Market Overview

The Global Halal Meat Market is anticipated to be valued at USD 339.5 billion in 2024 and is further predicted to reach USD 805.1 billion by 2033, at a CAGR of 10.1 %. The growing demand for halal packaging and meat substitutes is driving consumer interest in halal meat products, which ensures food safety and aligns with Islamic dietary laws.

Halal meat is different from other meat as it is distributed according to Islamic dietary laws, allowing Muslims to eat clean meat. Halal is a term derived from Arabic, which is considered permissible. The slaughtering process of halal meat is different from other normal ones as it is done according to religious protocol, ensuring food safety and compliance with food safety testing standards.

This meat is obtained from animals that are alive and healthy at the time of slaughter, and the process must be carried out by a Muslim who prays in the name of Allah (God). This sacrifice is done by swiftly cutting the throat of the animal to ensure quick death, and the blood is completely drained from the body. This method is believed to be more humane, which also aligns with food safety & quality standards to ensure high-quality products.

Animals like cattle, sheep, goats, and poultry are considered permissible according to Islamic teachings. However, pigs are not allowed to be consumed according to Islamic law. The production of halal meat also includes considerations such as animal welfare, hygiene, and avoiding prohibited substances, ensuring that halal meat is free from contaminants and unhealthy additives.

Halal certification is often demanded by meat producers to assure Muslim consumers that the meat is produced according to religious beliefs and food safety standards.

Key Takeaways

- Market size: The Global Halal Meat Market is expected to grow by 434.9 billion, at a CAGR of 10.1 % during the forecasted period of 2025 to 2033.

- Market Definition: Halal meat is meat that is slaughtered according to Islamic law and it is commonly labeled clean and hygienic.

- Product Segment Analysis: In terms of product, poultry is expected to dominate the halal meat market with the largest revenue share of 45.2 % in 2024.

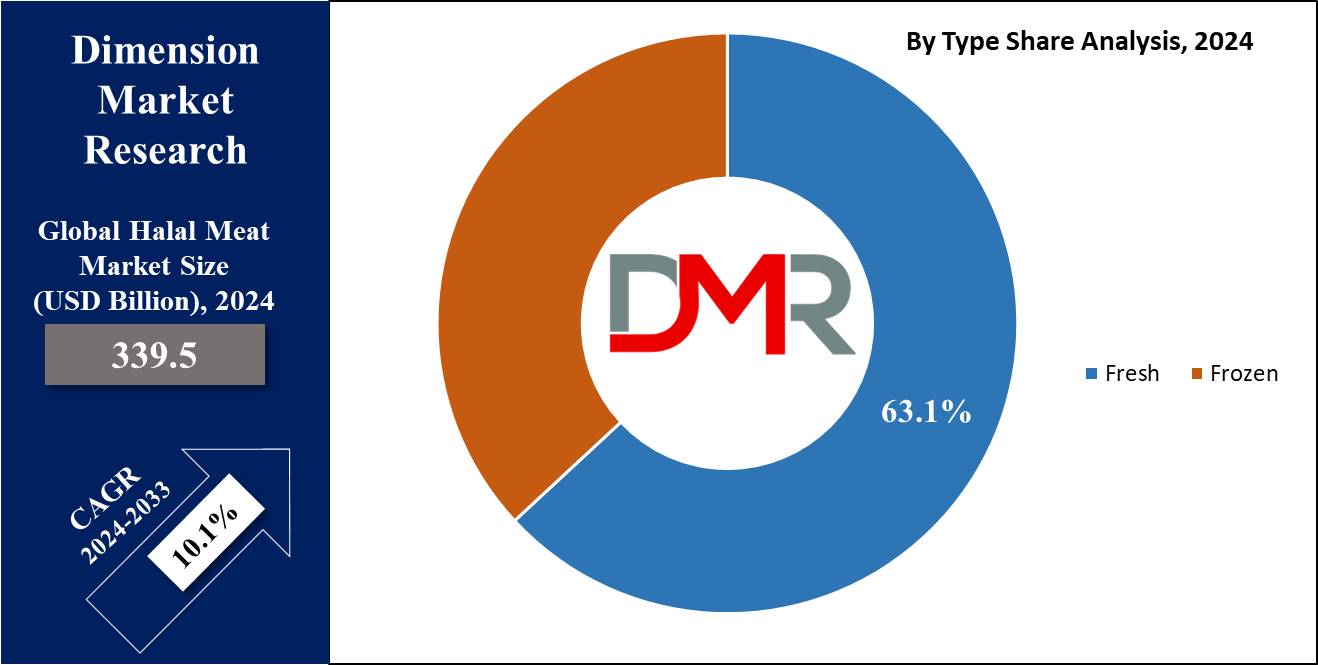

- Type Segment Review: Based on type, the fresh meat segment is anticipated to lead the market with the largest revenue share in 2024.

- End-Users Segment Analysis: Household consumer is predicted to experience notable growth based on end users throughout the forecasted period.

- Distribution Channel: Based on the distribution channel, supermarket/hypermarket segments are expected to dominate the halal meat market with the largest revenue share in 2024.

- Regional Analysis: Asia-Pacific is expected to dominate the market with a revenue share of 40.1 % in 2024.

Use Cases

- Health Considerations: Halal meats are clean and hygienic as animals used in this process are healthy and meet stringent food safety testing protocols, following Islamic guidelines that help reduce the risk of contamination and ensure food pathogen testing standards.

- Religious Observance: Halal meat is primarily consumed by Muslims who follow Islamic dietary regulations. Halal meat not only meets religious obligations but also aligns with consumer concerns over ethical food production, making it attractive to non-Muslims in regions like Europe and the United Kingdom vegan meat market, where there is rising interest in healthy snacks and organic pet food.

- Food Service: Manufacturers & restaurant owners are offering halal meat options to satisfy Muslim customers and adhere to halal food regulations.

- Halal Certification: Halal certification officials play an important role in verifying the meat and food items labeled as halal adhere to the required standards and criteria. This certification is essential for consumers who depend on the accuracy of halal products.

Market Dynamic

Drivers

Rising Global Muslim Population

The halal meat market is growing due to the increasing population of Muslims worldwide, many of whom reside in developing countries like Indonesia, Malaysia, Iran, Saudi Arabia, and Morocco. These regions also see an increased demand for biodegradable packaging and temperature-controlled packaging solutions that ensure the safety and quality of the meat during transportation.

Demand for Certified Items

Muslim consumers are becoming more aware of the importance of consuming halal-certified items and the benefits they offer in ensuring adherence to food safety standards. This demand is leading to greater product availability and an expansion of the cross-border e-commerce logistics for halal meat products..

Restraints

Increasing Adoption of Plant-based Proteins

There is a change in consumers' preference as they move to plant-based proteins from animal-based, ones due to their numerous benefits in lowering cholesterol, blood pressure, body weight, and heart disease, which has garnered attention from Muslims seeking alternatives beyond fish & vegetarian options at restaurants and fast-food chains. As a result, plant-based protein has emerged as a major competitor to the meat industry, adversely affecting the halal meat market.

Absence of International Standards and Regulations

The lack of standardized certification processes is one of the major challenges that constraints the growth of the market. Varying procedures across countries can confuse and hinder businesses from entering new markets. There is great uncertainty about which ingredients are considered halal, leading to confusion among consumers and manufacturers, which obstructs the growth of the market.

Opportunities

Technological Advancement in Food Products

Advancements in technology within the halal food sector are giving a great opportunity for halal products to grow in the global market. Highly equipped halal laboratories are actively involved in ensuring food safety as the demand for halal meat rises. They are focused on analyzing food products to maintain quality standards and identify substances like alcohol, blockchain, or porcine material, which enhance customer trust and market credibility.

Increasing Product launch

Different innovations in halal products and an increase in the launch of products by major players in the market, present various growth opportunities for market. For instance, Marks & Spencer introduced its own-brand halal-ready meals such as chicken and leek bake, chicken hotpot, chicken arrabbiata, chicken and mushroom tagliatelle, chicken jalfrezi, and chicken tikka masala. These outlets are available in different cities and are operated by Al-Futtaim.

Trend

Rising Demand for Convenient and Ethical Halal Products

There is a growing trend for quick and hassle-free meal solutions due to busy lifestyles, boosting the convenience food sector. The rising global demand for convenient foods and value-added Halal products like Halal organic, Halal free-range, and Halal farm-assured items reflects the changing consumer landscape. Consumers are becoming aware of quality, ethics, and health considerations which leads to prefer Halal food products that resonate with personal values and dietary needs.

Research Scope and Analysis

By Product

Poultry is expected to lead the halal meat market with a revenue share of 45.2 % in 2024, as it is preferred by many consumers due to its versatility and adaptability in many food applications. Chicken is the most demanded poultry product which is popular, acceptable, and consumed globally, contributing to the growth of the poultry segment within in halal meat market.

Chicken is also preferred for its protein content which is appealing to health-conscious individuals and extends across many demographics, making it suitable for both Muslim and non-Muslim diets. This segment is also economical among others due to affordable pricing and widespread availability in many regions. It is constantly fulfilling the demand of customers due to shorter manufacturing cycles and is also expanding the growth of this market.

Moreover, poultry continues to remain in a prominent position in the halal meat industry, due to strict halal certification standards, the ability to mix well with many culinary styles, and suitability for modern dietary trends favoring leaner protein options, which serve a wide range of consumers.

Beef is also growing rapidly due to constant use in many cuisines and regions, particularly in countries with a preference for red meat. It is also included in burgers, steaks, ground beef, sausages, and roasts, which contribute to the growth of this segment.

By Type

The fresh segment is expected to dominate the halal meat market based on type with the largest revenue share in 2024, due to its flavor, texture, and ability to be used in traditional dishes effectively.

It includes unprocessed cuts of beef, lamb, chicken, and goat, and plays an important role in culinary and cultural traditions, providing a desired taste and texture experience. Further, this meat is suitable for instant cooking, fulfilling the demand for meal preparation and quality assurance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Eating fresh meat is a means of sticking to restricted diets and religious adherence. These involve acquiring fresh halal meat from reliable sources, processing it, and distributing it to consumers or retailers to preserve its freshness. This meat is appreciated by consumers who prefer flavor, tenderness, consistency, same-day consumption and support local halal vendors.

Frozen is also experiencing some growth in the halal meat market in 2024 due to its prolonged shelf life. Freezing these products helps maintain the safety and freshness of frozen meat for an extended period and contributes to the growth of this segment.

By Certification

Halal certification is anticipated to dominate the halal meat market with the largest revenue share in 2024, as it allows the products to meet Islamic dietary requirements for Muslim consumers.

This certification ensures that the meat products are at every stage of the supply chain, including sourcing, processing, and distribution. It helps to provide transparency and assurance to consumers in the halal meat industry and increases their confidence in purchasing food.

Non-certified meat products are labeled as halal but lack official certification from halal certification bodies. They are claimed to follow Islamic dietary guidelines and standards but do not offer the same level of assurance and transparency as products with official halal certification.

By Distribution Channel

Supermarkets/hypermarket is anticipated to dominate the halal meat market based on distribution channels in 2024 due to its convenience, diverse product range, and established consumer trust. These retailers provide an extensive shopping experience by offering a wide variety of Halal meat products, including both fresh and packaged options in one place.

They serve consumers' choice of processed meat, beef, chicken, lamb, and other cuts of halal meat. These stores allow consumers to assess the quality and the freshness of the meat before purchase.

The online halal industry significantly expanded with the increase of e-commerce like Amazon, and Flipkart. Online retailers and manufacturers allow consumers to order their preferred cuts or processed halal items from the comfort of their homes.

Online distribution channel allows consumers to order their preferred cuts or processed halal items from the comfort of their homes. These channels are suitable for busy professionals, and consumers searching for certain halal options which provide a wide range of products and doorstep delivery services.

By End User

Household consumers as end users are expected to dominate the Halal Meat Market with the largest revenue share in 2024 due to increasing demand among households.

This segment is influenced by several factors, such as dietary requirements, cultural and religious beliefs, and a preference for halal items that are certified and of excellent quality. These are commonly available in homes due to their presence in local markets and online shops, which contributes to the expansion of this market.

Food services are anticipated to grow significantly with the highest market share in 2024 as it includes institutional buyers, restaurants, hotels, and catering services.

Restaurants frequently include halal options to attract Muslim customers, which expands the market reach. Halal meat is widely used in different types of eateries, ranging from fast-food joints to traditional dishes, reflecting its popularity and versatility in many food applications. Other end-users include industrial users, wholesalers, and distributors who purchase halal meat in large quantities for processing or distribution purposes.

The Global Halal Meat Market Report is segmented based on the following

By Product

- Poultry

- Beef

- Sheep & Goat

- Others

By Type

By Certification

- Halal Certification

- Non-Certified

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

By End User

- Household Consumers

- Food Service Sector

- Others

Regional Analysis

Asia-Pacific is expected to dominate the halal meat market with the largest revenue of 40.1% in 2024, due to the large Muslim-majority countries like Malaysia, Thailand, Indonesia, India, and China.

Also, the government is investing significantly in the development of meat products, which significantly contributes to the demand for this market in the Asian region. Large Muslim residents in this region offer a strong and consistent demand for certified halal meat products, which contributes to the growth of this region.

Europe is expected to be the second-largest region in the market due to the increasing Muslim population. There is also increasing awareness and acceptance of halal certification standards among non-Muslim consumers in this region. Consumers are searching for premium and ethically produced meat products, and are choosing halal-certified products due to their belief that halal practices adhere to higher standards of animal care, hygiene, and quality control.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Key market participants commonly employ strategies such as introducing new products and expanding through investments. Certified halal producers and buyers are focusing on logistical improvements and strengthening distribution channels as part of their business growth strategies. These initiatives are improving the product adoption rates among global consumers.

The halal meat market is fragmented due to many participants, and it is anticipated that there will be moderate to intense competition among the companies. Amana Foods, Al Islami Foods, Tariq Halal, Tahira Foods Ltd, SIS Company, and Al Kabeer Group ME are the major players known for their diversified production and supply chain network of halal meat. These key players and other halal meat suppliers collectively influence the halal meat market’s growth, supply, and demand dynamics.

Some of the prominent players in the global halal meat market are

- BRF Global

- Amana Foods

- Al Islami Foods

- Tariq Halal

- Tahira Foods Ltd

- SIS Company

- Al Kabeer Group ME

- Prairie Halal Foods

- Nema Halal

- Thomas International

- Al-Aqsa

- Others

Recent Development

- In August 2023, BRF announced the establishment of a joint venture with the Halal Products Development Company (HPDC), a subsidiary of Saudi Arabia's sovereign wealth fund, the Public Investment Fund.

- In June 2023, HPDC revealed a significant partnership with Tanmiah Food Company, which strengthened and localized the halal products market to foster its growth both regionally and globally.

- In September 2022, Bourke's small-scale meat processing plant resumed operations, focusing on processing goats and providing employment opportunities for the local community.

- In July 2022, Al Islami Foods received the top-grade Gold Award from Dubai Municipality's Health and Safety Department for demonstrating excellence in maintaining health and safety standards.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 339.5 Bn |

| Forecast Value (2033) |

USD 805.1 Bn |

| CAGR (2024-2033) |

10.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Poultry, Beef, Sheep & Goat, and Others), By Type (Fresh, and Frozen), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By End Users (Household Consumers, Food Service Sector, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BRF Global, Amana Foods, Al Islami Foods, Tariq Halal, Tahira Foods Ltd, SIS Company, Al Kabeer Group ME, Prairie Halal Foods, Nema Halal, Thomas International, Al-Aqsa, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

How big is the Global Halal Meat Market?

▾ The Global Halal Meat Market size is estimated to have a value of USD 339.5 billion in 2024 and is expected to reach USD 805.1 billion by the end of 2033.

Which region accounted for the largest Global Halal Meat Market?

▾ Asia Pacific is expected to be the largest market share for the Global Halal Meat Market with a share of about 40.1 % in 2024.

Who are the key players in the Global Halal Meat Market?

▾ Some of the major key players in the Global Halal Meat Market are Amana Foods, Al Islami Foods, Tariq Halal and many others.

What is the growth rate in the Global Halal Meat Market?

▾ The market is growing at a CAGR of 10.1 percent over the forecasted period.