.

A greenhouse is a house made of glass that can be utilized to cultivate plants. The sun’s radiations warm the plants & the air inside the greenhouse. The heat trapped inside can’t escape out & warms the greenhouse which is important for the growth of the plants. The same is the case in the earth’s atmosphere.

Further, during the day the sun heats the earth’s atmosphere. At night, when the earth cools down the heat is radiated back into the atmosphere. During this process, the heat is absorbed by the greenhouse gases in the earth’s atmosphere, which makes the surface of the earth warmer and makes the survival of living beings on earth possible.

As demand for sustainable agricultural solutions surges, greenhouse markets worldwide have experienced incredible expansion. Greenhouses are becoming indispensable in meeting

food security demands year round thanks to year-round production of crops in greenhouses equipped with smart technologies and climate control systems that optimize production efficiencies while decreasing resource waste.

Recent advances in greenhouse technology have given way to innovative systems like hydroponics and vertical farming that are revolutionizing agriculture by offering higher yields in smaller spaces while using less water, thus cutting reliance on traditional farming techniques - this trend attracting both investors and agricultural entrepreneurs alike.

Urbanization continues, creating greater demand for fresh produce grown locally; greenhouses offer an ideal solution to urban farming initiatives by meeting this rising need. Urban greenhouse initiatives are flourishing as more greenhouses open their doors for business in order to satisfy this growing consumer hunger for locally produced foods - opening doors of opportunity for greenhouse manufacturers and operators.

As per Eurostat In 2022, greenhouse gas emissions across Europe decreased by 31% compared to 1990 levels - equivalent to an observable reduction of 1,456 million tonnes of CO2-equivalent emissions. This decline demonstrates ongoing efforts by governments and nongovernmental organisations (NGOs) to decrease emissions; exempting land use change/land-use change/forestry factors (LULUCF factors); as LULUCF impacts are taken into consideration; overall trends show consistent decline across multiple gases.

Though COVID-19 pandemic rebound accounted for an initial increase of 6%, emissions decreased 1.3% between 2021-2022 - equivalent to 42 million tonnes CO2-equivalent reduction versus 2021, as per data provided by Eurostat and European Environment Agency. This results in long-term downward trends for greenhouse gas emissions across EU Member States.

Each greenhouse gas has its own global warming potential (GWP), which measures their ability to cause global warming relative to carbon dioxide over 100 years. CO2, for instance, has an approximate GWP value of 1. Methane has 28 GWPs while nitrous oxide and sulfur hexafluoride each boast around 265. Hydrofluorocarbons and perfluorocarbons often possess several gases with variable GWP values as well.

The US Greenhouse Market

The US Greenhouse Market is projected to reach USD 8.5 billion in 2024 at a compound annual growth rate of 9.7% over its forecast period.

The greenhouse market in the US provides growth opportunities driven by higher demand for locally grown, fresh produce, and development in smart agriculture. As consumers prioritize sustainability & organic farming, the adoption of greenhouse technologies is rising. In addition, government incentives and support for sustainable farming practices further boost the potential for expanding greenhouse operations across many regions in the U.S.

The U.S. greenhouse market is driven by the rising need for year-round, locally sourced produce & advancements in smart agriculture technologies. However, growth is restrained by high initial investment costs & energy expenses associated with maintaining optimal greenhouse conditions. Balancing these factors is important for market expansion as sustainability and affordability become increasingly important.

Key Takeaways

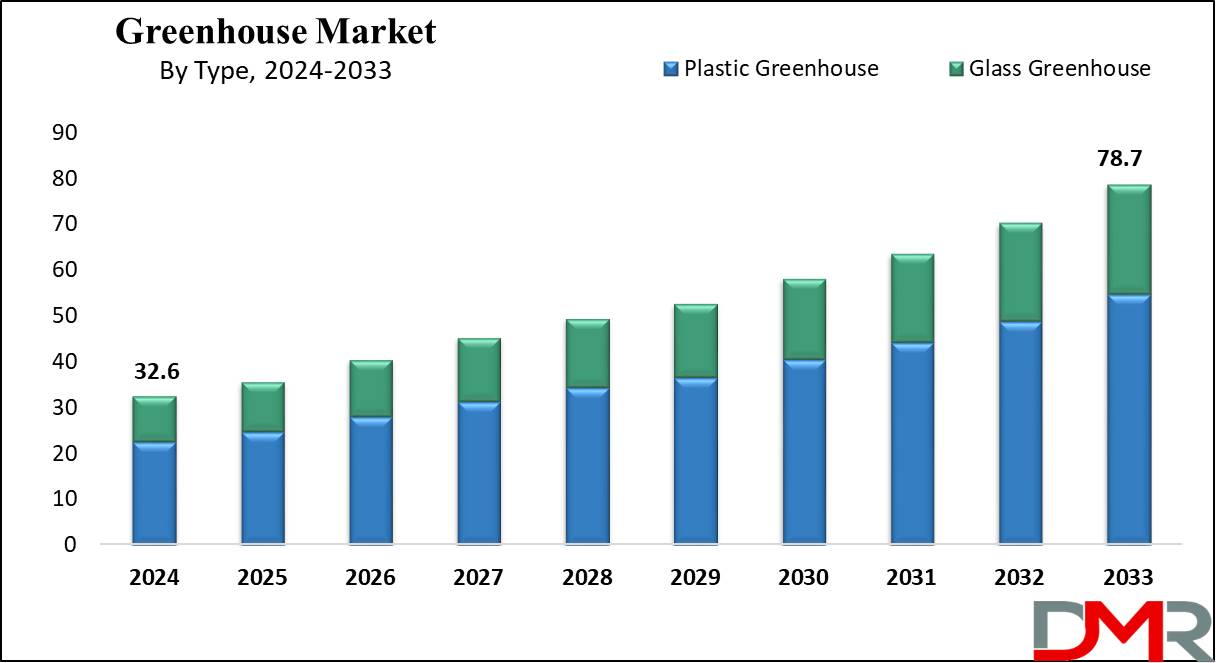

- Market Growth: The Greenhouse Market size is expected to grow by 43.1 billion, at a CAGR of 10.3% during the forecasted period of 2025 to 2033.

- By Type: The plastic greenhouse are expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Offering: The hardware segment is expected to lead the Greenhouse market in 2024.

- By End User: The commercial growers segment is expected to get the largest revenue share in 2024 in the Greenhouse market.

- Regional Insight: Europe is expected to hold a 33.5% share of revenue in the Global Greenhouse Market in 2024.

- Use Cases: Some of the use cases of Greenhouse include agriculture, horticulture, and more.

Use Cases

- Agriculture: Controlled environment for expanding crops year-round, maximizing yield by managing temperature, humidity, and light.

- Research: Conducting experiments on plant growth, genetics, & breeding under controlled conditions to study environmental impacts.

- Horticulture: Cultivating ornamental plants, flowers, and exotic species that need specific climates or protection from pests.

- Education: Teaching students about plant biology, environmental science, and sustainable farming practices through hands-on experience.

Market Dynamic

Driving Factors

Rising Demand for Fresh Produce

Higher consumer preference for fresh, locally grown, and organic food drives greenhouse farming growth, allowing year-round cultivation and reducing dependency on seasonal crops.

Technological Advancements

Developments in greenhouse automation, climate control, and energy-efficient systems improve productivity and sustainability, making greenhouse farming more attractive and affordable for growers.

Restraints

High Initial Investment

Major upfront costs linked to constructing and equipping a modern greenhouse, like advanced climate control systems, can be a barrier for small and medium-sized farmers.

Energy Consumption

Maintaining optimal conditions in a greenhouse requires more energy, mainly in colder climates, resulting in high operational costs and potential environmental concerns related to energy use.

Opportunities

Sustainable Agriculture

The growing interest in eco-friendly farming practices allows greenhouses to adopt renewable energy sources & water-saving technologies, appealing to environmentally conscious consumers and minimizing operational costs.

Urban Farming Expansion

The growth of urban

agriculture creates opportunities for greenhouse farming in cities, where space is limited. Greenhouses can be used for vertical farming or rooftop gardens, providing fresh produce locally & reducing food miles.

Trends

Integration of Smart Technologies

The adoption of IoT devices,

AI, and data analytics in greenhouses is on the rise, allowing correct monitoring and automation of climate control, irrigation, and crop management for optimized growth & resource efficiency.

Use of LED Lighting

The switch towards energy-efficient LED grow lights is becoming a trend, as they provide better light spectrum control, minimize energy consumption, and support year-round crop production, even in low-light conditions.

Research Scope and Analysis

By Type

The greenhouse market is divided into glass, and plastic types, with the plastic segment further categorized into polyethylene, polycarbonate, and polymethyl-methacrylate. In 2024, the plastic segment is anticipated to dominate in revenue and is expected to continue dominating the market throughout the forecast period.

A key advantage of plastic greenhouses over glass is their minimal installation cost. Among plastics, polycarbonate is set to hold the largest market share in 2024 due to its durability & resistance to shattering. Unlike regular glass, polycarbonate can withstand harsh impacts from weather elements like stones, wind, & snow without damage, making it a flexible and resilient choice.

Further, the glass greenhouse segment is set to experience the highest growth rate during the forecast period. Known for its durability, strength, & longevity, glass remains a popular choice despite higher costs. Glass greenhouses are valued for their aesthetic appeal, mainly the clarity of the glass, which can be maintained over the years with regular cleaning, which includes horticulture glass and other types like tempered glass, float glass, laminated glass, and frosted or hammered glass.

By Offering

The hardware segment is set to lead the greenhouse market in 2024, accounting for the majority of the total revenue, which is driven by the increase in demand for hardware among farmers to maintain optimal greenhouse environments. Important tools like climate control systems play a major role in regulating greenhouse conditions, ensuring crops are grown under ideal circumstances.

As farmers increasingly adopt modern smart agriculture and innovative technologies, the hardware segment constantly expands with the incorporation of lighting systems, climate control systems, sensors, and irrigation systems, all of which support the indoor cultivation of crops. Further, the climate control systems segment is anticipated to have the highest growth rate during the forecast period, as these systems automate temperature management within greenhouses, using advanced technology to improve crop quality & yield.

Moreover, the software segment is anticipated to grow at the highest rate over the forecast period. Greenhouse management software is becoming highly important for improving crop planning, tracking, and facility operation, with minimal manual intervention, which allows farmers to implement efficient & environmentally friendly farming practices, as it includes web-based and cloud-based solutions, with the web-based segment capturing the largest revenue share.

The growth of web-based services is driven by AgriTech 4.0 initiatives, which aim to develop agricultural technology through innovation & research. These initiatives focus on developing secure, web-based control systems that combine various devices to optimize plant growth processes in greenhouse farming.

By Crop Type

Crops and herbs are set to play a vital role in driving the growth of the greenhouse market and are expected to the market in 2024 as well. Greenhouses provide an ideal environment for cultivating a variety of crops and herbs year-round, regardless of external weather conditions, which allows farmers to grow high-value, perishable crops like leafy greens and various herbs, which are in constant demand. The ability to produce organic, fresh, and high-quality produce throughout the year not only meets consumer demand but also supports local supply chains. As a result, the cultivation of crops and herbs in greenhouses contributes highly to the market's expansion.

Further, fruits are also a key driver in the expansion of the greenhouse market, as greenhouses allow for the cultivation of high-demand, delicate fruits like strawberries, tomatoes, & berries, regardless of season. The controlled environment of a greenhouse creates optimal growing conditions, improving fruit quality, yield, and consistency, which is mostly valuable for meeting the rising consumer demand for locally grown, fresh, and organic fruits year-round. In addition, the protection greenhouses provide from pests & extreme weather minimizes crop loss, making fruit production more reliable and profitable.

By End User

The commercial growers segment is predicted to dominate the greenhouse market in 2024, capturing the largest revenue share, which is driven by the higher popularity of greenhouse farming, which provides numerous benefits, like better control over growing conditions and higher crop yields. Commercial growers are highly adopting greenhouse farming to stay updated with the latest agricultural technologies, industry trends, and pest control methods, making them more effective & competitive.

In addition, government support, like financial assistance and subsidies, further boosts this segment. Like, in India, the National Horticultural Board (NHB) provides a 50% subsidy on greenhouse projects, up to a maximum of INR 11.2 million per beneficiary, encouraging more commercial growers to invest in greenhouse farming.

Further, the research & educational institutes segment is projected to experience the fastest growth during the forecast period. These institutions play a major role in advancing greenhouse technology & development, benefiting both farmers and students. By promoting STEM (Science, Technology, Engineering, and Mathematics) education, greenhouse institutes support and inspire the next generation to pursue careers in agriculture.

Educational programs provide hands-on training in horticulture, plant science, breeding, and modern agricultural techniques, equipping students & farmers with the knowledge needed to succeed in the evolving agricultural landscape

The Greenhouse Market Report is segmented on the basis of the following

By Offering

- Hardware

- Sensors

- Irrigation System

- Lighting System

- Climate Control Systems

- Others

- Software

- Services

- System Integration & Consulting

- Managed Services

- Assisted Professional Services

By Type

- Glass Greenhouse

- Plastic Greenhouse

- Polycarbonate

- Polymethyl-methacrylate

- Polyethylene

By Crop Type

- Fruits

- Vegetables & Herbs

- Flower & Ornamentals

- Others

By End User

- Retail Gardens

- Commercial Growers

- Research & Educational Institutes

- Others

Regional Analysis

Europe is projected to dominate the greenhouse market, accounting for around

33.5% of revenue in 2024, with strong growth expected throughout the forecast period. The region's increasing population and lower availability of arable land are key factors driving the switch toward greenhouse farming.

As traditional farming methods struggle to meet the need to feed a large population, the demand for technology-driven agricultural solutions is becoming highly critical. Greenhouse farming provides an effective alternative by increasing land use and ensuring consistent crop production, making it an important component of Europe’s agricultural strategy.

Further, the Asia Pacific region is expected to experience the highest growth in the greenhouse market by 2033. The growing population and the demand to ensure food security are driving the adoption of high-yield, alternative farming techniques across the region. Emerging nations like Australia, Indonesia, and India are highly embracing greenhouse farming to improve their agricultural output.

Greenhouse farming is mainly appealing in these countries due to its ability to produce higher yields in comparison to traditional farming methods. In addition, major players in greenhouse agriculture, like China, Japan, Taiwan, and South Korea, are creating the way to advance greenhouse technologies in the Asia Pacific region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global greenhouse market is highly competitive, with various players aiming at technological development and innovative solutions to gain a competitive edge. Companies are investing in R&D to improve climate control systems, automation, and energy efficiency, catering to the rising demand for sustainable and high-yield farming practices.

Strategic partnerships, mergers, and acquisitions are common, as firms look to expand their market presence and provide integrated solutions to meet the various needs of commercial growers and emerging markets.

Some of the prominent players in the Global Greenhouse are

- Signify Holdings

- Berry Global

- Sotrafa

- Logips B.V.

- Certhon

- Agra Tech

- Hort Americas

- Richel Group

- Stuppy Greenhouse

- NETAFIM

- Other Key Players

Recent Developments

- In August 2024, KUBO claims to have launched a transformative cultivation strategy: CO2 Negative Cultivation, which marks a step towards sustainable horticulture & contributes to global efforts to combat climate change and can transform horticulture from a CO2 emitter to a CO2 reducer.

- In August 2024, Helle-Tech Oy and Bloemteknik (Bloem) announced a partnership to develop modular adjustable LED fixtures designed particularly for high wire and leafy green growers. Further, the Balance Platform allows growers to expand photosynthetic photon flux density (PPFD) on the vertical face of vine-growing crops by up to 36 percent, without rising energy consumption.

- In June 2024, Rijk Zwaan announced the building of its newest breeding greenhouse in Dinteloord, the Netherlands, which is dedicated to R&D related to new berry varieties. The new greenhouse features advanced climate control, energy-efficient systems, and sustainable practices, allowing optimal conditions for year-round research and breeding.

- In February 2024, Bosch Berries announced its plan to locate its first location in the United States right here in the commonwealth speaks volumes about what our state has to offer, which move uses the pre-existing greenhouse infrastructure to improve growing environments, implement new technologies, and establish a sustainable and efficient operation. The facility can assist about 1 million strawberry plants, indicating this operation’s scale and potential impact

- In December 2023, The Union Territory of Ladakh announced to building of 1,875 eco-friendly greenhouses with a total cost of INR 43.78 crore. These greenhouses are developed to help farmers grow vegetables like cabbage, cauliflower, tomato, and numerous types of green leafy vegetables even during the harsh winter months, which was shared by the Ministry of Home Affairs (MHA) with Rajya Sabha.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 32.6 Bn |

| Forecast Value (2033) |

USD 78.7 Bn |

| CAGR (2024-2033) |

10.3% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 8.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Glass Greenhouse and Plastic Greenhouse ), By Offering (Hardware, Software, Services), By Crop Type (Fruits, Vegetables & Herbs, Flower & Ornamentals, and Others), By End User (Retail Gardens, Commercial Growers, Research & Educational Institutes, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Signify Holdings, Berry Global, Sotrafa, Logips B.V., Certhon, Agra Tech, Hort Americas, Richel Group, Stuppy Greenhouse, NETAFIM, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |