Market Overview

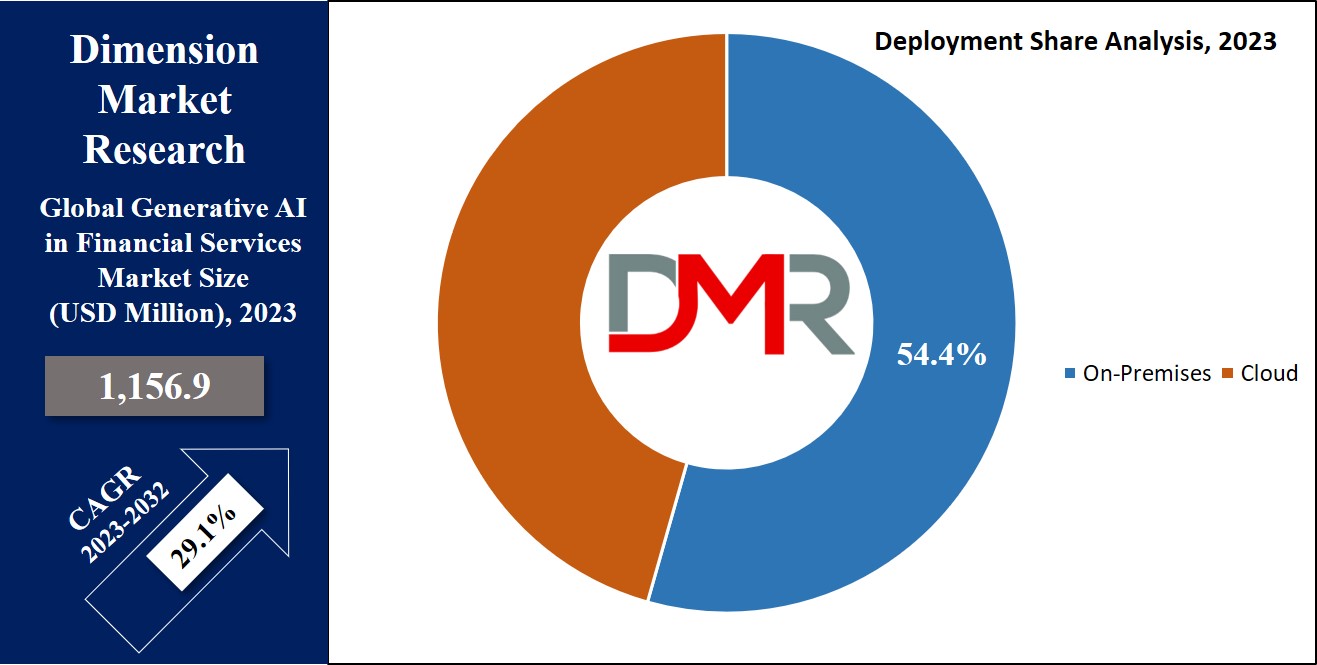

The Global Generative AI in Financial Services Market is expected to reach a value of USD 1,156.9 million in 2023, and it is further anticipated to reach a market value of USD 11,527.4 million by 2032 at a CAGR of 29.1%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Generative AI has emerged as an essential asset within the financial sector, improving various operations like fraud detection, risk assessment, investment forecasting, & customer service. A major advantage of generative AI lies in its quick analysis of large datasets, allowing the identification of patterns that could be avoided by human observation. This, in turn, helps financial institutions in making well-informed decisions and reducing risks effectively.

The quick integration of Generative AI into financial applications to meet the need for accurate & reliable services has driven its quick adoption. Mainly, industry leaders like IBM Corp, Microsoft Corp, & AWS have taken major steps in this generative AI financial services market. They have heavily invested in R&D to enhance their capabilities & extend their market influence.

According to Allaboutai, generative AI in financial services is poised to significantly impact the industry, with banks expected to save up to $487 billion by 2024, mainly through enhanced front and middle-office operations. As of now, 91% of U.S. banks leverage AI for fraud detection, and 80% of global banks have integrated AI to improve operations.

AI-driven tools are processing transactions 90% faster and improving customer service, while also enabling smarter trading strategies. By 2025, 75% of banks with assets over $100 billion will fully adopt AI strategies. Furthermore, over 90% of financial services firms are either evaluating or actively using AI, and banks could save $1 trillion by 2030.

AI’s role in risk management is notable, with 56% of financial services companies utilizing AI for this purpose. In total, 85% of financial institutions employ AI to enhance financial operations, contributing to a 10% reduction in operational costs for 36% of financial services executives. Additionally, approximately 77% of consumers now use AI technologies for banking.

Market Dynamic

The growing need for accurate & effective financial services is a prominent driver for expanding the financial services industry to adopt generative AI. This technology can inspect large volumes of data to detect patterns and anomalies, assisting financial institutions in making more informed decisions & better managing risks. Furthermore, developments in machine learning algorithms & the large availability of data have increased the effectiveness of generative AI in financial applications.

As mobile banking gains popularity, there is an increasing need for

chatbots & virtual assistance powered by generative AI, to meet the demand for quick & personalized customer service. This AI-driven approach also supports the security of cardholders' information & financial resources for fintech companies. These factors, along with others, are synergistically contributing to the quick expansion of the

generative AI sector.

However, there are several factors challenging its growth. Among these challenges, a significant one is the uncertainty of placing trust in AI-driven decisions, particularly in critical financial domains such as risk assessment & fraud detection. The complexity of AI algorithms makes them challenging to decode & inadequately designed or tested algorithms could yield biased or unfair outcomes. Further, the expensive implementation costs of generative AI could prove restrictive for small-scale financial institutions. Additionally, the regulatory framework governing AI in finance is constantly evolving, giving growth to uncertainties & potential compliance complications.

Research Scope and Analysis

By Type

The Generative AI Financial Services market shows a clear bifurcation into two different segments namely solutions & services. In 2023, solutions emerge as the category contributing significantly towards the overall revenue of the market due to their role in providing software tools that facilitate AI-powered banking solutions capable of quickly extracting accurate & comprehensive data from a large dataset.

Further certain enterprises' solutions can help in improving retail banking through next-best-action software, tackling financial fraud, & increasing customer relationships through multimode experiences. While solutions currently take the lead, the services segment is also anticipated to grow rapidly during the forecasted period, driven by its capacity to efficiently manage AI-enabled Fintech applications.

By Deployment

Categorized by deployment mode, the generative AI financial services market is divided into two major segments: cloud & on-premise. In 2023, the on-premise mode emerges as the most profitable form of deployment within the global generative AI in the financial services market. The choice of on-premise deployment includes the installation of software or services within the confines of a financial institution's systems or physical premises.

This growth can be said due to AI algorithms that hold historical data within a cloud environment to notice current standards & subsequently offer recommendations. The integration of cloud computing & AI has the potential to enhance productivity, efficiency, & the security of digital data management & validation. This automated approach also serves to eradicate human errors at the time of data processing.

By Application

Categorized by application, the generative AI financial services market consists of distinct segments including credit scoring, fraud detection, risk management, forecasting & reporting, as well as other varied applications. Mainly, the forecasting & reporting segment emerges as the primary driver fueling the growth of the global generative AI in the financial services market in 2023 and is anticipated to do so throughout the forecasted period.

This growth can be attributed to several factors, including increased operational efficiency, data-informed decision-making, & increased revenue generation. Many businesses are using the synergy of business analytics, AI &

Big Data to enhance their decision-making processes. As the fintech sector experiences significant growth, the integration of AI within this domain follows suit and is anticipated to significant growth in customer behavioral analytics in the coming years.

The Global Generative AI in Financial Services Market Report is segmented on the basis of the following:

By Type

By Deployment

By Application

- Fraud Detection

- Credit Scoring

- Forecasting & Reporting

- Risk Management

- Others

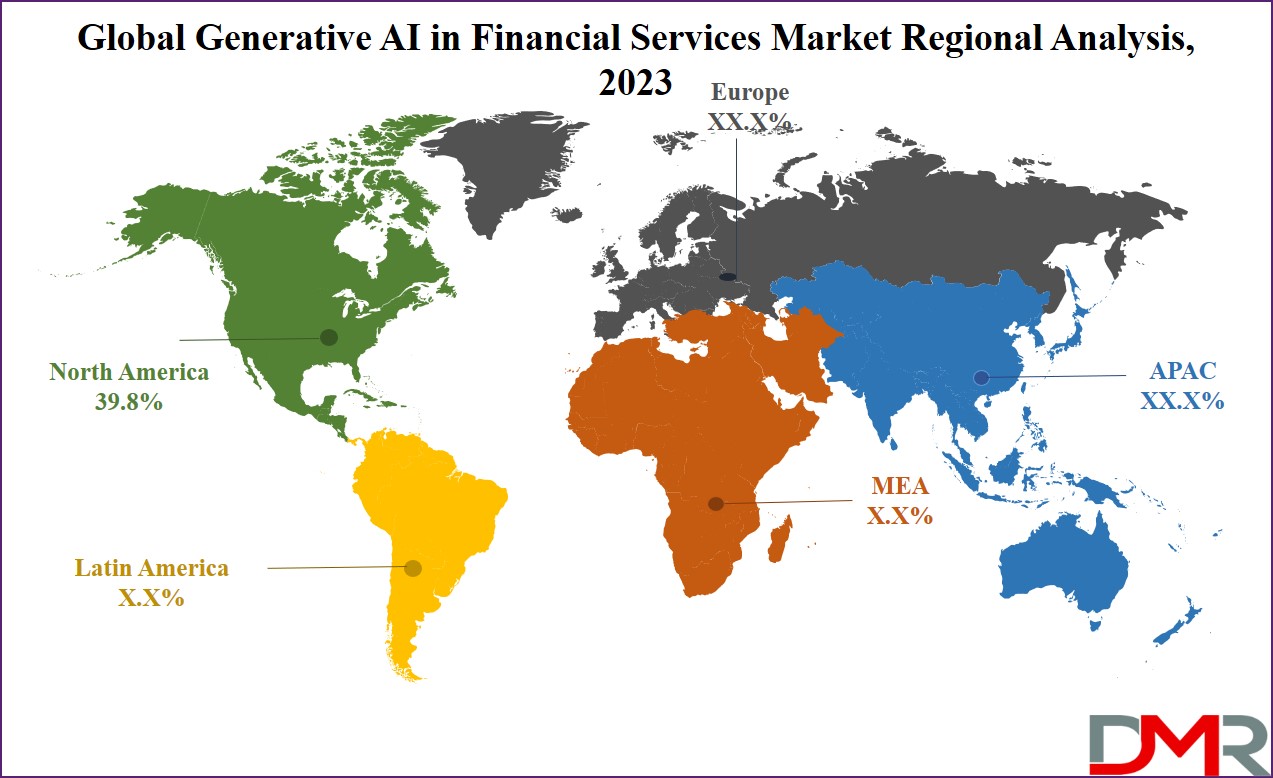

Regional Analysis

In 2023, the North American region holds a significant market share, commanding about

39.8% of the total revenue in the Global Generative AI In Financial Services Market. This significant lead of this region owes to its strong focus on research & development-driven advancements in well-developed economies like the United States & Canada.

These nations display the most rapid & competitive progression in AI technology adoption for financial services. Alongside established players, various startups & emerging enterprises are also contributing by offering AI solutions to the financial sector.

Moreover, the Asia Pacific area is anticipated to undergo significant growth over the forecasted period, with this growth mainly due to the vigorous adoption of digital payment systems & the growth in the use of internet-based services across the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Companies providing financial services face challenges owing to rising competition in the finance sector. This is driven by the need for better financial processes, cost efficiency, & engaging customer experiences. These factors present the risk of not performing well in a highly competitive market. In recent times, market players have been teaming up & partnering to strengthen their market presence.

For instance, in June 2022, Virgin Money partnered with SurePay to improve consumer protection against online fraud & misdirected payments. This partnership involved the usage of SurePay's real-time service, Confirmation of Payee (CoP), which verifies names in real-time, offering assurance to UK payers that their payments were correctly directed to the intended recipients.

Some of the prominent players in the Global Generative AI in Financial Services Market are

- IBM Corp

- Intel Corp

- Amazon Web Services Inc

- Microsoft Corp

- Google LLC

- Salesforce Inc

- Narrative Science

- Other Key Players

Recent Developments

- Last month (August 2025): Anthropic launched Claude for Financial Services, a tailored version of its Claude AI platform. Designed for tasks like market research, due diligence, financial modeling, risk assessment, and compliance, it integrates with enterprise platforms like Databricks, Snowflake, Box, and S&P Global.

- December 2024: Godrej Capital unveiled its SAKSHAM-AI/ML generative AI platform, now live across various solutions in customer interactions, credit risk management, analytics of 100% of customer communications, NPS feedback, and real-time decision-making capabilities for the NBFC segment in India.

- July 2025: Gradient Labs, a London-based startup offering "Otto"—an autonomous AI agent handling customer operations like fraud, payment disputes, and compliance workflows—secured €11.08 million in Series A funding (roughly $11–12 million), following a prior £2.8 million seed round. They reached US$1 million ARR within four months and were recognized among Europe’s 50 most promising seed-stage startups.

- Last month (August 2025): HDFC Bank made a strategic investment in CoRover, the creator of BharatGPT—marking the first such generative AI model investment by a major private Indian bank. The amount wasn’t disclosed, but it's a significant signal of AI integration in banking.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 1,156.9 Mn |

| Forecast Value (2032) |

USD 11,527.4 Mn |

| CAGR (2023-2032) |

29.1% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Solutions and Services), By Deployment (Cloud and On-Premises), By Application (Fraud Detection, Credit Scoring, Forecasting & Reporting, Risk Management and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

IBM Corp, Intel Corp., Amazon Web Services Inc., Microsoft Corp, Google LLC, Salesforce Inc, Narrative Science, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Generative AI in Financial Services Market size is estimated to have a value of USD 1,156.9

million in 2023 and is expected to reach USD 11,527.4 million by the end of 2032.

North America dominates the Global Generative AI in Financial Services Market with a share of 39.8% in

2023.

Some of the major key players in the Global Generative AI in Financial Services Market are IBM Corp,

Intel Corp, Google LLC, and many others.

The market is growing at a CAGR of 29.1 % over the forecasted period.