Market Overview

The

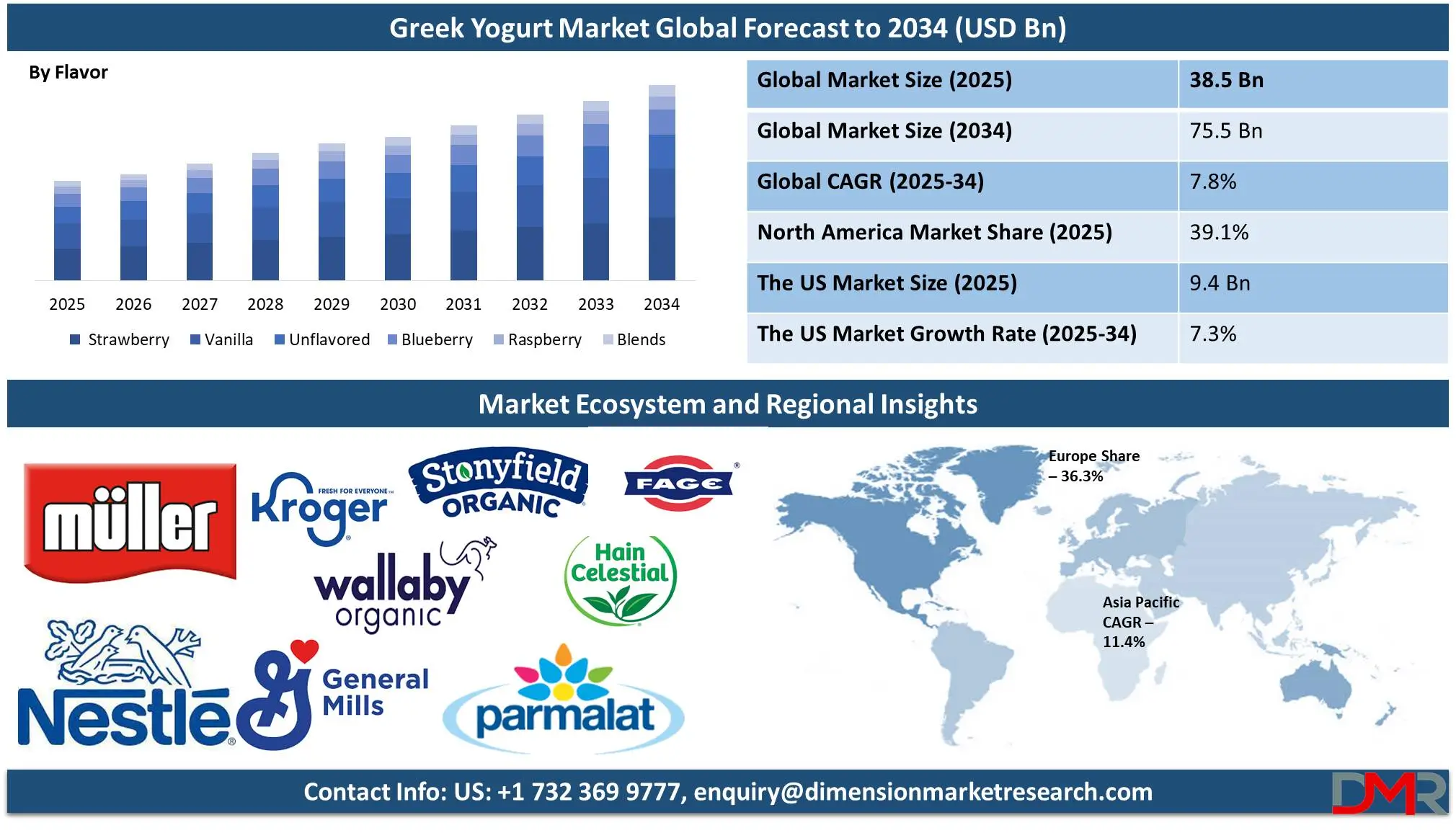

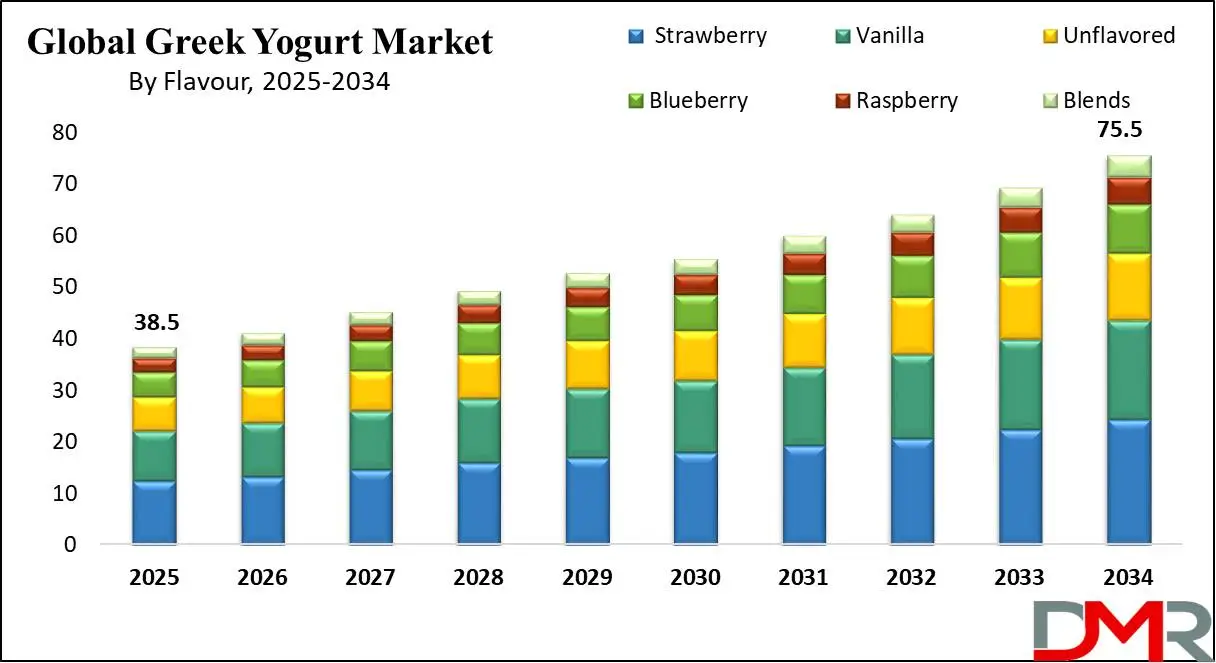

Global Greek Yogurt Market size is expected to reach a

value of USD 38.5 billion in 2025, and it is further anticipated to reach a market

value of USD 75.5 billion by 2033 at a

CAGR of 7.8%.

Greek Yogurt is an amazing dairy product made by straining regular yogurt to remove its liquid component which is normally known as "whey". This process creates a thick texture and higher protein content compared to regular yogurt, making it a favorite snack or meal accompaniment among many. Greek Yogurt's tart flavor pairs perfectly with both sweet and savory dishes like smoothies, parfaits, dips, or marinades. Also, it is lower in carbs, especially plain unsweetened varieties, and packed full of probiotics, calcium, and essential vitamins to support digestive health and bone strength which makes this versatile yet healthful food.

The Greek yogurt market experienced tremendous growth due to rising consumer interest in high-nutritional foods like Greek yogurt. Greek yogurt's high protein and probiotic benefits have become a top pick among health-minded individuals, reflecting an ever-increasing trend toward more healthful diets worldwide. Recent market developments include product innovations and the launch of innovative flavors to satisfy diverse consumer preferences.

Companies are expanding their product lines to offer organic and low-fat options to reach more people looking for healthier solutions. Greek yogurt consumption has seen explosive growth throughout North America and Europe as consumers increasingly incorporate this versatile product into their diets as an everyday food item. Furthermore, its global rise is providing manufacturers with opportunities for global expansion.

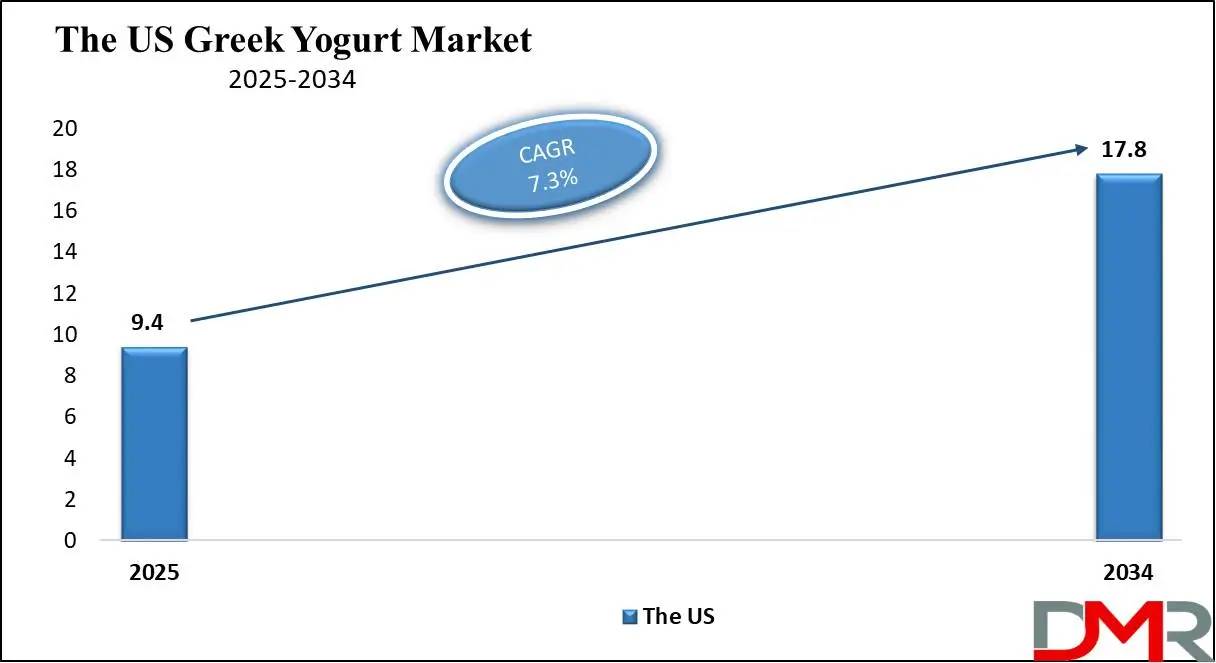

The US Greek Yogurt Market

The US Greek Yogurt market is projected to be valued at USD 9.4 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 17.8 billion in 2033 at a CAGR of 7.3%.

The U.S. Greek yogurt market is driven by the rising consumer demand for high-protein, low-fat, and nutrient-dense food options. Health-conscious lifestyles and a growing emphasis on digestive health have led to the increased popularity of probiotic-rich products like Greek yogurt.

Innovation in flavors, such as exotic and seasonal varieties, is driving consumer engagement.

Functional Greek yogurts infused with added probiotics, fiber, or vitamins are gaining traction among health-focused buyers. Another significant trend is the shift toward sustainable packaging, reflecting growing environmental concerns.

Key Takeaways

- Market Growth: The global Greek Yogurt market is anticipated to expand by USD 34.4 billion, achieving a CAGR of 7.8% from 2025 to 2033.

- Flavor Analysis: The strawberry flavor is predicted to dominate the Global Greek Yogurt Market with the largest revenue share in 2024

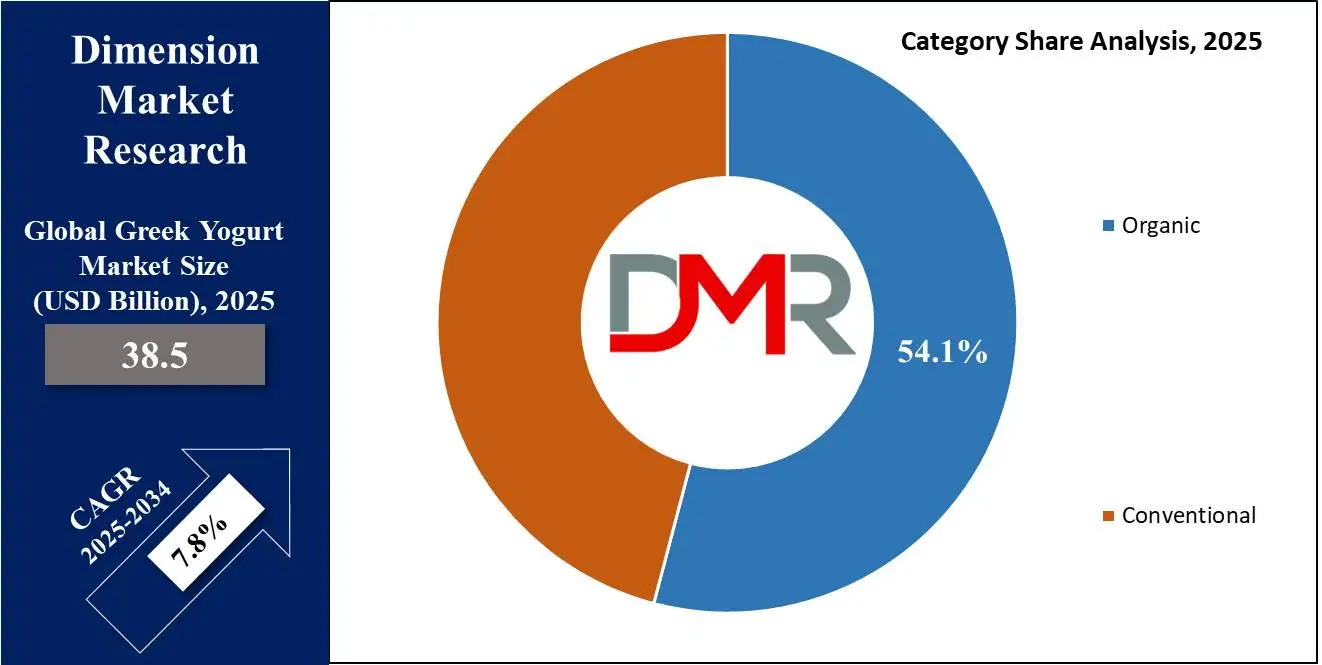

- Category Analysis: The organic category is predicted to emerge as the highest revenue share in 2024.

- Package Type Analysis: Cups & Tubs are predicted to dominate the Greek yogurt market based on packed type with the largest revenue share in 2024

- Distribution Channel Analysis: Supermarkets are predicted to dominate the global market in terms of distribution channels with the largest market share.

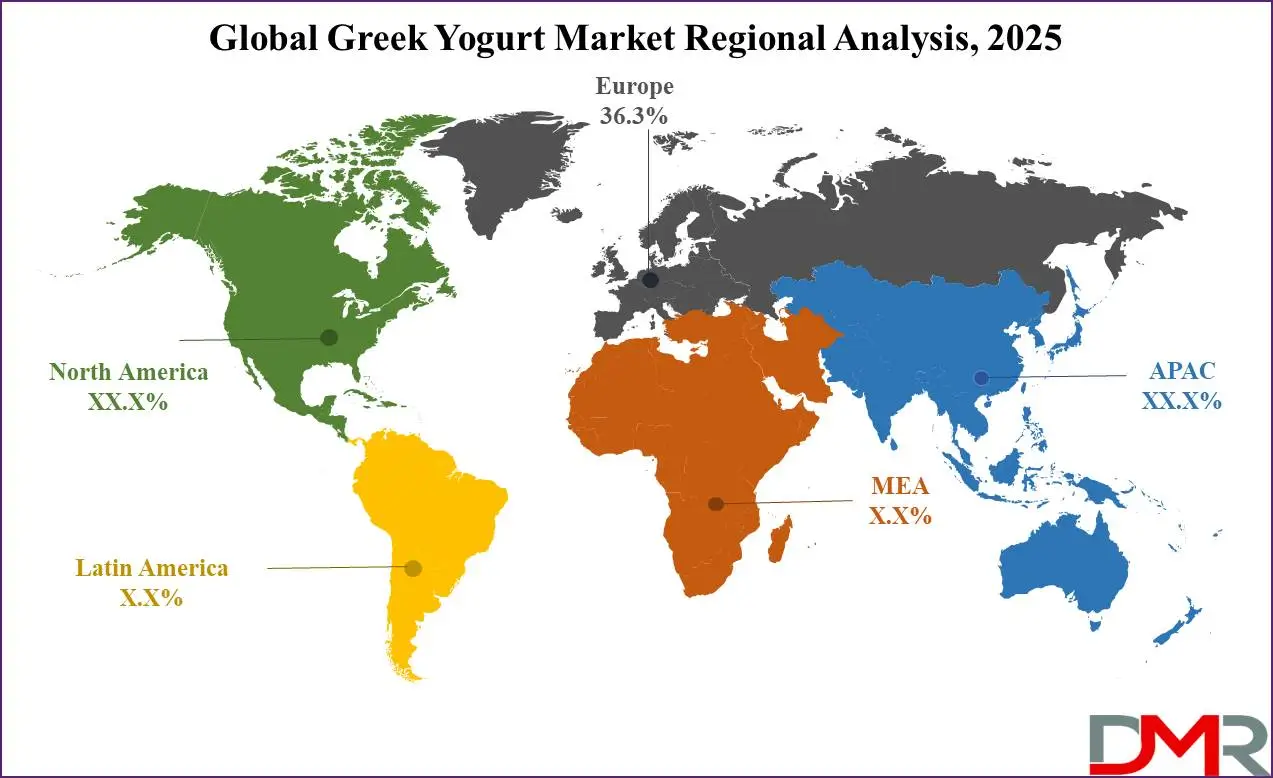

- Regional Analysis: Europe is projected to dominate the global Greek yogurt market, holding a market share of 36.3% by 2024.

Use Cases

- Healthy Breakfast Option: Greek yogurt is a popular choice for a nutritious breakfast. Packed with protein, probiotics, and calcium, it provides sustained energy throughout the day. Pair it with fruits, granola, or honey for added flavor and nutrients.

- Smoothie Base: As a creamy and tangy base, Greek yogurt enhances the texture and nutritional profile of smoothies. Blend it with fresh fruits, spinach, or protein powders for a quick, nutrient-dense drink. Its high protein content and probiotics support digestion, making it ideal for post-workout recovery or a midday energy boost.

- Substitute for High-Calorie Ingredients: Greek yogurt is a versatile replacement for sour cream, mayonnaise, or heavy cream in recipes. Its creamy consistency and mild tang reduce calories and fat without sacrificing flavor. Use it in dressings, dips, or baked goods to create healthier versions of your favorite dishes while maintaining a delicious taste.

- Dessert Enhancer: Transform Greek yogurt into a guilt-free dessert by sweetening it with honey, maple syrup, or a sprinkle of cocoa powder. Its rich texture makes it a perfect complement to fresh fruits or nuts. Freeze it for a creamy treat, offering a healthier alternative to ice cream with similar satisfaction.

Stats & Facts

- In 2022, U.S. yogurt sales exceeded USD 7.2 billion, with Greek yogurt comprising approximately 51% of these sales. According to Statista, this indicates that Greek yogurt generated over USD 3.6 billion in revenue, highlighting its significant role in the American yogurt market. The U.S. yogurt market has experienced steady growth since 2017, with sales revenue reaching over USD 8 billion in 2023.

- Despite rising prices, yogurt consumption in the U.S. has increased, with average annual consumption rising by over 9% between 2000 and 2023. According to Statista, Greek-style yogurt accounted for 37.5% of yogurt sold to U.S. consumers as of 2016. This growing consumer preference underscores the expanding market share of Greek yogurt within the dairy industry.

- A Lindberg International study highlights that 73% of consumers would opt for organic dairy products if they were widely available, underscoring the growing demand. Additionally, the trend toward clean-label products is fueling the organic segment’s growth.

- According to Cargill Inc., 8 out of 10 customers prefer products with transparent, natural ingredients. Manufacturers are responding by expanding their organic product lines, capitalizing on this demand to drive market growth.

Market Dynamic

Driving Factors

Health Benefits and Nutritional Value The health benefits associated with Greek yogurt are one of its primary drivers for market expansion. Packed with proteins, Greek yogurt provides a satisfying protein meal while stabilizing blood sugar levels, aiding muscle development, and fat loss, lactose-sensitive individuals can opt for this nutritious option, while its higher calcium and protein content compared to regular yogurt attracts health-minded consumers looking for nutritionally dense food options that promote good health. With creamy texture options like Greek Yogurt adding further appeal.

Shifting Preferences Toward Healthier and Convenient Foods

Consumers' increased focus on diets rich in essential nutrients has fuelled Greek yogurt's rise as both a meal replacement and snack food option. Greek yogurt's popularity as an efficient weight management product has seen increased interest, particularly among health-conscious customers in North America and Canada. Greek yogurt's versatile nature in replacing high-calorie ingredients further boosts its appeal as an attractive food product. Natural and organic Greek yogurt products reflect consumer preference for chemical- and gluten-free options, coupled with urbanization, an expanding middle-class population, and online sales platforms - which all play key roles in driving market expansion and evolution.

Restraints

High Price Point

Greek yogurt typically commands higher prices due to its unique production process and higher protein content, but this premium pricing may make the product inaccessible to price-sensitive consumers in developing markets or economic downturns, prompting many of them to opt for less costly options instead, which in turn would impede its market expansion. Manufacturers must strike an optimal balance between accessibility, profitability, and product differentiation when setting pricing strategies to attract the broadest range of users while remaining cost-competitive.

Greek Yogurt Awareness in Emerging Markets

While Greek yogurt's popularity in developed markets continues to expand rapidly, its awareness and acceptance remain relatively low in emerging markets. Many consumers in these regions remain unaware of Greek yogurt's many health and culinary uses - this lack of awareness could limit adoption thus slowing global expansion of Greek yogurt products. Education campaigns and targeted marketing initiatives must therefore be employed to increase consumer understanding as well as build demand where Greek yogurt consumption may still not yet be widespread.

Opportunities

Expansion into Emerging Markets

Greek yogurt has quickly gained global appeal, particularly among emerging markets where demand for healthy and protein-rich food sources is on the increase. Countries across Asia, Africa, and Latin America present tremendous potential growth potential; brands can leverage this by localizing their product with region-specific flavors while raising awareness regarding health benefits as well as setting affordable price points to make Greek yogurt accessible across a wider demographic.

Convenient Single-Serve Packaging

As busy lifestyles continue to shape consumer purchasing behavior, Greek yogurt brands can capitalize on consumer desire for convenience by providing single-serve packaging for on-the-go consumption of breakfast or snack products such as Greek yogurt. Such convenient packaging could drive sales within breakfast and snack categories - especially among young professionals, students, and families seeking quick yet nutritious meal solutions.

Trends

Premium and Flavored Greek Yogurts

Consumers increasingly want premium, indulgent experiences, resulting in the rise of gourmet Greek yogurt products with exotic and trendy flavors such as matcha, turmeric, and exotic fruits as well as indulgent ingredients like honey chocolate, or nuts. These innovative offerings meet diverse taste preferences while positioning brands within this premium space and targeting both health-focused consumers as well as indulgence-seekers alike.

Sustainability and Eco-Friendly Packaging

With increased environmental consciousness among consumers, consumers are gravitating toward brands that prioritize sustainability in their operations and packaging choices. Greek yogurt companies are responding by adopting eco-friendly packaging options while responsibly sourcing ingredients; innovations like recyclable or biodegradable packaging solutions; commitments to reduce carbon emissions are becoming key elements in the consumer decision-making process - brands who emphasize this element may gain the loyalty and long-term growth opportunities that accompany such buyers.

Research Scope and Analysis

By Flavor

The strawberry flavor is predicted to dominate the market with the largest revenue share in 2024, due to its widespread appeal among consumers and rising interest in fruity-flavor varieties. Strawberry-flavored Greek yogurt has quickly become one of the most beloved food products globally thanks to its naturally sweet and tart taste that complements the creamy texture of yogurt, providing an enjoyable sensory experience. According to sales figures, this flavor's popularity is nearly 2.5 times higher than vanilla. Strawberry's versatility and wide acceptance among different age groups and regions help cement its position as the largest production segment in which health consciousness plays a large part in driving its success.

These are well known for providing many vital antioxidants, vitamins, and fiber benefits that may make an important addition to diets around the globe. Strawberry-flavored Greek yogurt offers an easily digestible source of nutrition with its combination of taste and nutrition, aligning perfectly with modern consumer trends that favor functional foods for health purposes. On the other hand, vanilla Greek yogurt holds second place among its counterparts due to its timeless appeal and versatile nature, being both classic and neutral in flavor profile. As its neutral profile makes it compatible with various toppings or add-ons, vanilla Greek yogurt remains a popular choice when customizing.

By Category

Organic Greek yogurt products are predicted to emerge as the highest revenue share in 2024, due to rising consumer preferences for health-focused and clean-label options, drawing appeal among many who prioritize ingredient transparency and sustainability in their food choices. Products in this category tend to be free from allergens or synthetic additives addressing concerns over safety and health; thus creating strong appeal with those searching for dairy-free options or those made with minimally processed ingredients. The second dominating segment is the conventional category, which remains popular due to its affordability and widespread availability.

While conventional products lack the specialized appeal of organic options, they cater to a broad audience seeking high-protein, nutrient-rich snacks at accessible price points. Conventional Greek yogurt continues to thrive as a staple in households globally, balancing tradition with functionality. However, the growing preference for organic and clean-label alternatives suggests a potential shift in dominance in the future.

By Package Type

Cups & Tubs are predicted to dominate the Greek yogurt market with the largest revenue share in 2024, due to consumer preferences for convenience and practicality, serving both individual consumers as well as families alike. Furthermore, cups & tubs packaging formats meet both these criteria effectively. Single-serve cups have become an increasingly popular option among busy consumers looking for quick and nutritious snack or meal replacement solutions on the go, thanks to their portable size and portion control features that make them convenient. Their increased popularity contributes to their dominance in the market.

Additionally, larger tubs of Greek yogurt are an attractive choice for home consumption by families or those using Greek yogurt in food- and baking-related applications. Their ability to remain sealed while multiple people enjoy them adds to their practicality. Manufacturers use attractive packaging designs for cups and tubs manufactured by them to increase visual appeal in retail settings and drive impulse buys. The Bottles segment may not be dominant but has established itself among health-minded consumers looking for drinkable yogurt options, especially those looking for protein-packed drinks to aid fitness or post-workout recovery.

By Distribution Channel

Supermarkets are projected to lead the Greek yogurt market with revenue share by 2024, providing customers with access to an assortment of Greek yogurt brands and flavors for any taste or preference. Plus, their convenient location makes shopping for Greek yogurt alongside groceries all the more appealing! Customers can quickly compare products based on price, quality, and packaging information for informed choices. Supermarkets are located strategically near high-traffic areas to draw in new shoppers while their brand recognition attracts potential consumers further.

Greek yogurt's growing popularity due to its healthful properties and protein-rich composition has spurred supermarkets to meet this rising demand, placing Greek yogurt at the core of their dairy sections and their online channels are fast-beating that market in terms of sales growth. Online sales represent its second-biggest channel. E-commerce platforms provide the ease and convenience of browsing multiple brands and reading reviews before having products sent directly to consumers' doorsteps. Furthermore, online shopping also enables personalized recommendations which increase Greek yogurt sales while expanding customer reach.

The Greek Yogurt Market Report is segmented based on the following

By Flavor

- Unflavored

- Vanilla

- Strawberry

- Blueberry

- Raspberry

- Blends

By Category

- Organic

- Conventional

- Others

By Package Type

By Distribution Channel

- Supermarkets

- Convenience Stores

- Online

- Others

Regional Analysis

Europe is likely to

account for 36.3% of the revenue share in the Greek yogurt market by the end of 2024, solidifying its position as a leader in the Greek yogurt industry. The region offers numerous untapped opportunities for market growth. Eastern Europe, in particular, is projected to surpass Western European markets, where dairy sales are declining due to the rising demand for dairy-free alternatives. Many European yogurt manufacturers are upgrading their facilities with automated production lines for fresh milk to enhance efficiency.

The Asia-Pacific region is expected to witness the fastest growth in the Greek yogurt market in the coming years, driven by a growing preference for healthier snacking options. Rising awareness of the importance of gut health and protein-rich diets is fueling demand. Furthermore, the expansion of e-commerce and supermarkets in the region has enhanced accessibility. Local adaptations, such as incorporating regional flavors, cater to diverse tastes, further driving consumption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global Greek yogurt market is intensely competitive, with numerous companies striving for market share and consumer loyalty. Leading players in this sector have secured their positions through strong branding, extensive distribution networks, and a focus on ongoing product innovation. To maintain a competitive edge, these companies emphasize product differentiation and are broadening their offerings to meet shifting consumer tastes. This includes introducing new flavors, utilizing natural and organic ingredients, and developing healthier options with lower fat and sugar content.

Manufacturers are also dedicating resources to marketing and advertising campaigns to boost brand visibility and highlight the advantages of Greek yogurt, such as its rich protein content and probiotic benefits. Strategic collaborations and partnerships are a common strategy, enabling companies to extend their geographic reach and connect with new customer bases. Additionally, mergers and acquisitions play a significant role, allowing firms to strengthen their market position while benefiting from combined manufacturing, distribution, and research and development capabilities.

Some of the prominent players in the global Greek yogurt market are

- Chobani Holdings LLC

- Danone

- Fage International S.A

- Nestle S.A

- General Mills, Inc.

- Parmalat S.p.A

- Muller UK & Ireland Group

- The Kroger Co.

- Wallaby Yogurt Company

- The Hain Celestial Group

- Stonyfield

- Other Key Players

Recent Development

- In April 2024, Walmart unveiled Bettergoods, a new private food brand designed to make high-quality, chef-inspired culinary experiences more accessible. This launch marks Walmart's most significant private brand food debut in two decades and the fastest launch of a food private brand in its history, showcasing the retailer's ability to bring innovative products to market rapidly and at scale.

- In October 2024, SPC Baskin Robbins Introduces Creative New Ice Cream Flavor

- Baskin Robbins launched its October flavor of the month, Sung-ya, Greek..., an imaginative creation by a sixth-grade student. Combining flat peaches, Greek yogurt, and granola, the flavor merges youthful trends with a unique name that captures its playful essence, drawing widespread attention.

- In June 2024, Chobani introduced Zero Sugar Drinks, expanding its Zero Sugar range to include drinkable options. These portable, protein-rich beverages are made with natural ingredients, catering to consumers seeking convenient, better-for-you choices.

- In April 2023, Yasso debuted its largest advertising campaign, Ridiculously Better, highlighting the exceptional taste and nutritional benefits of its frozen Greek yogurt snacks. This milestone celebrates Yasso’s dedication to delivering indulgent yet health-conscious treats that elevate the snacking experience.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 38.5 Bn |

| Forecast Value (2033) |

USD 75.5 Bn |

| CAGR (2024-2033) |

7.8% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 9.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Flavor (Unflavored, Vanilla, Strawberry, Blueberry, Raspberry, Blends), By Category (Organic, and Conventional), By Package Type (Cups & Tubs, and Bottles), By Distribution Channel (Supermarkets, Convenience Stores, Online, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Chobani Holdings LLC., Danone, Fage International S.A, Nestle S.A, General Mills, Inc., Parmalat S.p.A, Muller UK & Ireland Group, The Kroger Co., Wallaby Yogurt Company, The Hain Celestial Group, Stonyfield, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Greek Yogurt Market size is estimated to have a value of USD 38.5 billion in 2024 and is expected to reach USD 75.5 billion by the end of 2033.

The US Greek Yogurt market is projected to be valued at USD 9.4 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 17.8 billion in 2033 at a CAGR of 7.3%.

Europe is expected to have the largest market share in the Global Greek Yogurt Market with a share of about 36.3% in 2024.

Some of the major key players in the Global Greek Yogurt Market are Puritan Medical Products, COPAN Diagnostics, Becton, Dickinson and Company, Thermo Fisher Scientific, Inc., Quidel Corporation, and many others.

The market is growing at a CAGR of 7.8 percent over the forecasted period.