Gene Synthesis Service market is poised for substantial expansion, thanks to an increasing integration of synthetic genes across different fields such as drug discovery, personalized medicine and agricultural biotechnology. As costs decrease and accessibility improves, industries across various fields are using DNA synthesis services as part of innovation and product development processes - synthetic biology advancements like CRISPR technology increase this need significantly; making gene synthesis an indispensable enabler within such disciplines.

Competition dynamics within this market are intensifying rapidly, with leading players prioritizing innovation and service differentiation to secure market share. Bioinformatics- and cloud-based platforms are improving service efficiency and scalability to attract diverse clients such as academic institutions, pharmaceutical companies, biotech firms as well as academicians. With increased emphasis placed upon personalized medicine and targeted therapies projected to drive high throughput gene synthesis services as a solution, more tailored and more cost effective solutions may become possible for patients to use.

As with any market, gene synthesis service market faces challenges including regulatory complexity, intellectual property issues and stringent quality controls that may limit expansion if these obstacles are mismanaged. Yet despite such hurdles, its outlook remains positive due to ongoing advances in gene synthesis technology which have applications across various fields; long-term growth for this market can only become increasingly prevalent as gene engineering and synthetic biology become mainstream technologies.

Key Takeaways

- Global Gene Synthesis Service Market reach a value of USD 22.34 Bn in 2033 at a CAGR of 24.1%.

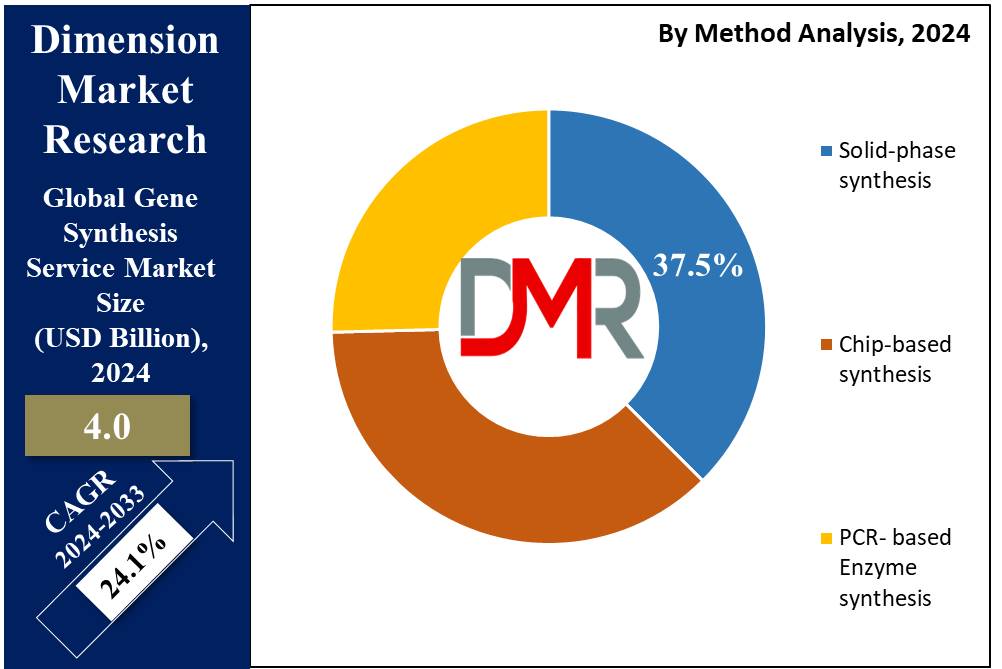

- By method: Solid-phase synthesis segment has accounted revenue share of 37.5% in 2024.

- By service: Antibody DNA synthesis segment has captured 61.2% revenue share in 2024.

- By application: gene & cell therapy development segment has generated 36.5% revenue share in 2024.

- By end use: academic and government research institutes segment accounting revenue share of 56.8% in 2024.

- North America accounted highest revenue share of 41% in 2024.

Use Cases

- Gene synthesis services allow pharmaceutical companies to quickly discover therapeutics targeting genetic diseases more efficiently by creating specific DNA sequences through gene synthesis services. This service creates sequences tailored towards therapeutic innovation.

- Custom gene synthesis is essential in engineering organisms with desired traits, such as bacteria engineered to produce biofuels or crops with enhanced nutritional content - driving advances in agriculture and industrial biotechnology.

- Synthesized genes can quickly generate viral proteins or messenger RNA sequences necessary for producing effective vaccines against emerging infectious diseases.

- Gene synthesis can produce guide RNA sequences and donor DNA templates used by CRISPR gene editing technology, providing precise genetic research as well as therapeutic applications.

- Custom synthesized genes can be utilized in the creation of advanced diagnostic assays that detect specific genetic markers associated with various conditions like cancer or heritable disorders.

Driving Factors

Advanced Gene Editing Technologies Are Fuelling Demand for Synthesized Genes

CRISPR-Cas9 gene editing technology has revolutionized genetic research, greatly expanding demand for synthetic genes. These cutting-edge tools enable precise changes to genetic sequences, making them indispensable in numerous fields from functional genomics to developing gene therapies. As researchers seek to better investigate and manipulate genetic material, the demand for high-quality custom synthesized genes has skyrocketed. Gene synthesis services should remain pivotal to cutting-edge genomics research and personalized medicine initiatives as CRISPR and other gene editing technologies advance.

Synthetic Biology Applications Expand: Fuelling Market Growth in Diverse Sectors

Synthetic biology's expanding application has been one of the main drivers behind the expansion of Gene Synthesis Service Market. Synthetic biology, the practice of designing and creating novel biological parts, devices and systems using synthetic methods is rapidly expanding across numerous industries including pharmaceuticals, agriculture and biofuel production. As gene editing applications continue to expand, custom gene synthesis services are in high demand as these enable customized organism creation for specific industrial requirements.

Synthetic biology has proven its usefulness across industries; pharmaceutical firms utilizing synthetic biology for novel drug and vaccine development while agriculture uses it to increase crop traits and resilience. Biofuels' increasing popularity highlights the demand for synthetic organisms engineered to enhance energy production processes. As synthetic biology develops further, gene synthesis services will remain key elements in its success across various sectors.

Increased Funding for Genomic Research: Speeding Market Expansion

Substantial investments from both public and private institutions into genomic research has played an indispensable part in expanding the Gene Synthesis Service Market. Funded initiatives aiming at understanding genetic diseases, creating novel therapeutics and furthering personalized medicine have created an unprecedented demand for gene synthesis services.

Global spending on genomic research has seen steady increase, with NIH allocating billions annually towards genomic initiatives. Funding of large research projects as well as innovation and adoption of cutting edge technologies by gene synthesis companies. As genomic research investments increase, demand for gene synthesis services should also surge; particularly among projects focused on understanding complex genetic disorders and creating targeted therapies. Thus, sustained financial support remains one of the cornerstones of growth within Gene Synthesis Service Market.

Growth Opportunities

Development of Novel Therapeutics: Accelerating Gene Therapy Advancements

2024 is expected to bring great opportunities for global Gene Synthesis Service market growth as more attention and development of innovative therapeutics focuses on gene therapy and novel treatments targeting previously untreatable conditions, driving demand for custom gene synthesis services to increase. Gene therapy holds tremendous promise of offering solutions for genetic disorders, cancer and chronic illnesses which requires precise gene synthesis techniques tailored specifically for each condition treated - this makes gene synthesis services essential components in next-gen medical therapies.

Integrating Artificial Intelligence: Optimizing Efficiency and Driving Cost-Effectivness

Integrating artificial intelligence (AI) and machine learning technologies into gene synthesis processes represents an ideal opportunity for market expansion in 2024. Businesses using AI to optimize gene design, predict outcomes of syntheses and reduce errors will experience greater efficiency and cost-cutting services from this technological advance; not to mention reduced time and resource requirements required to produce custom genes - providing companies a competitive edge and helping expand markets at once!

Collaboration With Biopharma Companies: Expanding Market Horizons Through Strategic Alliances

Strategic collaborations between pharmaceutical and biotechnology companies present the Gene Synthesis Service market with an exciting opportunity in 2024. By joining forces in drug discovery and development partnerships, gene synthesis service providers play an integral role in biopharma value chains - accessing new markets while improving service offerings to promote therapeutic development innovation and creating opportunities for market expansion as demand for tailored gene synthesis services keeps rising. This trend could expand market expansion significantly over time as demand continues to surge for tailored gene synthesis services in drug development projects.

Key Trends

Automation of Gene Synthesis Processes: Enhancing Efficiency and Controlling Costs

In 2024, the global Gene Synthesis Service market is witnessing a significant trend towards the automation of gene synthesis processes. Automation also facilitates high-speed production of gene sequences with greater accuracy - meeting growing customer demands for faster and more reliable gene synthesis services. Increasing scaleability while offering competitive prices are two other main benefits derived from automating gene synthesis services which have opened them up to biotechnology, pharmaceuticals and academic research sectors alike.

Customization of Gene Sequences: Responding to Precision and Customization Needs

A notable trend in 2024 is the growing demand for highly customized gene sequences tailored to specific research and development needs. Gene synthesis service providers have increasingly focused on offering tailored solutions tailored specifically for their client base -- from academic researchers to pharmaceutical companies -- with customized gene sequences meeting project goals proving an increasingly key differentiating factor that drives customer loyalty while expanding service offerings.

An Increase in Gene Synthesis Services Offerings: Expanding to Include Comprehensive Solutions

Another key trend in the Gene Synthesis Service market is companies' expansion of service portfolios by providers. By 2024, many service providers had broadened their services offerings to include complementary ones like gene editing, cloning and protein expression services as part of integrated end-to-end solutions that support customers throughout their research and development lifecycles. This move towards integrated offerings is expected to boost customer retention while opening new revenue channels thereby contributing towards market expansion overall.

Restraining Factors

Intellectual Property Worries Are Holdbacks to Innovation and Market Expansion

Intellectual Property (IP) issues pose a substantial obstacle in the Gene Synthesis Service Market. Due to complexities related to patenting synthetic genes and related technologies, their patenting poses significant hurdles for companies operating within this space. As gene synthesis technologies advance rapidly, questions regarding who owns rights to newly synthesized genes or processes used to produce them become ever more frequent.

These intellectual property issues may result in lengthy legal battles and increased costs, as well as hesitation among companies to invest in new technologies or expand their offerings. IP rights uncertainty deters smaller firms and startups from entering the market, thus hindering innovation and competition. Such uncertainty limits market potential growth while creating barriers for developing and commercializing innovative applications - something particularly applicable to fields like synthetic biology and personalized medicine where innovation often moves quickly.

Ethical and Regulatory Challenges: Minimising Market Potential through Stringent Oversight

Ethical and regulatory obstacles remain one of the primary restraining forces on Gene Synthesis Service Market growth. Misuse of synthesized genes for controversial applications such as human germline editing has raised significant ethical concerns that must be resolved prior to expansion in this market. As a response, several stringent regulatory frameworks have been put in place in an attempt to prevent unethical practices and ensure gene synthesis technologies are used responsibly.

However, these regulations can hinder market expansion by placing strict oversight and compliance requirements that impede technological development and commercialization of new technologies. For instance, in many countries regulatory bodies have implemented stringent approval processes for gene synthesis applications related to human health that delay introduction of new products or services onto the market.

By Method

Solid-phase synthesis was the market leader for Method Segment Gene Synthesis Services market in 2024, accounting for

37.5% market share in this Method segment of Gene Synthesis Services market. This popularity can be attributed to its well-established use, high accuracy standards and efficiency when synthesizing long DNA sequences efficiently - attributes which make solid phase synthesis popular with researchers as well as industry players alike.

Chip-based synthesis quickly gained ground, taking advantage of advances in microarray technology which allow parallel gene synthesis on one chip. This approach proved especially valuable for high-throughput applications like synthetic biology and large genomic projects; its ability to rapidly generate large libraries of genetic material quickly and cost-effectively has resulted in its becoming a key player driving further innovation within gene synthesis technology.

PCR-based enzyme synthesis has also become an indispensable method in Gene Synthesis Services market, especially due to its application in creating high-fidelity DNA sequences. Utilizing polymerase chain reaction's precise methods for amplifying and synthesizing genes with advantages in speed and specificity; its use is especially popular when short DNA sequences or fast turnaround times are essential - something the demand for tailored gene sequences will only make more prevalent over time, adding further diversity among market methodologies.

By Service

Antibody DNA Synthesis was the clear market leader within Gene Synthesis Service market in 2024, accounting for more than 61.2% of market shares within Service Segment 1. This success can be attributed to increasing demand for custom antibodies across therapeutic development, diagnostics and research applications; its ability to produce custom antibody DNA sequences tailored specifically against particular antigens made this service indispensable in both pharmaceutical and biotech sectors alike - monclonal antibody therapies have further propelled demand and strengthened this position in the marketplace.

Viral DNA synthesis has become an important segment in Gene Synthesis Service market due to its crucial role in vaccine development, gene therapy and virology research. With increased global focus on infectious diseases and viral vectors used for gene therapy treatments such as CRISPR/Cas9 genome editing technologies that use viral vectors as vectors to deliver genetic material into target cells via DNA synthesis services like those provided by GenSyn, viral DNA synthesis has gained increasing traction as an essential method. Viral DNA synthesis plays an integral part in these endeavors - specifically vaccine development where its precise sequences create effective immunogens; Additionally it helps supports advancements of CRISPR/Gen editing technologies where viral vectors use deliver genetic material directly into target cells using viral vectors synthesis services as an aiding method.

By Application

Gene & cell therapy development dominated the Application segment of Gene Synthesis Service market in 2024 with over 36.5% market share, likely driven by advances in personalized medicine as well as adoption of gene and cell therapy treatments to treat various genetic disorders and cancers. Gene synthesis services have long been recognized for their capacity to synthesize specific genes for therapeutic interventions - an integral component in creating advanced treatments such as regenerative medicine or gene therapies to treat previously incurable conditions - making their importance unmistakable.

Gene Synthesis Service markets offer many vital applications in vaccine development, especially with global attention focused on pandemic preparedness and emerging infectious diseases. Gene synthesis services play an essential part in rapid design and synthesis of viral gene sequences needed for developing vaccines - both mRNA and DNA vaccines - against an expanding array of pathogens; their efficiency and speed have become essential in expediting vaccine pipelines; ultimately propelling their overall expansion. Vaccine development represents one such example.

Disease diagnosis is another key element of gene synthesis services. With increasing emphasis on precision medicine and early identification of genetic disorders, demand has skyrocketed for synthesized genes used in diagnostic assays and tools. By creating unique genetic markers through gene synthesis services, gene synthesis services contribute significantly to creating advanced diagnostic tests that identify diseases at their molecular core - this application is particularly essential when applied to hereditary diseases or cancer, where early and accurate diagnosis can significantly enhance patient outcomes.

By End User

Academic and government research institutes were the market leaders for Gene Synthesis Services End User segment in 2024, accounting for more than 56.8% market share in terms of End Users market segment share. Gene synthesis services enjoy such success due to their widespread usage across fundamental research, genomics studies and large government-funded initiatives aimed at understanding genetic diseases, biodiversity and other major scientific inquiries. Synthesized genes play a significant role in driving innovation and discovery within molecular biology, genetics and synthetic biology - fields where grants from government bodies support innovation. Synthetic biology researchers in particular rely heavily on synthesized DNA for innovation. This has provided substantial benefits for their industries as a whole.

Biotech and pharmaceutical companies represent another segment in the Gene Synthesis Service market, employing gene synthesis for drug discovery, the creation of gene and cell therapies and biologics manufacturing. With rising demands for personalized medicine and targeted therapies fuelling adoption of gene synthesis services by these entities. Rapid production of custom genes necessary for therapeutic development drives adoption further as biotech/pharma companies invest in innovative treatments; their share in this sector should continue to rise, broadening out use cases.

Contract Research Organizations (CROs) have become significant users of gene synthesis services as providers of outsourced R&D for pharmaceutical, biotechnological and medical device firms. CROs use gene synthesis services to meet their clients' demands for customized research and clinical trial materials, while providing expert resources that allow drug discovery to proceed more rapidly - thus driving demand for gene synthesis services and further propelling their popularity among clients. With outsourcing becoming ever more prominent among pharmaceutical and biotechnology industries, this sector looks set for continued expansion making CROs an integral component in growing Gene Synthesis Service market share.

The Gene Synthesis Service Market Report is segmented based on the following:

By Method

- Solid-phase synthesis

- Chip-based synthesis

- PCR- based Enzyme synthesis

By Service

- Antibody DNA synthesis

- Viral DNA synthesis

- Others

By Application

- Gene & cell therapy development

- Vaccine development

- Diseases diagnosis

- Others

By End Users

- Biotechnology & pharmaceutical companies

- Academic & government research institutes

- Contract research organizations

Regional Analysis

Gene Synthesis Service Market can be divided into various regions with North America holding almost 41% of global share, driven by strong biotech and pharmaceutical sectors as well as significant genomic research investments made there, major industry players present and extensive R&D activities supported by government grants which boost its growth further.

Europe comes close behind, holding an equally sizeable market share due to the region's emphasis on precision medicine, synthetic biology and an established healthcare infrastructure. Countries such as Germany, UK and France stand out with high levels of research funding available as well as collaboration among academic institutions and biotech firms in place.

Asia Pacific region has experienced tremendous market expansion due to increasing adoption of gene synthesis technologies and expanding biopharmaceutical industries as well as government initiatives across China, Japan and India. Due to their large populations, increasing healthcare needs, and expansion of local biotech firms. Asia Pacific region stands as an impressive showcase of growth within global healthcare market.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In 2024, the global Gene Synthesis Service market is marked by the dominance of several key players who are driving innovation and growth through a combination of advanced technologies, strategic partnerships, and comprehensive service offerings. GeneScript and GeneArt (Thermo Fisher Scientific) stand out as leaders in this market, due to their vast capabilities for high-throughput gene synthesis and customization for diverse industries such as biotechnology, pharmaceuticals and academic research.

Genescript stands out by meeting diverse research needs spanning genetic studies to complex therapeutic applications with its comprehensive platform. GeneArt capitalizes on Thermo Fisher's vast resources and global reach to maintain a leading market presence by offering comprehensive gene synthesis services integrated with essential molecular biology tools.

Some of the prominent players in the Global Gene Synthesis Service Market are:

- Genescript

- GeneArt (Thermofischer)

- IDT

- Eurofins Genomics

- DNA 2.0 (ATUM)

- BBI

- Genewiz

- Gene Oracle

- SBS Genetech

- Bio Basic

- Merck KGaA

- Thermo Fisher Scientific

Recent developments

- Twist Bioscience and Astellas announced in January 2024 a multitarget antibody discovery research collaboration - designed to discover antibodies for multiple targets of interest as curative therapies in cases with limited treatment options and improve service offerings across both companies. The partnership should help Twist Bioscience increase service offerings.

- OraSure Technologies introduced OmniGene, their Gut DNA and DNA product (OMR-205).

- DNA Script launched its early access program for SYNTAX system customers in April 2022, offering organizations early access to any new advances or upgrades in enzymatic DNA synthesis technology.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.0 Bn |

| Forecast Value (2033) |

USD 29.9 Bn |

| CAGR (2024-2033) |

24.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Method(Solid-phase synthesis, Chip-based synthesis, PCR- based Enzyme synthesis), By Service(Antibody DNA synthesis, Viral DNA synthesis, Others), By Application(Gene & cell therapy development, Vaccine development, Diseases diagnosis, Others), By End Users(Biotechnology & pharmaceutical companies, Academic & government research institutes, Contract research organizations) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Genescript, GeneArt (Thermofischer), IDT, Eurofins Genomics, DNA 2.0 (ATUM), BBI, Genewiz, Gene Oracle, SBS Genetech, Bio Basic, Merck KGaA, Thermo Fisher Scientific |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |