Market Overview

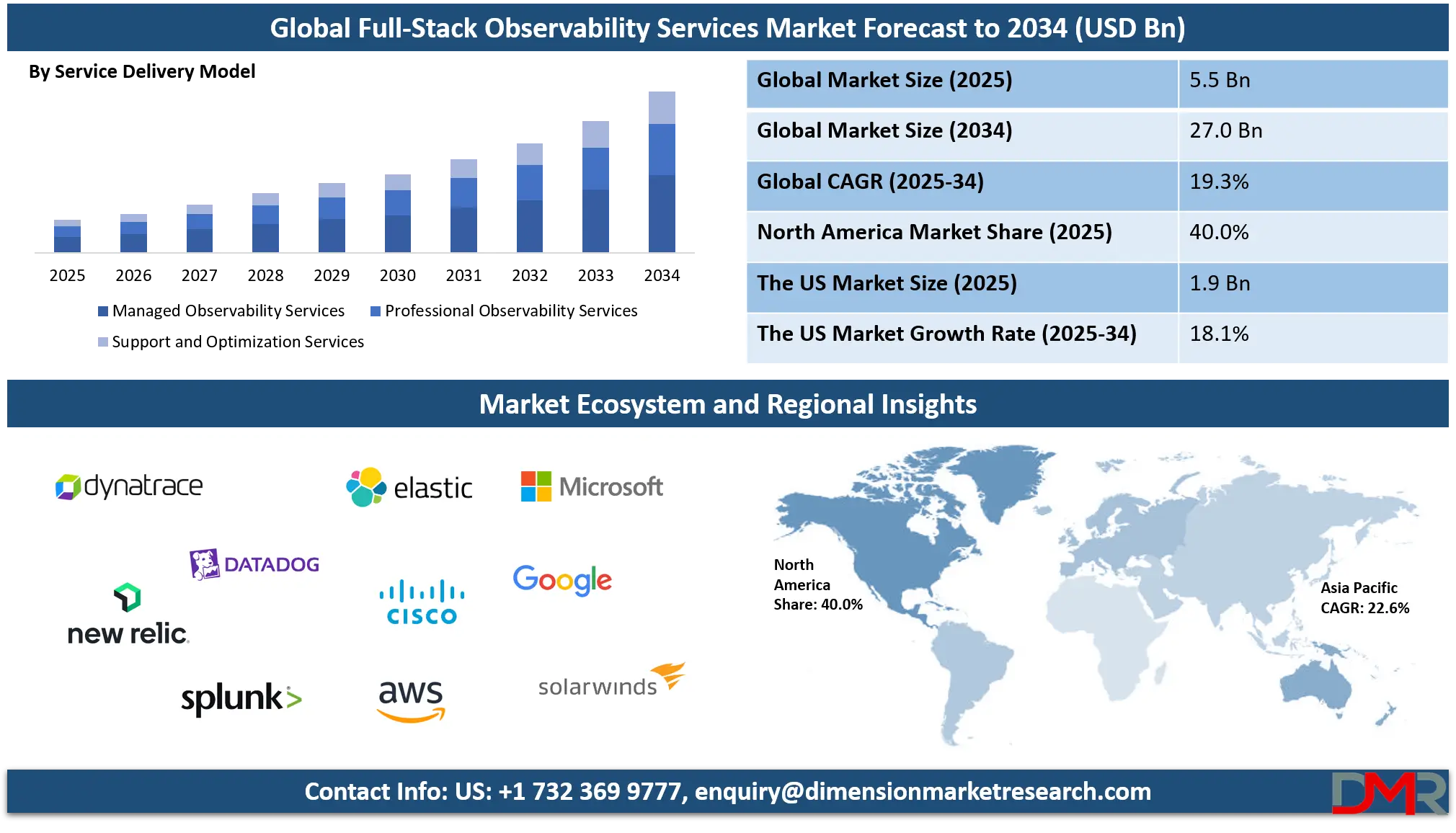

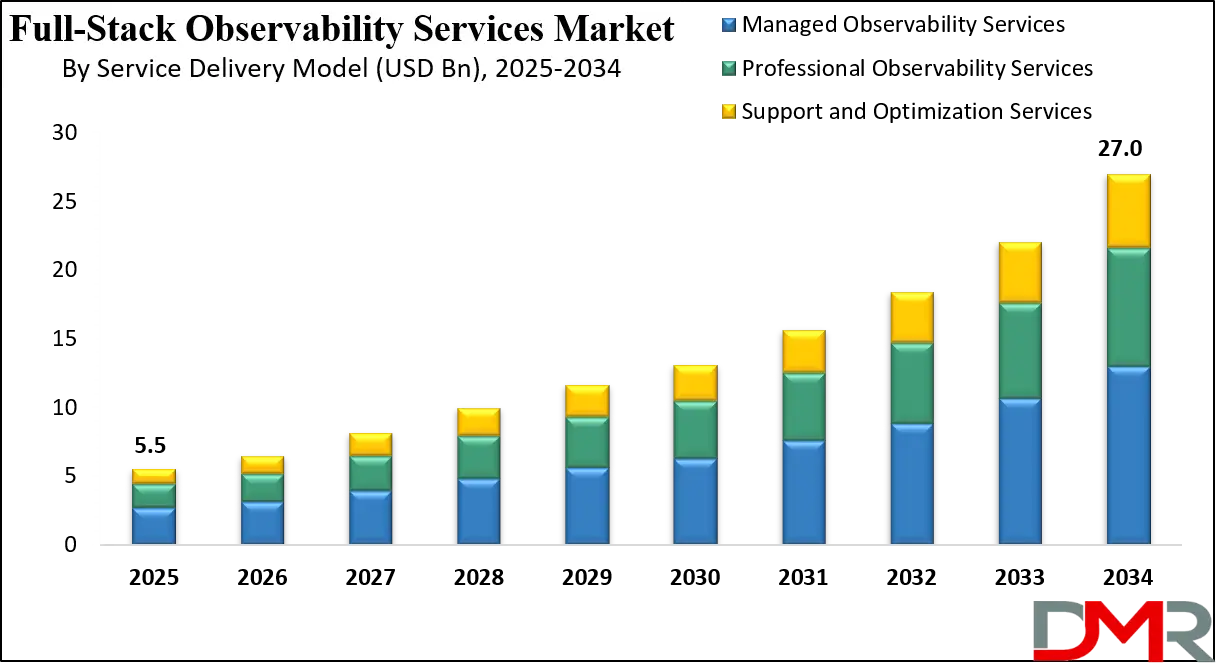

The global full stack observability services market was valued at approximately USD 5.5 billion in 2025 and is projected to reach USD 27.0 billion by 2034, expanding at a CAGR of 19.3%. Market growth is driven by rising adoption of cloud native architectures increasing complexity of distributed systems and growing demand for real time monitoring performance analytics and operational intelligence across enterprise IT environments.

Full stack observability services refer to a comprehensive set of managed and professional services that enable organizations to gain end to end visibility across applications infrastructure networks and user experience within complex digital environments. These services collect and correlate telemetry data such as metrics logs traces and events to help enterprises monitor system health detect anomalies analyze performance bottlenecks and identify root causes in real time. By combining operational monitoring analytics automation and expert support full stack observability services allow businesses to maintain service reliability optimize performance and improve incident response across cloud native hybrid and on premise environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global full stack observability services market represents a rapidly expanding segment of the enterprise IT services landscape driven by the growing complexity of distributed systems digital transformation initiatives and cloud adoption. Organizations across industries are increasingly relying on observability services to support continuous application delivery ensure uptime of mission critical platforms and manage large volumes of machine generated data. Rising adoption of microservices containerized workloads and API driven architectures has further increased demand for advanced observability capabilities delivered through managed and professional service models.

Market growth is also supported by increasing enterprise focus on proactive monitoring operational intelligence and data driven decision making. Industries such as banking technology retail healthcare and telecommunications are investing heavily in observability services to enhance system resilience improve customer experience and reduce mean time to resolution. As businesses continue to scale digital operations globally the full stack observability services market is expected to witness sustained demand supported by cloud migration initiatives growing DevOps adoption and the need for unified visibility across increasingly dynamic IT ecosystems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Full-Stack Observability Services Market

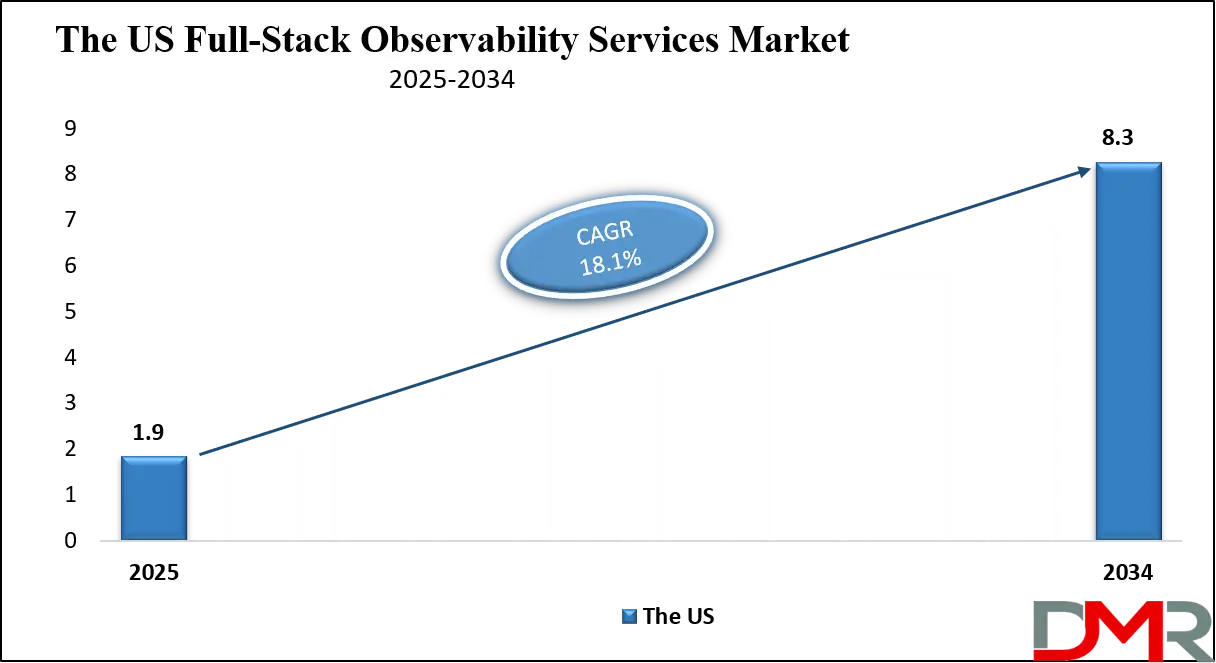

The U.S. Full-Stack Observability Services Market size was valued at USD 1.9 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 8.3 billion in 2034 at a CAGR of 18.1%.

The United States full stack observability services market represents the largest and most mature regional landscape globally, supported by early adoption of cloud computing advanced DevOps practices and large scale digital transformation initiatives. Enterprises across sectors such as technology banking healthcare and retail increasingly rely on observability services to manage complex application ecosystems and ensure high system availability. Strong presence of leading observability service providers combined with high enterprise IT spending continues to accelerate adoption of end to end monitoring analytics and performance optimization solutions across public cloud hybrid and on premise environments.

Market expansion in the United States is further driven by growing demand for proactive incident management automation and real time visibility across distributed architectures. Increasing use of microservices container platforms and artificial intelligence driven applications has amplified the need for advanced observability services capable of handling large volumes of telemetry data. Regulatory compliance requirements cybersecurity concerns and focus on customer experience optimization also contribute to sustained investment in observability services as organizations prioritize operational resilience reduced downtime and faster resolution of performance issues.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Full-Stack Observability Services Market

The Europe full stack observability services market was valued at USD 3.0 billion in 2025, driven by widespread digital transformation initiatives, rapid adoption of cloud computing, and the increasing complexity of enterprise IT environments. Organizations across industries such as banking, technology, retail, and healthcare are investing in observability solutions to gain end to end visibility into applications, infrastructure, and user experience. The growing focus on operational efficiency, performance monitoring, and real time analytics is further supporting market expansion in the region.

Market growth in Europe is also fueled by the adoption of hybrid IT environments, microservices architectures, and containerized workloads that require continuous monitoring and proactive performance management. Regulatory compliance, data security requirements, and increasing emphasis on customer experience are prompting enterprises to deploy advanced observability services that provide predictive insights and faster incident resolution. The Europe market is expected to grow at a CAGR of 18.0%, reflecting strong demand for managed and professional observability services across cloud, on premise, and hybrid infrastructures.

Japan Full-Stack Observability Services Market

The Japan full stack observability services market was valued at USD 728 million in 2025, driven by rapid digital transformation across enterprises and growing adoption of cloud computing, containerized applications, and microservices architectures. Japanese organizations, particularly in technology, finance, and manufacturing sectors, are investing in observability solutions to monitor applications, infrastructure, and user interactions in real time. The increasing need for operational efficiency, system reliability, and improved customer experience is boosting demand for comprehensive full stack observability services in the region.

Market expansion in Japan is also supported by the adoption of hybrid IT environments and AI‑enabled analytics for predictive monitoring and proactive incident management. Regulatory compliance, cybersecurity requirements, and the push for high service availability are encouraging enterprises to implement advanced observability tools that provide actionable insights and faster root cause analysis. The Japan market is expected to grow at a CAGR of 17.0%, highlighting steady adoption of full stack observability solutions to optimize performance and strengthen digital infrastructure resilience.

Global Full-Stack Observability Services Market: Key Takeaways

- Explosive Market Growth: The global full-stack observability services market is witnessing rapid expansion, projected to grow from USD 5.5 billion in 2025 to USD 27.0 billion by 2034, driven by cloud adoption, distributed systems, and digital transformation.

- AI-Driven Observability: Integration of AI and machine learning enhances predictive analytics, anomaly detection, and automated root cause analysis, enabling proactive system monitoring and faster incident resolution.

- Regional Dynamics: North America dominates the market with 40.0% revenue share, while Asia-Pacific shows strong growth due to cloud adoption, digitalization, and increasing IT infrastructure investments.

- Enterprise Adoption Patterns: Large enterprises lead adoption due to complex IT environments, while SMEs are gradually leveraging managed and professional services to optimize performance and reduce downtime.

- Industry-Specific Demand: BFSI and IT sectors dominate adoption, prioritizing real-time performance monitoring, transaction reliability, and operational resilience, with emerging verticals like manufacturing and government providing new growth opportunities.

Global Full-Stack Observability Services Market: Use Cases

- Application Performance Monitoring: Full stack observability services enable real time visibility into application behavior helping organizations identify performance issues reduce latency and ensure service availability across cloud native and distributed environments.

- DevOps and Release Monitoring: Observability services support DevOps workflows by tracking deployments runtime performance and system stability enabling faster troubleshooting and more reliable continuous delivery processes.

- Infrastructure and Cloud Visibility: These services provide unified monitoring of cloud and on premise infrastructure allowing enterprises to optimize resource usage control operational costs and maintain system health.

- Digital Experience Optimization: Full stack observability services help organizations analyze user interactions and service responsiveness improving customer experience and supporting data driven performance optimization strategies.

Impact of Artificial Intelligence on the global Full-Stack Observability Services market

The impact of artificial intelligence on the global full stack observability services market has been transformative, reshaping how enterprises monitor, analyze, and act on system data. AI integrated observability platforms enhance automation by using machine learning models to detect anomalies, predict performance degradation, and correlate vast streams of metrics, logs, and traces with minimal human intervention. This reduces alert fatigue and accelerates root cause analysis, enabling IT teams to focus on strategic improvements rather than repetitive troubleshooting.

AI driven capabilities such as predictive analytics and pattern recognition also improve the accuracy of incident detection and forecasting, allowing organizations to proactively prevent outages and optimize infrastructure performance. Natural language processing and AI powered insights democratize access to observability data by enabling intuitive querying and contextual explanations of complex system behavior. As enterprises continue adopting cloud native technologies microservices architectures and highly distributed environments, AI powered observability is becoming essential for delivering reliable digital experiences, improving operational efficiency, and supporting agile development practices across industries.

Global Full-Stack Observability Services Market: Stats & Facts

Digital Agency Japan – Priority Plan for the Advancement of a Digital Society (June 2025)

- As of February 2025, the number of systems using Government Cloud increased by 335% from 671 in August 2024 to 2,918 systems.

- The number of ministries and agencies using Government Solution Services (GSS) increased by 30% from February 2024 to February 2025.

- There were approximately 42,000 connected GSS users in July 2025.

- Out of 34,592 systems targeted for standardization, 8.6% were subject to migration support as of January 2025.

- 31.0% of government organisations had systems subject to migration support as of end of January 2025.

UK Government – State of Digital Government Review (January 2025)

- Around 55% of central government organisations reported that over 60% of their estate is now on cloud.

- In 2023 the UK public sector spent £26 billion on technology and data.

- 47% of government services still rely on non‑digital methods such as phone and paper forms.

- The public sector workforce engaged in digital and data roles was 97,000 people.

- 28% of central government systems were classified as legacy technology in 2024.

