-flight, reducing auxiliary engine use and cutting emissions in ports and airports.

- Off-Grid and Micro-Grid Prime Power: In remote communities, mining sites, or telecommunications towers, fuel cell stacks powered by delivered hydrogen or on-site reformed fuels provide continuous, low-maintenance prime power, eliminating the need for expensive and polluting diesel fuel logistics.

Global Fuel Cell Stacks Market: Stats & Facts

- According to the International Renewable Energy Agency (IRENA), hydrogen and its derivatives could meet up to 12% of global final energy demand by 2050, with fuel cells being the primary conversion technology for a significant portion, necessitating terawatt-scale stack manufacturing capacity.

- BloombergNEF (BNEF) analysis indicates that the levelized cost of hydrogen (LCOH) from renewable sources could fall to USD 1.50/kg by 2030 in optimal regions, a price point at which fuel cell trucks become cheaper to run than diesel trucks, triggering a commercial tipping point.

- The U.S. Department of Energy's "H2@Scale" initiative reports that advancements in catalyst layer engineering have already reduced platinum loading in PEMFC stacks by over 80% since 2005, with ongoing R&D on PGM-free catalysts targeting a further 10x reduction in catalyst cost.

- A 2024 study by the Fuel Cell & Hydrogen Energy Association (FCHEA) found that announced global manufacturing capacity for fuel cell systems will exceed 25 GW per year by 2027, indicating an imminent step-change in production scale that will dramatically reduce stack costs through economies of scale.

- The International Council on Clean Transportation (ICCT) projects that fuel cell heavy-duty trucks could constitute 30% of new zero-emission truck sales in key markets like the EU, US, and China by 2030, translating into demand for hundreds of thousands of high-power stacks annually.

- The European Patent Office (EPO) and International Energy Agency (IEA) joint report highlights that hydrogen technology patents grew at double the average rate for all technologies between 2011-2020, with Japan, the EU, and the US leading, and fuel cell stack design accounting for the largest share of these innovations.

Global Fuel Cell Stacks Market: Market Dynamic

Driving Factors in the Global Fuel Cell Stacks Market

Confluence of Stringent Global Climate Policy and Corporate Net-Zero Pledges

The alignment of binding international agreements (e.g., Paris Accord), national net-zero legislation, and ambitious corporate sustainability commitments (e.g., RE100, Climate Pledge) is creating an inescapable pull for deep decarbonization technologies. Fuel cell stacks offer a viable, technologically ready solution for "hard-to-abate" sectors where direct electrification is challenging. Carbon pricing mechanisms (like the EU ETS) and mandates for zero-emission vehicle sales (e.g., California's Advanced Clean Trucks rule, the EU's CO2 standards for trucks) are transforming fuel cells from an option into a compliance necessity for entire industries.

Strategic National Competitiveness and Energy Security Imperatives

Beyond climate, nations view leadership in the hydrogen and fuel cell value chain as a strategic economic and geopolitical imperative. Countries are investing to secure domestic manufacturing jobs, reduce dependence on volatile fossil fuel imports, and establish export positions in future clean technology markets. This has led to "hydrogen arms race"-like dynamics, with major economies like the US, EU, China, Japan, and South Korea launching comprehensive national strategies with hundreds of billions in funding, all of which directly stimulate demand for fuel cell stacks.

Restraints in the Global Fuel Cell Stacks Market

Persistent Economic Hurdles in the Green Hydrogen Value Chain

The economic viability of fuel cell systems remains intrinsically linked to the cost and availability of green hydrogen. While costs are falling, large-scale, low-cost renewable hydrogen production, efficient liquefaction or compression, and long-distance transportation infrastructure are still under development. This creates a "chicken-and-egg" dilemma where high hydrogen costs limit fuel cell adoption, and limited demand slows hydrogen infrastructure investment. Until this loop is broken at scale, growth in some regions and applications will be constrained.

Material Supply Chain Vulnerabilities and Scalability Concerns

The production of fuel cell stacks, particularly PEMFCs, depends on critical raw materials with supply chain risks. Platinum group metals (PGMs), though loading is decreasing, are geographically concentrated (e.g., South Africa, Russia). Perfluorosulfonic acid (PFSA) membranes rely on specialty chemicals with limited global production capacity. Scaling stack manufacturing to the terawatt level required for a global hydrogen economy will stress these supply chains, potentially leading to price volatility and bottlenecks, necessitating significant investment in alternative materials and circular recycling economies.

Opportunities in the Global Fuel Cell Stacks Market

Unlocking the Maritime and Aviation Decarbonization Frontier

Maritime shipping and aviation are among the most challenging sectors to decarbonize. Fuel cells, particularly high-temperature PEMFC and SOFC stacks running on green hydrogen or hydrogen-derived fuels (e.g., ammonia, methanol), present a major opportunity. Projects for fuel cell-powered ferries, cruise ships, and auxiliary power are already underway. In aviation, fuel cells are targeted for regional aircraft and APUs. Developing lightweight, marine-grade, and aviation-certified stack systems represents a massive, high-value market opportunity with first-mover advantages.

Integration with Carbon Capture and Industrial Process Gases

Beyond pure hydrogen, certain fuel cell types offer unique opportunities in industrial settings. Molten Carbonate Fuel Cell (MCFC) and Solid Oxide Fuel Cell (SOFC) stacks can utilize industrial by-product gases (e.g., from steel production, biogas from waste) or even be configured for direct carbon capture from flue streams. This creates a dual value proposition: generating clean power while reducing industrial carbon emissions. Deploying fuel cell stacks as carbon-capture-combined power plants at cement, steel, or chemical facilities is a nascent but highly promising application that turns a cost center (emissions) into a potential revenue stream.

Trends in the Global Fuel Cell Stacks Market

Rise of the Gigafactory and Automated, High-Volume Manufacturing

Mirroring the evolution of the lithium-ion battery industry, the fuel cell stack market is transitioning from low-volume, semi-manual assembly to gigafactory-scale, highly automated production. Companies like Bosch, Cummins, and Plug Power are investing in automated lines for MEA stacking, bipolar plate bonding, and end-of-line testing. This shift is critical to achieve order-of-magnitude cost reductions through economies of scale, improved consistency, and lower labor content. Standardized stack platforms designed for robotic assembly are becoming the norm.

Convergence with Digitalization: IoT, AI, and Digital Twins

The digital transformation of stack operation and management is accelerating. Embedded IoT sensors provide real-time data on temperature, pressure, humidity, and impedance across the stack. This data feeds AI-powered digital twin models that predict degradation, optimize operating parameters for efficiency and lifespan, and enable condition-based predictive maintenance. Furthermore, blockchain-enabled tracking of stack performance data and hydrogen fuel origin is emerging for guarantees of origin and carbon credit certification, adding a layer of financial and environmental verification to the technology.

