Market Overview

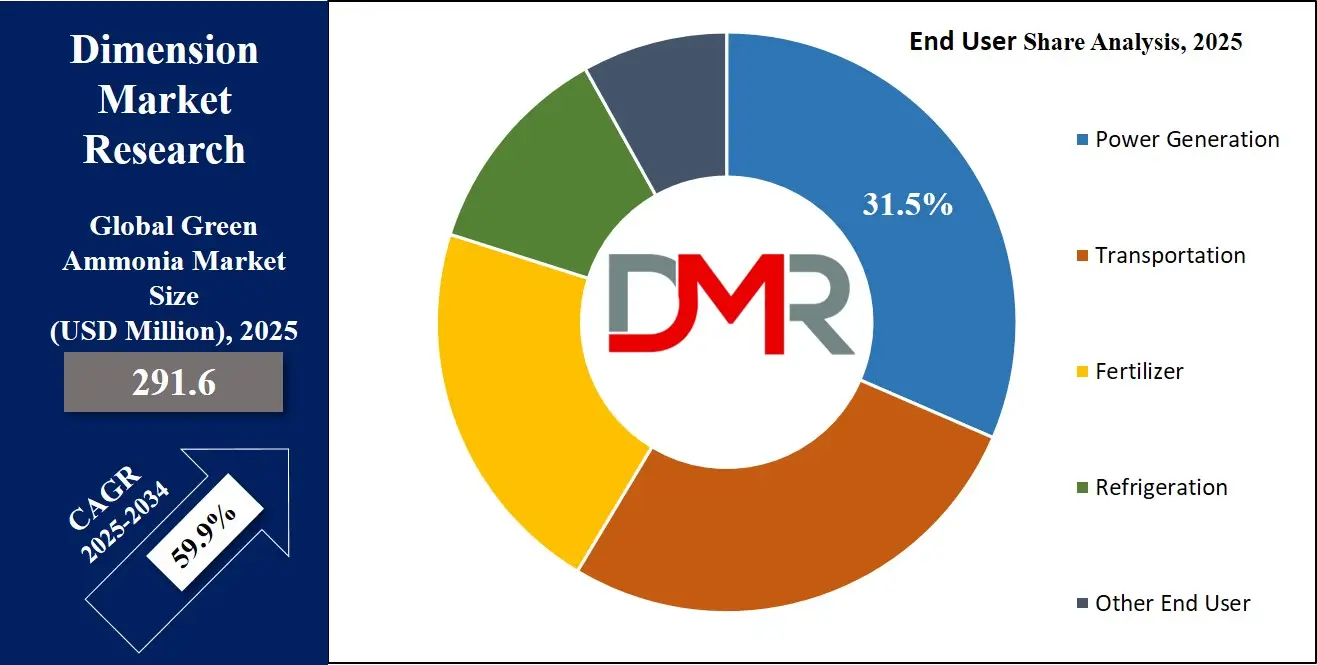

The Global Green Ammonia Market size is projected to reach

USD 291.6 million in 2025 and grow at a compound annual growth rate of

59.9% from there until 2034 to reach a value of

USD 19,938.8 million.

The industry of green ammonia experiences rapid market expansion as a response to increasing sector-wide demands for carbon-neutral operations and reduced emissions. The renewable energy-powered electrolytic production of green ammonia serves as an environmentally friendly substitute for traditional ammonia manufacturing, which depends on fossil fuels. The transition toward green ammonia represents an essential step toward reaching net-zero goals and climate change mitigation.

The market expansion occurs through vital technological progress. Improvements in electrolyzer technology combined with renewable energy adoption have lowered the economic barriers to green ammonia manufacturing. The development of small-scale modular production units enables decentralized ammonia generation, which reduces transportation expenditures while cutting down emissions.

Green ammonia market development faces obstacles, including substantial financial outlays, an insufficient renewable energy framework, and limited storage solutions for transporting ammonia. The widespread adoption of ammonia faces limitations from toxicity risks, coupled with non-uniform regional regulations.

These obstacles do not minimize the substantial possibilities within the green ammonia market. Its potential applications span various sectors, including agriculture, where it can serve as a carbon-free fertilizer; energy storage, acting as a carrier for hydrogen; and Green ammonia functions as a hydrogen carrier for energy storage and enables the operation of hydrogen-based transportation systems in shipping alongside heavy-duty vehicles. The growing implementation of environmental regulations combined with renewable energy investments will drive up green ammonia demand to establish it as an essential component in building a sustainable energy ecosystem.

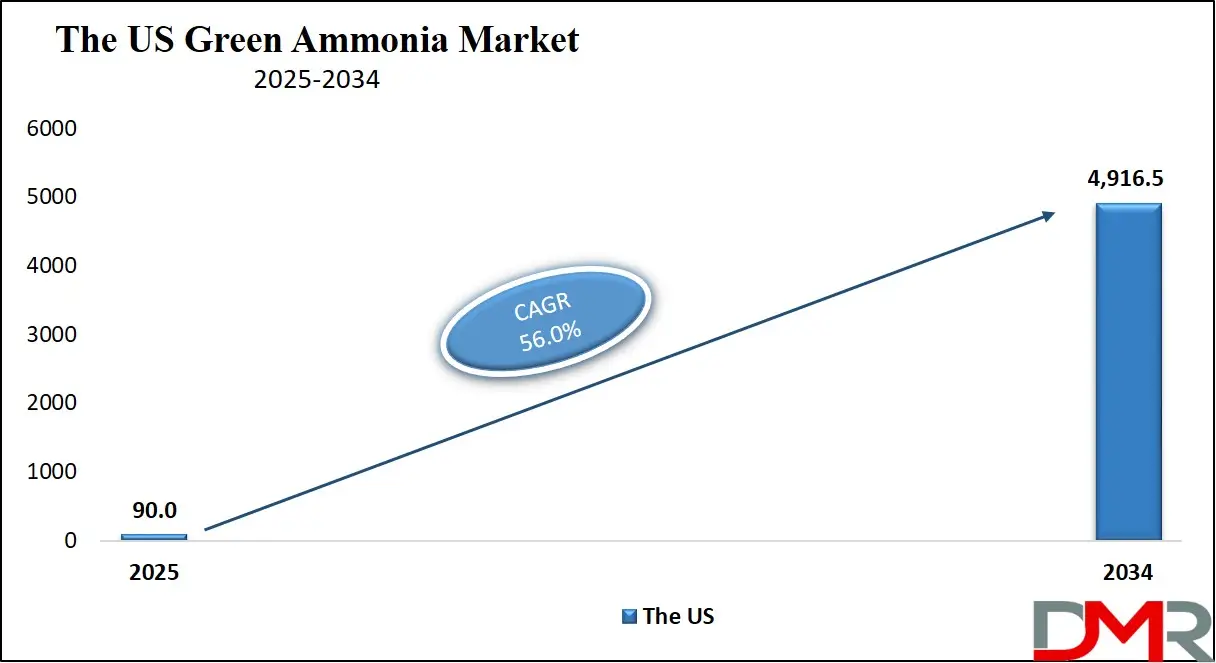

The US Green Ammonia Market

The US Green Ammonia Market size is projected to reach USD 90.0 million in 2025, which is further expected to reach USD 4,916.5 million in 20234 at a compound annual growth rate of 56.0% over its forecast period.

The United States sees rising interest in green ammonia alongside its national strategy to build a low-carbon economy. The U.S. Department of Energy (DOE) positions clean hydrogen alongside its derivative green ammonia as key elements for enhancing energy security and environmental performance. The Inflation Reduction Act of 2022 supports clean energy projects through funding and tax breaks to boost the construction of green ammonia facilities.

The advancement of electrolyzer technology and improved methods to incorporate renewable sources make green ammonia production more commercially viable. The bedding down of renewable resources, including Midwestern wind power and Southwest solar power, establishes America as an ideal base for green ammonia manufacturing. Existing networks used for ammonia distribution provide the industry with pathways toward market entry.

Substantial capital needs and security protocol development for ammonia management and regulatory establishment continue to present challenges. Various institutions partnering with government agencies and private companies are making progress toward solving these difficulties. By funding research into both production efficiency and cost reduction, the offices of Hydrogen and Fuel Cell Technologies at DOE are supporting the improvement of the industry.

The United States benefits from its extensive agricultural domain and industrial establishments, making them ideal targets for green ammonia applications as sustainable fertilizer and alternative industrial fuel. The U.S. stands ready to emerge as a major player in global green ammonia markets thanks to improving policies and technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Green Ammonia Market

The European Green Ammonia Market size is projected to reach

USD 51.32 million in 2025 at a compound annual growth rate of

44.9% over its forecast period.

Europe leads the green ammonia market because its climate targets receive strong backing through governmental regulations. Green ammonia serves as a vital component to help the European Union reach its goal of at least 55% greenhouse gas emission reduction by 2030 through its Green Deal and Fit for 55 package.

Renewable Energy Directive (RED II) within the EU provides requirements for using renewable fuels such as green ammonia throughout multiple industrial sectors, while the forthcoming RED III will enforce similar demands. Through the Carbon Border Adjustment Mechanism (CBAM), the EU plans to tax imports with high carbon content to create a domestic market for green ammonia production.

Germany and the Netherlands, together with Denmark, have started substantial investments to develop their green ammonia infrastructure. The National Hydrogen Strategy of Germany outlines its plans to produce and import green ammonia products. The Netherlands operates the North2 project, which seeks to harness offshore wind power for producing green hydrogen along with ammonia.

The demographic advantage of Europe stems from its industrialized economy, which emphasizes sustainability in all sectors. The Japan Green Growth Strategy details how the country will build its fuel ammonia system by establishing both national production facilities and international cooperation agreements. The implementation of green ammonia faces ongoing obstacles between production expenses and the necessity of developing logistical structures. The green ammonia market leadership position in Europe requires ongoing investments and policy backing to address present hurdles.

The Japan Green Ammonia Market

Japan Green Ammonia Market size is projected to reach USD 17.50 million in 2025 at a compound annual growth rate of 54.6% over its forecast period.

Japan plans to use green ammonia to reach its goal of carbon neutrality by 2050. Ammonia stands as a vital decarbonization element for the energy sector according to the Ministry of Economy Trade and Industry (METI), which focuses mainly on power generation and shipping applications.

The Japanese Green Growth Strategy details action plans to establish domestic renewable ammonia production while creating international supply network partnerships. Through NEDO and other government-funded initiatives, Japan supports research to improve ammonia synthesis technologies while working to decrease production costs.

The establishment of a stable green ammonia supply through cooperative projects with Australia remains a current priority. Several Japanese firms are putting their money into Australian renewable energy operations, which will produce green ammonia intended for export to Japan. Green ammonia testing through pilot projects runs simultaneously with thermal power plant tests, aiming to cut carbon emissions.

Japan benefits from its demographic edge through advanced technology coupled with innovative practices in environmental protection. The nation's dependence on energy imports causes green ammonia to become an interesting solution for improving energy safety and fulfilling its climate targets. Despite remaining obstacles, including expensive production and infrastructure requirements, Japan maintains its leading position in the global green ammonia sector because of dedicated research partnerships and policy backing.

Global Green Ammonia Market: Key Takeaways

- The Global Market Share Insights: The Global Green Ammonia Market size is estimated to have a value of USD 291.6 million in 2025 and is expected to reach USD 19,938.8 million by the end of 2034.

- The Global Market Share Insights: The US Green Ammonia Market is projected to be valued at USD 90.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4,916.5 million in 2034 at a CAGR of 56.0%.

- Regional Insights: North America is expected to have the largest market share in the Global Green Ammonia Market with a share of about 36.7% in 2025.

- Key Players: Some of the major key players in the Global Green Ammonia Market are Yara, Siemens Energy, ThyssenKrupp, Nel, MAN Energy, ENGIE, Uniper, BASF, ITM Power, McPhy, Green Hydrogen Systems, Enapter, Starfire Energy, ACME, Iberdrola, Hiringa Energy, Haldor Topsoe, and many others.

- The Global Market Growth Rate Insights: The market is growing at a CAGR of 59.9 percent over the forecasted period of 2025.

Global Green Ammonia Market: Use Cases

- Agricultural Fertilizers: Green ammonia functions as a carbon-neutral fertilizer replacement for traditional nitrogen-based fertilizers that typically stem from fossil fuels. Green ammonia processing through renewable electricity enables farmers to decrease their climate-warming emissions. Through its green design, green ammonia enables environmental sustainability in agriculture while protecting soils and supporting international targets for food production sustainability.

- Energy Storage: Green ammonia functions effectively as an energy storage medium through which renewable power can be safely transported across great distances. Excess solar and wind power storage overcome intermittency problems through conversion into chemical compounds. Dual-fuel engines along with emerging ammonia-powered vessels, establish green ammonia as a vital component for pollution-free maritime transport.

- Maritime Fuel: The shipping industry is actively adopting green ammonia as a zero-carbon marine fuel because it can replace heavy fuel oil for ship propulsion. Within combustion, green ammonia delivers no CO₂ emissions, thus satisfying decarbonization standards established by the International Maritime Organization. Ammonia emerges as an essential component of clean maritime transport through its application in dual-fuel engines alongside emerging ammonia-powered vessels.

- Power Generation: The energy sector utilizes green ammonia in gas turbines and fuel cells to create electricity while preventing carbon dioxide emissions during the process. Power generation from green ammonia stands out as a vital solution for locations without grid connection and countries that aim to move past their coal-based power generation.

- Industrial Feedstock: Green ammonia functions as a low-carbon raw material in petrochemicals and manufacturing products, where it produces nitric acid and explosives alongside synthetic fibers. The substitution of fossil-derived ammonia within these sectors contributes to overall industrial climate change reduction. Green ammonia functions to help businesses sustain crucial chemical output levels required by worldwide supply chains, alongside achieving their carbon reduction targets.

Global Green Ammonia Market: Stats & Facts

European Union – European Commission

- The European Commission has allocated over USD 166.7 million from its Innovation Fund to support green ammonia and hydrogen-related demonstration projects across the bloc.

- As part of its 2020 Hydrogen Strategy, the EU aims to develop a €100 billion per year green hydrogen economy by 2025, a key enabler for the decarbonization of ammonia production and related industries.

Germany – H2Global Foundation & Federal Government

- Under its H2Global initiative, Germany has awarded a long-term contract to Fertiglobe to supply at least 259,000 metric tons of green ammonia from Egypt between 2027 and 2033.

- The total value of the contract stands at €397 million, covering over 10% of Germany’s current annual ammonia demand.

- Further rounds of H2Global import tenders are expected, worth up to €3.5 billion, with additional co-financing from the government of the Netherlands, signaling a significant pipeline for green ammonia imports.

Japan – Ministry of Economy, Trade and Industry (METI)

- Japan has announced a USD 21 billion subsidy framework to support the delivery of clean hydrogen, including green ammonia, over 15 years starting from 2023.

- The Japanese energy company Idemitsu Kosan has committed to importing over 1 million tonnes of low-carbon ammonia by 2030, utilizing existing facilities at its Tokuyama plant for domestic supply chain integration.

Saudi Arabia – NEOM Green Hydrogen Company & Ministry of Energy

- In 2021, Saudi Arabia unveiled a USD 5 billion investment in a green hydrogen and ammonia production facility located in the NEOM smart city development.

- The plant is expected to become operational in 2025 and aims to become one of the world's largest exporters of green ammonia, produced via renewable-powered electrolysis.

United Nations & United Nations Industrial Development Organization (UNIDO)

- The Green Hydrogen Catapult, launched in December 2020 under the UN umbrella with support from RMI and multiple industrial partners, has set a global target to reduce the cost of green hydrogen below USD 2 per kilogram by 2026—a crucial benchmark for green ammonia feasibility.

- UNIDO’s Global Programme for Hydrogen in Industry, initiated in 2021, aims to fast-track green hydrogen deployment in industrial applications across partner countries, backed by nations such as Austria, China, Germany, and Italy.

Mauritania – Ministry of Petroleum, Mines and Energy

- The AMAN project, launched by the Mauritanian government with international partners, includes the development of 12 GW of wind and 18 GW of solar power to produce 1.7 million tonnes of green hydrogen or up to 10 million tonnes of green ammonia annually.

- The project is geared toward both domestic energy use and large-scale exports, positioning Mauritania as a potential global hub for green fuel.

Namibia – Government of Namibia & Federal Ministry for Economic Cooperation and Development (Germany)

- With German financial and technical support, Namibia has begun implementing its first national-scale green hydrogen and ammonia project.

- The initiative is part of a broader bilateral cooperation for sustainable energy and is seen as a model for other Sub-Saharan African countries.

Singapore – Energy Market Authority (EMA)

- Singapore is currently developing a 600 MW hydrogen-ready combined-cycle power plant, scheduled to be operational by the first half of 2026.

- The plant is a part of the country's strategy to transition to low-carbon fuels, including green ammonia and hydrogen, for power generation.

Spain – Spanish Government & Private Sector Consortium

- In early 2021, a coalition of 30 Spanish companies announced plans to invest in 93 GW of solar power and 67 GW of electrolyzer capacity.

- These assets are expected to support large-scale production of green hydrogen and ammonia, primarily for industrial use and export by 2030.

Australia – Department of Industry, Science, Energy and Resources

- The Australian government has committed USD 201.7 million through its Low Emissions Technology Statement to scale up renewable hydrogen and ammonia projects.

- Australia views green ammonia as a major export commodity in its decarbonization roadmap, with several pilot projects already under development.

United States – Supported by U.S. Department of Energy (DoE) in Partnership with International Corporates

- A partnership including Idemitsu Kosan (Japan), Mitsubishi Corporation, and Swiss energy firm Proman is evaluating a low-carbon ammonia production plant in Lake Charles, Louisiana.

- The facility is expected to produce 1.2 million metric tons of ammonia annually by 2030, utilizing natural gas with carbon capture technologies to reduce emissions.

International Maritime Organization (IMO)

- According to long-term decarbonization forecasts by the IMO, ammonia could comprise up to 25% of the total global marine fuel mix by 2050.

- This projection underscores green ammonia's potential as a zero-carbon shipping fuel and its strategic importance in achieving maritime emission reduction targets.