Global Full-Stack Observability Services Market: Market Dynamics

Global Full-Stack Observability Services Market: Driving Factors

Rapid Cloud Adoption and Digital Transformation

Enterprises across industries are accelerating cloud migration and digitalization of core business processes, increasing demand for comprehensive observability tools that deliver end to end visibility across hybrid and multi-cloud environments. As organizations deploy more microservices containerized applications and distributed architectures, full stack observability services become essential to monitor performance, trace requests, and ensure seamless digital service delivery.

Focus on Service Reliability and User Experience

Increasing emphasis on delivering high quality digital experiences is driving adoption of observability solutions that provide real time performance analytics and actionable insights. Businesses are investing in observability to reduce system downtime, improve application responsiveness, and gain deeper understanding of customer interactions and behavior, which enhances operational resilience and competitive differentiation.

Global Full-Stack Observability Services Market: Restraints

Integration Complexity across Heterogeneous Systems

Enterprises often struggle to integrate full stack observability services with legacy infrastructure, disparate monitoring tools, and multiple cloud platforms. This complexity can lead to inconsistent data, configuration challenges, and extended implementation timelines that slow overall adoption and increase total cost of ownership for observability initiatives.

Shortage of Skilled Observability Professionals

Effective deployment and tuning of observability services require specialized skills in areas such as telemetry data analysis, metrics interpretation, and performance engineering. A shortage of trained professionals capable of managing and optimizing observability platforms can limit the value organizations derive from these services and hinder broader implementation across teams.

Global Full-Stack Observability Services Market: Opportunities

AI and Machine Learning Enhanced Observability

The integration of artificial intelligence and machine learning into observability platforms presents significant growth opportunities. AI driven analytics can automate anomaly detection, forecast performance issues, and provide predictive insights that reduce manual effort and improve operational efficiency. This helps businesses move from reactive incident response to proactive system monitoring.

Expansion into Emerging Industry Verticals

Industries such as manufacturing energy automotive and government services are beginning to adopt full stack observability to support Industry 4.0 initiatives, IoT ecosystems, and digital services modernization. Expanding observability services into these sectors offers new revenue streams and encourages development of specialized solutions tailored to industry specific performance, security, and compliance requirements.

Global Full-Stack Observability Services Market: Trends

Convergence of Observability and Security Monitoring

There is a growing trend toward combining observability with security analytics to enhance threat detection and risk management. Converged platforms use telemetry data not only for performance insights but also for identifying anomalous behavior, supporting faster incident response, and strengthening overall cyber resilience.

Adoption of Open Standards and Interoperable Toolchains

Organizations are increasingly favoring observability solutions that support open standards, interoperable APIs, and ecosystem integrations. This enables better data portability, seamless integration with DevOps toolchains, and flexibility to combine best of breed monitoring, logging and tracing components while avoiding vendor lock in.

