Market Overview

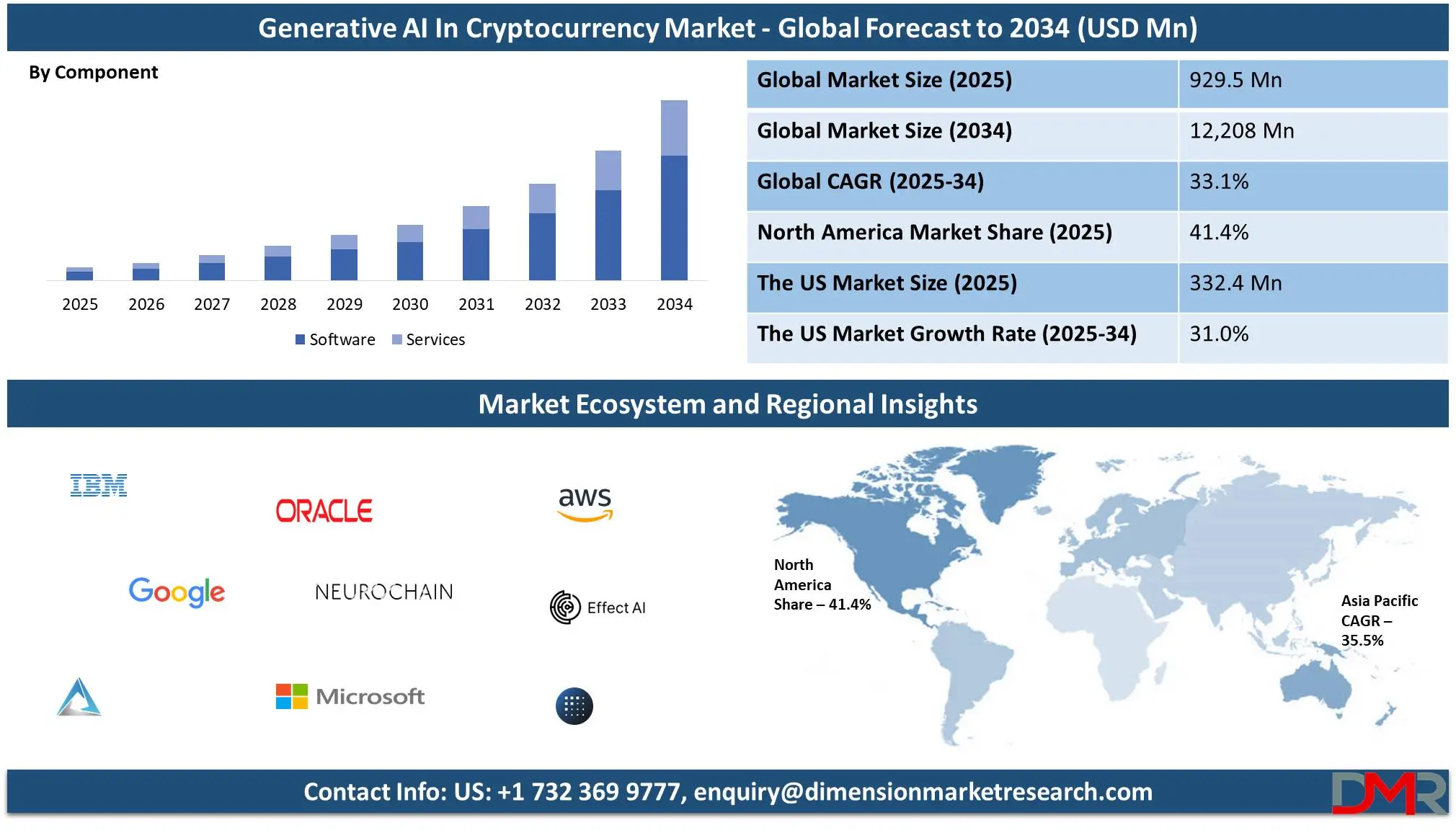

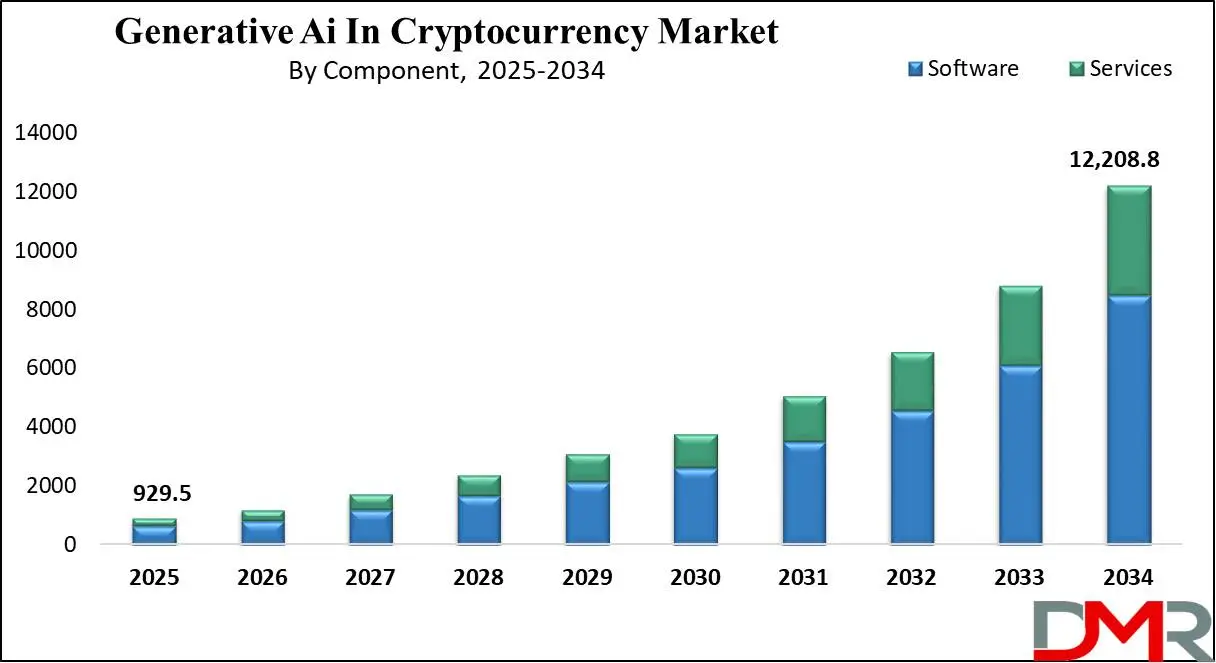

The Global Generative AI In Cryptocurrency Market is projected to reach

USD 929.5 million in 2025 and grow at a compound annual growth

rate of 33.1% from there until 2034 to reach a value of

USD 12,208.8 million.

Generative AI in cryptocurrency refers to the application of artificial intelligence for creating, analyzing, and improving blockchain-based applications, trading strategies and digital assets. AI technology makes possible automated content production, smart contract development and the generation of synthetic financial data for predictive analysis. AI-powered crypto solutions can increase security, detect fraudulent transactions, and optimize trading strategies without human interference. Generic AI uses machine learning to refine its predictions, making crypto markets more efficient and intelligent. As both AI and blockchain technologies advance, their combination has led to innovative advancements in decentralized finance (DeFi) systems along with automated trading systems.

Since cryptocurrency adoption has increased significantly in recent years, the demand for AI-enhanced tools to streamline operations and prevent fraud has steadily risen. Many traders and investors now rely on bots powered by artificial intelligence (AI) for market analyses and faster trade execution than humans can, which stems from blockchain networks growing more complex over time as businesses use AI for compliance management as well as risk mitigation measures; AI can even assess blockchain security to detect vulnerabilities before they're exploited, thus increasing demand. As cryptocurrency adoption surges further ahead, demand for tools powered by AI will undoubtedly rise accordingly.

Key trends demonstrate the importance of AI for cryptocurrency. AI-generated trading signals and predictive analytics have become indispensable tools for investors looking to maximize profits, while decentralized applications (DApps) have begun adopting artificial intelligence-powered features for enhanced automation and user experience. Furthermore, artificial intelligence is being used to create synthetic tokens and algorithmic stablecoins, which adapt their supply based on market conditions, while smart contracts powered by artificial intelligence allow agreements to be executed autonomously without risk of human error - all indicators that AI is helping shape digital finance ecosystems while making cryptocurrency ecosystems smarter and more efficient than ever.

Recent events have illustrated the expanding presence of AI-powered cryptocurrency projects. Their emergence prompted increased investments into AI-blockchain startups; major blockchain firms adopted AI to optimize their networks, reducing transaction fees and speeding processing speeds while regulatory bodies discussed AI's use in audit systems; some crypto exchanges introduced customer service tools powered by generative AI to address customer queries while simultaneously detecting suspicious activities - all demonstrating AI's expanding role within cryptocurrency.

Moreover, the key advantage of generative AI in cryptocurrency is its capacity to minimize human dependency while increasing efficiency. Traditional crypto trading needs constant monitoring; AI automates this process, executing trades based on real-time data. AI also strengthens blockchain security by detecting potential threats or anomalies within decentralized networks; it provides insights that support investors in making more informed decisions, decreasing losses from emotional trading; its ability to adapt strategies makes AI an invaluable asset in digital finance, while its ongoing evolution highlights AI's transformative potential in digital finance.

As AI develops further, its combination with cryptocurrency should open up exciting new horizons in decentralized finance, automated governance, and tokenized assets. AI could one day power autonomous blockchain ecosystems where transactions, lending, financial management, and even regulatory oversight are handled entirely by intelligent algorithms - but ethical concerns, data privacy, and regulatory oversight remain significant considerations when designing AI applications to work within cryptocurrency spaces. While AI may have great potential in revolutionizing the cryptocurrency space, responsible development and use will remain essential components to long-term success - as both technologies progress further, their combined impact will only grow stronger on the digital economy as both technologies advance simultaneously.

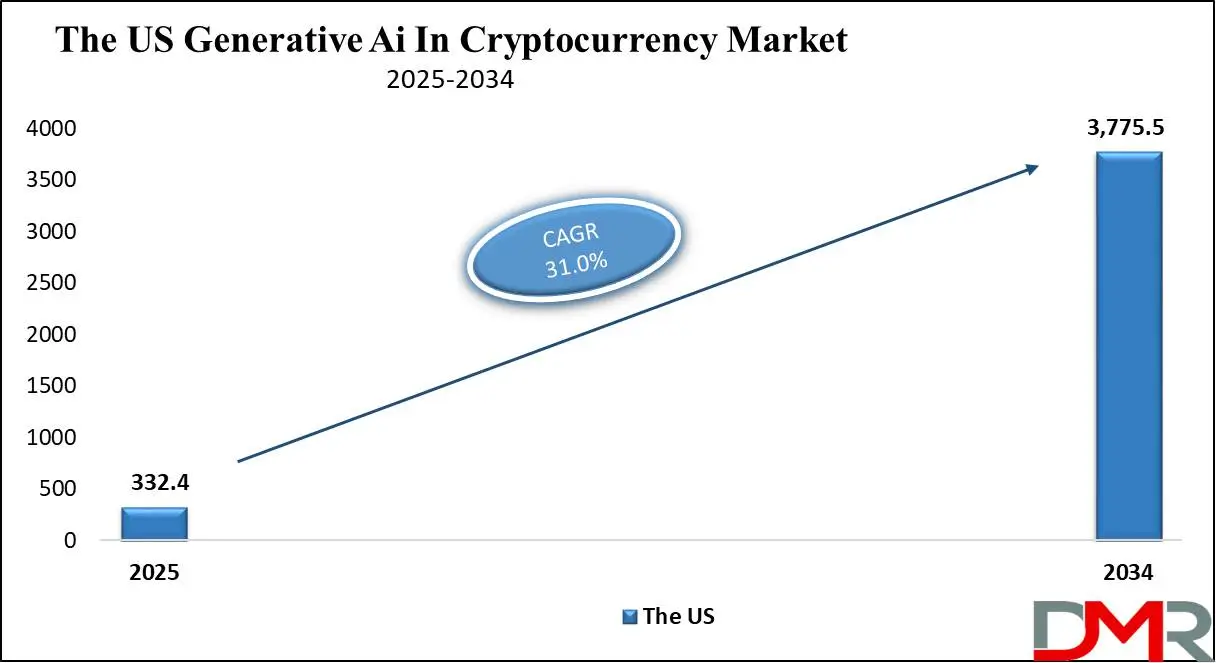

The US Generative AI In Cryptocurrency Market

The US Generative AI In Cryptocurrency Market is projected to reach USD 332.4 million in 2025 at a compound annual growth rate of 31.0% over its forecast period.

The US has strong growth opportunities in generative AI within the cryptocurrency market due to its advanced AI research, growth in institutional adoption, and supportive regulatory framework. The rising demand for AI-driven trading, fraud detection, and blockchain security is fueling innovation. With the expansion of DeFi applications and growing investor interest, the U.S. is set to lead in AI-powered crypto advancements.

Further, the market is driven by advanced AI research, increasing institutional adoption, and strong demand for automated trading and fraud detection. However, regulatory uncertainty and concerns over data privacy pose challenges. While innovation in DeFi and blockchain security constantly expand opportunities, evolving compliance requirements and cybersecurity threats may slow adoption in certain areas of the market.

Generative AI In Cryptocurrency Market: Key Takeaways

- Market Growth: The Generative AI In Cryptocurrency Market size is expected to grow by 11,002.4 million, at a CAGR of 33.1%, during the forecasted period of 2026 to 2034.

- By Component: The software segment is anticipated to get the majority share of the Generative AI In Cryptocurrency Market in 2025.

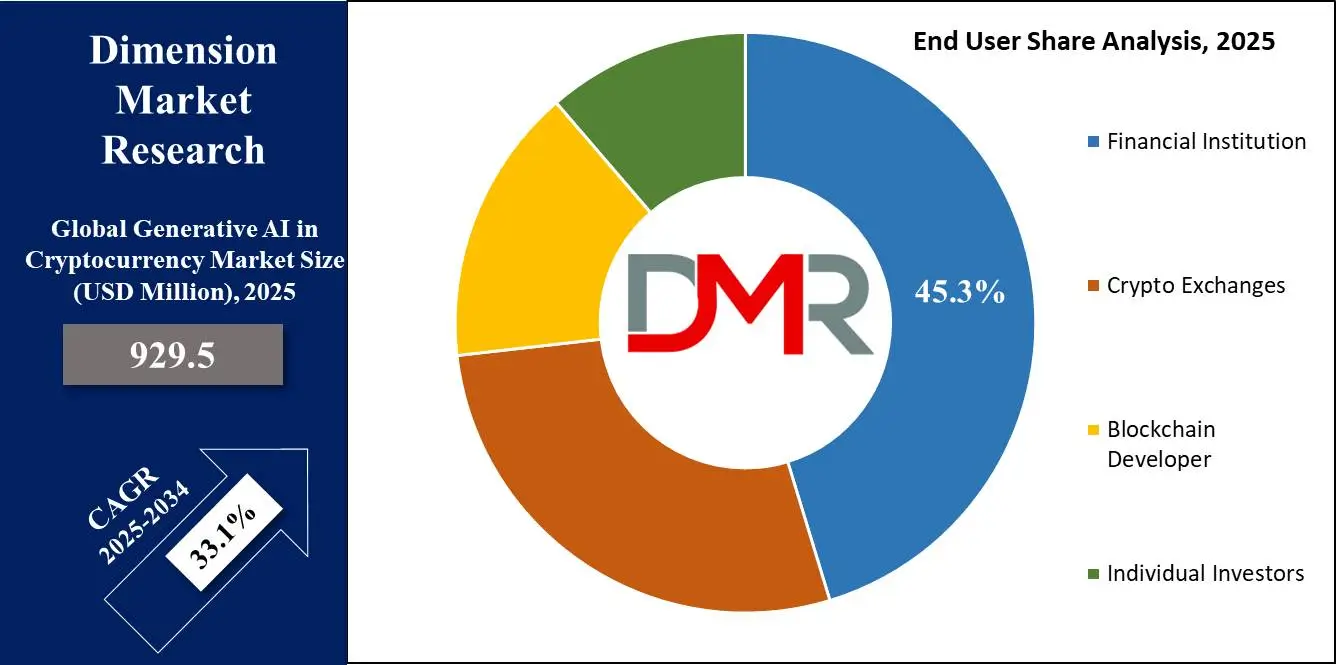

- By End User: The financial institutions are expected to get the largest revenue share in 2025 in the Generative AI In Cryptocurrency Market.

- Regional Insight: North America is expected to hold a 41.4% share of revenue in the Global Generative AI In Cryptocurrency Market in 2025.

- Use Cases: Some of the use cases of Generative AI In Cryptocurrency include fraud detection & security, synthetic asset creation, and more.

Generative AI In Cryptocurrency Market: Use Cases

- AI-Powered Trading Bots: Generative AI enables automated trading bots that analyze market trends, execute trades, and optimize strategies without human intervention, enhancing efficiency and profitability.

- Fraud Detection & Security: AI enhances blockchain security by detecting suspicious transactions, identifying anomalies, and preventing fraud, making cryptocurrency networks more secure.

- Smart Contract Automation: Generative AI enhances smart contracts by enabling self-executing agreements with minimal human input, reducing errors, and ensuring seamless decentralized operations.

- Synthetic Asset Creation: AI helps generate synthetic cryptocurrencies and algorithmic stablecoins that adjust supply and demand dynamically, enhancing liquidity and stability in digital finance.

Stats & Facts

- Darktrace reports that 74% of IT security professionals acknowledge that their organizations are experiencing a significant impact from AI-powered threats, focusing on the rising complexity of cyberattacks.

- IBM reveals that the global cost of a data breach has reached a record-breaking USD 4.88 million in the past year, representing a sharp 10% increase and underscoring the financial strain on businesses.

- The Ponemon Institute highlights that social engineering and phishing remain the most common cyber threats, affecting 56% of organizations, followed by web-based attacks (50%) and credential theft (49%).

- Netacea warns that 93% of businesses anticipate facing AI-driven cyberattacks on a daily basis in the next year, reflecting the intensifying landscape of AI-powered threats.

- Crypto.com states that AI was the best-performing sector in 2024, boasting an 84% average log return. AI agents led at a staggering 186%, followed by decentralized compute networks at 41%.

- Deep Instinct finds that 97% of cybersecurity professionals fear AI-generated security incidents, stressing the urgent need for companies to bolster their defenses.

- Crypto.com reports that the Decentralized Physical Infrastructure Network (DePIN) sector achieved a 15% log return in 2024, while real-world assets (RWAs) saw a 29% surge, largely fueled by growing adoption from traditional financial institutions.

- Darktrace indicates that 87% of IT professionals foresee AI-driven threats continuing to affect their organizations for years, reinforcing the long-term cybersecurity challenges ahead.

- Bankrate notes that Bitcoin, which started with a value of less than a penny, skyrocketed to an all-time high of over $73,000, cementing its place as the world’s most valuable cryptocurrency.

- Kraken and the Finance Industry Development Council (FIDC) reveal that crypto adoption is accelerating, with 562 million people—approximately 6.8% of the global population—owning cryptocurrency, while over 52% of American adults have engaged in crypto investments.

- Karen Crypto states that crypto trading activity remains robust, with combined spot, futures, and PTL volumes surging to USD 77 million in March 2024, marking the second-highest level since March 2021’s $100 million peak.

- Darktrace identifies AI-powered cyber threats—such as malware distribution, vulnerability exploits, sensitive data leaks, social engineering, and zero-day attacks—as the most pressing concerns for cybersecurity teams.

- Crypto.com reports that while Bitcoin recorded a remarkable 79% gain in 2024 (log return), Bitcoin Layer-2 solutions suffered a staggering 98% drop, highlighting contrasting growth patterns within the crypto space.

- Karen Crypto notes that the average crypto investor enjoyed a rebound in 2023, with net realized gains of $887—an encouraging recovery from the devastating USD 7,102 average loss in 2022.

Market Dynamic

Driving Factors in the Generative AI in Cryptocurrency Market

Increasing Demand for AI-Driven Trading & AutomationOne of the key drivers of generative AI in the cryptocurrency market is the growth in the demand for AI-powered trading tools and automation. As crypto markets operate 24/7 with high volatility, traders and institutions seek intelligent algorithms that can analyze large volumes of data in real time, execute trades efficiently, and minimize risks. Generative AI models can predict price movements, detect market patterns, and optimize trading strategies, giving users a competitive edge. In addition, automated portfolio management and AI-driven risk assessment tools are becoming important for institutional investors looking to navigate the complexities of digital assets, which is driving their adoption in the cryptocurrency sector.

Enhanced Blockchain Security & Fraud Prevention

With the growth of cyber threats, scams, and financial fraud in the crypto space, the demand for advanced security solutions has become a major growth driver for generative AI adoption. AI-powered fraud detection systems can identify suspicious transactions, flag anomalies, and predict potential attacks before they occur. Blockchain networks are for incorporating AI to improve security protocols, prevent money laundering, and ensure compliance with global regulations. Smart contract vulnerabilities, which can lead to major financial losses, are being minimized through AI-driven code analysis and automated auditing tools. As security concerns continue to rise, more cryptocurrency platforms and blockchain projects are turning to AI-powered solutions to protect digital assets and maintain trust among investors.

Restraints in the Generative AI in Cryptocurrency Market

Regulatory Uncertainty & Compliance Challenges

One of the biggest restraints in the adoption of generative AI in cryptocurrency is the unclear and transforming regulatory landscape. Governments and financial authorities around the world are still formulating rules regarding AI usage in financial markets and blockchain ecosystems. The lack of standardized regulations creates uncertainty for businesses, limiting large-scale AI adoption in crypto trading, DeFi, and blockchain security.

In addition, concerns over AI-generated transactions potentially violating anti-money laundering (AML) and know-your-customer (KYC) requirements make compliance more complex. Regulatory crackdowns or restrictive policies could slow innovation and discourage firms from integrating AI-driven solutions in cryptocurrency operations. Until clearer legal frameworks emerge, regulatory uncertainty remains a major barrier to AI expansion in the crypto sector.

Data Privacy & Ethical Concerns

The integration of generative AI in cryptocurrency creates many concerns about data privacy, transparency, and ethical implications. AI models require a large volume of data to function effectively, but in decentralized networks, accessing and processing personal or financial data poses risks. Users worry about how AI-driven platforms handle sensitive information, leading to potential conflicts with privacy-focused blockchain principles.

In addition, AI-generated trading strategies or synthetic assets can manipulate markets if misused, creating ethical questions about fairness and accountability. The possibility of biased AI decision-making or unexplainable algorithmic behaviors also adds to the challenges of trust and adoption. Without clear guidelines and ethical AI governance, these concerns could hinder the broad acceptance of AI in the cryptocurrency space.

Opportunities in Generative AI in Cryptocurrency Market

Revolutionizing Decentralized Finance (DeFi) & Smart Contracts

Generative AI presents many opportunities to improve DeFi platforms and smart contract functionality by introducing automation, predictive analytics, and better risk management. AI-powered DeFi solutions can optimize lending and borrowing rates, predict market fluctuations, and automate liquidity management to create more effective financial ecosystems. In addition, AI-driven smart contracts can self-correct vulnerabilities, minimizing the risk of exploits and improving security. These developments can attract more institutional investors and mainstream users to DeFi, increasing adoption. As AI technology constantly evolves, DeFi applications will become more intelligent, adaptive, and capable of handling complex financial transactions with minimal human intervention.

Enhancing Crypto Security & Fraud Prevention

The growth in threats of cyberattacks, scams, and fraud in the cryptocurrency sector creates a strong demand for AI-powered security solutions. Generative AI can improve blockchain security by detecting malicious activities in real time, identifying vulnerabilities in smart contracts, and preventing unauthorized access to digital wallets.

AI-driven anti-money laundering (AML) and know-your-customer (KYC) solutions can help crypto exchanges and financial institutions comply with regulations while reducing fraudulent transactions. In addition, AI can enhance transaction monitoring, flagging suspicious behavior before it leads to financial losses. As cybersecurity remains a top concern in the crypto market, AI-driven security innovations provide a major growth opportunity for businesses looking to build trust and ensure safer digital transactions.

Trends in Generative AI in Cryptocurrency Market

Integration of AI with Blockchain for Enhanced Automation

A key trend in the cryptocurrency market is the increasing integration of generative AI with blockchain technology to enhance automation and efficiency. AI-driven smart contracts are becoming more advanced, enabling self-executing agreements that can adapt to real-time market conditions. AI-powered trading bots are also evolving, using deep learning and predictive analytics to optimize trading strategies without human intervention. Moreover, AI-enhanced blockchain networks are improving transaction validation processes, reducing delays, and increasing scalability.

As AI models become more sophisticated, decentralized applications (dApps) are leveraging AI for decision-making, fraud detection, and personalized financial services. This growing synergy between AI and blockchain is transforming how transactions, investments, and decentralized financial operations function in the crypto space.

Rise of AI-Generated Synthetic Assets & Predictive Market Models

Another emerging trend is the creation of AI-generated synthetic assets and predictive market models that are reshaping cryptocurrency investment strategies. Generative AI enables the development of algorithmically stable coins and synthetic cryptocurrencies that adjust supply and demand dynamically, improving liquidity in digital markets. In addition, AI-powered analytics tools are providing investors with more accurate predictions of price movements, assisting them in making data-driven trading decisions.

Crypto hedge funds and institutional investors are highly dependent on AI to generate risk-adjusted portfolio strategies. AI-based NFT creation is also gaining traction, allowing for the automated generation of digital assets with unique attributes. As AI-driven financial modeling advances, the role of predictive analytics and synthetic assets will continue to expand in the cryptocurrency ecosystem.

Research Scope and Analysis

By Component Analysis

The software segment will be leading in 2025 with a share of 69.3%. The software segment plays an important role in driving the growth of generative AI in the cryptocurrency market. AI-powered software solutions are improving crypto trading, security, and blockchain automation. Trading bots, fraud detection systems, and AI-driven smart contracts are helping users make better financial decisions while reducing risks.

As more investors and institutions adopt AI for portfolio management and market analysis, demand for intelligent software tools is rising. Additionally, blockchain networks are integrating AI to improve transaction efficiency and security. The increasing need for AI-powered applications in DeFi, NFT creation, and risk management is fueling software adoption in the crypto sector. With constant advancements in AI models and blockchain technology, software solutions will remain at the forefront of innovation in the cryptocurrency market.

Further, the services segment is set to have significant growth over the forecast period, as it is becoming a key driver of generative AI adoption in the cryptocurrency market. As AI-powered solutions become more complex, businesses and investors need expert support for implementation, maintenance, and security enhancements. Consulting, AI model training, and managed services are in high demand as companies look to integrate AI-driven trading bots, fraud detection systems, and smart contract automation into their operations.

Additionally, AI-as-a-Service (AIaaS) is gaining traction, allowing crypto firms to look into powerful AI tools without large infrastructure costs. Cybersecurity services that use AI to detect fraud and prevent attacks are also becoming vital in the crypto space. With the growing need for AI expertise, the services segment will play an important role in supporting businesses as they navigate the evolving AI-driven cryptocurrency landscape.

By Deployment Mode Analysis

In 2025, cloud-based is set to have a share of 74.2%; it is playing a vital role in the growth of generative AI in the cryptocurrency market. Cloud solutions offer scalability, flexibility, and cost-effectiveness, making them ideal for AI-driven crypto applications. AI-powered trading bots, fraud detection systems, and blockchain analytics tools benefit from cloud-based infrastructure, ensuring live processing and global accessibility. Cloud platforms allow smooth AI model updates, improving security and efficiency in crypto transactions.

In addition, AI-driven decentralized applications (dApps) and DeFi platforms depend on cloud-based AI services to handle large volumes of data efficiently. Also, businesses and investors prefer cloud deployment due to its ability to integrate AI with blockchain networks without requiring costly hardware. With growth in adoption of AI-powered services in the crypto industry, cloud-based solutions will constantly drive innovation, security, and automation in blockchain and digital asset management.

Moreover, the on-premises deployment is anticipated to have significant growth over the forecast period, as they remain a crucial choice for organizations prioritizing security, control, and data privacy in the generative AI-driven cryptocurrency market. Many financial institutions, blockchain firms, and crypto exchanges prefer on-premises solutions to protect sensitive transaction data from cyber threats and regulatory risks. AI-powered risk assessment tools and algorithmic trading systems deployed on local servers provide greater customization and independence from third-party cloud providers.

Additionally, enterprises handling high-frequency trading and large-scale blockchain operations benefit from reduced latency and faster AI processing. As regulatory concerns and cybersecurity threats rise, on-premises AI deployment provides a reliable alternative for firms looking for complete control over their AI-powered crypto infrastructure.

By Application Analysis

With a share of 37.9% in 2025, trading and investment applications will be playing a major role in the growth of generative AI in the cryptocurrency market. AI-driven trading bots and predictive analytics tools are assisting investors in making faster and smarter decisions by analyzing market trends in real time. These AI-powered solutions minimize human errors, optimize portfolio management, and identify profitable trading opportunities. Automated AI systems can react instantly to price fluctuations, improving efficiency and minimizing risks for traders. Institutional investors and hedge funds are majorly adopting AI for algorithmic trading strategies, enhancing accuracy and profitability.

AI-driven sentiment analysis tools also help traders understand market psychology by processing large volumes of data from news, social media, and trading patterns. With AI constantly improving trading efficiency, risk management, and investment strategies, its role in cryptocurrency markets will keep expanding.

Further, crypto mining optimization will have significant growth over the forecast period, as generative AI is becoming an essential factor in the cryptocurrency market. AI-powered algorithms enhance mining efficiency by adjusting computing power, minimizing energy consumption, and optimizing hardware performance. Smart AI-driven mining systems help miners predict the most profitable coins to mine, minimizing operational costs while maximizing rewards.

AI also enhances cooling systems and hardware maintenance, extending the lifespan of mining equipment. As energy costs and environmental concerns rise, AI-driven mining solutions are helping companies adopt greener and more sustainable practices. With AI optimizing mining operations, improving profitability, and reducing resource wastage, its adoption in the crypto mining sector is expected to grow steadily.

By End User Analysis

Based on the end user, financial institutions are driving the growth of generative AI in the cryptocurrency market, as they will be leading in 2025 with a share of 45.3% by using advanced AI-powered solutions for security, trading, and risk management. Banks, hedge funds, and investment firms are integrating AI to improve fraud detection, automate trading strategies, and provide better financial services. AI-driven analytics support institutions in identifying market trends, predicting price movements, and optimizing portfolio management.

As regulatory compliance becomes stricter, AI tools are supported in ensuring transparency and detecting suspicious activities in crypto transactions. Many financial institutions are also exploring AI-powered smart contracts for seamless and secure transactions. AI improves customer experiences by offering automated financial advice and personalized investment strategies. With the growth in institutional adoption of AI in crypto, financial organizations are playing a crucial role in shaping the future of digital assets and blockchain finance.

Further, individual investors are becoming vital in the expansion of generative AI in the cryptocurrency market by having significant growth over the forecast period. AI-powered trading bots and predictive analytics tools are making it easier for retail investors to navigate the volatile crypto landscape. AI-driven platforms provide personalized investment recommendations, real-time market insights, and risk management strategies, supporting individuals in making informed decisions.

AI automation allows traders to execute trades with precision, minimizing emotional biases and human errors. Many investors are using AI to analyze sentiment data from social media and news sources to predict market trends. Additionally, AI-powered educational tools are making crypto investing more accessible to beginners. With more individuals adopting AI-driven crypto solutions for smarter trading and portfolio management, the role of retail investors in the market is set to expand.

The Generative AI in Cryptocurrency Market Report is segmented on the basis of the following

By Component

- Software

- AI-driven Trading Bots

- Blockchain Analytics Tools

- Smart Contract Generators

- Services

- Consulting & Integration

- Managed Services

By Deployment Mode

By Application

- Trading & Investment

- Risk Management & Fraud Detection

- Smart Contracts & Blockchain Automation

- Crypto Mining Optimization

- Sentiment Analysis

By End User

- Financial Institution

- Crypto Exchanges

- Blockchain Developer

- Individual Investors

Regional Analysis

Leading Region in the Generative AI In Cryptocurrency Market

North America will be leading in 2025 with a

share of 41.4%, playing a crucial role in the growth of generative AI in the cryptocurrency market owing to its strong technological advancements, high adoption of AI-driven financial solutions, and well-established crypto ecosystem. The region is home to major AI and blockchain companies, driving constant innovation in automated trading, risk management, and fraud detection. Many financial institutions and hedge funds in the US and Canada are integrating AI to improve cryptocurrency investments and trading strategies.

North America also has a favorable regulatory environment that promotes AI-powered crypto applications while ensuring security and compliance. The growth in demand for AI-driven analytics, smart contracts, and decentralized finance (DeFi) solutions is further fueling market growth. In addition, the presence of top AI research institutions and a growing number of AI-focused crypto startups is accelerating development in this space. With rising interest from institutional investors and retail traders, North America is set to remain a leader in the generative AI-driven cryptocurrency revolution.

Fastest Growing Region in the Generative AI In Cryptocurrency Market

Asia Pacific is emerging as a key region in the expansion of generative AI in the cryptocurrency market during the forecast period due to its strong technological infrastructure and increasing adoption of AI-driven crypto solutions. Countries like China, Japan, South Korea, and Singapore are leading in AI and blockchain research, promoting innovation in automated trading, fraud detection, and decentralized finance (DeFi). The growing number of crypto investors and exchanges in the region is driving demand for AI-powered tools that enhance security and efficiency. With growing government initiatives supporting AI and blockchain, Asia Pacific is set to play a major role in shaping the future of AI-driven cryptocurrency markets.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The generative AI in the cryptocurrency market is rapidly evolving, with various players competing to innovate and gain an edge. Companies are focusing on AI-powered trading bots, predictive analytics, and risk management tools to attract both institutional and retail investors. The market is experiencing strong competition in areas like automated crypto trading, fraud detection, and decentralized finance (DeFi) applications.

Many firms are also investing in AI-driven security solutions to combat cyber threats and enhance blockchain transparency. Strategic partnerships, mergers, and collaborations are becoming common as businesses focus on expanding their technological capabilities. With constant advancements in AI and blockchain, competition is expected to intensify, driving further innovation and shaping the future of the crypto market.

Some of the prominent players in the Global Generative AI In Cryptocurrency are

- Microsoft

- NVIDIA

- Amazon (AWS)

- Google

- Oracle

- Fetch.ai

- Numerai

- HashCash

- IBM

- Cortex

- Render Network

- Effect.AI

- NeuroChain

- DeepBrain Chain

- Iris Energy

- Hut 8

- Stratum

- Antier

- Sahara AI

- Bittensor

- Other Key Players

Recent Developments

- In April 2025, Google and Sphere Entertainment Co. announced a new AI technology partnership to support bringing the groundbreaking The Wizard of Oz at Sphere to life using generative AI (gen AI). The project, which includes first-of-its-kind engineering work and thousands of creators, coders, VFX artists, and more, will mark a pivotal moment in entertainment technology and a leap forward for the future of visual storytelling akin to The Wizard of Oz's use of Technicolor nearly 90 years ago.

- In March 2025, Anthropic unveiled updates to the “responsible scaling” policy for its artificial intelligence technology, like defining which of its model safety levels are powerful enough to demand additional protections.

- In March 2025, Lockheed Martin and Google Public Sector announced their intent to integrate Google's advanced generative artificial intelligence (gen AI) into Lockheed Martin's AI Factory ecosystem, which would improve Lockheed Martin's ability to train, deploy, and sustain high-performance AI models alongside other leading providers, accelerating AI-driven capabilities in critical national security, aerospace, and scientific applications. Further, they are both open-source and proprietary AI models, providing traceability, reliability, and monitoring to ensure trust, security, and high-assurance deployment. Google Cloud's AI capabilities will become part of this ecosystem, complementing Lockheed Martin's comprehensive approach to AI.

- In January 2025, Voice AI company SoundHound unveiled a partnership with electric vehicle maker Lucid as it released its hands-free voice assistant, Lucid Assistant, powered by SoundHound’s artificial intelligence. Developing Lucid Assistant in cooperation with SoundHound allows us to deliver much more than a voice control feature. Assistant can grow in functionality and capability over time, delivering an ever-better experience for Lucid owners.

- In September 2024, nChain announced that they have identified and successfully tested ways in which the output of an AI system can be verified using a blockchain, which can be used to ensure the model operates according to its specifications, is free of critical bugs, and adheres to ethical standards like fairness, transparency, and safety. All without revealing proprietary information of the system, a major step in bringing trust and accountability to AI. Further, nChain successfully demonstrated verifiable AI inference (processing queries) on Bitcoin, showing the relevant transactions on the original protocol Bitcoin, Bitcoin Satoshi Vision Blockchain (BSV Blockchain). The transactions can be found on mainnet with the corresponding generation code on Github.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 929.5 Mn |

| Forecast Value (2034) |

USD 12,208.8 Mn |

| CAGR (2025-2034) |

33.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 332.4 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software and Services), By Deployment Mode (Cloud-Based and On-Premises), By Application (Trading & Investment, Risk Management & Fraud Detection, Smart Contracts & Blockchain Automation, Crypto Mining Optimization, and Sentiment Analysis), By End User (Financial Institution, Crypto Exchanges, Blockchain Developer, and Individual Investors) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Microsoft, NVIDIA, Amazon (AWS), Google, Oracle, Fetch.ai, Numerai, HashCash, IBM, Cortex, Render Network, Effect.AI, NeuroChain, DeepBrain Chain, Iris Energy, Hut 8, Stratum, Antier, Sahara AI, Bittensor, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Generative AI In Cryptocurrency Market size is expected to reach a value of USD 929.5 million in 2025 and is expected to reach USD 12,208.8 million by the end of 2034.

North America is expected to have the largest market share in the Global Generative AI In Cryptocurrency Market, with a share of about 41.4% in 2025.

The Generative AI In Cryptocurrency Market in the US is expected to reach USD 332.4 million in 2025.

Some of the major key players in the Global Generative AI In Cryptocurrency Market are Google, AWS, Microsoft, and others

The market is growing at a CAGR of 33.1 percent over the forecasted period.