Global Green Ammonia Market: Market Dynamic

Driving Factors in the Global Green Ammonia Market

Government Support and Policies

The global green ammonia market grew significantly because of government support through policies. The European Union, along with the United States and Japan, leads a worldwide initiative to fulfill climate objectives through carbon emission cuts and switching to renewable power sources. The development of green ammonia receives governmental support through a combination of subsidy programs and financial grants, and tax benefits for renewable energy investment.

The European Union's Green Deal and the U.S. Inflation Reduction Act allocate major funds specifically for clean energy programs that extend to green ammonia manufacturing operations. Green ammonia becomes a profitable production option because policy frameworks lower the barrier to entry by providing financial benefits for renewable energy infrastructure development and ammonia plant construction. A carbon pricing system, including carbon taxes that certain governments implemented, acts as an incentive for industries to choose green ammonia because of its reduced environmental impact. The existing policies support the emergence of a prosperous green ammonia market space by giving producers financial reasons to use renewable energy instead of fossil fuels during production.

Increasing Demand for Clean Energy Solutions

The green ammonia market expands due to intensifying worldwide interest in sustainable energy solutions. Different industries and governments that aim to reduce their carbon impact choose to combine renewable power sources, including solar power and wind power, and hydropower, across their operations. Green ammonia fulfills the essential function of delivering clean energy through its capability to store renewable energy in transportable forms.

The substance performs as a power source in fuel cells to deliver clean, sustainable energy by replacing fossil fuels. Green ammonia functions as a hydrogen transport mechanism because experts predict that hydrogen will develop into a dominant power source. The market for green ammonia experiences strong growth because industries use hydrogen as a clean energy alternative to natural gas. Being able to efficiently store and transport hydrogen makes ammonium essential in building the future hydrogen economy. Traditional ammonia production methods maintain lower costs than green ammonia production despite being environmentally unfriendly.

Restraints in the Global Green Ammonia Market

High Production Costs

The production of green ammonia involves atmospheric nitrogen elements combined with hydrogen obtained from renewable electricity using electrolysis. Clean ammonia production occurs when nitrogen from the air combines with hydrogen that is derived from renewable electricity obtained by electrolysis. Large amounts of energy are needed for the production process, which makes wind and solar power more expensive than traditional fossil-fuel-based power generation. The current production costs of green ammonia exceed those associated with ammonia derived from natural gas through the Haber-Bosch method.

The development of green ammonia infrastructure requires building liquid ammonia storage facilities together with pipeline networks, as well as the creation of ammonia transportation systems between regions. Green ammonia faces challenges in remaining price competitive because its costs are influenced by market changes in renewable energy prices. The market's capacity for scale-up production depends on renewable energy and electrolysis technology reaching a lower cost point.

Limited Infrastructure for Storage and Transport

The global green ammonia market faces substantial limitations because of reduced ammonia infrastructure for storage and delivery methods. The industrial production of ammonia mainly occurs at central facilities close to manufacturing centers, followed by bulk distribution to end-users across large territories. The global energy and fertilizer needs stand at risk of being limited by insufficient infrastructure investment for green ammonia production and distribution. The shipping industry across the world produces significant amounts of greenhouse gas pollution, which has now become an urgent priority for international organizations and governing bodies.

The maritime industry identifies green ammonia as an effective alternative fuel because of its dense energy content and its capacity to burn without emissions. The International Maritime Organization (IMO) established target goals to decrease shipping sector greenhouse gas emissions by at least 50% by 2050, prompting the industry to investigate alternative fuels. Currently, only several nations operate dedicated transport systems for green ammonia designed to support market development. The global green ammonia market reveals a bright potential through its ability to function as a hydrogen carrier solution for energy storage systems. The market has limited potential regarding its growth because of inadequate robust storage and transport infrastructure.

Opportunities in the Global Green Ammonia Market

Expansion in Maritime Transport

Green ammonia stands to experience substantial growth through its adoption in the maritime transport market. The global shipping industry generates significant greenhouse gas emissions that international bodies and governments now recognize as a top priority for decarbonization. The worldwide adoption of hydrogen as a natural gas replacement will require advanced hydrogen storage and distribution networks, which will expand in importance. Several companies, together with governmental agencies, study how green ammonia could power bulk carriers along with container ships and tankers.

The International Maritime Organization (IMO) has established a goal to reduce shipping greenhouse gas emissions by at least 50% by 2050, which drives the industry to research new fuel alternatives. Irrigation systems and ships powered by green ammonia are gaining supporters worldwide, particularly through Norwegian and Japanese projects to develop ammonia-driven vessels. The expansion of the worldwide green hydrogen market will necessitate increased production of green ammonia over the next few years. Green ammonia is poised to become a dominant marine fuel because of rising shipping emission standards, which will fuel market demand.

Ammonia as a Hydrogen Carrier for Energy Storage

The global green ammonia market holds remarkable growth prospects as an alternative hydrogen carrier system for energy storage solutions. The clean energy properties of hydrogen face obstacles when it comes to energy storage and transport because of its low density and volatile nature. Green ammonia addresses these problems by providing a solid and transferable hydrogen storage solution. Through renewable energy generation, ammonia functions as a liquid carrier for hydrogen storage.

Energy sources serve as a key foundation for the hydrogen economy of tomorrow because they enable efficient hydrogen distribution to every region without requiring special transport infrastructure. The ability of ammonia to transform into a liquid form at normal temperatures leads to both affordable and expandable hydrogen delivery solutions. Countries worldwide are adopting hydrogen as their clean natural gas replacement, which will drive the demand for efficient hydrogen storage and distribution networks. The green ammonia market shows strong growth potential because ammonia stands as a vital element for developing worldwide hydrogen supply networks.

Trends in the Global Green Ammonia Market

Rise in Green Hydrogen Production

The market for green ammonia develops directly alongside the expansion of green hydrogen production technologies. The production of green ammonia depends on electrolysis technology, where renewable electricity splits water molecules into oxygen and hydrogen products. After electrolysis produces hydrogen, the resulting product undergoes a chemical combination with atmospheric nitrogen to create ammonia. Several national governments have established green hydrogen production as their core decarbonization initiative because they urgently seek clean energy solutions.

A worldwide increase in green hydrogen production scale-up drives more projects and funding allocations from nations. The expanding green hydrogen sector worldwide will drive substantial growth in the demand for green ammonia during the upcoming years. Aggressive green hydrogen production policies developed by Germany, the U.S., and Japan are expected to create direct markets for green ammonia solutions in industrial and agricultural sectors. Countries including Australia and those throughout the Middle East concentrate on exporting green hydrogen, which drives up the need for green ammonia.

Shift to Carbon-Free Fertilizers

The agricultural sector stands to benefit strongly from green ammonia because it provides sustainable, carbon-free alternatives to fossil fuel-based ammonia production. The demand for sustainable agricultural practices has grown because agriculture represents large volumes of global greenhouse gas emissions, so green ammonia-based fertilizers have gained momentum. Different countries across Europe and North America are making shifts toward low-carbon agricultural systems where green ammonia enables fertilizer production via nitrogen compounds. Increasing demands from fertilizer manufacturers to lower their production carbon footprint drive investment in green ammonia production technologies.

Governments from around the world are promoting farmers to transition to green ammonia fertilizers by implementing subsidy programs along with tax advantages and regulatory changes. The market demands lower environmental impact from fertilizers while simultaneously creating more economical solutions because rising energy costs in traditional production methods. The growth of green ammonia as a main ingredient in global fertilizer markets becomes possible through environmental sustainability awareness rising with government-supported policies for agricultural emission reduction.

Global Green Ammonia Market: Research Scope and Analysis

By Technology Analysis

Solid Oxide Electrolysis (SOE) is projected to emerge as the dominant technology in the production of green ammonia by the end of 2025. The production of green ammonia is being largely influenced by the rise of Solid Oxide Electrolysis (SOE) technology due to its efficient use of renewable energy sources. The high operating temperature range of 700°C to 1000°C enables SOE to perform electrolysis, which breaks water molecules into hydrogen and oxygen.

SOE operates at high temperatures, thereby decreasing the necessary electrical energy requirements, which enables lower production costs than PEM or Alkaline Electrolysis systems. The process of SOE achieves better energy efficiency because it works in partnership with renewable energy thermal sources, including concentrated solar power and industrial waste heat streams.

SoE possesses the capability to manufacture both the necessary hydrogen and oxygen components needed for green ammonia creation. SOE offers adjustable operation that simplifies its deployment during ammonia synthesis processes needing substantial hydrogen supplies. The energy conversion efficiency of SOE systems surpasses other technologies, which expands their suitability for widespread industrial deployment.

The scalability of SOE technology makes it adaptable for ammonia production facilities of any size. Thanks to its high efficiency at medium and large scale, coupled with its renewable energy input capacity, SOE remains the leading contender in the green ammonia market sector. Green ammonia production on a large scale will grow through SOE technology because research prioritizes sustainable methods and industry demands advanced approaches to ammonia production.

By End User Analysis

The power generation sector is expected to be the dominant end user of green ammonia market wth hghest arket share in 2025. Stored green ammonia performs a critical function because it supports grid stability by addressing the intermittent nature of renewable energy sources. Power generation facilities now choose green ammonia as a promising fuel because nations pursue both energy decarbonization and emission reductions. Ammonia serves as a hydrogen carrier in power plants and behaves as a reliable, scalable method to store and generate energy with no adverse environmental impacts that fossil fuels create.

Combined-cycle power plants (and ammonia-powered gas turbines) utilize green ammonia to achieve ground-breaking improvements in the power generation sector. Green ammonia provides a storage and transport solution that enables power generation facilities to employ it as backup or principal fuel when renewable energy from wind and solar is inaccessible. The storage abilities of green ammonia prove essential for maintaining grid stability because renewable energy generation lacks a consistent flow. Power plants that utilize green ammonia can maintain their energy supply continuity regardless of fluctuations in renewable energy production.

The implementation of green ammonia combined with power plant cycle operations or ammonia-powered gas turbine operations brings major advancements to contemporary power generation markets. The application offers a transition to cleaner and sustainable power through its natural gas alternative while using current infrastructure networks. The power generation industry represents a key market for green ammonia implementation as the world moves towards cleaner energy alternatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Green Ammonia Market Report is segmented on the basis of the following:

By Technology

- Solid Oxide Electrolysis

- Proton Exchange Membrane

- Alkaline Water Electrolysis

By End User

- Power Generation

- Transportation

- Fertilizer

- Refrigeration

- Other End User

Global Green Ammonia Market: Regional Analysis

Region with the Highest Market Share in the Global Green Ammonia Market

North America is expected to stand as a dominant force in the global green ammonia market with

36.7% of market share in 2025. The North American region leads the worldwide green ammonia market because of beneficial governmental programs and robust renewable power systems, along with powerful agricultural operations. The United States leads the global race to pursue renewable energy by advancing its investments in green hydrogen and ammonia production technology.

Government initiatives through tax incentives, alongside grants and carbon neutrality goals, generate major growth for the green ammonia market. Through funding projects related to carbon-free ammonia production and hydrogen storage technologies, the U.S. Department of Energy supports the green ammonia sector directly.

The region holds significant renewable power-generating potential through states like Texas, California, and Colorado, so it proves to be a leader in green ammonia manufacturing. Green ammonia production depends heavily on these renewable energy resources that split water molecules into hydrogen before combining them with nitrogen. North America possesses a robust infrastructure that promotes both the development and the distribution of green ammonia.

Leading firms in the region, such as chemical and energy companies, utilize their current infrastructure to implement cleaner ammonia production systems. China devotes substantial funding to ammonia research for ship fuel application to fulfill the International Maritime Organization (IMO) decarbonization standards. North America's position as a leader in the green ammonia space remains secure because of its sustainable political dedication and technological advancements, and existing infrastructure network.

Region with the Highest CAGR in the Global Green Ammonia Market

The green ammonia market in Asia Pacific demonstrates the highest Compound Annual Growth Rate (CAGR) because major nations, including China, India, Japan, and South Korea, are actively pursuing rapid industrialization, increasing their energy needs, and integrating sustainable practices into their policies. Increased industrial activities are propelling the growing economies of the region, which require rapid deployment of cleaner, sustainable energy sources because of high energy consumption rates. The energy transition plans of the region integrate green ammonia because it acts as an important component for storing and transporting renewable energy through hydrogen systems.

China leads this energy transition as it moves toward cutting carbon pollution and expanding renewable energy facilities. Green ammonia production has recently received multiple national initiatives from the country because it strongly relies on green hydrogen production. The large investments China makes in ammonia-based fertilizer facilities create additional demand for green ammonia throughout agricultural applications. The maritime industry of Japan actively embraces green ammonia as an essential component of its operations. Chinese maritime operators invest heavily in ammonia fuel development to comply with environmental regulations stipulated by the International Maritime Organization (IMO).

As India expands its renewable energy sector and modernizes its agricultural industry it intensifies its focus on producing green ammonia. The market holds significant growth prospects because India continues to develop sustainable farming systems and storage solutions for energy. The growing development of infrastructure and government backing for green energy projects through policies enables the rapid adoption of green ammonia in the region. Asia Pacific will maintain domination of the market through its rapid industrial development while benefiting from excellent policy tools and advanced technologies to achieve high market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Green Ammonia Market: Competitive Landscape

Multiple major players compete actively in the worldwide green ammonia market to exploit increasing requirements for sustainable power solutions. Siemens Energy, together with Haldor Topsoe and CF Industries and Yara International, and Thyssenkrupp, are major companies operating in the market. Green ammonia production leaders are established through the innovation activities pursued by these companies, together with their technological advancements and strategic partnership initiatives.

The market utilizes research and development to enhance the efficiency of electrolysis and ammonia synthesis processes, along with other prominent strategies. Siemens Energy dedicates significant investments to green ammonia production technologies by creating partnerships with renewable energy providers. Companies are forming joint projects and collaborations with partners to optimize resource sharing, which results in improved production capacities.

Green ammonia producers have been investing in building facilities within key markets across Europe, North America, and Asia Pacific because these regions experience fast-growing demand for clean ammonia spurred by increasing clean energy usage and government backing. Companies operating in the green ammonia market gain competitive advantages through the successful scaling of production, coupled with efficient energy usage and expenditures in environmental compliance measures. Companies will start differentiating their green ammonia offerings through technological innovations and cost-effectiveness, combined with their capabilities to merge with existing energy and agricultural systems.

Some of the prominent players in the Global Green Ammonia Market are:

- Yara International ASA

- Siemens Energy

- ThyssenKrupp AG

- Nel ASA

- MAN Energy Solutions

- ENGIE SA

- Uniper SE

- BASF SE

- ITM Power PLC

- McPhy Energy SA

- Green Hydrogen Systems

- Enapter S.r.l.

- Starfire Energy

- ACME Group

- Iberdrola S.A.

- Hiringa Energy Ltd.

- Haldor Topsoe

- CF Industries Holdings Inc.

- Fertiglobe plc

- First Ammonia

- Other Key Players

Recent Developments in the Global Green Ammonia Market

- April 2025 JERA and ReNew E-Fuels Collaboration: JERA Co., Inc. and ReNew E-Fuels Private Limited signed an agreement to jointly develop a green ammonia production project in Paradip, Odisha, India. The project aims to produce approximately 100,000 tons of green ammonia annually using 500 MW of renewable energy, with plans to export the ammonia to Japan.

- February 2025, mYamnaCo's Green Ammonia Project in Brazil: YamnaCo secured a land reservation agreement with the Port of Açu for a major green ammonia project in Brazil. The project aims to produce up to one million tonnes of green ammonia per year, requiring 1.8 GW of electrolysers.

- January 2025 Sembcorp's Green Ammonia Supply to Japan: Singapore-based Sembcorp Green Hydrogen Pte Ltd signed an agreement with two Japanese firms to supply green ammonia from its 200,000-metric-tonne capacity plant in India to Japan.

- October 2024 BASF and AM Green's Low-Carbon Chemicals Collaboration: BASF and AM Green B.V. signed an MoU to explore business opportunities for low-carbon chemicals made with renewable energy in India, including an annual offtake of 100,000 tons of ammonia produced solely with renewable energy.

- September 2024 India Energy Week 2024: ACME Group and the Indian Gas Exchange (IGX) signed an MoU to develop the market for green hydrogen and ammonia in India, aiming to create a physically traded market across the country.

- June 2024 Hygenco and Ameropa's Strategic Supply Deal: Hygenco Green Energies signed a term sheet with Ameropa for the potential supply of green ammonia from its upcoming plant in Gopalpur, Odisha. The first phase is projected to produce 600 tonnes per day, reaching a full capacity of 1.1 million tonnes per annum by 2030.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 291.6 Mn |

| Forecast Value (2034) |

USD 19,938.8 Mn |

| CAGR (2025–2034) |

59.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 90.0 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (Solid Oxide Electrolysis, Proton Exchange Membrane, and Alkaline Water Electrolysis), By End User (Power Generation, Transportation, Fertilizer, Refrigeration, and Other End Users) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Yara International ASA, Siemens Energy, ThyssenKrupp AG, Nel ASA, MAN Energy Solutions, ENGIE SA, Uniper SE, BASF SE, ITM Power PLC, McPhy Energy SA, Green Hydrogen Systems, Enapter S.r.l., Starfire Energy, ACME Group, Iberdrola S.A., Hiringa Energy Ltd., Haldor Topsoe, CF Industries Holdings Inc., Fertiglobe plc, First Ammonia and other key players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Green Ammonia Market?

▾ The Global Green Ammonia Market size is estimated to have a value of USD 291.6 million in 2025 and is expected to reach USD 19,938.8 million by the end of 2034.

What is the size of the US Green Ammonia Market?

▾ The US Green Ammonia Market is projected to be valued at USD 90.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4,916.5 million in 2034 at a CAGR of 56.0%.

Which region accounted for the largest Global Green Ammonia Market?

▾ North America is expected to have the largest market share in the Global Green Ammonia Market with a share of about 36.7% in 2025.

Who are the key players in the Global Green Ammonia Market?

▾ Some of the major key players in the Global Green Ammonia Market are Yara, Siemens Energy, ThyssenKrupp, Nel, MAN Energy, ENGIE, Uniper, BASF, ITM Power, McPhy, Green Hydrogen Systems, Enapter, Starfire Energy, ACME, Iberdrola, Hiringa Energy, Haldor Topsoe, and many others.

What is the growth rate in the Global Green Ammonia Market in 2025?

▾ The market is growing at a CAGR of 59.9 percent over the forecasted period of 2025.