Market Overview

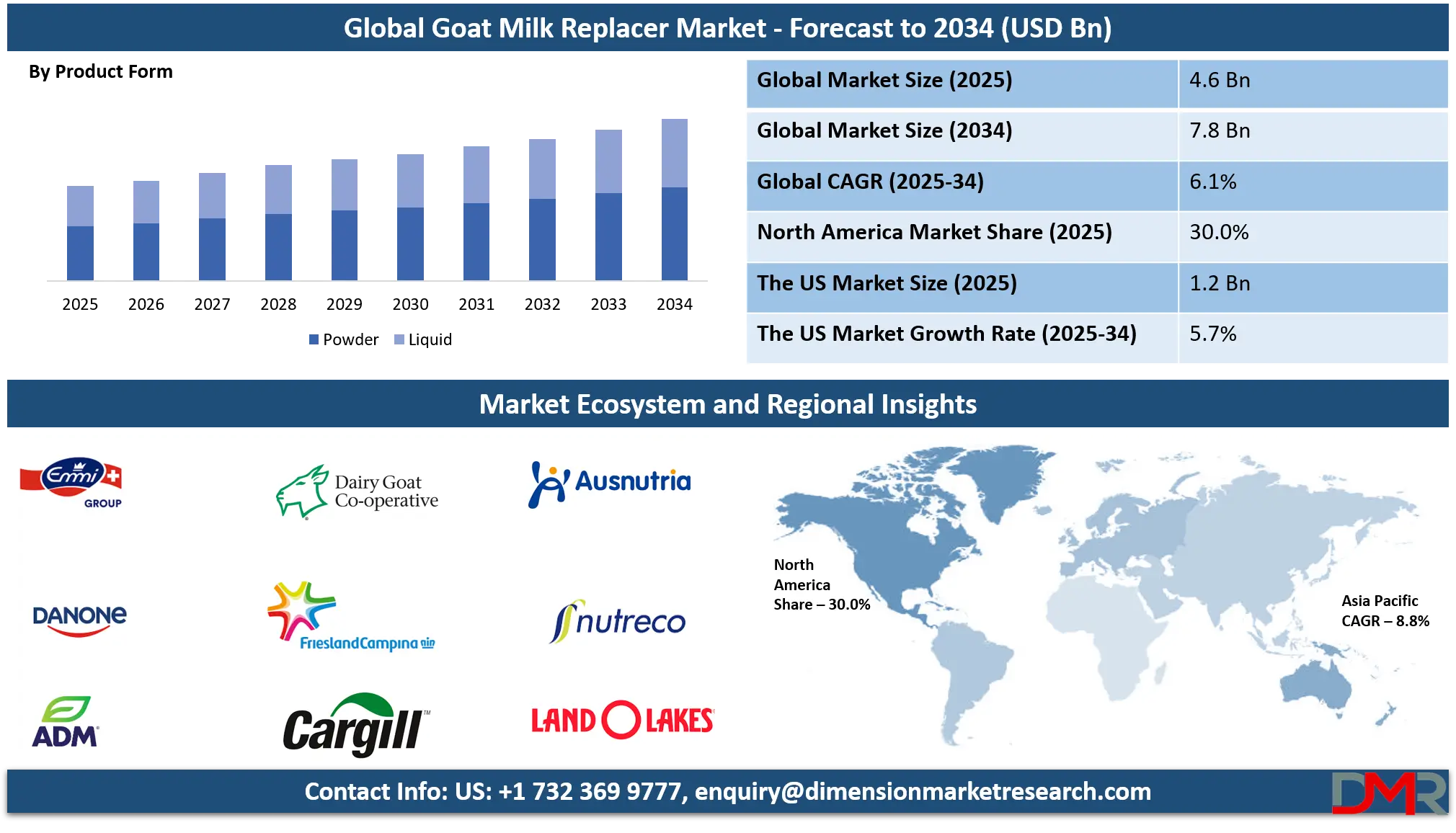

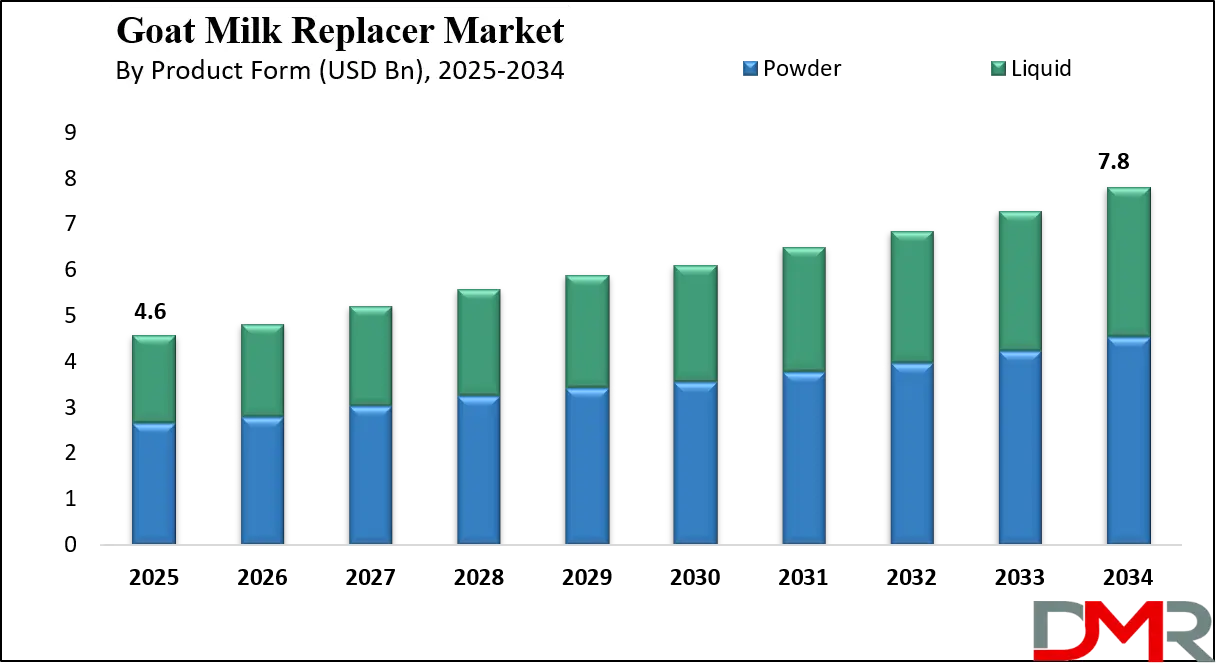

The Global Goat Milk Replacer Market size is projected to reach USD 4.6 5billion in 2025 and grow at a compound annual growth rate of 6.1% to reach a value of USD 7.8 billion in 2034.

Goat Milk Replacer refers to a formulated nutritional substitute designed to replicate the composition and functional properties of natural goat milk for feeding young goats. It includes powdered and liquid forms made from whole goat milk, dairy protein blends, and plant-based ingredients, combined with essential fats, vitamins, and minerals. These formulations are used during the neonatal, growth, weaning, and therapeutic feeding stages. The product plays a critical role in maintaining consistent nutrition, improving survivability, and supporting healthy early-life development, particularly in managed livestock systems where access to maternal milk is limited or controlled.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market has evolved due to development in animal nutrition science and growth in awareness of early-stage livestock health. Developments in formulation technologies have enhanced digestibility, immune support, and nutrient bioavailability. Regulatory emphasis on animal welfare, biosecurity, and standardized feeding practices has further encouraged adoption. Shifts toward structured farming, predictable feeding outcomes, and reduced disease transmission risks are influencing product acceptance across both commercial and small-scale goat farms.

Also, product development continues to focus on ingredient optimization, including functional dairy proteins, lactose control, and sustainable plant-based blends. Investment in research-driven formulations, quality assurance systems, and controlled feeding solutions is increasing. Distribution channels are expanding through specialized farm supply networks and digital platforms, shaping long-term adoption and reinforcing the role of goat milk replacers within modern livestock nutrition frameworks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Goat Milk Replacer Market

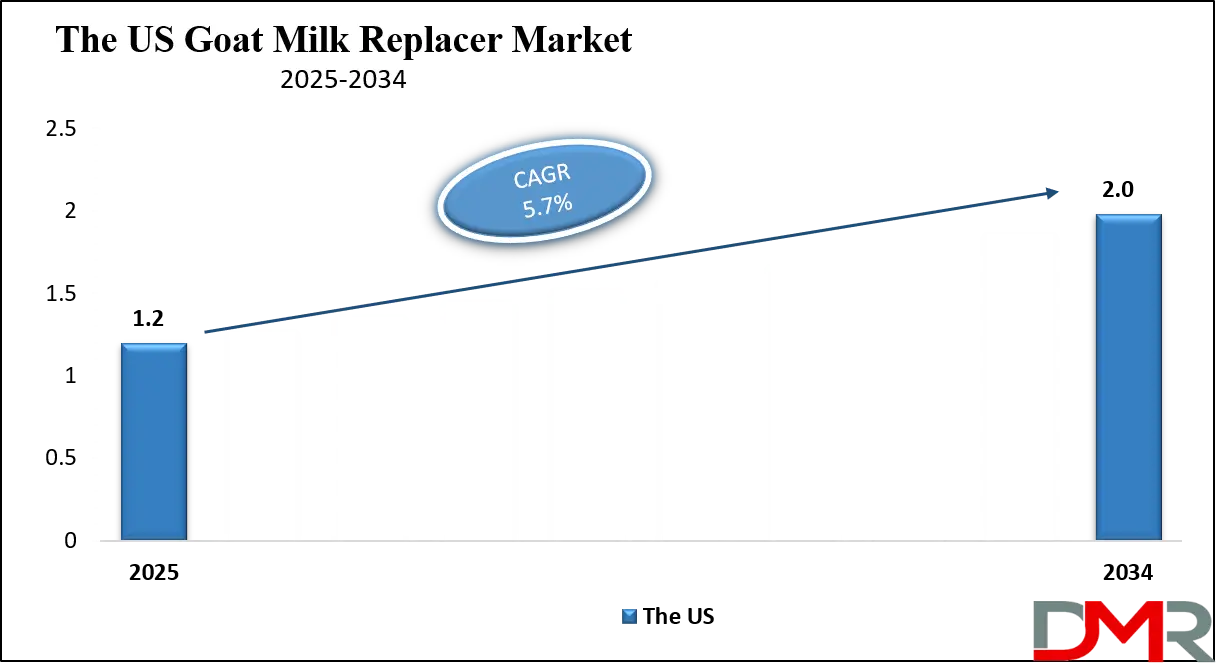

The US Goat Milk Replacer Market size is projected to reach USD 1.2 billion in 2025 at a compound annual growth rate of 5.7% over its forecast period.

The United States market is influenced by structured livestock management practices, high awareness of neonatal animal nutrition, and established feed supply chains. Commercial goat farms and breeding operations increasingly rely on milk replacers to ensure consistent feeding outcomes and reduce dependency on raw milk availability. Regulatory oversight related to animal welfare and feed quality standards supports product adoption. The presence of advanced veterinary services and feed formulation expertise further strengthens market penetration, while growing interest in herd productivity and survivability continues to support steady demand across different farm sizes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Goat Milk Replacer Market

Europe Goat Milk Replacer Market size is projected to reach USD 1.6 billion in 2025 at a compound annual growth rate of 5.6% over its forecast period.

Europe demonstrates strong adoption driven by animal welfare regulations, sustainability objectives, and controlled feeding practices. Regional policies aligned with environmental responsibility encourage efficient resource use and standardized livestock nutrition. Goat farms in countries such as France, Spain, and the Netherlands increasingly use formulated milk replacers to comply with welfare and traceability requirements. Innovation in sustainable ingredient sourcing and premium formulations is prominent, supported by cooperative farming models and research-backed feed programs that accelerate adoption across both traditional and organic farming systems.

Japan Goat Milk Replacer Market

Japan Goat Milk Replacer Market size is projected to reach USD 230 million in 2025 at a compound annual growth rate of 7.1% over its forecast period.

Japan’s market growth is shaped by limited agricultural land availability, high-quality livestock management standards, and government-backed agricultural modernization initiatives. Goat farms increasingly adopt milk replacers to ensure controlled nutrition, reduce disease risks, and improve productivity within confined farming environments. Emphasis on precision feeding, biosecurity, and feed efficiency supports adoption. Challenges such as higher production costs are offset by strong institutional support, technical expertise, and demand for reliable feeding solutions in specialized livestock operations.

Goat Milk Replacer Market: Key Takeaways

- Market Growth: The Goat Milk Replacer Market size is expected to grow by USD 3.0 billion, at a CAGR of 6.1%, during the forecasted period of 2026 to 2034.

- By Product Form: The powder segment is anticipated to get the majority share of the Goat Milk Replacer Market in 2025.

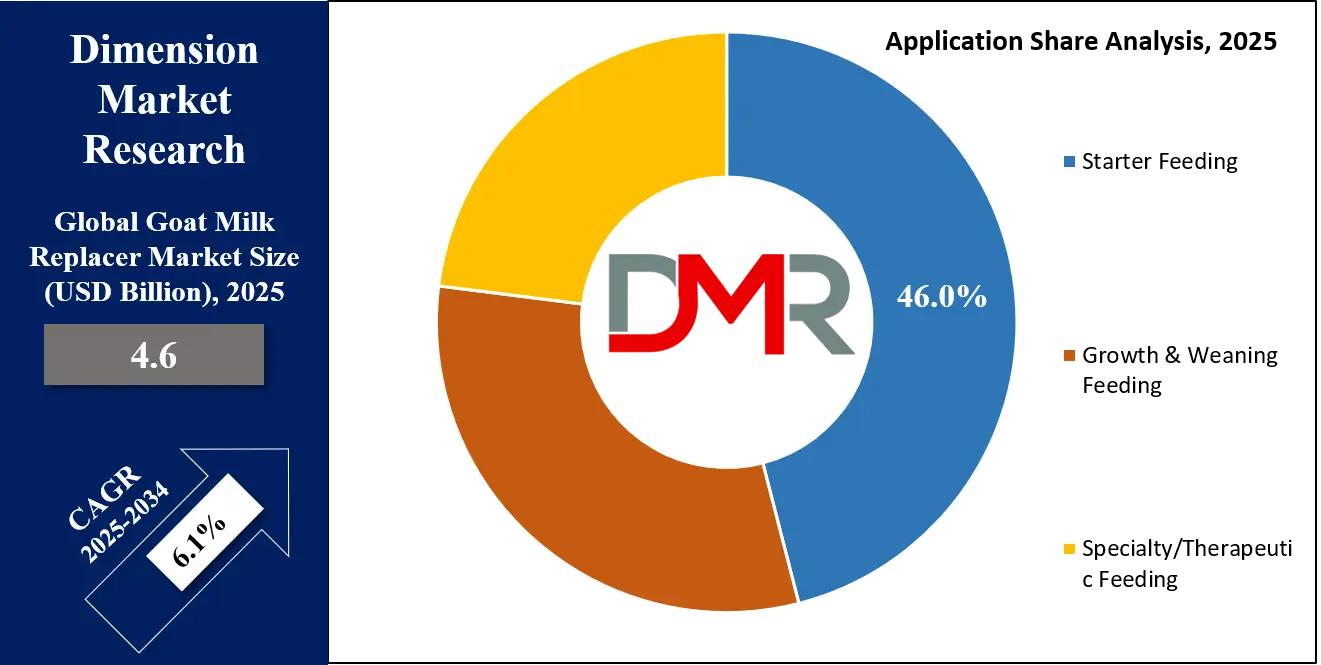

- By Application: The starter feeding segment is expected to get the largest revenue share in 2025 in the Goat Milk Replacer Market.

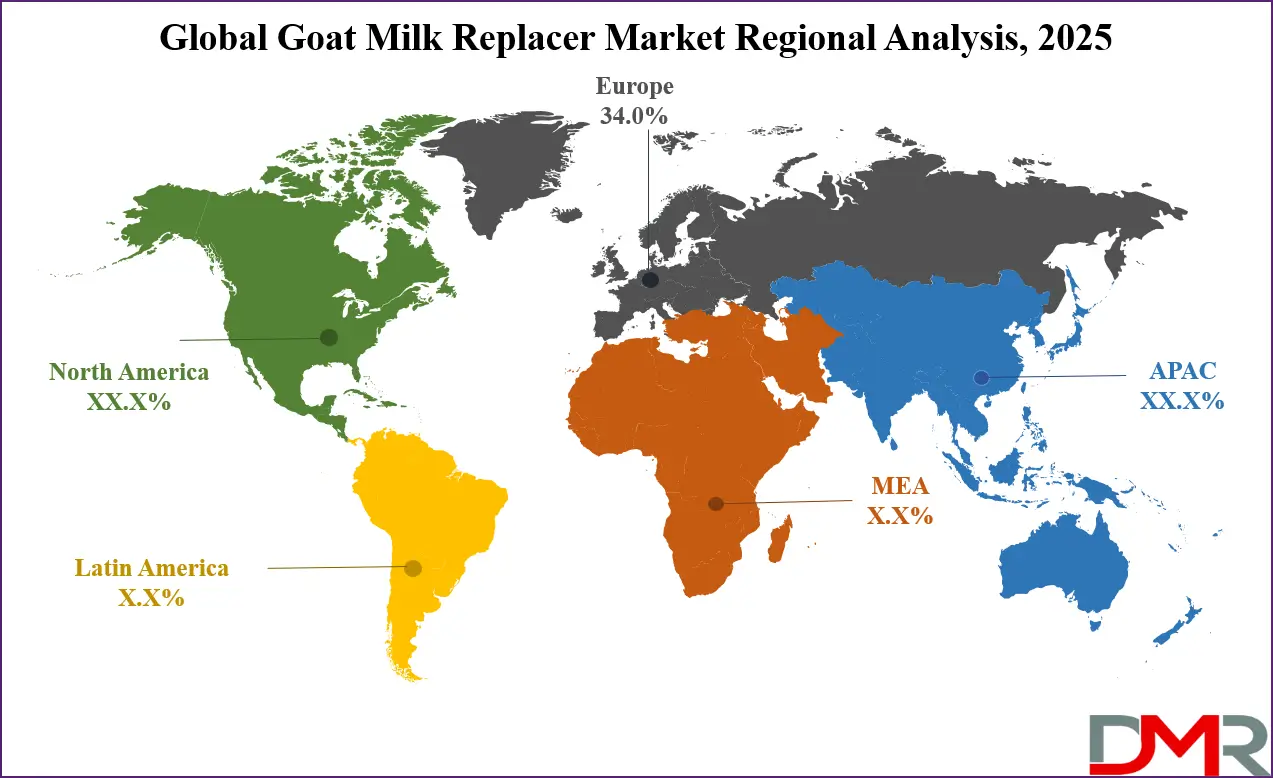

- Regional Insight: Europe is expected to hold a 34.0% share of revenue in the Global Goat Milk Replacer Market in 2025.

- Use Cases: Some of the use cases of Goat Milk Replacer include neonatal feeding, veterinary & research feeding, and more.

Goat Milk Replacer Market: Use Cases

- Neonatal Feeding: Ensures stable nutrition for newborn goats during the critical early-life period when maternal milk is insufficient or unavailable.

- Growth and Weaning Feeding: Supports nutritional requirements during pre-weaning and post-weaning stages to promote healthy weight gain and development.

- Specialty and Therapeutic Feeding: Used for goats requiring controlled nutrition due to illness, recovery, or specific health conditions.

- Veterinary and Research Feeding: Enables standardized feeding protocols in clinical, academic, and livestock research environments.

Stats & Facts

- U.S. Department of Agriculture (USDA) stated in 2024 that more than 2.6 million goats were managed under formal livestock systems in the United States, increasing reliance on structured early-life feeding inputs.

- European Commission reported in 2025 that regulated livestock nutrition programs were implemented across a majority of licensed goat farms operating under animal welfare compliance frameworks.

- Ministry of Agriculture, Forestry and Fisheries of Japan confirmed in 2024 that government-supported feed optimization initiatives expanded to over 1,200 goat farming units nationwide.

- Global Agricultural Outlook documented in 2024 that improvements in feed efficiency technologies contributed to reduced neonatal livestock mortality across multiple regions.

- International Dairy Federation noted in 2025 that specialty milk replacer formulations were commercially introduced across more than 40 livestock-focused national markets.

- World Bank indicated in 2024 that livestock productivity improvement projects supporting structured feeding practices were active in 18 developing economies.

Market Dynamic

Driving Factors in the Goat Milk Replacer Market

Advancements in Animal Nutrition Science

Scientific developments in animal nutrition have significantly improved the formulation of goat milk replacers. Enhanced understanding of protein digestibility, fat emulsification, and micronutrient balance has resulted in products that closely mimic natural goat milk. These improvements support stronger immune development, improved gut health, and consistent growth outcomes. As livestock producers increasingly prioritize measurable performance and survivability, reliance on scientifically formulated milk replacers continues to rise across diverse farming systems.

Expansion of Managed Livestock Farming

The shift toward managed and semi-intensive goat farming systems has increased demand for predictable feeding solutions. Milk replacers enable farmers to control feeding schedules, reduce disease transmission risks, and optimize labor efficiency. As herd sizes grow and farm operations become more structured, the need for standardized nutritional inputs becomes essential, positioning goat milk replacers as a core component of modern livestock management strategies.

Restraints in the Goat Milk Replacer Market

High Cost of Premium Ingredients

The use of high-quality dairy proteins, functional additives, and specialized fats increases production costs. These higher costs can limit adoption among small-scale or resource-constrained farms. Price sensitivity remains a key challenge, particularly in regions where traditional feeding practices dominate and access to premium inputs is limited.

Limited Awareness in Traditional Farming Regions

In some rural and developing areas, farmers continue to rely on conventional feeding methods due to limited awareness of formulated milk replacers. Lack of technical knowledge and resistance to change can slow adoption. Educational outreach and extension services remain necessary to improve understanding of long-term productivity benefits.

Opportunities in the Goat Milk Replacer Market

Rising Demand for Performance-Oriented Feeding

Growing focus on herd productivity, survivability, and feed efficiency presents strong opportunities. Farmers increasingly seek feeding solutions that deliver consistent outcomes, particularly in commercial breeding operations. Performance-oriented milk replacers designed for specific growth stages offer significant expansion potential.

Adoption of Sustainable and Alternative Ingredients

Sustainability concerns are driving interest in alternative protein sources and environmentally responsible formulations. Plant-based blends and responsibly sourced dairy ingredients create opportunities for differentiation, especially in regions with strong sustainability mandates and eco-conscious farming practices.

Trends in the Goat Milk Replacer Market

Shift Toward Precision Feeding

Precision feeding practices are gaining momentum, supported by data-driven farm management tools. Goat milk replacers are increasingly tailored to specific age groups and health conditions, allowing farmers to optimize nutrition while reducing waste and inefficiencies.

Digitalization of Distribution and Advisory Services

Digital platforms are transforming access to livestock nutrition products and advisory services. Online distribution channels, digital ordering systems, and remote consultation tools are expanding reach, particularly for small and medium farms seeking specialized feeding solutions.

Impact of Artificial Intelligence in Goat Milk Replacer Market

- Formulation Optimization: Artificial Intelligence models analyze nutritional data to refine ingredient ratios for improved digestibility and growth outcomes.

- Health Monitoring Integration: AI systems link feeding patterns with health indicators to improve early-life care.

- Customized Feeding Protocols: AI enables age- and condition-specific feeding recommendations.

- Supply Chain Forecasting: AI improves demand planning and inventory management.

- Quality Assurance Automation: AI-powered systems monitor formulation consistency and production quality.

Research Scope and Analysis

By Product Form Analysis

Powdered goat milk replacers account for approximately 58.0% of total consumption in 2025, reflecting their widespread acceptance across commercial and organized farming operations. Their extended shelf life allows for long-term storage without quality degradation, making them suitable for bulk procurement and centralized inventory management. Powdered formulations are easier to transport and distribute across long distances, reducing logistical constraints for large farms and feed suppliers. Farmers prefer these products due to consistent formulation quality, controlled mixing ratios, and flexibility in reconstitution based on herd size and feeding schedules.

Additionally, powdered replacers integrate well with automated feeding systems, improving labor efficiency and reducing wastage. These advantages collectively reinforce their dominant position in structured and high-volume goat farming environments.

Liquid goat milk replacers are emerging as the fastest-growing product form, driven by increasing demand for convenience-oriented feeding solutions. Although their overall share remains lower than powdered alternatives, adoption is accelerating among small and medium farms where simplicity and time efficiency are critical. Liquid formulations eliminate the need for mixing and reconstitution, reducing preparation errors and labor requirements. This makes them particularly suitable for farms with limited workforce availability or lower technical expertise.

Improvements in packaging, preservation methods, and cold-chain logistics have enhanced product stability and usability. As access to localized distribution and on-demand supply improves, liquid replacers are increasingly favored for immediate feeding applications and short-term nutritional management.

By Ingredient Type Analysis

Whole goat milk–based formulations represent nearly 62.0% of ingredient usage in 2025, positioning them as the most preferred option across feeding applications. Their dominance is attributed to their close nutritional similarity to natural goat milk, offering superior digestibility, balanced fat composition, and enhanced nutrient absorption. These formulations support immune development, gut health, and consistent growth, making them especially suitable for neonatal and sensitive feeding stages. Farmers value their predictable performance outcomes and reduced risk of digestive stress in young goats. Additionally, whole goat milk–based replacers align well with welfare-focused farming practices and quality-driven production systems. Their strong acceptance across commercial and institutional users continues to sustain their leadership within the ingredient landscape.

Plant-based blends are gaining momentum as sustainability, cost optimization, and ingredient diversification become increasingly important considerations. While their overall share remains lower, demand is expanding due to advancements in processing technologies that enhance protein digestibility and nutritional balance. These blends help reduce reliance on dairy inputs and offer more stable pricing in regions affected by milk supply volatility.

Improved formulation techniques have addressed earlier performance gaps, making plant-based options more viable for growth and weaning applications. Their adoption is particularly notable among farms focused on environmental responsibility and long-term cost management. Continued innovation and regulatory support are expected to further improve acceptance across diverse farming systems.

By Application Analysis

Starter feeding accounts for approximately 46.0% of total application usage in 2025, underscoring its critical importance in early-life goat nutrition. This stage directly influences survival rates, immune system development, and long-term productivity. Controlled and consistent nutrition during the neonatal period helps reduce mortality risks associated with inadequate maternal milk access. Goat milk replacers used in starter feeding are formulated to support digestive stability, energy intake, and rapid physiological development. Farmers prioritize this application due to its measurable impact on herd performance and economic outcomes. As awareness of early-life nutritional management increases, the use of replacers in starter feeding continues to remain the primary application focus.

Growth and weaning feeding is expanding steadily as farmers emphasize smoother dietary transitions and sustained development beyond the neonatal stage. This application supports gradual adaptation from milk-based diets to solid feed, reducing stress and growth interruptions. Goat milk replacers used during this phase help maintain nutrient continuity, support weight gain, and stabilize digestive function. Increased attention to post-weaning performance and long-term herd efficiency has driven adoption across both commercial and small-scale farms. As feeding programs become more structured, demand for replacers tailored to growth and weaning requirements is expected to continue rising.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

Commercial goat farms account for nearly 54.0% of total end-user adoption in 2025, reflecting their reliance on standardized, performance-driven feeding systems. These operations manage larger herd sizes and require consistent nutritional inputs to maintain productivity, biosecurity, and cost efficiency. Goat milk replacers enable controlled feeding schedules, reduced disease transmission risks, and improved labor utilization. Commercial farms also benefit from bulk purchasing, technical advisory support, and compatibility with automated feeding equipment. Their focus on measurable outcomes such as survivability, growth rates, and feed efficiency reinforces sustained demand for formulated milk replacers within this user segment.

Small and medium farms are witnessing rapid adoption as access to affordable formulations, digital distribution platforms, and advisory services improves. These farms increasingly recognize the benefits of structured feeding in reducing mortality and improving growth consistency. Milk replacers provide flexibility in managing limited maternal milk availability and fluctuating herd sizes. The growing availability of smaller packaging sizes and simplified formulations has lowered adoption barriers. As awareness spreads and rural supply chains strengthen, small and medium farms are expected to play a significant role in future market expansion.

By Distribution Channel Analysis

Offline distribution accounts for nearly 63.0% of total product sales in 2025, making it the dominant channel for goat milk replacers. Feed and farm supply stores, along with veterinary clinics, play a crucial role by offering immediate product availability, technical guidance, and trust-based purchasing relationships. Farmers often prefer offline channels due to direct consultation with veterinarians and feed specialists, which helps ensure correct product selection and feeding practices. Physical stores also support bulk purchasing and emergency supply needs, particularly during kidding seasons. In many rural and semi-urban regions, offline retail remains the most accessible and reliable option. Strong distributor networks and long-standing supplier relationships continue to reinforce the importance of offline channels in structured livestock nutrition ecosystems.

Online distribution is expanding rapidly as digital infrastructure improves and farmers seek greater convenience and product variety. Although its share is smaller, adoption is accelerating due to access to detailed product information, competitive pricing, and doorstep delivery. E-commerce platforms and direct manufacturer sales allow farmers to compare formulations, read usage guidance, and access advisory support remotely. This channel is particularly beneficial for small and medium farms located in remote areas with limited access to specialized feed stores. Improved logistics, subscription-based ordering, and digital payment options are further strengthening online adoption. As digital literacy among farmers increases, online channels are expected to play a more prominent role in future distribution strategies.

By Price Range Analysis

Mid-range goat milk replacers represent approximately 49.0% of total demand in 2025, reflecting their balance between quality, affordability, and performance. These products are widely adopted across both commercial and small-scale farms, offering reliable nutritional profiles without the higher costs associated with premium formulations. Mid-range replacers typically use blended dairy proteins and standardized additives to ensure consistent growth outcomes. Farmers prefer this category for routine feeding programs where cost control and dependable performance are equally important. The availability of mid-range products across offline and online channels further supports their widespread use. Their adaptability across multiple applications makes them the most practical choice for diverse farming conditions.

Premium goat milk replacers are experiencing the fastest growth as farms increasingly prioritize performance optimization, animal welfare, and early-life survivability. These products feature high-quality ingredients such as whole goat milk, functional proteins, immune-support additives, and advanced fat compositions. Premium formulations are commonly used in neonatal, therapeutic, and breeding-focused operations where consistent outcomes are critical.

Although higher in cost, farmers view these products as long-term investments due to improved growth efficiency and reduced health risks. Adoption is particularly strong among commercial farms, veterinary institutions, and welfare-compliant operations. Continued innovation and evidence-based performance benefits are expected to sustain demand growth.

The Goat Milk Replacer Market Report is segmented on the basis of the following:

By Product Form

By Ingredient Type

- Whole Goat Milk–Based

- Dairy Protein Blends

- Plant-Based Blends

By Application

- Starter Feeding

- Growth & Weaning Feeding

- Specialty / Therapeutic Feeding

By End User

- Commercial Goat Farms

- Small & Medium Farms

- Veterinary & Research Institutions

By Distribution Channel

- Offline

- Feed & Farm Supply Stores

- Veterinary Clinics

- Online

- E-commerce Platforms

- Direct Manufacturer Sales

By Price Range

- Premium

- Mid-range

- Economy

Regional Analysis

Leading Region in the Goat Milk Replacer Market

Europe accounts for nearly 34.0% of global demand in 2025, making it the leading region for goat milk replacer adoption. This position is supported by well-established regulatory frameworks that emphasize animal welfare, feed safety, and traceability across livestock operations. Farmers in the region widely adopt controlled feeding practices to comply with strict welfare standards and improve productivity outcomes. Strong investment in sustainable agriculture, supported by regional policies and funding programs, has accelerated the adoption of scientifically formulated nutrition solutions. Additionally, the presence of advanced veterinary infrastructure, research institutions, and cooperative farming models enables faster dissemination of best practices. These factors collectively reinforce Europe’s leadership in the structured use of goat milk replacers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Goat Milk Replacer Market