Global Full-Stack Observability Services Market: Research Scope and Analysis

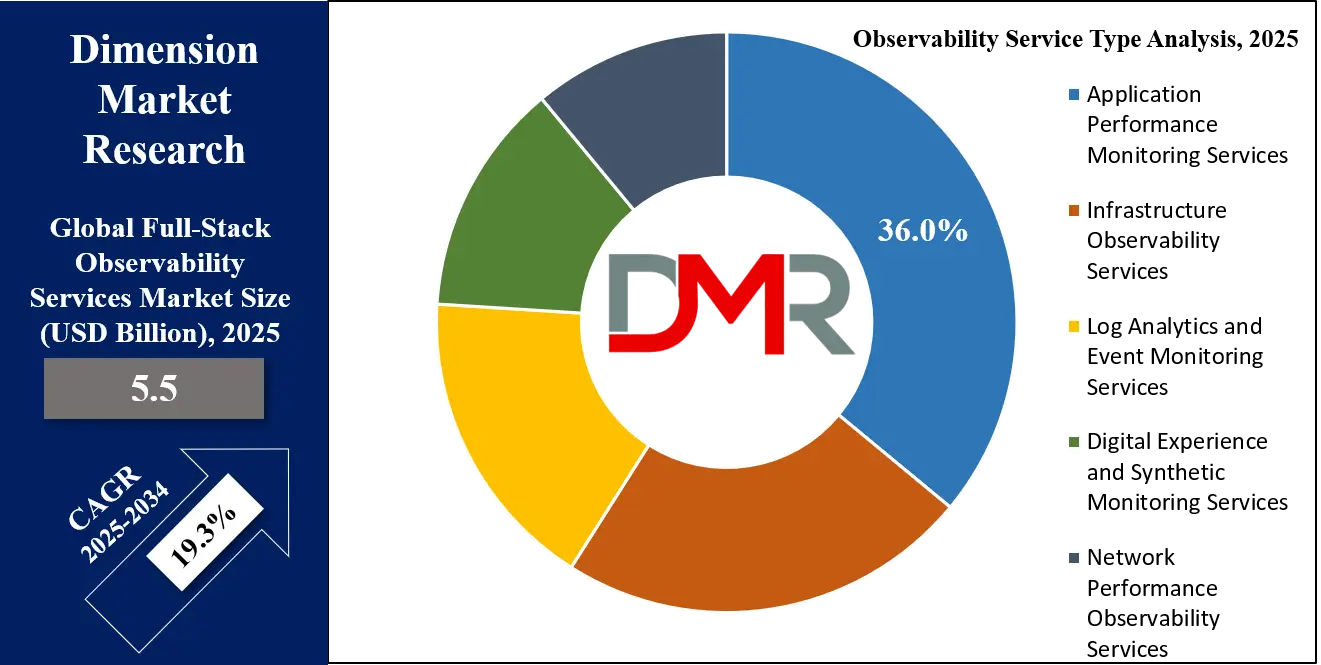

By Observability Service Type Analysis

Application performance monitoring services are anticipated to dominate the observability service type segment, capturing around 36.0% of the total market share in 2025, as enterprises increasingly prioritize real time visibility into application behavior across complex digital environments. The growing reliance on cloud native applications microservices and distributed systems has significantly increased the need to monitor transaction performance latency response time and application availability. Application performance monitoring services help organizations quickly identify bottlenecks reduce downtime and improve user experience by correlating metrics logs and traces. Their ability to support proactive performance optimization and faster root cause analysis makes them a critical component of full stack observability strategies across industries.

Infrastructure observability services also play a vital role within this segment by enabling continuous monitoring of underlying compute storage and network resources that support modern applications. These services provide insights into resource utilization capacity planning and infrastructure health across public cloud hybrid and on premise environments. As enterprises scale digital operations and adopt dynamic infrastructure models such as containers and virtualized workloads infrastructure observability services help ensure system stability and operational efficiency. Together with application performance monitoring them enable end to end visibility allowing organizations to maintain reliable service delivery and optimize performance across the entire technology stack.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Service Delivery Model Analysis

Managed observability services are anticipated to dominate the service delivery model segment, capturing around 48.0% of the total market share in 2025, as organizations increasingly prefer outsourced monitoring and management of complex IT environments. Enterprises are relying on managed services to handle continuous system monitoring alert management incident response and performance optimization without the need to build large in house observability teams. This approach helps reduce operational overhead improve uptime and ensure consistent visibility across cloud native hybrid and on premise infrastructures while allowing internal teams to focus on core business initiatives.

Professional observability services also represent a significant portion of the market as enterprises seek expert support for designing implementing and optimizing observability frameworks. These services are commonly used during initial deployment platform integration and customization of observability solutions aligned with specific business requirements. Professional services help organizations establish effective telemetry pipelines improve data correlation and adopt best practices for performance analytics and root cause analysis. As observability maturity grows professional services continue to support system scaling advanced analytics implementation and long term observability strategy development.

By Deployment Environment Analysis

Public cloud environments are anticipated to dominate the deployment environment segment, capturing around 61.0% of the total market share in 2025, as enterprises increasingly migrate workloads to cloud platforms to leverage scalability, flexibility, and cost efficiency. Full stack observability services in public cloud environments enable organizations to monitor applications, infrastructure, and user experience across distributed and dynamic cloud resources. These services provide real time insights into performance, availability, and resource utilization, helping businesses optimize cloud operations, prevent downtime, and maintain service reliability in highly dynamic multi-tenant architectures.

Hybrid enterprise environments also hold a significant share in this market segment as many organizations adopt a combination of on premise and cloud infrastructure to balance control, compliance, and scalability requirements. Observability services in hybrid deployments provide unified monitoring across legacy data centers and modern cloud platforms, enabling consistent visibility and performance management. These services help enterprises manage resource allocation, ensure system stability, and maintain operational efficiency while supporting gradual cloud adoption and seamless integration of diverse infrastructure components across the IT ecosystem.

By Core Business Function Analysis

IT operations and infrastructure management are anticipated to dominate the core business function segment, capturing around 41.0 percent of the total market share in 2025, as enterprises increasingly rely on full stack observability services to maintain system stability and ensure seamless IT performance. These services provide real time monitoring of servers, networks, storage, and other critical infrastructure components, helping organizations detect issues, optimize resource utilization, and prevent downtime. By delivering actionable insights into system health and operational efficiency, observability solutions support proactive management, reduce incident response times, and enhance overall enterprise reliability across cloud, hybrid, and on premise environments.

DevOps and site reliability engineering functions also represent a significant portion of this market segment, driven by the need for continuous integration and continuous delivery of applications in fast paced digital environments. Observability services for DevOps and SRE teams enable monitoring of application deployments, infrastructure dependencies, and performance metrics in real time, helping identify potential bottlenecks and prevent service disruptions. These services facilitate collaboration between development and operations teams, accelerate incident resolution, and support automation of routine tasks, ensuring stable and efficient release cycles while maintaining high service availability and improved user experience.

By Organization Size Analysis

Large enterprises are anticipated to dominate the organization size segment, capturing around 72.0% of the total market share in 2025, as these organizations manage complex IT environments with multiple applications, distributed infrastructure, and high transaction volumes. Full stack observability services help large enterprises monitor performance across applications and infrastructure in real time, detect anomalies, and optimize system efficiency. The ability to gain end to end visibility, reduce downtime, and support proactive incident management makes these services critical for maintaining operational resilience, ensuring business continuity, and enhancing user experience at scale.

Small and medium sized enterprises represent a smaller portion of this market segment but are gradually increasing adoption of full stack observability services to support growing digital operations and cloud migration initiatives. Observability solutions for SMEs enable efficient monitoring of applications and infrastructure without requiring extensive in house IT teams, helping optimize resource utilization, improve system reliability, and accelerate problem resolution. By leveraging managed or professional observability services, SMEs can achieve operational insights, enhance performance, and compete more effectively in digital markets while keeping costs and complexity under control.

By Industry Vertical Analysis

Banking, financial services, and insurance are anticipated to dominate the industry vertical segment, capturing around 27.0% of the total market share in 2025, as these sectors rely heavily on complex digital platforms, real time transactions, and high availability systems. Full stack observability services help BFSI organizations monitor application performance, infrastructure health, and transaction flows to ensure seamless operations, regulatory compliance, and secure customer experiences. By providing real time insights and proactive incident management, these services reduce downtime, prevent service disruptions, and support efficient risk and performance management across critical financial systems.

The IT and software services industry also represents a significant portion of this market segment due to the rapid adoption of cloud native applications, microservices architectures, and large scale software delivery pipelines. Observability services in this sector enable monitoring of application deployments, infrastructure dependencies, and system performance, helping software organizations maintain high availability, optimize performance, and accelerate issue resolution. By providing comprehensive visibility across development and production environments, these services support continuous integration, continuous delivery, and enhanced operational efficiency, allowing IT service providers to deliver reliable digital experiences to their customers.

The Full-Stack Observability Services Market Report is segmented on the basis of the following:

By Observability Service Type

- Application Performance Monitoring Services

- Infrastructure Observability Services

- Log Analytics and Event Monitoring Services

- Digital Experience and Synthetic Monitoring Services

- Network Performance Observability Services

By Service Delivery Model

- Managed Observability Services

- Professional Observability Services

- Support and Optimization Services

By Deployment Environment

- Public Cloud Environments

- Hybrid Enterprise Environments

- On-Premise Data Center Environments

By Core Business Function

- IT Operations and Infrastructure Management

- DevOps and Site Reliability Engineering

- Security Operations and Risk Monitoring

- Digital Business Performance Optimization

- Customer Experience Assurance

By Organization Size

By Industry Vertical

- BFSI

- IT & Software Services

- Retail and Digital Commerce

- Healthcare and Life Sciences

- Telecommunications

- Manufacturing and Industrial Enterprises

- Government and Public Sector

Global Full-Stack Observability Services Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global full stack observability services market, capturing around 40.0% of total market revenue in 2025, driven by early adoption of cloud computing, advanced DevOps practices, and large scale digital transformation initiatives across enterprises. The presence of major observability service providers, high IT spending, and strong focus on operational efficiency and customer experience are fueling demand for comprehensive monitoring, performance analytics, and infrastructure visibility solutions. Organizations in the region are leveraging full stack observability services to manage complex distributed systems, ensure application reliability, and optimize digital service delivery across cloud, hybrid, and on premise environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the full stack observability services market due to rapid digital transformation, increasing cloud adoption, and expanding IT infrastructure across emerging economies such as India, China, and Southeast Asian nations. Enterprises in the region are investing in observability solutions to monitor complex applications, optimize performance, and enhance user experience across hybrid and cloud native environments. The growing adoption of microservices, containerization, and DevOps practices, combined with rising demand for real time analytics and operational intelligence, is driving strong market expansion in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Full-Stack Observability Services Market: Competitive Landscape

The global full stack observability services market is highly competitive, characterized by the presence of numerous established and emerging players offering a wide range of monitoring, analytics, and performance optimization solutions. Companies compete on the basis of service capabilities, deployment flexibility, integration with cloud and hybrid environments, and advanced analytics features including AI and machine learning driven insights. Innovation in automated incident detection, real time telemetry correlation, and predictive performance management is shaping market dynamics, while strategic partnerships, mergers, and service expansions continue to drive differentiation and enhance global reach in this rapidly growing market.

Some of the prominent players in the global Full-Stack Observability Services market are:

- Dynatrace

- Datadog

- New Relic

- Splunk

- Elastic

- Cisco Systems

- Microsoft Corporation

- Google

- Amazon Web Services

- SolarWinds

- Grafana Labs

- Honeycomb

- Sumo Logic

- LogicMonitor

- ServiceNow

- ScienceLogic

- Riverbed Technology

- Broadcom

- AppNeta

- Sentry

- Other Key Players

Global Full-Stack Observability Services Market: Recent Developments

- January 2026: A major company announced expanded observability capabilities and new collaborative enhancements across AI, cloud monitoring, and security at a flagship industry event, showcasing improved real‑time performance insights and integration with large cloud platforms.

- January 2026: A leading cloud data provider announced its intent to acquire a prominent observability platform to unify telemetry data collection and enhance monitoring capabilities within its data ecosystem, reflecting ongoing consolidation in observability and data operations.

- November 2025: A major cybersecurity firm moved to acquire a next‑generation observability platform built for the AI era in a multi‑billion dollar deal aimed at strengthening real‑time performance visibility and resilience across cloud and enterprise systems.

- October 2025: A startup launched a new automated observability migration tool designed to help engineering teams transition between vendors and reduce lock‑in, enabling more flexible monitoring and telemetry workflows in complex distributed environments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.5 Bn |

| Forecast Value (2034) |

USD 27.0 Bn |

| CAGR (2025–2034) |

19.3% |

| The US Market Size (2025) |

USD 1.9 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Observability Service Type (Application Performance Monitoring Services, Infrastructure Observability Services, Log Analytics and Event Monitoring Services, Digital Experience and Synthetic Monitoring Services, Network Performance Observability Services), By Service Delivery Model (Managed Observability Services, Professional Observability Services, Support and Optimization Services), By Deployment Environment (Public Cloud Environments, Hybrid Enterprise Environments, On-Premise Data Center Environments), By Core Business Function (IT Operations and Infrastructure Management, DevOps and Site Reliability Engineering, Security Operations and Risk Monitoring, Digital Business Performance Optimization, Customer Experience Assurance), By Organization Size (Large Enterprises, SMEs), and By Industry Vertical (BFSI, IT & Software Services, Retail and Digital Commerce, Healthcare and Life Sciences, Telecommunications, Manufacturing and Industrial Enterprises, Government and Public Sector) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Dynatrace, Datadog, New Relic, Splunk, Elastic, Cisco Systems, Microsoft Corporation, Google, Amazon Web Services, SolarWinds, Grafana Labs, Honeycomb, Sumo Logic, LogicMonitor, and Others.

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Full-Stack Observability Services market?

▾ The global Full-Stack Observability Services market size was valued at USD 5.5 billion in 2025 and is expected to reach USD 27.0 billion by the end of 2034.

What is the size of the US Full-Stack Observability Services market?

▾ The US Full-Stack Observability Services market was valued at USD 1.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.3 billion in 2034 at a CAGR of 18.1%.

Which region accounted for the largest global Full-Stack Observability Services market?

▾ North America is expected to have the largest market share in the global Full-Stack Observability Services market, with a share of about 40.0% in 2025.

Who are the key players in the global Full-Stack Observability Services market?

▾ Some of the major key players in the global Full-Stack Observability Services market are Dynatrace, Datadog, New Relic, Splunk, Elastic, Cisco Systems, Microsoft Corporation, Google, Amazon Web Services, SolarWinds, Grafana Labs, Honeycomb, Sumo Logic, LogicMonitor, and Others.