Market Overview

The

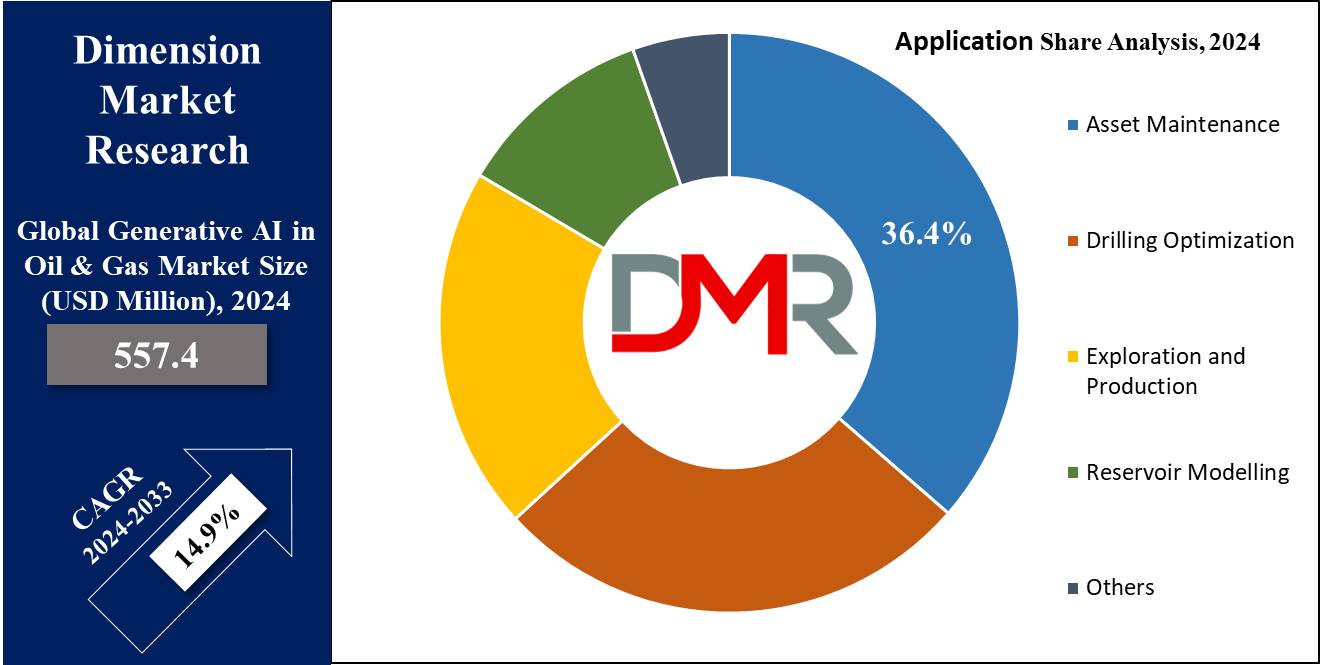

Global Generative AI in Oil and Gas Market is expected to reach a value of

USD 557.4 million by the end of 2024, and it is further anticipated to reach a market value of

USD 1,951.5 million by 2033 at a CAGR of 14.9%.

Generative AI is a type of

artificial intelligence (AI) that focuses on to assist the user develop an image, video, or song utilizing different instructions called “prompts, which are made possible by the large amount of data analyzed on all web platforms. Further, in the oil and gas industry, Generative AI is an advanced tool that can change how oil and gas experts tackle tasks, interpret data, and convey complex concepts.

In addition Generative AI has the potential to transform the oil and gas industry by improving refinery processes, from crude oil distillation to product blending & yield optimization, predictive maintenance of equipment & machinery, risk management, and live monitoring of operations.

Also, applications showcases the potential of generative AI to revolutionize many aspects of the oil and gas industry, from exploration to production and environmental sustainability, as in exploration, generative AI algorithms can inspect large volume of geological and seismic data to look into potential drilling locations, optimizing oil and gas discoveries' efficiency & success rate. Moreover, generative AI models can mock reservoir behavior, predict production rates, optimize well placement, and improve extraction techniques. However, it's important to be mindful of potential risks associated with generative AI, mainly in a safety-critical industry like oil and gas.

Key Takeaways

- Market Growth: The Generative AI in Oil and Gas Market size is expected to grow by 1,319.4 million, at a CAGR of 14.9% during the forecasted period of 2025 to 2033.

- By Deployment: Cloud-based segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Function: Data analysis and interpretation function is expected to get the largest revenue share in 2024 in the Generative AI in Oil and Gas market.

- By Application: Asset Maintenance is expected to lead Generative AI in Oil and Gas market in 2024

- By End User: Oil and gas companies are expected to get the largest revenue share in 2024 in the Generative AI in Oil and Gas market.

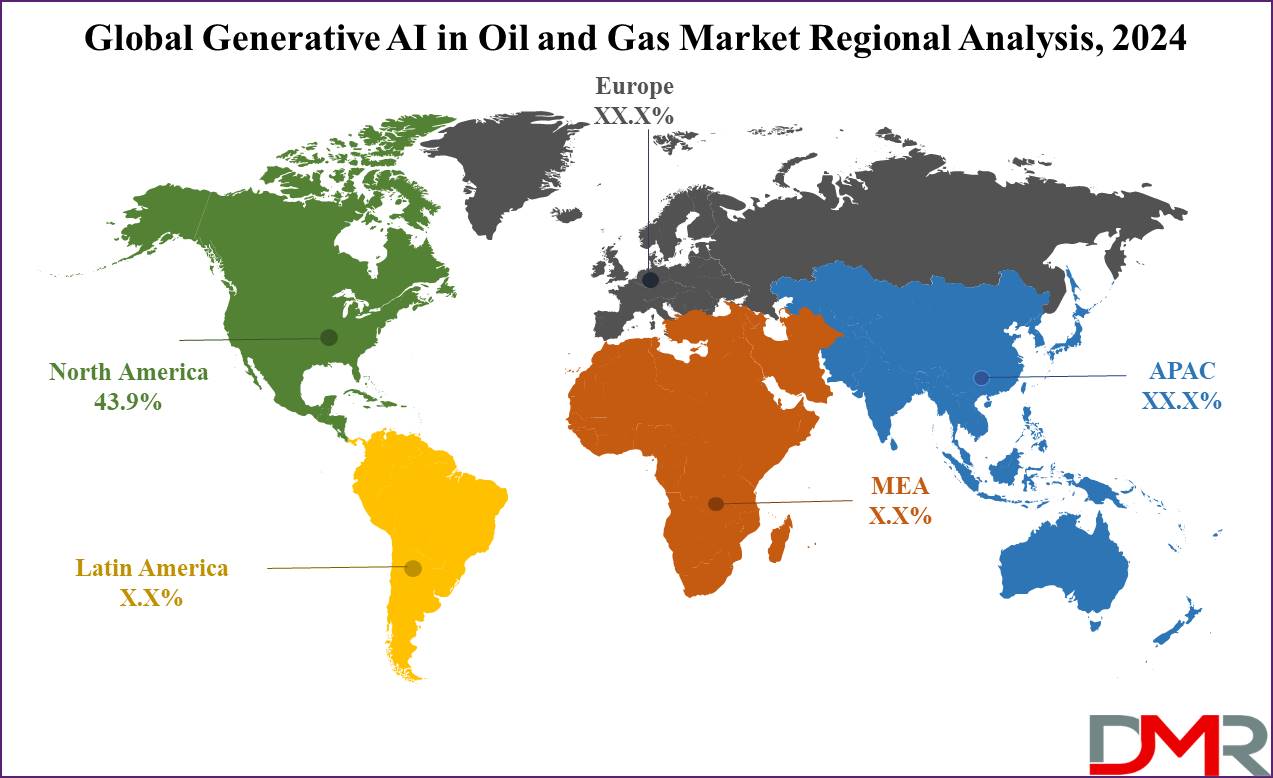

- Regional Insight: North America is expected to hold a 43.9% share of revenue in the Global Generative AI in Oil and Gas Market in 2024.

- Use Cases: Some of the use cases of Generative AI in Oil and Gas include seismic data augmentation, reservoir simulation, and more.

Use Cases

- Seismic Data Augmentation: Generative AI can improve seismic data by generating synthetic seismic traces that replicate real-world conditions, which helps in training machine learning models for enhanced interpretation of subsurface structures, leading to better exploration & reservoir characterization.

- Reservoir Simulation: Generative AI can be used to mock reservoir behavior by generating synthetic reservoir models based on past geological data. These models can help in understanding complex fluid dynamics, optimizing production strategies, and project reservoir performance under different operating conditions.

- Drilling Optimization: Generative AI algorithms can inspect drilling data to generate optimized drilling trajectories & parameters. By replicating numerous drilling scenarios, these algorithms can support in lowering drilling costs, minimizing environmental impact, and improving wellbore stability and productivity.

- Predictive Maintenance: Generative AI can project equipment failures and maintenance requirements by generating artificial sensor data based on previous sensor readings and equipment performance. By looking patterns indicative of impending failures, as it allows proactive maintenance, reduces downtime, and enhances overall asset reliability in oil and gas operations.

Market Dynamic

Driving Factors

Generative AI is attaining traction in the oil and gas industry mainly to its ability to handle large amounts of data and optimize drilling methods, improving operational efficiency. By analyzing large datasets, businesses can make informed decisions & streamline processes, making cost savings and better outcomes, which allows organizations to fine-tune drilling techniques and production processes, lowering expenses and maximizing productivity. Also, Generative AI's predictive capabilities helps in resource allocation and waste reduction, further driving down costs.

Further, safety concerns & risk management initiatives are also driving the adoption of Generative AI in oil and gas industry. By using realistic simulations, companies can accurately look and lower potential hazards, making sure the well-being of personnel and safeguarding assets, which minimizes the risk of accidents & promotes a secure working environment. In addition, as the industry switch towards sustainability, Generative AI plays a major role in facilitating the integration of renewable energy solutions. By optimizing renewable energy systems & incorporating clean energy practices, companies can lower carbon emissions while maintaining operational efficiency within current infrastructures.

Opportunities

Generative AI is expected to transform the oil and gas industry by maximizing exploration activities & revolutionizing maintenance practices. Through the analysis of large geological and seismic data, Generative AI allows more informed decision-making in exploration, causing to the discovery of new reserves while minimizing costs and improving drilling success rates. Moreover, by artificial reservoir behavior and predicting production rates, it can optimizes production processes, improving extraction techniques and increasing operational efficiency.

Furthermore, Generative AI supports predictive maintenance by inspecting sensor data to expect equipment failures, allowing proactive maintenance measures that reduces downtime and optimize asset usage. In addition, it improves safety and risk management by using risk simulation technology to build robust strategies, thereby lowering potential accidents or environmental damage and improving overall safety standards in the industry.

Restrain Factors

The complexity of implementing advanced AI algorithms creates a major challenge for companies in the oil and gas sector. Without experienced data scientists and engineers, organizations may struggle to simply integrate generative AI into their existing systems. In addition, limited access to high-quality and large datasets can hinder the accuracy and reliability of generative AI models, impacting overall performance.

Further, regulatory compliance and data privacy issues add another layer of complexity. The industry operates under strict rules governing sensitive information, requiring critical consideration of data privacy measures when installing generative AI solutions. Moreover, the current funding and infrastructure needs may inhibits smaller organizations with tighter budgets from fully embracing this technology. Adopting advanced computing resources, designing AI models, and training personnel can experience higher costs, potentially limiting broad adoption within the industry.

Trends

Generative AI is highly used in collection with digital twin technology, supporting the creation of

virtual representations of physical assets for real-time monitoring & optimization of operations. These digital twins allow constant analysis and forecasting of asset performance, helped by Generative AI's simulation capabilities & predictive maintenance functionalities. Mainly major integration of Generative AI with Internet of Things (IoT) devices, like sensors and connected equipment, which build large data for advanced analytics, which allows for live monitoring, predictive analysis, and operational optimization, improving efficiency and productivity.

Another major trend is the application of Generative AI for anomaly detection & condition monitoring. By looking at sensor data and historical patterns, these models can quickly identify deviations from normal operating conditions, supporting early intervention to reduce downtime, prevent costly repairs, and optimize maintenance activities. In addition, the integrating Generative AI,

machine learning, and deep learning techniques improves predictive models, using simulated scenarios and synthesized data alongside pattern recognition for more accurate decision-making in the oil and gas industry.

Research Scope and Analysis

By Deployment

Generative AI in oil and gas market is categorized into cloud and on-premise segment, where the cloud-based deployment mode is expected to dominate by 2024, capturing the majority share of revenue, which is due to the many advantages provided by cloud platforms, mainly scalability and flexibility, without requiring hefty initial investments in infrastructure. Cloud solutions provides dynamic resource allocation based on demand, thereby simplifying scaling capabilities.

In addition, these solutions possess augmented computational power and higher storage capacity, important for accommodating the complex algorithms and large datasets complex to generative AI technologies. Further, the cloud-based deployment mode comes out as an attractive choice for oil and gas companies, providing efficient access to generative AI capabilities while optimizing resource usage and operational agility in an industry characterized by changing demands and complexities.

By Function

In the global generative AI in oil and gas market, function segment is categorized into predictive modeling, data analysis and interpretation, anomaly detection, decision support, and other functions. Among these, the data analysis and interpretation segment are projected to hold the largest revenue share in 2024, due to the oil and gas industry's dependency on high data streams from various sources like sensors & drilling operations. Using data analytics and interpretation techniques allows companies to withdraw valuable insights, improving decision-making and operational efficiency. Generative AI algorithms, mainly expert at analyzing complex datasets, using companies to gain better insights into reservoir behavior, production trends, and operational performance, thereby optimizing complete operations.

Moreover, predictive modeling analysis is set to be another crucial function in the generative AI in oil and gas market, expected to experience rapid growth. Predictive modeling is important to the industry's pursuit of precise forecasts, important for optimizing exploration, production, and maintenance activities. By using generative AI algorithms, predictive modeling allow companies to simulate & forecast reservoir behavior, production rates, and equipment performance. These predictive models support data-driven decision-making, optimize resource allocation, and improve operational efficiency, thereby driving the growth of this function within the generative AI in oil and gas market.

By Application

The Asset Maintenance segment is anticipated to hold the largest revenue share in 2024. Generative AI plays a vital role in asset maintenance by using predictive capabilities to predict equipment failures and implement proactive maintenance strategies. By inspecting historical data and sensor information, Generative AI algorithms can inspect patterns typical of potential failures or maintenance requirements, which helps in lowering downtime, optimizing asset usage, and improving overall operational efficiency within the oil and gas industry.

Further, drilling optimization is expected to be as the fastest-growing segment during the forecasted period. Drilling optimization is major for improving efficiency and lowering costs in oil and gas operations. Generative AI supports drilling optimization by inspecting historical drilling data along with current sensor information, identifying patterns and correlations that contribute to more efficient drilling processes and informed decision-making. Through the optimization of drilling operations, Generative AI helps in improving overall operational efficiency while simultaneously lesser risks associated with drilling activities within the oil and gas sector.

By End User

In the global Generative AI in oil and gas market, the oil and gas companies segment is expected to have the largest revenue share in 2024, which is due to access to large datasets, like geological, seismic, production, and maintenance records. Such rich data resources gives a major advantage for training and refining Generative AI models, allowing accurate predictions and optimizations.

In addition, the availability of proprietary data improves their capacity to create customized Generative AI solutions mainly to their operations and assets. Furthermore, oil & gas companies have the resources and expertise to invest in the R&D of Generative AI technologies, having dedicated teams of data scientists, engineers, and AI experts for in-house development and implementation.

Further, the drilling contractors are emerges to be the fastest-growing segment within the Generative AI market for oil and gas. Drilling contractors play a major role in conducting drilling operations efficiently and safely. By using advanced Generative AI technologies, they optimize drilling processes, improves decision-making, and enhances operational performance.

Generative AI provides drilling contractors many advantages, like assistance in well placement optimization based on geological and reservoir data, along with predictive capabilities for forecasting subsurface conditions, thereby improving accuracy and lowering risks during drilling operations.

The Generative AI in Oil and Gas Market Report is segmented on the basis of the following

By Deployment

By Function

- Data Analysis & Interpretation

- Predictive Modelling

- Anomaly Detection

- Decision Support

- Others

By Application

- Asset Maintenance

- Drilling Optimization

- Exploration & Production

- Reservoir Modelling

- Others

By End User

- Oil & Gas Companies

- Drilling Contractors

- Equipment Manufacturers

- Service Providers

- Consulting Firms

Regional Analysis

In the global Generative AI in oil and gas market, North America is expected to have a major dominance,

with a projected highest revenue share of 43.9% in 2024, due to the region's advanced technological capabilities and well-established ecosystem for innovation. Mainly in the United States, there is a plenty of technology firms, research institutions, and startups specializing in AI/ML, actively assisting the development and deployment of Generative AI solutions customized for the oil and gas industry.

Further, the Asia-Pacific (APAC) region is set be to be the fastest-growing market segment during the forecast period. Also, APAC countries have been constantly pursuing digital transformation initiatives across many sectors, including oil and gas. Using advanced technologies, the region focuses on to enhance operational efficiency, streamline processes, and assist innovation. Generative AI is highly recognized as an important tool in achieving these objectives, thus driving its adoption and growth in the APAC region's oil and gas industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the global Generative AI in oil and gas market, many players compete for market share, providing many solutions and services. Established technology companies, research institutions, and startups specializing in AI/ML contribute to the market's dynamism. These entities aims on developing and deploying Generative AI solutions customized to the unique needs of the oil and gas industry, using their expertise in data analytics, machine learning, and predictive modeling. In addition, partnerships & collaborations among industry players further enhances the competition, as companies look to improve their offerings and expand their market presence. As the need for advanced AI technologies continues to grow, competition in the Generative AI market within the oil and gas industry is anticipated to remain fierce, driving innovation and technological development.

Some of the prominent players in the global Generative AI in Oil and Gas Market are:

- AI

- Beyond Limits

- SLB Schlumberger

- Baker Hughes

- SparkCognition

- Halliburaton

- Other Key Players

Recent Developments

- In March 2024, Saudi Aramco launched its first ever generative AI (GenAI) model, Aramco Metabrain AI, at the annual LEAP tech conference in Riyadh, Saudi Arabia. Aramco’s AI model is said to be a leading technology in the industrial sector, and has 250 billion parameters that are adjustable during training to generate outputs or make predictions. The AI was trained utilizing over seven trillion data points, having more than 90 years of company history.

- In February 2024, Seeq, launched the Seeq AI Assistant, a generative AI (GenAI) resource embedded across its industrial analytics platform, which provides live assistance to users across the enterprise, allowing them to expand mastery of the Seeq platform, build advanced analytics, machine learning, and AI skills and knowledge, and enhance insights to better decision making in pursuit of operational excellence and sustainability.

- In September 2023, Amazon Web Services, Inc. introduced five groundbreaking artificial intelligence (AI) innovations developed to strengthen oil and gas enterprises of all scales to design innovative generative AI applications, enhance workforce efficiency, and revolutionize their operations. Among these innovations is the broadly used Amazon Bedrock, a fully managed service providing foundational models (FMs) sourced from leading AI firms through a single application programming interface (API).

- In August 2023, Wintershall Dea announced a collaboration with IBM Consulting to establish an AI Center of Competence (CoC) while progressing multiple value-generating AI use cases supporting an efficient energy production. Together, both companies maintain strong relationships with Microsoft as a technology partner, as Wintershall Dea already uses Microsoft Azure for its data platform while IBM Consulting maintains a collaboration with Microsoft for delivering data and AI projects based on Azure.

- In January 2023, C3 AI launched the C3 Generative AI Product Suite with the release of its first product C3 Generative AI for Enterprise Search, which provides enterprise users with a better user experience utilizing a natural language interface to rapidly locate, retrieve, and provide all relevant data across the entire corpus of an enterprise’s information systems, which expands transformation efforts across business functions and industries, like sustainability, supply chain, reliability, oil & gas, CRM, ESG, aerospace, utilities, CPG, healthcare, financial services, and defense and intelligence.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 557.4 Mn |

| Forecast Value (2033) |

USD 1,951.5 Mn |

| CAGR (2023-2032) |

14.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Deployment (On-Premise and Cloud-based), By Function (Data Analysis & Interpretation, Predictive Modelling, Anomaly Detection, Decision Support, and Others), By Application (Asset Maintenance, Drilling Optimization, Exploration & Production, Reservoir Modelling, Others), By End User (Oil & Gas Companies, Drilling Contractors, Equipment Manufacturers, Service Providers, and Consulting Firms) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

AI, Beyond Limits, SLB Schlumberger, Baker Hughes, SparkCognition, Halliburaton, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Generative AI in Oil and Gas Market size is estimated to have a value of USD 557.4 million in 2024 and is expected to reach USD 1,951.5 million by the end of 2033.

North America is expected to have the largest market share in the Global Generative AI in Oil and Gas Market with a share of about 43.9% in 2024.

Some of the major key players in the Global Generative AI in Oil and Gas Market are AI, Beyond Limits, SLB Schlumberger, and many others.

The market is growing at a CAGR of 14.9 percent over the forecasted period.