Asia-Pacific is experiencing the fastest expansion due to rapid growth in livestock farming, increasing commercialization of goat production, and government-backed agricultural modernization initiatives. Rising demand for consistent early-life nutrition is driving adoption, particularly in emerging economies where traditional feeding practices are being replaced by formulated solutions. Public-sector support programs focused on productivity improvement and disease prevention are encouraging the use of standardized milk replacers. Additionally, expanding rural distribution networks and improving access to veterinary guidance are reducing adoption barriers. As awareness of survivability, growth efficiency, and herd health improves, the region is expected to continue registering strong uptake of goat milk replacers across both small-scale and commercial farming systems.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market is moderately consolidated, with competition centered on formulation quality, ingredient sourcing, and technical support services. Companies focus on R&D investment, strategic partnerships with veterinary institutions, and expansion of distribution networks. Entry barriers include formulation expertise, regulatory compliance, and quality assurance capabilities. Innovation, brand trust, and advisory support remain key differentiators.

Some of the prominent players in the global Goat Milk Replacer are:

- Land O’Lakes Inc.

- Cargill Incorporated

- Archer Daniels Midland Company

- Nutreco N.V.

- Royal FrieslandCampina N.V.

- Danone S.A.

- Ausnutria Dairy Corporation Ltd.

- Dairy Goat Co-operative (NZ) Ltd.

- Glanbia plc

- Alltech Inc.

- Trouw Nutrition

- Mead Johnson Nutrition

- HiPP GmbH & Co. KG

- Holle Baby Food AG

- Meyenberg Goat Milk Products

- Goat Partners International

- Redwood Hill Farm & Creamery

- Saputo Inc.

- Emmi Group

- St. Helen’s Farm Ltd.

- Other Key Players

Recent Developments

- In December 2025, PetAg announced an expansion of its product offerings by adding two new products, namely Goat’s Milk KMR® and DYNE® High Calorie Liquid Nutritional Supplement for Livestock. According to the company, the addition of these products represents another milestone in its retail partnership with Tractor Supply.

- In January 2024, Kabrita USA unveiled a goat-milk infant formula following a prolonged duration to determine its whey protein concentrate and non-fat dry goat milk as generally recognized as safe (GRAS) for infants, the brand’s director of medical and scientific affairs.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.6 Bn |

| Forecast Value (2034) |

USD 7.8 Bn |

| CAGR (2025–2034) |

6.1% |

| The US Market Size (2025) |

USD 1.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Form (Powder and Liquid), By Ingredient Type (Whole Goat Milk–Based, Dairy Protein Blends, and Plant-Based Blends), By Application (Starter Feeding, Growth & Weaning Feeding, and Specialty / Therapeutic Feeding), By End User (Commercial Goat Farms, Small & Medium Farms, and Veterinary & Research Institutions), By Distribution Channel (Offline and Online), By Price Range (Premium, Mid-range, and Economy) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Land O’Lakes Inc., Cargill Incorporated, Archer Daniels Midland Company, Nutreco N.V., Royal FrieslandCampina N.V., Danone S.A., Ausnutria Dairy Corporation Ltd., Dairy Goat Co-operative (NZ) Ltd., Glanbia plc, Alltech Inc., Trouw Nutrition, Mead Johnson Nutrition, HiPP GmbH & Co. KG, Holle Baby Food AG, Meyenberg Goat Milk Products, Goat Partners International, Redwood Hill Farm & Creamery, Saputo Inc., Emmi Group, St. Helen’s Farm Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Goat Milk Replacer Market?

▾ The Global Goat Milk Replacer Market size is expected to reach USD 4.6 billion by 2025 and is projected to reach USD 7.8 billion by the end of 2034.

Which region accounted for the largest Global Goat Milk Replacer Market?

▾ Europe is expected to have the largest market share in the Global Goat Milk Replacer Market, with a share of about 34.0% in 2025.

How big is the Goat Milk Replacer Market in the US?

▾ The US Goat Milk Replacer market is expected to reach USD 1.2 billion by 2025.

Who are the key players in the Goat Milk Replacer Market?

▾ Some of the major key players in the Global Goat Milk Replacer Market include Danone, ADM, Emmi Group, and others

What is the growth rate in the Global Goat Milk Replacer Market?

▾ The market is growing at a CAGR of 6.1 percent over the forecasted period.