Generative AI generates artificial information for risk modeling, trains fraud detection algorithms, and tailors’ services to individual consumers, boosting customer satisfaction. Automating approaches reduce costs, and errors, and complement efficiency, especially evident in credit score card fraud detection by Generative Adversarial Networks, which discern real and hacked data, triggering alerts for banks.

Overall, generative artificial intelligence revolutionizes fintech by leveraging data to deliver personalized services, detect fraud, and automate complex strategies, fostering efficiency and enhancing customer experience.

As per Business 2 Community, Generative AI is revolutionizing the fintech market, with 90% of companies utilizing AI technologies. Of these, 80% leverage machine learning, yet access to quality data remains a key hurdle for 80% of firms. The sector comprises over 32,000 fintech companies globally, including startups. By 2030, AI is projected to boost finance industry employment by 20%.

Adoption is accelerating, with 36% already implementing AI and 42% planning to do so within two years. AI-driven initiatives have yielded $447 billion in cost savings, primarily in front and middle office operations, with profitability enhancements reported by 30% of respondents.

Generative AI is transforming the fintech landscape, offering innovative solutions in areas like fraud detection, personalized financial advice, and algorithmic trading. Fintech conferences and events increasingly spotlight generative AI, highlighting its potential to enhance customer experience, streamline operations, and unlock new revenue streams.

These events provide opportunities for industry leaders, startups, and investors to explore cutting-edge applications, collaborate on AI-driven products, and stay ahead in a competitive market. Attending such conferences is crucial for leveraging AI advancements, gaining insights into regulatory challenges, and networking with key players shaping the future of finance.

Key Takeaways

- Market Value: This market is projected to reach a market value of USD 2,384.8 million in 2025, in comparison to USD 31,066.8 million in 2033 at a CAGR of 37.4%.

- Market Definition: Generative AI in Fintech utilizes advanced algorithms to research sizeable financial datasets, automate tasks, detect fraud, and provide personalized services, revolutionizing decision-making and customer experiences within the financial sector.

- Component Segment Analysis: Software is expected to exert its dominance in the component segment with the highest market value in 2024.

- Deployment Segment Analysis: On-premise is expected to dominate this segment in the global generative AI in fintech market share in 2024.

- Application Segment Analysis: Compliance and fraud detection are anticipated to exert prominence in the application segment with 24.1% of market share in 2024.

- End User Analysis: Investment banking is projected to command the generative in AI in the fintech market with the highest market value in 2024.

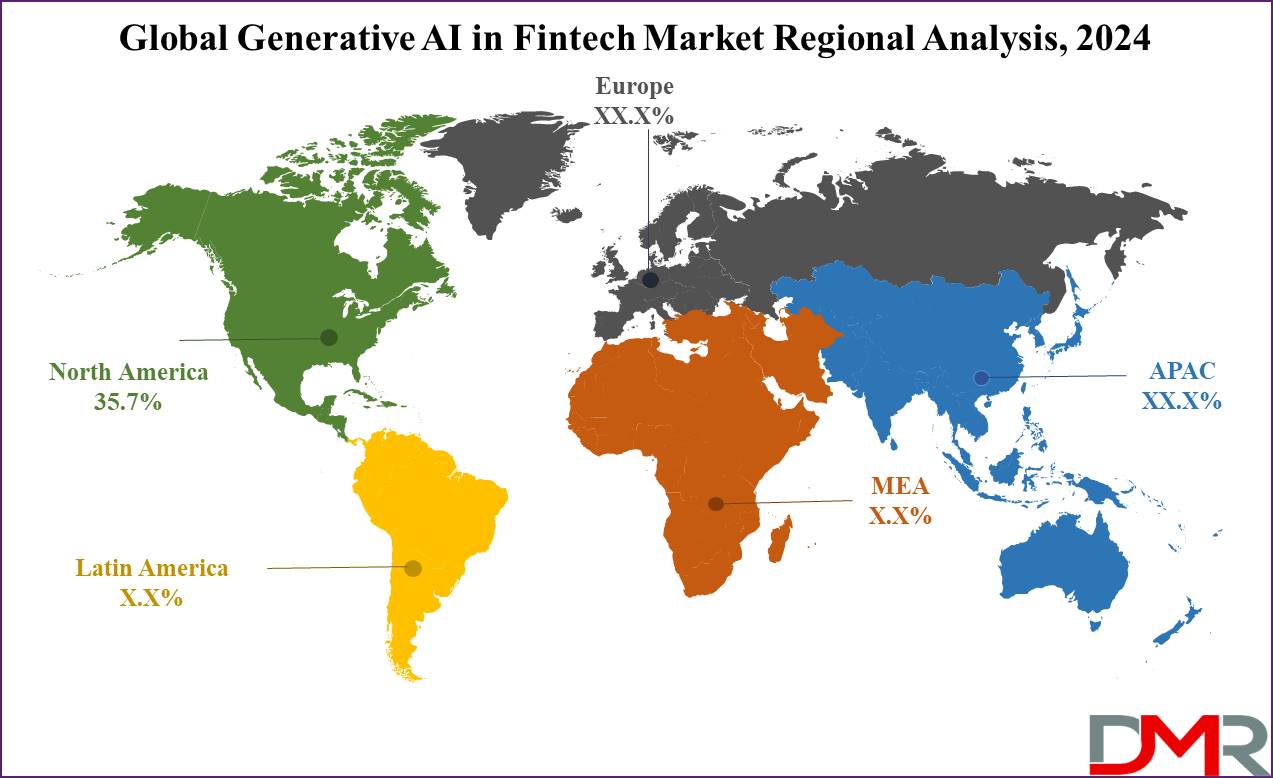

- Regional Analysis: North America is anticipated to dominate global generation AI in the fintech market with 35.7% of the market share in 2024.

Use Cases

- Risk Management: Generative AI investigates and assesses market volatility, optimizes portfolios, and conducts stress testing improving risk assessment accuracy and mitigating financial uncertainties in fintech.

- Fraud Detection: Leveraging advanced algorithms, Generative AI identifies anomalies, patterns of threats, and trends in transactional information, bolstering fraud detection competencies and safeguarding financial integrity.

- Personalized Financial Advice: Generative AI analyzes client statistics to deliver tailor-made investment strategies, budgeting recommendations, and insurance options, enhancing customer satisfaction.

- Compliance Automation: Generative AI automates regulatory compliance checks, along with AML and KYC approaches, by ensuring adherence to financial regulations and minimizing compliance risk for fintech organizations.

- Algorithmic Trading: Utilizing predictive analytics, Generative AI develops trading algorithms, executing high-frequency trades, optimizing investment decisions, and capitalizing on market opportunities in fintech.

Market Dynamic

Drivers

Rising Availability of Data: This explosive growth in digital financial transactions has brought up a lot of data which can be immensely helpful in gaining an understanding of the behavior of consumers or market trends. These vast data sets fuel the training and further improvement of the generative AI models, which in turn enables them to be more precise and relevant.

Enhanced Risk Modeling and Fraud Detection: With the help of Simulation AI, organizations will be able to synthesize data that can impersonate different financial situations thus aiding in risk modeling and stress testing. Moreover, it assists in fraud detection algorithm training by feeding it synthetic data that is expected to detect possibilities of fraud patterns.

Personalized Customer Services: Through the analysis of customer information, AI technology in the finance industry affords businesses to use customized financial products based on their customer preferences and deliver matching services. As a result, customers’ satisfaction and engagement will be heightened which drive the growth of the global generative AI in the fintech market.

Restraints

Data Security and Privacy Concerns: The fine line upon which money’s information operates raises issues about security and privacy. The fintech industry at the forefront of employing generative AI must affirm stringent regulations to prevent the risks of security issues and data misuse which could not only lead to their downfall but also have depressive consequences.

Integration Challenges and Technical Complexity: Implementing generative AI solutions within current fintech infrastructures may be hard because of technical complexities and integration issues. Fintech groups are now facing hurdles in integrating generative AI into their systems seamlessly, leading to delays and accelerated implementation expenses. Additionally, making sure compatibility with legacy systems and scalability can pose extensive challenges for fintech corporations.

Opportunities

Investment in Research and Development: The big players in the industry like NVIDIA, Microsoft, and Google are allocating a lot of resources on the way to enhance the application of the generative AI application in Fintech. This investment demonstrates that generative AI is gaining more prominence and could be the focal point of innovation in financial services.

Enhanced Customer Experience: Generative AI algorithms can interpret customer data which can help to offer customized advice and offers to customers, thereby leading to customer satisfaction and retention. Fintech firms are capable of generating AI that surpasses industry standards, with a focus on improving customer experience to secure a significant market share.

Trends

Algorithmic Trading and Portfolio Optimization: Generative AI is increasingly applied in algorithmic trading and portfolio optimization within the fintech sector. AI algorithms can analyze large quantities of financial data, identify patterns, and generate predictive models to optimize trading strategies and portfolio management. These AI-powered systems can execute trades autonomously and adapt to converting marketplace conditions in real-time, leading to improved investment performance and risk management for financial institutions.

Fraud Detection and Risk Management: Generative AI techniques such as deep learning and neural networks are being leveraged by using fintech companies to improve the fraud detection and threat control systems. These AI models can examine complex financial transactions, detect anomalous patterns, and improve the ability to identify instances of fraud or monetary crime with greater accuracy and velocity than traditional rule-based approaches. By leveraging generative AI for fraud detection and danger control, fintech firms can mitigate financial losses, protect consumer assets, and hold regulatory compliance more efficiently.

Research Scope and Analysis

By Component

Software is expected to dominate the generative AI in the fintech market section primarily due to its versatility and important function in allowing various functionalities inside economic establishments. The range of software products, from

Natural Language Processing (NLP) for text analysis to Deep Learning for complex data processing, contains Algorithmic trading software for automatic trading strategies, and recommend personalized financial plans with robo-advisory software, risk assessment and management software to reduce the possibility of capital loss while maintaining stable investment portfolios with portfolio management software.

These multi-functional program solutions enable fintech companies to run their business processes in an efficient manner, enhance analysis process and decision-making both inside and outside of their organizations, and to provide new and advanced services to their clients. Moreover, software program components offer scalability and flexibility, permitting financial institutions to conform to evolving market trends and consumers' needs effectively.

Fintech firms closely depend upon software program solutions to leverage generative AI capabilities in automating duties, improving customer experiences, and optimizing financial outcomes. Furthermore, software program-based services facilitate seamless integration with current systems and technologies, ensuring smooth implementation and minimal disruption to operations. Overall, the dominance of software components underscores their indispensability in driving the adoption and fulfillment of generative AI in the fintech industry.

By Deployment

On-premises deployment of generative AI in fintech is projected to dominate this segment with 63.9% of the market share in 2023 due to numerous key factors that align with the unique requirements and preferences of financial institutions. Firstly, the finance sector normally handles touchy and exclusive data, together with customer financial information and transactional statistics.

Due to this, quite often financial institutions give the first priority to the information security and compliance that they may retain all the data using the own web hosting which is situated in the safe and secure place within their premises. On-premise deployment empowers financial institutions with tighter control over compliance matters thus enabling them to formulate measures that are in line with best practices within their respective industries and regulators’ requirements.

Moreover, reducing reliance on external service providers and decreasing the risk that comes with downtime or service disruptions can be achieved by deployment on premises since internet connectivity is essential. Summarizing these factors, we notice that the top reason behind the on-premises deployment in generative AI in the fintech marketplace is due to the financial institutions' concerns towards data protection, security, performance, and administrative and financial control over their infrastructures and operations.

By Application

Compliance & fraud detection is anticipated to dominate the generative AI in the fintech market with 24.1% of the market share in this segment because of the essential significance placed on regulatory compliance and fraud prevention in the finance industry. Financial establishments face stringent policies, rules, and regulations aimed at preventing money laundering, terrorist financing, and different illicit activities.

Compliance with regulations together with Anti-Money Laundering (AML) and Know Your Customer (KYC) necessities is a requirement for financial establishments to ensure the integrity of their operations and defend against criminal and reputational risks.

Generative AI technology offers advanced features for analyzing vast amounts of data, identifying patterns, and detecting anomalies indicative of fraudulent activity or non-compliance.

Machine learning algorithms can constantly learn and adapt to evolving threats, improving the effectiveness of fraud detection and prevention measures.

Moreover, the complexity and sophistication of economic crimes necessitate advanced technological solutions to combat them efficiently. Generative AI enables economic institutions to automate compliance processes, streamline transaction monitoring, and enhance the accuracy and performance of fraud detection efforts.

By End User

Generative AI for the fintech industry will be driven largely by the investment banking division where it is projected to have a significant share in the fintech end-user segment since of its intricate and data-dependent nature and the critical importance of right choices and risk management. Investment banks, brokerage firms and wealth management firms are operating in significantly competitive environments where the right moment and applicable knowledge can have a big impact on financial outcomes.

Incorporating AI technologies in the investment banking ensures the institutions' ability to perform more accurate analytics as well as obtain deep insights into market developments, identify risks, and define better funding strategies.

As a matter of further fact, investment banking involves big amounts of economic data that comes from different sources including the market data, client portfolios and economic indicators. Generative AI gives these entities an opportunity to process and look into the huge data sets in a timely way, and reveal in them the secret connections and correlations that serve as the basis for the investment strategies and portfolio management decision making.

Similarly, the investment banks are rapidly employing automated trading and algorithmic disciplines to reinforce themselves and yield the highest return for their clients. AI generative technology plays a major role for attracting investments and the creation of complicated trading strategies and risk management, which allows banks to maximize their profits and take risks without having to carefully inspect the market signals.

The Generative AI in Fintech Market Report is segmented based on the following

By Component

- Software

- Natural Language Processing (NLP) Software

- Deep Learning Software

- Algorithmic Trading Software

- Robo-Advisory Software

- Risk Management Software

- Portfolio Management Software

- Other

- Service

- Consulting Services

- Implementation Services

- Support & Maintenance Services

- Training & Education Services

By Deployment

- On-premises

- Cloud

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application

- Compliance & Fraud Detection

- Anti-Money Laundering (AML)

- Know Your Customer (KYC)

- Transaction Monitoring

- Fraud Detection & Prevention

- Personal Assistants

- Chatbots

- Virtual Assistants

- Voice Assistants

- Asset Management

- Portfolio Optimization

- Risk Assessment

- Asset Allocation

- Predictive Analysis

- Portfolio Optimization

- Risk Assessment

- Asset Allocation

- Business Analytics & Reporting

- Customer Behavioral Analytics

- Other

By End User

- Investment Banking

- Investment Banks

- Brokerage Firms

- Wealth Management Firms

- Retail Banking

- Stock Trading Firms

- Hedge Funds

- Others

Regional Analysis

North America is expected to dominate the global generative artificial intelligence in fintech

market with 35.7% of the market share in 2024.

North America dominates this global market for numerous reasons this region offers a sturdy atmosphere for the fintech startups, set-up financial establishments, and technology corporations, fostering innovation and adoption of advanced technologies like generative AI. Moreover, North America has a fairly advanced financial offerings region with sophisticated infrastructure and regulatory frameworks conducive to fintech innovation.

Major economic hubs along with New York City and Silicon Valley serve as epicenters for fintech pastime, attracting funding and expertise from around the world. Additionally, North American organizations lead the development and deployment of generative AI technologies, leveraging their expertise in artificial intelligence, machine learning, and data analytics. Furthermore, this region's strong culture of entrepreneurship and venture capital investment provides adequate investment and aid for fintech projects. Overall, North America's combination of technological prowess, financial expertise, and supportive ecosystem positions it as the dominant presence inside the global generative AI in fintech market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global generative AI in fintech market’s landscape is highly competitive due to the extreme competition amongst established technology giants, emerging startups, and niche players. Industry leaders which include NVIDIA, Microsoft, and Google dominate the marketplace with their contemporary AI technology and huge resources for research and development.

These companies offer comprehensive generative AI solutions tailored to the specific needs of the fintech sector, starting from herbal language processing software to chance control and fraud detection gear. Additionally, established fintech firms like Square and PayPal are investing heavily in generative AI to improve their product services.

Moreover, the marketplace is witnessing a proliferation of startups specializing in generative AI applications for fintech, leveraging innovative algorithms and approaches to address specific challenges in the industry.

These startups regularly focus on niche segments such as compliance automation, customized financial recommendation, or alternative records analysis, providing specialized solutions to meet the evolving needs of financial institutions and consumers.

Some of the prominent players in the Global Generative AI in Fintech Market are

- Open AI

- Microsoft Corporation

- Google LLC

- Genie AI Ltd.

- IBM Corporation

- MOSTLY AI Inc.

- Veesual AI

- Adobe Inc.

- Synthesis AI

- Salesforce

- Other Key Players

Recent Development

- In September 2023, Bank of America and Palantir have developed a fraud detection system utilizing machine learning to sift through extensive data sets and adaptively learn from trends. This enables the system to pinpoint suspicious activities effectively, thereby reducing instances of financial fraud.

- In August 2023, Bud Financial's Bud.ai platform leverages AI to transform transaction data into personalized banking experiences, with Jas, an evolving AI chat interface, enhancing customer engagement and workflow efficiency.

- In May 2023, Trovata introduces Trovata AI, powered by OpenAI's ChatGPT, automating cash workflows and business intelligence for finance, accounting, and treasury, enabling quick scenario planning and report generation.

- In June 2022, Developer integrates SEON's real-time fraud prevention into AML software, available via Licinuity’s platform, offering customers compliance risk services spanning transaction monitoring to real-time fraud detection and prevention.

- In April 2022, Cross River and Sardine collaborate to construct essential risk and payments infrastructure for Fintech, Web3, and Crypto firms. Sardine integrates Cross River’s payments platform for fraud prevention across fiat and crypto transactions.

- In April 2022, PayPal and Stripe are implementing machine learning algorithms within their payment processing systems to identify and thwart unauthorized activities. This proactive approach aims to safeguard users' financial information, ensuring security and peace of mind during online transactions.