Overview

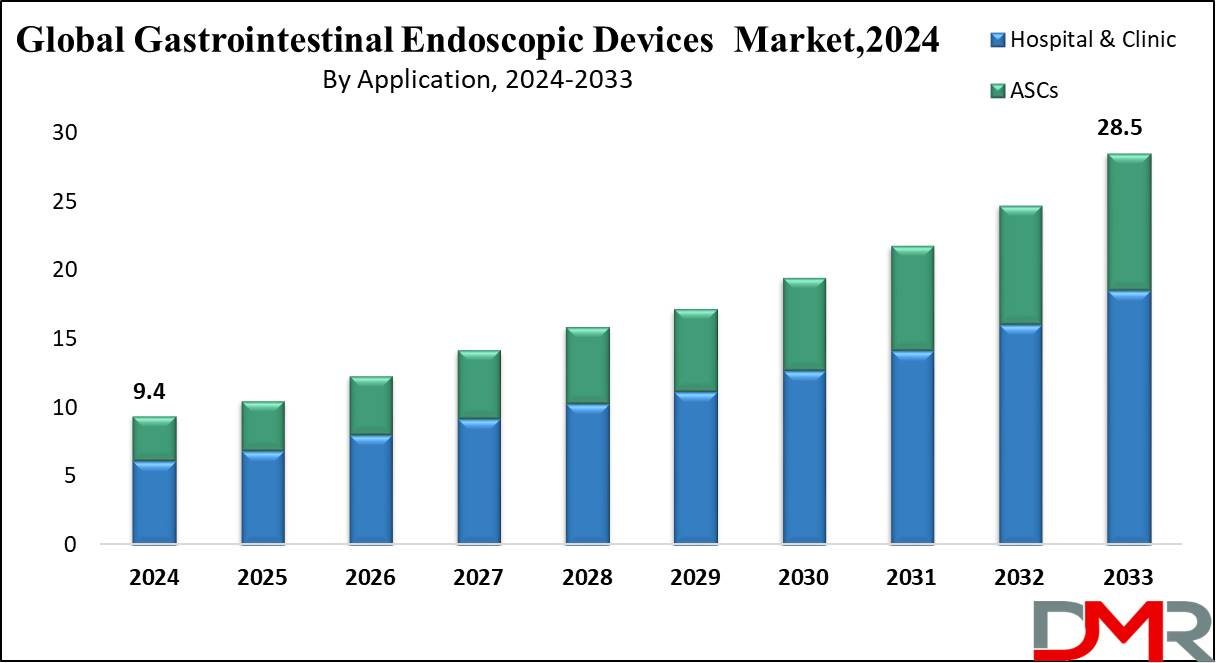

Global Gastrointestinal Endoscopic Devices Market size was valued at USD 9.4 Bn in 2024 and it is further anticipated to reach a market value of USD 28.5 Bn in 2033 at a CAGR of 13.1%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Endoscopy is a medical procedure used to detect, prevent, and treat complications related to internal organs. This procedure entails inspecting hollow organs or body cavities using special devices; typically these devices are introduced through natural openings in the mouth or anus; in some instances small incisions may also be made such as with arthroscopy.

Endoscopic devices typically come equipped with cameras and light sources enabling healthcare professionals to visually inspect and analyze internal organs of interest; endoscopies can often be seen investigating digestive symptoms such as nausea vomiting abdominal pain difficulty swallowing difficulty swallowing difficulties or even gastrointestinal bleeding.

Global Gastrointestinal Endoscopic Devices Market report offers an in-depth analysis of the target market, encompassing factual data like market size and shares at both regional and country levels, with CAGR and year-on-year growth rates. The report gives crystal view on market trends, opportunities, restrains and challenges along with competitive landscape analysis. Porters Five Forces, PESTLE, supply-chain analysis, Ecosystem analysis and Macro economic factors are included to cover all the target market aspects.

The research report on the global gastrointestinal endoscopic devices market includes both qualitative as well as quantitative analysis of the market, company profiles of major market players along with complete product details and their competitive scenario. The report highly exhibits on the current and upcoming market trends and provides comprehensive analysis of all the factors that impact the global gastrointestinal endoscopic devices market growth and size. The report will help companies to make better strategical business decisions.

Key Takeaways

- Market Size & Share: Gastrointestinal Endoscopic Devices Market size was valued at USD 9.4 Bn in 2024 and it is further anticipated to reach a market value of USD 28.5 Bn in 2033 at a CAGR of 13.1%.

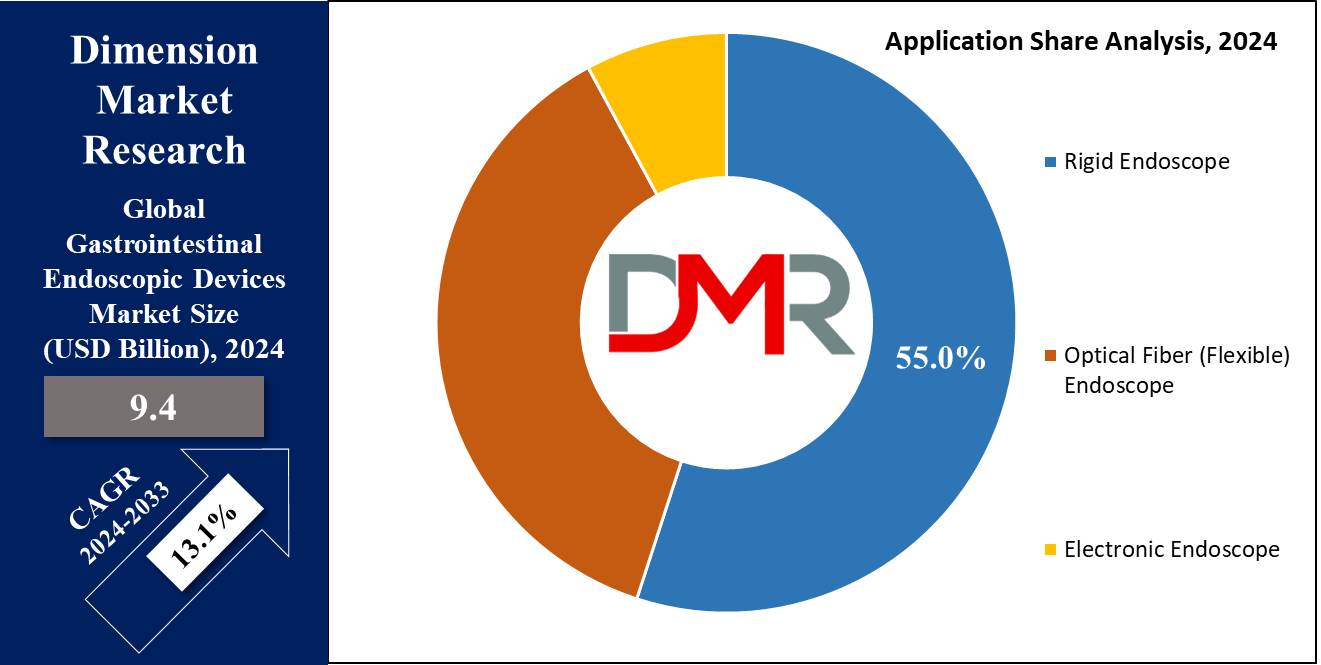

- Type Analysis: Electronic Endoscopes were the market leaders in 2024, holding approximately 55% of market share.

- Application Analysis: Hospitals & Clinics were the leaders of the Gastrointestinal Endoscopic Devices Market in 2024, accounting for approximately 65% of market share.

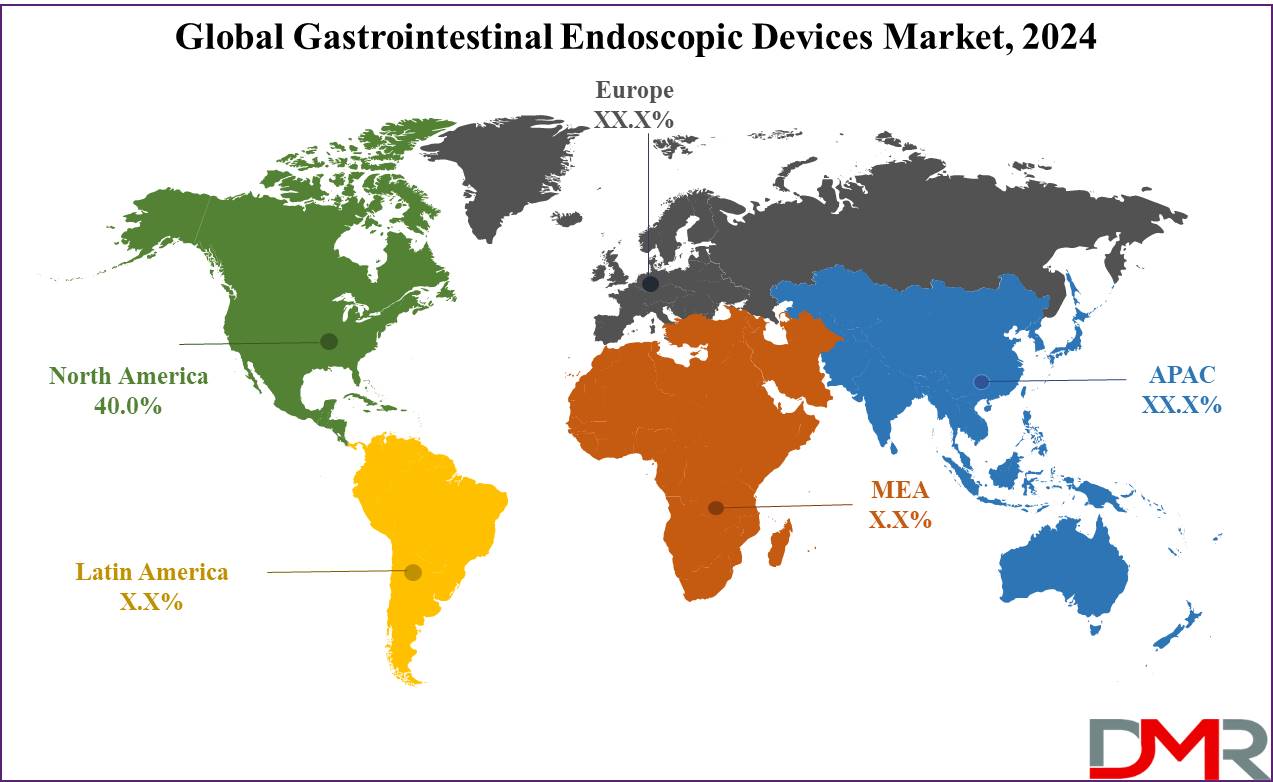

- Regional Analysis: North America held approximately 40% of the Gastrointestinal Endoscopic Devices Market in 2024.

- Technological Advancements: Innovation in digital imaging, AI integration, and robotic-assisted endoscopy are enhancing diagnostic accuracy and procedural outcomes.

- Growth Drivers: Increasing gastrointestinal disorders, a preference for minimally invasive procedures, and expanding healthcare access in emerging markets are key growth factors.

Use Cases

- Diagnostic Endoscopy: GI endoscopic devices are widely used to visualize the gastrointestinal tract, aiding in the diagnosis of conditions like ulcers, cancers, and inflammatory bowel disease (IBD). These devices allow for real-time observation and tissue biopsy.

- Therapeutic Procedures: They are employed in treating various GI conditions, such as removing polyps, cauterizing bleeding vessels, and performing endoscopic mucosal resections (EMR) or submucosal dissections (ESD) for early-stage cancers.

- Stent Placement: Endoscopic devices are used to place stents in the GI tract to relieve obstructions caused by tumors or strictures, thereby improving the patient's quality of life.

- Foreign Body Removal: Endoscopic tools are essential for safely removing foreign objects that have been ingested or lodged in the GI tract, preventing potential complications.

- Endoscopic Retrograde Cholangiopancreatography (ERCP): This specialized procedure uses endoscopy to treat conditions related to the bile ducts and pancreas, such as gallstones, strictures, or tumors.

Market Dynamics

Driver

The primary driver of the Gastrointestinal Endoscopic Devices Market is the increasing prevalence of gastrointestinal diseases, including colorectal cancer, inflammatory bowel disease (IBD), and gastroesophageal reflux disease (GERD). These conditions are becoming more common due to factors such as unhealthy diets, sedentary lifestyles, and an aging population.

Additionally, the growing preference for minimally invasive procedures over traditional surgeries is propelling the demand for endoscopic devices. These devices reduce patient recovery times, minimize hospital stays, and lower healthcare costs, making them highly desirable in modern healthcare settings.

Trend

Technological advancements are a key trend in the market. Innovations like high-definition imaging, narrow-band imaging, and capsule endoscopy are enhancing the diagnostic and therapeutic capabilities of endoscopic devices. Capsule endoscopy, in particular, has gained attention as it allows for non-invasive visualization of the entire gastrointestinal tract, especially the small intestine, which is difficult to access with traditional endoscopes. Furthermore, robotic-assisted endoscopy is emerging as a cutting-edge trend, providing enhanced precision and control during procedures, which is especially beneficial in complex cases.

Restraint

One of the significant restraints in the Gastrointestinal Endoscopic Devices Market is the high cost of endoscopic procedures and devices. While the long-term benefits of minimally invasive procedures are clear, the initial costs can be prohibitive, particularly in developing regions with limited healthcare budgets. Additionally, the lack of skilled professionals to operate advanced endoscopic equipment can hinder market growth. Training and expertise are crucial for the effective use of these devices, and shortages in skilled healthcare workers can limit their adoption.

Opportunity

Despite the challenges, the market presents significant opportunities, particularly in emerging markets. As healthcare infrastructure improves in developing countries, there is increasing demand for advanced medical devices. Companies can capitalize on this by offering cost-effective and innovative endoscopic solutions tailored to these regions. Moreover, the rising awareness of early cancer detection through endoscopy presents a substantial growth opportunity, as more patients and healthcare providers prioritize preventative care.

The COVID-19 Pandemic & Recession: Impact on the Global Gastrointestinal Endoscopic Devices Market:

Dimension Market Research has closely monitored the impact of COVID-19 and the recession on specific business segments, along with its short and long-term implications at both the global and regional levels. The initial outbreak of the COVID-19 pandemic caused unprecedented economic damage across numerous regions. The COVID-19 pandemic severely disrupted production, sales, and supply chain activities in developed as well as developing economies. Our report comprehensively covers the pre and post-COVID-19 impacts, along with an analysis of the recession's effects on the global gastrointestinal endoscopic devices market.

Market Segmentation Analysis

Type Analysis

Gastrointestinal Endoscopic Devices Market can be divided into Rigid Endoscopes, Optical Fiber (Flexible) Endoscopes, and Electronic Endoscopes. Rigid Endoscopes are typically utilized during upper GI tract procedures that offer straight-line access; providing durability and stability. Optical Fiber Endoscopes and Electronic Endoscopes offer better durability and versatility than Rigid Endoscopes in terms of straight line access and stability. However, their usefulness is often limited due to a lack of flexibility.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Optical Fiber (Flexible) Endoscopes have become more widely adopted due to their ability to navigate complex gastrointestinal structures more accurately and precisely. Electronic Endoscopes were the market leaders in 2024, holding approximately 55% of market share. They utilize optical fiber technology for optimal image quality during diagnostic and therapeutic procedures. These endoscopes utilize advanced digital imaging sensors that deliver HD quality images, increasing accuracy and effectiveness for diagnostic and therapeutic interventions.

Electronic endoscopes have quickly become the go-to choice in modern medical practices that prioritize high quality patient outcomes, due to their superior visualization capabilities, ease of use and integration with cutting-edge imaging technologies. Their popularity can be seen through their excellent visualization abilities, user friendliness and integration with cutting-edge imaging systems. As a result, electronic endoscopes are quickly becoming a preferred choice.

Application Analysis

Hospitals & Clinics were the leaders of the Gastrointestinal Endoscopic Devices Market in 2024, accounting for approximately 65% of market share. Their success can be attributed to extensive infrastructure, advanced technology, and highly trained personnel available within these settings allowing them to handle a range of complex gastrointestinal procedures more easily than any other provider. Hospitals & clinics are preferred settings for both diagnostic and therapeutic endoscopic interventions especially those dealing with severe or intricate cases.

Ambulatory Surgical Centers (ASCs) have become increasingly popular as patients recognize their cost-effectiveness, convenience, and shorter waiting times as appealing benefits of ASC care. While ASCs may be suitable for less complex procedures like routine check-ups or less invasive surgeries, their market share remains smaller compared to hospitals or clinics; nonetheless this segment is expected to experience consistent growth over time with demand for outpatient services increasing while providing patients with more accessible alternatives than traditional hospital care.

Market Analysis and Research Scope:

We provide Comprehensive insights about the gastrointestinal endoscopic devices market along with crucial Key factors such as market size, market CAGR, market potential, recent developments, trends, opportunities, new technologies and innovations, recent product launches, restraints and market regulations. This report will help our clients immensely in getting an inside out view of the gastrointestinal endoscopic devices market by providing them with the complete information about the gastrointestinal endoscopic devices market and its prominent players with their competitive analysis and strategies.

The global gastrointestinal endoscopic devices market research report provides accurate estimations for the forecast period 2024 to 2033 based on in-depth research and analysis through rigorous compilation of exhaustive primary and secondary research data. The final data will be carried out after verifying the in-house research analysis by the key opinion leaders of the global gastrointestinal endoscopic devices market. Our triangulate research method minimizes error margin and gives holistic view on the report.

The Global Gastrointestinal Endoscopic Devices Market Report is segmented on the basis of the following:

Type

- Rigid Endoscope

- Optical Fiber (Flexible) Endoscope

- Electronic Endoscope

Application

Geographical Segmentation of the Global Gastrointestinal Endoscopic Devices Market:

North America held approximately 40% of the Gastrointestinal Endoscopic Devices Market in 2024. This impressive performance can be attributed to North America's advanced healthcare infrastructure, high adoption of cutting-edge medical technologies and rising gastrointestinal disorders prevalence rate; as well as favorable reimbursement policies and strong presence of key market players - with the United States playing a particularly vital role due to increased demand for minimally invasive procedures as well as continuous advancements in endoscopic technology.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region and Countries

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Nordic

- Benelux

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Egypt

- Rest of MEA

The global gastrointestinal endoscopic devices market research report provides competitive examination analysis of the leading players including company description, SWOT analysis, and financial information, exhaustive product portfolio with specifications, key business areas, market share analysis, acquisitions and mergers, and key developments, etc.

Competitive Landscape:

The global gastrointestinal endoscopic devices market is highly fragmented due to the presence of several leading players. Prominent market players of the gastrointestinal endoscopic devices market are exhibiting a keen interest towards the emerging economies such as China, India, etc. to enhance their revenue generating opportunities. The major market players are continuously focusing on their product branding, marketing and expansion of R&D, to increase their customer base. Exhaustive key vendor analysis has been done to meet the ever-changing needs of our clients and provide them with a complete overview on the competitiveness of the global gastrointestinal endoscopic devices market.

Global Gastrointestinal Endoscopic Devices Market Key Players:

Recent Developments

- Technological Innovations: In 2024, the introduction of AI-powered endoscopy systems gained momentum, enhancing diagnostic accuracy and reducing the reliance on manual interpretation. AI integration has improved real-time detection of abnormalities like polyps and early-stage cancers, leading to more effective treatments.

- Expansion of Capsule Endoscopy: Capsule endoscopy continued to evolve, with several companies launching next-generation devices. These capsules are now equipped with higher-resolution imaging and longer battery life, allowing for better visualization of the gastrointestinal tract, particularly the small intestine.

- Robotic Endoscopy: Robotic-assisted endoscopy has become more prominent, with new systems offering improved maneuverability and precision during complex procedures. This trend is particularly relevant for minimally invasive surgeries, where precision and control are critical.

- Partnerships and Collaborations: The market has seen several strategic partnerships between medical device companies and healthcare providers. These collaborations are aimed at accelerating the development and deployment of advanced endoscopic technologies in clinical settings.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 9.2 Bn |

| Forecast Value (2033) |

USD 26.4 Bn |

| CAGR (2024-2033) |

12.6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Rigid Endoscope, Optical Fiber (Flexible) Endoscope, Electronic Endoscope) By Application (Hospital & Clinic, ASCs) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Olympus, Karl Storz, Stryker, Fujifilm, Medtronic, Conmed, B.Braun Melsungen |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |