Market Overview

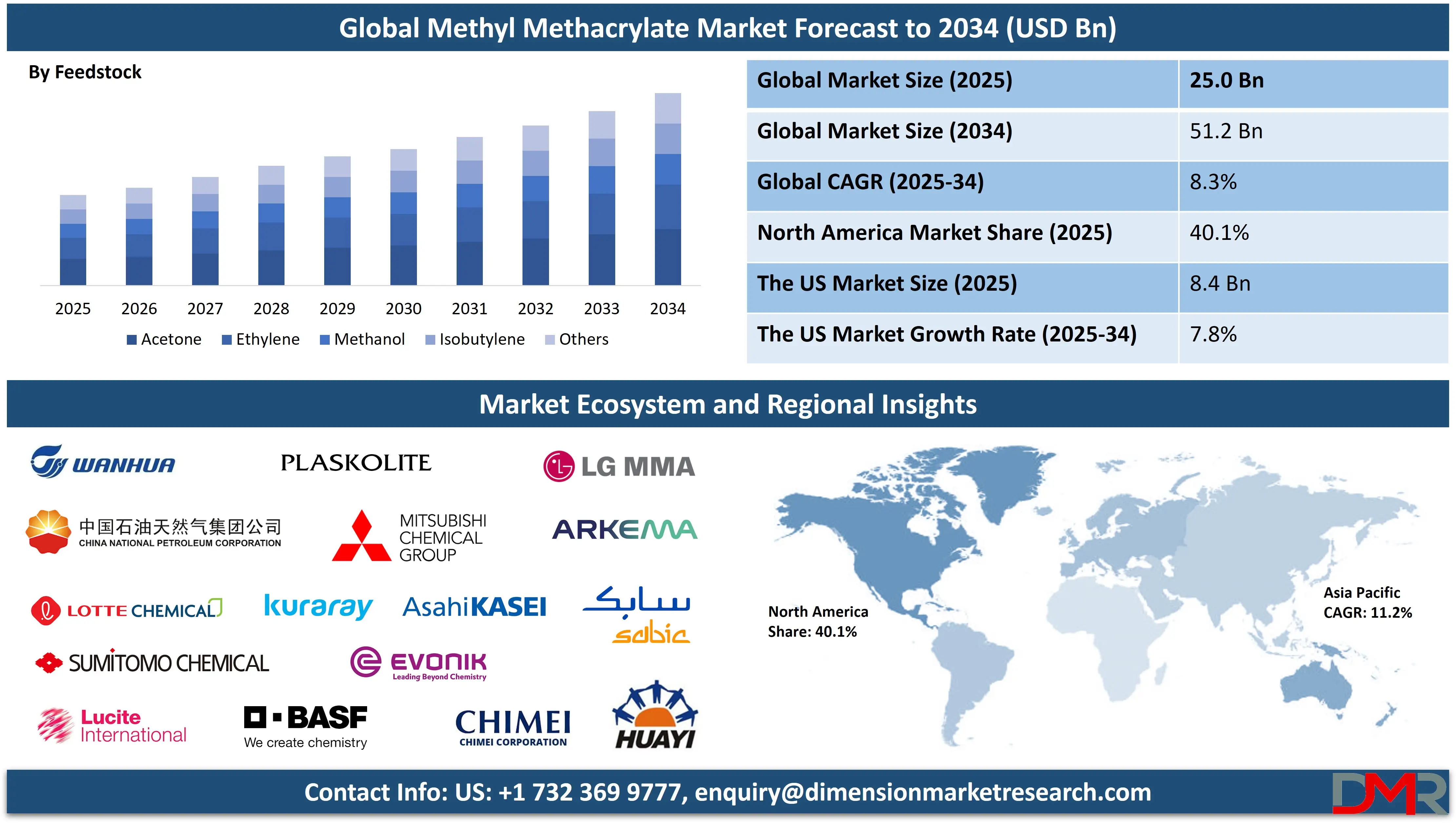

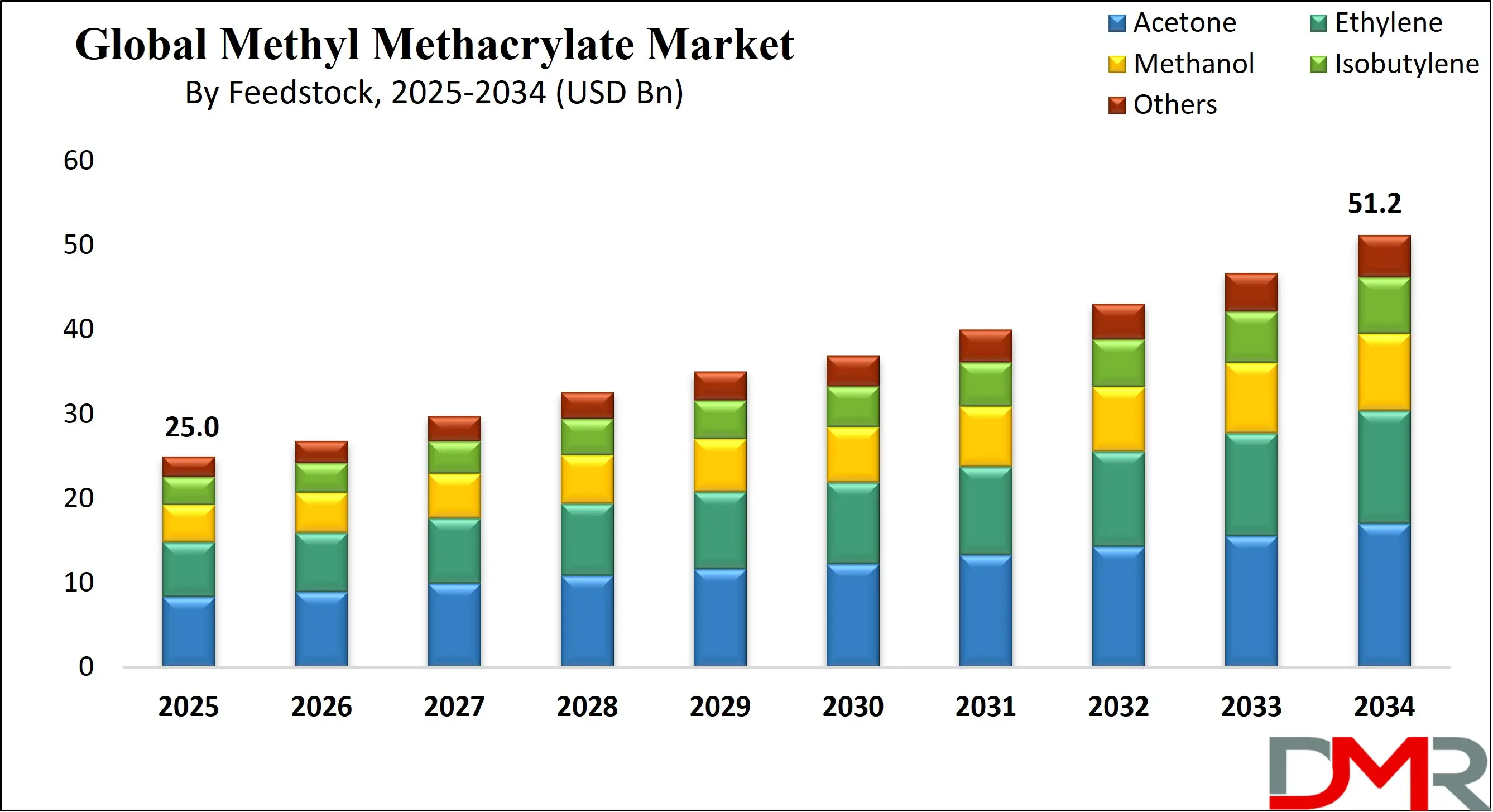

The Global Methyl Methacrylate Market is projected to reach USD 25.0 billion in 2025 and grow at a compound annual growth rate of 8.3% from there until 2034 to reach a value of USD 51.2 billion.

The global methyl methacrylate market is steadily growing, driven by the rising demand for advanced polymers such as polymethyl methacrylate (PMMA), used extensively in construction, automotive lighting, signage, and medical applications. As industries shift towards lightweight, durable, and weather-resistant materials, MMA has become a key building block in producing transparent plastics, specialty coatings, and adhesives. Innovation in sustainable feedstocks like methanol, ethylene, and bio-based raw materials is promoting more eco-friendly production techniques and aligning with green chemistry trends.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One significant market trend is the transition towards circularity, especially in Europe and Asia, where companies are developing chemical recycling technologies to convert post-consumer PMMA into virgin-grade MM. MM This not only reduces dependency on fossil-based raw materials but also meets the growing demand for low-carbon manufacturing. Moreover, growth prospects are strong in emerging economies such as India, China, and Southeast Asia, where infrastructure development and urbanization drive demand for MMA-based products in construction, electronics, and healthcare.

Despite these opportunities, the market faces some restraints, particularly due to regulatory challenges. Environmental regulations in North America and Europe are tightening, focusing on VOC emissions and occupational exposure limits. Compliance often requires expensive process upgrades and emission control systems, which can raise operational costs. Volatility in crude oil prices also affects feedstock availability and pricing, adding another layer of uncertainty to supply chains.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Nonetheless, global production is scaling up, and new capacity additions in Asia-Pacific are set to meet the growing demand. With continued investments in sustainable chemistry, advanced formulations, and downstream applications, the methyl methacrylate market is well-positioned for robust long-term growth.

The US Methyl Methacrylate Market

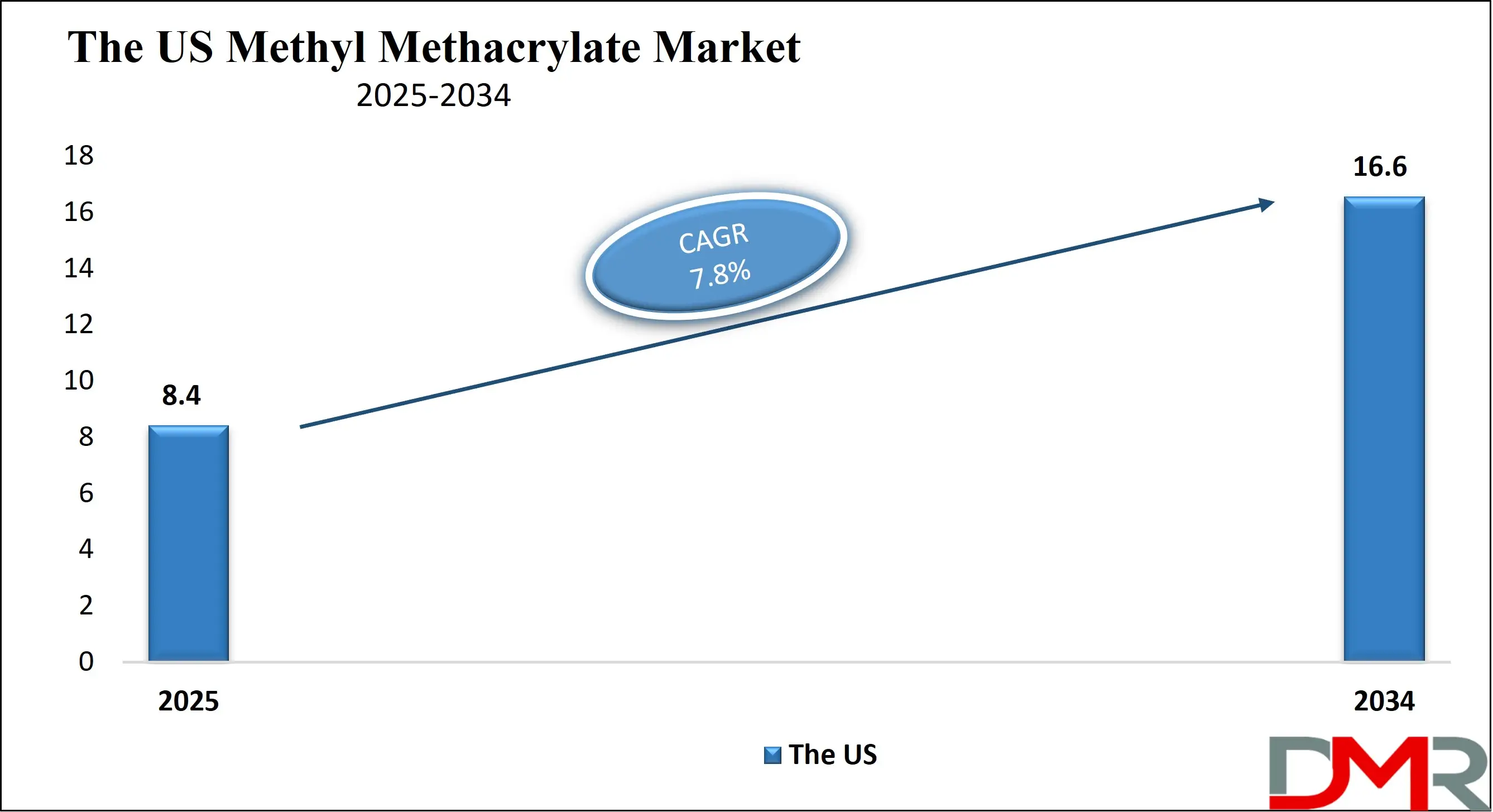

The US Methyl Methacrylate Market is projected to reach USD 8.4 billion in 2025 at a compound annual growth rate of 7.8% over its forecast period.

The United States methyl methacrylate market is a mature and strategically important segment of the nation’s chemical industry. MMA is widely used in producing durable acrylic sheets, coatings, adhesives, and orthopedic materials. Industrial clusters in Texas and Louisiana contribute significantly to domestic production, benefiting from abundant access to feedstocks such as acetone and ethylene.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Historically, the U.S. has maintained a strong export profile. Even in the early 1990s, the country exported over 100 million pounds of MMA while keeping imports low. Today, the U.S. continues to be a key player globally due to its well-established petrochemical infrastructure and innovation in green technologies.

Regulatory bodies such as the Environmental Protection Agency (EPA) have instituted strict standards on volatile organic compound (VOC) emissions and workplace safety, driving technological upgrades in MMA production. The EPA recognizes methyl methacrylate’s potential respiratory and skin irritant effects and has set an inhalation reference concentration to protect workers in manufacturing environments.

From a demographic standpoint, growing urban populations and increased investment in healthcare infrastructure are fueling demand for MMA in construction and medical devices. The rising use of PMMA in noise barriers, energy-efficient windows, and signage supports growth in both commercial and residential sectors.

Government-backed R&D programs and strong collaborations between industry and institutions continue to support the development of circular solutions, such as MMA recycling and bio-based MMA synthesis. These initiatives position the U.S. market as both environmentally conscious and economically robust, capable of weathering raw material volatility and global competition.

The European Methyl Methacrylate Market

The European Methyl Methacrylate Market is estimated to be valued at USD 3.7 billion in 2025 and is further anticipated to reach USD 5.3 billion by 2034 at a CAGR of 4.0%.

Europe's methyl methacrylate market is highly advanced, driven by its commitment to sustainable industrial practices, technological leadership, and regulatory compliance. Countries like Germany, France, and the Netherlands are key production hubs, supplying MMA for automotive, construction, and medical applications across the continent.

Recent initiatives align with the EU Green Deal and Circular Economy Action Plan, promoting the use of recycled MMA from post-consumer PMMA products. An estimated 470,000 tons of MMA are produced annually in the EU, with over two-thirds consumed domestically. Recycling of PMMA into MMA is gaining traction in construction components like kitchen sinks, bathtubs, and façade cladding sectors that generate significant waste volumes.

Europe is also one of the leading regions in deploying low-VOC MMA binders in paints, sealants, and adhesives. The EU’s stringent REACH and CLP regulations drive continuous improvement in product safety, emissions control, and lifecycle performance. These legal frameworks require companies to adopt best available techniques (BAT) for emissions and process efficiency.

Demographically, an aging population supports growing demand for MMA-based bone cement in joint replacements and dental prosthetics. In addition, the region's advanced manufacturing base facilitates the production of optical-quality PMMA for lighting, glazing, and high-end consumer electronics.

With supportive policies, established R&D capabilities, and a proactive stance on sustainability, Europe is well-positioned to lead innovation in MMA production and recycling. The combination of regulatory stability, internal demand, and technological excellence makes Europe a resilient and forward-looking market.

The Japan Methyl Methacrylate Market

The Japan Methyl Methacrylate Market is projected to be valued at USD 1.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.3 billion in 2034 at a CAGR of 5.0%.

Japan’s methyl methacrylate market is deeply embedded in its high-precision manufacturing ecosystem, supporting industries such as electronics, automotive, optics, and healthcare. Domestic producers are recognized for developing high-purity MMA and PMMA used in displays, optical lenses, and medical devices.

Japan maintains a strong export profile, with regulatory oversight from the Ministry of Economy, Trade and Industry (METI) ensuring fair trade and anti-dumping compliance. The country’s industrial strategy prioritizes advanced material science, positioning MMA as a key component in producing lightweight, durable, and high-performance materials.

Environmental responsibility is central to Japan’s chemical sector. Stringent air and water quality regulations have pushed manufacturers to invest in clean production technologies and emission mitigation systems. Companies are optimizing catalyst efficiencies and transitioning to low-waste ethylene and isobutylene-based production methods to enhance process sustainability.

A key demographic factor influencing MMA demand is Japan’s aging population. This drives consistent demand for medical-grade MMA in orthopedic cement and dental materials. Hospitals and clinics rely on MMA-based products for their safety, effectiveness, and long service life.

In electronics, Japan’s reputation for premium displays and camera systems supports demand for optical-grade PMMMMA derivatives are also used in scratch-resistant coatings, light guides, and flexible optical films applications crucial to the country's leadership in consumer electronics.

In conclusion, Japan’s MMA market benefits from world-class technology, stringent regulatory compliance, and strong demand across medical, optical, and industrial applications. Its emphasis on sustainable manufacturing, precision engineering, and product quality ensures long-term resilience and global competitiveness.

Global Methyl Methacrylate Market: Key Takeaways

- Global Market Size Insights: The Global Methyl Methacrylate Market size is estimated to have a value of USD 25.0 billion in 2025 and is expected to reach USD 51.2 billion by the end of 2034.

- The US Market Size Insights: The US Methyl Methacrylate Market is projected to be valued at USD 8.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 16.6 billion in 2034 at a CAGR of 7.8%.

- Regional Insights: North America is expected to have the largest market share in the Global Methyl Methacrylate Market with a share of about 40.1% in 2025.

- Key Players: Some of the major key players in the Global Methyl Methacrylate Market are Mitsubishi Chemical Group Corporation, Evonik Industries AG, LG Chem Ltd., Sumitomo Chemical Co., Ltd., Dow Inc., BASF SE, Lucite International Ltd., Arkema S.A., Asahi Kasei Corporation, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025.

Global Methyl Methacrylate Market: Use Cases

- Acrylic Glazing in Construction: MMA-derived PMMA is used in skylights, windows, and noise barriers. It offers exceptional UV resistance, weather durability, and optical clarity. Architects and builders prefer it for lightweight, sustainable construction that enhances energy efficiency and natural lighting in green buildings.

- Automotive Lighting Components: Tail lights, indicator lenses, and headlamp covers are increasingly made using MMA-based polymers. These parts offer superior impact strength, weather resistance, and optical precision, making them ideal for high-performance and electric vehicles prioritizing weight reduction and design flexibility.

- Bone Cement in Orthopedics: MMA is a core material in medical-grade bone cement used in joint replacement surgeries. It offers biocompatibility and mechanical stability, allowing for long-lasting fixation of implants like hip and knee prostheses. It plays a vital role in aging populations with rising joint disorders.

- Display and Optical Films in Electronics: Smartphones, tablets, and LED screens use MMA-based coatings and films for surface protection and optical enhancement. These films offer transparency, impact resistance, and touch-sensitivity, supporting the production of durable, high-quality consumer electronic devices.

- Surface Coatings and Industrial Sealants: Industrial floors, bridges, and concrete structures benefit from MMA in high-performance coatings and adhesives. These applications provide fast curing, chemical resistance, and long-term durability, crucial for infrastructure exposed to wear, temperature extremes, and corrosive substances.

Global Methyl Methacrylate Market: Stats & Facts

U.S. Environmental Protection Agency (EPA)

- The EPA has established an inhalation reference concentration (RfC) for methyl methacrylate at 0.7 mg/m³. This value is designed to protect against respiratory irritation over a lifetime of continuous inhalation exposure in both occupational and environmental settings.

- MMA is classified by the EPA as "not likely to be carcinogenic to humans" (Group E), based on extensive studies in laboratory animals that did not show cancerous effects.

- Chronic exposure studies in animals showed no evidence of cancer, reinforcing the EPA's position that MMA is non-carcinogenic under normal exposure levels.

- Cases of acute irritation involving the eyes, skin, and mucous membranes have been reported in occupational settings involving MMA, prompting safety guidelines on personal protective equipment and ventilation.

- The EPA has documented neurological symptoms, such as headaches and lethargy, associated with high-concentration short-term MMA exposure.

- In 1974, U.S. industrial facilities emitted an estimated 7.9 million pounds of MMA, according to EPA data, underscoring the importance of air quality management practices.

- The emissions factor for MMA production via the acetone cyanohydrin process is 0.08 pounds of VOCs per ton of product. This forms the basis for air emissions reporting and regulatory controls.

- The EPA targeted reinforced-plastics facilities in its regulatory scope, estimating that new VOC and Hazardous Air Pollutants (HAPs) standards could cut HAP emissions by 7,682 tons/year or about 43%, reducing health risks significantly.

EPA IRIS & Toxicological Reviews

- EPA's Integrated Risk Information System (IRIS) reaffirmed its classification of MMA as non-carcinogenic in its 1998 toxicological review, supporting its use under controlled exposure conditions.

- Chronic inhalation studies identified a No Observed Adverse Effect Concentration (NOAEC) at 104 mg/m³ in rat models, indicating that long-term exposure below this level poses minimal health risks.

- Benchmark dose modeling was employed in deriving the RfC, ensuring a scientifically rigorous risk assessment for MMA inhalation.

European Chemicals Agency (ECHA) / REACH

- The European Economic Area (EEA) records annual MMA manufacturing and import volumes ranging from 100,000 to 1,000,000 tonnes, making it a major industrial chemical under REACH registration.

- In 2021, ECHA updated MMA's classification to Category 1 for respiratory sensitization due to verified occupational asthma cases during controlled inhalation testing.

- ECHA notes that 52% of MMA consumption in Europe is used to produce polymethyl methacrylate (PMMA), demonstrating its dominance in polymer applications.

Canadian Federal Health Agencies

- Canada does not produce MMA domestically and relies entirely on imports. In 1988, Canada imported 20 kilotonnes, projected to reach 24 kilotonnes by 1993, highlighting its industrial dependence.

- Environmental risk assessments concluded that MMA concentrations in surface water are a million times lower than the threshold for toxicity to aquatic life.

- Human exposure levels were found to be 100 million times below the daily intake amount associated with chronic toxicity, demonstrating minimal risk to public health.

- MMA has a short atmospheric half-life ranging from 1.1 to 9.7 hours, suggesting rapid degradation and low persistence in the environment.

U.S. EPA ChemExpo / NIOSH

- MMA is widely used in industrial categories such as cleaning products, electronics, and pharmaceuticals, as identified in the EPA ChemExpo database.

- The NIOSH Pocket Guide specifies a Permissible Exposure Limit (PEL) for MMA at 100 ppm or 410 mg/m³ as an 8-hour time-weighted average. This provides a benchmark for occupational safety protocols.

ICIS / European Industry Data

- ICIS and other European industrial sources confirm that 52% of MMA produced in Europe is converted into PMMA for use in automotive, signage, and construction sectors.

- Annual MMA production in Europe exceeds 470,000 tonnes, underscoring the region's manufacturing capacity and market relevance.

- European pilot initiatives aim to chemically recycle 5,000 tonnes/year of PMMA into virgin-grade MMA, promoting circular economy practices.

- Europe manufactures over 1.5 million PMMA-based kitchen sinks and bathroom fixtures annually, with each item typically containing 20% to 30% MMA.

Market Dynamics & Supply Chain Events

- In early 2024, a critical shortage of MMA occurred in Europe due to Red Sea shipping disruptions, delaying feedstock supplies and straining regional inventories.

- This shortage caused European spot prices of MMA to spike to EUR 3,125/tonne in August 2024, before falling to EUR 1,920/tonne by December as supply conditions normalized.

- Germany leads MMA demand in the EU, accounting for approximately 23.5% of total consumption, driven by its automotive and construction sectors.

Canada Environmental Protection Data

- Canadian estimates based on U.S. Toxic Release Inventory data suggest that 0.46% of total MMA production is lost to emissions in air, water, or soil.

- MMA evaporates rapidly from surface waters; in a 1-meter-deep river, the estimated evaporation half-life is about 6.3 hours.

- Photolysis in the ambient atmosphere degrades MMA within a few hours during summer and a few days in winter, supporting its classification as non-persistent.

Global Methyl Methacrylate Market: Market Dynamics

Driving Factors in the Global Methyl Methacrylate Market

Expansion of the Global Automotive and Construction Sectors

The expanding global automotive and construction industries are two major growth drivers for the MMA market. In automotive manufacturing, MMA is extensively used in the production of PMMA for rear lamps, indicator covers, windshields, and sunroofs due to its lightweight, UV resistance, and clarity. As electric vehicle production surges globally, particularly in Asia Pacific and Europe, demand for lighter and energy-efficient components is accelerating MMA consumption. Similarly, in construction, MMA-based resins are essential in surface coatings, adhesives, and architectural glass panels. The rise of urbanization and smart infrastructure projects across emerging economies, especially India, Indonesia, and parts of Africa, is further boosting demand. This structural growth is compounded by increasing renovation activity in mature markets such as North America and Western Europe, where MMA-based sealants and paints are preferred for their durability and environmental resistance.

Technological Advancements in Polymerization and Recycling Processes

Technological innovations are driving cost efficiency and expanding application scope for MMBreakthroughs in catalytic polymerization have improved the efficiency and environmental safety of MMA production. Simultaneously, advanced depolymerization and thermal cracking technologies are being adopted to enable the chemical recycling of PMMA back into MMA monomer, supporting a digital circular economy. This is especially relevant in Europe, where recycling mandates under the EU Green Deal are driving innovation. Companies are exploring closed-loop MMA recovery systems in signage, automotive trims, and electronics. Such processes not only reduce environmental impact but also allow manufacturers to offset feedstock costs and reduce waste. The growing integration of Industry 4.0 technologies like Artificial Intelligence and real-time analytics in MMA production plants is also improving yield, operational efficiency, and quality consistency.

Restraints in the Global Methyl Methacrylate Market

Volatility in Raw Material Prices and Feedstock Availability

The MMA market is heavily dependent on petrochemical feedstocks such as acetone, methanol, ethylene, and isobutylene. Fluctuations in global crude oil prices directly affect the cost of these raw materials, creating pricing uncertainty for MMA producers. Geopolitical instability (e.g., sanctions on Russia), OPEC output adjustments, or logistical issues like the Red Sea shipping crisis have led to significant input cost surges. Feedstock bottlenecks also result from refinery shutdowns, supply-chain disruptions, and environmental regulations in countries like China, where carbon emission limits have curtailed upstream chemical production. These cost pressures often cannot be fully passed onto end-users, squeezing producer margins and delaying project expansions. Moreover, reliance on a few global players for key feedstocks increases market vulnerability to monopoly pricing or trade disruptions.

Regulatory Constraints and Environmental Concerns

MMA and its derivatives are subject to rigorous regulatory scrutiny due to concerns about toxicity, VOC emissions, and occupational hazards. In the EU, MMA has been classified as a respiratory sensitizer under REACH since 2021, placing stricter compliance burdens on manufacturers. Similarly, the U.S. EPA and OSHA have established occupational exposure limits, requiring continuous air monitoring and costly mitigation technologies. Regulatory compliance costs and liabilities related to worker safety, emissions control, and waste treatment can significantly elevate operational expenses. In addition, public sentiment around plastic pollution and synthetic polymers is driving legislation favoring biodegradable alternatives, which could suppress demand for MMA-based plastics. Environmental organizations have also raised concerns about PMMA's end-of-life challenges, prompting policymakers to push for mandatory recycling targets or material substitution in key sectors.

Opportunities in the Global Methyl Methacrylate Market

Rising Demand for MMA in Medical and Healthcare Applications

Methyl methacrylate is increasingly finding use in medical-grade polymers and prosthetics, opening a promising avenue for future market expansion. Its biocompatibility, mechanical stability, and optical clarity make MMA-based polymers ideal for use in intraocular lenses, bone cement, dental prosthetics, and orthopedic implants. With a growing global elderly population, particularly in developed economies such as Japan, Germany, and the U.S., the demand for advanced medical materials is steadily rising. Moreover, the surge in minimally invasive surgeries and customized 3D-printed prosthetics is increasing the need for specialty-grade PMMA, thus stimulating MMA consumption. MMA’s role in producing medical device housings and diagnostic equipment panels has also grown since the COVID-19 pandemic. Regulatory approvals and certifications in healthcare markets remain a barrier, but also create high-margin opportunities for manufacturers able to meet stringent compliance standards.

Growing Electronics and Optical Applications in Asia-Pacific

Asia-Pacific, led by China, South Korea, and Taiwan, is the epicenter of global electronics manufacturing and a critical growth zone for MMMMA-based PMMA is used in light guides, optical fibers, LED panels, display screens, and protective casings. The proliferation of smart gadgets, televisions, smartphones, and wearable tech continues to boost MMA consumption. Moreover, MMA's use in protective films, optical lenses, and transparent displays positions it as a high-value material in 5G and AR/VR device components. Government incentives in countries like China for expanding domestic chip and display manufacturing capacities are further increasing regional MMA demand. Additionally, PMMA's anti-glare, UV-resistance, and high-luminosity properties make it ideal for applications in solar panels and vehicle HUDs (Heads-Up Displays), expanding downstream utility across sustainable energy and intelligent transport systems.

Trends in the Global Methyl Methacrylate Market

Shift Toward Bio-Based MMA Production

One of the most prominent trends shaping the MMA market is the global pivot toward sustainable and bio-based alternatives to traditional petrochemical feedstocks. With increasing regulatory pressure and consumer demand for environmentally friendly products, manufacturers are investing heavily in the development of bio-based MMA using renewable resources such as glycerol, plant oils, and biomass. Companies like Röhm, Mitsubishi Chemical, and Arkema are piloting bio-based MMA plants in Europe and These alternatives aim to reduce greenhouse gas emissions, minimize environmental toxicity, and decrease dependence on fossil fuels. While still in early commercial stages, bio-based MMA is poised to disrupt the market, especially in regions with stringent carbon-neutrality goals such as the EU and Japan. Though production costs remain higher, the long-term viability and potential for eco-certification in end-use industries (like automotive, electronics, and consumer goods) are driving interest.

Integration of MMA in Advanced PMMA Composites

PMMA (polymethyl methacrylate) demand is rising due to its integration in lightweight, durable, and optically clear components. The trend toward advanced PMMA composites is particularly strong in the automotive and electronics sectors, where MMA-derived materials are replacing traditional glass and polycarbonate due to better light transmission, weather resistance, and processability. Emerging applications include solar panels, automotive glazing, medical devices, and LED screens. The rapid rise of electric vehicles (EVs) and smart consumer electronics has expanded the use of high-purity MMA for lightweight, high-clarity displays and panels. Furthermore, advanced extrusion and co-polymerization techniques are enabling enhanced customization of MMA-based materials for niche engineering purposes.

Global Methyl Methacrylate Market: Research Scope and Analysis

By Feedstock Analysis

Acetone is projected to dominate the feedstock in the production of Methyl Methacrylate (MMA) due to its high availability, cost-effectiveness, and chemical compatibility in the acetone cyanohydrin (ACH) process, historically the most widely used manufacturing route for MMA. This process involves reacting acetone with hydrogen cyanide to form acetone cyanohydrin, which is subsequently converted into MMA. The global chemical industry has developed deep infrastructure for acetone production, largely as a byproduct of phenol manufacturing, ensuring a stable and abundant supply chain. Acetone's relatively low price and high reactivity make it an economically viable option for large-scale MMA producers, especially in North America and parts of Asia.

Additionally, acetone-based processes benefit from mature operational models, established regulatory frameworks, and extensive industrial know-how, making them easier to optimize and scale. The ACH route, although facing environmental and safety challenges due to hydrogen cyanide use, still holds a competitive edge in terms of output volume and process stability. Recent innovations in waste recovery and emissions control have made this method more sustainable, helping acetone retain its lead.

Emerging feedstocks like ethylene and methanol are gaining traction, particularly in China, where cleaner technologies are prioritized. However, they remain less dominant due to higher capital expenditure and technical complexity. As a result, acetone continues to be the backbone of MMA production, especially where legacy plants and infrastructure favor its use, maintaining its leadership position in global feedstock share.

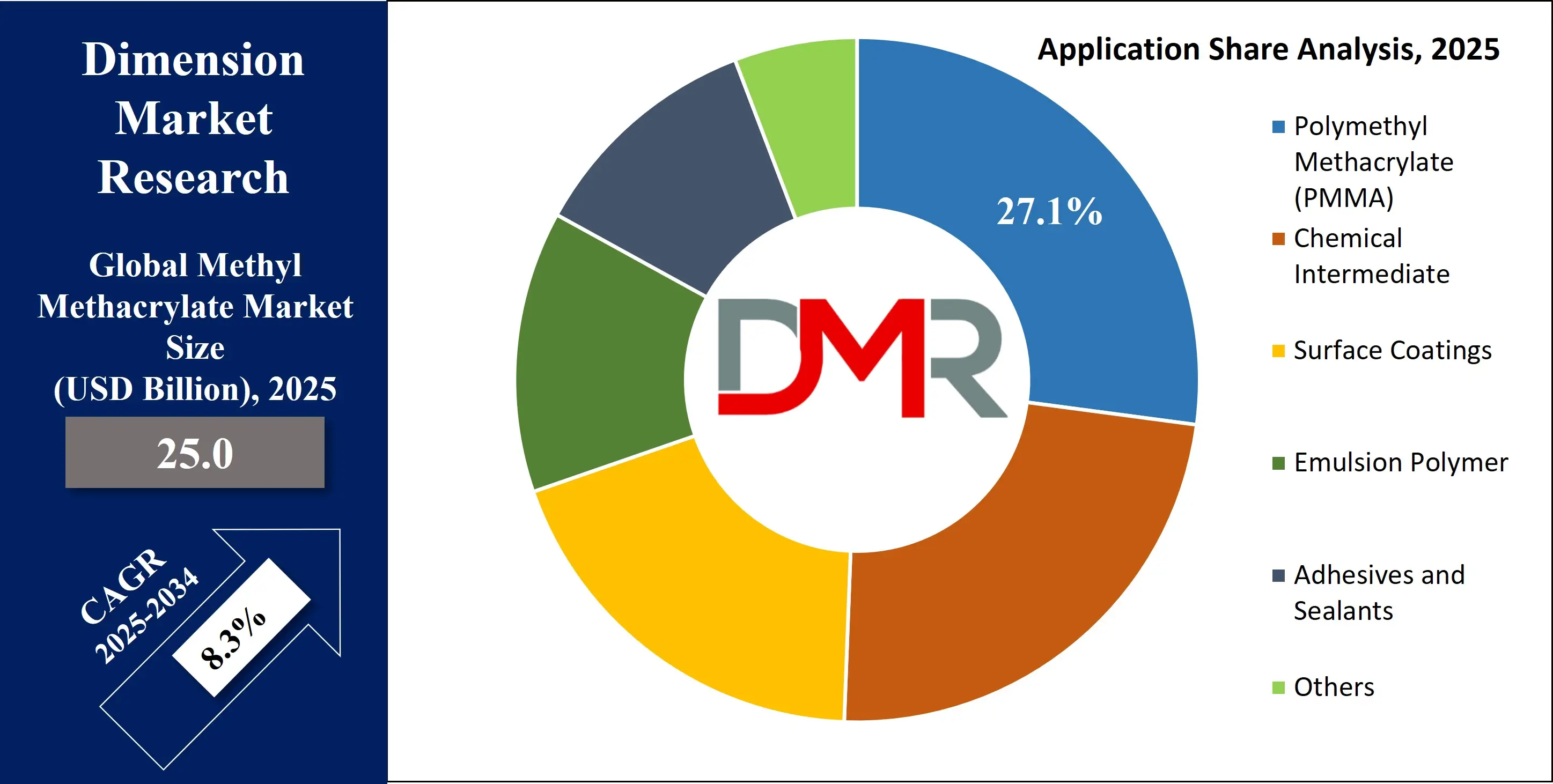

By Application Analysis

Polymethyl Methacrylate (PMMA) dominates the MMA application segment because it accounts for the largest share of global MMA consumption, driven by its wide-ranging use in high-performance, transparent, and durable plastic products. PMMA, often known by trade names such as acrylic, Lucite, or Plexiglas, is valued for its exceptional clarity, UV resistance, weatherability, and strength-to-weight ratio. These properties make PMMA ideal for use in automotive lighting systems, optical lenses, signage, light guides, medical devices, and display screens, all of which have seen sustained growth in recent years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The automotive industry alone is a major consumer of PMMA due to the push toward lighter, more fuel-efficient vehicles and the growing use of LED lighting systems. In electronics, PMMA is favored for its superior light transmission in backlit panels and smartphone displays. Moreover, in building and construction, PMMA is used in skylights, windows, and bathroom fixtures due to its glass-like appearance and impact resistance. This broad utility makes it the most commercially important MMA derivative.

Another key factor is the ability to modify PMMA’s properties through copolymerization, enabling tailored formulations for niche applications like medical implants or aerospace components. PMMA is also recyclable, with recent advancements in depolymerization making it possible to recover high-purity MMA from post-consumer waste. Despite competition from polycarbonate and other plastics, PMMA’s performance advantages and cost balance keep it in high demand. As innovation in end-use sectors continues, especially in electric vehicles, consumer electronics, and healthcare, PMMA will remain the dominant application segment for MMA.

By End-Use Industry Analysis

The Building & Construction industry is anticipated to dominates the end-use segment of the Methyl Methacrylate market due to its extensive reliance on MMA-based materials for durability, aesthetics, safety, and performance. MMA is primarily used in this sector through PMMA sheets, adhesives, sealants, coatings, and surface finishes that offer critical features such as UV resistance, weatherability, transparency, and thermal stability. These characteristics make MMA-derived materials ideal for architectural glazing, skylights, façade panels, sanitary ware, flooring, and waterproof coatings.

Urbanization and infrastructure development are major growth catalysts. Rapid urban expansion in emerging markets such as India, Southeast Asia, and Latin America is fueling the demand for modern architectural solutions that rely on MMA products for both form and function. In developed regions like North America and Europe, renovation of aging infrastructure, coupled with green building codes, drives the use of MMA-based low-VOC coatings and durable composite materials. Moreover, PMMA is increasingly used in translucent and solar panel roofing, aligning with sustainable design practices.

The construction sector also benefits from MMA’s quick curing time, chemical resistance, and bonding strength essential for adhesives used in structural glazing and pre-fabricated components. The shift toward lightweight and energy-efficient materials further reinforces MMA’s role. As the sector adopts more innovative and modular construction techniques, the use of MMA in 3D printed building elements, transparent acoustic barriers, and smart facades is growing. Given the scale and evolution of global construction demands, this industry will continue to lead MMA consumption in the foreseeable future.

The Global Methyl Methacrylate Market Report is segmented on the basis of the following

By Feedstock

- Acetone

- Ethylene

- Methanol

- Isobutylene

- Others

By Application

- Polymethyl Methacrylate (PMMA)

- Chemical Intermediate

- Surface Coatings

- Emulsion Polymer

- Adhesives and Sealants

- Others

By End-Use Industry

- Building & Construction

- Automotive

- Electronics

- Aerospace

- Paints & Coatings

- Medical

- Others

Global Methyl Methacrylate Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominates the global Methyl Methacrylate (MMA) market as it command over 40.1% of the total market revenue by the end of 2025, due to its strong industrial infrastructure, technological advancement in chemical manufacturing, and widespread use of MMA in key end-use sectors such as automotive, construction, and medical devices. The U.S., in particular, houses several major MMA producers like Dow Inc. and Lucite International (Mitsubishi Chemical), which operate large-scale, integrated production facilities. These facilities benefit from access to low-cost shale-based feedstocks like acetone and natural gas derivatives, which enhance cost efficiency and output.

Furthermore, North America leads in innovation related to high-performance polymers, lightweight automotive components, and sustainable coatings, all of which drive steady MMA demand. The construction industry’s shift toward smart and green buildings has increased the use of MMA-based adhesives, sealants, and durable glazing solutions. In addition, regulatory support for advanced recycling technologies and circular economy models has encouraged PMMA recycling, boosting demand for regenerated MMA. A well-established distribution network, strong R&D base, and growing adoption of medical-grade PMMA in U.S. healthcare further reinforce the region’s market leadership.

Region with the Highest CAGR

Asia Pacific is projected to register the highest CAGR in the global MMA market due to its rapidly expanding manufacturing base, rising urbanization, and increasing demand across the automotive, electronics, and construction sectors. Countries like China, India, South Korea, and Japan are investing heavily in infrastructure, housing, and industrial development, all of which require MMA-based paints, coatings, and acrylic sheets. China, the world’s largest chemical producer, is leading the shift to new MMA production routes such as the ethylene-based Alpha process, reducing environmental impact and cost.

The region also dominates global electronics and optical product manufacturing, where PMMA is used in LED displays, lenses, and light guides. Government support for domestic production, along with favorable trade agreements and labor cost advantages, attracts investment from global MMA players. Additionally, rising disposable incomes and consumer awareness in Southeast Asia are driving demand for high-quality automotive and cosmetic products, further stimulating MMA consumption. This combination of structural industrial growth and policy support underpins the region’s accelerated market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Methyl Methacrylate Market: Competitive Landscape

The global Methyl Methacrylate market is moderately consolidated, with a mix of large multinational corporations and regional players competing through capacity expansions, innovation, and sustainability initiatives. Key players include Mitsubishi Chemical Group, Röhm GmbH, Sumitomo Chemical, Arkema S.A., LG Chem, Dow Inc., and Lucite International. These companies focus on vertical integration and operate large-scale MMA and PMMA facilities across North America, Europe, and Asia.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A major trend in the competitive landscape is the shift toward sustainable MMA production. Companies like Röhm are investing in bio-based MMA routes and circular economy models, such as the depolymerization of PMMA waste. Mitsubishi Chemical has implemented the Alpha technology, which reduces hazardous byproducts and lowers production costs, giving it a competitive edge. Partnerships and joint ventures in Asia, such as LG Chem’s alliances in South Korea, are expanding production capacity to meet surging regional demand.

Players are also prioritizing R&D investment to enhance product quality and diversify application portfolios, especially for medical-grade PMMA and optoelectronics. The competitive focus is also shifting toward regional market penetration, with North America and Asia Pacific being the primary battlegrounds due to high demand and technological advancements. Mergers, capacity additions, and regulatory compliance continue to define competitive strategies.

Some of the prominent players in the Global Methyl Methacrylate Market are

- Mitsubishi Chemical Group

- Evonik Industries AG

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Dow Inc.

- BASF SE

- Lucite International (a subsidiary of Mitsubishi Chemical)

- Arkema Group

- Asahi Kasei Corporation

- Chi Mei Corporation

- Kuraray Co., Ltd.

- SABIC

- Plaskolite LLC

- Lotte Chemical Corporation

- Daesan MMA Corp.

- China National Petroleum Corporation (CNPC)

- Wanhua Chemical Group Co., Ltd.

- Shanghai Huayi Acrylic Acid Co., Ltd.

- Zhejiang Jiangshan Chemical Co., Ltd.

- LG MMA Corp.

- Other Key Players

Recent Developments in the Global Methyl Methacrylate Market

- January 2025: Evonik Industries launched a new specialty monomer under its VISIOMER® brand called HEMA P 100, a phosphate methacrylate designed to improve adhesion, corrosion resistance, and flame retardancy in coatings and adhesives. This launch signals the company's continued expansion in the MMA derivatives segment, focusing on high-performance and sustainable chemical solutions for industrial coatings, electronics, and energy applications.

- May 2025: The Gujarat Chem & Petrochem Conference, one of India’s key industrial chemical expos, hosted a session dedicated to innovation in methacrylate chemistry. Industry experts from academia and companies such as Reliance, SABIC, and Mitsubishi Chemical presented sustainable production methods, MMA downstream application trends, and recycling pathways for PMMA. The forum served as a platform to foster international collaborations and local adoption of cleaner MMA processes.

- February 2024: Arkema completed the acquisition of Alquisola, a specialty polymer manufacturer based in Spain. The acquisition strengthens Arkema’s presence in Southern Europe and adds to its advanced materials portfolio. By integrating Alquisola’s technology and customer base, Arkema is expected to enhance its European MMA distribution and broaden its application offerings, especially in the construction and automotive sectors.

- July 2023: Mitsubishi Chemical upgraded its PMMA production plant in Japan by introducing a new dehydration polymerization unit. The modernization aims to improve MMA conversion efficiency, reduce water usage, and lower emissions, aligning with the company’s sustainability roadmap. The plant will serve both domestic and regional markets with high-grade PMMA used in optical and medical applications.

- June 2023: Evonik also increased its MMA production capacity at its Singapore Jurong Island facility, raising total output to over 410,000 tons per annum. This move is in response to increased demand in electronics, automotive components, and transparent sheet manufacturing.

- July 2023: LG Chem entered into a technology collaboration with Covestro (Germany) to co-develop advanced branched polymers derived from MMA. These new formulations aim to provide enhanced thermal resistance and viscosity control for applications in electric vehicles, light diffusion panels, and high-temperature plastics. The two companies plan to commercialize the first set of polymers in 2024 after pilot testing.

Frequently Asked Questions

How big is the Global Methyl Methacrylate Market?

▾ The Global Methyl Methacrylate Market size is estimated to have a value of USD 25.0 billion in 2025 and is expected to reach USD 51.2 billion by the end of 2034.

What is the size of the US Methyl Methacrylate Market?

▾ The US Methyl Methacrylate Market is projected to be valued at USD 8.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 16.6 billion in 2034 at a CAGR of 7.8%.

Which region accounted for the largest Global Methyl Methacrylate Market?

▾ North America is expected to have the largest market share in the Global Methyl Methacrylate Market with a share of about 40.1% in 2025.

Who are the key players in the Global Methyl Methacrylate Market?

▾ Some of the major key players in the Global Methyl Methacrylate Market are Mitsubishi Chemical Group Corporation, Evonik Industries AG, LG Chem Ltd., Sumitomo Chemical Co., Ltd., Dow Inc., BASF SE, Lucite International Ltd., Arkema S.A., Asahi Kasei Corporation, and many others.

What is the growth rate in the Global Methyl Methacrylate Market in 2025?

▾ The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025.