Handheld Electric Nutrunners Market refers to electric tools designed for precisely fastening and loosening bolts, nuts, and other fasteners. These cutting-edge tools are essential for efficient operations in automotive, aerospace, and industrial manufacturing environments.

Handheld electric nutrunners provide many advantages over manual or pneumatic alternatives, including consistent torque delivery, reduced operator fatigue, and enhanced accuracy. As industries increasingly demand automation and reliability, this market is growing steadily due to innovations in battery technology, ergonomics, and smart features. Key decision-makers such as vice presidents, CEOs, CMOs, and product managers use these tools to optimize production processes while maintaining quality control standards.

Handheld Electric Nutrunners Market Analysts note a rapid development, driven by technological advancements and changing industry requirements. This market is experiencing strong growth due to an increasing need for precision and efficiency across manufacturing operations such as automotive and aerospace production processes. Electric nutrunners offer unique advantages over their pneumatic or manual counterparts such as precise torque control, reduced operator fatigue, and increased reliability over traditional tools.

Integrating cutting-edge technologies like digital torque control and advanced battery systems is a significant growth driver. These innovations meet the demand for higher operational accuracy and ergonomic benefits while following wider trends towards automation and smart manufacturing. As industries adapt Industry 4.0 principles, adoption of electric nutrunners should increase due to their compatibility with automated systems as well as their enhanced performance features.

Market growth is being supported by increasing preference for cordless electric nutrunners that offer greater mobility and flexibility, particularly in regions with robust manufacturing and infrastructure sectors such as North America and Asia-Pacific where industrial development is significant.

Key Takeaways

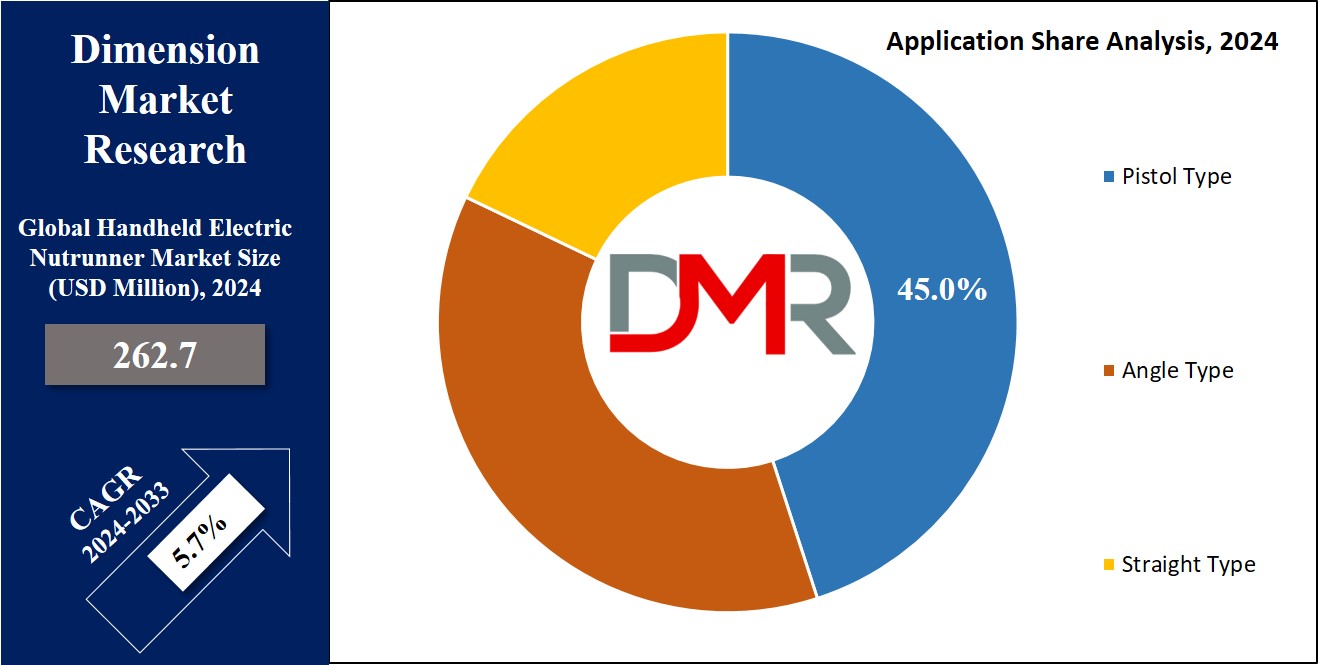

- Market Growth Projection: The market size for handheld electric nutrunners is anticipated to grow from USD 262.7 million in 2024 to USD 433.1 million by 2033, reflecting a robust CAGR of 5.7%.

- Dominant Product Segment: The automotive sector remains the largest application segment, holding approximately 50% of the market share in 2023, driven by high precision and efficiency needs in manufacturing and repair operations.

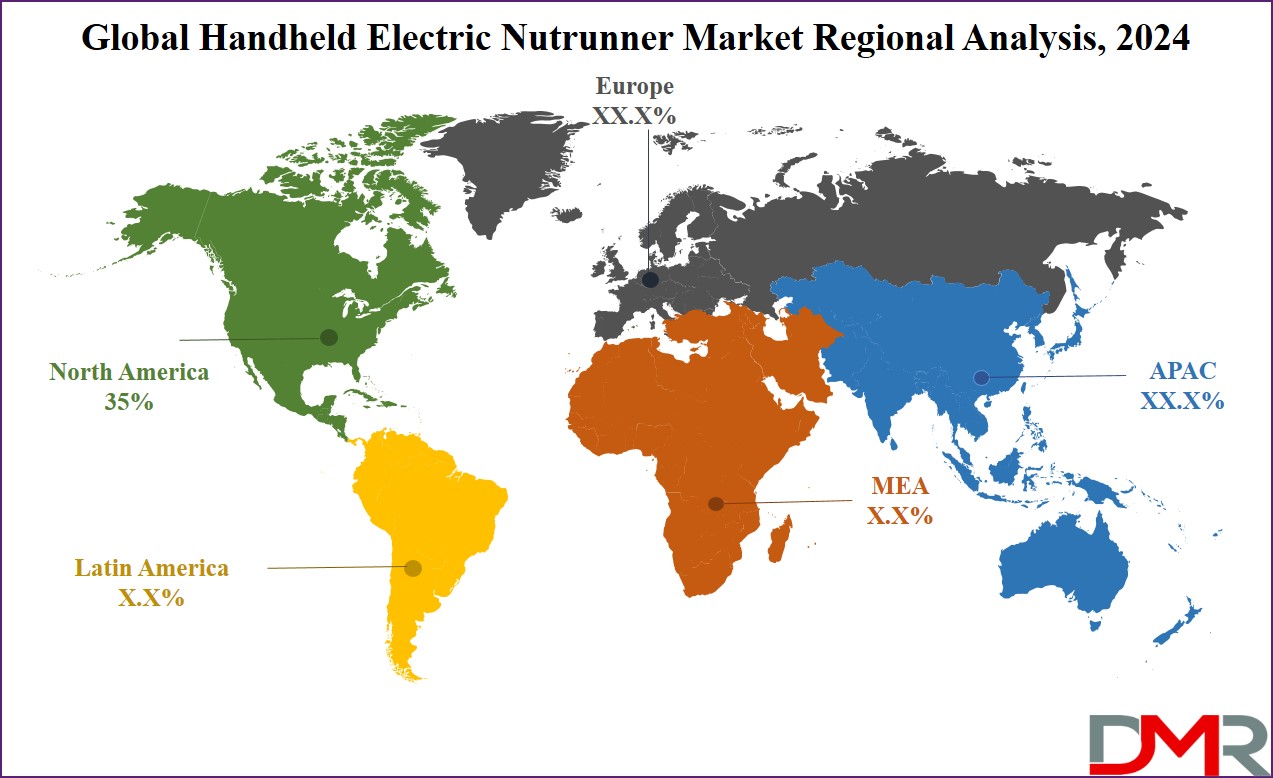

- Regional Leadership: North America leads the market with a 35% share in 2023, bolstered by advanced manufacturing infrastructure and a strong emphasis on automation technologies.

- Technological Innovations: Key growth drivers include advancements such as digital torque control features and improved battery systems, enhancing precision and ergonomic benefits in electric nutrunners.

- Growth Opportunities: Customization and personalization, aftermarket parts, and sustainability are significant growth areas, as they cater to specific industry needs, maintenance demands, and environmental goals.

Use Cases

- Automotive Assembly: Essential for high-precision tasks on assembly lines, these tools enhance efficiency and reduce operator fatigue in automotive production.

- Aerospace Manufacturing: Ideal for assembling complex aircraft components, offering precise torque control and ergonomic benefits for safety-critical applications.

- Construction Projects: Streamline fastening in large-scale infrastructure projects with enhanced mobility and flexibility, improving project timelines and reducing downtime.

- Machinery Maintenance: Provide reliable and precise fastening for complex machinery repairs, ensuring operational efficiency and minimizing maintenance time.

- E-commerce Sales: Boost market reach and customer access through online platforms, facilitating product comparisons and driving adoption across various industries.

Driving Factors

Rising Construction Activities

Construction activities have been an essential factor driving the growth of the Handheld Electric Nutrunners Market. As global urbanization and infrastructure development accelerate, demand for efficient tools increases exponentially - especially handheld electric nutrunners because of their precision, speed, and reliability in fastening applications; such tools become especially essential as projects become increasingly complex requiring tools that deliver consistent performance while minimising downtime.

Construction industry expansion can be seen worldwide due to significant investments in infrastructure projects and rising residential and commercial construction activity. Global industry projections estimate compound annual growth at 5.2% between 2023-2028 - with this projection leading directly to increased demand for electric nutrunners that facilitate efficient assembly and installation processes; advanced tools like handheld electric nutrunners likely becoming part of companies' initiatives for improving productivity while producing superior quality results, spurring market expansion further.

Focus on Worker Safety and Ergonomics

Handheld Electric Nutrunners Market. As emphasis on worker safety and ergonomics grows in modern industrial settings, demand for tools that not only increase operational efficiency but also minimize injury risk increases significantly. Handheld electric nutrunners were designed with ergonomics in mind; featuring lightweight designs with user-friendly controls to minimize physical exertion for prolonged usage while increasing comfort levels significantly.

Ergonomic design has become an essential requirement in numerous sectors, driven by regulations and corporate policies aimed at minimizing workplace injuries while simultaneously increasing productivity. Ergonomic tools have proven especially helpful at helping prevent Musculoskeletal Disorders (MSDs), common among industries involving repetitive tasks or heavy lifting; their market continues to expand as organizations invest more money in equipment that fulfills health and safety regulations, driving demand for advanced electric nutrunners that offer both safety and efficiency advantages.

Global Economic Recover Post-COVID-19

Handheld Electric Nutrunners Market growth has been propelled forward by global economic recovery following COVID-19 pandemic. Recovering economies have placed renewed emphasis on infrastructure development and industrial production as part of plans to stimulate growth; more investment into manufacturing and construction sectors that rely heavily on electric nutrunners has followed these recovery phases as manufacturing production picks back up again.

Pandemic had initially caused delays and disruptions to construction and manufacturing activities; but as nations emerge from economic slowdowns, countries are making concerted efforts to accelerate projects and catch up on deferred maintenance and development tasks that had fallen behind. As countries resume economic activity there has been an effort made to accelerate projects as quickly as possible and catch up on deferred maintenance and development tasks that had fallen by the wayside, spurring demand for high-efficiency tools that improve productivity while meeting modern industry's higher productivity standards - electric nutrunners playing an instrumental part.

Growth Opportunities

Customization and Personalization Services

Customization and personalization present significant growth opportunities in the Handheld Electric Nutrunners Market by 2023. The rising demand for tailored solutions is altering its dynamics. Industries across automotive, aerospace, and manufacturing sectors are seeking tools that feature specific features suited for their specific applications. Manufacturers are responding by offering customizable electric nutrunners, featuring adjustable torque settings, modular components, and ergonomic designs. This trend towards personalization enhances tool performance and user satisfaction while meeting diverse operational needs. By offering custom solutions, companies can differentiate their products, develop stronger customer relationships, and tap niche market segments - driving growth while simultaneously maintaining a competitive edge.

Aftermarket and Replacement Parts

As handheld electric nutrunner sales increase, so too do maintenance and replacement needs for these tools, creating more of an imperative for spares to support their ongoing operation. As these tools continue to proliferate into everyday lives, so too do the maintenance needs of aftermarket components become even greater. Companies looking to break into this niche have an incredible opportunity in this segment to produce high-quality, durable components that ensure the continued efficiency and reliability of electric nutrunners. Offering comprehensive aftermarket services drives not only additional revenue but also improves customer loyalty by providing reliable maintenance solutions. As more electric nutrunners are installed, so too does demand for replacement parts - making this area of expansion and investment an integral component of growth and strategy.

Sustainability and energy efficiency

Sustainability and energy efficiency are increasingly shaping the Handheld Electric Nutrunners Market. There is an emphasis on developing tools that are environmentally friendly and energy efficient, with manufacturers investing in technologies to lower energy consumption while meeting regulatory standards for sustainability goals. By adopting greener practices, manufacturers not only meet global environmental goals and standards more easily but also appeal to environmentally conscious customers further reinforcing their commitment to sustainability and driving growth through market positioning.

Key Trends

Digital Torque Control Features Available Now

Digital torque control features will become an essential feature in 2023 for the handheld electric nutrunners market. Digital torque controllers enhance precision and consistency during fastening applications by offering real-time feedback and adjustments, furthering precision. These features allow for more precise torque settings and reduce the risk of over-tightening or under-tightening, essential in upholding high-quality standards in manufacturing processes. Digital torque controls have become an indispensable tool in assembly operations due to their ability to increase efficiency and reduce errors. Industries demand greater accuracy and automation; companies that incorporate such advanced features into their nutrunners may gain a competitive edge by meeting market needs more effectively.

Demand in Automotive and Aerospace Industries Has Increased Significantly

Handheld Electric Nutrunners Market analysts believe the increase in automotive and aerospace industries demand is one of the main influences in 2023 for this market segment. Both sectors require tools capable of performing precise fastening tasks consistently, which may necessitate high-performance tools with precise fastening capacities that meet these criteria. The automotive industry's push towards automation and aerospace's stringent quality standards has fuelled a greater need for reliable and efficient electric nutrunners. As industries expand and evolve, their demand for sophisticated tools that meet their rigorous demands increases. Companies specializing in electric nutrunners have taken note by tailoring products specifically to these sectors; taking advantage of increased market demand to gain significant market share.

E-commerce Platforms Are Exploding

E-commerce platforms are rapidly revolutionizing how handheld electric nutrunners are sold and marketed. Online retail channels have created increased market access and allowed manufacturers and distributors to reach a broader customer base. E-commerce platforms allow for easier comparison of product features, prices, and reviews - which facilitates consumer decision-making while driving market expansion. Online platforms meet consumer preferences for fast and convenient purchases by providing quick digital transactions. As e-commerce continues to expand, it creates opportunities for market penetration and customer engagement that fuel its own growth in the Handheld Electric Nutrunners Market.

Restraining Factors

Maintenance and Calibration Costs (in USD)

One of the key restraints on Handheld Electric Nutrunners Market growth is maintenance and calibration expenses associated with these tools. Handheld electric nutrunners boast advanced features and precision but require regular servicing and calibration to function at their peak performance. However, this task may be expensive and time-consuming for businesses with extensive tool inventories. Maintaining operations efficiently can be hindered by costly service personnel requirements and potential downtime during maintenance activities, leading to lower operational efficiency and increasing overall costs. Small companies or those with tight budgets may find these expenses discouraging, restricting their ability to invest and adopt electric nutrunners. Although these tools provide high performance, their high costs could impede market expansion - particularly within price-sensitive segments.

Market Competition from Manual Tools

Manual tools pose another threat to the Handheld Electric Nutrunners Market's expansion. Manual tools, like wrenches and screwdrivers, may often seem more cost-effective compared to their electric counterparts. Manual tools require no external power source, further decreasing operational dependencies. They're still widely utilized across various industries due to their simplicity, lower initial costs, and ease of maintenance - these factors account for their enduring popularity. Electric nutrunners provide many advanced features, but their competitive edge may be diminished by their entrenchment in manual tools. Electric nutrunners tend to cost more initially and this may discourage businesses from switching over, thus slowing the overall market adoption rate.

Limited Awareness and Education Available

Limited education regarding the benefits and capabilities of handheld electric nutrunners further restrains market expansion. Electric nutrunners offer many potential users’ distinct advantages over manual tools, including enhanced precision, reduced labor costs, and increased efficiency. Unfortunately, due to a lack of knowledge of many potential users, they underutilize this technology and hesitate to invest in advanced tools. Additionally, insufficient training on the use and benefits of these tools can prevent businesses from fully realizing their potential. To address this, efforts must be made to educate potential customers as well as offering comprehensive training programs; raising awareness of electric nutrunners' long-term value may help overcome resistance and boost market expansion.

Research Scope Analysis

By Type

Pistol Type Nutrunners held an estimated market share of 45% in 2023 for handheld electric nutrunners, thanks to their ergonomic designs that allow easy use and maneuverability in various applications. Pistol-type nutrunners were particularly favored during assembly lines or repair tasks where quick fastening times are essential, providing comfortable gripping capabilities with precise control for high torque applications and low torque applications; further cementing their leading market position.

Angle Nutrunners held around 30% market share. Angle nutrunners are known for their ability to access tight or hard-to-reach spaces where traditional tools don't fit, with their compact design and flexible head angle providing increased access and control in tight environments. Their use is proliferating across automotive and aerospace industries where precision and accessibility are vital. Furthermore, the adaptability of angle nutrunners to various working conditions contributes significantly to their market appeal resulting in substantial market shares for this segment.

Straight Type Nutrunners were estimated to hold approximately 25% of market share in 2023. Straight nutrunners are known for their straightforward designs that boast high torque output and robustness; often used in industrial settings where durability and consistent performance are of vital importance. Though not as versatile as pistol or angle types, straight nutrunners remain key components for applications requiring direct and powerful fastening capabilities at high torque levels; their reliable performance keeps their presence solid within the market.

By Application

In 2023, the automotive segment held the leading market position in the Handheld Electric Nutrunners Market with roughly 50% market share. This dominance can be attributed to their extensive use in assembly lines and repair shops as a tool for assembly maintenance repair tasks as well as high demands for precision and efficiency in automotive manufacturing/service operations that make these tools indispensable. Their capacity to consistently deliver torque while accommodating various fastening applications makes these tools invaluable tools within these environments.

Transportation held approximately 25% market share. Handheld electric nutrunners are an increasingly important tool in the transportation sector for assembling and maintaining various vehicle components - trains, trucks, and ships alike. Due to its focus on operational reliability and safety, tools offering precise fastening solutions such as handheld electric nutrunners have become an indispensable element of fastening solutions within this sector. As transportation continues its rapid evolution and grows further into new territory, demand for advanced fastening solutions capable of handling heavy-duty applications is growing at an impressive rate - especially as regards reliable performance remains at an all-time high level.

Machinery Manufacturing represented approximately 15% of the market in 2023. Within this sector, handheld electric nutrunners were utilized for assembly and maintenance of complex machinery and equipment, providing high torque precision that ensured integrity and functionality of machine components. As manufacturing processes become more advanced, demand for reliable fastening tools that met stringent industrial standards increased significantly.

The others category, comprising sectors such as electronics and home appliances, represented approximately 10% of market share in 2014. Though smaller in comparison, this sector represents a diverse set of applications where handheld electric nutrunners were utilized to complete assembly or repair tasks across a variety of industries - contributing significantly to their market presence overall.

The Handheld Electric Nutrunners Market Report is segmented based on the following:

By Type

- Pistol Type

- Angle Type

- Straight Type

By Application

- Automotive

- Transportation

- Machinery Manufacturing

- Others

Regional Analysis

North America held approximately 35% of the Global Handheld Electric Nutrunners Market in 2023, accounting for nearly 35% of sales. The region's success can be attributed to its advanced manufacturing infrastructure, high adoption rates of automation technologies, and a strong focus on innovation within industrial sectors - particularly automotive, aerospace, and machinery manufacturing industries in both nations. Furthermore, many leading manufacturers operating here and their increasing focus on precision tools have only enhanced this dominance further.

Europe represented approximately 30% of the global handheld electric nutrunner market, driven by its established automotive and machinery manufacturing sectors in countries such as Germany, the UK, and France. Europe's stringent regulatory standards for manufacturing safety support the widespread adoption of advanced fastening tools - further increased by an increased emphasis on sustainable and energy-saving technologies across European industries that increase the demand for handheld nutrunners.

Asia Pacific emerged as a rapidly expanding region in the handheld electric nutrunners market, accounting for an approximate 25% market share. This growth can be attributed to China, Japan, and India's thriving manufacturing sectors as well as expansion in automotive production, infrastructure development, rising industrial activities, and increasing demands for reliable fastening tools - Asia Pacific offers ample opportunity for market expansion due to its diverse industrial base and competitive manufacturing costs.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

C-Level Executives were critical in shaping the strategic direction and growth of the global Handheld Electric Nutrunners Market in 2023. Under their guidance, innovation has been fostered, product portfolios improved, market complexities navigated successfully to secure competitive advantages, investing in cutting-edge technologies to penetrate emerging markets to maintain industry leadership, as well as sustained market expansion.

Marketing Managers, Brand Managers, and Product Managers have played a critical role in shaping market dynamics through their strategic efforts in brand positioning and product development. Leveraging market research techniques as well as customer engagement techniques, these professionals’ ensured products stayed aligned with consumer preferences as well as regulatory standards; creating targeted marketing strategies while enhancing product features has allowed businesses to meet evolving consumer preferences while remaining cost-competitive for market adoption and expansion.

Sales managers, sales officers, regional sales managers, and country managers have long been considered key forces behind revenue growth and market expansion. Optimizing sales strategies, creating strong client relationships, and exploring new market opportunities have all played an integral part in increasing market share and expanding into various regional markets. Procurement Managers, Production Managers, Technical Personnel, and Distributors have also contributed significantly to this growth by ensuring efficient supply chains, maintaining high production standards, and offering widespread product availability. In tandem, these key players have played an essential role in driving forward the global Handheld Electric Nutrunners Market by meeting industry demands while continuing innovation and expansion.

Some of the prominent players in the Global Handheld Electric Nutrunners Market are:

- C-Level Executives

- Marketing Manager, Brand Manager, Product Manager

- Sales Manager, Sales Officer, Regional Sales Manager, Country Manager

- Procurement Manager

- Production Manager

- Technical Personnel

- Distributors

Recent developments

- In 2024, August: The market introduced advanced digital torque control systems, enhancing precision and consistency in fastening applications.

- In 2024, March: Sustainable practices have gained traction with the integration of energy-efficient battery technologies, reducing overall energy consumption.

- In 2023, November: E-commerce platforms have significantly expanded market access, facilitating broader consumer reach and driving adoption.

- In 2023, July: New ergonomic designs have been developed to minimize operator fatigue and improve comfort, addressing growing safety and ergonomics concerns.

- In 2022, October: The automotive and aerospace industries have increasingly adopted specialized electric nutrunners, reflecting a push towards higher automation and quality standards.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 262.7 million |

| Forecast Value (2032) |

USD 433.1 million |

| CAGR (2023-2032) |

5.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Pistol Type, Angle Type, Straight Type), By Application (Automotive, Transportation, Machinery Manufacturing, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

C-Level Executives, (Marketing Manager, Brand Manager, Product Manager), (Sales Manager, Sales Officer, Regional Sales Manager, Country Manager), Procurement Manager,Production Manager, Technical Personnel, Distributors |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |