Market Overview

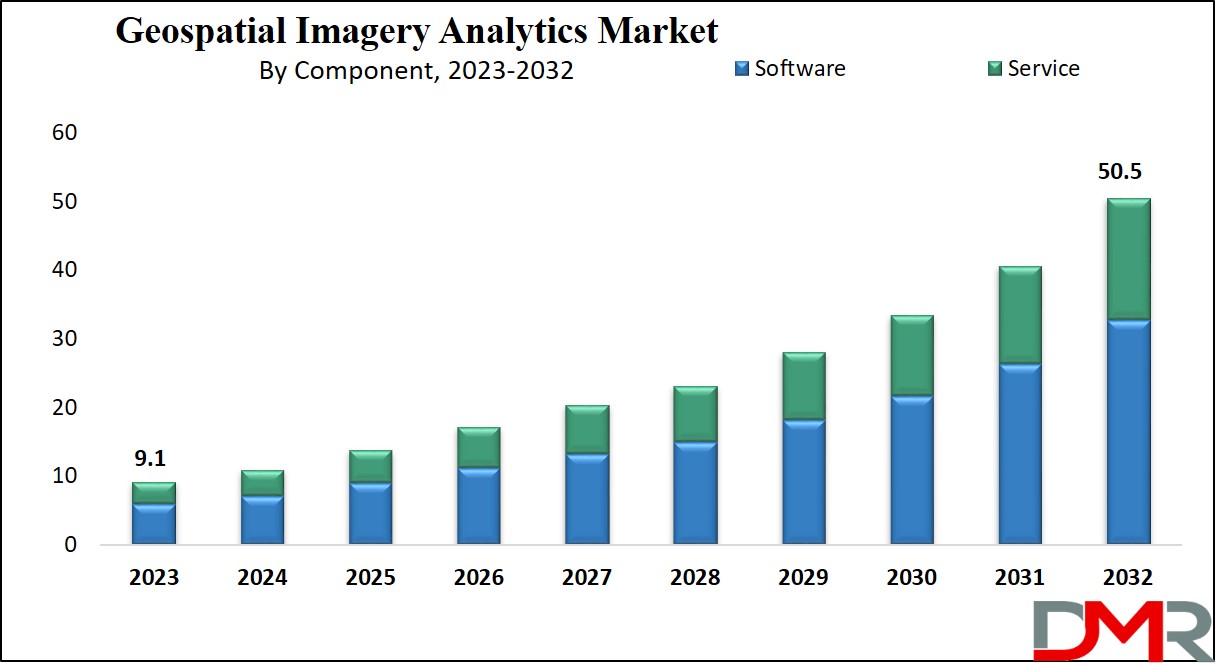

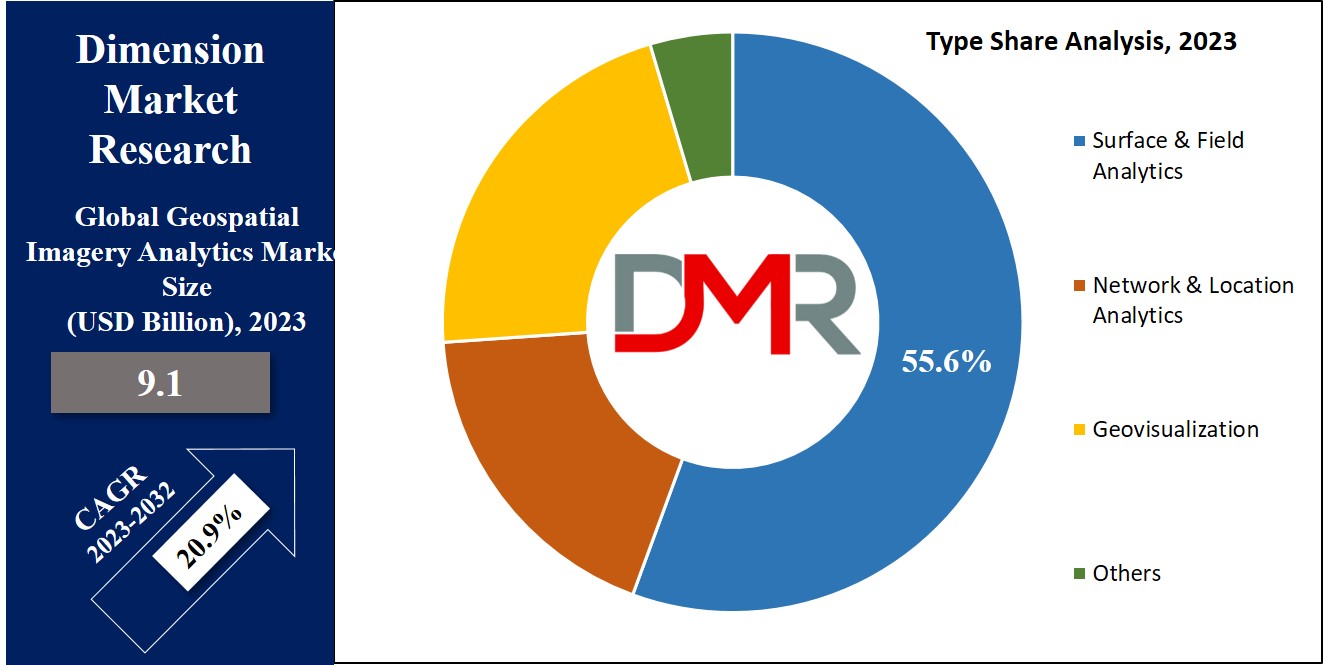

The Global Geospatial Imagery Analytics Market is expected to reach a value of USD 9.1 billion in 2023, and it is further anticipated to reach a market value of USD 50.5 billion by 2032 at a b The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Geospatial imaging analytics includes a set of tools that analyze data from GPS, satellite imagery, or maps to derive valuable insights for important business decisions, which utilizes big data & predictive analytics, benefiting both private & public sectors in decision-making, risk assessment, urban planning, disaster management, & climate analysis, providing more detailed images compared to 2D & 3D analyses.

Key Takeaways

- Market Growth: The global geospatial imagery analytics market is projected to rise from USD 9.1 billion in 2023 to USD 50.5 billion by 2032, reflecting a CAGR of 20.9%.

- Software Leadership: In 2023, the software segment leads in revenue due to growing adoption for business intelligence and applications like environment monitoring and traffic surveillance.

- Service Expansion: Demand for installation, training, and support services is surging as more organizations deploy geospatial analytics solutions, driving rapid growth for the services segment.

- Type Dynamics: Surface and field analytics dominate revenue in 2023 for infrastructure and agriculture, while network and location analytics are growing fastest, optimizing marketing and real-time data visualization.

- End User Trends: Environmental monitoring is the largest and fastest-growing end-user sector, boosted by urgent climate and conservation efforts using satellite imagery and GIS.

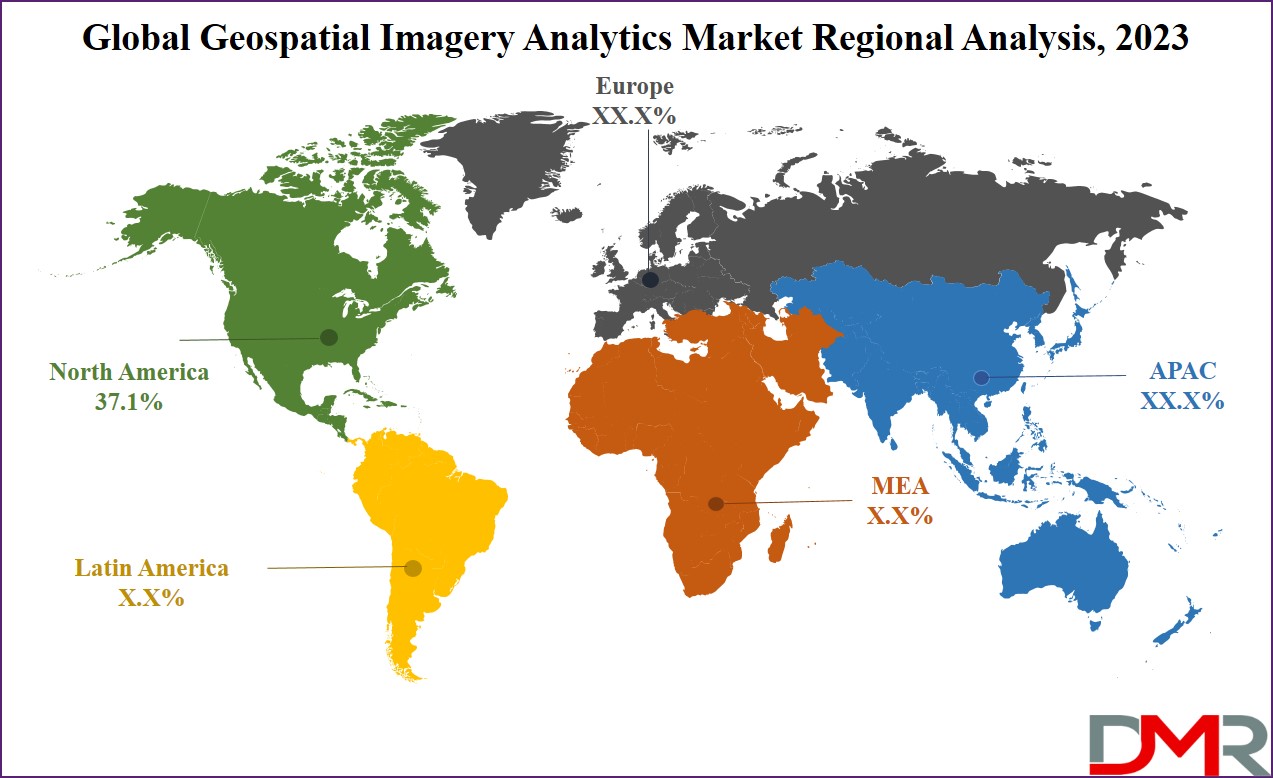

- Regional Insights: North America holds the largest market share (37.1% in 2023), thanks to major corporations and tech investments, with Asia Pacific expected to see strong growth in urban planning and logistics.

- Competitive Landscape: The market is highly competitive, with innovation, partnerships, and product diversification as major strategies. Key players include Microsoft, Google, ESRI, and others.

Use Cases

- Environmental Monitoring: Geospatial imagery analytics enables real-time environmental monitoring, helping agencies track deforestation, climate changes, and support conservation initiatives with actionable data for better decision-making.

- Infrastructure Development: The technology supports infrastructure planning by analyzing land surfaces, assessing water flow, and designing drainage systems for efficient and sustainable urban development.

- Agriculture Optimization: Farmers and agribusinesses utilize geospatial analytics to monitor soil erosion, assess crop health, and optimize resource allocation, improving yields and reducing environmental impact.

- Disaster Management: Emergency services use geospatial imagery for rapid assessment and response, improving coordination during natural disasters like floods, hurricanes, and wildfires for risk mitigation and recovery.

- Marketing & Retail: Organizations harness location analytics to optimize marketing, tailor promotions, and identify new market opportunities by understanding customer movement and preferences in various locations.

- Logistics & Transportation: Geospatial systems streamline logistics through route optimization, live tracking, and improved fleet management, supporting faster and more cost-effective transportation solutions.

Market Dynamic

The rapid development of analytics technology stands as the key driving force behind the global geospatial imagery analytics market's growth, with the growth in demand for geospatial imaging analytics propelled by the abundance of data from diverse sources like global navigation satellite systems, satellite remote sensing, aerial surveys, digital cameras, radar, & LiDAR. Deep learning &

artificial intelligence (AI) play an important role in automating the recognition of objects & patterns within satellite imagery.

However, strict government regulations pose a restraint to market expansion. On the flip side, the growth in adoption of location-based services is anticipated to fuel market growth over the projected period, as businesses & consumers alike recognize the value of location-based data & services for different applications.

Research Scope and Analysis

By Component

In terms of component, the software segment takes the lead in revenue contribution in 2023, majorly because businesses the growing in the adoption of software solutions to acquire location-based Business Intelligence (BI), allowing more informed decision-making, which is further propelled by the growing adoption of analytics software for purposes like forest management, environment monitoring, and traffic surveillance. In addition, the emergence of 4-dimensional GIS software augments the growth prospects of the software segment.

Further, the services segment is anticipated to witness rapid expansion during the forecast period, which can be attributed to the increase in demand for installation, training, & support services, which is driven by the rise in deployment of software & solutions. Government agencies & public safety organizations are using analytics for natural resource monitoring, infrastructure projects, border security, & vehicle safety enhancements. Further, companies are introducing Geospatial Analytics-as-a-Service to meet changing market demands.

By Type

In 2023, the surface and field analytics segment take the lead in revenue generation, highly due to its widespread adoption by government entities & private companies for many applications, like infrastructure development projects, water flow assessment, & the design of drainage systems, which is also instrumental in agriculture for analyzing topsoil erosion.

Further, the network & location analytics segment is anticipated to experience the fastest growth in the foreseeable future. Its rising popularity is driven by its increased utilization in optimizing marketing strategies and creating highly personalized promotional content. Location plays a pivotal role in geospatial analytics, enhancing the functionality and relevance of data analysis. It also enables real-time data organization and visualization, offering valuable insights and patterns for effective marketing activities, essential for expanding operations, exploring new markets, and achieving customer satisfaction.

By End User

The environmental monitoring sector stands out as the leading revenue generator in 2023 and is projected to show the most rapid growth in the future. The increasing concerns over environmental issues, like global warming, have increased the demand for geospatial technologies like Remote Sensing (RS) & Geographic Information Systems (GIS) for effective monitoring of environmental changes. These technologies use satellite imagery to map & assess the Earth's surface, aiding in the analysis of geospatial images to comprehend the impact of human activities on the environment. This valuable insight catalyzes conservation & preservation initiatives, addressing growing environmental apprehensions.

The Geospatial Imagery Analytics Market Report is segmented on the basis of the following

By Component

By Type

- Surface & Field Analytics

- Network & Location Analytics

- Geovisualization

- Others

By End User

- Environmental Monitoring

- Defense & Security

- Energy & Utility

- Engineering & Construction

- Others

Regional Analysis

The North American region maintains its dominant position in the global geospatial imagery analytics market, holding a significant

share of 37.1% in 2023, which can be attributed to the presence of large corporations & growing investments in advanced satellite systems. Further, the rapid adoption of technologies like

machine learning, big data, & cloud computing is expected to drive market growth in this region by improving data analysis & utilization.

Also, the Asia Pacific region is anticipated to have significant market growth in the coming years, which is primarily driven by the growth in development projects driven by the growing demand for geospatial imagery analytics, mainly for urban planning in emerging economies. In addition, the rising need for location-based services & real-time information, along with the expanding e-commerce sector, is allowing the integration of geospatial imagery analytics systems, majorly for logistics & transportation requirements in the Asia Pacific region.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global geospatial imagery analytics market is highly competitive, characterized by many players offering diverse solutions, as key players focus on innovation, technology partnerships, & global expansions to gain a competitive edge. Small & niche players specialize in specific industry verticals, to meet the unique customer needs. The market is dynamic, with constant advancements, strategic collaborations, & product diversification driving competition and growth.

For instance, in July 2023, the global spatial technology provider, Locana, announced its partnership with OpenStreetMap US, an NGO committed to developing the OpenStreetMap (OSM) project. OSM's mission is to enhance access to top-notch geographical data, lessen the expenses associated with location intelligence, & empower a wide range of organizations to harness valuable insights from location data.

Some of the prominent players in the global Geospatial Imagery Analytics Market are:

- Microsoft

- Google

- ESRI

- UrtheCast

- Hexagon AB

- Oracle

- Geocento

- OneView

- Mapidea

- Hydrosat

- Other Key Players

Recent Developments

- In December 2024, Hexagon AB launched the HxGN Content Program, expanding its high-resolution geospatial data products for environmental monitoring and urban planning.

- In October 2024, Esri introduced new AI-powered geospatial analysis tools at the Esri User Conference, enhancing automation in geospatial data analysis.

- In September 2024, Planet Labs launched a new series of high-resolution satellite imagery products focused on climate research and disaster recovery applications.

- In August 2024, DeepMatrix, a geospatial analytics startup, raised $1.6 million in Pre-Series A funding led by YourNest and Arali Ventures to scale its SaaS offerings globally.

- In April 2024, Descartes Labs, a US-based geospatial analytics firm, acquired Geosite to strengthen its geospatial intelligence platform and analytics capabilities.

- In October 2024, EarthDaily Analytics acquired Descartes Labs, enhancing EarthDaily’s core geospatial AI capabilities and access to new industry verticals.

- In September 2024, Hexagon AB released new on-demand 2D and 3D geospatial data products and expanded delivery options for its HxDR platform.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 9.1 Bn |

| Forecast Value (2032) |

USD 50.5 Bn |

| CAGR (2023-2032) |

20.9% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software and Service), By Type (Surface & Field Analytics, Network & Location Analytics, Geovisualization, and Others), By End User (Environmental Monitoring, Defense & Security, Energy & Utility, Engineering & Construction, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Microsoft, Google, ESRI, UrtheCast, Hexagon AB, Oracle, Geocento, OneView, Mapidea, Hydrosat, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Geospatial Imagery Analytics Market size is estimated to have a value of USD 9.1 billion in

2023 and is expected to reach USD 50.5 billion by the end of 2032.

North America has the largest market share for the Global Geospatial Imagery Analytics Market with a

share of about 41.2% in 2023.

Some of the major key players in the Global Geospatial Imagery Analytics Market are Volvo, ZF, Intel,

and many others.

The market is growing at a CAGR of 20.9 percent over the forecasted period.