Global Fuel Cell Stacks Market: Research Scope and Analysis

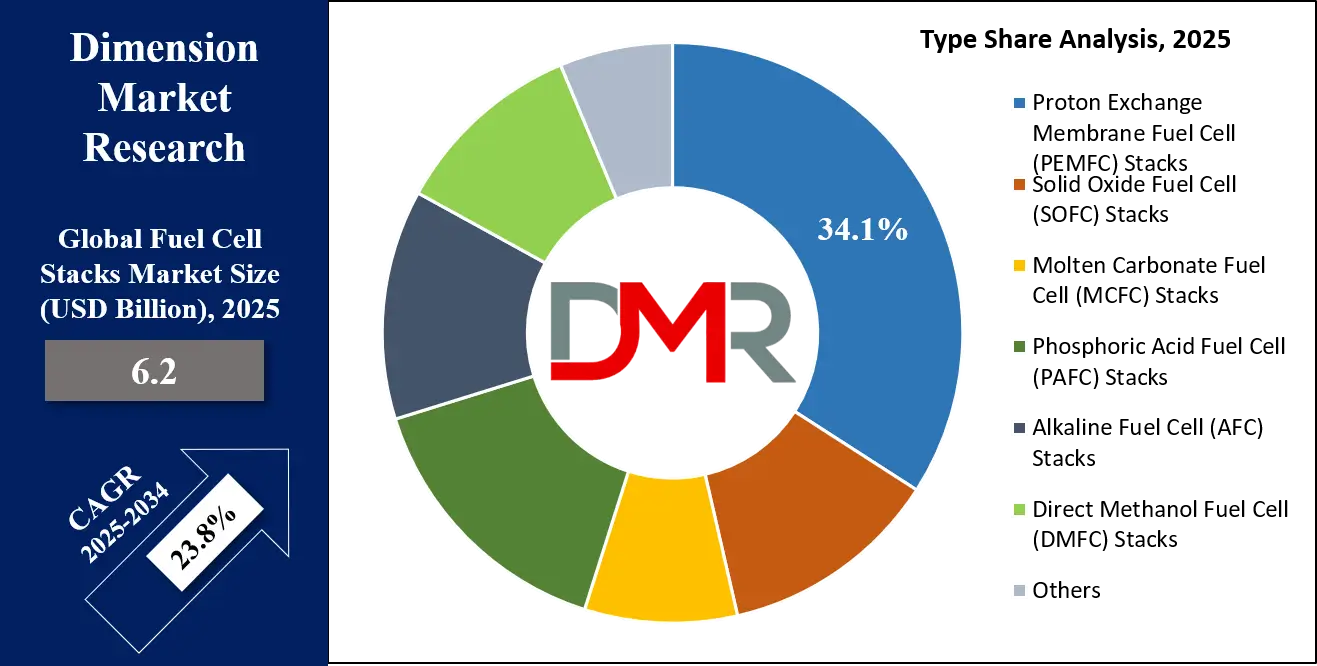

By Type Analysis

Proton Exchange Membrane Fuel Cell (PEMFC) Stacks are unequivocally projected to dominate the global market, holding the largest revenue share throughout the forecast period. This dominance is rooted in their unmatched suitability for dynamic, mobile applications. Key attributes include low operating temperature (60-80°C), enabling rapid cold starts, high power density critical for vehicle packaging, and a solid polymer electrolyte, simplifying system design.

The primary demand driver is the transportation sector, especially light-duty and heavy-duty vehicles, where PEMFC's performance profile is ideal. Continuous R&D is tackling historical limitations: advanced hydrocarbon membranes are improving durability and reducing cost versus traditional PFSA; graded catalyst layers are optimizing platinum utilization; and innovative bipolar plate materials (e.g., coated metal, composite) are enhancing corrosion resistance and reducing weight. The sheer volume of investment and policy focus on FCEVs ensures PEMFC stacks will remain the workhorse of the industry, with innovation focused on cost reduction and performance enhancement for mass-market automotive adoption.

Solid Oxide Fuel Cell (SOFC) Stacks constitute the second-largest and fastest-growing type segment within stationary power. Their advantage lies in high electrical efficiency (60%+) and exceptional fuel flexibility they can electrochemically convert hydrogen, natural gas, biogas, or syngas directly into electricity without a complex external reformer. This makes them perfect for distributed combined heat and power (CHP), prime power for large buildings, and industrial power generation.

The trend is toward lowering operating temperatures from ~800°C to 500-700°C, which reduces material costs (allowing use of stainless steel interconnects instead of ceramics) and improves startup time and thermal cycling durability. The segment is seeing increased deployment in data centers and microgrids, where their high efficiency and ability to provide high-grade heat are highly valued.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Transportation is poised to be the largest and most dominant application segment, accounting for over 38.3% of stack demand by value by 2030. This segment encompasses a hierarchy of maturity: Material Handling Equipment (MHE) is the established, high-volume baseline; Passenger Cars and Buses are in the early commercialization phase; and Heavy-Duty Trucks, Trains, and Marine represent the high-growth frontier.

The dominance is reinforced by stringent tailpipe emission regulations globally, corporate fleet decarbonization goals, and the operational advantages of fuel cells (range, refueling speed) in demanding duty cycles. The convergence of hydrogen infrastructure rollout along key trucking corridors and declining total cost of ownership projections is creating a compelling investment case, locking in transportation's lead.

Stationary Power Generation is the established and rapidly diversifying second-largest application segment. It includes three sub-categories: Backup/UPS Power for critical infrastructure (high reliability, premium market), Primary Power/CHP for buildings and industry (high efficiency, continuous operation), and Grid-Support/Large-Scale Power Plants (utility-scale, dispatchable generation). The growth driver here is the need for resilient, decarbonized, and distributed power amidst increasing grid instability and the phase-out of fossil-fueled generation. Fuel cells offer silent, low-emission, and siting-flexible alternatives to diesel generators and natural gas turbines.

By End User Analysis

Automotive OEMs and Commercial Vehicle Manufacturers are anticipated to dominate as the primary end users, as they are the integrators who embed stacks into final products (FCEVs). Their decisions on powertrain architecture (fuel cell vs. battery), supplier selection (in-house stack development vs. external procurement, e.g., Toyota vs. Hyundai purchasing from Hyundai Mobis), and production volumes directly dictate market size and technological direction. They drive the most stringent cost, performance, and durability requirements, forcing rapid innovation in the stack supply chain. Their scaling production plans (e.g., Daimler Truck and Volvo Group aiming for series production of fuel cell trucks by the late 2020s) represent the single largest demand signal for high-power PEMFC stacks.

Energy & Utility Companies and Independent Power Producers (IPPs) represent the second-largest and strategically vital end-user segment. They deploy fuel cell stacks in distributed generation assets, microgrids, and utility-scale power plants. Their focus is on levelized cost of energy (LCOE), availability, and long-term service contracts. They are key players in creating demand for multi-MW SOFC and PEMFC systems and are often the anchor customers for green hydrogen, thus stimulating the entire upstream value chain. Their investment decisions are driven by grid modernization needs, renewable integration strategies, and regulatory mandates for clean capacity.

The Global Fuel Cell Stacks Market Report is segmented on the basis of the following:

By Type

- Proton Exchange Membrane Fuel Cell (PEMFC) Stacks

- Solid Oxide Fuel Cell (SOFC) Stacks

- Molten Carbonate Fuel Cell (MCFC) Stacks

- Phosphoric Acid Fuel Cell (PAFC) Stacks

- Alkaline Fuel Cell (AFC) Stacks

- Direct Methanol Fuel Cell (DMFC) Stacks

- Others

By Application

- Transportation

- Passenger Vehicles

- Buses

- Trucks (Medium & Heavy Duty)

- Trains & Rail

- Marine & Maritime

- Aerospace & UAVs

- Material Handling Equipment

- Stationary Power Generation

- Prime Power & CHP

- Backup & UPS Power

- Grid Support & Large-Scale Plants

- Portable Power

- Others

By End User

- Automotive OEMs & Commercial Vehicle Manufacturers

- Energy & Utility Companies / IPPs

- Industrial & Manufacturing Enterprises

- Government & Defense Agencies

- Residential & Commercial Building Owners

- Data Center Operators

- Others

Impact of Artificial Intelligence in the Global Fuel Cell Stacks Market

- Generative AI for Novel Material Discovery: AI models are being trained on vast materials databases to predict the properties of new catalyst alloys, membrane polymers, and composite materials for stacks. This accelerates the R&D cycle for next-generation materials with higher activity, lower cost, and better durability, potentially bypassing years of trial-and-error experimentation.

- Computational Fluid Dynamics (CFD) Coupled with Machine Learning for Flow Field Optimization: High-fidelity CFD simulations of reactant flow, heat, and water management within a stack's bipolar plates generate massive datasets. Machine learning algorithms analyze this data to iteratively design optimized, topology-optimized flow field patterns that maximize reactant distribution, minimize pressure drop, and improve water removal, leading to higher and more uniform stack performance.

- AI-Powered Real-Time Adaptive Control Systems: Advanced control algorithms use AI to dynamically adjust stack operating parameters such as temperature, humidity, backpressure, and stoichiometry in response to real-time load demand and internal sensor data. This maximizes efficiency across the entire operating range, prevents damaging conditions (like flooding or drying), and extends stack life by avoiding stressful transient states.

- Computer Vision and ML for Automated Quality Assurance in Manufacturing: AI-powered visual inspection systems scan catalyst-coated membranes (CCMs), gas diffusion layers (GDLs), and bipolar plates during production. They detect microscopic defects pinholes, cracks, coating inhomogeneities with superhuman accuracy, ensuring only perfect components enter the assembly line, dramatically improving yield and long-term stack reliability.

- Predictive Digital Twins for Fleet Management and Warranty Modeling: For large fleets of FCEVs or stationary systems, each physical stack has a high-fidelity digital twin that ages in sync with it, using operational data. AI analyzes fleet-wide twin data to predict remaining useful life, schedule proactive maintenance, and optimize warranty reserves for manufacturers, transforming after-sales service into a data-driven profit center.

Global Fuel Cell Stacks Market: Regional Analysis

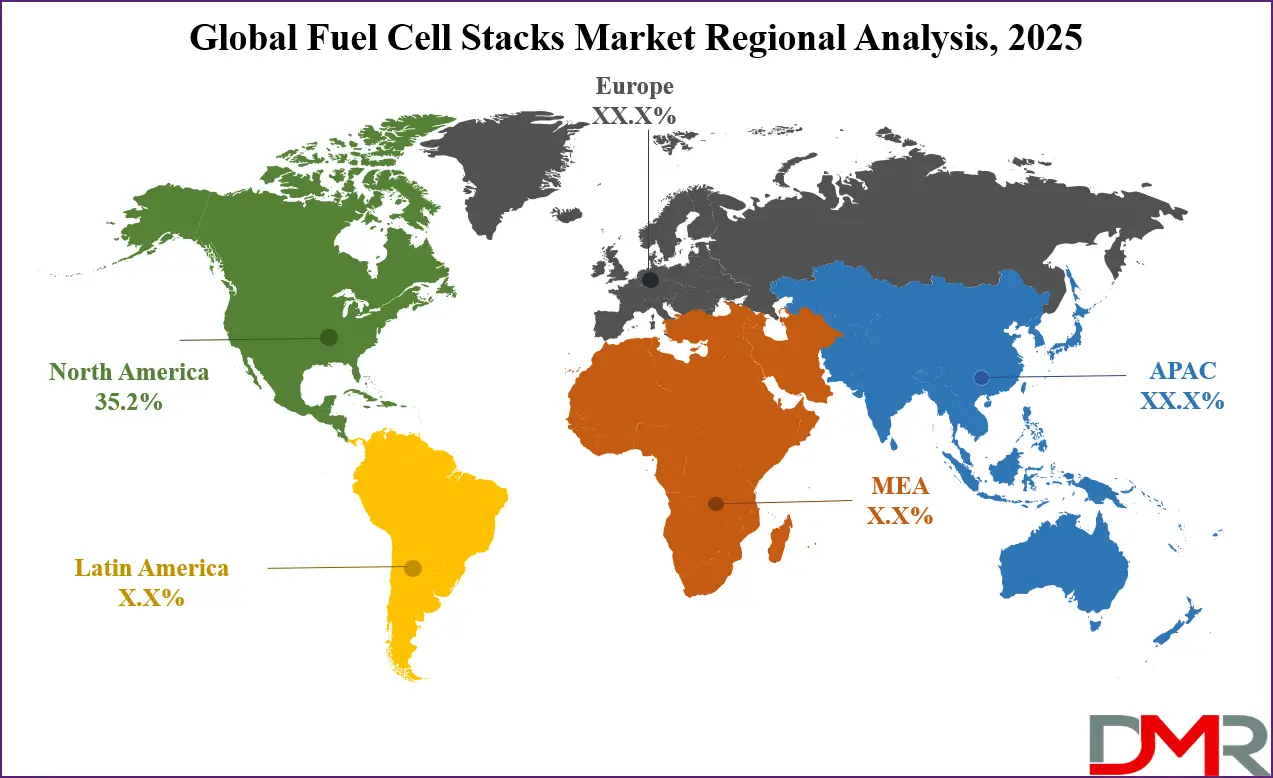

Region with the Largest Revenue Share

North America is projected to command the largest revenue share, estimated at 35.2% of the global market in 2025. This leadership is not incidental but built on a formidable foundation of market-creating policy, technological primacy, and first-mover commercialization. The United States is the epicenter, where the Inflation Reduction Act (IRA) has fundamentally altered the investment landscape. Its clean hydrogen production tax credit (45V PTC) and investment tax credits (48 and 45Q) for energy property and carbon capture make integrated "green hydrogen + fuel cell" projects financially compelling.

The USD 8 billion Regional Clean Hydrogen Hubs (H2Hubs) program ensures demand is geographically distributed and linked to end-use. Commercially, North America hosts the world's most mature market for fuel cell material handling equipment and is the testing ground for fuel cell heavy-duty trucking. Leading stack technology companies like Ballard Power Systems (Canada) and Plug Power (USA) are globally recognized. Furthermore, a deep venture capital ecosystem continuously funds disruptive startups in stack components and advanced manufacturing.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia-Pacific (APAC) is poised to register the highest CAGR during the forecast period and is expected to overtake North America in market size by the end of the forecast period, driven by sheer scale, aggressive government mandates, and manufacturing might. China's influence is paramount; its "Dual Carbon" goals (peak carbon by 2030, carbon neutrality by 2060) have mobilized a national industrial policy. China is already the world's largest producer and deployer of fuel cell systems, primarily for buses and trucks, supported by substantial subsidies and city cluster demonstration programs (e.g., Beijing-Tianjin-Hebei, Shanghai, Guangdong).

Chinese companies are rapidly advancing up the technology curve and building massive manufacturing capacity with a focus on cost reduction. Japan and South Korea provide the high-tech counterpoint, with their aforementioned national strategies and global OEMs (Toyota, Hyundai, Honda). South Korea's "Hydrogen Economy Roadmap" aims for 6.2 million FCEVs and 15 GW of fuel cell power generation by 2040. APAC's combination of policy drive, manufacturing scalability, and massive domestic markets creates an unstoppable growth engine, giving it the highest CAGR and eventual market leadership.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Fuel Cell Stacks Market: Competitive Landscape

The Global Fuel Cell Stacks Market is in a dynamic state of competitive flux, evolving from a landscape of specialist startups and industrial conglomerates' R&D departments into an arena featuring deep-pocketed industrial giants, strategic joint ventures, and vertically integrated ecosystems. The competition is no longer just about stack performance in a lab; it is about cost at scale, manufacturing prowess, system integration capability, and access to durable hydrogen offtake agreements.

Companies like Ballard Power Systems and Plug Power have evolved from stack developers into full system providers with extensive field experience and large installed bases, giving them deep operational data and brand recognition. The landscape is defined by major alliances. The cellcentric JV (Daimler Truck/Volvo Group) aims to be a European champion for truck stacks. Hyundai Motor Group has a vertically integrated stack supply through Hyundai Mobis. Toyota licenses its stack technology to partners like BMW and Hino. Cummins, through acquisitions and its Accelera brand, is a full-spectrum player from components to systems.

Bloom Energy (SOFC) and FuelCell Energy (MCFC) dominate the large-scale stationary power conversation, with multi-megawatt installations and a focus on utility and industrial customers. Companies like Gore (membranes), 3M (catalysts), Toray (GDLs), and ElringKlinger (bipolar plates) compete at the component level, supplying the entire industry. Their innovations in materials science trickle up to define stack performance ceilings. The key competitive strategies observed are vertical integration to control costs and supply, strategic licensing to rapidly proliferate technology, formation of ecosystem consortia to de-risk projects, and intense focus on automated manufacturing to win the cost race.

Some of the prominent players in the Global Fuel Cell Stacks Market are:

- Ballard Power Systems Inc.

- Plug Power Inc.

- Cummins Inc. (Accelera by Cummins)

- Toyota Motor Corporation

- Hyundai Motor Company / Hyundai Mobis

- Honda Motor Co., Ltd.

- Bloom Energy

- Ceres Power Holdings plc

- FuelCell Energy, Inc.

- Robert Bosch GmbH

- Doosan Fuel Cell Co., Ltd.

- Nuvera Fuel Cells, LLC (A Hyster-Yale Group Company)

- PowerCell Sweden AB

- ElringKlinger AG

- Nedstack Fuel Cell Technology B.V.

- Horizon Fuel Cell Technologies Pte Ltd.

- Intelligent Energy Limited

- Advent Technologies Holdings, Inc.

- Loop Energy Inc.

- AVL List GmbH

- Other Key Players

Recent Developments in the Global Fuel Cell Stacks Market

- November 2025: Ballard Power Systems launched its FCgen®-9HP stack platform, achieving a power density of 5.0 kW/L. The company announced a parallel manufacturing innovation program targeting a 30% reduction in unit cost at volume production by 2027, specifically designed for heavy-duty truck and bus applications, reinforcing its technology roadmap for the commercial vehicle sector.

- October 2025: Bosch officially opened its highly automated, USD 1+ billion solid oxide fuel cell stack production facility. The factory has an initial annual capacity of 200 MW, scalable to 1 GW, and will produce stacks for stationary CHP units, marking a decisive step in bringing SOFC technology to mass-market cost points.

- October 2025: The Department of Energy's Hydrogen and Fuel Cell Technologies Office (HFTO) funded a new consortium, including Argonne National Lab, 3M, and GM, to develop PGM-free catalyst electrodes and hydrocarbon-based membranes with a durability target of 25,000 hours under automotive cycling conditions, aiming to break the cost dependency on platinum.

- September 2025: The alliance goes beyond supply, involving co-development of a next-generation 350kW PEMFC stack platform for North American Class 6-8 trucks. The partnership combines Hyundai's proprietary stack technology with Cummins' Accelera brand's systems integration, manufacturing, and aftermarket service network for heavy-duty applications.

- August 2025: Ceres secured a USD 50 million deal with a top-three Chinese automaker to co-develop and license its SteelCell® SOFC technology for use as a range extender in battery-electric passenger vehicles. This represents a significant new application pathway for SOFCs beyond stationary power.

- July 2025: Plug Power announced the production of its 50,000th fuel cell stack from its state-of-the-art automated facility in Rochester, NY. The company reported the line achieved its target of a 40% reduction in direct labor costs and a defect rate below 50 ppm, proving the viability of high-volume, automotive-quality manufacturing for PEMFC stacks.

- June 2025: A consortium including ABB, Ballard, and Wärtsilä launched the Hy2Mega project with USD 50 million in Horizon Europe funding. The goal is to develop, build, and test a 5-10 MW PEMFC stack module capable of integration into large ocean-going vessels, addressing the critical power scale needed for deep-sea shipping decarbonization.

- April 2025: Toyota released a white paper detailing its third-generation PEMFC stack, featuring a new cell structure that simplifies components, a proprietary catalyst deposition process that further reduces platinum loading, and enhanced cold-start performance down to -30°C, slated for launch in the mid-2020s.

- March 2025: The Chinese Ministry of Industry and Information Technology released the GB/T 2025-XXXX standard, establishing uniform testing protocols for stack power density, efficiency, durability, and safety. This move is aimed at eliminating low-quality products, encouraging technological advancement, and facilitating a transparent, high-quality domestic supply chain.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.2 Bn |

| Forecast Value (2034) |

USD 42.7 Bn |

| CAGR (2025–2034) |

23.8% |

| The US Market Size (2025) |

USD 1.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Proton Exchange Membrane Fuel Cell (PEMFC) Stacks, Solid Oxide Fuel Cell (SOFC) Stacks, Molten Carbonate Fuel Cell (MCFC) Stacks, Phosphoric Acid Fuel Cell (PAFC) Stacks, Alkaline Fuel Cell (AFC) Stacks, Direct Methanol Fuel Cell (DMFC) Stacks, Others), By Application (Transportation, Stationary Power Generation, Portable Power, Others), By End User (Automotive OEMs & Commercial Vehicle Manufacturers, Energy & Utility Companies / IPPs, Industrial & Manufacturing Enterprises, Government & Defense Agencies, Residential & Commercial Building Owners, Data Center Operators, Others)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Ballard Power Systems Inc., Plug Power Inc., Cummins Inc. (Accelera by Cummins), Toyota Motor Corporation, Hyundai Motor Company / Hyundai Mobis, Honda Motor Co., Ltd., Bloom Energy, Ceres Power Holdings plc, FuelCell Energy, Inc., Robert Bosch GmbH, Doosan Fuel Cell Co., Ltd., Nuvera Fuel Cells, LLC (A Hyster-Yale Group Company), PowerCell Sweden AB, ElringKlinger AG, Nedstack Fuel Cell Technology B.V., Horizon Fuel Cell Technologies Pte Ltd., Intelligent Energy Limited, Advent Technologies Holdings, Inc., Loop Energy Inc., AVL List GmbH., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Fuel Cell Stacks Market?

▾ The Global Fuel Cell Stacks Market size is estimated to have a value of USD 6.2 billion in 2025 and is expected to reach USD 42.7 billion by the end of 2034, representing a period of transformative growth.

What is the growth rate in the Global Fuel Cell Stacks Market?

▾ The market is growing at a compound annual growth rate (CAGR) of 23.8 percent over the forecasted period from 2025 to 2034.

What is the size of the US Fuel Cell Stacks Market?

▾ The US Fuel Cell Stacks Market is projected to be valued at USD 1.8 billion in 2025. It is expected to witness strong subsequent growth, reaching USD 11.2 billion in 2034, expanding at a CAGR of 22.3%.

Which region accounted for the largest Global Fuel Cell Stacks Market?

▾ North America is expected to have the largest market share in the Global Fuel Cell Stacks Market in the early forecast period, with a share of about 35.2% in 2025, driven by strong policy and early commercial adoption.

Who are the key players in the Global Fuel Cell Stacks Market?

▾ Some of the major key players in the Global Fuel Cell Stacks Market are Ballard Power Systems, Plug Power Inc., Cummins Inc. (Accelera), Toyota Motor Corporation, Hyundai Motor Company, Bloom Energy, and Ceres Power, among many other established and emerging participants.