Market Overview

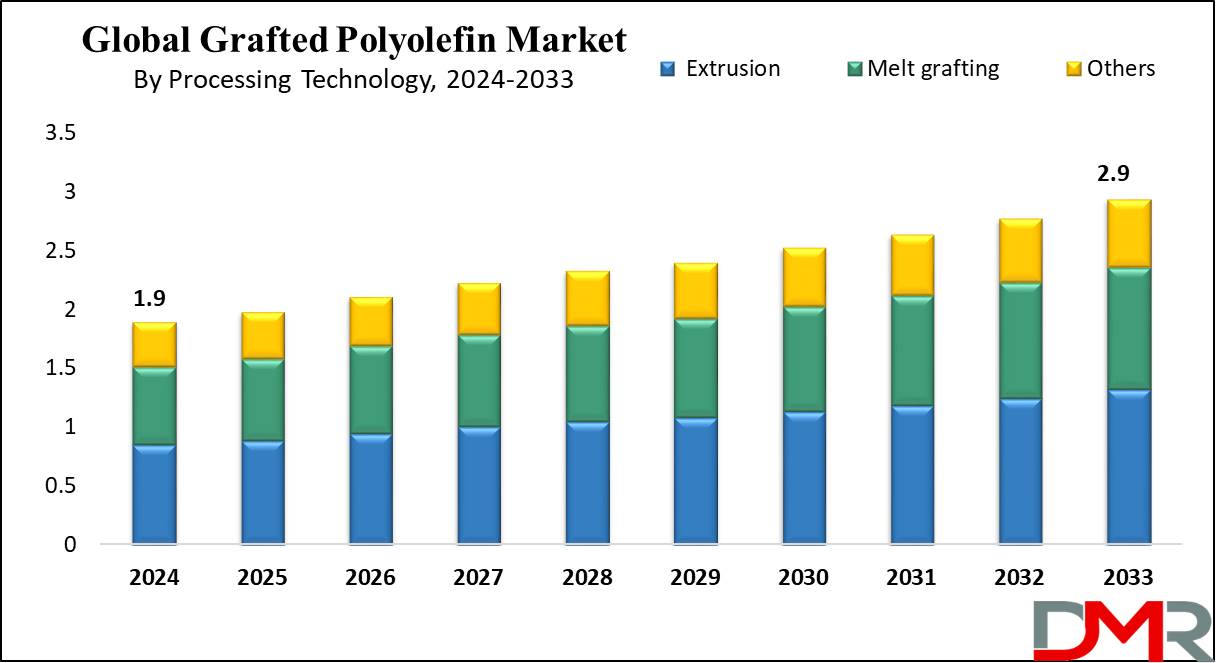

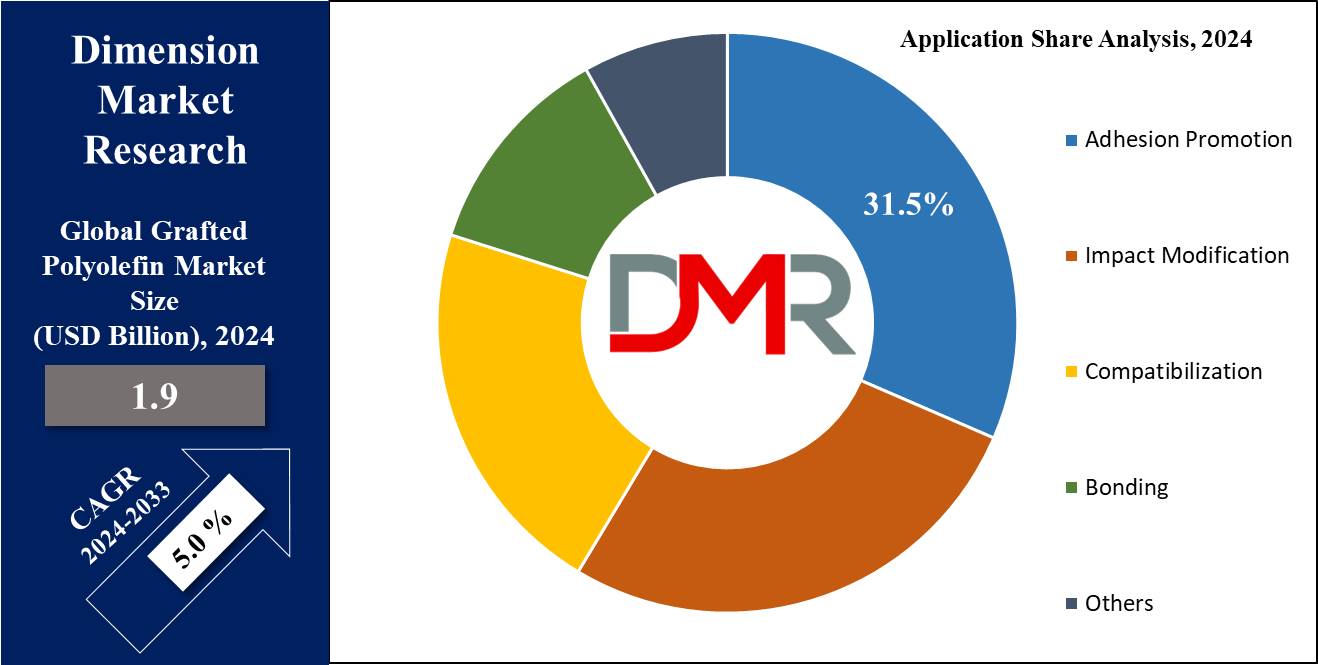

The Global Grafted Polyolefins Market size is estimated to reach USD 1.9 billion in 2024 and is further predicted to reach USD 2.9 billion by 2033, at a CAGR of 5.0%.

Grafted Polyolefins are materials in which a polymer chain from one type of polyolefin is chemically bonded to a different kind of polymer chain. This process involves combining the different properties of both polymers, making it an important part of the Polyethylene and the

polypropylene compounds.

The material formed by this process possesses unique characteristics such as improved mechanical strength, enhanced thermal stability, or modified surface properties.

Due to their versatility and properties, it is used in many sectors like packaging, automotive parts, and coatings, where demand overlaps with the plastic and plastic compounding. The growth of grafted polyolefins is fueled by the rising demand for lightweight and durable materials in many industries, especially in the automotive plastic compounding.

It offers the inherent strength and chemical resistance of polyolefins with properties like improved adhesion, impact resistance, and thermal stability due to the grafting process. Thus, it has special applications in automotive interior components, flexible packaging, and building materials, which drive the growth of this market and are closely related to specialty chemicals.

Key Takeaways

- Market size: The global grafted polyolefins market size is expected to grow by 0.9 billion, at a CAGR of 5.0 % during the forecasted period of 2025 to 2033.

- Market Definition: Grafted Polyolefins are materials formed by chemically bonding polymer chains of different polyolefin types, merging their properties for improved strength, stability, or surface qualities.

- Type Analysis: Maleic Anhydride Grafted PE (Polyethylene) is projected to be the dominant force in the market, capturing the largest revenue share in 2024.

- Processing Technology Analysis: Extrusion is expected to witness significant growth with the highest revenue share based on processing technology throughout the forecast period.

- Application Analysis: Adhesion Promotion is forecasted to hold the largest market share and dominate the global market in 2024.

- End-use Analysis: Automotive is anticipated to lead the market with the largest market share based on end-use and dominate the grafted polyolefins market in 2024.

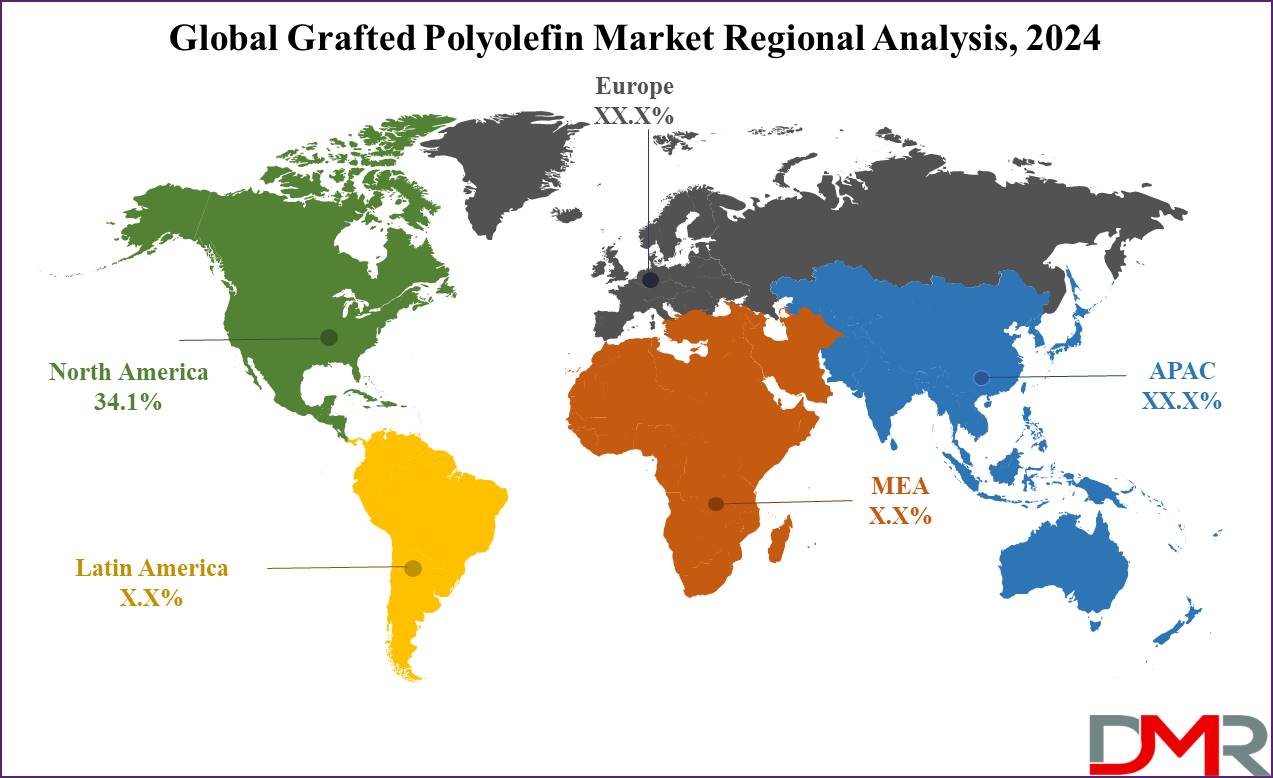

- Regional Analysis: North America is anticipated to dominate the grafted polyolefins market, capturing a revenue share of 34.1 % in 2024.

Use Cases

- Applications in Adhesive and Coating: Grafted polyolefins are widely used in adhesive and coating as they improve bonding strength between substrates and provide enhanced durability and resistance to environmental factors. This directly supports the Adhesive, including sub-segments such as the wood adhesives and marine adhesives.

- Functional Additives: These polyolefins serve as functional additives in many processes as they act as dispersing agents in polymer processing to improve the dispersion of fillers or pigments, resulting in more uniform and stable formulations, which have synergies with the plastic films and Sheets and medical plastic compounds.

- Compatibilizers in Polymer Blends: Used in the compatibilization of polymers such as PE and PP, this directly connects with the injection molded plastic and the blow molded plastics applications.

- Polymer Reinforcement: Grafted polyolefins improve adhesion between polymer matrices and reinforcing materials like glass fibers or carbon fibers, supporting trends in the fiber-reinforced plastic (FRP) recycling and the long glass fiber reinforced polyamide.

Market Dynamic

Drivers

Increase Demand for Enhanced Polymers

The grafted polyolefins market is fueled by increasing demand for polymers with improved properties. Traditional polyethylene (PE) and polypropylene (PP) were popular for their versatility, cost-effectiveness, and availability, but industries now require the improved attributes of polyolefins. These improved polymers are achieved through grafting processes, which offer many benefits like enhanced adhesion, compatibility with diverse materials, and improved thermal stability.

Boost in the Automotive Segment

There is a continuous focus on producing lightweight materials with superior performance, which increases the use of grafted polyolefin materials in the automotive segment. They find their application in interior trim components, under-the-hood parts, and exterior body panels, which offer a mixture of strength, durability, & weight reduction.

Restraints

Strict Regulatory Compliance

Grafted polyolefin manufacturers face challenges due to increased scrutiny and oversight from regulatory bodies, industry monitors, and environmental agencies, which restrain the growth of the market. This increased scrutiny forces companies to follow numerous rules, standards, and guidelines to ensure compliance, which obstructs the growth of the market.

The regional, national, and international regulations also differ in scope, requirements, and enforcement methods. Thus, the manufacturer is required to stay updated on evolving regulations and implement necessary changes, which can consume significant time and resources.

Opportunities

Innovative Applications

Innovative advancements in functional additives, nanocomposites, and surface modifications lead to improvements in the properties of grafted polyolefins to fulfill certain industry requirements, which creates growth opportunities for this market. It involves the development of grafted polyolefins with antimicrobial attributes, which increases their demand across healthcare,

food packaging, and consumer goods sectors.

Functional Advancements

Grafted polyolefins mixed with conductive fillers or additives like carbon nanotubes or graphene during the grafting process allow them to exhibit electrical conductivity. These functional advancements are useful in electronic components like printed circuit boards, flexible electronics, and electromagnetic interference (EMI) shielding. They are beneficial for improving electrical performance and compatibility with polymer substrates.

Trends

Recyclability of Grafted Polyolefins

Advancement in both compatibilizers and recycling technologies leads to improvements in the recyclability of grafted polyolefins. Compatibilizers are important in improving the compatibility between different polymers, which makes it easier to recycle mixed plastics and grafted polyolefins. Also, there is a continuous focus on developing advanced recycling technologies such as chemical recycling and pyrolysis.

Collaborative Research

Collaboration between different industry players, research institutions, and government bodies drives innovation in grafted polyolefins. They are focused on developing standardized testing methods and performance benchmarks for grafted polyolefins.

Research Scope and Analysis

By Type

Maleic anhydride grafted PE is expected to dominate the global grafted polyolefins market with a high revenue share in 2024. It offers a diverse combination of properties that are highly desirable across a wide range of industries. This polyethylene is used to improve adhesion, compatibility with other materials, & surface properties, which makes it suitable for packaging, coatings, & automotive components.

They can be useful for multiple market needs with a single material due to their versatility. These are frequently adopted by chemical firms for improved performance and sustainability.

There are different industries that are searching for materials that offer improved properties while reducing the environmental impact. They are expected to emerge as a favorable option due to their ability to improve the recyclability and processability of polyethylene.

Maleic Anhydride Grafted PP is anticipated to show significant growth due to its wide application in automotive, packaging, & consumer goods. It offers excellent thermal stability, chemical resistance, & mechanical properties, expanding its use in challenging environments. They are capable of improving polypropylene's characteristics, such as impact resistance & tensile strength, while preserving its core properties, driving the growth of the market.

By Processing Technology

Extrusion is anticipated to lead the grafted polyolefins market with the highest market share in 2024, due to its efficiency and versatility. It allows for continuous production of grafted polyolefins with precise control over parameters like temperature, pressure, & mixing.

This process is capable of giving consistent quality & uniformity of the grafted products, which is required in standardized materials. This process is cost-effective and is suitable for mass production while keeping the production cost as low as possible.

Melt grafting is the second largest segment driving the growth of the market due to its application required for in-situ grafting of polyolefins during processing. It involves direct mixing of polyolefins and grafting agents in a molten state, which allows for efficient bonding & grafting reactions to occur.

It offers benefits like shorter processing times, lower energy consumption, and reduced production steps compared to other grafting methods. It is environmentally friendly as it reduces solvent usage & waste generation.

By Application

Adhesion Promotion is predicted to dominate the global grafted polyolefins market in 2024, due to the increasing demand across industries for enhanced bonding solutions. There is a need for reliable adhesion between different substrates as products become more complex and diverse in material composition.

Grafted polyolefins improve adhesion between surfaces that struggle to stick together, such as plastics to metals or rubber to plastics. Industries like automotive, packaging, and construction benefit significantly from this capability, ensuring durable and reliable product assemblies.

Impact modification is valuable due to its improved strength and endurance of polyolefin materials. It involves grafting elastomeric polymers onto polyolefin matrices, which improves impact resistance while maintaining other mechanical properties.

These polyolefins act as impact modifiers in polymer blends, improving the overall toughness, impact strength, and resistance to cracking. These properties are important in applications like sports equipment and consumer goods where durability is required.

By End Use

The automotive segment is expected to dominate the global grafted polyolefins market in 2024 with the largest revenue share, as these materials improve the toughness and durability of components like bumpers, interior trim, and under-the-hood parts.

Also, it helps in adhesion promotion for multi-material assemblies, contributing to lightweight efforts and fuel efficiency improvements. These materials are known for providing properties like chemical resistance, high strength-to-weight ratio, & versatility, which makes them suitable for many automotive applications.

The packaging segment is expected to be the second-largest application in this market due to the rising adoption of eco-friendly packaging materials. These polyolefins are sustainable materials due to their recyclability and reduced environmental impact compared to traditional materials that are used in packaging.

There is a need for efficient packaging materials as more consumers opt for online shopping. They help protect goods during transit, reduce damage, and ensure product integrity; thus, they become a preferred choice for packaging in the e-commerce industry.

The Global Grafted Polyolefins Market Report is segmented based on the following

By Type

- Maleic Anhydride Grafted PE(Polyethylene)

- Maleic Anhydride Grafted PP (Polypropylene)

- Maleic Anhydride Grafted EVA (Ethylene vinyl acetate)

- Others

By Processing Technology

- Extrusion

- Melt grafting

- Others

By Application

- Adhesion Promotion

- Impact Modification

- Compatibilization

- Bonding

- Others

By End Use

- Automotive

- Packaging

- Construction

- Adhesives & Sealants

- Others

Regional Analysis

North America is predicted to dominate the grafted polyolefins market with a revenue share of

34.1% in 2024. This region is rapidly expanding due to factors like a strong economy, substantial disposable income, & advanced technological capabilities. The major manufacturers of the market are concentrated in this region and are investing heavily in research & development to introduce new and advanced products.

The increasing demands for these materials in packaging, electronics, and automotive further fuel the growth of this region. Further, this region is growing due to its rising capabilities in the field of polymer chemistry and material science.

This allows efficient production and distribution of grafted polyolefins, making them available to meet the increasing demand from diverse end-use sectors. Moreover, North America's technological advancement, strong industrial base, and logistical advantages contribute significantly to the growth of this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Key players in the grafted polyolefins market commonly employ strategies such as introducing new products and expanding through investments. Manufacturers are focusing on logistical improvements and strengthening distribution channels as part of their business growth strategies. These initiatives are improving the product adoption rates among global consumers. The market is fragmented due to many participants, and it is anticipated that there will be moderate to intense competition among the companies.

Some of the prominent players in the global grafted polyolefins market are

- Mitsubishi Chemical Group Corporation

- Guangzhou Lushan New Materials Co. Ltd.

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals Asia Pacific Ltd.,

- Arkema

- Clariant

- Borealis AG

- SI Group Inc.

- Dow

- COACE

- Others

Recent Development

- In November 2023, Borealis acquired Integra Plastics AD, a prominent advanced mechanical recycling company based in Bulgaria, which boosts its advanced recycling capabilities by adding more than 20,000 tons of recycling capacity.

- In November 2023, Borealis finalized its acquisition of Rialti S.p.A., an Italian specialist in polypropylene (PP) compounds, particularly recyclates, which expands Borealis' PP compounds range with an additional 50,000 tons per year of mechanical recyclates, meeting the increasing demand from customers for eco-friendly solutions.

- In December 2023, Industrie Polieco-MPB SpA's Compounding Division, known as MPB, formed a new partnership with OQEMA Italy, a chemical distributor. This collaboration aims to strengthen MPB's market presence in high-barrier films, multilayer structures, and specialty compounds.

- In March 2022, The Compound Company acquired the production site, product range, and customer base for Exxelor polymer resins from ESSO Deutschland GmbH, ExxonMobil in Cologne, Germany, which boosts its capacity to around 70 kilotons per year and significantly expands its reach into new markets. Exxelor polymer resins are specialized chemically modified polyolefin and elastomer-based resins used to improve the performance of engineering thermoplastics and other polymers.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 1.9 Bn |

| Forecast Value (2033) |

USD 2.9 Bn |

| CAGR (2024-2033) |

5.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Maleic Anhydride Grafted PE, Maleic Anhydride Grafted PP, Maleic Anhydride Grafted EVA, and Others), By Processing Technology (Extrusion, Melt grafting, and Others), By Application (Adhesion Promotion, Impact Modification, Compatibilization, Bonding, and Others ),By End Use (Automotive, Packaging, Construction, Textiles, Adhesives & Sealants, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Mitsubishi Chemical Group Corporation, Guangzhou Lushan New Materials Co. Ltd., LyondellBasell Industries Holdings B.V., Mitsui Chemicals Asia Pacific, Ltd., Arkema, Clariant, Borealis AG, SI Group, Inc., Dow, COACE, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Grafted Polyolefins Market size is estimated to have a value of USD 1.9 billion in 2024 and is expected to reach USD 2.9 billion by the end of 2033.

North America is expected to be the largest market share for the Global Grafted Polyolefins Market with a share of about 34.1% in 2024.

Some of the major key players in the Global Grafted Polyolefins Market are Mitsubishi Chemical Group Corporation, Guangzhou Lushan New Materials Co. Ltd., LyondellBasell Industries Holdings B.V., and many others.

The market is growing at a CAGR of 5.0 percent over the forecasted period.