Market Overview

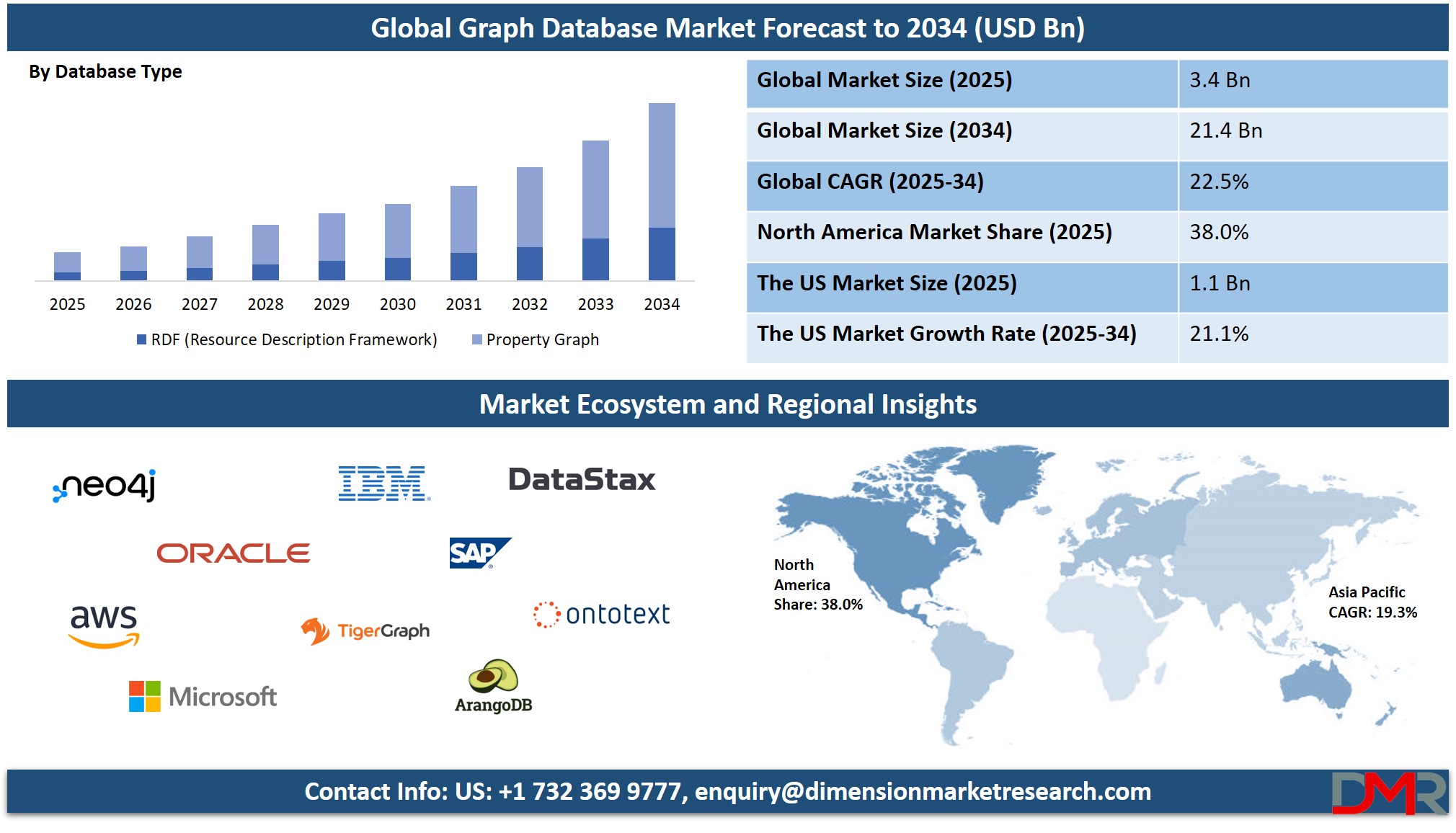

The Global Graph Database Market is projected to reach USD 3.4 billion in 2025 and expand to USD 21.4 billion by 2034, growing at a robust CAGR of 22.5%. This growth is driven by rising demand for connected data analytics, real-time relationship mapping, and scalable NoSQL solutions across industries.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A graph database is a type of NoSQL database that uses graph structures with nodes, edges, and properties to represent and store data. Unlike traditional relational databases that rely on tables, rows, and columns, graph databases are optimized to handle complex and highly connected data. This structure enables efficient querying of relationships, making them ideal for applications such as fraud detection, recommendation engines, knowledge graphs, and social network analysis. By leveraging graph theory, these databases enable the real-time traversal of data connections, offering high performance and flexibility in managing dynamic data relationships.

The global graph database market is experiencing rapid expansion as organizations demand advanced data modeling techniques that surpass relational constraints. The surge in connected data across industries such as BFSI, telecom, retail, and healthcare is propelling the adoption of graph technology for real-time analytics, identity resolution, and enterprise knowledge management. Businesses are seeking solutions that offer flexible schema design, scalability, and the ability to uncover hidden patterns in complex data sets. Graph databases offer an intuitive approach to modeling real-world relationships, making them valuable for AI and machine learning applications, semantic search, and data lineage tracking.

With the rise of digital transformation, enterprises are integrating graph-powered systems to enhance customer experience, streamline operations, and drive intelligent automation. The market growth is further supported by growing investment in cloud-based graph solutions and open-source technologies. Vendors are offering tools that combine graph processing capabilities with big data platforms, enabling enterprises to analyze large-scale, interconnected datasets in real time. The expanding use cases in cybersecurity, supply chain optimization, and fraud analytics are expected to solidify the position of graph databases as a core component of the modern data stack.

The US Graph Database Market

The U.S. Graph Database Market size is projected to be valued at USD 1.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 6.1 billion in 2034 at a CAGR of 21.1%.

The US graph database market is experiencing significant momentum, fueled by the country's advanced digital infrastructure and strong presence of leading technology firms. With the growing adoption of AI-driven analytics, big data platforms, and real-time recommendation systems, graph databases are becoming an integral part of enterprise data strategies.

American companies across sectors such as financial services, healthcare, e-commerce, and cybersecurity are utilizing graph-based technologies to gain deeper insights into connected data, enhance fraud detection systems, and optimize customer personalization. The growing reliance on cloud-native platforms and microservices architecture further boosts the demand for flexible and scalable data storage models like graph databases.

Moreover, the presence of major players such as Neo4j, Amazon Web Services, IBM, and Microsoft Azure contributes to the accelerated innovation and widespread deployment of graph database solutions in the US. Enterprises are integrating graph-powered knowledge graphs, identity resolution tools, and relationship-based AI models to support intelligent automation and business intelligence initiatives.

The rising importance of data lineage, semantic search, and complex network analysis in regulatory compliance and digital transformation projects also positions the US as a key contributor to the global graph database ecosystem. As organizations prioritize data agility and contextual insights, the US market is expected to maintain its leadership in graph database adoption and development.

Europe Graph Database Market

In 2025, the Europe graph database market is projected to reach a value of approximately USD 800 million. This strong presence is attributed to the region's advanced IT infrastructure, growing emphasis on data privacy and compliance, and the widespread adoption of digital technologies across sectors. The enforcement of regulations such as the General Data Protection Regulation (GDPR) has pushed enterprises to adopt more sophisticated data management systems, with graph databases emerging as a preferred solution for handling complex and interconnected data. Industries such as BFSI, telecom, government, and healthcare in countries like Germany, France, the UK, and the Nordics are rapidly integrating graph technology for fraud detection, network optimization, and semantic data querying.

The European graph database market is expected to grow at a CAGR of 21.2% from 2025 to 2034, driven by rising demand for AI-powered analytics, enterprise knowledge graphs, and cloud-based data infrastructure. As organizations focus on extracting meaningful insights from connected datasets, graph databases offer the flexibility and scalability required for advanced data modeling and decision-making.

Additionally, European research institutions and academic organizations are leveraging RDF-based graph solutions for metadata management and semantic search applications. With a growing ecosystem of solution providers, ongoing innovation, and government support for digital transformation, Europe is positioned to remain a vital and fast-expanding region within the global graph database landscape.

Japan Graph Database Market

In 2025, the graph database market in Japan is estimated to be valued at around USD 130 million, representing approximately 3% of the global market. Although relatively modest in comparison to larger regions like North America and Europe, Japan’s market is steadily gaining momentum, supported by its robust industrial base and growing digital transformation initiatives.

Key sectors such as finance, telecom, manufacturing, and public services are exploring graph databases to enhance fraud detection, supply chain transparency, and personalized service delivery. Additionally, the country’s strong focus on precision, efficiency, and technological advancement aligns well with the benefits offered by graph data models, particularly in handling complex relational data structures.

The Japanese graph database market is expected to grow at a healthy CAGR of 20.1% from 2025 to 2034, fueled by rising demand for real-time analytics, semantic search, and AI-driven applications. With ongoing investments in smart cities, IoT infrastructure, and digital healthcare, the need for systems that can manage and analyze highly interconnected datasets is accelerating.

Enterprises in Japan are also showing increased interest in knowledge graphs and AI-enhanced business intelligence, which are key applications of graph database technology. The gradual shift from traditional relational databases to graph-based architectures, integrated with local innovation and partnerships with global tech providers, is setting the stage for sustained growth in this highly specialized segment.

Global Graph Database Market: Key Takeaways

- Market Value: The global graph database market size is expected to reach a value of USD 21.4 billion by 2034 from a base value of USD 3.4 billion in 2025 at a CAGR of 22.5%.

- By Component Segment Analysis: Software components are anticipated to dominate the component segment, capturing 75.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-Based mode will dominate the deployment mode segment, capturing 66.0% of the market share in 2025.

- By Database Type Segment Analysis: Property Graphs are poised to consolidate their dominance in the database type segment, capturing 70.0% of the total market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises are expected to maintain their dominance in the organization size segment, capturing 72.0% of the total market share in 2025.

- By Application Segment Analysis: Fraud Detection & Prevention applications will account for the maximum share in the application segment, capturing 23.0% of the total market value.

- By Industry Vertical Segment Analysis: The BFSI industry is expected to consolidate its dominance in the industry vertical segment, capturing 26.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global graph database market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global graph database market are Neo4j, Oracle, AWS, Microsoft (Azure Cosmos DB), IBM (Db2 Graph), TigerGraph, ArangoDB, DataStax, SAP (SAP HANA Graph), Ontotext, Franz (AllegroGraph), Cambridge Semantics, and Others.

Global Graph Database Market: Use Cases

- Fraud Detection and Risk Analytics in BFSI: In the banking and financial services industry, graph databases are instrumental in detecting and mitigating fraud. Traditional systems often fall short in identifying sophisticated fraud schemes due to their inability to trace indirect relationships in real time. Graph databases, however, can seamlessly uncover complex connections between customers, transactions, devices, and accounts. Financial institutions utilize graph technology to strengthen anti-money laundering measures, monitor suspicious transaction patterns, and ensure robust know-your-customer compliance. These systems support real-time analytics, enabling financial entities to respond swiftly to emerging threats while reducing false positives.

- Recommendation Engines for E-commerce and Digital Platforms: Modern e-commerce platforms and digital service providers depend heavily on recommendation engines to improve customer engagement and drive sales. Graph databases allow for real-time modeling of user-product interactions, browsing patterns, and preference histories. This enables platforms to deliver highly personalized product, content, or service suggestions tailored to individual user journeys. Unlike conventional relational models, graph databases adapt dynamically to changes in user behavior, making them ideal for scalable recommendation engines that evolve continuously. This enhances customer satisfaction, improves conversion rates, and boosts overall platform performance.

- Enterprise Knowledge Graphs and Semantic Search: Corporations across industries are adopting enterprise knowledge graphs to link and manage distributed data sources. Graph databases power these systems by organizing structured and unstructured data into meaningful relationships, allowing for enhanced semantic search capabilities. These knowledge graphs help employees and AI systems retrieve contextually relevant information more accurately and efficiently. By integrating internal documents, customer interactions, product data, and external sources, businesses improve decision-making, automate workflows, and unlock deeper insights from their data ecosystems.

- Network and IT Infrastructure Monitoring: Graph databases play a critical role in managing complex IT infrastructures by mapping the relationships between servers, applications, databases, APIs, and cloud components. Network operations teams use graph-based models to visualize service dependencies, track configurations, and analyze the impact of outages or performance issues. These databases help in conducting real-time root cause analysis, optimizing resource utilization, and forecasting infrastructure needs. They also support cybersecurity use cases by identifying vulnerabilities, monitoring lateral movement, and strengthening the organization's digital resilience.

Impact of Artificial Intelligence on the Graph Database Market

Artificial Intelligence (AI) is significantly accelerating the adoption and evolution of graph databases by enhancing their ability to manage, analyze, and derive insights from complex and connected datasets. Graph databases are inherently designed to represent relationships, and AI thrives on relationship-driven data, making their integration highly synergistic.

AI models, particularly those involving machine learning, natural language processing, and deep learning, require dynamic, contextual data to improve predictive accuracy. Graph databases provide the ideal data architecture for feeding AI algorithms with structured relationships, such as social connections, customer behavior, transaction flows, and network topologies.

One of the most transformative impacts of AI on the graph database market is in the development of intelligent applications like recommendation systems, fraud detection, knowledge graphs, and real-time analytics engines. AI-driven graph analytics can uncover hidden patterns, anomalies, and multi-hop relationships at a scale and speed that traditional data models cannot match.

Additionally, AI techniques such as graph neural networks (GNNs) are being used to process graph data more efficiently, enabling advanced use cases in genomics, supply chain optimization, and semantic search. As a result, the fusion of AI and graph databases is driving innovation in data science, enhancing automation, and shaping the next generation of decision intelligence systems. This convergence is expected to be a major growth catalyst for the global graph database market over the coming decade.

Global Graph Database Market: Stats & Facts

US Federal Data (Data.gov)

- Data.gov hosts over 370,000 datasets, making it the largest single repository of open government data in the US.

- Originally launched with just 47 datasets, Data.gov has expanded significantly to support cross-agency interoperability.

UK Open Data Initiatives (Data.gov.uk)

- The UK’s open-data portal went live in September 2009, officially launching in January 2010.

- Its dataset count has grown from approximately 2,500 at launch to over 47,000 datasets by 2023.

India’s Data Sharing Policy (NDSAP)

- India’s National Data Sharing and Accessibility Policy (NDSAP) was approved on February 9, 2012, mandating sharing of non-sensitive public-sector data.

- The policy requires all shareable data, whether generated centrally or by states, to be made available in digital, machine-readable formats.

US DHS Data Analytics

- The Department of Homeland Security uses Data Analysis Tools (DATs) to search, correlate, and visualize multiple data sources for pattern detection and threat analysis.

US FDA Data Mining

- As of 2018, the FDA processes around 2 million adverse event reports per year, applying data-mining tools to detect safety signals from pharmacovigilance data.

DARPA / US Defense Research

- A 2024 paper supported by DARPA emphasizes the use of financial knowledge graphs to identify systemic risks within markets.

Global Graph Database Market: Market Dynamics

Global Graph Database Market: Driving Factors

Rising Demand for Real-Time Relationship Mapping

With enterprises focused on understanding complex interconnections between users, transactions, and systems, the demand for real-time relationship mapping is surging. Graph databases excel in modeling dynamic and highly connected datasets, enabling organizations to visualize and analyze data relationships instantly. Use cases such as fraud detection, social media analysis, and recommendation systems rely on this capability, pushing adoption across banking, telecom, and e-commerce sectors. This growing need for connected data analysis is a critical driver of market expansion.

Growth of Big Data and AI Integration

The proliferation of big data across enterprises has created a need for databases that can handle intricate data relationships at scale. Graph databases support artificial intelligence and machine learning applications by offering fast traversal of connected data and efficient data modeling. The integration of graph neural networks and AI-driven analytics with graph databases has enabled advancements in knowledge graphs, predictive modeling, and automated reasoning, thereby driving adoption in healthcare, retail, and logistics industries.

Global Graph Database Market: Restraints

Lack of Standardized Query Languages and Tooling

Despite growing adoption, graph databases face limitations due to the absence of a universally accepted query language. While Cypher, Gremlin, and SPARQL are commonly used, the lack of a unified standard creates a fragmented ecosystem. This results in challenges for developers and data engineers in learning, integration, and interoperability with other data systems, slowing the overall adoption curve in traditional enterprise environments.

High Complexity in Implementation and Migration

Deploying graph database solutions often requires a complete restructuring of existing data architectures. For organizations used to relational database management systems, migrating to a graph-based model involves significant time, cost, and technical expertise. The steep learning curve and the need for specialized talent limit the market's accessibility, particularly for small and medium-sized enterprises that may lack the resources to manage complex graph data infrastructures.

Global Graph Database Market: Opportunities

Expanding Use in Cybersecurity and Threat Intelligence

As cyber threats become more sophisticated, graph databases offer a strategic advantage in identifying anomalies and attack patterns by mapping relationships across users, devices, and access points. Security analysts can use graph analytics to trace lateral movements in network intrusions and uncover hidden vulnerabilities. The growing investment in cybersecurity solutions across governments and enterprises presents a significant opportunity for graph database vendors to offer graph-powered threat intelligence platforms.

Adoption in Healthcare Data Interoperability

In the healthcare sector, graph databases are being used to link patient records, medical research, clinical trials, and drug data. By creating interconnected health knowledge graphs, healthcare providers and researchers can improve diagnostic accuracy, streamline clinical workflows, and accelerate drug discovery. The push for electronic health records interoperability and personalized medicine creates strong growth potential for graph database solutions in this vertical.

Global Graph Database Market: Trends

Emergence of Graph AI and Graph Neural Networks (GNNs)

A major trend transforming the market is the fusion of graph databases with artificial intelligence through graph neural networks. GNNs are enabling more accurate and scalable analysis of graph-structured data, powering applications in recommendation engines, fraud detection, and drug discovery. This intersection of graph databases and AI is driving a new wave of innovation, particularly in advanced analytics and cognitive computing domains.

Growth of Cloud-Native and Managed Graph Database Services

With the growing shift to cloud computing, graph database providers are offering fully managed services that support scalable and cost-effective deployment. Cloud-native platforms allow businesses to avoid infrastructure overhead while benefiting from high availability, security, and real-time performance. This trend is encouraging adoption across startups and large enterprises alike, contributing to rapid market expansion and vendor differentiation through platform-as-a-service (PaaS) offerings.

Global Graph Database Market: Research Scope and Analysis

By Component Analysis

In the component segmentation of the graph database market, software components are projected to hold a dominant position, accounting for approximately 75.0% of the total market share in 2025. This dominance is primarily driven by the widespread deployment of graph database platforms that support high-performance querying, data visualization, and real-time analytics.

Organizations are investing in graph database software solutions to manage and analyze large volumes of connected data efficiently. These software platforms offer robust capabilities such as schema flexibility, graph traversal, visualization tools, and integration with machine learning and AI frameworks, which are critical for applications like fraud detection, recommendation engines, knowledge graphs, and network analysis.

On the other hand, the services segment plays a vital supporting role in the market. This includes professional services such as consulting, system integration, deployment support, training, and ongoing maintenance. As many enterprises lack in-house expertise to implement and optimize graph database solutions, service providers offer the technical know-how to ensure smooth adoption, scalability, and performance tuning.

These services are essential in tailoring graph solutions to specific business needs, managing data migrations from legacy systems, and providing continued optimization and support. As the technology matures and adoption expands across various industries, the demand for specialized graph database services is expected to grow steadily, particularly among mid-sized enterprises and organizations undergoing digital transformation.

By Deployment Mode Analysis

In the deployment mode segment of the graph database market, cloud-based solutions are expected to lead, capturing around 66.0% of the total market share in 2025. This strong preference for cloud deployment is largely driven by its scalability, flexibility, and cost-efficiency. Businesses are opting for cloud-based graph databases to avoid the complexities of infrastructure management, enable real-time collaboration, and support remote access.

Cloud platforms also offer seamless integration with other cloud-native tools and services, allowing enterprises to deploy and scale their data analytics and AI-driven applications more rapidly. As digital transformation accelerates across industries, cloud deployment becomes the preferred choice for both startups and large enterprises seeking faster implementation, lower upfront costs, and managed services.

Despite the growing dominance of the cloud, on-premises deployment continues to hold significance in the graph database market, particularly among organizations with stringent data privacy, compliance, or security requirements.

Sectors such as banking, government, and defense often favor on-premises solutions to maintain full control over their data and IT infrastructure. These deployments allow for customized configurations, better data governance, and reduced risk of external data exposure.

However, on-premises models can involve higher initial investments, ongoing maintenance, and require in-house technical expertise. While their market share is comparatively smaller, on-premises solutions remain crucial for enterprises prioritizing security and regulatory compliance in their data strategies.

By Database Type Analysis

Within the database type segment of the graph database market, property graphs are set to dominate significantly, accounting for 70.0% of the total market share in 2025. This dominance is attributed to their intuitive structure, flexibility, and strong support for practical use cases across various industries.

Property graphs allow nodes and edges to carry properties, enabling richer data modeling and more efficient querying. Their architecture aligns well with real-world scenarios such as social networks, fraud detection, recommendation systems, and knowledge graphs, where understanding and analyzing complex relationships is critical.

Property graphs also enjoy broader industry support, with popular platforms like Neo4j, Amazon Neptune, and TigerGraph being based on this model, making them a go-to choice for many developers and enterprises seeking performance, scalability, and ease of use.

In contrast, RDF (Resource Description Framework) databases, while more specialized, continue to play a significant role, especially in applications requiring semantic understanding and interoperability across different data sources.

RDF is particularly well-suited for scenarios involving linked data, ontologies, and metadata management. It uses a subject-predicate-object triple model to define relationships and is often used in academic research, healthcare, and government projects that require adherence to W3C standards and structured vocabularies.

Though RDF databases capture a smaller share of the market, their value lies in enabling semantic search, supporting data integration across distributed systems, and enabling AI models to reason over structured knowledge bases. As data complexity and regulatory requirements increase, RDF databases are likely to retain relevance in highly specialized and compliance-focused environments.

By Organization Size Analysis

In the organization size segment of the graph database market, large enterprises are projected to retain a dominant position, accounting for 72.0% of the total market share in 2025. This dominance stems from their vast and complex data ecosystems, which require advanced tools to model and analyze relationships across customers, systems, and operations.

Large organizations across sectors such as finance, healthcare, telecom, and retail are adopting graph databases to support high-volume data processing, fraud detection, AI-driven personalization, and real-time analytics. These enterprises often have the necessary IT budgets, infrastructure, and skilled personnel to implement and scale sophisticated graph-based solutions. Their focus on digital transformation and competitive differentiation further fuels the demand for advanced database technologies that can deliver deep insights from connected data.

On the other hand, small and medium-sized enterprises (SMEs) are gradually recognizing the value of graph databases but face certain adoption barriers such as limited resources, technical expertise, and budget constraints.

However, the growing availability of cloud-based, open-source, and managed graph database services is lowering the entry barrier for SMEs. These businesses are starting to use graph technologies for targeted use cases like customer segmentation, supply chain visibility, and lightweight recommendation engines.

As more SMEs move toward digital platforms and data-driven decision-making, their adoption of graph databases is expected to grow steadily, supported by cost-effective deployment options and simplified integration tools. While their market share is smaller compared to large enterprises, SMEs represent a rising growth segment in the overall market landscape.

By Application Analysis

In the application segment of the graph database market, fraud detection and prevention is expected to capture the largest share, accounting for 23.0% of the total market value in 2025. This significant market presence is driven by the growing need among financial institutions, insurance companies, and e-commerce platforms to identify and mitigate fraudulent activities in real time.

Graph databases enable organizations to analyze complex relationships between users, transactions, devices, and locations, allowing them to detect suspicious patterns that traditional databases might overlook. By leveraging graph-based analytics, organizations can uncover hidden connections, monitor multi-layered transactions, and prevent fraudulent behaviors such as identity theft, money laundering, and transaction manipulation with greater speed and accuracy. The growing regulatory pressure and the rising sophistication of cyber threats are further pushing companies to adopt graph database solutions for advanced fraud management.

Recommendation engines also represent a rapidly growing application area within the graph database market. These systems use the power of graph structures to model user behaviors, product interactions, and content preferences, allowing businesses to deliver highly personalized experiences.

E-commerce platforms, streaming services, and social media networks are relying on graph-based recommendation engines to enhance user engagement, drive conversions, and improve retention. Unlike traditional approaches, graph databases provide more nuanced insights by evaluating direct and indirect relationships across large datasets. As consumer expectations for tailored content and product discovery rise, the adoption of graph databases in recommendation systems is set to expand across industries, contributing significantly to the overall growth of the market.

By Industry Vertical Analysis

In the industry vertical segment of the graph database market, the BFSI sector is expected to dominate, accounting for 26.0% of the total market share in 2025. Financial institutions, insurance providers, and investment firms are adopting graph database technologies to strengthen fraud detection systems, streamline customer onboarding, and comply with regulatory requirements such as AML and KYC.

The ability of graph databases to map intricate relationships between transactions, customers, accounts, and devices makes them particularly effective in identifying suspicious patterns and enabling real-time risk analysis. Additionally, BFSI organizations leverage graph databases to build customer-centric strategies by analyzing behavioral data and uncovering connections across financial products, thereby improving personalization, cross-selling, and portfolio management.

The IT and telecom sector is another major contributor to the graph database market, utilizing the technology to manage complex networks, optimize service delivery, and monitor infrastructure dependencies.

Telecommunication providers use graph databases to map relationships between devices, user accounts, applications, and network nodes, which helps in fault detection, capacity planning, and service impact analysis. In IT operations, graph-based models enable more efficient asset management, configuration tracking, and root cause analysis.

The adoption is further driven by the shift toward 5G, IoT ecosystems, and edge computing, all of which require real-time data connectivity and monitoring. As service providers look to enhance operational efficiency and deliver seamless digital experiences, the role of graph databases in IT and telecom continues to grow steadily.

The Graph Database Market Report is segmented based on the following:

By Component

By Deployment Mode

By Database Type

- RDF (Resource Description Framework)

- Property Graph

By Organization Size

By Application

- Fraud Detection & Prevention

- Recommendation Engines

- Knowledge Graphs

- Risk & Compliance Management

- Supply Chain & Logistics

- Social Network Analysis

- Network & IT Operations

By Industry Vertical

- BFSI

- IT & Telecom

- Retail & E-commerce

- Healthcare & Life Sciences

- Manufacturing

- Government & Defense

- Media & Entertainment

- Others

Global Graph Database Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global graph database market in 2025, capturing 38.0% of the total market revenue. This dominance is driven by the region's early adoption of advanced data technologies, strong presence of key market players, and a highly developed IT infrastructure.

Enterprises across sectors such as finance, healthcare, retail, and technology in the United States and Canada are leveraging graph databases for use cases including fraud detection, recommendation engines, knowledge graphs, and network analysis.

The growing integration of artificial intelligence, big data analytics, and cloud computing further accelerates the adoption of graph database solutions. Moreover, the region benefits from a mature regulatory environment and high demand for data-driven decision-making, positioning North America as a key innovation hub in the global graph database ecosystem.

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the graph database market over the coming years, driven by rapid digital transformation, growing investments in cloud infrastructure, and rising adoption of advanced analytics across emerging economies such as China, India, and Southeast Asia.

As industries like e-commerce, fintech, telecommunications, and healthcare expand their digital footprints, there is a growing need for scalable and intelligent data management solutions capable of handling complex relationships.

Governments in the region are also promoting data localization and smart city initiatives, which further encourage the adoption of graph-based technologies. With a rising focus on AI integration, real-time decision-making, and personalized customer experiences, Asia-Pacific is emerging as a key growth engine for the global graph database market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Graph Database Market: Competitive Landscape

The global competitive landscape of the graph database market is characterized by intense innovation and strategic expansion, with both established technology giants and emerging startups vying for market share.

Leading players such as Neo4j, Amazon Web Services, Microsoft, IBM, and Oracle are continuously enhancing their graph capabilities through feature-rich platforms, AI integration, and cloud-native offerings. These companies are focusing on scalability, performance optimization, and seamless integration with big data and analytics tools to cater to diverse enterprise needs.

At the same time, niche vendors like TigerGraph, ArangoDB, and Dgraph Labs are gaining traction by offering specialized, high-performance graph solutions tailored for advanced analytics and real-time querying. The market is also witnessing increased collaboration, open-source innovation, and acquisitions aimed at expanding capabilities and customer reach. This competitive environment is fostering rapid technological advancement and pushing graph database adoption across a wide range of industries globally.

Some of the prominent players in the global graph database market are:

- Neo4j, Inc.

- Oracle Corporation

- Amazon Web Services (AWS)

- Microsoft Corporation (Azure Cosmos DB)

- IBM Corporation (Db2 Graph)

- TigerGraph, Inc.

- ArangoDB GmbH

- DataStax, Inc.

- SAP SE (SAP HANA Graph)

- Ontotext AD

- Franz Inc. (AllegroGraph)

- Cambridge Semantics Inc.

- Bitnine Global Inc. (AgensGraph)

- MarkLogic Corporation

- Dgraph Labs, Inc.

- GraphAware Ltd.

- Stardog Union, Inc.

- Virtuoso by OpenLink Software

- Redis Labs (RedisGraph)

- Fluree PBC

- Other Key Players

Global Graph Database Market: Recent Developments

Product Launches

- July 2025: Graphwise launched GraphDB 11, enhancing enterprise knowledge graph capabilities and enabling AI agents by bridging LLMs with organizational data.

- May 2025: Neo4j released Neo4j Aura Graph Analytics, a serverless, zero ETL graph analytics offering that integrates with any data platform.

Mergers & Acquisitions

- May 2025: IBM completed its acquisition of DataStax, integrating its graph and AI data capabilities into the watsonx ecosystem.

- October 2024: Ontotext merged with Semantic Web Company to form Graphwise, a combined knowledge graph and AI provider.

Funding News

- April 2025: Neo4j secured USD 325 million in Series F funding led by Eurazeo, becoming one of the largest investments in a private database company and valuing it over USD 2 billion.

- April 2025: Across 36 graph database startups, a total of USD 936 million was raised in venture capital funding, signaling strong investor demand for graph technology.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.4 Billion |

| Forecast Value (2034) |

USD 21.4 Billion |

| CAGR (2025-2034) |

22.5% |

| The US Market Size (2025) |

1.1 Billion |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software and Services), By Deployment Mode (Cloud-Based and On-Premises), By Database Type (RDF and Property Graph), By Organization Size (Large Enterprises and SMEs), By Application (Fraud Detection and Prevention, Recommendation Engines, Knowledge Graphs, Risk and Compliance Management, Supply Chain and Logistics, Social Network Analysis, and Network and IT Operations), By Industry Vertical (BFSI, IT and Telecom, Retail and E-commerce, Healthcare and Life Sciences, Manufacturing, Government and Defense, Media and Entertainment, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Neo4j, Oracle, AWS, Microsoft (Azure Cosmos DB), IBM (Db2 Graph), TigerGraph, ArangoDB, DataStax, SAP (SAP HANA Graph), Ontotext, Franz (AllegroGraph), Cambridge Semantics, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global graph database market?

▾ The global graph database market size is estimated to have a value of USD 3.4 billion in 2025 and is expected to reach USD 21.4 billion by the end of 2034.

What is the size of the US graph database market?

▾ The US graph database market is projected to be valued at USD 1.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.1 billion in 2034 at a CAGR of 21.1%.

Which region accounted for the largest global graph database market?

▾ North America is expected to have the largest market share in the global graph database market, with a share of about 38.0% in 2025.

Who are the key players in the global graph database market?

▾ Some of the major key players in the global graph database market are Neo4j, Oracle, AWS, Microsoft (Azure Cosmos DB), IBM (Db2 Graph), TigerGraph, ArangoDB, DataStax, SAP (SAP HANA Graph), Ontotext, Franz (AllegroGraph), Cambridge Semantics, and Others.

What is the growth rate of the global graph database market?

▾ The market is growing at a CAGR of 22.5 percent over the forecasted period.