Market Overview

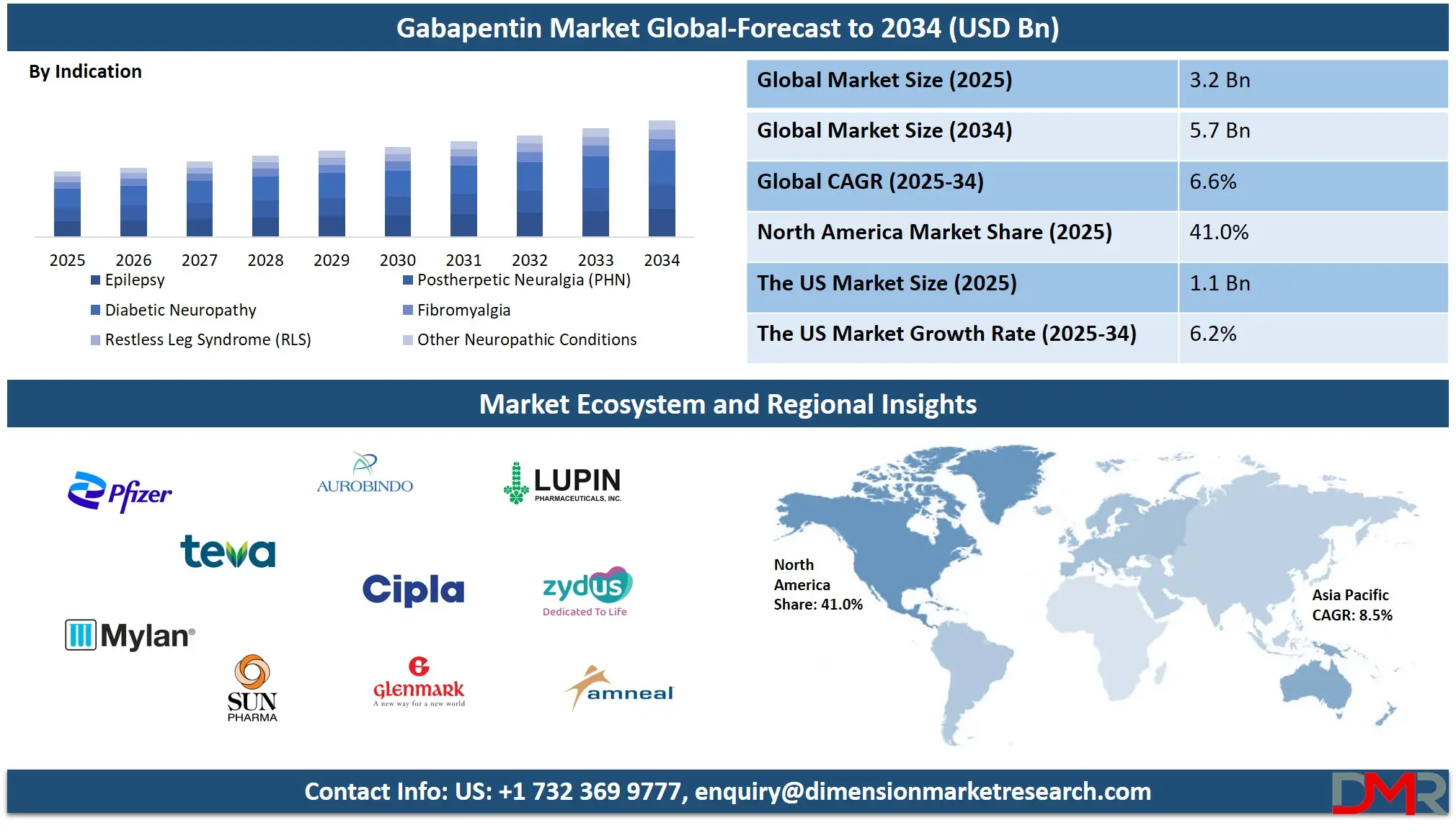

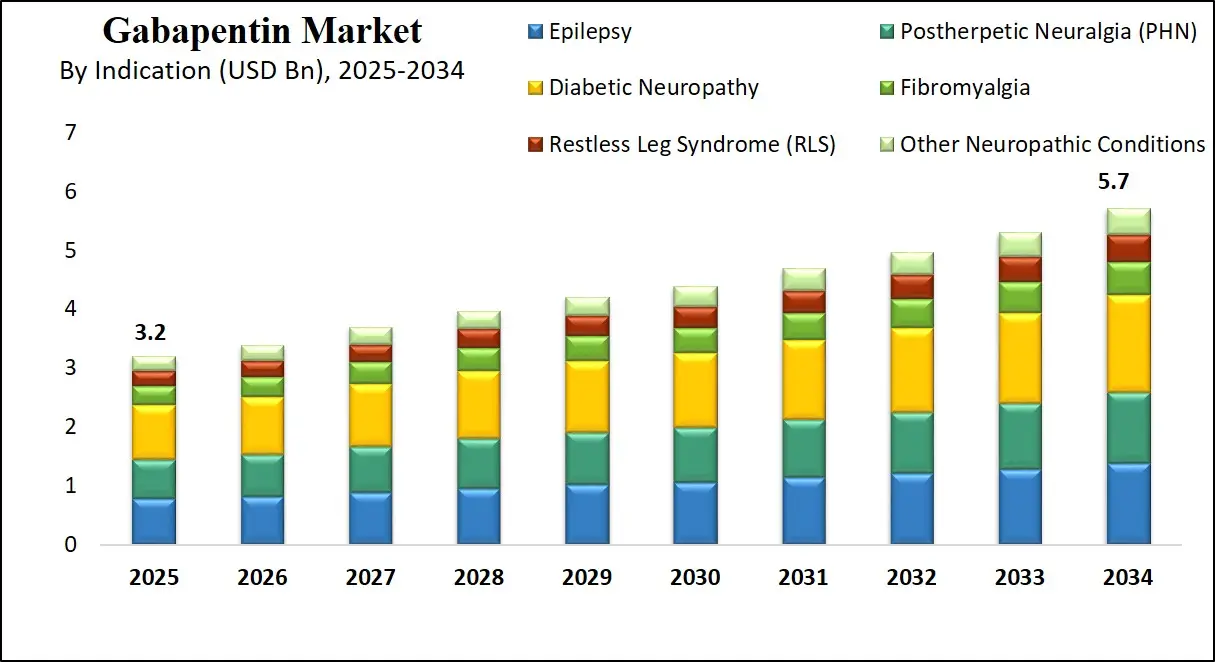

The global gabapentin market is projected to reach USD 3.2 billion by 2025 and is expected to grow to USD 5.7 billion by 2034, expanding at a CAGR of 6.6%. This growth is driven by the rising prevalence of neuropathic pain, growing use in seizure disorders, and expanding off-label applications across chronic Pain Management Therapeutics.

Gabapentin is a synthetic analogue of the neurotransmitter gamma-aminobutyric acid (GABA), primarily prescribed for managing partial seizures, neuropathic pain, and postherpetic neuralgia. Although it structurally resembles GABA, gabapentin does not bind directly to GABA receptors; instead, it modulates calcium channels in the nervous system, which helps reduce the excitability of nerve cells. Its pharmacological profile makes it effective in treating conditions where nerve overactivity plays a role, such as fibromyalgia, restless leg syndrome, and certain anxiety disorders.

Neuropathic pain therapeutics and other

Neurological Disorder Drugs often include gabapentin formulations due to their effectiveness and safety profile. Gabapentin is widely available in oral dosage forms like capsules, tablets, and solutions, and is valued for its tolerability, limited drug interactions, and broad off-label use. With its rising prescription rate among patients suffering from chronic pain and neurological disorders, gabapentin continues to play a vital role in neurotherapeutic regimens across diverse patient populations.

The global gabapentin market encompasses the production, distribution, and sale of gabapentin-based medications used in both neurology and Pain Management Therapeutics. The market is being propelled by an aging population susceptible to nerve-related conditions, a growing prevalence of diabetes leading to diabetic neuropathy, and rising awareness about chronic pain management options. Pharmaceutical companies globally are focused on expanding their gabapentin portfolios, particularly in the form of gabapentin formulations, extended-release formulations, and combination therapies, to address growing clinical demand. Generic drug manufacturers have also played a pivotal role in broadening accessibility, making gabapentin a commonly prescribed medication in developed and emerging economies alike.

In addition to increased incidence of neuropathic disorders, favorable reimbursement policies and expanded healthcare infrastructure in developing regions are further fueling the adoption of gabapentin. The market is also witnessing innovation in drug delivery systems and extended-release dosage forms to improve patient adherence. Strategic collaborations among manufacturers, growing online pharmacy penetration, and a shift toward outpatient treatment models, supported by Digital Health platforms and Healthcare Analytics, are accelerating global distribution. With consistent regulatory support for generic drug approvals and an expanding base of chronic pain patients, the gabapentin market is expected to maintain steady growth in the years ahead.

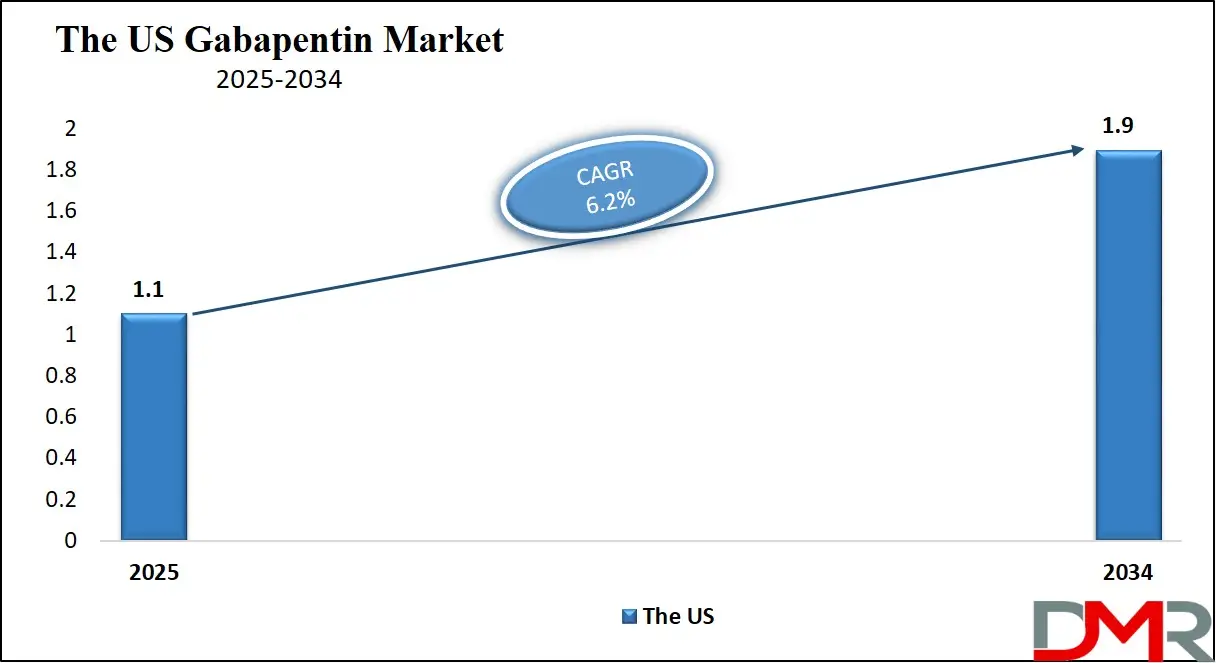

The US Gabapentin Market

The U.S. Gabapentin Market size is projected to be valued at USD 1.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.9 billion in 2034 at a CAGR of 6.2%.

The United States gabapentin market holds a dominant position globally, driven by high prescription rates and widespread clinical use in managing neuropathic pain, epilepsy, and postherpetic neuralgia. With an aging population and a significant prevalence of chronic conditions such as diabetes and fibromyalgia, demand for gabapentin continues to grow steadily.

The U.S. healthcare system supports broad adoption of gabapentin through both brand-name and generic formulations, including immediate-release and extended-release variants. Physicians in the U.S. frequently prescribe gabapentin for off-label uses, including anxiety disorders and migraine prophylaxis, further expanding its therapeutic footprint. Additionally, the presence of major pharmaceutical players and strong distribution networks ensures consistent availability across retail pharmacies, hospitals, and online drugstores.

Regulatory initiatives by the FDA and the growing approval of generic gabapentin products have fueled market competition and enhanced accessibility for patients. Moreover, the rise in opioid alternatives has positioned gabapentin as a preferred option for non-opioid pain management, especially amid growing concerns around opioid dependency. The market also benefits from a robust reimbursement environment, extensive clinical research, and ongoing innovations in drug delivery systems.

As telehealth and mail-order pharmacies gain traction, particularly post-COVID-19, the U.S. market is witnessing a shift in purchasing behavior, further boosting sales through digital health platforms. With strong clinical adoption and a mature pharmaceutical infrastructure, the U.S. gabapentin market is expected to maintain its leadership in both revenue generation and prescription volume over the next decade.

The Europe Gabapentin Market

The Europe gabapentin market is projected to be valued at approximately USD 800 million in 2025, supported by growing diagnoses of neuropathic conditions and a steadily aging population across key countries such as Germany, France, the United Kingdom, and Italy. The region shows growing demand for effective chronic pain management alternatives, particularly non-opioid therapies like gabapentin, due to heightened awareness of opioid-related risks. Additionally, widespread adoption of generic drugs across European healthcare systems has contributed to the accessibility and affordability of gabapentin, reinforcing its role as a frontline treatment option in both primary and specialist care settings. National health insurance schemes and cost-containment policies continue to support its usage, especially in managing diabetic neuropathy, epilepsy, and postherpetic neuralgia.

Over the forecast period from 2025 to 2034, the Europe market is expected to expand at a CAGR of 6.1%, driven by growing prescription volumes, greater homecare-based treatment adoption, and rising off-label use for psychiatric conditions like anxiety and insomnia. Furthermore, the expansion of telehealth and e-prescription services post-pandemic has made gabapentin more accessible to patients in both urban and rural areas. Ongoing investments in healthcare infrastructure and digital pharmacy platforms are likely to strengthen the distribution network across the continent. While regulatory scrutiny and competition from newer antiepileptic and neuropathic drugs may pose challenges, gabapentin’s proven clinical efficacy and economic viability position it for stable growth in the European therapeutic market.

The Japan Gabapentin Market

The Japan gabapentin market is estimated to be worth around USD 100 million in 2025, supported by the country’s rapidly aging population and a high prevalence of chronic neurological and pain-related conditions. Japan has one of the highest rates of age-related disorders such as diabetic neuropathy, postherpetic neuralgia, and epilepsy, making gabapentin a vital part of the national pharmacological toolkit. The drug is widely prescribed in both urban and regional healthcare centers due to its effectiveness in long-term nerve pain management and its relatively safe profile. Additionally, the availability of gabapentin in various oral formulations aligns well with Japan’s strong home-based and outpatient care ecosystem, where elderly patients often prefer self-administered and low-risk medications.

Looking ahead, the Japanese gabapentin market is expected to grow at a CAGR of 5.5% between 2025 and 2034. Growth will be supported by growing awareness around non-opioid treatment alternatives, the expansion of digital healthcare services, and steady investments in elderly care infrastructure. Although the market faces challenges such as strict regulatory frameworks and slower generic penetration compared to Western countries, ongoing efforts to improve access to generic drugs and cost-efficient therapies are gradually reshaping the pharmaceutical landscape. The push for value-based healthcare and the integration of telepharmacy and e-prescriptions are also expected to support continued growth of gabapentin usage across primary and secondary care settings in Japan.

Global Gabapentin Market: Key Takeaways

- Market Value: The global gabapentin market size is expected to reach a value of USD 5.7 billion by 2034 from a base value of USD 3.2 billion in 2025 at a CAGR of 6.6%.

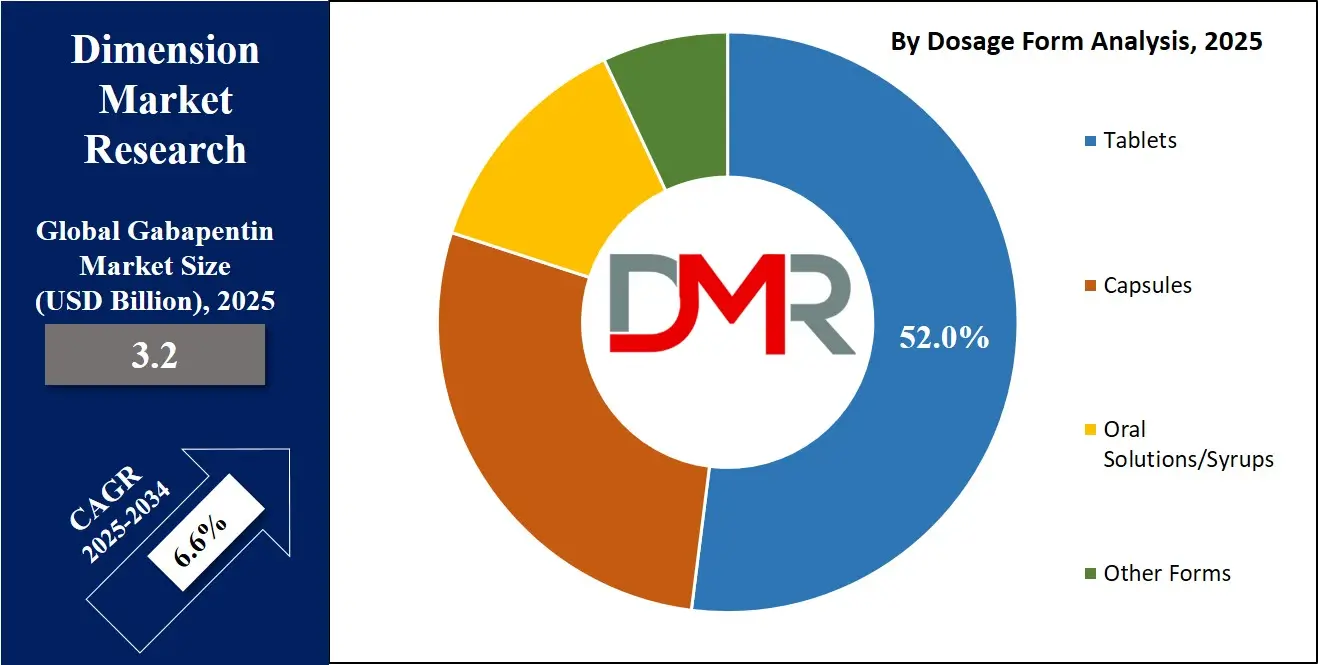

- By Dosage Form Segment Analysis: Tablets are anticipated to dominate the dosage form segment, capturing 52.0% of the total market share in 2025.

- By Route of Administration Segment Analysis: Oral route is poised to consolidate its dominance in the route of administration segment, capturing 93% of the total market share in 2025.

- By Strength Segment Analysis: The 300 mg strength type is expected to maintain its dominance in the strength segment, capturing 41.0% of the total market share in 2025.

- By Distribution Channel Segment Analysis: Retail Pharmacies will lead in the distribution channel segment, capturing 46.0% of the market share in 2025.

- By Indication Segment Analysis: Diabetic Neuropathy will lead the indication segment, capturing 29.0% of the market share in 2025.

- By End User Segment Analysis: Homecare Settings will dominate the end user segment, capturing 41.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global gabapentin market landscape with 41.0% of total global market revenue in 2025.

- Key Players: Some key players in the global gabapentin market are Pfizer Inc., Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), Sun Pharmaceutical Industries Ltd., Aurobindo Pharma, Cipla Ltd., Glenmark Pharmaceuticals, Lupin Ltd., Zydus Lifesciences Ltd., Amneal Pharmaceuticals, Apotex Inc., and Others.

Global Gabapentin Market: Use Cases

- Management of Neuropathic Pain in Diabetic Patients: Gabapentin plays a critical role in treating diabetic neuropathy, a prevalent complication in long-term diabetes patients. With the global burden of diabetes steadily growing, particularly in North America and Asia-Pacific, there is a growing need for non-opioid therapies that can effectively manage nerve-related pain. Gabapentin reduces abnormal nerve signaling by modulating calcium channel activity in the central nervous system, helping alleviate burning, tingling, and shooting pain symptoms. Its favorable safety profile and lower risk of dependence compared to traditional analgesics make it a key option in long-term pain relief strategies. The rising preference for neuropathic pain medications in outpatient and homecare settings continues to fuel their demand globally.

- Adjunctive Therapy for Partial-Onset Seizures: Gabapentin is approved as an adjunctive treatment for partial-onset seizures, especially in patients unresponsive to conventional monotherapies. It is widely used in pediatric and adult neurology to stabilize electrical activity in the brain and prevent seizure episodes. As the global epilepsy population grows, particularly in emerging economies where diagnosis and treatment gaps persist, gabapentin's affordability and accessibility are driving its adoption. Neurologists often combine gabapentin with other antiepileptic drugs for enhanced seizure control, making it an essential part of comprehensive seizure management plans. The growing demand for antiepileptic combination therapy is expanding market opportunities for both branded and generic gabapentin products.

- Off-Label Use in Anxiety and Mood Disorders: Beyond its approved indications, gabapentin is used off-label for treating anxiety disorders, bipolar disorder, and other mood-related conditions. Mental health practitioners prescribe it to manage generalized anxiety disorder, social phobia, and insomnia, particularly in patients with a history of substance abuse who cannot tolerate benzodiazepines. Its calming effects without sedation make it a popular alternative for psychiatric care. The rising mental health burden globally, along with efforts to find non-addictive alternatives to traditional anxiolytics, has contributed to off-label market expansion. Telehealth platforms and digital prescription services have further enabled access to gabapentin in mental health treatment protocols.

- Pain Management in Cancer and Post-Surgical Patients: Gabapentin is widely utilized in oncology and surgical care settings for controlling post-operative pain and cancer-related neuropathic pain. It is frequently included in multimodal analgesia regimens to reduce reliance on opioids, thereby helping prevent potential addiction. In cancer patients, it alleviates chemotherapy-induced peripheral neuropathy, improving quality of life and treatment adherence. Post-surgery, gabapentin is prescribed to minimize acute nerve-related pain and facilitate early recovery. Its integration into hospital pain management protocols and enhanced recovery after surgery (ERAS) programs has significantly increased usage in inpatient and outpatient care globally. The growing demand for safer and more effective pain relief options is expected to further elevate its clinical relevance.

Impact of Artificial Intelligence on Gabapentin Market

Artificial intelligence is significantly transforming the gabapentin market, used primarily for neuropathic pain and seizure disorders, through enhancements in drug development, clinical optimization, and market access strategies. AI-powered systems accelerate the identification of novel gabapentin analogs and optimize formulations by simulating molecular interactions, which leads to improved efficacy, reduced side effects, and faster time to market. In clinical settings, predictive algorithms help determine the most effective dosing regimens and patient segments, improving treatment outcomes.

Additionally, AI-driven analytics in real-world data and prescription trends enable manufacturers and healthcare providers to forecast demand, tailor educational outreach, and streamline pharmacovigilance processes. Ultimately, AI fosters smarter drug discovery, precision prescribing, and more efficient supply chain planning within the gabapentin landscape.

Global Gabapentin Market: Market Dynamics

Global Gabapentin Market: Driving Factors

Rising Prevalence of Neuropathic Disorders Globally

The growing global incidence of neuropathic conditions such as diabetic neuropathy, postherpetic neuralgia, and sciatica is a significant driver for gabapentin demand. These chronic pain disorders, often associated with diabetes and aging populations, require long-term pharmacological management. Gabapentin has become a mainstay in neuropathic pain therapy due to its efficacy and favorable safety profile. As healthcare systems emphasize pain management in both hospital and ambulatory settings, the demand for nerve pain relief medications like gabapentin continues to grow.

Surge in Off-Label Prescriptions in Psychiatry and Pain Clinics

Gabapentin is extensively prescribed off-label for a wide range of conditions, including anxiety disorders, bipolar disorder, insomnia, and alcohol withdrawal symptoms. Mental health professionals and pain management specialists frequently favor gabapentin over sedatives or opioids due to its lower potential for abuse and minimal drug interactions. The growing interest in non-opioid pain relievers and alternative psychiatric medications is expanding gabapentin’s usage across therapeutic areas beyond its original indications.

Global Gabapentin Market: Restraints

Growing Regulatory Scrutiny and Risk of Misuse

Despite its low abuse potential compared to opioids, gabapentin is facing regulatory attention in certain regions due to concerns over misuse, especially when combined with other central nervous system depressants. Countries like the United States and the United Kingdom have implemented monitoring programs or reclassified the drug, which may limit over-the-counter accessibility and increase compliance burdens for prescribers. This regulatory tightening could impact sales and market penetration, particularly in the generic drug segment.

Availability of Alternative Therapies

The presence of newer anticonvulsants and neuropathic pain treatments such as pregabalin, duloxetine, and amitriptyline is creating stiff competition in the neurotherapeutic space. These alternatives often come with more favorable dosing schedules or targeted mechanisms of action. Additionally, the rise of personalized medicine and advanced biologics in neurology and pain care could potentially limit gabapentin's market share if innovations prove to be more effective or better tolerated in certain patient segments.

Global Gabapentin Market: Opportunities

Expansion in Emerging Markets with Rising Healthcare Access

Countries across Asia-Pacific, Latin America, and the Middle East are experiencing improvements in healthcare infrastructure and growing access to prescription medications. This opens new avenues for generic gabapentin manufacturers to enter untapped markets. As awareness grows around the management of chronic pain and epilepsy, and public health programs begin to support broader neurological care, the demand for affordable, effective treatments like gabapentin is expected to rise significantly in these regions.

Growth in the Geriatric Population and Homecare Usage

The aging global population is more prone to conditions such as fibromyalgia, shingles-related nerve pain, and epilepsy. This demographic shift increases the demand for long-term, home-based treatments that are easy to administer. Gabapentin, available in oral and extended-release forms, is well-suited for elderly patients in home care or outpatient settings. Additionally, the rise in mail-order pharmacies and remote consultations is making gabapentin more accessible to aging patients, further boosting market growth.

Global Gabapentin Market: Trends

Increasing Preference for Extended-Release Formulations

To improve patient compliance and reduce dosing frequency, pharmaceutical companies are focusing on developing extended-release (ER) and once-daily formulations of gabapentin. These innovations offer sustained pain control, especially in chronic conditions, with fewer side effects and lower risk of peak-dose toxicity. The shift toward ER drugs is also driven by hospital protocols favoring consistent plasma levels and reduced medication administration burden.

Digital Health and E-Prescription Integration

With the rise of digital healthcare services, gabapentin prescriptions are being managed through e-prescription systems, particularly in regions like North America and Western Europe. This transition not only streamlines chronic disease management but also ensures better regulatory oversight. Moreover, online pharmacies and telehealth platforms are expanding access to gabapentin, especially among patients with mobility challenges or limited local healthcare access, reshaping how this medication is distributed and consumed.

Global Gabapentin Market: Research Scope and Analysis

By Dosage Form Analysis

In the gabapentin market, tablets are expected to hold the dominant position within the dosage form segment, accounting for approximately 52.0% of the total market share in 2025. This dominance can be attributed to several key factors, including ease of administration, precise dosing, and higher patient compliance. Tablets are widely prescribed in both hospital and outpatient settings for their convenience and extended shelf life.

Moreover, advancements in formulation technologies have enabled the development of extended-release and once-daily tablet versions, further enhancing their popularity among patients managing chronic conditions like neuropathic pain and epilepsy. The widespread availability of gabapentin tablets in both branded and generic versions across retail and online pharmacies also contributes significantly to their market leadership.

Capsules, while slightly behind tablets in terms of market share, continue to hold a strong position within the segment. They are particularly preferred by patients who experience difficulty swallowing harder tablet forms, offering a smoother ingestion experience. Capsules also tend to dissolve more quickly in the digestive tract, which can lead to faster onset of action in some cases. Pharmaceutical companies frequently use capsules for specific dosage strengths and immediate-release formulations, making them a vital option in flexible treatment regimens. Their continued relevance in neurology and pain management prescriptions ensures that capsules will maintain a stable presence in the gabapentin market over the forecast period.

By Route of Administration Analysis

The oral route is set to solidify its dominance in the gabapentin market, accounting for an estimated 93% of the total market share in 2025. This overwhelming preference for oral administration is primarily driven by patient convenience, non-invasiveness, and widespread familiarity among both healthcare providers and patients. Gabapentin is most commonly prescribed in oral forms such as tablets, capsules, and liquid solutions, making it suitable for long-term outpatient and home-based treatment. These forms are easy to dose and administer, which significantly enhances adherence in patients with chronic conditions like diabetic neuropathy, postherpetic neuralgia, and partial seizures.

Additionally, the oral route supports both immediate-release and extended-release formulations, catering to a variety of clinical needs without requiring specialized medical settings or equipment.

On the other hand, the parenteral route, which involves intravenous or intramuscular administration, occupies a much smaller share of the market and is typically reserved for specific or investigational uses. Gabapentin is not widely available in parenteral form for routine clinical use, as its pharmacokinetics are well-suited to oral absorption. However, in rare cases where patients are unable to take medications orally, such as in post-operative scenarios, critical care units, or during acute gastrointestinal conditions—parenteral administration may be considered under strict medical supervision. Limited commercial availability, higher costs, and the need for professional administration limit the broader application of this route, making it a niche segment in the overall gabapentin market landscape.

By Strength Analysis

In the strength segment of the gabapentin market, the 300 mg dosage is projected to dominate, accounting for around 41.0% of the total market share in 2025. This strength is widely favored due to its versatility in treating a broad range of conditions such as neuropathic pain, epilepsy, and fibromyalgia. It is often used as both an initial and maintenance dose, offering an optimal balance between efficacy and tolerability. The 300 mg variant is readily available in multiple oral formats including capsules and tablets, which supports its high prescription rate across outpatient and hospital settings. Its compatibility with titration protocols also makes it a go-to choice for clinicians who prefer to adjust the dose gradually based on the patient's response and symptom severity.

The 100 mg strength, while occupying a smaller portion of the market, plays a crucial role in specific therapeutic scenarios. It is commonly used in geriatric populations, patients with renal impairment, or individuals who are highly sensitive to medication and require a slow, cautious initiation of treatment. This low-dose option is also essential in pediatric care or in cases where fine-tuned dosing is necessary. Although it does not hold a dominant market share, the 100 mg strength is valued for its role in personalized medicine, where precision dosing is critical to avoiding side effects while achieving therapeutic benefits. Its continued use in niche but important patient groups ensures its relevance in the overall strength segmentation of the gabapentin market.

By Distribution Channel Analysis

In the distribution channel segment of the gabapentin market, retail pharmacies are projected to lead with a 46.0% share of the total market in 2025. This dominance is largely due to the high volume of outpatient prescriptions for chronic conditions such as neuropathic pain, restless leg syndrome, and epilepsy, which are primarily filled through community pharmacies. Retail outlets provide easier access for patients and typically offer a broad range of branded and generic gabapentin formulations, including various strengths and dosage forms. The growing trend of self-managed care, along with the convenience of in-person and online pharmacy services, further reinforces retail pharmacies as the primary point of distribution, especially in urban and semi-urban areas.

Hospital pharmacies, while accounting for a smaller market share compared to retail, play a critical role in acute care settings. They are the preferred distribution channel for inpatients requiring gabapentin for post-surgical nerve pain, seizure control, or pain associated with cancer and chemotherapy.

Gabapentin in these settings is often part of a larger treatment plan under continuous monitoring, making hospital-based dispensing essential. Moreover, hospital pharmacies are instrumental in initiating therapy in newly diagnosed patients, who are then transitioned to retail pharmacies for long-term maintenance. As healthcare infrastructure improves and the rate of hospitalization for chronic conditions increases, hospital pharmacies will continue to serve as a vital segment in the distribution landscape of the gabapentin market.

By Indication Analysis

In the indication-based segmentation of the gabapentin market, diabetic neuropathy is expected to lead with a 29.0% share of the total market in 2025. This dominance is driven by the growing global prevalence of diabetes, particularly in aging populations across North America, Europe, and Asia-Pacific.

Diabetic neuropathy, a common and painful complication of long-term diabetes, often results in nerve damage that causes burning, tingling, and shooting pain. Gabapentin has become a widely prescribed treatment in this area due to its ability to modulate nerve signals and provide effective relief without the risks associated with opioids. The medication is commonly integrated into chronic disease management plans, making it a key therapeutic option in both primary and specialized care settings. Its use is further supported by guidelines from endocrinologists and pain specialists, reinforcing its position as a first-line pharmacological approach for neuropathic symptoms in diabetic patients.

Epilepsy, while holding a slightly smaller share of the indication segment, remains a foundational use case for gabapentin, especially as an adjunct therapy for partial-onset seizures. It is particularly useful in patients who require combination therapy due to inadequate response to monotherapy. Gabapentin’s favorable side effect profile, minimal drug interactions, and proven efficacy in seizure stabilization make it a preferred option among neurologists. It is commonly prescribed in both pediatric and adult populations, often initiated in hospital settings and continued in outpatient care.

While newer antiepileptic drugs have entered the market, gabapentin maintains strong clinical relevance due to its affordability and accessibility, particularly in low- and middle-income regions. Its ongoing role in epilepsy care ensures its steady contribution to the overall market despite growing competition in the segment.

By End User Analysis

In the end user segmentation of the gabapentin market, homecare settings are projected to dominate with a 41.0% market share in 2025. This trend is largely influenced by the rising prevalence of chronic conditions such as diabetic neuropathy, fibromyalgia, and postherpetic neuralgia, which require long-term treatment that can be managed outside of clinical environments. Gabapentin’s oral formulations, favorable safety profile, and ease of administration make it highly suitable for home-based care.

The shift towards outpatient management of chronic pain, along with the growing availability of telemedicine and mail-order pharmacies, has further supported the growth of homecare as a primary end-use segment. Additionally, elderly patients and those with mobility limitations prefer medication regimens that do not require frequent hospital visits, contributing to the rising demand for gabapentin in this setting.

Hospitals continue to represent a significant end-user category, particularly for patients requiring initial diagnosis, dose initiation, or management of acute conditions such as post-surgical nerve pain or epilepsy-related emergencies. In hospital environments, gabapentin is often used as part of multimodal pain management strategies and in enhanced recovery protocols after surgery.

It is also administered to stabilize seizure activity before transitioning the patient to long-term therapy. While the hospital segment may not match homecare in terms of volume, it plays a vital role in starting treatment and ensuring proper titration, especially in complex cases. The integration of gabapentin into inpatient care plans reinforces its importance in clinical settings, where accurate monitoring and multidisciplinary intervention are necessary.

The Gabapentin Market Report is segmented on the basis of the following

By Dosage Form

- Tablets

- Capsules

- Oral Solutions

- Other Forms

By Route of Administration

By Strength

- 100 mg

- 300 mg

- 400 mg

- 600 mg

- 800 mg

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

By Indication

- Diabetic Neuropathy

- Epilepsy

- Postherpetic Neuralgia (PHN)

- Fibromyalgia

- Restless Leg Syndrome (RLS)

- Other Neuropathic Conditions

By End User

- Homecare Settings

- Hospitals

- Clinics

Global Gabapentin Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominate the global gabapentin market in 2025, accounting for 41.0% of total market revenue. This leadership is primarily driven by high prescription rates, a well-established healthcare infrastructure, and a large patient population suffering from chronic neuropathic conditions such as diabetic neuropathy, postherpetic neuralgia, and fibromyalgia.

The widespread off-label use of gabapentin for anxiety, insomnia, and other neurological disorders further boosts its demand across the region. Additionally, favorable reimbursement policies, a high level of awareness among healthcare providers, and the strong presence of major pharmaceutical manufacturers contribute to North America's leading position. The growing shift toward non-opioid pain management therapies amid growing opioid concerns also supports sustained growth in this region.

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the gabapentin market over the forecast period, driven by the rising prevalence of diabetes, expanding geriatric population, and growing awareness of neuropathic pain management. Countries like India, China, and Japan are experiencing rapid improvements in healthcare infrastructure, which is enhancing access to prescription medications, including gabapentin.

Additionally, the growing availability of affordable generic formulations and the shift toward outpatient care are encouraging wider adoption across urban and semi-urban areas. Government initiatives to improve neurological care and pain treatment, integrated with rising demand for non-opioid alternatives, are further accelerating market expansion in the region, positioning Asia-Pacific as a high-potential growth hub in the global landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Gabapentin Market: Competitive Landscape

The global competitive landscape of the gabapentin market is characterized by a strong presence of both multinational pharmaceutical giants and regional generic drug manufacturers, creating a highly fragmented yet competitive environment. Leading players such as Pfizer Inc., Teva Pharmaceutical Industries, Viatris, and Sun Pharmaceutical Industries continue to dominate through extensive product portfolios, strategic alliances, and broad geographic reach. At the same time, numerous regional companies like Aurobindo Pharma, Lupin, and Intas Pharmaceuticals play a crucial role by offering cost-effective generic formulations, especially in emerging markets.

Competition is further intensified by ongoing patent expirations, growing approvals of generic equivalents, and growing demand for extended-release formulations. Companies are also focusing on supply chain optimization, regulatory compliance, and expanding distribution through retail and online pharmacy channels to strengthen market positioning. This competitive intensity is driving innovation, price competition, and greater accessibility across diverse patient populations globally.

Some of the prominent players in the global gabapentin market are

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (now part of Viatris)

- Sun Pharmaceutical Industries Ltd.

- Aurobindo Pharma

- Cipla Ltd.

- Glenmark Pharmaceuticals

- Lupin Ltd.

- Zydus Lifesciences Ltd.

- Amneal Pharmaceuticals

- Apotex Inc.

- Torrent Pharmaceuticals

- Dr. Reddy’s Laboratories

- Sandoz (a Novartis division)

- Alkem Laboratories

- Tris Pharma

- Sciegen Pharmaceuticals

- Hikma Pharmaceuticals

- Intas Pharmaceuticals

- Strides Pharma Science Ltd.

- Other Key Players

Global Gabapentin Market: Recent Developments

- June 2025: Sunshine Biopharma’s Canadian division, Nora Pharma, launched a new generic gabapentin (100 mg, 300 mg, 400 mg capsules) for neuropathic pain and epilepsy in Canada, targeting a CAD 1.92 billion segment of the global market.

- May 2025: Sunshine Biopharma successfully closed a CAD 2.46 million registered direct offering, strengthening its capital base to support future product expansions including gabapentin and biosimilar pipelines.

- January 2024: The FDA approved the first generic version of Gralise, a once-daily extended-release gabapentin tablet, expanding non-immediate-release therapy options for postherpetic neuralgia.

- April 2023: GSK plc announced its acquisition of Bellus Health Inc., a Canadian late-stage biopharmaceutical company, in a transaction valued at approximately USD USD 2 billion.

- December 2022: JanOne completed its acquisition of Soin Therapeutics and its LDN medication, a novel low-dose formulation, as part of efforts to broaden its neurology-focused portfolio.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.2 Bn |

| Forecast Value (2034) |

USD 5.7 Bn |

| CAGR (2025–2034) |

6.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Dosage Form (Tablets, Capsules, Oral Solutions, and Other Forms), By Route of Administration (Oral, Parenteral, and Others), By Strength (100 mg, 300 mg, 400 mg, 600 mg, and 800 mg), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies), By Indication (Diabetic Neuropathy, Epilepsy, Postherpetic Neuralgia (PHN), Fibromyalgia, Restless Leg Syndrome (RLS), and Other Neuropathic Conditions), and By End User (Homecare Settings, Hospitals, and Clinics) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Pfizer Inc., Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), Sun Pharmaceutical Industries Ltd., Aurobindo Pharma, Cipla Ltd., Glenmark Pharmaceuticals, Lupin Ltd., Zydus Lifesciences Ltd., Amneal Pharmaceuticals, Apotex Inc., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global gabapentin market size is estimated to have a value of USD 3.2 billion in 2025 and is expected to reach USD 5.7 billion by the end of 2034.

The US gabapentin market is projected to be valued at USD 1.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.9 billion in 2034 at a CAGR of 6.2%.

North America is expected to have the largest market share in the global gabapentin market, with a share of about 41.0% in 2025.

Some of the major key players in the global gabapentin market are Pfizer Inc., Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), Sun Pharmaceutical Industries Ltd., Aurobindo Pharma, Cipla Ltd., Glenmark Pharmaceuticals, Lupin Ltd., Zydus Lifesciences Ltd., Amneal Pharmaceuticals, Apotex Inc., and Others.

The market is growing at a CAGR of 6.6 percent over the forecasted period.