Market Overview

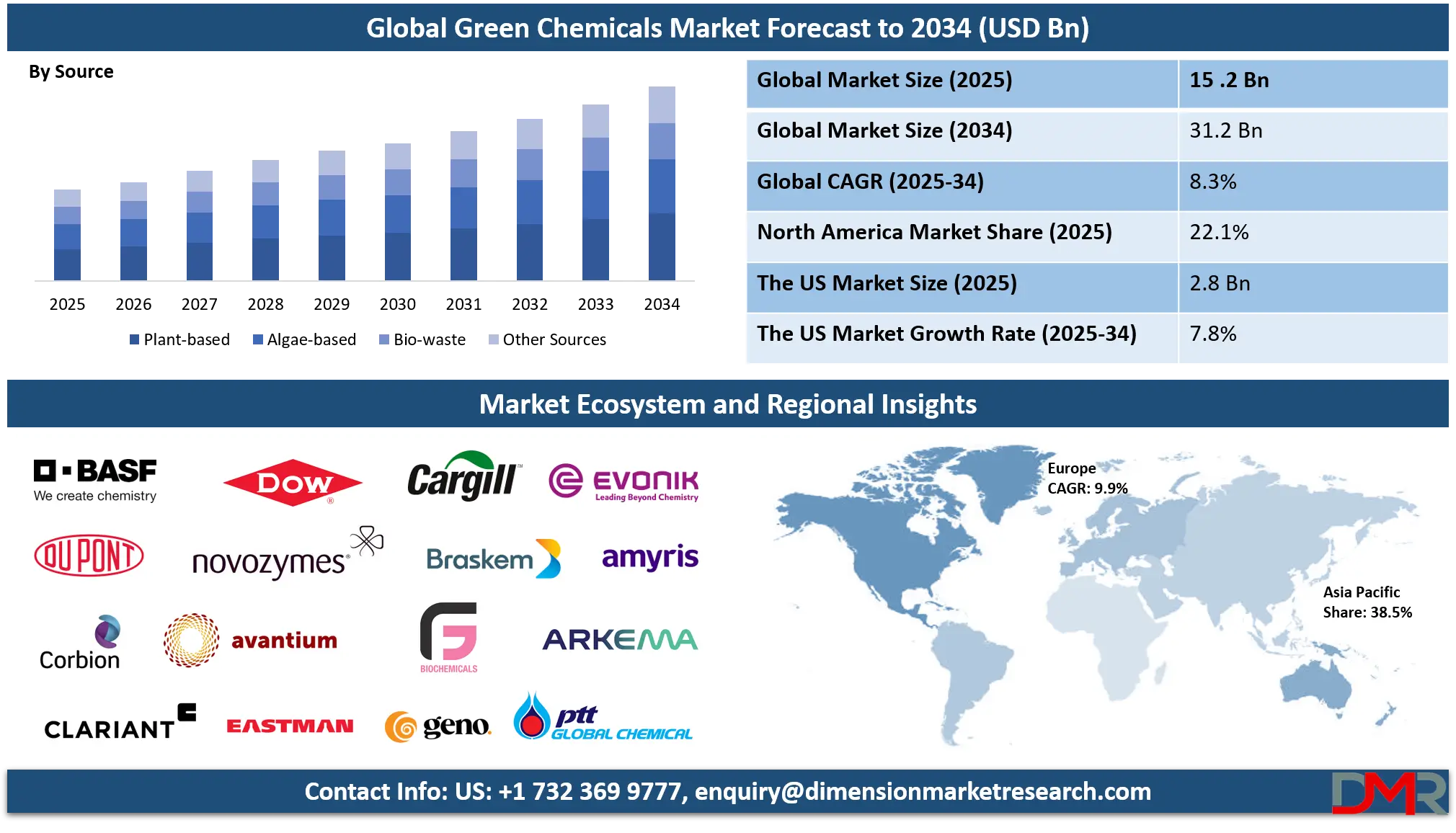

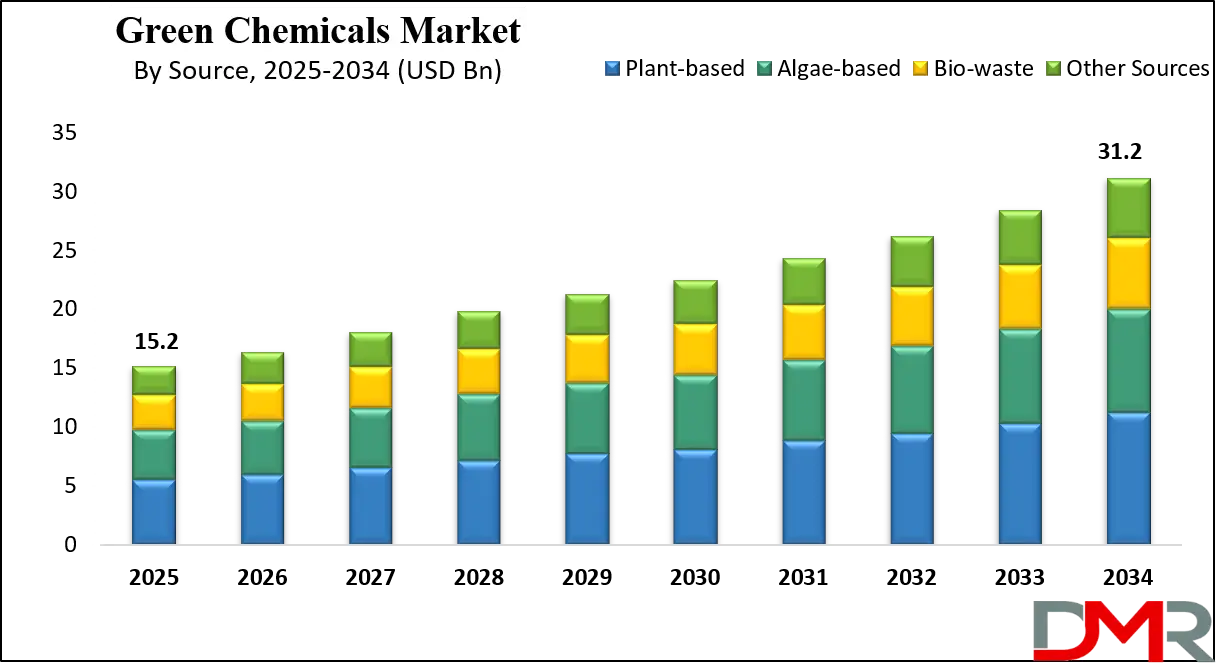

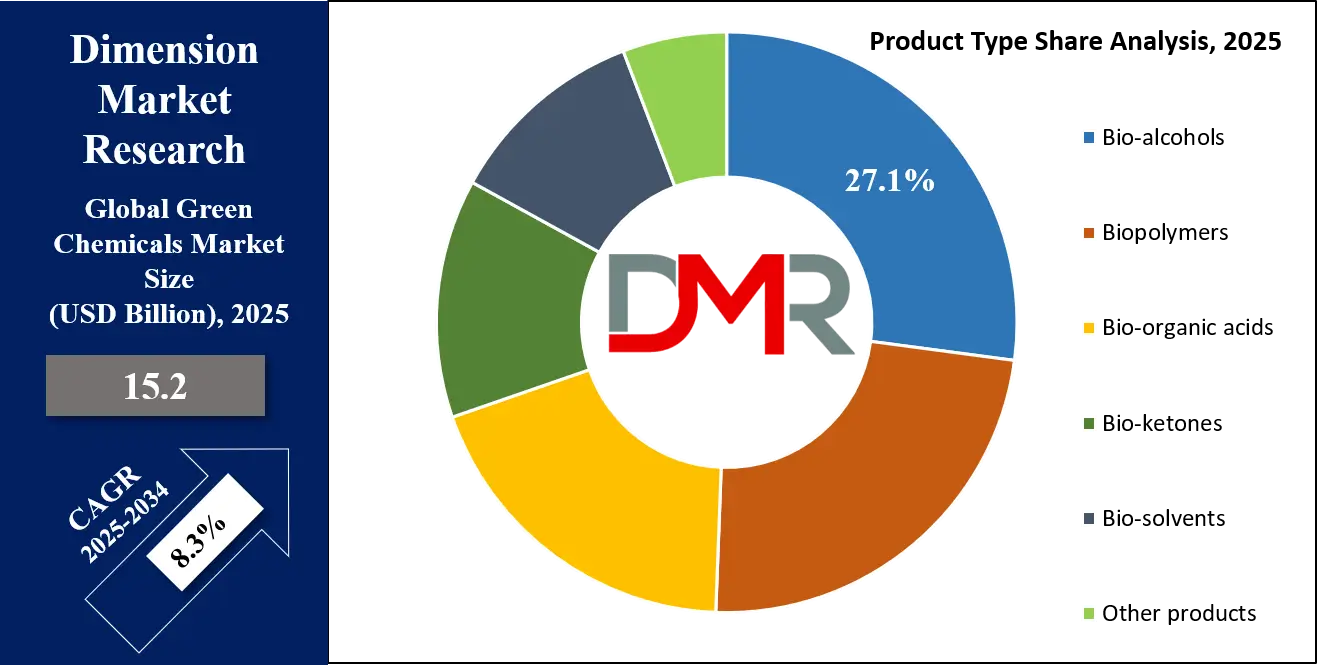

The Global Green Chemicals Market is projected to reach USD 15.2 billion in 2025 and grow at a compound annual growth rate of 8.3% from there until 2034 to reach a value of USD 31.2 billion.

Green chemistry and green chemicals are transforming the chemical value chain by shifting from fossil feedstocks to renewable raw materials, bio-based intermediates, and catalytic or biocatalytic routes. Manufacturers are increasingly adopting atom-economy processes, solvent substitution, and lifecycle thinking to lower energy use, reduce hazardous byproducts, and meet circular-economy commitments.

Opportunities are expanding where policy, decarbonization, and industrial research intersect. Biorefineries, fermentation and enzymatic processes, and renewable electricity-based electrosynthesis are scaling to produce bio-alcohols, biopolymers, and green solvents at commercial levels. These enable product-level substitution across packaging, coatings, agriculture, and personal-care industries, accelerating the transition toward low-carbon supply chains.

Restraints are linked to entrenched petrochemical infrastructure, feedstock competition with food and land use, and the high capital intensity of industrial electrification and hydrogen integration. Volatile energy prices and regulatory complexity across regions also add compliance costs and extend commercialization timelines, slowing adoption despite strong demand signals.

Statistical assessments of bioeconomy potential highlight the vast availability of agricultural residues, forestry byproducts, and municipal waste streams that can underpin chemical substitution. Studies show hundreds of millions of tonnes of biomass and wood residues are suitable for use in bio-products, supporting mid-century circular bioeconomy targets and emissions-reduction goals.

Growth prospects hinge on the advancement of conversion technologies, new biorefinery infrastructure, and policy incentives such as carbon pricing, green public procurement, and R&D support. If investments and regulatory frameworks align, green chemicals will capture a larger share of polymer, solvent, and specialty-chemical markets while delivering added benefits for environmental protection, industrial safety, and supply-chain resilience.

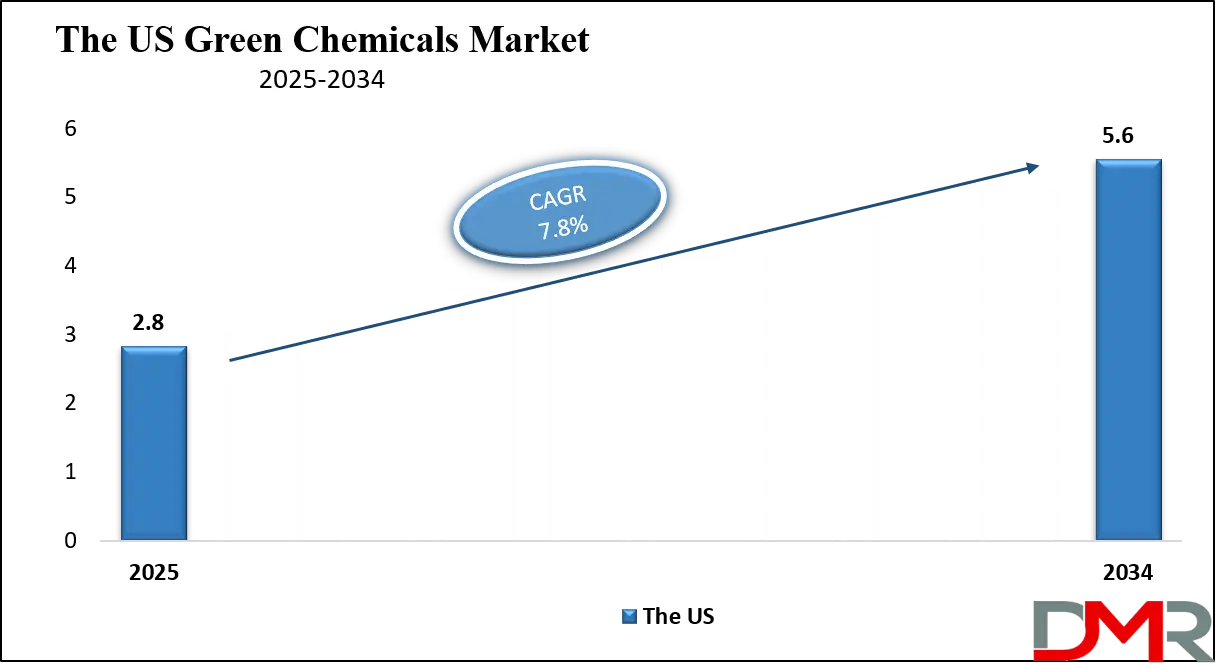

The US Green Chemicals Market

The US Green Chemicals Market is projected to reach USD 2.8 billion in 2025 at a compound annual growth rate of 7.8% over its forecast period.

The United States has built a strong foundation for green chemicals through federal programs promoting safer chemistry and sustainable industrial practices. The Environmental Protection Agency’s Green Chemistry Program integrates pollution-prevention principles, recognizes innovators through national awards, and supports the adoption of chemical processes that minimize toxicity and waste. The Department of Energy’s bioenergy initiatives and feedstock assessments further strengthen the sector by mapping biomass availability and funding pilot-to-commercial scale projects.

The country benefits from a demographic and economic structure that supports large-scale adoption. Major agricultural production and forestry residues provide abundant bio-based feedstock potential, while chemical and petrochemical hubs ensure efficient distribution and manufacturing capacity. Universities, national laboratories, and industrial R&D clusters create a pipeline of innovation that feeds into industrial-scale applications in packaging, personal care, agriculture, and automotive sectors.

Government procurement policies, state-level incentives, and federal funding programs help reduce risks associated with early-stage commercialization. By encouraging the use of safer substitutes and bio-based content in products purchased by public institutions, demand for sustainable chemicals is directly stimulated. Regulatory frameworks addressing chemical safety and environmental quality are further driving reformulation and encouraging industry to adopt greener solutions. Combined, these initiatives position the U.S. as a key hub for the development and scale-up of bio-based and low-carbon chemical solutions.

The Europe Green Chemicals Market

The Europe Green Chemicals Market is estimated to be valued at USD 2.2 billion in 2025 and is further anticipated to reach USD 5.3 billion by 2034 at a CAGR of 9.9%.

Europe’s green chemicals market is underpinned by the European Green Deal, the EU Circular Economy Action Plan, and the EU Bioeconomy Strategy, which collectively target a systemic transition toward low-carbon, circular industrial models. These frameworks emphasize reducing hazardous substances, improving resource efficiency, and substituting fossil-derived inputs with bio-based and recycled alternatives.

The region benefits from dense industrial clusters with strong downstream demand in packaging, automotive, agriculture, and healthcare. Established waste-management systems and recycling infrastructure provide a reliable stream of secondary feedstocks, while cross-border collaborations and research programs enable faster piloting and scaling of innovative processes such as enzymatic catalysis and chemical recycling. Public funding under Horizon Europe and other EU initiatives de-risks early-stage technologies and strengthens industry–research cooperation.

Demographically, Europe’s high urbanization rate supports efficient logistics for waste collection and feedstock recovery. Regulatory emphasis on consumer safety, reduced toxicity, and lifecycle emissions reduction incentivizes the uptake of bio-based and green alternatives in multiple sectors. National strategies complement EU-level policy, fostering innovation hubs in countries such as Germany, the Netherlands, and France.

Despite challenges of high energy costs and regulatory harmonization across member states, the EU’s strong policy backing, consumer demand for sustainable products, and industrial capacity position it as a global leader in the adoption of green chemicals, particularly in specialty and high-performance applications.

The Japan Green Chemicals Market

The Japan Green Chemicals Market is projected to be valued at USD 912.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1,760.0 million in 2034 at a CAGR of 7.6%.

Japan’s green chemicals development is strongly supported by government-led initiatives that align industrial policy with climate and energy-transition goals. The Ministry of Economy, Trade and Industry (METI) and the Green Innovation Fund allocate substantial resources toward hydrogen production, carbon recycling, and bio-based alternatives, enabling industrial decarbonization while enhancing energy security.

The country’s demographic and structural advantages include a compact, highly urbanized market that concentrates demand for packaging, electronics, and automotive applications, where greener alternatives can be adopted swiftly. Japan also has a world-class manufacturing and R&D base with advanced process engineering, catalyst development, and polymer innovation capabilities that accelerate the commercialization of green chemical technologies.

Government agencies and consortia, such as the New Energy and Industrial Technology Development Organization (NEDO), fund pilot-scale biorefineries, bio-based polymer projects, and chemical recycling plants. These efforts mitigate commercialization risks and establish local value chains for green alternatives. With limited land area for biomass production, Japan prioritizes high-value, resource-efficient chemical pathways such as specialty polymers, solvents, and additives that deliver both performance and environmental benefits.

Policy emphasis on circular plastics and sustainable materials aligns with consumer preferences for eco-friendly products and corporate commitments to reduce lifecycle emissions. The focus on high-value manufacturing niches, combined with significant government support and industrial expertise, positions Japan as a technology-driven leader in specialty segments of the global green chemicals market.

Global Green Chemicals Market: Key Takeaways

- Global Market Size Insights: The Global Green Chemicals Market size is estimated to have a value of USD 15.2 billion in 2025 and is expected to reach USD 31.2 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Green Chemicals Market is projected to be valued at USD 2.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.6 billion in 2034 at a CAGR of 7.8%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Green Chemicals Market with a share of about 38.5% in 2025.

- Key Players: Some of the major key players in the Global Green Chemicals Market are BASF SE, Dow Inc., Cargill, Incorporated, Evonik Industries AG, DuPont de Nemours, Inc., Novozymes A/S, Corbion N.V., Amyris, Inc., and many others.

Global Green Chemicals Market: Use Cases

- Bio-based Packaging Solutions: Green chemicals derived from biomass are used to create biodegradable plastics and coatings, replacing petroleum-based packaging. These solutions reduce landfill waste, lower carbon footprints, and support circular-economy initiatives, particularly in the food and beverage industries seeking sustainable alternatives.

- Renewable Construction Materials: Bio-polymers, bio-solvents, and eco-friendly adhesives improve building sustainability by offering low-VOC and energy-efficient materials. They enhance indoor air quality, reduce toxic emissions, and align with green-building certifications while supporting infrastructure projects that emphasize environmental performance and lifecycle durability.

- Sustainable Automotive Components: The automotive sector incorporates green polymers, bio-alcohols, and natural-fiber composites to develop lightweight and durable parts. These materials improve fuel efficiency, cut emissions, and support manufacturers’ commitments to sustainable mobility and carbon-neutral vehicle production goals worldwide.

- Eco-friendly Agriculture Inputs: Bio-based fertilizers, pesticides, and solvents reduce soil toxicity and improve crop yields sustainably. Green chemicals enable precision agriculture practices, enhance soil health, and minimize environmental harm, aligning with regulatory frameworks and farmer demand for safer agricultural inputs.

- Healthcare and Personal Care Products: Green chemistry enables safer pharmaceuticals, biodegradable medical polymers, and natural ingredients in cosmetics. These reduce harmful residues in wastewater, improve patient and consumer safety, and meet regulatory and ethical standards for sustainability in healthcare and personal care sectors.

Global Green Chemicals Market: Stats & Facts

U.S. Environmental Protection Agency (EPA)

- The EPA reports that green chemistry practices prevent over 1 billion pounds of hazardous substances from entering the environment each year.

- The EPA’s Safer Choice program has certified more than 2,000 products that meet strict sustainability standards.

- Green chemistry initiatives have saved over 21 billion gallons of water annually in U.S. industries.

- EPA highlights that energy savings from green chemistry practices exceed 500 trillion BTUs annually.

European Environment Agency (EEA)

- The EEA states that renewable raw materials represent nearly 12% of Europe’s chemical feedstocks.

- The EU’s bio-based chemicals reduce greenhouse gas emissions by up to 65% compared to fossil-based alternatives.

- Bioplastics production capacity in Europe reached 1.2 million tonnes in 2023.

- Circular economy action plans in Europe aim to increase chemical recycling rates to 70% by 2030.

European Commission

- The EU’s Green Deal targets a 55% reduction in greenhouse gas emissions by 2030, heavily relying on green chemicals.

- Bio-based plastics are expected to make up 10% of total plastics production in the EU by 2030.

U.S. Department of Energy (DOE)

- The DOE notes that biofuels and bio-based chemicals contribute to reducing U.S. petroleum dependence by 20%.

- Advanced biorefineries in the U.S. produced 5.2 billion gallons of biofuels in 2022.

- DOE highlights that renewable chemicals can achieve up to 80% lower carbon intensity compared to conventional ones.

International Energy Agency (IEA)

- The IEA projects renewable chemicals to grow by 6% annually through 2030.

- Chemicals account for 14% of global oil use, making green alternatives critical for decarbonization.

- The IEA states that energy efficiency measures in green chemical production can cut industrial CO₂ emissions by 900 million tonnes annually.

Food and Agriculture Organization (FAO)

- FAO estimates that 14% of global agricultural output is directed toward bio-based materials, including green chemicals.

- The use of agricultural residues for green chemical feedstocks could replace 20% of fossil-based inputs globally.

Organisation for Economic Co-operation and Development (OECD)

- OECD notes that green chemistry innovations could save the global economy up to $65 billion annually by reducing waste.

- The OECD reports that environmentally friendly solvents account for over 25% of global solvent markets.

United Nations Environment Programme (UNEP)

- UNEP highlights that replacing hazardous chemicals with green alternatives could prevent 1 million deaths annually worldwide.

- UNEP estimates that bio-based products could account for 30% of the global chemical industry by 2030.

U.S. Department of Agriculture (USDA)

- USDA reports that the U.S. bio-based products industry contributed $470 billion to the economy in 2021.

- The industry also supported 4.6 million American jobs in the same year.

- USDA highlights that bio-based chemicals have a 46% lower carbon footprint compared to petroleum-based alternatives.

World Bank

- The World Bank reports that adopting green chemistry in developing economies could reduce pollution-related healthcare costs by 25%.

- The Bank highlights that investments in green chemical infrastructure in the Asia-Pacific have grown by 12% annually since 2015.

Global Green Chemicals Market: Market Dynamic

Driving Factors in the Global Green Chemicals Market

Stringent Environmental Regulations and Policies

The implementation of strict environmental regulations across regions is a primary growth driver for the green chemicals market. Governments and international bodies are enforcing limits on greenhouse gas emissions, industrial waste, and hazardous substances. Regulations such as the European Union’s REACH framework, the U.S. EPA’s pollution prevention initiatives, and Japan’s Green Growth Strategy are encouraging industries to adopt eco-friendly alternatives.

These policies create both penalties for non-compliance and incentives such as tax credits, subsidies, and funding for sustainable R&D. As industries face growing public and regulatory pressure, the demand for bio-based plastics, biodegradable materials, and renewable chemicals is accelerating. This driver is particularly critical for sectors like automotive, construction, and packaging, where sustainability metrics are becoming procurement criteria.

Additionally, carbon-neutrality pledges by governments and corporations are reinforcing regulatory influence, making the adoption of green chemicals essential for long-term competitiveness in global markets. The regulatory momentum ensures steady and sustained demand growth worldwide.

Rising Consumer Awareness and Demand for Sustainable Products

Consumer-driven sustainability awareness is another powerful driver shaping the green chemicals market. Increasingly, end-users demand products that align with their values on environmental responsibility, climate action, and health safety. Millennials and Gen Z, who represent a growing share of global purchasing power, are particularly attentive to eco-friendly product attributes. This behavioral shift is fueling demand across multiple industries, from sustainable packaging and renewable textiles to plant-based food additives and bio-cosmetics. Brands are actively marketing their green credentials, creating a competitive advantage through eco-labeling and certifications.

Furthermore, digital platforms amplify consumer advocacy, holding corporations accountable for unsustainable practices and accelerating green transitions. The rise in e-commerce has also boosted the visibility of green product offerings, enabling faster market penetration of eco-friendly alternatives. As consumer preferences become increasingly influential in shaping business strategies, companies are compelled to invest in green chemistry solutions, driving substantial growth for bio-based and renewable chemicals globally.

Restraints in the Global Green Chemicals Market

High Production Costs and Scalability Challenges

Despite growing adoption, the green chemicals market faces significant challenges from high production costs compared to conventional petrochemicals. Feedstock procurement, specialized biorefinery infrastructure, and R&D investments often result in cost premiums that limit affordability and adoption in price-sensitive markets. Small and medium-sized enterprises face particular challenges due to limited capital availability, making large-scale commercialization difficult.

In addition, supply chain limitations such as feedstock seasonality, land use competition, and logistics add complexity. This cost disadvantage hinders competitiveness in commodity markets like plastics and fuels, where petrochemical incumbents benefit from established economies of scale. While government subsidies and incentives help bridge this gap, long-term viability requires further process optimization, technological breakthroughs, and industry collaboration. Without sustained cost reductions, green chemicals risk remaining niche applications rather than becoming mainstream solutions, slowing down their broader adoption in global industries.

Limited Consumer Awareness in Emerging Markets

Another key restraint is the limited awareness and education about green chemicals in emerging markets. While developed economies have strong consumer-driven demand for sustainable products, many developing countries prioritize affordability and availability over environmental attributes. Lack of awareness campaigns, inadequate labeling, and absence of regulatory enforcement hinder adoption in these regions.

Furthermore, the infrastructure required for proper waste management, recycling, and composting is often insufficient, reducing the effectiveness of green chemical applications such as biodegradable packaging. This knowledge gap also extends to industrial buyers, many of whom perceive green chemicals as costly substitutes without recognizing long-term savings in energy, compliance, or waste reduction. Without widespread consumer and industrial awareness, market penetration remains uneven globally. Bridging this gap requires governments, NGOs, and corporations to invest in education, capacity building, and awareness programs, ensuring that the benefits of green chemistry are understood and embraced beyond developed markets.

Opportunities in the Global Green Chemicals Market

Expansion in Bioplastics and Sustainable Packaging

The rapid growth of e-commerce, single-use packaging bans, and mounting concerns about plastic pollution are creating strong opportunities for green chemicals in bioplastics and sustainable packaging. Governments worldwide are phasing out petroleum-based plastics, opening large-scale demand for alternatives derived from renewable sources. Bioplastics such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch blends are increasingly being adopted by consumer goods, food, and beverage industries due to their biodegradability and compostability.

This opportunity extends beyond packaging into sectors such as automotive interiors, construction materials, and agricultural films. As multinational companies pledge to achieve 100% recyclable, compostable, or reusable packaging by 2030, demand for green chemical solutions is set to surge. Moreover, continuous advancements in material performance, cost-efficiency, and scalability are broadening adoption. The bioplastics sector thus presents a lucrative growth avenue for chemical manufacturers looking to diversify portfolios and strengthen their presence in sustainable materials markets.

Technological Advancements in Biotechnology and Green Chemistry

Rapid innovations in biotechnology and chemical engineering are creating transformative opportunities in the green chemicals market. Breakthroughs in synthetic biology, enzyme catalysis, and microbial fermentation are improving efficiency in producing renewable chemicals such as bio-based solvents, polymers, and surfactants. These advancements are reducing production costs, enhancing scalability, and enabling new chemical functionalities. Startups and established players are increasingly collaborating with research institutions and governments to accelerate the commercialization of innovative bio-refineries and carbon capture technologies.

Furthermore, advances in digitalization, artificial intelligence, and process automation are improving life-cycle analysis, resource optimization, and predictive modeling, making green chemistry more competitive with conventional processes. These technological improvements not only expand the applications of green chemicals across industries but also position them as essential components of the global low-carbon economy. As innovation ecosystems strengthen, biotechnology-driven green chemistry is expected to open high-value opportunities for both developed and emerging markets.

Trends in the Global Green Chemicals Market

Expansion of Bio-based Feedstocks Across Industries

One of the strongest trends in the green chemicals market is the transition from fossil-based raw materials to bio-based feedstocks such as corn, sugarcane, algae, and agricultural waste. This transformation is gaining traction due to the rising need to reduce carbon intensity across the value chain. Bio-based feedstocks offer not only environmental benefits but also greater supply chain resilience, as they lower dependency on volatile crude oil prices. Industries like packaging, automotive, consumer goods, and textiles are increasingly incorporating bio-based resins, solvents, and polymers to meet consumer expectations for sustainability.

Additionally, governments are investing heavily in R&D for bio-refineries, improving process efficiency and expanding the scalability of feedstock conversion technologies. The trend is reinforced by a strong focus on circular economy initiatives, where bio-based chemicals can be more easily reintegrated into production cycles. This global push is reshaping the competitive landscape by encouraging innovation and positioning green chemicals as mainstream alternatives to petrochemicals.

Integration of Circular Economy Principles

Circular economy adoption is significantly influencing the green chemicals market by promoting reuse, recycling, and recovery models that reduce waste and improve resource efficiency. Green chemicals are at the core of this transition, enabling the design of biodegradable plastics, recyclable packaging, and eco-friendly coatings. Governments and corporations are pushing extended producer responsibility programs, mandating companies to reduce lifecycle emissions and optimize material usage.

The trend emphasizes cradle-to-cradle design, where chemicals are created with end-of-life management in mind, thereby minimizing environmental footprints. For example, bio-based polymers and green solvents are designed to degrade harmlessly or be recycled back into production without losing material value. This shift is driving innovation in chemical engineering, biotechnology, and sustainable design, making green chemistry not only a compliance necessity but also a competitive advantage. As industries align their strategies with global sustainability goals, the circular economy framework is expected to cement the role of green chemicals in future manufacturing ecosystems.

Global Green Chemicals Market: Research Scope and Analysis

By Product Type Analysis

Bio-alcohols, particularly bioethanol and biobutanol, are projected to dominate the global green chemicals market owing to their scalability, strong policy backing, and wide application across industries. Bioethanol, derived from renewable feedstocks like corn, sugarcane, and lignocellulosic biomass, is the most commercially mature biofuel. It is primarily blended with gasoline to lower greenhouse gas (GHG) emissions, meet renewable energy targets, and reduce crude oil dependency.

Nations such as the U.S. (through the Renewable Fuel Standard), Brazil (via Proálcool), and EU member states have implemented mandatory blending programs, ensuring steady demand. Biobutanol, although less mature, is gaining attention due to its higher energy density, lower volatility, and greater compatibility with existing fuel infrastructure, giving it an edge over ethanol for next-generation fuel applications.

Additionally, bio-methanol, sourced from biomass gasification and carbon recycling, is rising as a sustainable feedstock for biodiesel and as a marine fuel aligned with the International Maritime Organization’s decarbonization roadmap. Beyond fuels, bio-alcohols serve as critical building blocks for bioplastics, coatings, adhesives, pharmaceuticals, and cosmetics, enabling deep integration into industrial value chains. Compared to other product categories like biopolymers, bio-ketones, or bio-acids, bio-alcohols enjoy greater commercial scale, established production facilities, and lower production costs per unit, supported by decades of research and infrastructure investments.

Their role as both an immediate fuel substitute and a versatile industrial solvent solidifies their dominance in the green chemicals market. With accelerating global energy transition and decarbonization mandates, bio-alcohols remain the cornerstone of renewable chemical innovation, ensuring their sustained leadership position.

By Source Analysis

Plant-based sources are anticipated to dominate the global green chemicals market due to their abundant availability, mature supply chains, and lower commercialization barriers compared to alternative feedstocks like algae or bio-waste. Biomass derived from corn, sugarcane, soy, rapeseed, and wheat is the foundation for producing bioethanol, biodiesel, bioplastics, and bio-based solvents at an industrial scale.

Countries with strong agricultural output, such as the U.S., Brazil, China, and India, ensure a reliable supply chain for plant-derived feedstocks, while government incentives and agricultural subsidies strengthen their economic viability. For instance, the EU’s Renewable Energy Directive (RED II) and the U.S. Department of Energy’s Bioenergy Technologies Office support large-scale use of corn, soybean, and sugarcane biomass to promote renewable energy integration and bio-economy growth.

Plant-based feedstocks have also enabled the commercialization of bioplastics such as polylactic acid (PLA), starch-based polymers, and bio-PET, which are increasingly used in packaging, textiles, and consumer goods. Similarly, plant oils like soybean and canola are major inputs for biodiesel production, ensuring a strong foothold in the transportation sector.

While algae-based chemicals are emerging due to their higher oil yield and minimal land requirement, they face challenges of high cultivation costs, limited infrastructure, and scale-up issues, restricting immediate adoption. Bio-waste feedstocks, although sustainable, lack consistent quality and availability across geographies.

In contrast, plant-derived sources benefit from established farming, processing, and logistics infrastructure, making them the most reliable and cost-effective option for large-scale industrial use. Their compatibility with existing refining systems, coupled with continuous advancements in genetic engineering and crop optimization, ensures that plant-based feedstocks retain their dominance in the green chemicals industry.

By End-User Analysis

The packaging sector is poised to stand as the leading end-user of green chemicals, fueled by stringent regulatory frameworks, consumer-driven sustainability demand, and global efforts to tackle plastic pollution. With increasing bans on single-use plastics across Europe, North America, and parts of Asia, industries are rapidly shifting toward bio-based, recyclable, and biodegradable packaging solutions.

Biopolymers like polylactic acid (PLA), bio-PET, polyhydroxyalkanoates (PHA), and starch blends are gaining widespread adoption in the production of bottles, films, trays, and rigid containers. Packaging giants are leveraging these materials to meet corporate sustainability commitments, with global food and beverage brands pledging to achieve 100% recyclable, compostable, or bio-based packaging by 2030.

For instance, companies like Coca-Cola, Nestlé, and Unilever are investing heavily in green packaging materials to reduce their environmental footprint. Additionally, the rise of e-commerce has amplified packaging demand, prompting logistics and retail firms to adopt lightweight, eco-friendly alternatives that comply with waste reduction targets.

Compared to other end-use sectors like automotive, agriculture, or healthcare, packaging offers higher consumption volumes, quicker commercialization timelines, and easier integration of bioplastics into existing supply chains. Moreover, regulatory measures such as the EU Single-Use Plastics Directive and extended producer responsibility (EPR) programs are accelerating adoption rates.

Consumer awareness also plays a significant role, with growing preference for environmentally friendly packaging influencing purchasing decisions across retail and FMCG segments. Given its scale, visibility, and central role in addressing global plastic waste challenges, the packaging industry not only dominates the green chemicals market but also acts as the primary catalyst for driving large-scale adoption of bio-based materials worldwide.

The Global Green Chemicals Market Report is segmented on the basis of the following:

By Product Type

- Bio-alcohols

- Biopolymers

- Bio-organic acids

- Bio-ketones

- Bio-solvents

- Other products

By Source

- Plant-based

- Algae-based

- Bio-waste

- Other Sources

By End-User

- Construction

- Healthcare

- Pharmaceuticals and Personal Care Products

- Packaging

- Food and beverages

- Paints and coatings

- Automotive

- Agriculture

- Other Applications

Impact of Artificial Intelligence in the Global Green Chemicals Market

- Process Optimization: AI enables real-time monitoring and predictive modeling of chemical reactions, improving yields and energy efficiency in green chemical production. This reduces waste, enhances scalability, and ensures cost-effective biofuel, biopolymer, and bio-based chemical manufacturing for large-scale industrial deployment.

- Feedstock Utilization: Machine learning algorithms analyze agricultural and bio-waste feedstocks to identify optimal sources for bioethanol, biodiesel, and bioplastics. This allows better yield prediction, resource efficiency, and cost reduction while minimizing the environmental impacts of biomass cultivation and chemical processing.

- Supply Chain Efficiency: AI-powered analytics streamline logistics, demand forecasting, and distribution of green chemicals. By predicting raw material availability and consumer demand, AI reduces transportation costs, inventory waste, and ensures the timely supply of sustainable chemicals to key industrial end-users.

- R&D Acceleration: AI-driven simulations accelerate the discovery of new catalysts, biopolymers, and eco-friendly chemical alternatives. By reducing experimental cycles, AI supports faster commercialization of innovative green chemical products, lowering R&D costs and bridging gaps between laboratory research and industrial application.

- Sustainability Monitoring: AI integrates life-cycle assessment (LCA) tools to measure carbon footprint, energy usage, and environmental impact across production chains. This enables compliance with global green regulations, improves transparency, and strengthens companies’ ESG commitments while driving investor confidence in sustainable markets.

Global Green Chemicals Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to dominate the global green chemicals market with 38.5% of total revenue by the end of 2025, due to its vast industrial base, large population, and strong government policies supporting sustainable development. Countries such as China, India, and Japan are rapidly adopting bio-based alternatives to reduce carbon emissions and meet international environmental targets. The region benefits from abundant agricultural resources and bio-waste, which serve as low-cost feedstocks for biofuels, bioplastics, and bio-based solvents. In addition, rapid urbanization and rising disposable incomes have increased demand for eco-friendly consumer goods, packaging, and automotive materials, further driving green chemical adoption.

Government support is another critical factor, with initiatives like India’s National Bio-Energy Mission and China’s push for circular economy practices creating a favorable environment for bio-based industries. Multinational corporations are investing in large-scale production facilities across the Asia Pacific to leverage cost efficiencies and proximity to growing end-user industries such as food and beverages, pharmaceuticals, and construction. Moreover, the Asia Pacific is emerging as a key exporter of bio-based chemicals to Western markets, given its scale of production and competitive pricing. This blend of policy support, resource availability, and industrial expansion ensures the region maintains its dominant position in the global market.

Region with the Highest CAGR

Europe is anticipated to register the highest CAGR in the green chemicals market, driven by stringent regulatory frameworks, strong sustainability goals, and consumer awareness. The European Union’s Green Deal, Circular Economy Action Plan, and REACH regulations mandate industries to shift towards low-carbon, renewable, and bio-based alternatives. This policy environment pushes industries such as automotive, construction, packaging, and healthcare to adopt green chemicals at an accelerated pace.

Furthermore, European consumers are highly conscious of sustainability, creating strong demand for eco-friendly personal care products, biodegradable packaging, and bio-based textiles. This consumer-driven shift encourages rapid innovation and commercialization of advanced bio-polymers, bio-alcohols, and green solvents. Europe also benefits from its strong research and development ecosystem, with significant investments from both public and private entities aimed at advancing biotechnological processes and scaling up production.

Additionally, the region is witnessing increasing collaborations between academic institutions, startups, and multinational corporations to develop cutting-edge solutions in renewable feedstocks and industrial biotechnology. Countries such as Germany, France, and the Netherlands are leading in bioplastic production and recycling infrastructure, further strengthening Europe’s growth momentum. With favorable policy frameworks, high innovation intensity, and strong consumer demand, Europe is expected to sustain the fastest growth rate in the global green chemicals market over the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Green Chemicals Market: Competitive Landscape

The global green chemicals market is highly competitive, with players focusing on innovation, strategic partnerships, and capacity expansion to strengthen their market position. Leading companies such as BASF SE, Cargill Incorporated, DuPont de Nemours Inc., Mitsubishi Chemical Holdings, and Braskem S.A. dominate the landscape through diversified portfolios of bio-based products, including biopolymers, bio-alcohols, and bio-organic acids.

BASF and Braskem lead in biopolymer innovations, while Cargill and DuPont focus on renewable feedstocks and biotechnological advancements for sustainable chemical production. Companies are investing heavily in R&D to discover high-performance bio-based alternatives that can match or exceed the properties of petrochemical counterparts. Partnerships between green chemical producers and major end-user industries in automotive, construction, and packaging are also expanding to accelerate adoption.

Regional players in the Asia Pacific, such as Mitsubishi Chemical, benefit from low-cost feedstock availability, while European companies are leveraging regulatory incentives to scale production. Startups and emerging players are entering niche markets such as algae-based chemicals, creating competitive pressure on established firms. Sustainability certifications, carbon footprint reduction, and compliance with international green standards remain critical factors for competitiveness.

Overall, the competitive landscape is characterized by consolidation, innovation-driven rivalry, and a focus on expanding global footprints, ensuring that established leaders and new entrants alike play a significant role in shaping the green chemicals market.

Some of the prominent players in the Global Green Chemicals Market are:

- BASF SE

- Dow Inc.

- Cargill, Incorporated

- Evonik Industries AG

- DuPont de Nemours, Inc.

- Novozymes A/S

- Corbion N.V.

- Amyris, Inc.

- Braskem S.A.

- Eastman Chemical Company

- Clariant AG

- Arkema S.A.

- PTT Global Chemical Public Company Limited

- Avantium N.V.

- GFBiochemicals

- Genomatica, Inc.

- Metabolic Explorer S.A.

- Borregaard ASA

- Mitsubishi Chemical Holdings Corporation

- Other Key Players

Recent Developments in the Global Green Chemicals Market

- August 2025: BASF launched a large-scale biopolymer production line in Germany, designed to replace petroleum-based plastics in packaging, leveraging renewable feedstocks. The initiative strengthens Europe’s transition to circular economy targets aligned with the EU Green Deal policies.

- July 2025: Braskem partnered with Japanese firm Sumitomo to advance algae-based biochemicals production, focusing on bio-based solvents. The collaboration addresses Asia-Pacific demand while aligning with sustainability goals under Japan’s Green Growth Strategy for carbon neutrality by 2050.

- June 2025: Dow announced $500 million investment in expanding U.S. bio-ethanol-to-ethylene facilities. The expansion supports sustainable plastics production, meeting the U.S. Department of Energy’s bioeconomy strategy focused on reducing fossil dependency and increasing renewable chemical adoption.

- May 2025: Corbion showcased advancements in algae-based bioplastics at the International Biopolymers Symposium, Netherlands. The conference emphasized biopolymer role in replacing conventional plastics in food and beverage packaging while aligning with the European Union waste-reduction Directives.

- April 2025: Mitsubishi Chemical merged with Ube Industries’ chemical division to accelerate research in green solvents and bio-based polymers. The merger strengthens Japan’s bio-chemicals market leadership by enhancing innovation capabilities and meeting industrial decarbonization targets.

- March 2025: Evonik unveiled a collaboration with the University of Queensland to advance bio-waste-derived chemical solutions. The project aims to develop cost-efficient conversion technologies, supporting Asia-Pacific’s leadership in green chemicals innovation and reducing reliance on non-renewable resources.

- February 2025: Archer Daniels Midland (ADM) invested in expanding U.S.-based lactic acid production facilities. This expansion boosts supply for bioplastics and bio-based solvents industries while aligning with the USDA’s goals to accelerate renewable agriculture-based products.

- January 2025: Cargill announced a collaboration with Nestlé to supply plant-based green chemicals for packaging and food applications. This partnership enhances corporate sustainability commitments while addressing consumer demand for eco-friendly packaging alternatives in North America and Europe.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 15.2 Bn |

| Forecast Value (2034) |

USD 31.2 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 2.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Bio-alcohols, Biopolymers, Bio-organic acids, Bio-ketones, Bio-solvents, and Other products), By Source (Plant-based, Algae-based, Bio-waste, and Other Sources), By End- user (Construction, Healthcare, Pharmaceuticals and Personal Care Products, Packaging, Food and Beverages, Paints and Coatings, Automotive, Agriculture, and Other Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BASF SE, Dow Inc., Cargill, Incorporated, Evonik Industries AG, DuPont de Nemours, Inc., Novozymes A/S, Corbion N.V., Amyris, Inc., Braskem S.A., Eastman Chemical Company, Clariant AG, Arkema S.A., PTT Global Chemical Public Company Limited, Avantium N.V., GFBiochemicals, Genomatica, Inc., Metabolic Explorer S.A., Borregaard ASA, Mitsubishi Chemical Holdings Corporation, and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Green Chemicals Market size is estimated to have a value of USD 15.2 billion in 2025 and is expected to reach USD 31.2 billion by the end of 2034.

The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025.

The US Green Chemicals Market is projected to be valued at USD 2.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.6 billion in 2034 at a CAGR of 7.8%.

Asia Pacific is expected to have the largest market share in the Global Green Chemicals Market with a share of about 38.5% in 2025.

Some of the major key players in the Global Green Chemicals Market are BASF SE, Dow Inc., Cargill, Incorporated, Evonik Industries AG, DuPont de Nemours, Inc., Novozymes A/S, Corbion N.V., Amyris, Inc., and many others.