Market Overview

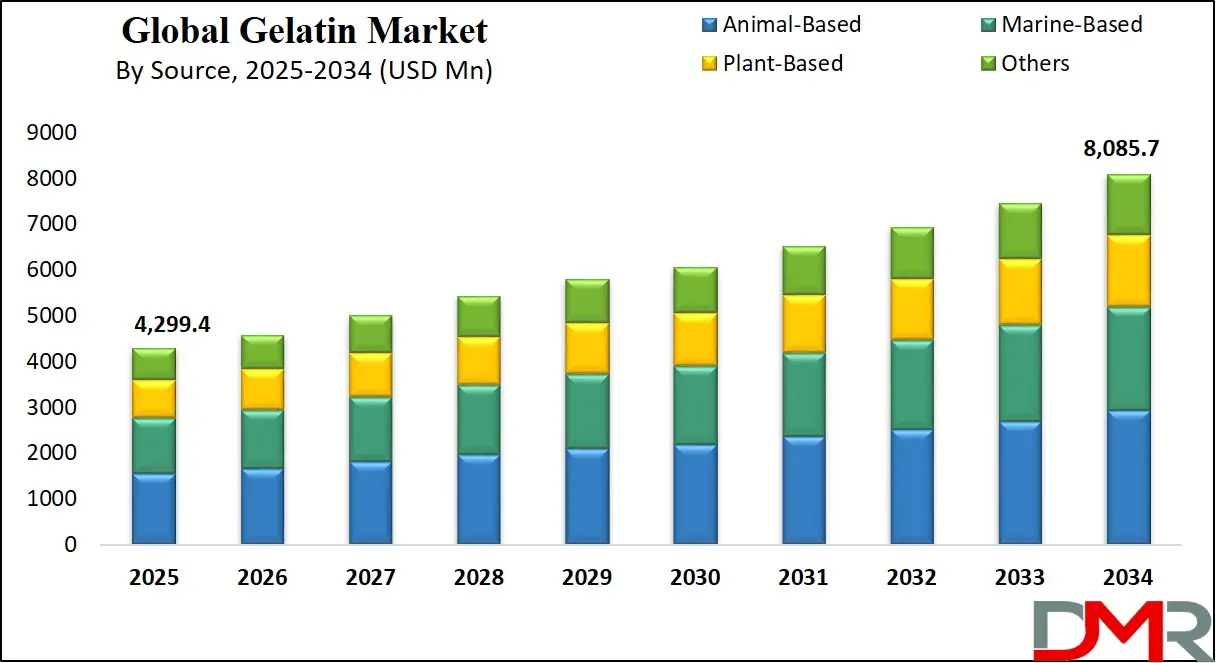

The Global Gelatin Market is projected to reach

USD 4,299.4 million in 2025 and grow at a compound annual growth rate of

7.3% from there until 2034 to reach a value of

USD 8,085.7 million.

The global gelatin market is undergoing rapid transformation due to its multifunctional applications across industries such as food and beverages, healthcare, pharmaceuticals, cosmetics, and nutraceuticals. Gelatin is a protein obtained by partial hydrolysis of collagen, typically extracted from animal-based sources like bovine, porcine, and fish. Its excellent film-forming, emulsifying, and water-binding properties make it ideal for various end-use products, especially in clean-label and functional food categories. In the food sector, gelatin is favored for its ability to enhance mouthfeel, improve texture, and stabilize emulsions.

A major trend shaping the market is the consumer shift toward

health and wellness, which has accelerated the demand for collagen supplements and functional products. Collagen peptides derived from gelatin are increasingly used in beauty-from-within supplements and joint health formulas. Additionally, the rising adoption of gelatin in pharmaceutical formulations for tablets, capsules, and wound care is contributing to sustained growth.

The market is also benefiting from innovations in sourcing and processing techniques. Ethical concerns and dietary restrictions are leading to the development of plant-based and marine-derived gelatin alternatives, enabling brands to tap into vegetarian and flexitarian segments. These innovations are further being supported by advancements in extraction efficiency and bioactive compound preservation.

However, the market faces restraints such as raw material volatility, supply chain inconsistencies, and religious dietary restrictions that limit gelatin use in specific communities. Competition from plant-based hydrocolloids like agar-agar and pectin poses a potential challenge, especially as food formulators look for vegan-friendly gelling solutions. Despite these hurdles, the gelatin market holds robust long-term prospects as it adapts to modern dietary trends and continues to penetrate emerging functional categories.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

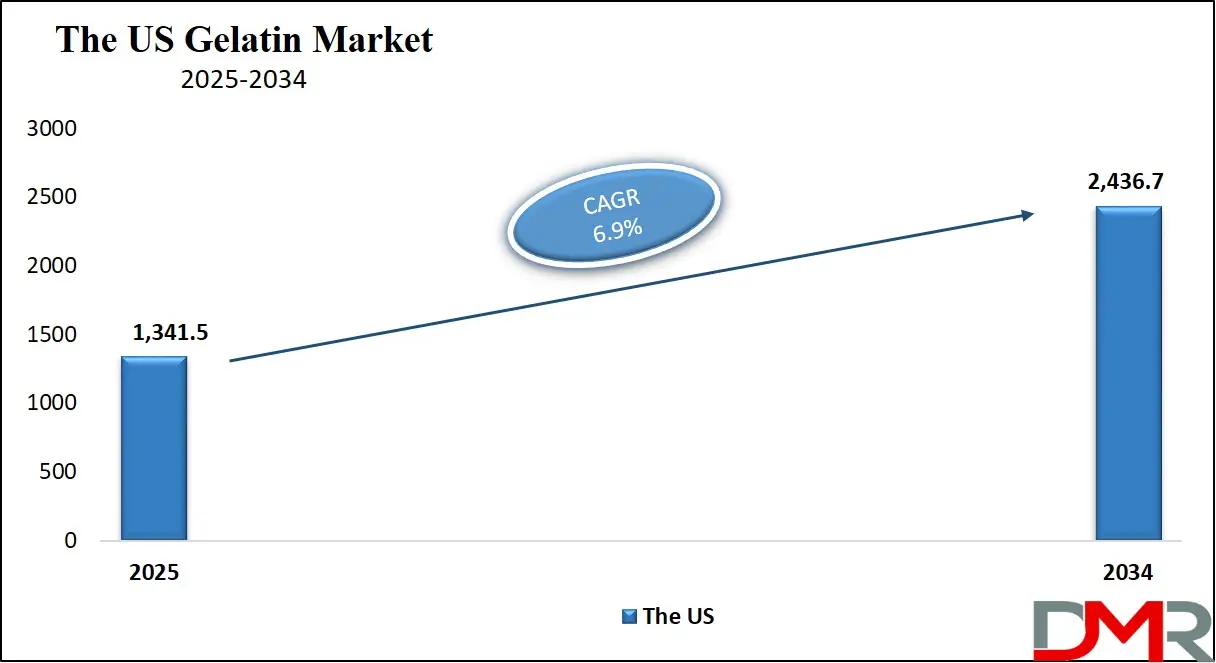

The US Gelatin Market

The US Gelatin Market is projected to reach

USD 1,341.5 million in 2025 at a compound annual growth rate of

6.9% over its forecast period.

The U.S. gelatin market plays a pivotal role in the global supply and demand chain due to the country's advanced manufacturing base and diversified end-use industries. Gelatin is widely used in America’s food and beverage sector, particularly in desserts, dairy-based items, and confectionery. Its functional characteristics, gelling, stabilizing, and emulsifying, make it indispensable in processed food products aligned with evolving consumer preferences toward texture-enhanced and fortified consumables.

In the pharmaceutical landscape, gelatin is critical for encapsulation technologies. The U.S. Food and Drug Administration supports gelatin-based products for their proven safety and bioavailability. This has led to widespread use of gelatin in nutraceuticals and over-the-counter medications. Moreover, growing awareness of collagen’s health benefits, including improved skin health and joint mobility, has led to a surge in demand for gelatin-derived supplements, especially among aging populations.

The U.S. has a demographic advantage with a large base of health-conscious, aging consumers seeking functional foods. According to public health databases, chronic joint and skin conditions are among the top concerns for middle-aged and elderly citizens. This demographic shift, combined with rising disposable income and interest in preventive healthcare, is fueling gelatin’s integration into daily dietary routines.

Another growth lever is the demand for clean-label and natural ingredients, a trend supported by U.S. agriculture and food safety policies that emphasize transparency. Gelatin, being a naturally derived animal protein with high traceability, aligns with this trend. Furthermore, the growth of halal, kosher, and marine-derived gelatin variants is expanding consumer access while supporting ethical sourcing standards.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Gelatin Market

The European gelatin Market is estimated to be valued at

USD 756.7 million in 2025 and is further anticipated to reach

USD 1,333.7 million by 2034 at a

CAGR of 6.5%.

Europe’s gelatin market is mature yet evolving, shaped by a complex regulatory framework, high consumer awareness, and sustainability-driven innovation. The region is home to some of the world’s largest gelatin producers and suppliers, with extensive distribution across Western and Central Europe. Gelatin is a staple in Europe’s food culture, prominently featured in confectioneries, meat aspics, dairy desserts, and bakery fillings. Its natural origin and functional performance cater to clean-label demands rising among European consumers.

The pharmaceutical and nutraceutical sectors in Europe are key drivers of gelatin demand. Capsules, tablets, and wound care applications all benefit from gelatin's biodegradability and compatibility with active pharmaceutical ingredients. With an aging population and increasing investment in wellness, Europe sees a surge in collagen-based dietary supplements, many of which are derived from gelatin. These trends are strengthened by European Union directives that support innovation and ensure high product safety.

Europe also benefits from demographic and cultural preferences that favor high-quality, traceable, and ethically sourced products. As consumer demand shifts toward sustainability, manufacturers are investing in marine-sourced and certified gelatin alternatives. The market is further supported by the European Food Safety Authority’s (EFSA) initiatives, which require stringent testing and quality assurance, boosting consumer confidence.

Another contributing factor is the rising trend of flexitarianism. Many Europeans are moderating their meat intake while still consuming animal-derived ingredients like gelatin in processed foods. This has opened avenues for value-added gelatin applications in functional beverages, snacks, and meal replacements. As Europe continues to lead in sustainable food innovation, the gelatin market is well-positioned to thrive.

The Japan Gelatin Market

The Japan Gelatin Market is projected to be valued at USD 258.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 435.8 million in 2034 at a CAGR of 6.0%.

Japan's gelatin market is rooted in tradition yet increasingly aligned with contemporary health trends. Gelatin has long been used in Japanese cuisine, especially in wagashi (traditional confections), which often use gelatin as a gelling and stabilizing agent. Its application has expanded beyond traditional sweets into modern dairy desserts, low-calorie jellies, and beverages, driven by rising health consciousness among the population.

In the pharmaceutical and biomedical sectors, Japan maintains rigorous quality standards, and gelatin remains a preferred excipient for capsules and drug delivery systems. Japanese pharmaceutical companies favor gelatin due to its high purity, solubility, and stability, ensuring safe and effective therapeutic outcomes. Additionally, Japan’s demographic profile, characterized by one of the world’s oldest populations, drives demand for supplements focused on bone, joint, and skin health. Collagen peptides derived from gelatin are commonly used in functional drinks and tablets targeting these health issues.

Consumer behavior in Japan is also shaped by cultural and dietary awareness. The population is highly receptive to health and wellness trends, with a growing demand for natural, additive-free products. Gelatin, being protein-rich and low in calories, fits this demand perfectly. Moreover, local companies are exploring marine-based and halal-certified gelatin to cater to both dietary needs and export opportunities.

From a regulatory standpoint, Japan’s Ministry of Health promotes food safety and innovation, enabling gelatin manufacturers to maintain quality while developing new applications. As domestic health trends evolve and food culture blends with Western influences, gelatin continues to gain relevance as both a functional and traditional ingredient.

Global Gelatin Market: Key Takeaways

- Global Market Size Insights: The Global Gelatin Market size is estimated to have a value of USD 4,299.4 million in 2025 and is expected to reach USD 8,085.7 million by the end of 2034.

- The US Market Size Insights: The US Gelatin Market is projected to be valued at USD 1,341.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,436.7 million in 2034 at a CAGR of 6.9%.

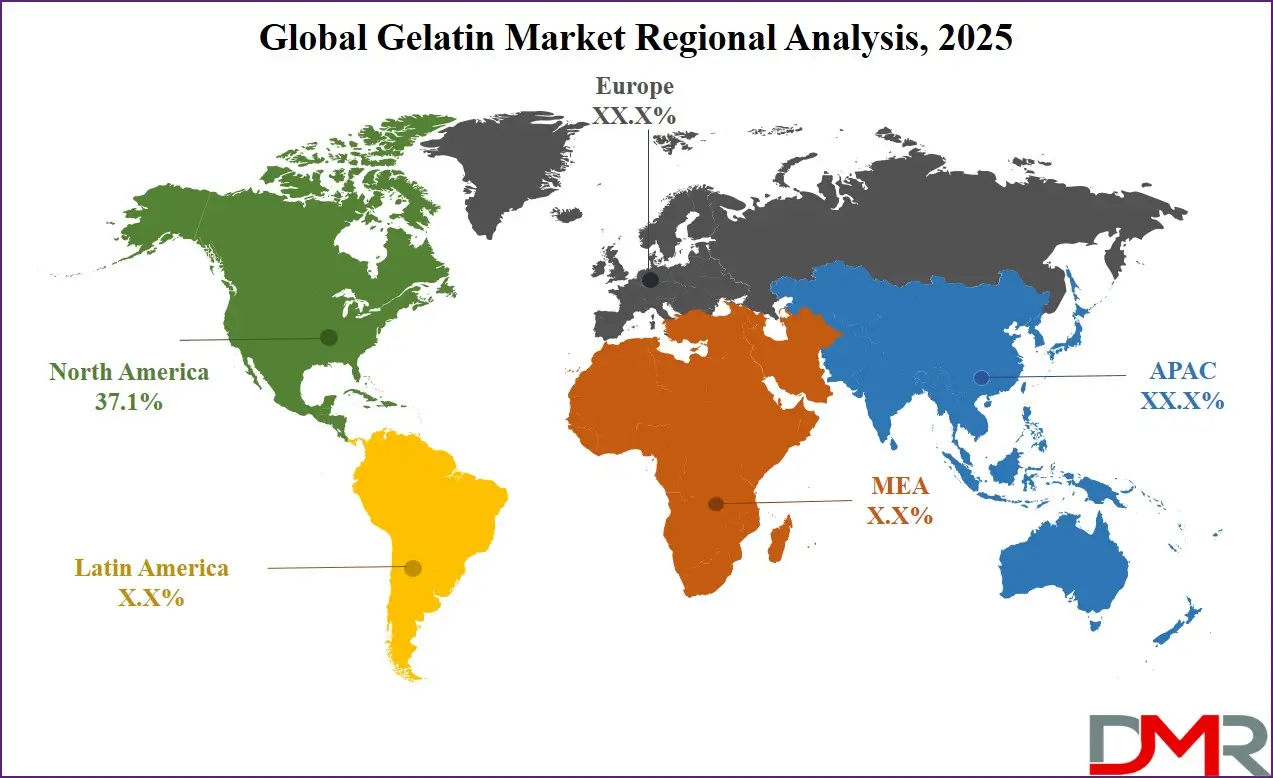

- Regional Insights: North America is expected to have the largest market share in the Global Gelatin Market with a share of about 37.1% in 2025.

- Key Players: Some of the major key players in the Global Gelatin Market are Gelita AG, Rousselot (Darling Ingredients Inc.), PB Leiner (Tessenderlo Group), Nitta Gelatin, Inc., Weishardt Group, Ewald-Gelatine GmbH, Italgel S.r.l., Sterling Biotech Ltd., TROPHIC (Guangdong) Products Co., Ltd., Qinghai Gelatin Co., Ltd, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

Global Gelatin Market: Use Cases

- Pharmaceutical Capsules: Gelatin is essential in pharmaceutical manufacturing, especially for soft and hard capsules. It offers excellent bioavailability, protects active ingredients, and dissolves quickly in the digestive tract, making it an ideal delivery system for both over-the-counter and prescription medications.

- Functional Gummies and Confectionery: In the food industry, gelatin is widely used in producing gummy candies, jellies, marshmallows, and other chewy confections. It helps achieve the desired texture, clarity, and stability, making it a favorite for natural and clean-label sweet products.

- Nutritional Supplements and Collagen Peptides: Gelatin and its hydrolyzed form, collagen peptides, are gaining popularity in dietary supplements aimed at improving skin elasticity, joint mobility, and bone density. These products are increasingly incorporated into powders, bars, and beverages for the growing wellness market.

- Cosmetic and Skincare Formulations: Gelatin is utilized in topical beauty products like facial masks and creams for its film-forming and moisturizing capabilities. It supports skin hydration, elasticity, and tone, making it a natural choice in anti-aging and dermal enhancement formulations.

- Photography and Industrial Applications: Beyond food and pharma, gelatin finds niche uses in photographic films, specialty papers, and industrial coatings due to its adhesive and binding qualities. Its ability to form a durable, flexible layer enhances the performance of photographic emulsions and other sensitive applications.

Global Gelatin Market: Stats & Facts

U.S. Census Bureau & Simmons National Consumer Survey (NHCS)

- In 2020, around 150 million U.S. consumers used flavored gelatin desserts, reflecting a widespread dietary preference.

- The number is expected to grow steadily, potentially reaching over 153 million by 2024, indicating consistent consumer loyalty.

National Bureau of Statistics of China

- China's per capita disposable income rose by over 6% in 2022, reaching 36,883 yuan. This improvement in purchasing power contributes to increased demand for protein-enriched and functional foods, including gelatin-based supplements and desserts.

Japan Ice Cream Association

- Ice cream remains one of Japan’s most consumed desserts. Over 28% of the population consumes it weekly, and nearly 8% indulge in it daily. Many frozen desserts use gelatin as a stabilizer or gelling agent, which supports demand in the food sector.

Federation of German Food and Drink Industries

- Europe’s food and beverage industry experienced a nearly 18% year-on-year growth in 2022, with revenues exceeding USD 20 billion. This growth stimulates the use of gelatin in confectionery, meat processing, and dairy applications.

Cosmetics Europe

- The European cosmetics and personal care industry was valued at approximately USD 88 billion in 2022. Gelatin, collagen, and hydrolyzed protein are widely used in creams, masks, and beauty supplements, driving strong regional demand.

U.S. Food and Drug Administration (FDA)

- Gelatin is designated as “Generally Recognized As Safe” (GRAS) when used under regulated manufacturing practices. It is permitted as an ingredient in many food items, pharmaceuticals, and dietary supplements.

European Food Safety Authority (EFSA)

- EFSA confirms that gelatin and its hydrolyzed forms, including collagen peptides, are safe for human consumption when used as food additives within defined limits, supporting their integration in multiple functional foods and beverages.

U.S. Department of Agriculture (USDA)

- USDA guidelines allow gelatin to be used in meat products, confections, and dairy applications, subject to certain compositional and labeling standards. Gelatin’s functionality in binding and emulsification aligns with USDA quality criteria.

Global Gelatin Market: Market Dynamic

Driving Factors in the Global Gelatin Market

Expanding Application in Nutraceuticals and Functional FoodsThe global shift toward preventive healthcare has bolstered the demand for nutraceuticals and functional foods, with gelatin playing a crucial role as both an active and functional ingredient. In products like collagen-enriched drinks, protein bars, and vitamin gummies, gelatin not only acts as a carrier but also offers direct benefits such as improved joint health, skin elasticity, and gut function.

Its bioavailability and compatibility with a wide range of bioactives make it a preferred ingredient for supplement makers. The rise in aging populations, particularly in countries like Japan, Germany, and Italy, adds to the demand for functional foods aimed at bone density and skin regeneration. Gelatin’s ability to provide both structure and nutrition makes it indispensable in this growing market segment. As awareness around collagen’s health benefits continues to rise, gelatin-based formulations are expected to witness increasing inclusion across wellness and anti-aging platforms.

Pharmaceutical Industry's Reliance on Gelatin Capsules

The pharmaceutical industry is one of the largest consumers of gelatin, particularly in the production of hard and soft gelatin capsules. Gelatin’s biocompatibility, stability, and ability to form reliable, digestible casings make it the ideal choice for oral dosage forms. Capsules offer easier swallowing, enhanced bioavailability, and more consistent dosing, which are vital for patient adherence and therapeutic effectiveness.

The growth in chronic disease prevalence and increasing demand for personalized medicine is pushing pharmaceutical companies to explore modular delivery systems that often use gelatin-based shells. Furthermore, the expanding market for over-the-counter (OTC) health products, herbal medicines, and dietary supplements is also driving gelatin demand. With regulatory agencies such as the FDA and EMA continuing to recognize gelatin as a safe excipient, its role in capsule formulation remains unchallenged. This industrial reliance acts as a critical long-term growth engine for the global gelatin market.

Restraints in the Global Gelatin Market

Religious and Dietary Restrictions on Animal-Derived Gelatin

One of the most prominent limitations for the global gelatin market lies in religious, cultural, and dietary restrictions. Traditional gelatin is primarily derived from bovine and porcine sources, which poses challenges in Muslim, Jewish, Hindu, and vegan communities. For instance, pork-derived gelatin is prohibited in both Islamic and Jewish dietary laws, while bovine-sourced gelatin faces scrutiny in India due to cultural sensitivities. Furthermore, the growing adoption of vegan and vegetarian diets, especially in North America and Europe, creates resistance to animal-based ingredients.

Although gelatin can be certified halal or kosher, the sourcing, handling, and certification process often increases costs and limits supply flexibility. This restricts the full penetration of gelatin-based products in segments that require religious or ethical compliance, pushing brands to seek alternative ingredients or reformulate their products entirely. Such barriers limit market scalability and complicate global distribution strategies for gelatin-based goods.

Supply Chain Disruptions and Raw Material Price Volatility

The gelatin industry is heavily dependent on the meat processing sector, where bones, hides, and skins are primary raw materials. Any fluctuation in livestock processing volumes due to diseases (e.g., BSE, ASF), trade restrictions, or pandemics directly impacts gelatin availability. Additionally, rising awareness of animal welfare issues and regulatory pressures on slaughterhouse operations can reduce the supply of animal by-products.

Gelatin extraction is a resource-intensive process requiring energy, water, and chemicals, all of which have faced inflationary pressures in recent years. These factors, coupled with transportation bottlenecks and geopolitical tensions, can disrupt the stability of gelatin supply chains and lead to price volatility. For manufacturers, this creates a challenging procurement environment and forces them to carry higher inventory or explore alternative suppliers, ultimately impacting profitability and production timelines across industries reliant on gelatin.

Opportunities in the Global Gelatin Market

Emergence of Marine and Plant-Based Gelatin Alternatives

The rise in ethical consumerism, coupled with religious and dietary restrictions, has created a significant opportunity for marine- and plant-based gelatin alternatives. While traditional gelatin is derived mainly from bovine and porcine sources, there is increasing demand for alternatives that meet halal, kosher, and vegan standards. Marine-based gelatin, extracted from fish skins and scales, provides similar functional properties while eliminating concerns associated with animal diseases or cultural objections.

Meanwhile, innovations in polysaccharide-based gelling agents (like agar-agar and pectin) are being refined to mimic the behavior of traditional gelatin. This market segment, though still emerging, is likely to see robust growth, especially in Asia-Pacific and Middle Eastern countries where religious compliance is crucial. Companies investing in scalable marine extraction methods and fermentation-based gelatin substitutes are well-positioned to capture this untapped demand, creating new revenue streams and reducing supply-chain vulnerabilities.

Bioengineering and Biomedical Innovations Using Gelatin

Gelatin’s biocompatibility and biodegradability make it a prime candidate for next-generation biomedical applications. It is already being used in wound dressings, tissue scaffolds, and drug delivery systems. With advancements in bioengineering, researchers are exploring gelatin-based hydrogels for applications in regenerative medicine and 3D bioprinting. These materials can simulate extracellular matrices, support cell growth, and enable controlled release of therapeutic agents.

In surgical applications, gelatin sponges are used for hemostasis, and their role in vaccine stabilization is being revisited amid the rise of mRNA technologies. The convergence of healthcare digitization, personalized medicine, and minimally invasive therapies is likely to expand the biomedical use of gelatin. This opens up high-value, technology-driven markets beyond traditional food and pharmaceutical boundaries, offering significant long-term opportunities for manufacturers that can meet strict purity and performance standards.

Trends in the Global Gelatin Market

Rising Demand for Clean Label and Functional Ingredients

Consumers are increasingly gravitating toward natural, transparent, and recognizable ingredients in their food and personal care products. Gelatin, derived from animal collagen, is often considered a clean-label ingredient when it is minimally processed and free from chemical additives. This shift has encouraged manufacturers across the food, cosmetics, and nutraceutical industries to reformulate their products to align with consumer values around health, sustainability, and traceability.

The use of gelatin in fortified gummies, protein supplements, and hydrolyzed collagen beverages has soared, particularly among health-conscious millennials and older populations seeking joint and skin support. Furthermore, brands now highlight gelatin content as a positive nutritional trait rather than a processing aid, which helps build consumer trust. This trend also intersects with the broader movement toward protein enrichment and bioactive supplements, making gelatin a staple in the evolving clean-label marketplace.

Technological Advancements in Gelatin Extraction and Processing

Innovations in gelatin production have significantly improved extraction efficiencies, reduced energy and water use, and enabled the customization of gelatin properties for different applications. Advanced hydrolysis techniques and the use of enzymatic processing have allowed producers to develop gelatin variants with enhanced solubility, faster gelling times, and improved compatibility with diverse formulation systems.

These advances support the use of gelatin in more complex applications such as pharmaceutical capsules, 3D food printing, and biomedical materials. Additionally, marine- and plant-derived alternatives have emerged, broadening the market while aligning with the growing demand for halal, kosher, and animal-free options. Technology has also enabled higher traceability and batch control, critical for pharmaceutical compliance and food safety. As a result, gelatin manufacturers can offer more tailored products to meet the performance needs of different industries, fueling market expansion and diversification.

Global Gelatin Market: Research Scope and Analysis

By Source Analysis

Animal-based gelatin is expected to continue to dominate the global gelatin market due to its superior functional, economic, and technological advantages. Primarily sourced from bovine hides, pig skins, and fish by-products, animal-based gelatin exhibits excellent gelling strength, elasticity, and emulsifying capacity, which makes it indispensable in food, pharmaceutical, and industrial applications. These attributes are difficult to replicate using non-animal or synthetic alternatives. Traditional processing techniques for animal-based gelatin are well-established, allowing for standardized production, global scalability, and cost-effectiveness. This industrial maturity ensures consistent supply chains and predictable quality for end-users.

Cultural familiarity and regulatory acceptance further strengthen its position. Many global regulatory bodies, including the FDA and EFSA, recognize animal-based gelatin as safe and effective for consumption and pharmaceutical use. In addition, gelatin derived from animals has greater thermal reversibility and unique thermosetting properties, making it ideal for temperature-sensitive formulations in confectionery, dairy, and encapsulation products. Despite growing demand for vegan or plant-based substitutes, alternatives like agar or carrageenan lack the full spectrum of functionalities offered by animal gelatin, especially in high-protein diets and biocompatible pharmaceuticals.

Moreover, technological innovations have allowed manufacturers to certify animal-based gelatin as halal or kosher, expanding its acceptability among religious communities. The expanding applications in health supplements, protein-rich snacks, and soft gel capsules have kept demand high, particularly in developed markets. Its cost-efficiency, multifunctionality, and broad regulatory compliance make animal-based gelatin the segment leader, ensuring its sustained dominance in the foreseeable future.

By Type Analysis

Type A gelatin is anticipated to hold dominance in the global gelatin market largely due to its acid-treated manufacturing process, which imparts unique physical and chemical properties that are critical across various applications. Derived primarily from pigskin, Type A gelatin is processed via acid hydrolysis, yielding gelatin with a lower molecular weight and a relatively high isoelectric point, typically around pH 7 to 9. This makes it particularly useful in pH-sensitive applications such as dairy desserts, gummy candies, and capsule shells, where stability and controlled setting behavior are essential.

Its superior gelling strength, clarity, and viscosity consistency allow it to outperform other types in both functional and sensory attributes. These properties are particularly valued in food formulations where texture, elasticity, and mouthfeel are crucial for consumer satisfaction. In pharmaceutical applications, Type A gelatin is preferred for producing soft capsules due to its rapid dissolution and low allergenic potential, ensuring better drug absorption and therapeutic impact.

Additionally, the abundance of porcine raw material and faster processing time compared to Type B (which requires alkaline treatment over a longer period) make Type A gelatin more economically viable and easier to scale. Its processing efficiency aligns well with high-throughput industrial production, giving it a commercial edge.

As global demand for convenient, protein-rich, and health-conscious consumables continues to surge, manufacturers gravitate toward the versatility and dependability of Type A gelatin. These functional, processing, and economic advantages collectively drive its dominance, positioning it as the preferred gelatin type across multiple high-growth industries, including food, nutraceuticals, and pharmaceuticals.

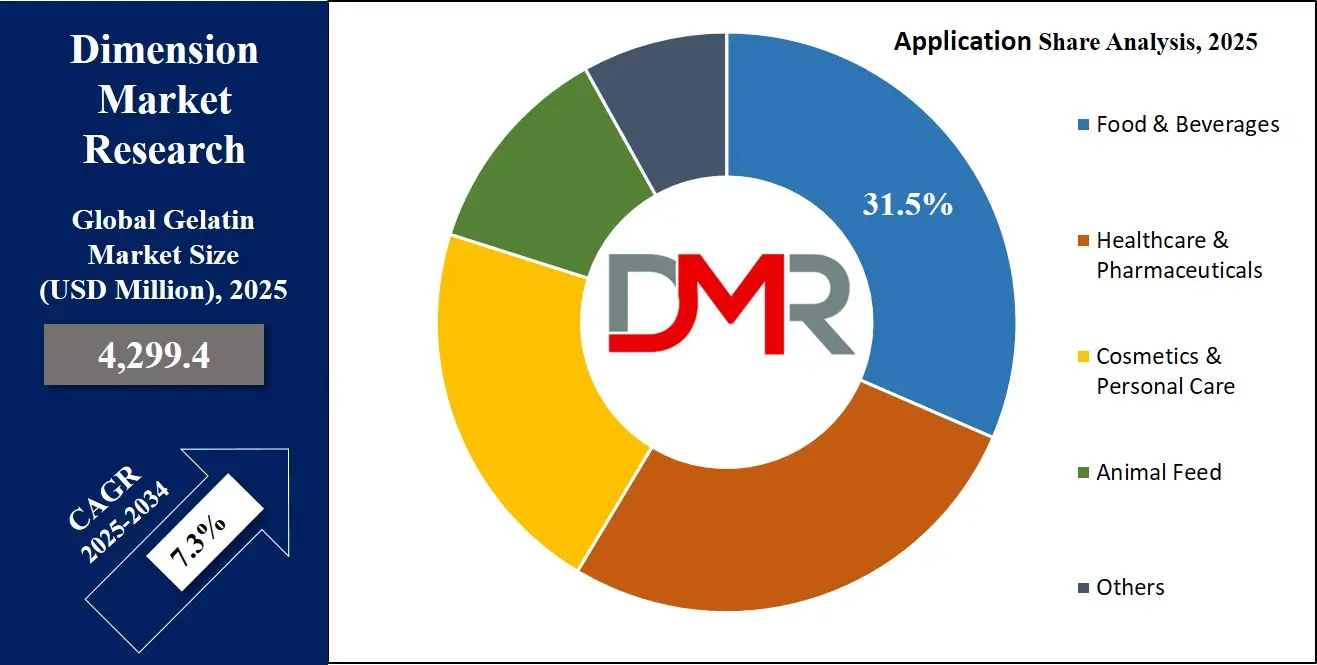

By Application Analysis

The food and beverage segment is expected to remain the dominant application in the global gelatin market due to gelatin’s exceptional versatility in modifying texture, stabilizing emulsions, and enhancing mouthfeel across a wide range of consumables. Gelatin is particularly prized for its thermoreversible gelation properties, which enable it to set and melt at body temperature, delivering a unique sensory experience in confectionery products such as marshmallows, gummies, and jellies. Its ability to create desirable textures without synthetic additives aligns with clean-label and natural ingredient trends, further cementing its role in modern formulations.

In dairy applications, gelatin prevents syneresis and improves creaminess in yogurts and puddings. In meat processing, it acts as a binding and moisture-retention agent, enhancing product shelf life and quality. Moreover, in beverages, particularly protein drinks and functional shots, gelatin is used to suspend ingredients evenly while providing added nutritional value as a collagen source. As demand for high-protein, fortified, and low-fat food products rises globally, gelatin’s role as a nutritional and structural enhancer becomes indispensable.

The food industry’s regulatory frameworks across Europe, North America, and Asia have long approved gelatin as a safe and natural ingredient, facilitating its broad acceptance. Additionally, consumer preferences for visually appealing and texturally satisfying products push food developers to incorporate gelatin for aesthetic and functional superiority.

Its non-toxic, biodegradable nature also aligns with sustainable food manufacturing goals. Given the ongoing evolution of dietary lifestyles and the emphasis on functional, clean-label ingredients, gelatin continues to dominate the food and beverage segment with strong growth momentum.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Function Analysis

Gelatin’s projected to exert its dominance as a thickening agent in the global market stems from its unique rheological properties that provide viscosity control, stability, and desirable texture across multiple end-use sectors. Unlike starches or synthetic thickeners, gelatin forms a thermoreversible gel, meaning it liquefies when heated and solidifies upon cooling, offering functional flexibility ideal for culinary and industrial applications. This characteristic is particularly advantageous in products like soups, sauces, gravies, and desserts, where dynamic temperature profiles demand a reliable thickening mechanism that maintains sensory appeal.

In the food industry, gelatin not only thickens but also stabilizes emulsions and suspends particulates, improving both mouthfeel and appearance. These multifaceted capabilities reduce the need for multiple additives, aligning with clean-label product strategies. In beverages and dairy, gelatin acts as a thickener that enhances viscosity while ensuring clarity and consistency, especially in protein shakes and yogurt-based drinks.

Pharmaceuticals also benefit from gelatin's thickening properties, especially in liquid syrups and suspensions where controlled flow characteristics are essential for uniform dosing. Its natural origin, biodegradability, and biocompatibility make it preferable to synthetic thickening agents in health-sensitive applications.

Moreover, the global push toward natural, multifunctional, and consumer-friendly ingredients has given gelatin a competitive edge over alternatives like gums and modified celluloses. With industries prioritizing simplicity, performance, and sustainability in formulation, gelatin’s superiority as a thickener, both functionally and commercially, solidifies its market leadership. As consumer demand for texture-rich, health-centric, and label-conscious products continues to climb, gelatin’s thickening role will remain essential across sectors.

The Global Gelatin Market Report is segmented on the basis of the following

By Source

- Animal-Based

- Marine-Based

- Plant-Based

- Others

By Type

By Application

- Food & Beverages

- Confectionery

- Desserts

- Functional Foods

- Functional Beverages

- Meat Processing

- Healthcare & Pharmaceuticals

- Dietary Supplements

- Drug Encapsulation

- Wound Dressing

- Cosmetics & Personal Care

- Animal Feed

- Others

By Function

- Thickener

- Stabilizer

- Gelling Agent

- Others

Global Gelatin Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global gelatin market with

37.1% of the total revenue by the end of 2025, owing to its robust pharmaceutical, nutraceutical, and food processing industries, which collectively generate substantial demand for gelatin-based formulations. The U.S., in particular, benefits from an advanced healthcare ecosystem, where gelatin is extensively used in soft gel capsules, wound dressings, and protein supplements. Moreover, the presence of stringent yet favorable regulatory frameworks by the U.S. Food and Drug Administration (FDA) ensures product safety, quality, and consistency, fostering confidence among manufacturers and consumers.

In the food and beverage segment, high consumption of protein-rich snacks, ready-to-eat meals, and confectionery further drives gelatin integration as a gelling, thickening, and stabilizing agent. Additionally, North America's increasing focus on fitness and collagen-based products has pushed gelatin demand in sports nutrition and personal care. The region also benefits from well-established cold chain infrastructure and technologically advanced manufacturing units, allowing for high-volume and quality-controlled gelatin production. Strategic investments in research, combined with the abundant availability of animal by-products from the meat industry, provide the region with a competitive supply-side advantage. These factors collectively sustain North America’s dominant share in the global gelatin market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia Pacific is experiencing the fastest growth in the gelatin market due to a confluence of rising health awareness, expanding middle-class population, and rapidly growing food and pharmaceutical sectors. Countries such as China, India, Japan, and South Korea are witnessing increasing consumption of protein-fortified food, functional beverages, and nutraceutical supplements segments that rely heavily on gelatin for its gelling, emulsifying, and stabilizing properties.

The region’s favorable demographic trends, such as an aging population in Japan and increasing disposable incomes in Southeast Asia, have created surging demand for collagen-enhanced beauty and joint-health products. Additionally, local governments have been promoting domestic production of pharmaceutical ingredients, resulting in higher consumption of gelatin in capsule manufacturing.

Furthermore, food processing industries across China and India are expanding rapidly, creating a massive appetite for gelatin in confectionery, dairy, and meat applications. Cost-effective labor, improved logistics, and increasing investments in R&D and industrial-scale production facilities contribute to the region’s exceptional growth trajectory, making Asia Pacific the fastest-growing gelatin market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Gelatin Market: Competitive Landscape

The global gelatin market is characterized by the presence of both multinational corporations and regionally focused producers, competing on the basis of product purity, functional innovation, regulatory compliance, and halal/kosher certifications. Key players in the market include GELITA AG, Nitta Gelatin Inc., Rousselot (a Darling Ingredients brand), and PB Leiner. These companies dominate through vertically integrated operations, global supply chains, and continual investments in research and development for specialty gelatins tailored to pharmaceutical, food, and biomedical applications.

In recent years, firms have intensified their focus on clean-label, collagen-enriched, and non-GMO product lines to align with evolving consumer trends. Strategic partnerships with pharmaceutical and nutraceutical brands have expanded the application scope for gelatin in dietary supplements, encapsulation technologies, and tissue engineering. Additionally, some players are venturing into hybrid gelatin solutions, combining animal and plant-based sources to meet ethical and religious consumption requirements.

Regional players in emerging markets are increasingly upgrading manufacturing capabilities and certifications to access export opportunities, especially to Europe and North America. Mergers and acquisitions, as well as capacity expansions, remain key strategies to enhance market positioning and meet the surging global demand. The competitive landscape is evolving rapidly, driven by innovation and consumer-centric product customization.

Some of the prominent players in the Global Gelatin Market are

- Gelita AG

- Rousselot (Darling Ingredients Inc.)

- PB Leiner (Tessenderlo Group)

- Nitta Gelatin, Inc.

- Weishardt Group

- Ewald-Gelatine GmbH

- Italgel S.r.l.

- Sterling Biotech Ltd.

- TROPHIC (Guangdong) Products Co., Ltd.

- Qinghai Gelatin Co., Ltd.

- Narmada Gelatines Ltd.

- Xiamen Gelken Gelatin Co., Ltd.

- Kenney & Ross Limited

- Lapi Gelatine S.p.A.

- India Gelatine & Chemicals Ltd.

- Hangzhou Qunli Gelatin Chemical Co., Ltd.

- Sandesara Group

- Great Lakes Gelatin Company (Vital Proteins)

- Norland Products Inc.

- Argentine Gelatin S.A.

- Other Key Players

Recent Developments in the Global Gelatin Market

- May 2024: PB Leiner announced a strategic partnership with a leading pharmaceutical company to develop gelatin-based drug delivery systems. This collaboration focuses on creating innovative solutions that enhance the efficacy and patient compliance of oral medications.

- April 2024: Rousselot introduced a range of gelatin-based solutions designed for the nutraceutical market. These products cater to the rising consumer interest in health and wellness, offering benefits such as improved joint health and skin elasticity.

- March 2024: Gelita AG expanded its production capacity by opening a new state-of-the-art facility in Europe. This expansion aims to meet the growing demand for high-quality gelatin in the food and beverage industry.

- January 2024: Nitta Gelatin India Ltd. launched a premium gelatin product manufactured using advanced Japanese technology. This new offering is tailored for food applications, providing superior gelling strength and clarity.

- December 2023: Darling Ingredients Inc. secured a patent for its specialized formulation known as StabiCaps. This innovative gelatin enhances the stability of soft gel capsules, making it suitable for a diverse array of pharmaceutical applications.

- October 2023: Gelita AG launched a novel line of pharmaceutical-grade gelatin designed for the encapsulation of sensitive pharmaceutical ingredients. This development aligns with the growing demand for more effective drug delivery systems.

- August 2023: Rousselot announced a strategic merger with a leading bioactive supplier to enhance its product portfolio and expand its research capabilities. This merger is anticipated to strengthen Rousselot’s position as a leader in the pharmaceutical gelatin market.

- June 2023: Nitta Gelatin Inc. announced a significant expansion of its production facilities in India to meet the increasing demand for pharmaceutical gelatin in the Asian market.

- April 2023: Darling Ingredients Inc. acquired Gelnex, a leading manufacturer of gelatin and collagen products in Brazil. This acquisition helped Darling expand its production capabilities to meet the growing demand for gelatin in the market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4,299.4 Mn |

| Forecast Value (2034) |

USD 8,085.7 Mn |

| CAGR (2025–2034) |

7.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1,341.5 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Source (Animal-Based, Marine-Based, Plant-Based, Others), By Type (Type A, Type B), By Application (Food & Beverages, Healthcare & Pharmaceuticals, Cosmetics & Personal Care, Animal Feed, Others), By Function (Thickener, Stabilizer, Gelling Agent, Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Gelita AG, Rousselot (Darling Ingredients Inc.), PB Leiner (Tessenderlo Group), Nitta Gelatin, Inc., Weishardt Group, Ewald-Gelatine GmbH, Italgel S.r.l., Sterling Biotech Ltd., TROPHIC (Guangdong) Products Co., Ltd., Qinghai Gelatin Co., Ltd., Narmada Gelatines Ltd., Xiamen Gelken Gelatin Co., Ltd., Kenney & Ross Limited, Lapi Gelatine S.p.A., India Gelatine & Chemicals Ltd., Hangzhou Qunli Gelatin Chemical Co., Ltd., Sandesara Group, Great Lakes Gelatin Company (Vital Proteins), Norland Products Inc., Argentine Gelatin S.A., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Gelatin Market?

▾ The Global Gelatin Market size is estimated to have a value of USD 4,299.4 million in 2025 and is expected to reach USD 8,085.7 million by the end of 2034.

What is the size of the US Gelatin Market?

▾ The US Gelatin Market is projected to be valued at USD 1,341.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,436.7 million in 2034 at a CAGR of 6.9%.

Which region accounted for the largest Global Gelatin Market?

▾ North America is expected to have the largest market share in the Global Gelatin Market with a share of about 37.1% in 2025.

Who are the key players in the Global Gelatin Market?

▾ Some of the major key players in the Global Gelatin Market are Gelita AG, Rousselot (Darling Ingredients Inc.), PB Leiner (Tessenderlo Group), Nitta Gelatin, Inc., Weishardt Group, Ewald-Gelatine GmbH, Italgel S.r.l., Sterling Biotech Ltd., TROPHIC (Guangdong) Products Co., Ltd., Qinghai Gelatin Co., Ltd, and many others.

What is the growth rate in the Global Gelatin Market in 2025?

▾ The combined annual growth rate of the Global Gelatin Market in 2025 is 7.3%.