The Generator Sets Market encompasses the development, supply, and utilization of portable and stationary generators designed to deliver reliable power in residential, commercial, and industrial applications across a range of environments - residential, commercial, and industrial. This market comprises different kinds of diesel, gas, and hybrid models to suit different power requirements and operational environments. Key factors driving market expansion include rising demand for uninterrupted power supplies due to advances in generator technology as well as expanding infrastructure projects; companies are investing in innovations designed to maximize efficiency and reduce emissions while meeting evolving regulatory standards within this competitive arena.

The Generator Sets Market has experienced impressive expansion, driven by increased demand for reliable power solutions across numerous sectors. Infrastructure expansion, data center proliferation, and real estate developments all act as growth drivers; as these sectors expand further their demand for both portable and stationary generators increases exponentially.

Technological innovations are revolutionizing the marketplace, prompting a significant transition toward hybrid and gas-powered generators that boast increased efficiencies, lower emissions, and superior operational performance when compared with their diesel counterparts. Furthermore, remote monitoring, automated load management tools, advanced fuel technologies, and remote load monitoring play an increasingly prominent role in sustainability initiatives and cost-efficiency goals within industry trends.

Regulatory forces are also affecting market dynamics. Stringent emission standards have forced manufacturers to invest more heavily in research and development efforts for high-performance solutions that comply with emission requirements; at the same time, natural disasters and power outages have resulted in a greater need for reliable backup power solutions.

Key Takeaways

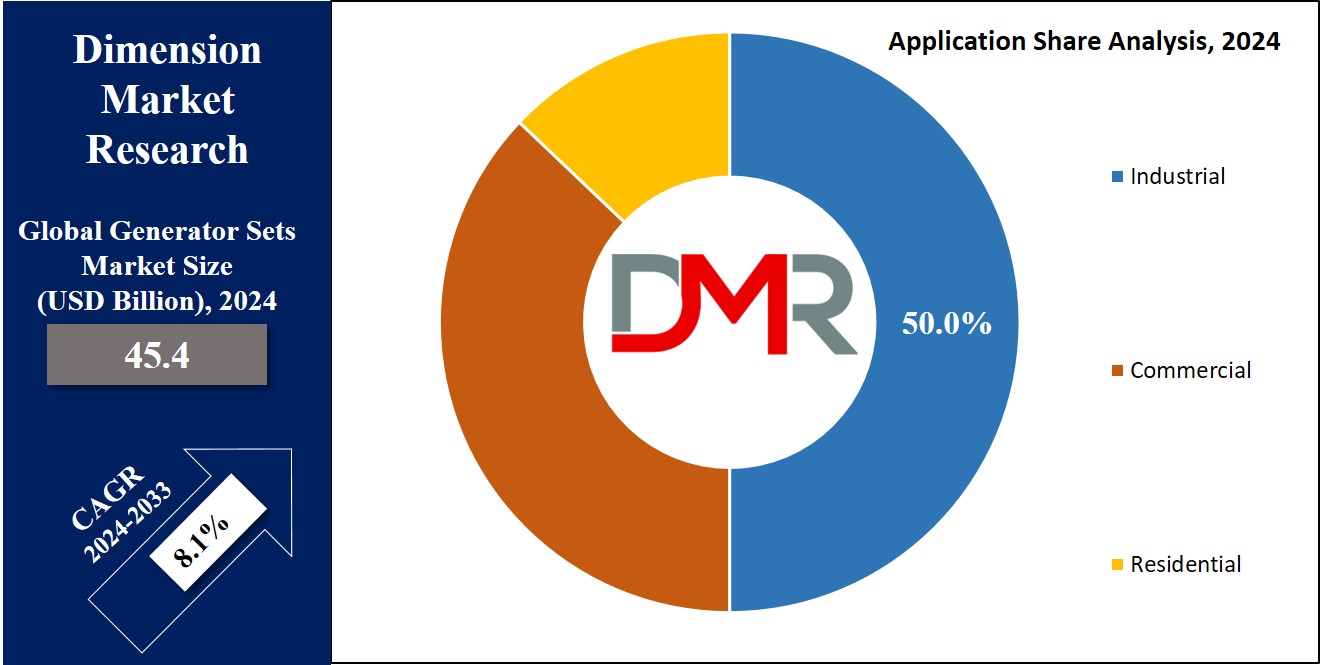

- Market Growth and Forecast: The global Generator Sets Market is projected to expand significantly, reaching USD 45.4 billion in 2024 and USD 91.5 billion by 2033, with a robust CAGR of 8.1%.

- Dominant Fuel Types: Diesel generators currently dominate the market with a 55% share, valued for their reliability and high power output. However, gas generators are gaining ground, holding a 30-35% share due to their lower emissions and alignment with environmental regulations.

- Leading Power Ratings: Low power generators (1-20 kVA) are the largest segment by market share, at approximately 45%, driven by residential and small business needs. Medium power generators (20-200 kVA) hold a 35% share, while high power generators (>200 kVA) account for 20%, essential for industrial and data center applications.

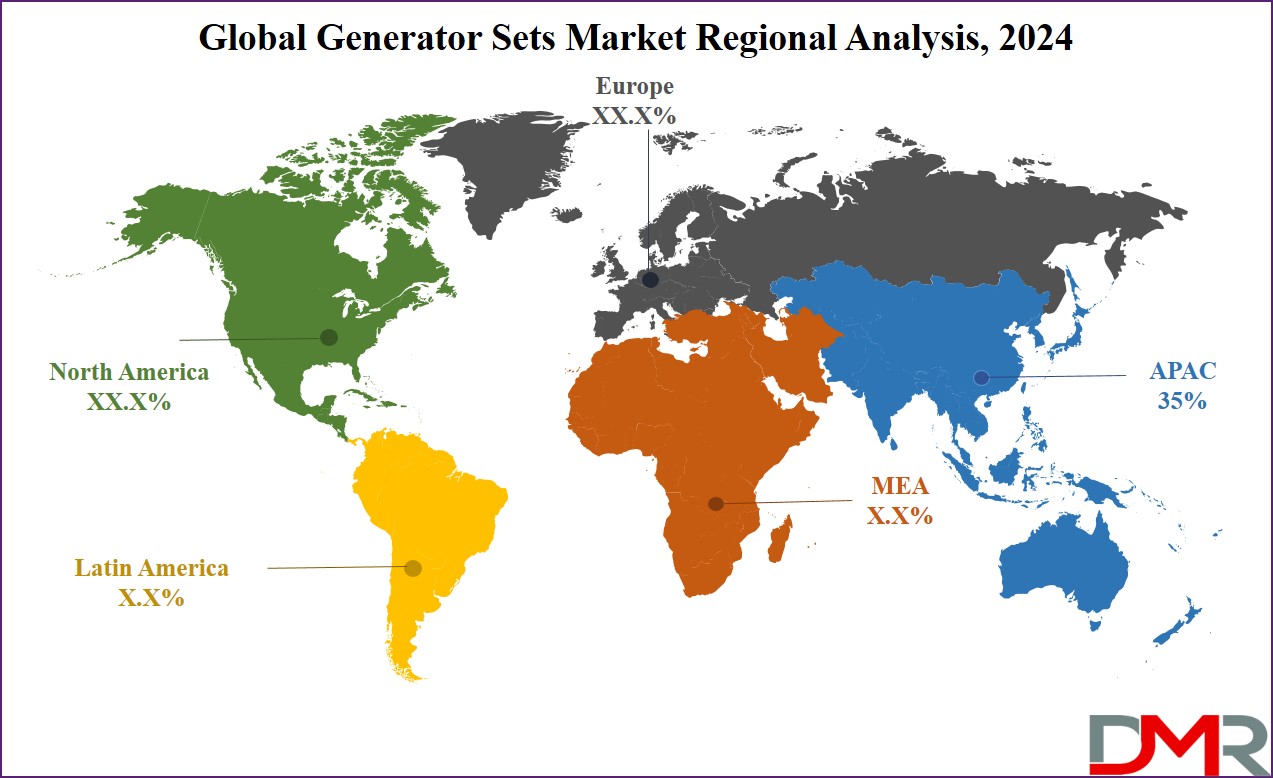

- Key Regions: Asia-Pacific leads the global market with a 35% revenue share, driven by China’s rapid industrialization and infrastructure projects. North America follows with 25%, supported by strong regulatory standards and technological advancements.

- Technological and Regulatory Trends: The market is witnessing a shift towards hybrid and gas-powered generators, driven by technological innovations aimed at improving efficiency and reducing emissions. Regulatory support and incentives are further boosting the adoption of advanced and eco-friendly generator technologies.

Use Cases

- Emergency Backup Power for Healthcare Facilities: Hospitals rely on generator sets to ensure continuous operation of critical medical equipment during power outages.

- Support for Industrial Manufacturing Operations: Manufacturing plants use generators to avoid costly production downtime and maintain operational efficiency during power disruptions.

- Infrastructure Projects and Construction Sites: Generators provide essential power for machinery and temporary facilities on construction sites and infrastructure projects, supporting project timelines.

- Backup Power for Data Centers: Data centers depend on high-power generators to maintain uninterrupted data services and protect sensitive information during power interruptions.

- Residential Emergency Power Solutions: Homeowners use generators to maintain essential services like heating and cooling during outages, particularly in areas prone to extreme weather.

Driving Factors

Need for emergency backup power solutions

Recent statistics demonstrate a surge in global extreme weather events and natural disasters; consequently increasing demand for emergency backup power solutions. According to the International Disaster Emergency Service, disaster events have seen an upsurge of 30 percent over the past 10 years. With their increased vulnerability comes greater investment from both residential and commercial sectors in backup power systems to ensure continuity of operations during power interruptions and lessen their effects. Due to increased awareness about emergency backup solutions' need, the generator sets market is currently experiencing tremendous growth - both businesses and households strive for reliable backup power solutions as safeguards against unexpected power disruptions.

Expanding Manufacturing Activities

Manufacturing activities across multiple regions is another driving factor of the Generator Sets Market. As global industrialization accelerates, new manufacturing facilities and industrial operations are opening in emerging markets around the globe, particularly those serving emerging economies. Statista estimates that global manufacturing output will expand at an estimated compound annual growth rate of 3.2% from 2023-2028, which necessitates reliable power supplies to support continuous production processes - thus driving generator demand. Industries including automotive manufacturing, pharmaceutical production, and food processing that need uninterrupted power access have increasingly invested in generator systems to avoid downtime costs while improving operational efficiencies.

Progresses in Generator Technologies

Technology advancements are revolutionizing the generator sets market, propelling growth through enhanced efficiency, decreased emissions, and enhanced functionality. Recent innovations include hybrid and gas-powered generators that boast superior performance compared to their diesel counterparts. Hybrid generators that combine diesel and battery storage can significantly decrease fuel consumption and emissions while simultaneously providing a reliable power supply. Grand View Research predicts the global hybrid generator market to expand at an anticipated compound annual growth rate of 5.8% between 2024-2030. Advanced remote monitoring and automated load management systems make managing and optimizing generator sets much simpler for their owners, meeting stricter regulatory standards while placing increasing emphasis on sustainability and operational cost reduction - further propelling market expansion.

Growth Opportunities

Demand for Healthcare and Related Services has increased over Time

2023 is witnessing an exponential surge in generator set sales as demand is propelled by healthcare and other essential services, especially healthcare facilities that rely on uninterrupted power for life-saving equipment and patient safety, driving demand for backup generators. This trend is especially prevalent in developing regions, where power reliability remains an issue; global expansion further heightens this need; consequently, there has been an upsurge in generator installations within healthcare settings that serve both emergency and regular operations.

Government Initiatives and Incentives

Government initiatives and incentives are creating enormous opportunities in the Generator Sets Market. Governments across various nations are now offering financial incentives, such as subsidies or tax breaks, to encourage the adoption of advanced and eco-friendly generator technologies that reduce carbon emissions while increasing energy resilience. Countries across Europe have adopted such policies by supporting hybrid or gas-powered generator investments through grants or financial support - this policy-driven push should accelerate adoption, expand market reach, and align solutions with global sustainability objectives.

Focus on Emergency Preparedness

Generator Sets Market opportunities also lie within an increase in disaster preparedness. As natural disasters continue to threaten both public and private sectors, more investments are being made into backup power solutions to strengthen resilience against power outages and ensure continuity during disruptions. Organizations have increasingly implemented advanced generator systems into their disaster readiness strategies to increase resilience against outages; further driving market growth. This trend highlights how essential generator sets can be in mitigating emergency impacts while keeping operational continuity intact during disruptions.

Key Trends

Shifting To Hybrid Solutions

Hybrid generator solutions have emerged as an increasingly popular trend, due to their improved efficiency and lower environmental impact. This shift is being driven by increasing awareness of sustainability as well as operational cost-cutting efforts; hybrid generators offer enhanced fuel efficiency and reduced emissions compared to conventional models, aligning with global efforts against climate change. Recent market research predicts hybrid sales to experience compound annual compound annual growth of 5.8% until 2030 due to increasing adoption across various sectors.

Backup Power Solutions Receive Regulatory Support

Government support of backup power solutions is another significant trend driving market growth. Governments globally are adopting policies and regulations that promote backup power solutions adhering to stringent emissions standards, with financial incentives like tax credits and subsidies to encourage their adoption. Such backing should make advanced generator systems more cost-effective for end-users while fulfilling environmental regulations fueling innovation and driving demand for generators with higher performance and sustainability requirements.

Market Expansion in Asia-Pacific

Asia-Pacific countries are seeing rapid industrialization and urbanization, fuelling market expansion. Countries like China, India, and Southeast Asian nations are investing heavily in infrastructure projects and manufacturing facilities; driving demand for reliable power solutions; while rising middle classes and rising energy needs fuel the Asia-Pacific Generator Sets Market by expanding at an estimated compound annual growth rate of 6.2% from 2023-2028 - this expansion supported by ongoing infrastructure development as well as rising emphasis on improving energy reliability.

Restraining Factors

Market Overcapacity

Overcapacity in the Generator Sets Market poses a substantial restraint, leading to fiercer competition and undercutting profit margins. Due to an influx of generator manufacturers and suppliers entering this sector, supply outweighs demand significantly. This surplus has led to price decreases and an upsurge in marketing activities as companies compete for market share. According to Global Data’s research report on generator markets worldwide, overcapacity had an estimated impact on average selling prices by 5 percent in 2023. While lower prices may benefit consumers, their effects can negatively impact manufacturer profitability and discourage investment in new technologies and innovation. An imbalance between supply and demand creates a difficult environment for companies seeking financial stability and growth.

Environmental regulations are becoming more stringent each year

Environmental regulations are also hindering growth in the Generator Sets Market. Global governments have implemented more stringent emissions standards and environmental regulations in an attempt to combat climate change and limit pollution levels. European Union Stage V emissions standards and similar regulations across other regions require significant cuts in nitrogen oxide (NOx) and particulate matter (PM) emissions from diesel generators. Compliance with these regulations often necessitates substantial investments in new technologies and modifications to existing products, increasing operational costs and burdensome regulations for manufacturers. According to research by the International Energy Agency, meeting new environmental standards can increase generator production costs by as much as 20%.

Fluctuations in Raw Material Prices

Fluctuations in raw material prices further hamper the Generator Sets Market. Essential materials like steel, copper and aluminum have experienced price fluctuations caused by global supply chain disruptions and geopolitical tensions; steel prices saw a 30% jump over one year resulting in higher manufacturing costs for generator sets as a whole - leading to unpredictable production costs leading to higher end user prices; according to Market Watch this has contributed to a 15% surge in generator prices over two years due to raw material cost increases leading to unpredictable production costs resulting in unpredictable production costs as unpredictable production costs lead to unpredictable production costs that impact production costs leading to unpredictable production costs leading to unpredictable production costs which in turn leads higher end user prices leading to higher end-user prices which has resulted in unpredictable production costs leading to unpredictable manufacturing costs which affect both investment decisions as well as growth and profitability.

Research Scope Analysis

By Fuel Type

Diesel generators held the highest market share among all product types within the Generator Sets Market in 2023, representing roughly 55%. Diesel is popularly chosen due to their reliability, high power output, and established infrastructure - making them suitable for applications including industrial backup power needs as well as emergency backup power requirements. Their robust performance even under fluctuating loads makes them especially suitable for environments requiring high operational uptime.

However, gas generators have seen significant market share gains, accounting for 30-35%. Gas generators are increasingly recognized for their lower emissions and environmental impact compared to diesel counterparts; becoming particularly appealing in regions with stringent environmental regulations or where there is pressure for cleaner energy solutions. Natural gas infrastructure development as well as economic benefits associated with using natural gas as a fuel source have further spurred their adoption; which aligns well with global trends towards sustainability and cleaner energy that are expected to fuel further expansion within this segment.

By Power Rating

Low Power Generators held the top market position within the Generator Sets Market with approximately 45% market share In 2023, Low-power generators typically range between 1-20 kVA in output capacity and are often utilized for residential purposes, small businesses, and backup power solutions in less demanding environments due to their cost-effectiveness, compact size, and ease of maintenance; making them especially suitable for intermittent power requirements or regions where affordability and efficiency were crucial components.

Conversely, Medium Power Generators ranging from 20 kVA represent approximately 35% of the market share. Medium power generators play an essential role in applications at small to mid-sized enterprises (SME), commercial establishments, and critical infrastructure that require larger amounts of power supply. Medium power generators offer an optimal balance between power output and operational efficiency that makes them the perfect solution for facilities requiring uninterrupted and reliable power during outages or peak demand periods.

High Power Generators with capacities over 200kVA hold approximately 20% of the market. These generators are typically utilized in large industrial operations, data centers, and critical infrastructure that require high power output with redundancy features. Although their market share may be smaller relative to low and medium-power generators, high-power generators remain indispensable tools for maintaining uninterrupted operations in sectors with extensive power requirements and stringent reliability requirements.

By Application

In 2023, the Industrial segment held the highest market share for Generator Sets Market sales at 50% of total market revenue. Industrial generators play an essential role in large-scale operations like manufacturing facilities, mining operations, and oil and gas industries where reliable power supply is crucial to keeping production going and minimizing downtime. Demand in this sector stemmed from high-capacity generators capable of handling significant loads while operating under difficult conditions for maximum resilience and operational efficiency.

The Commercial segment accounts for roughly 30% of market share. Generators used within commercial establishments such as office buildings, retail shops, and other business establishments typically require backup power during power outages to protect sensitive equipment while providing continuity. Its growth can be seen through its increased reliance on technology while needing uninterrupted power to support vital functions and customer operations.

The Residential segment accounts for roughly 20% of the market share, consisting of generators designed for home use as backup power solutions for households. These generators help provide essential services like heating, cooling, and refrigeration during power outages; their growth is being propelled by rising consumer awareness about its advantages due to extreme weather events or an aging infrastructure.

The Generator Sets Market Report is segmented based on the following:

By Fuel Type

By Power Rating

- Low Power Generator

- Medium Power Generator

- High Power Generator

By Application

- Industrial

- Commercial

- Residential

Regional Analysis

Asia Pacific dominates the global Generator Sets Market with an approximate revenue share of 35%. This region is projected to remain in the lead thanks to several key factors; China being its primary influence. The rapid expansion of commercial office spaces, rising electricity demands, and expanding infrastructure projects and manufacturing facilities necessitate an increasing need for generator sets in China alone, further driving market growth prospects within this region. India and Southeast Asia's urbanization and industrialization further support growth potential within this market segment.

North America accounts for 25% of total market revenue. This region's market is supported by established infrastructure and stringent regulatory standards that encourage the adoption of advanced and efficient generator technologies. The United States stands out as being a market with strong residential backup needs as well as industrial applications for generators; technological innovations and sustainable energy solutions also play a vital role in shaping its market development.

Europe accounts for approximately 20% of the global generator market share and is marked by high demand for eco-friendly and compliant generator solutions due to stringent environmental regulations. Demand is led by countries like Germany, the UK, and France due to their significant industrial bases and focus on carbon emission reduction; furthermore, the European region continues to emphasize sustainability and energy efficiency as key market dynamics.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023 will see significant contributions from multiple key players within the global Generator Sets Market. Each will use its strengths to shape market dynamics. Atlas Copco AB stands out with its dedication to advanced technologies like hybrid power solutions and digital monitoring systems - which align perfectly with market demands for sustainability and efficiency. Caterpillar Inc. holds onto its leadership through an extensive offering of high-power generators and an expansive service network, investing heavily in technology to meet stringent emission standards while simultaneously improving performance. Cummins Inc. increases market presence through innovative diesel and gas generators that emphasize clean energy use while fuel efficiency, taking full advantage of its global reach.

Generac Holdings Inc. plays an invaluable role in both residential and commercial sectors with its user-friendly and cost-effective solutions, designed for ease of use and cost efficiency. Their smart technology advancements and remote monitoring services help meet an increasing need for reliable backup power solutions. General Electric (GE) contributes through high-capacity generators and renewable energy integration, supporting industry efforts toward sustainability. Briggs and Stratton Corporation has become known for producing reliable yet cost-effective generators, emphasizing innovation and customer service. Meanwhile, AKSA Power Generation and Cooper Corporation specialize in high-quality customized generators suitable for various applications that boost competitiveness through customized solutions that expand global reach.

Kohler Co., MTU Onsite Energy, Mitsubishi Heavy Industries Ltd, Doosan Corporation Wartsila Corporation, and Honda Siel Power Products Ltd all contribute to the global Generator Sets Market through their specialized solutions and technological innovations. These companies specialize in high-capacity generators with optimal efficiency and environmental compliance to meet market requirements; these businesses' diverse product portfolios and strategic investments position them well to take advantage of emerging trends while meeting growing market needs; as such they foster both growth and innovation within this space.

Some of the prominent players in the Global Generator Sets Market are:

- Atlas Copoco AB

- Caterpillar Inc.

- Cummins Inc.

- Generac Holdings Inc.

- General Electric

- Briggs and Stratton Corporation

- AKSA Power Generation

- Cooper Corporation

- Kohler Co.

- MTU Onsite Energy

- Mitsubishi Heavy Industries Ltd

- Doosan Corporation

- Wartsila Corporation

- Honda Siel Power Products Ltd.

Recent developments

- In June 2024, Generac Power Systems acquired PowerPlay Battery Energy Storage Systems from SunGrid Solutions, enhancing its energy solutions with advanced battery storage to support efficiency and sustainability.

- In August 2023, Kohler launched the KD Series industrial generators, including the KD700 and KD750, featuring advanced diesel engines that run on renewable Hydrotreated Vegetable Oil (HVO), ideal for critical applications and supported by a global service network.

- In July 2022, Taiwan Power Company awarded Mitsubishi Power, part of Mitsubishi Heavy Industries, contracts for refurbishing the Datan Power Plant in Taoyuan, Taiwan.

- In June 2022, Doosan Enerbility and Siemens Gamesa Renewable Energy signed an MoU to jointly develop Korea’s offshore wind power sector.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 45.4 billion |

| Forecast Value (2032) |

USD 91.5 billion |

| CAGR (2023-2032) |

8.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Fuel Type (Diesel, Gas), By Power Rating (Low Power Generator, Medium Power Generator, High Power Generator), By Application (Industrial, Commercial, Residential) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Atlas Copoco AB; Caterpillar Inc.; Cummins Inc.; Generac Holdings Inc.; General Electric; Briggs and Stratton Corporation; AKSA Power Generation; Cooper Corporation; Kohler Co.; MTU Onsite Energy; Mitsubishi Heavy Industries Ltd; Doosan Corporation Wartsila Corporation; Honda Siel Power Products Ltd. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |