Generative AI, uses neural networks, creates realistic content & proves highly valuable in trading due to its adaptability to market changes. By looking into a volume of historical data, it identifies complex patterns, providing actionable insights for decision-making. However, it's important to see that while Generative AI improves analytical capabilities, it acts as a complement to human judgment rather than a replacement, which integrates AI-generated insights with the better decision-making of experienced traders.

As per the AIPRM, the global generative AI market, valued at nearly $45 billion in 2023, is projected to surpass $200 billion by 2030, marking a 361% increase. The market generated $68 billion in revenue in 2023, a 68% rise from 2022, with North Americadominating 41% of the global share. More than two-thirds (68%) of users engaged with generative AI to answer queries, reflecting its broad utility.

Among businesses, 64% of leaders feel an urgent need to integrate generative AI, while 44% expect workforce reductions within three years. Millennials lead adoption, with 34.7% using generative AI monthly, and gender usage data reveals that 59% of men and 51% of women leveraged these tools in 2024. The marketing sector saw the highest application, with 37% utilizing generative AI for daily tasks in 2023. These trends underscore the transformative role of generative AI in reshaping the trading market and related industries.

Also, the future of Generative AI in trading holds high guarantees, with adaptive algorithms responding quickly to real-time market shifts. The prospect of autonomous trading systems, learning from historical data, shows future where AI plays a major role in looking at financial complexities, which promises a dynamic future, where innovation constantly pushes the boundaries of possibility in stock and forex markets.

Moreover, Generative AI's high-speed data processing capabilities makes traders to create informed decisions in real-time, grabbing market opportunities swiftly. Its accuracy is increased by removing human biases and emotions, leading to more objective trading strategies based on data-driven insights, which positions

Generative AI as a strong tool for traders looking to stay ahead in dynamic market environments.

Generative AI is rapidly transforming the trading sector, offering innovative opportunities and prompting significant developments. Amazon's AWS re Invent conference highlighted advancements in generative AI, including cost reductions through proprietary chips and the Bedrock platform, leading analysts to raise the company's stock price target. Robinhood plans to introduce AI-powered financial advice, aiming to provide cost-effective, accessible financial management services.

A survey by KPMG revealed that 65% of U.S. executives anticipate a high impact from generative AI within the next 3-5 years, though 60% feel unprepared for immediate adoption. Additionally, 15 AI-powered fintech startups have been identified by venture capitalists as promising, leveraging AI to revolutionize various financial services. These developments underscore the growing influence of generative AI in trading, offering new opportunities and challenges for the industry.

As per Tavus, Generative AI in the trading market is seeing widespread adoption, with usage rates in the United States at a consistent 28% across generations. Urban populations demonstrate a 15% higher exposure to generative AI compared to rural areas, underscoring its prominence in densely populated regions. Within the marketing and sales sectors, 84% of marketers report that AI enhances and accelerates customer interactions, while 71% of sellers leverage generative AI to automate personalized sales communications effectively.

Furthermore, a majority of marketing professionals anticipate that generative AI will complement human creativity rather than replace it in the next decade. These insights highlight generative AI’s transformative potential in trading markets, optimizing customer engagement and operational efficiencies while bridging technological gaps across demographic divides.

Alongside these advancements,

Explainable Artificial Intelligence (XAI) is gaining importance, ensuring transparency and accountability in AI-driven decision-making processes. By making complex algorithms more interpretable, XAI helps financial institutions and traders build trust, enhance compliance, and adopt AI solutions with greater confidence. Such developments mark a pivotal shift toward more ethical and transparent AI-driven strategies, shaping the future of trading and financial innovation.

Key Takeaways

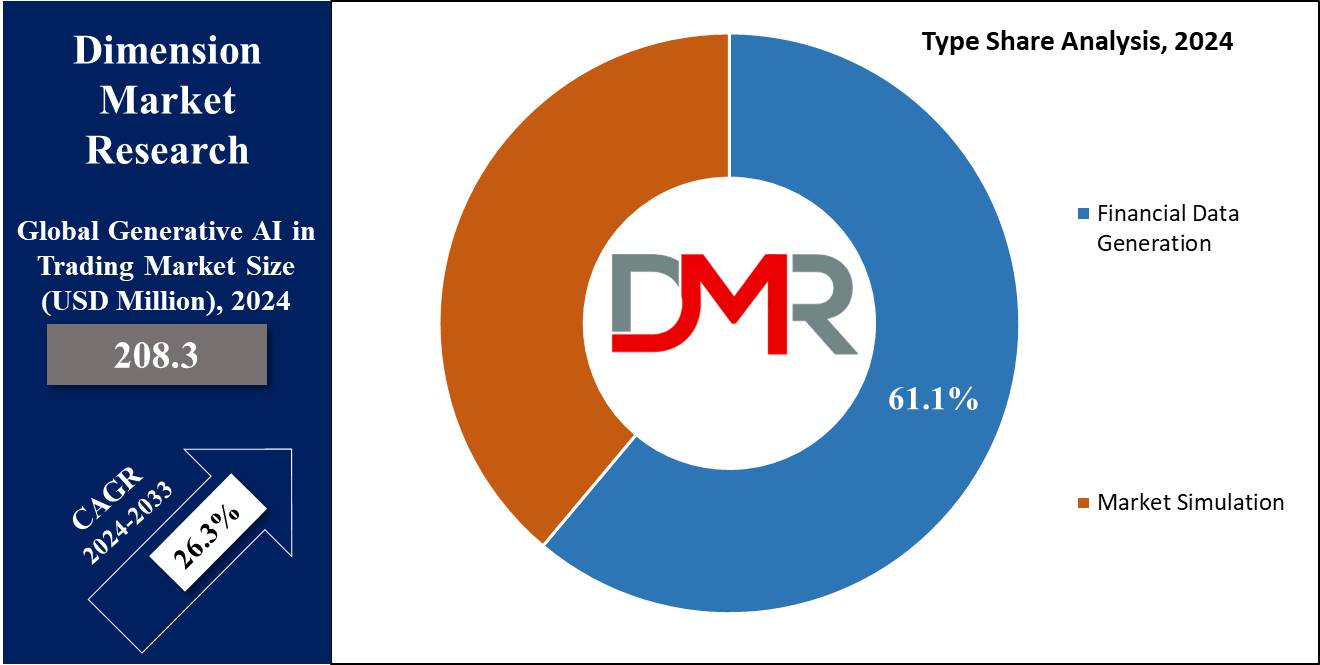

- Market Growth: The Generative AI in Trading Market is expected to grow by USD 1,447.6 million, at a CAGR of 26.3% during the forecasted period of 2025 to 2033.

- By Deployment: On-Premises segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Type: Financial Data Generation is expected to get the largest revenue share in 2024 in the Generative AI in trading market.

- By Application: Portfolio Optimization is expected to get the largest revenue share in 2024 in the Generative AI in trading market.

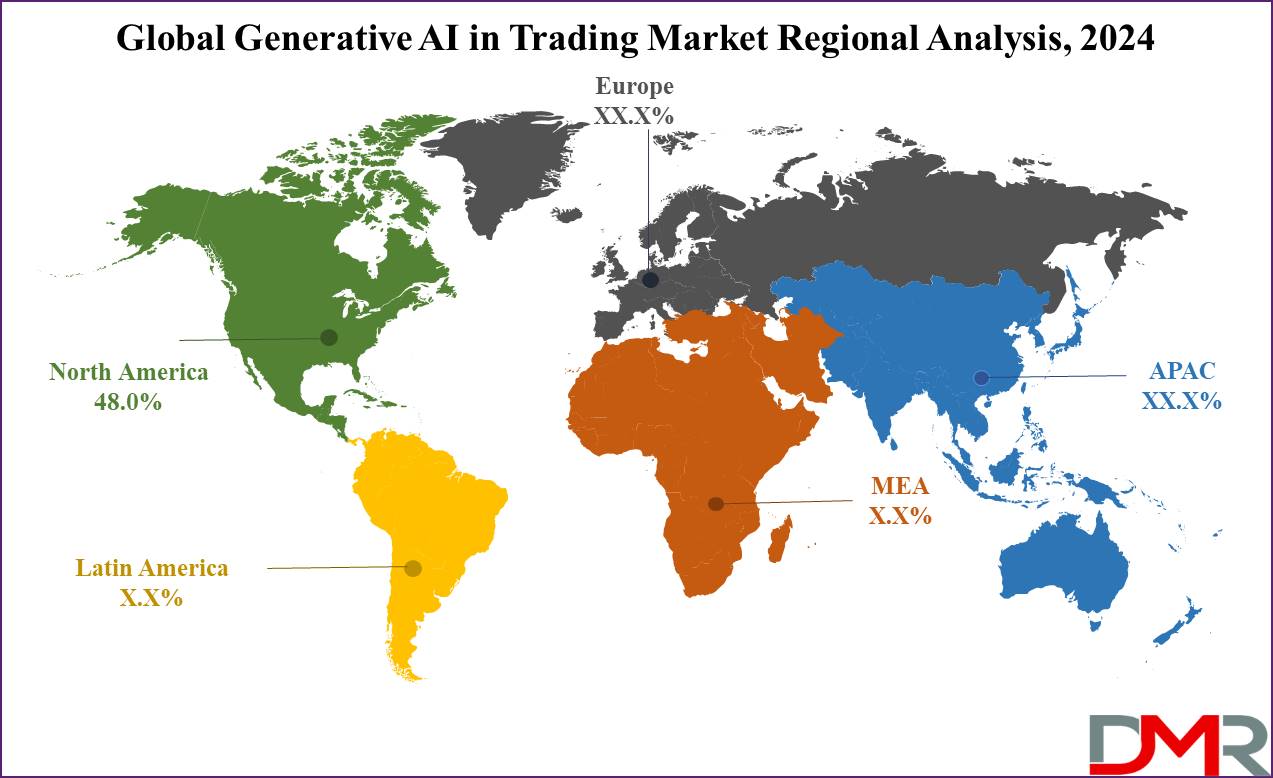

- Regional Insight: North America is expected to hold over 48.0% share of revenue in the Global Generative AI in Trading Market in 2024.

- Use Cases: Some of the use cases of the Generative AI in Trading include market prediction, risk management, and more.

Use Cases

- Market Prediction: Generative AI models can inspect large historical trading data to identify patterns & trends. By generating synthetic data based on these patterns, they can replicate potential future market scenarios. Traders can use these predictions to make better decisions about buying, selling, or holding assets.

- Risk Management: Generative AI can be used to act various risk scenarios by generating synthetic market data. Traders can then look into the potential impact of these scenarios on their portfolios & implement risk reducing strategies accordingly, which helps traders to better manage their exposure to market volatility & unexpected events.

- Strategy Generation: Generative AI can help traders in designing and optimizing trading strategies. By generating artificial market data and testing different trading algorithms against it, traders can recognize strategies that acts well under many market conditions, which can lead to the discovery of new trading approaches that may not have been visible through traditional analysis methods.

- Market Simulation: Generative AI can create artificial markets that mimic real-world market conditions. Traders can utilize these simulations to test the effectiveness of their strategies in a controlled environment before applying them to live trading, which helps traders to refine their strategies & adapt them to changing market dynamics without risking real capital.

Market Dynamic

Driving Factors

Generative AI in trading models develops artificial financial data that mirrors real-time market conditions, filling gaps in historical datasets and helping traders refine their models through data augmentation or synthetic data generation. By replicating market scenarios, traders can analyze the impact of various events on portfolio strategies and performance.

Additionally, generative AI supports risk assessment by creating artificial market environments, enabling traders to optimize systems and better understand risk exposure. Beyond trading, Generative AI in Customer Services is transforming how financial institutions interact with clients—automating responses, personalizing support, and predicting customer needs with high accuracy—ultimately enhancing engagement, satisfaction, and operational efficiency.

Moreover, Generative AI helps in identifying and reducing portfolio risks through imitating scenarios & data sets. By building scenarios, traders can create informed decisions on asset allocation and optimize portfolio performance.

Opportunities

Generative AI certify traders by helping them develop more effective trading strategies through mock data generation and market scenario modeling. By looking into hidden patterns & detecting emerging trading signals, these models improves predictive accuracy, potentially leading to better trading performance and profits. In addition, Generative AI helps in risk management by replicating extreme market conditions, enabling traders to identify vulnerabilities in their portfolios and proactively implement risk reduction strategies.

Further, Generative AI enables customizes investment strategies by looking into individual risk profiles, goals, and preferences, which improves the dependency of portfolios and optimizes investment outcomes. Furthermore, Generative AI improves customer experiences by meeting specific trader needs, like automating trade execution and improving effectiveness. By providing better market analysis and forecasting capabilities, Generative AI supports deeper insights into market dynamics, allowing traders to look for trends and make better investment decisions.

Restraint Factors

Generative AI's effectiveness depends on the accuracy of its training data. Flawed or biased inputs can yield unreliable synthetic models or erroneous data, undermining its utility in financial markets. However, maintaining diverse and high-quality datasets is challenging due to market biases and data limitations. Additionally, the complexity and opacity of generative AI in trading models creates perception challenges for humans, potentially impacting trust and acceptance, mainly in regulatory contexts where transparency is important.

Moreover, regulatory landscape creates further hurdles, as opaque AI models may create concerns regarding compliance with privacy, fairness, and risk management regulations. Overcoming these challenges need significant time and resources. Moreover, the risk of overfitting highlights the need for AI models to adapt quickly to transforming market conditions. Failure to do so may create inaccurate outputs & ineffective trading strategies, highlighting the importance of agile and adaptable generative AI in trading market.

Trends

In the field of trading, deep learning is gaining traction. Traders are integrating generative AI and reinforcement learning techniques to build intelligent trading agents. These agents learn to adapt to market dynamics via interactions and feedback loops. By using deep reinforcement learning, traders improves their decision-making processes & trading strategies. There's a rising trend of integrating dynamic AI models along with traditional quantitative trading models for better strategies.

Moreover, traders are largely using both generative models & econometric/statistical models together, which provides a more complete understanding of the market, improves the accuracy of trading strategies & predictions, and boosts returns. Also, looking at the interpretability challenge in generative AI, researchers are focusing on creating models that are both generative and explicable.

They aim on making the decision-making process of generative models more transparent & understandable for regulators & traders. In addition, transfer learning, where pre-trained models are applied to specific trading scenarios, is attaining popularity. By using generative models trained on large datasets, traders can quickly adapt master representations to new trading situations, overcoming data limitations & expanding model development.

Research Scope and Analysis

By Type

In the market of generative AI in trading, the financial data generation segment is expected to claim majority share of revenue in 2024, as it holds significant promise, by revolutionizing data generation processes in trading. By using specialized algorithms and neural networks, generative AI systems are capable of producing highly accurate financial data that closely replicate real-world market conditions.

Drawing insights from previous market information, these systems identify patterns & predict future scenarios, providing investors and traders with access to high amounts of reliable data, which empowers them to test, refine, and develop trading strategies, implement higher risk management practices, and gain deeper insights into market behavior. Ultimately, this technology refines decision-making processes, allowing traders to make well-informed investment choices that optimize returns.

Moreover, the market simulation segment comes out as the fastest-growing segment in the generative AI in trading market, as it generate mock data that replicates real market behavior with remarkable accuracy. These models uses advanced methodologies and algorithms to build virtual environments simulating market conditions, price fluctuations, & trading activities.

Using the power of generative AI, investors and traders can experiment with their strategies in a risk-free setting, gaining valuable insights into potential market outcomes & refining their decision-making skills. Simulations enables users to test many scenarios, assess algorithm efficiency, & develop future trading capabilities while reducing the overall risks, and highlight the growing importance of market simulation in improving traders' capabilities and enhancing overall trading performance.

By Deployment

Based on deployment, the market is segmented into on-premises, cloud-based and hybrid. Among these types, the on-premises is expected to be the most lucrative in the global generative AI in trading market, with the largest revenue in 2024. On-premises deployment of generative algorithms within the trading market indicate to implementing & operating

artificial intelligence-driven models and systems within an individual trader's physical infrastructure, which gives traders complete control & ownership over their AI solutions while meeting regulatory needs. Speedier processing of data enables immediate analysis & decision-making, while adaptable AI models can adopt more readily to meet local market conditions or trading strategies.

Further, cloud-based segment is expected to be the fastest growing deployment segment in generative AI in trading market throughout the forecasted period. Deployment of cloud-based generative AI within trading needs cloud computing platforms and resources to host & run AI models and systems, which provides traders with adaptability when increasing or decreasing computational resources based on individual needs. In addition, traders can easily inspect intelligent AI solutions from anywhere with internet access saving costs by removing infrastructure maintenance requirements of on-premise.

By Application

Global generative AI in trading market based on its applications are categorized into portfolio optimization, trading strategy development, and risk assessment and management. Among these, portfolio optimization is set to be the dominant segment, commanding a major market share in 2024. Through generative AI models, investors & traders can build and evaluate multiple portfolios across different market conditions. By generating mock data, these models looks into fundamental dynamics like asset price movements and correlations. Traders use this information to refine portfolio allocation strategies, positioned them with risk-return objectives. When integrated with AI, portfolio optimization processes allows traders to make better investment decisions, improves diversification, and look for optimal risk-adjusted returns in trading markets.

Further, trading strategy development is also expected to grow at a significant rate as it holds higher importance in the generative AI trading market. Generative AI uses modeling to simulate market data, creating prices similar to real-world markets, which allows traders to experiment with strategies & identify potential flaws before implementation. With generative AI, traders can altogether explore multiple markets & test different strategies in controlled environments, supporting the creation of strong & effective trading plans, which provides consistent profitability during the dynamic environment of trading markets, providing traders with a competitive edge.

The Generative AI in Trading Market Report is segmented on the basis of the following:

By Type

- Financial Data Generation

- Market Simulation

By Deployment

- Cloud-based

- On-Premises

- Hybrid

By Application

- Portfolio Optimization

- Trading Strategy Development

- Risk Assessment and Management

Regional Analysis

North America is anticipated to lead the global Generative AI in trading market

with about 48.0% market share in 2024, making it the most profitable region. The United States, in main, stands out as a major player in applying generative AI within trading markets. Known for its better financial services industry and strong tech ecosystem, which includes leading tech firms & research institutions, North America, mainly cities like New York and Chicago, acts as a hub for innovation in generative AI tools for trading. The region's longstanding commitment to adopting advanced technologies has driven it to the forefront of developing and integrating generative AI solutions for trading purposes.

Further, the Asia-Pacific region emerges as the fastest-growing market in the forecast period for generative AI in trading, as countries like Japan, China, and Singapore have quickly embraced generative AI within their trading markets. Growth in investment in technological development and increasing adoption by financial institutions highlights the region's commitment to using generative AI for trading automation, risk management, and market analysis. As counties in Asia-Pacific continue to embrace and invest in generative AI technologies, they are expected to play an importantly significant role in shaping the future of AI-driven trading strategies and innovations on a global scale.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the generative AI in trading market, players compete for market share, using advanced technologies & innovative solutions to gain a competitive edge. Key factors influencing competition like technological developments, research and development initiatives, and strategic partnerships within the financial services and technology sectors.

Further companies look to differentiate themselves by providing specialized generative AI tools customized to meet the changing needs of traders, looking on areas like portfolio optimization, trading strategy development, and risk assessment. With an aim on improving data accuracy, processing speed, and model interpretability, competitors focused to attract and retain clients by delivering complete, reliable, and efficient generative AI solutions for trading applications.

Some of the prominent players in the global Generative AI in Trading Market are

- Kavout Inc

- Numerai LLC

- OpenAI AP

- Aidyia Holding Ltd

- Pecan AI Ltd

- Sentient Technologies Holdings Ltd.

- Other Key Players

Recent Developments

- In February 2024, Birlasoft Ltd, launched a complete Generative AI platform named Cogito, which is expected make enterprises to assist in a new era of innovation, optimisation, and automation. With an aim on revolutionising businesses through Generative AI capabilities, the platform is developed to improve decision-making, automate processes, and boost overall business performance.

- In February 2024, TradeAlgo announced one of the world’s first generative AI products developed for retail traders with its latest product TradeGPT, as company's engineering teams worked on generative AI technology for long time to bring personal investing agents to millions of retail investors.

- In January 2024, The Federal Trade Commission issued orders to five companies needing them to provide information regarding recent investments & partnerships including generative AI companies and major cloud service providers, where it will scrutinize corporate partnerships & investments with AI providers to build an improved internal understanding of these relationships & their impact on the competitive landscape, which includes Alphabet, Inc., Amazon.com, Inc., Anthropic PBC, Microsoft Corp., and OpenAI, Inc.

- In January 2024, Markets regulator of India, SEBI announced that it will be utilizing a generative AI tool, which has been developed in-house, to clear IPO applications on time, as it has been found to be influential in reducing the time lag massively.

- In March 2023, Roundhill Investments, launched the Roundhill Generative AI & Technology ETF which begins trading on the NYSE Arca. CHAT provides investor’s exposure to companies at the leading of artificial intelligence technology, with a focus on generative AI.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 208.3 Mn |

| Forecast Value (2033) |

USD 1,705.1 Mn |

| CAGR (2023-2032) |

26.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Financial Data Generation and Market Simulation), By Deployment (Cloud-based, On-Premises, and Hybrid), By Application (Portfolio Optimization, Trading Strategy Development, and Risk Assessment and Management) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Kavout Inc, Numerai LLC, OpenAI AP, Aidyia Holding Ltd, Pecan AI Ltd, Sentient Technologies Holdings Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |