The global generator market serves as a major pillar in satisfying residential, commercial, and industrial power requirements across the world. Generators are an uninterruptible supply solution, especially in developing countries where grid electricity is extremely unreliable. "The market witnessed growth due to the rising need for uninterrupted power supply across developing and developed countries. This becomes quite vital with increasing urbanization and industrialization, particularly in the regions of Asia-Pacific and Africa.

Further impetus to growth has been provided by wide adoption across industries like healthcare, data centers, manufacturing, and retail facing potentially large operational losses for every minute of downtime. Sustainability concerns drove the development of environmentally friendly hybrid technologies in the field of generators as well.

This includes most importantly natural gas and renewable-integrated generators, especially due to increased regulation by governments over emission limits. For instance, Europe and North America have engaged in initiating laws against heavy usage by diesel-based systems; their manufacturers are trying to develop more eco-friendly and lower-emission models. In addition, the incorporation of digital monitoring for predictive maintenance also keeps drawing interest and assures further efficiency with prolonged systems' life. Such advancements serve the end-users who need economical and reliable strides toward power availability.

A host of opportunities exist in the generator market, more so in regions experiencing rapid infrastructural development. Many countries in South Asia and Sub-Saharan Africa are investing in grid infrastructure. As construction increases, so does the demand for generators, not only at the building site but also as a supplementary source of power. In addition, electric vehicles and renewable energy installations require backup systems to ensure stability in the grid, thus providing a very promising avenue for the players operating in this market.

The demand for portable generators in outdoor recreational activities and emergency disaster management further extends the scope of the market. Though there is scope for its growth, several factors act as obstacles to the global market of generators. The high initial cost for advanced systems of generators and expenses regarding maintenance would be a high burden and hence will decrease the adoption rate in cost-sensitive markets. Fluctuating fuel prices add to the uncertainty of operational costs and thereby affect end-user decisions.

Adding to the factors are other constraints that arise during the transition to cleaner sources of energy, wherein renewable energy alternatives such as solar panel installations, battery storage systems, and the emerging need for

solar panel recycling vie for space against conventional generator solutions. Such challenges must be met with technologically sound responses through strategic pricing on the part of companies in the sector..

Growth prospects for the market remain upbeat, with increasing energy consumption across the world and the need for reliable power in critical applications. The increasing dependence of the healthcare sector on uninterrupted energy for life-support systems, along with the expansion of remote work and e-commerce, is driving demand for data center backup power. Other innovations involve hybrid systems, combining the traditional generator with renewable sources of energy these will be realized and become more popular for ecologically sensitive consumers. Government support through incentives in adopting energy-efficient and low-emission technologies also encourages further market opportunities.

The US Generator Market

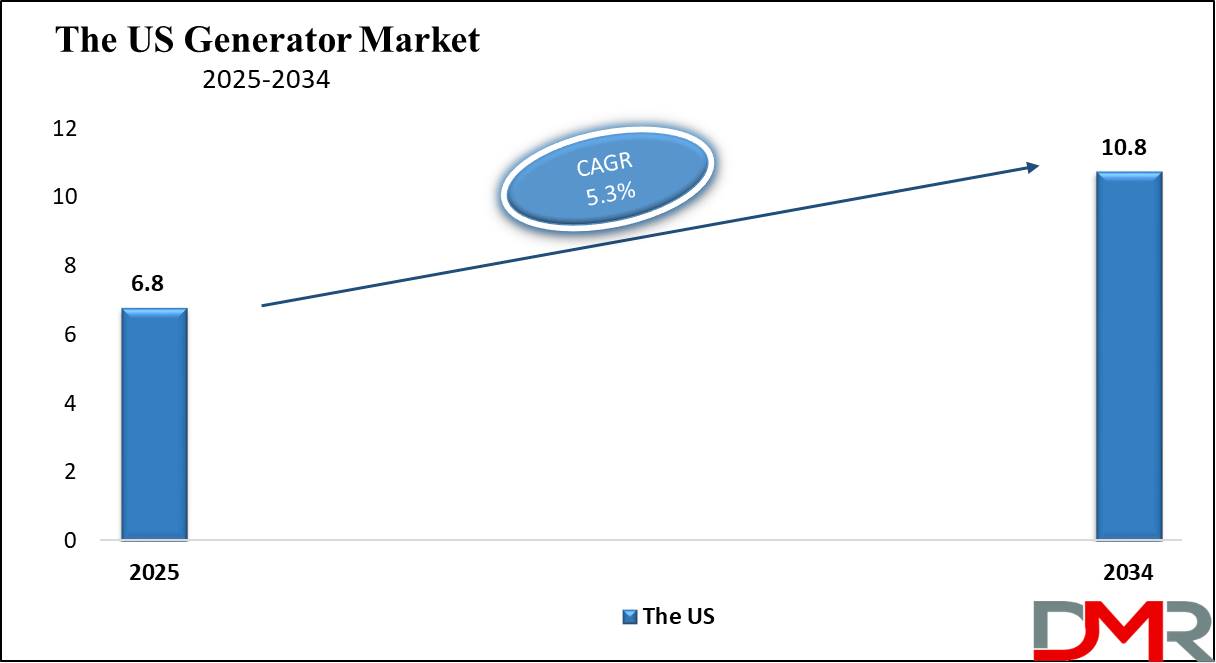

The US Generator Market is projected to reach USD 6.8 billion in 2025 at a compound annual growth rate of 5.3% over its forecast period.

The United States needs reliable backup power due to its aging electrical grid, which frequently experiences outages, especially during peak demand periods. More recent extreme weather events, from hurricanes in the Southeast to wildfires on the West Coast, have brought backup power needs from homes and condos to commercial and industrial customers under greater scrutiny.

The high urbanization rate and further dependence on digital infrastructure create a demographic advantage for the US. Fast growth in healthcare and data center sectors will drive higher demand for advanced and efficient generator systems. Applications of standby and portable generators among residential users are also on the rise to decrease the impact of power disruption.

It has led the world when it comes to low-emission and renewable-integrated, generator technologies. Hybrid systems involving natural gas-driven generators coupled with systems storing solar and wind energy became popular due to the government's incentives for greener technologies. Similarly, in the US, with its abundance of natural gas reserves at cheap access, natural gas systems emerge as a pretty valid alternative to Diesel-powered ones. Efficiency and reliability are further improved with the trending increase in smart generator systems that come with IoT capabilities for real-time monitoring and predictive maintenance.

A strong industrial base, combined with growing consideration for energy security, makes the US a strong ground for continuous growth in the generator market. Growth is further ensured by investments in upgrading aged infrastructure and the demand for reliable backup power sources in critical spheres. The US Generator Market will remain a bedrock of the country's energy strategy in light of the growing concerns about energy resiliency among businesses and households.

Key Takeaways

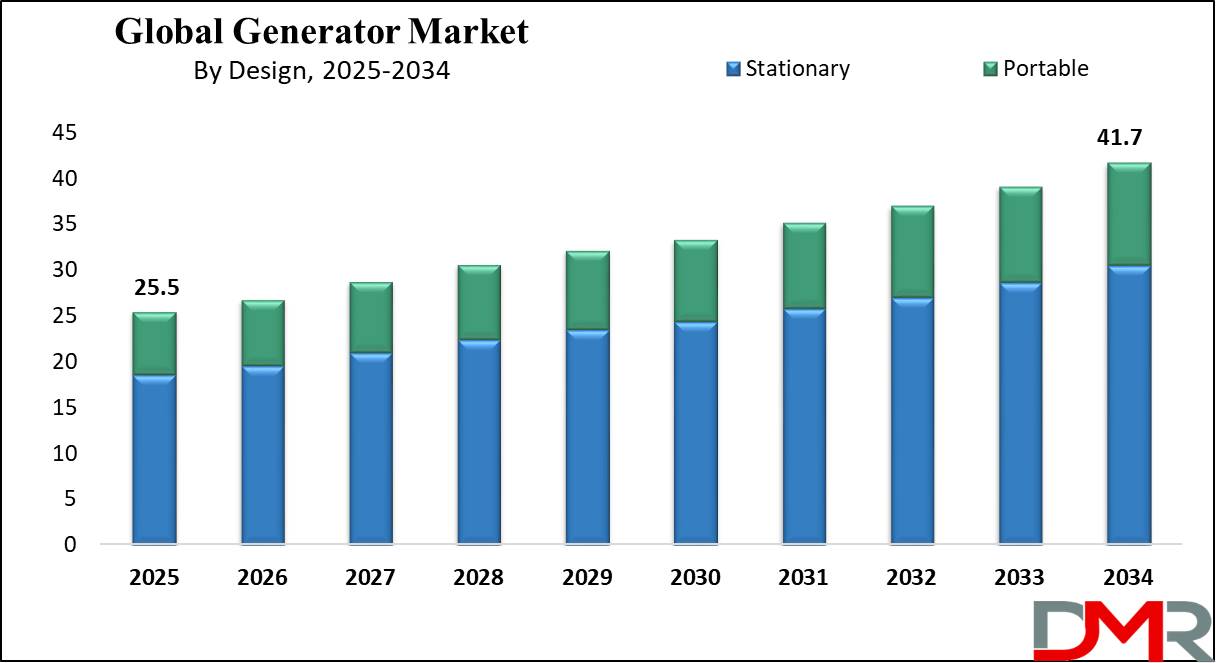

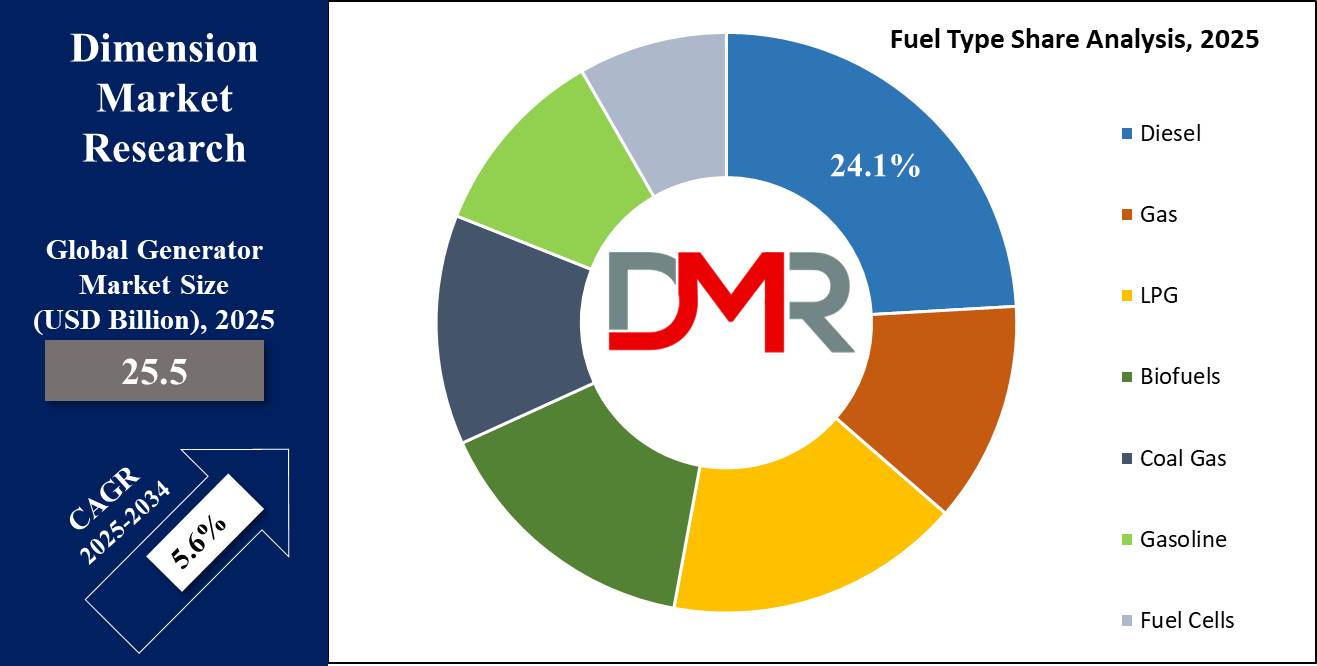

- Global Market Value: The Global Generator Market size is estimated to have a value of USD 25.5 billion in 2025 and is expected to reach USD 41.7 billion by the end of 2034.

- The US Market Value: The US Generator Market is projected to be valued at USD 6.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 10.8 billion in 2034 at a CAGR of 5.3%.

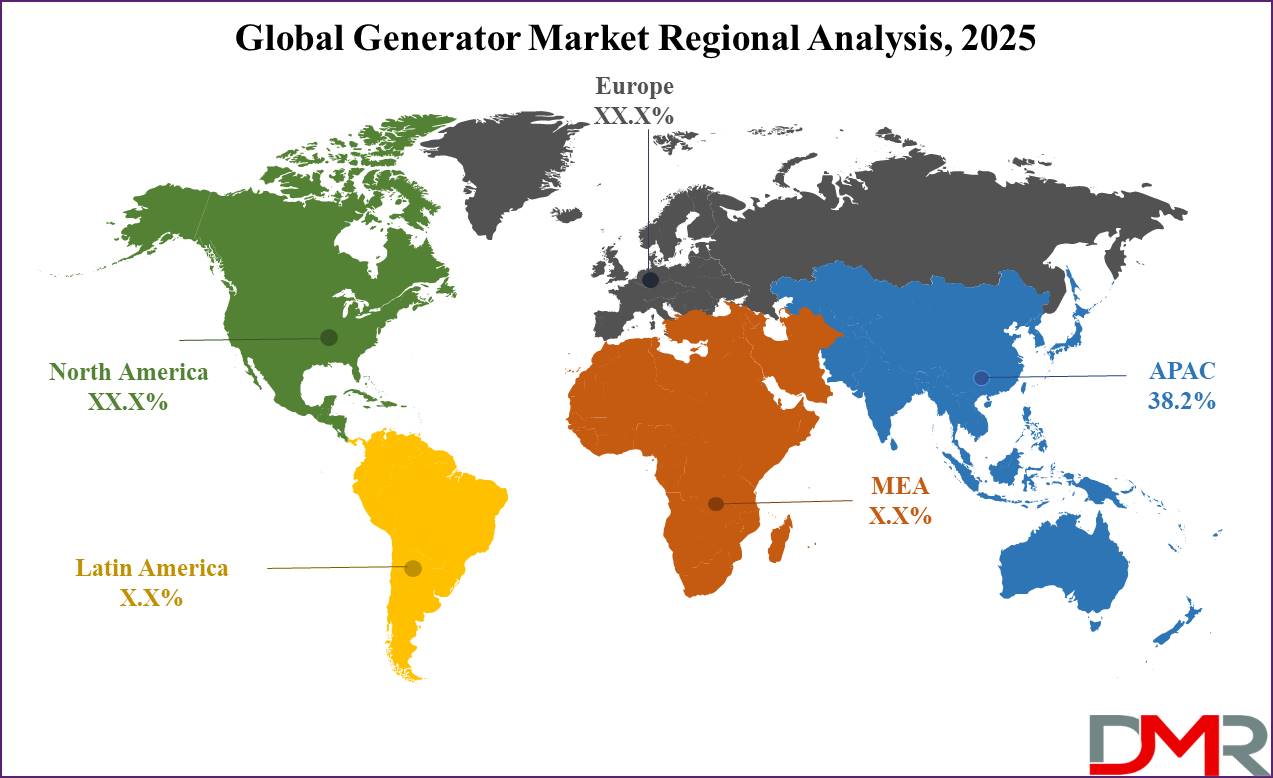

- Regional Analysis: Asia Pacific is expected to have the largest market share in the Global Generator Market with a share of about 38.2% in 2025.

- Key Players: Some of the major key players in the Global Generator Market are Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kohler Co., Briggs & Stratton Corporation, Atlas Copco, Honda Motor Co., and many others.

- Global Growth Rate: The market is growing at a CAGR of 5.6 percent over the forecasted period.

Use Cases

- Healthcare: Generators are a vital backup power solution in hospitals and clinics, especially for emergency cases. A power outage will affect the life-support systems, surgical operations, and refrigeration of all important medicines and vaccines.

- Data Centers: These have become all the more crucial in the digital age. Generators are used at data centers so that any case of downtime and loss of data integrity may well be avoided. The backup generators keep IT services, cloud computing platforms, and e-commerce companies running without a stop for whom operational disruptions mean losses.

- Construction Sites: In particular, the off-grid and remotely located construction sites are powered by generators, as they power heavy equipment, lighting, and tools. They also play a critical role in ensuring that the work is done effectively and that the project schedules are maintained. Mobile and portable generator solutions are especially preferred because of their flexibility and ease of movement.

- Agriculture: Generators play an important role in the agriculture sector by facilitating irrigation systems, water pumps, and storage facilities. Such machines will ensure that water is continuously available for the crops, hence good health and consistency in yield for the farmers in areas where electricity supplies are not reliable.

Market Dynamic

Driving Factors

Increasing Frequency of Power OutagesThe global generator market has been enjoying excellent growth, while increased power outages due to aging and fragile electrical grids, coupled with rapid and extreme weather fluctuations, boost surging demand for electricity. High power cuts every year in the developed world point to just how fundamental dependable backup for such sectors as healthcare and data centers are, as well as manufacturing lines because just a few minutes of power loss can equate to huge amounts.

Other growing markets are developing regions, where the inability of electricity infrastructure to meet demand contributes highly. For example, in areas like Africa and South Asia, standalone and backup generators have increasingly been used to help households and businesses during the frequency of blackouts, thereby driving the demand for these essential systems globally.

Rapid Industrialization in Emerging Economies

The industrialization and urbanization of developing economies, especially in the Asia-Pacific and Africa, are presenting tremendous opportunities for growth among generator manufacturers. Expansion in industries like manufacturing, construction, and mining has increased the need for reliable power solutions to maintain continuous operations.

Government initiatives towards infrastructure development, such as building transportation systems, urban housing, and upgrading utilities, will also require generators for both prime and standby applications. International investments in developing the industrial capabilities in these regions, which will necessitate the requirement for industrial generators in their growth path, back this trend.

Restraints

Stringent Environmental Regulations

Stricter environmental standards on emissions and noise pollution are posing a key challenge for the global generator market, especially for diesel-powered systems. This, in turn, has driven governments around the world to impose more stringent regulations to reduce the environmental footprint of generators. These changes are now forcing manufacturers to invest time and money in finding cleaner and quieter technologies. This usually translates to increased research and development costs, adding to the overall cost of production. This compliance requirement further restricts market penetration in regions like the European Union, where such standards are strictly implemented, hence reducing the rate of traditional generator system adoptions and presenting barriers to entry for small manufacturers.

High Initial Costs of Advanced Generators

The substantial upfront investment required for advanced generators, including hybrid and IoT-enabled systems, remains a barrier to market growth. The greater part of the generators involves big investments in infrastructure, installation, and integration that make them highly unattractive, especially to economic sectors like the SME sector, which are so cost-conscious. Moreover, every fluctuation in raw materials prices contributes additionally to all economic anxieties, aside from ongoing chain disruption, further scaring away purchasers. Situations remain financially worse in the developing world to access inexpensive financing for these investments until wider market entry is prevented completely.

Opportunities

Adoption of Renewable and Low-Emission Generators

Growing international awareness of sustainability and the resultant desire to reduce carbon emissions offers unparalleled growth opportunities for renewable and low-emission generators. Many governments and organizations around the world continue to incentivize cleaner energy solutions, complementing gas-powered and hybrid generators with other products to meet environmental policy goals. Accompanying the policies toward using green technologies have been funds for projects in renewable energies that make the pace of innovation and the diffusion of those innovations quicker.

Thus, companies that can respond well to this demand by providing eco-friendly solutions are likely to be at an advantage in the competitive scenario, since industries are looking for ways to reduce their operational carbon footprint and achieve regulatory compliance through sustainable power solutions.

Expanding Demand in Remote and Off-Grid Areas

The Increasing demand for reliable power in remote and off-grid areas presents generator manufacturers with an opportunity that promises significant rewards. Places that demand reliable sources of power include rural areas, mining and construction sites, and disaster-prone areas. The need for flexibility and the possibility of integrating renewable energy sources for cost-effective and sustainable power supply has made portable and hybrid generators popular. These systems are of particular interest in disaster recovery efforts and off-grid rural electrification projects where access to the conventional grid is either unavailable or unreliable.

Trends

Shift Toward Hybrid Generators

One of the major growth trends in the generator market is a hybrid system that can work in conjunction with traditional fuels such as diesel or natural gas and other renewable energy sources. Large energy efficiency, low emission, and cost economy are the prime offers of these systems to address the international urge for alternative sources of energy. Hybrid generators are finding their applications in industries that require very critical fuel saving and environmental concern, getting popular among segments such as telecommunications, construction, and remote site operations. Other technological developments like smart monitoring systems and auto-load balancing systems have given further impetus to the growth of these versatile power solution providers.

Rising Demand for IoT-Enabled Generators

IoT technology integrated into the generators has transformed the marketplace to real-time monitoring, predictive maintenance, and even remote operations. Some of them ensure higher operation efficiency and lesser downtime, hence their wide applications in those industries where uninterrupted power supply is crucial. IoT-enabled generators find their applications in critical industries such as data centers, healthcare, and industrial sectors where even minor disruptions may result in serious consequences. It also coincides with a merging interest in digitization and intelligent infrastructure that advocates for more technologically advanced generator systems across the world.

Research Scope and Analysis

By Fuel Type

Diesel engines are projected to dominate the global generator market because of their high reliability, efficiency, and consistency in power output across various applications. High energy density in diesel fuel enables longer operations and higher power generation compared to other fuel types, hence making it a popular choice for critical sectors like healthcare, manufacturing, and data centers. Strong construction makes diesel engines capable of working for long periods without any problem and can bear heavy loads, which may be very necessary in times of a prolonged power outage or off-grid location.

The reason is that diesel generators are also very cost-effective with respect to fuel consumption they have better fuel efficiency compared to their alternatives running on gasoline or natural gas, especially for high-power applications. Besides, diesel fuel is available all over the world, meaning that even in very remote areas, access to it is easy. But what makes diesel generators so appealing is the fact that they are very durable and don't require much maintenance they can work in very harsh environmental conditions and require minimal servicing.

These are concerns that, with the advancement in technology, have been upgraded in the new diesel generators that now come with better exhaust systems and fuel injection technologies that reduce the levels of pollutants in the environment. Most modern-day generators are clean and 'green' since they must conform to very stringent environmental regulations, especially in Europe and North America.

From small portable units to large industrial systems, their versatility and scalability make diesel generators the dominant choice for users in search of reliable and efficient backup or primary power solutions in residential, commercial, and industrial applications.

By Power Rating

The segment of 281-500 KW is the anticipated leading generator market in this segment, as it offers a perfect balance between capacity and versatility to serve a wide variety of applications in different industries. These generators can be applied to medium- and large-scale activities, such as health centers, manufacturing industries, and large commercial business areas where the power requirement falls within this range. These are practical for many users since they can give stable and adequate energy output without excessive fuel consumption.

Generators in this power range are highly sought after in data centers, where uninterrupted power supply is critical for maintaining operations. They also play a significant role in infrastructure projects, ensuring the seamless functioning of equipment and tools in the construction and engineering sectors. The scalability of these systems makes them suitable for both standalone use and integration into larger power networks.

The 281-500 kW sector is also enabled by technological improvements in hybrid systems, and IoT-enabled monitoring among other features that encourage efficiency, less maintenance, and an extended operational life. In addition are regulatory compliances related to emissions, making them cleaner due to good design and thus appealing to users who are eco-conscious.

Dominance in this segment is mainly because it allows the adaptation from different fuel sources such as diesel, and natural gas to biodiesel variants. It might remain in the top position in the generator market since its required power can be effectively delivered for significant applications without compromising on cost constraints.

By Sales Channel

The direct channel of sale is projected to dominate in sales channel segment in the generator market because it offers customized solutions, better pricing, and better relations with customers. It allows the manufacturer to be in direct contact with the end-users, hence enabling a clear understanding of the particular power needs of the customers. Using direct communication, the manufacturer has the opportunity to offer customized solutions for the generator needs of its customers either by using special power outputs, fuel preference, or integration with other systems.

Another critical factor that makes direct sales popular for buyers is that they are usually more cost-effective due to the elimination of intermediaries, making their prices relatively competitive. This will also be more attractive to industrial and large-scale commercial users because generators are mostly sold in bulk or as high-capacity systems. Besides selling, manufacturers may offer installation, maintenance, and training support services, which are rather important to achieve maximum performance and life span for generators.

Besides, customer loyalty is enhanced through personalized engagement and after-sales support in direct sales. The close relationship allows them to respond to operational challenges on time for customer satisfaction and retention. This channel is effective in both industrial and institutional markets, where trust and reliability are key concerns when making purchasing decisions.

With the rising complexity regarding new generator technologies in hybrid systems or IoT-enabled monitoring, direct sales are the right path for manufacturers to engage customers on effective product capabilities and resultant benefits. This focus on value-added services is why the direct channel remains the prime mode of sales for the generator market.

By Design

The major players in the stationary generator market are currently expected to dominate the sector due to the assurance of reliable high-capacity power solutions that can be availed for a very long time or for critical applications. Stationary generators are designed for fixed applications and, therefore, have widespread application in many facilities that require uninterrupted power backup, including heavy industries, hospitals, and offices. Their robust construction and durability allow for operation under harsh conditions during elongated periods of power outages.

These generators are usually installed on the premises of buildings and work automatically during grid failures. Stationary generators have various convenience and efficient features, like automatic transfer switches and remote monitoring systems. High-power output capability, remote monitoring, and operating sparing will ensure high value for these kinds of generators in operations where even brief losses of critical power result in huge financial or operational losses.

Advances in technology have made them even more acceptable due to the development of low-emission engines and noise-reduction systems. Compliance with tough environmental regulations also ensures that stationary generators remain a viable and sustainable option for large-scale users. Besides, stationary generators can be tailored to meet exacting power demands, fuel preferences, and operational conditions, hence their versatility across a wide array of industries.

This segment is to lead with dominance in the market is indeed a growing demand from the uninterruptable power of sectors such as data centers, manufacturing, and healthcare. Reliability along with efficiency and scalability continues to keep stationary generators on the edge by design type.

By Application

Standby generators are predicted to dominate the generator market in the context of application, as they are vital for smooth power supply in cases of emergencies or outages. These are designed to automatically turn on during power failures, hence providing a seamless transition with minimal disruption. Their main applications in sectors like healthcare, data centers, and residential complexes point towards their great importance in keeping operations running and safety intact.

Standby generator convenience is their feature for installation with automatic transfer switches that eliminate human intervention after power gets lost. Most importantly, in such critical applications as hospitals or data centers, even partial and short disruptions may lead to extremely dangerous situations in patients' treatment or heavy monetary losses.

Thereby, technological strides have made improvements pertaining not only to backup generators' functional status but also through the addition in the form of emissions-only small engines and their intelligent monitoring capacities. These befitting specifications attract nature savers while attesting to improved economic conditions. The recurring nature of disaster strikes, either in the disguise of hurricanes, rainfall or suddenly blowing snow, has indeed given a vital jolt concerning locating standby generators chiefly in disaster-heavy areas.

These attributes of standby generators provide confidence in operations both to homeowners and for business operations alike-have sealed its status as the dominating application in the generator market. Furthermore, reliability with evolving technology would be highly crucial for growth and adoption in diverse end-user segments.

By End User

The industrial sector is projected to be dominant in the generator market because of its wide power requirements and dependence on continuous energy supply for most vital operations. Large manufacturing plants, mining, and oil and gas refineries are some of the industrial facilities that require high-capacity generators to continue seamless operations without any disruption even at grid power failures. Their vital role in supporting heavy machinery and key processes makes them irreplaceable in the industrial segment.

The power needs of the industrial sector are pretty varied. For this, strong generator solutions are a must, wherein scalability is equally important. Some of the most used systems based on diesel or natural gas offer reliability and cost-effectiveness. Besides, industrial users very often need application-specific systems tailor-made to their working requirements, which drives demand in the segment.

Therefore, the growth in manufacturing and infrastructure projects in developing nations worldwide will spur the demand for generators in industries.

More specifically, new industrializing economies within Asia-Pacific and Africa emerge as the hotspots, since their rapid industrialization encourages demand for backup and primary power systems. Greater efficiency and lower maintenance costs for industrial users will be afforded by advanced development in the form of hybrid generators and IoT-enabled monitoring systems.

Strict emission norms have also encouraged the adoption of greener and more viable generator technologies for the industrial segment. A good balance of reliability, scalability, and compliance keeps industrial users as the biggest category of end-users in the generator market.

The Generator Market Report is segmented on the basis of the following

By Fuel Type

- Diesel

- Gas

- LPG

- Biofuels

- Coal Gas

- Gasoline

- Fuel Cells

By Power Rating

- Upto 50 KW

- 51-280 KW

- 281-500 KW

- 501-2,000 KW

- 2,001-3,500 KW

- Above 3,500 KW

By Sales Channel

By Design

By Application

- Standby

- Prime & Continuous

- Peak Shaving

By End User

- Industrial

- Utilities/Power Generation

- Oil & Gas

- Chemicals & Petrochemicals

- Mining & Metals

- Manufacturing

- Marine

- Construction

- Other

- Residential

- Commercial

- Healthcare

- IT & Telecommunications

- Data Centers

- Others

Regional Analysis

Asia Pacific is projected to dominate the global generator market as it will

hold 38.2% of the total market revenue by the end of 2025. The global generator market is dominated by the Asia-Pacific region, which is driven by rapid industrialization, urbanization, and robust infrastructure development across emerging economies. The manufacturing, construction, and mining sectors have been increasing significantly in countries like China, India, and Southeast Asian nations, all of which require reliable power solutions. This huge industrial base in the region has created substantial demand for both primary and backup generators, making the region a critical market segment.

The region's exposure to natural calamities like typhoons, earthquakes, and floods adds to the need for reliable backup power systems in countries such as Japan and the Philippines. Heavy investments being made by both governments and private sectors in emergency preparedness further boost the growth of generators.

Further, the growing population coupled with urbanization in the region of Asia Pacific has stressed power resulting in rampant power outages. Generators find huge applications in the residential, commercial, and industrial sectors to bridge the gap in demand for power and its supply. Increasing investments in data centers, telecommunication networks, and healthcare facilities round up the major factors driving demands for backup power solutions.

Cost advantages with regard to manufacturing and appropriate supply chains help the region of Asia-Pacific become a center for generator manufacturers, hence using price competitiveness effectively for market penetrations. Favorable government policies have given subsidies to all for energy-efficient systems. This growing awareness about renewable integrated and hybrid Generators is expected to lead to further concrete development in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global market for generators can be characterized by several established and regional manufacturers, whereby both groups are focusing on achieving an advantageous competitive position. The competition is dominated by leading companies with strong brand recognition, extensive global distribution networks, and innovation commitments, such as Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kohler Co., and Mitsubishi Heavy Industries. Key participants are highly focused on research and development activities so that the introduction of cleaner and more efficient technologies hybrid and low-emission variants can be provided.

Regional manufacturers in emerging markets, such as Asia-Pacific, have also contributed significantly by offering cost-effective solutions that meet certain regional requirements. Localized production and distribution advantages further add to the intense competition among these manufacturers.

Innovation remains a positive competitive factor characterized by IoT enablement of generator units and renewable integrated system products. Most companies actively apply these next-generation technologies toward ensuring operational efficiency, reducing GHG emissions levels, and improving customer relationship engagement.

The market is influenced by strategic consolidations, including mergers and acquisitions, which further help the companies achieve their geographical expansion and technological knowldge. More importantly, strategic partnerships of the generator manufacturers with renewable energy companies help in developing sustainable power solutions to meet the demand for global energy.

Some of the prominent players in the global Generator Market are

- Caterpillar Inc.

- Cummins Inc.

- Generac Holdings Inc.

- Kohler Co.

- Briggs & Stratton Corporation

- Atlas Copco

- Honda Motor Co., Ltd.

- Yanmar Co., Ltd.

- MTU Onsite Energy (Rolls-Royce Power Systems)

- Perkins Engines Company Limited

- Mitsubishi Heavy Industries, Ltd.

- Aksa Power Generation

- SDMO Industries (Kohler SDMO)

- Other Key Players

Recent Developments

- January 2025: Generac Holdings Inc. announced a strategic partnership with a renewable energy provider to co-develop hybrid generator systems aimed at industrial and large-scale applications, enhancing energy efficiency and sustainability.

- November 2024: Caterpillar Inc. launched its IoT-enabled generator series, featuring advanced energy management and remote monitoring capabilities, at the EnergyTech Expo in Singapore. The series is designed to optimize fuel usage and reduce emissions for commercial and industrial users.

- October 2024: Cummins Inc. committed USD 50 million to expand its manufacturing facility in India, increasing production capacity for diesel and gas-powered generators to meet the rising demand in Asia-Pacific.

- August 2024: Kohler Co. finalized its acquisition of a Southeast Asian generator manufacturer, strengthening its supply chain and market presence in the region. This move supports Kohler’s focus on expanding its portfolio of portable and stationary generators.

- June 2024: Mitsubishi Heavy Industries introduced its latest range of gas-powered generators at the Global Energy Summit in Tokyo. The generators are equipped with advanced emissions control technologies and cater to both commercial and residential segments.

- March 2024: The Power & Energy Conference in Dubai highlighted emerging trends in hybrid generator systems and featured innovations from global market leaders. The event provided a platform for showcasing new technologies and fostering industry collaborations.

- January 2024: Generac Holdings Inc. organized a seminar on disaster preparedness, promoting its portable and standby generators tailored for regions prone to typhoons and hurricanes. The seminar emphasized the importance of reliable backup power in disaster management.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 25.5 Bn |

| Forecast Value (2033) |

USD 41.7 Bn |

| CAGR (2024-2033) |

5.6% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 6.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Fuel Type (Diesel, Gas, LPG, Biofuels, Coal Gas, Gasoline, and Fuel Cells), By Power Rating (Up to 50 KW, 51–280 KW, 281–500 KW, 501–2,000 KW, 2,001–3,500 KW, and Above 3,500 KW), By Sales Channels (Direct, and Indirect), By Design (Stationary, Portable.

By Application (Standby, Prime & Continuous, and Peak Shaving), By End User (Industrial, Residential, and Commercial)

|

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kohler Co., Briggs & Stratton Corporation, Atlas Copco, Honda Motor Co., Ltd., Yanmar Co., Ltd., MTU Onsite Energy (Rolls-Royce Power Systems), Perkins Engines Company Limited, Mitsubishi Heavy Industries, Ltd., Aksa Power Generation, SDMO Industries (Kohler SDMO)., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |