Market Overview

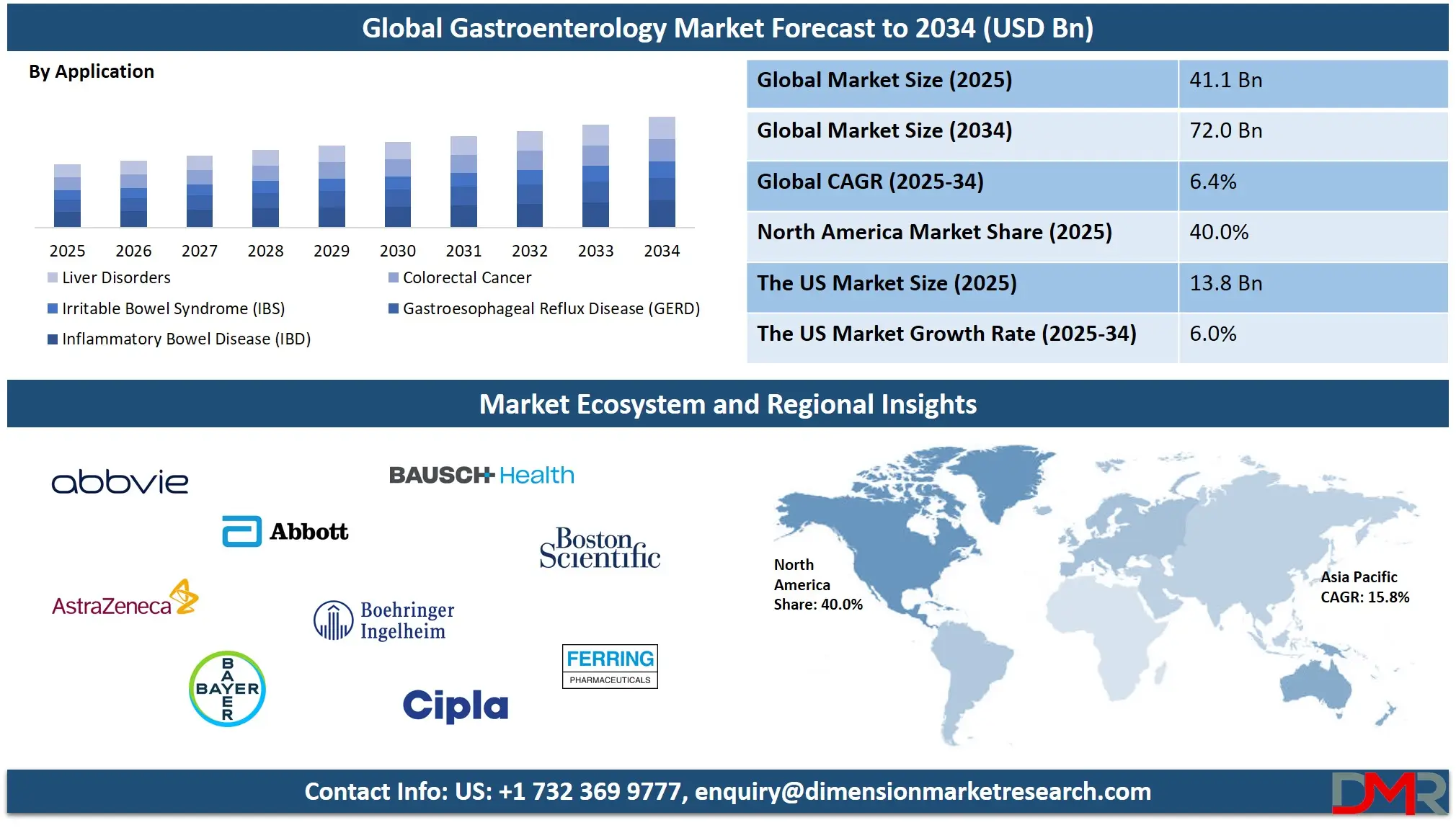

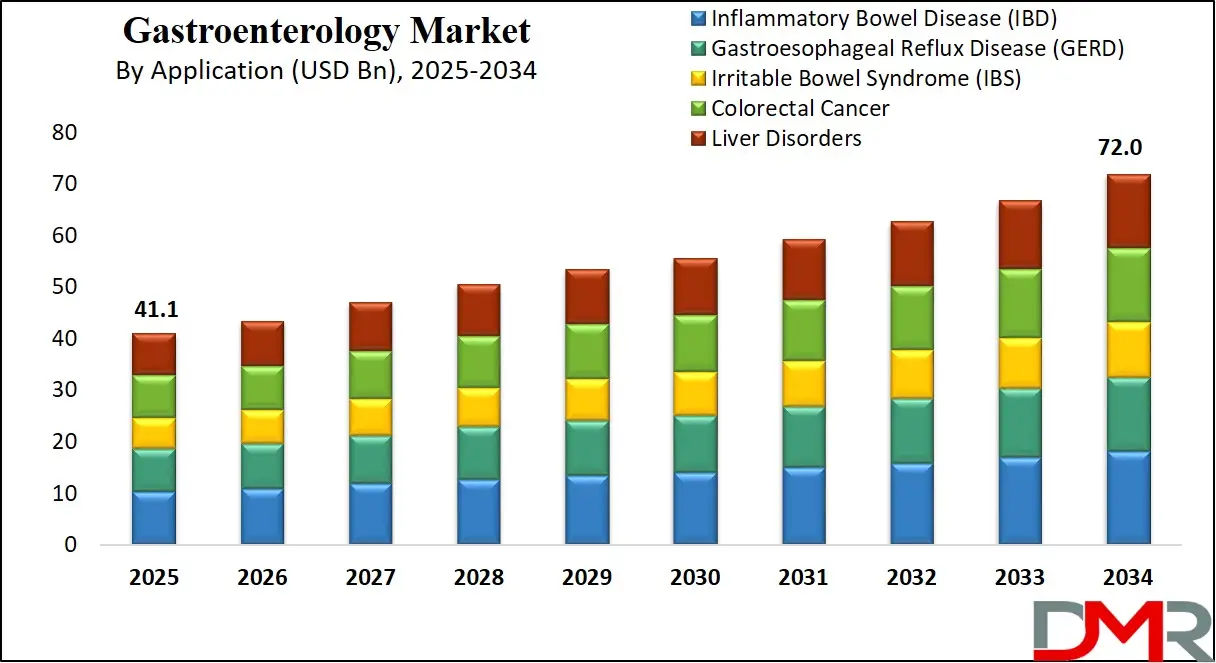

The global gastroenterology market is projected to grow from USD 41.1 billion in 2025 to USD 72.0 billion by 2034, registering a CAGR of 6.4%.

This growth is driven by the rising prevalence of digestive disorders, growing demand for advanced endoscopic and diagnostic solutions, and expanding adoption of therapeutic and minimally invasive treatment options across hospitals, clinics, and specialized gastroenterology centers globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Gastroenterology is a specialized branch of medicine that focuses on the diagnosis, treatment, and prevention of disorders related to the digestive system, which includes the esophagus, stomach, intestines, liver, pancreas, and gallbladder. It encompasses a wide range of conditions such as inflammatory bowel disease, gastroesophageal reflux disease, irritable bowel syndrome, colorectal cancer, and liver disorders.

Gastroenterologists employ advanced diagnostic tools, including endoscopy, imaging technologies, and laboratory tests, to accurately identify gastrointestinal ailments and develop effective treatment plans. This field also integrates therapeutic interventions using medications, minimally invasive procedures, and lifestyle management strategies to improve patient outcomes and enhance the overall health of the digestive system.

The global gastroenterology market represents a dynamic and rapidly evolving sector within the healthcare industry that caters to the growing prevalence of gastrointestinal diseases globally. It includes a wide array of products and services such as diagnostic equipment, therapeutics, endoscopic devices, and minimally invasive surgical instruments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is driven by factors including rising awareness of digestive health, an aging population, technological advancements in endoscopic and imaging tools, and growing healthcare expenditures. Emerging trends such as telemedicine, artificial intelligence-assisted diagnostics, and biologic therapies are further shaping the development of the market and expanding treatment options for patients.

The market also reflects significant regional variations with North America and Europe holding a substantial share due to well-established healthcare infrastructure, high disease awareness, and the presence of leading pharmaceutical and medical device companies. Meanwhile, Asia Pacific is witnessing accelerated growth supported by growing healthcare access, rising incidence of gastrointestinal disorders, and government initiatives to enhance medical facilities.

Continuous research and development, strategic partnerships among industry players, and innovations in drug delivery and diagnostic technologies are key factors sustaining the market growth and driving competitive dynamics across the globe.

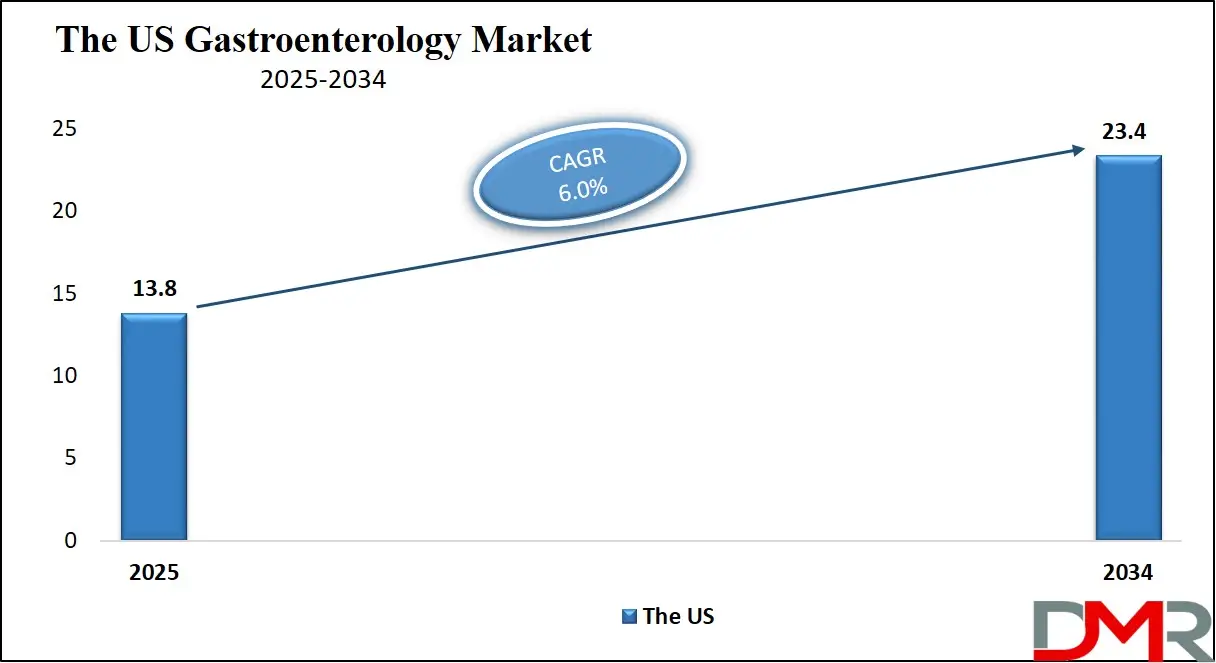

The US Gastroenterology Market

The US Gastroenterology Market is projected to be valued at USD 13.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 23.4 billion in 2034 at a CAGR of 6.0%.

The US gastroenterology market is one of the largest and most advanced globally, driven by high prevalence of gastrointestinal disorders, growing awareness of digestive health, and widespread adoption of innovative diagnostic and therapeutic solutions. Hospitals, specialized clinics, and outpatient care centers are increasingly investing in endoscopy systems, imaging technologies, and advanced biopsy instruments to accurately diagnose conditions such as inflammatory bowel disease, gastroesophageal reflux disease, irritable bowel syndrome, colorectal cancer, and liver disorders.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market benefits from robust healthcare infrastructure, substantial healthcare expenditure, and supportive government initiatives aimed at early detection and improved management of gastrointestinal diseases. Additionally, the presence of leading pharmaceutical and medical device companies contributes to the availability of cutting-edge therapeutics, biologics, and minimally invasive procedures, enhancing patient outcomes and overall market growth.

Technological advancements play a pivotal role in shaping the US gastroenterology market, including the adoption of artificial intelligence-assisted diagnostics, capsule endoscopy, and robotic-assisted surgical devices. Rising demand for outpatient care and personalized treatment solutions is further driving market expansion, particularly for chronic gastrointestinal conditions requiring long-term management.

The growing incidence of obesity, lifestyle-related digestive disorders, and liver diseases is creating a sustained need for innovative interventions and preventive care solutions. Market growth is also supported by strategic partnerships, mergers, and acquisitions among key players to expand their product portfolios and strengthen their presence in the US healthcare ecosystem. Overall, the market is characterized by continuous innovation, high patient awareness, and strong regulatory support, making it a leading segment in the global gastroenterology landscape.

Europe Gastroenterology Market

The Europe gastroenterology market is projected to reach approximately USD 11.0 billion in 2025, reflecting steady growth driven by the rising prevalence of gastrointestinal disorders and strong healthcare infrastructure across the region.

Countries such as Germany, France, the United Kingdom, and Italy are key contributors due to well-established hospitals, advanced diagnostic facilities, and high patient awareness of digestive health conditions. The growing incidence of inflammatory bowel disease, gastroesophageal reflux disease, colorectal cancer, and liver disorders is driving demand for advanced therapeutics, endoscopic devices, and minimally invasive procedures.

The market is expected to grow at a compound annual growth rate (CAGR) of 4.4% over the forecast period. This growth is supported by technological advancements such as high-definition endoscopy systems, AI-assisted diagnostic tools, and precision medicine tailored to patient-specific conditions. Rising healthcare expenditure, favorable reimbursement policies, and ongoing research and development by leading pharmaceutical and medical device companies are further propelling market expansion. The growing adoption of outpatient care centers and specialized gastroenterology clinics is also enhancing access to innovative diagnostics and therapies, strengthening Europe’s position as a key segment in the global gastroenterology market.

Japan Gastroenterology Market

The Japanese gastroenterology market is projected to reach approximately USD 3.1 billion in 2025, driven by the growing prevalence of gastrointestinal disorders and an aging population with a higher risk of digestive diseases.

Chronic conditions such as inflammatory bowel disease, gastroesophageal reflux disease, colorectal cancer, and liver disorders are contributing to sustained demand for advanced therapeutics, endoscopic procedures, and minimally invasive treatment options. Well-established healthcare infrastructure, high patient awareness, and strong government support for healthcare initiatives further reinforce Japan’s position as a significant regional market in the global gastroenterology landscape.

The market in Japan is expected to grow at a CAGR of 5.5% over the forecast period. Growth is supported by technological advancements, including high-definition endoscopy systems, AI-assisted diagnostics, and targeted biologic therapies that improve patient outcomes and procedural efficiency. Increasing investments in research and development, favorable reimbursement policies, and the adoption of outpatient and specialized gastroenterology centers are driving wider access to innovative treatment and diagnostic solutions. These factors collectively contribute to Japan’s strong growth trajectory within the global gastroenterology market.

Global Gastroenterology Market: Key Takeaways

- Market Value: The global Gastroenterology market size is expected to reach a value of USD 72.0 billion by 2034 from a base value of USD 41.1 billion in 2025 at a CAGR of 6.4%.

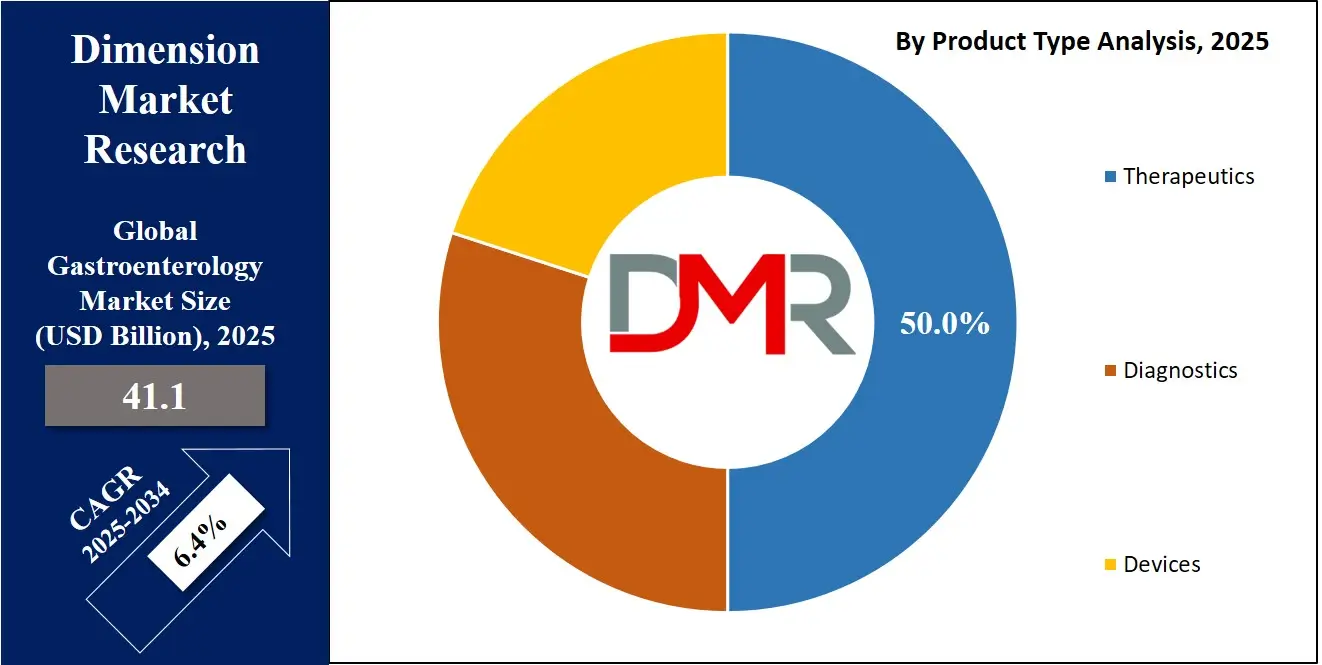

- By Product Type Segment Analysis: Therapeutics are anticipated to dominate the product type segment, capturing 50.0% of the total market share in 2025.

- By Route of Administration Segment Analysis: Injectables are expected to maintain their dominance in the route of administration segment, capturing 45.0% of the total market share in 2025.

- By Drug Type Segment Analysis: Branded Drugs will dominate the drug type segment, capturing 60.0% of the market share in 2025.

- By Application Segment Analysis: Inflammatory Bowel Disease (IBD) will dominate the application segment, capturing 25.0% of the market share in 2025.

- By End-User Segment Analysis: Hospitals will account for the maximum share in the end-user segment, capturing 50.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global Gastroenterology market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Gastroenterology market include AbbVie Inc., Abbott Laboratories, AstraZeneca plc, Bayer AG, Bausch Health Companies Inc., Boehringer Ingelheim GmbH, Boston Scientific Corporation, Cipla Ltd., Ferring Pharmaceuticals, GI Alliance, GlaxoSmithKline plc, Johnson & Johnson, Medtronic plc, Novartis AG, and Others.

Global Gastroenterology Market: Use Cases

- Chronic Disease Management: The global gastroenterology market plays a critical role in the long-term management of chronic gastrointestinal disorders such as inflammatory bowel disease, irritable bowel syndrome, and gastroesophageal reflux disease. Advanced therapeutics, biologics, and targeted drug delivery systems help control symptoms, reduce flare-ups, and improve patient quality of life. Integration of patient monitoring technologies, digital health platforms, and telemedicine solutions enables healthcare providers to track treatment adherence and personalize therapy plans, supporting better outcomes and reduced hospitalizations.

- Early Diagnosis and Screening: Early detection of gastrointestinal cancers, liver disorders, and other digestive conditions is a key use case driving market growth. Endoscopy systems, imaging technologies, and biomarker-based diagnostics facilitate accurate and timely identification of abnormalities. Preventive screenings for colorectal cancer and non-alcoholic fatty liver disease are increasingly adopted in hospitals and diagnostic centers, helping reduce disease progression and improve survival rates. AI-assisted imaging and minimally invasive procedures further enhance diagnostic efficiency and patient safety.

- Minimally Invasive and Surgical Interventions: Minimally invasive procedures are transforming gastroenterology by reducing recovery times and improving patient outcomes. Endoscopic surgeries, laparoscopic interventions, and robotic-assisted procedures are widely used to treat conditions such as polyps, tumors, and gastrointestinal obstructions. Advanced medical devices, including high-definition endoscopes, biopsy tools, and surgical staplers, allow precise interventions with fewer complications. This use case is particularly important in outpatient and specialized care settings where efficiency and patient comfort are prioritized.

- Personalized and Targeted Therapies: The market is witnessing increased adoption of personalized medicine approaches to treat complex gastrointestinal disorders. Genomic profiling, biomarker testing, and targeted biologics enable clinicians to tailor therapies according to individual patient characteristics. This approach is effective in managing inflammatory bowel disease, liver disorders, and certain gastrointestinal cancers. Personalized treatment strategies reduce adverse effects, optimize drug efficacy, and improve overall patient satisfaction, reinforcing the importance of precision medicine within the gastroenterology market.

Impact of Artificial Intelligence on the global Gastroenterology market

Artificial intelligence is transforming the global gastroenterology market by enhancing diagnostic accuracy, improving procedural efficiency, and enabling personalized patient care. AI-powered imaging tools and endoscopic systems assist clinicians in detecting gastrointestinal abnormalities, polyps, tumors, and early-stage cancers with higher precision than traditional methods. Machine learning algorithms analyze large datasets from electronic health records, laboratory tests, and imaging studies to identify patterns and predict disease progression, supporting proactive intervention and improved treatment outcomes.

In addition, AI facilitates the development of personalized treatment strategies by integrating patient-specific data, including genetic profiles, lifestyle factors, and response to previous therapies. Virtual assistants and predictive analytics platforms streamline workflow in hospitals and clinics, reducing procedural time and operational costs. The adoption of AI-driven telemedicine solutions and remote monitoring tools further extends specialized gastroenterology care to underserved regions, expanding market reach. Overall, artificial intelligence is accelerating innovation, driving efficiency, and reshaping clinical decision-making across the global gastroenterology market.

Stats & Facts

- National Institutes of Health (NIH)

- 2024: The NIH allocated USD 3.6 billion to gastrointestinal (GI) research, representing 7.4% of its total budget.

- 2024: The NIH supported 10 PRIMED grants totaling USD 6.9 million for up to five years, focusing on translational research in GI diseases.

- 2024: A funding opportunity was announced to support innovative mechanistic research on precision probiotic interventions for digestive diseases.

- 2025: The NIH announced an NOFO to support research on precision probiotic interventions, aiming to address barriers in their development for digestive diseases.

- 2025: The NIH's National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) awarded the Catalyst Award to support pioneering studies in digestive diseases.

- 2025: The NIH issued an NOFO to support Specialized Programs of Research Excellence (SPORE) grants for translational research in gastrointestinal cancers.

- Centers for Disease Control and Prevention (CDC)

- 2024: The CDC investigated 135 possible multistate outbreaks of enteric diseases, with 74 confirmed, resulting in 1,740 illnesses, 496 hospitalizations, and 15 deaths.

- 2025: The CDC's NoroSTAT data indicated ongoing norovirus activity, with monthly updates to track current and past outbreaks.

- Centers for Medicare & Medicaid Services (CMS)

- 2024: The Medicare physician conversion factor for 2024 was USD 33.2875.

- 2025: The proposed Medicare physician conversion factor for 2025 was USD 32.3465, a 2.83% decrease from 2024.

Market Dynamics

Global Gastroenterology Market: Driving Factors

Rising Prevalence of Gastrointestinal Disorders

The growing incidence of chronic digestive diseases such as inflammatory bowel disease, gastroesophageal reflux disease, colorectal cancer, and liver disorders is fueling demand for advanced gastroenterology solutions. Aging populations, lifestyle changes, and dietary habits contribute to higher disease prevalence, prompting hospitals, clinics, and diagnostic centers to invest in innovative endoscopy systems, imaging technologies, and targeted therapeutics. This trend drives market growth by expanding the patient base requiring specialized gastroenterology care.

Technological Advancements in Diagnostics and Therapeutics

The adoption of minimally invasive procedures, high-definition endoscopes, capsule endoscopy, and AI-assisted diagnostic tools is revolutionizing gastrointestinal care. These innovations enhance procedural accuracy, reduce recovery times, and improve patient outcomes. Additionally, the development of biologics, small molecule therapies, and personalized medicine approaches is transforming treatment strategies, growing the adoption of advanced therapeutics, and boosting overall market expansion.

Global Gastroenterology Market: Restraints

High Cost of Treatment and Medical Devices

Advanced gastroenterology solutions, including endoscopic systems, robotic-assisted surgical instruments, and biologic therapies, involve significant capital and operational costs. High treatment prices limit patient access, particularly in emerging economies, and can slow market adoption despite the availability of innovative technologies. Healthcare providers face budget constraints, which may restrict widespread deployment of cutting-edge diagnostic and therapeutic tools.

Regulatory and Reimbursement Challenges

Stringent regulatory approval processes and variable reimbursement policies across regions create obstacles for new product launches and market penetration. Lengthy clinical trials, compliance requirements, and approval delays can hinder the introduction of innovative therapies and devices. Additionally, inconsistent insurance coverage and reimbursement rates impact the affordability and accessibility of advanced gastroenterology solutions for patients, limiting market growth in certain regions.

Global Gastroenterology Market: Opportunities

Expansion in Emerging Markets

Emerging economies in the Asia Pacific, Latin America, and the Middle East offer significant growth potential for the gastroenterology market. Rising healthcare investments, growing awareness of digestive health, and expanding hospital infrastructure are creating opportunities for manufacturers and service providers. Affordable diagnostic solutions and localized therapeutic innovations can capture a growing patient base, supporting market penetration and long-term revenue growth.

Integration of Digital Health and Telemedicine

The growing use of digital health platforms, telemedicine, and remote patient monitoring in gastroenterology provides opportunities for improving patient engagement and chronic disease management. AI-driven analytics, wearable sensors, and mobile applications enable early detection, continuous monitoring, and personalized treatment recommendations, enhancing clinical efficiency and patient outcomes. These solutions expand market reach, especially in regions with limited access to specialized care.

Global Gastroenterology Market: Trends

Adoption of Artificial Intelligence and Machine Learning

AI and machine learning technologies are increasingly integrated into diagnostic imaging, endoscopy, and predictive analytics in gastroenterology. These tools enhance accuracy, reduce procedural errors, and support precision medicine by identifying disease patterns and predicting treatment response. The trend toward AI-driven gastroenterology is improving clinical decision-making and workflow efficiency while reducing overall operational costs.

Shift Toward Minimally Invasive and Outpatient Procedures

There is a growing preference for minimally invasive interventions such as laparoscopic surgeries, endoscopic resections, and robotic-assisted procedures. These approaches reduce patient recovery times, minimize complications, and lower hospitalization costs. Outpatient and ambulatory care centers are increasingly adopting these procedures, reflecting a broader trend toward patient-centric care and efficient healthcare delivery in the global gastroenterology market.

Research Scope and Analysis

By Product Type Analysis

In the global gastroenterology market, the therapeutics segment is expected to lead the product type category, accounting for approximately 50% of the total market share in 2025. This dominance is primarily driven by the growing prevalence of chronic gastrointestinal disorders such as inflammatory bowel disease, irritable bowel syndrome, gastroesophageal reflux disease, and colorectal cancer, which require long-term management and effective treatment solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Advancements in biologics, small molecule therapies, and targeted drug delivery systems are enhancing the efficacy and safety of treatments, allowing healthcare providers to offer personalized and precision medicine approaches. The growing focus on improving patient outcomes, reducing disease flare-ups, and minimizing hospitalizations further supports the sustained growth of the therapeutics segment within the gastroenterology market.

The diagnostics segment also plays a crucial role in the gastroenterology market by providing accurate and timely detection of digestive disorders. This segment encompasses endoscopic procedures, imaging technologies, and laboratory-based tests that are essential for identifying conditions such as liver disorders, gastrointestinal cancers, and inflammatory diseases at early stages.

With rising awareness about preventive care and early intervention, healthcare providers are increasingly investing in high-definition endoscopy systems, capsule endoscopy, and biomarker-based diagnostics. Additionally, technological innovations, including AI-assisted imaging and computer-aided detection, are improving diagnostic accuracy, reducing procedural errors, and enhancing overall clinical decision-making, thereby supporting the growth and adoption of the diagnostics segment in the market.

By Route of Administration Analysis

In the global gastroenterology market, the injectables segment is projected to maintain a leading position in the route of administration category, accounting for around 45% of the total market share in 2025. This dominance is largely attributed to the effectiveness of injectable therapies in treating chronic gastrointestinal conditions such as inflammatory bowel disease, ulcerative colitis, and Crohn’s disease.

Injectables, including biologics and targeted small molecule therapies, provide rapid therapeutic action, higher bioavailability, and improved patient outcomes compared to other administration methods. They are particularly preferred for severe or refractory cases, where oral medications may not achieve the desired efficacy. Hospitals, specialized clinics, and gastroenterology centers are increasingly relying on injectable formulations to manage complex cases, which sustains the strong growth of this segment.

Oral medications also constitute a significant portion of the gastroenterology market due to their convenience, ease of administration, and suitability for long-term management of chronic gastrointestinal disorders. These medications include proton pump inhibitors, antispasmodics, anti-inflammatory drugs, and oral biologics designed to target specific digestive system conditions.

Oral formulations are widely used in both outpatient and home care settings, offering patients a non-invasive and cost-effective alternative to injectables. With growing patient preference for self-administered treatments and advancements in drug delivery systems that enhance absorption and minimize side effects, oral medications continue to be a critical segment within the gastroenterology market.

By Drug Type Analysis

In the global gastroenterology market, branded drugs are expected to dominate the drug type segment, accounting for approximately 60% of the market share in 2025. The prominence of branded medications is driven by their established efficacy, extensive clinical validation, and strong trust among healthcare providers and patients.

These drugs often include innovative biologics, targeted therapies, and advanced small molecule treatments designed to manage complex gastrointestinal disorders such as inflammatory bowel disease, gastroesophageal reflux disease, colorectal cancer, and liver conditions. Branded drugs are typically supported by comprehensive marketing strategies, patient support programs, and robust research and development pipelines, which help maintain their leading position in the market. The reliability, consistent therapeutic outcomes, and physician preference for branded formulations further reinforce their dominance.

Generic drugs also play an important role in the gastroenterology market as cost-effective alternatives to branded medications. These drugs provide similar efficacy and safety profiles while offering a more affordable option for long-term management of chronic digestive disorders. Generic medications help increase access to essential treatments, particularly in emerging markets or among patients with limited healthcare coverage.

With growing regulatory approvals and growing acceptance among healthcare providers, generic drugs are contributing to market expansion by enabling wider patient reach and supporting sustainable healthcare expenditure. Their adoption is steadily growing, complementing the overall growth of the drug type segment in the gastroenterology market.

By Application Analysis

In the Global Gastroenterology Market, the application segment for Inflammatory Bowel Disease (IBD) is projected to dominate, accounting for around 25.0% of the market share in 2025. This growth is driven by the rising prevalence of conditions such as Crohn’s disease and ulcerative colitis worldwide, coupled with increasing awareness and early diagnosis.

The adoption of advanced biologics, targeted therapies, and personalized treatment approaches further fuels demand in this segment. Continuous monitoring and the need for long-term disease management make IBD a critical focus area, significantly influencing the overall growth and innovation within the gastroenterology market.

Gastroesophageal Reflux Disease (GERD) also holds a notable position in the global gastroenterology market due to its widespread prevalence and chronic nature. Factors such as obesity, poor dietary habits, and sedentary lifestyles contribute to the increasing incidence of GERD, which drives demand for effective management solutions.

The segment benefits from a broad range of treatment options, including over-the-counter medications, proton pump inhibitors, and emerging therapeutic innovations. While GERD’s market share is slightly lower than that of IBD, its persistent demand and high patient volume make it an important contributor to the expansion of the gastroenterology market globally.

By End-User Analysis

In the global gastroenterology market, hospitals are expected to account for the largest share in the end-user segment, capturing around 50% of the market in 2025. This dominance is driven by the availability of advanced diagnostic and therapeutic infrastructure, highly skilled gastroenterologists, and the capacity to manage complex and chronic gastrointestinal disorders.

Hospitals serve as primary centers for endoscopic procedures, surgical interventions, and biologic or injectable therapies, providing comprehensive care under one roof. The growing incidence of gastrointestinal diseases, integrated with rising patient preference for specialized and supervised treatment, reinforces hospitals as the preferred choice for both acute and chronic gastrointestinal conditions.

Diagnostic centers also play a significant role in the gastroenterology market by offering specialized imaging, laboratory, and endoscopic services. These centers are often equipped with high-resolution endoscopes, imaging technologies, and biomarker testing facilities that enable early detection and accurate diagnosis of conditions such as liver disorders, colorectal cancer, and inflammatory bowel disease.

The growing focus on preventive healthcare and screening programs is growing the demand for diagnostic centers, particularly for outpatient and routine testing. These centers provide efficient, cost-effective, and convenient solutions for patients, complementing hospital services and contributing to overall market growth.

The Gastroenterology Market Report is segmented on the basis of the following:

By Product Type

- Therapeutics

- Biologics

- Biosimilars

- Small Molecules

- Diagnostics

- Endoscopic Procedures

- Imaging

- Lab Tests

- Devices

- Biopsy Tools

- Surgical Instruments

By Route of Administration

- Injectables

- Oral Medications

- Others

By Drug Type

- Branded Drugs

- Generic Drugs

By Application

- Inflammatory Bowel Disease (IBD)

- Gastroesophageal Reflux Disease (GERD)

- Irritable Bowel Syndrome (IBS)

- Colorectal Cancer

- Liver Disorders

By End-User

- Hospitals

- Diagnostic Centers

- Retail Pharmacies

- Online Pharmacies

Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global gastroenterology market, accounting for approximately 40% of total market revenue in 2025. The region’s dominance is driven by advanced healthcare infrastructure, high prevalence of gastrointestinal disorders, and widespread adoption of innovative diagnostic and therapeutic solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Hospitals, specialized clinics, and outpatient care centers are increasingly investing in high-definition endoscopy systems, minimally invasive surgical instruments, and biologic therapies to manage conditions such as inflammatory bowel disease, gastroesophageal reflux disease, colorectal cancer, and liver disorders. Additionally, strong research and development capabilities, favorable regulatory frameworks, and high patient awareness contribute to the region’s leadership in the global gastroenterology landscape.

Region with significant growth

The Asia Pacific region is projected to witness significant growth in the global gastroenterology market over the coming years. This expansion is driven by growing healthcare investments, rising prevalence of gastrointestinal disorders, and improving access to advanced diagnostic and therapeutic solutions across the region.

Growing awareness of digestive health, expanding hospital infrastructure, and government initiatives to enhance medical facilities are further supporting market adoption. Additionally, the rising middle-class population and growing affordability of innovative treatments are accelerating demand for endoscopic procedures, imaging technologies, and targeted therapies, making Asia Pacific one of the fastest-growing regions in the gastroenterology market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global gastroenterology market is highly competitive, characterized by the presence of leading pharmaceutical, medical device, and diagnostic companies such as AbbVie, Abbott Laboratories, Johnson & Johnson, Takeda Pharmaceutical, and Boston Scientific. These players are focusing on strategic initiatives including mergers and acquisitions, partnerships, product launches, and geographic expansion to strengthen their market presence and enhance product portfolios.

Continuous investment in research and development, innovation in minimally invasive procedures, biologics, and advanced diagnostic technologies, as well as adoption of AI and digital health solutions, further intensifies competition. The market landscape is shaped by efforts to address unmet medical needs, improve patient outcomes, and capture a larger share in both developed and emerging regions.

Some of the prominent players in the global Gastroenterology market are:

- AbbVie Inc.

- Abbott Laboratories

- AstraZeneca plc

- Bayer AG

- Bausch Health Companies Inc.

- Boehringer Ingelheim GmbH

- Boston Scientific Corporation

- Cipla Ltd.

- Ferring Pharmaceuticals

- GI Alliance

- GlaxoSmithKline plc

- Johnson & Johnson

- Medtronic plc

- Novartis AG

- Olympus Corporation

- Pfizer Inc.

- Salix Pharmaceuticals

- Sanofi S.A.

- Sebela Pharmaceuticals

- Takeda Pharmaceutical Company

- Other Key Players

Recent Developments

- September 2025: The American Gastroenterological Association (AGA) Research Foundation awarded a USD 30,000 Pilot Research Award in Inflammatory Bowel Disease, supported by Pfizer, to promote innovative research in the field.

- July 2025: AbbVie announced the U.S. Food and Drug Administration (FDA) approval of RINVOQ (upadacitinib) as the first oral Janus Kinase (JAK) inhibitor for the treatment of giant cell arteritis (GCA) in adults. This marks the ninth approved indication for RINVOQ in the U.S., spanning rheumatology, gastroenterology, and dermatology.

- March 2025: Boston Scientific entered into a definitive agreement to acquire SoniVie, a developer of intravascular ultrasound systems. This acquisition aims to expand Boston Scientific's capabilities in the diagnostic imaging segment, particularly for cardiovascular applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 41.1 Bn |

| Forecast Value (2034) |

USD 72.0 Bn |

| CAGR (2025–2034) |

6.4% |

| The US Market Size (2025) |

USD 13.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Therapeutics, Diagnostics, Devices), By Route of Administration (Injectables, Oral Medications, Others), By Drug Type (Branded Drugs, Generic Drugs), By Application (Inflammatory Bowel Disease, Gastroesophageal Reflux Disease, Irritable Bowel Syndrome, Colorectal Cancer, Liver Disorders), By End-User (Hospitals, Diagnostic Centers, Retail Pharmacies, Online Pharmacies) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

AbbVie Inc., Abbott Laboratories, AstraZeneca plc, Bayer AG, Bausch Health Companies Inc., Boehringer Ingelheim GmbH, Boston Scientific Corporation, Cipla Ltd., Ferring Pharmaceuticals, GI Alliance, GlaxoSmithKline plc, Johnson & Johnson, Medtronic plc, Novartis AG, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Gastroenterology Market?

▾ The Global Gastroenterology Market size is estimated to have a value of USD 38.5 billion in 2024 and is expected to reach USD 66.4 billion by the end of 2033.

Which region accounted for the largest Global Gastroenterology Market?

▾ North America is expected to be the largest market share for the Global Gastroenterology Market with a share of about 38.6% in 2024.

Who are the key players in the Global Gastroenterology Market?

▾ Some of the major key players in the Global Gastroenterology Market are Takeda Pharmaceutical Company, AbbVie, and Pfizer. and many others.

What is the growth rate in the Global Gastroenterology Market?

▾ The market is growing at a CAGR of 6.2 percent over the forecasted period.

How big is the US Gastroenterology Market?

▾ The Global US Market size is estimated to have a value of USD 12.5 billion in 2024 and is expected to reach USD 20.5 billion by the end of 2033.