The Handheld Nutrunner Market refers to portable tools engineered for precise tightening and loosening of nuts and bolts. These portable tools, often powered by electric or pneumatic systems, play an essential role in improving operational efficiency and accuracy across manufacturing, automotive, aerospace, and construction industries. As more automation and quality control measures are implemented globally the Handheld Nutrunner Market has experienced explosive growth due to technological innovations including torque control improvements as well as ergonomic designs; understanding this market is therefore imperative when making strategic decisions regarding product development, market positioning, or competitive advantage.

The Handheld Nutrunner Market has seen remarkable expansion, driven by advancements in manufacturing processes and an increasing focus on automation. McKinsey analysts identify several critical drivers behind its rapid expansion; rising precision, efficiency, and safety requirements across industries like automotive, aerospace, and construction are driving the adoption of sophisticated handheld nutrunners that increase operational performance while improving quality control - these tools have become an essential element in meeting rigorous standards and optimizing production workflows.

Technological innovation is a cornerstone of market growth. Innovations such as digital torque control, wireless connectivity, and integrated sensor technologies have greatly expanded the capabilities and appeal of handheld nutrunners in recent years. As manufacturers shift toward more automated production environments, such advanced tools play an integral role in attaining higher levels of accuracy and productivity.

Additionally, the market is witnessing an increasing shift towards portable and battery-powered models due to an increased need for adaptability in various work settings. Focused efforts at reducing downtime and increasing productivity have contributed to the widespread adoption of these advanced solutions.

Key Takeaways

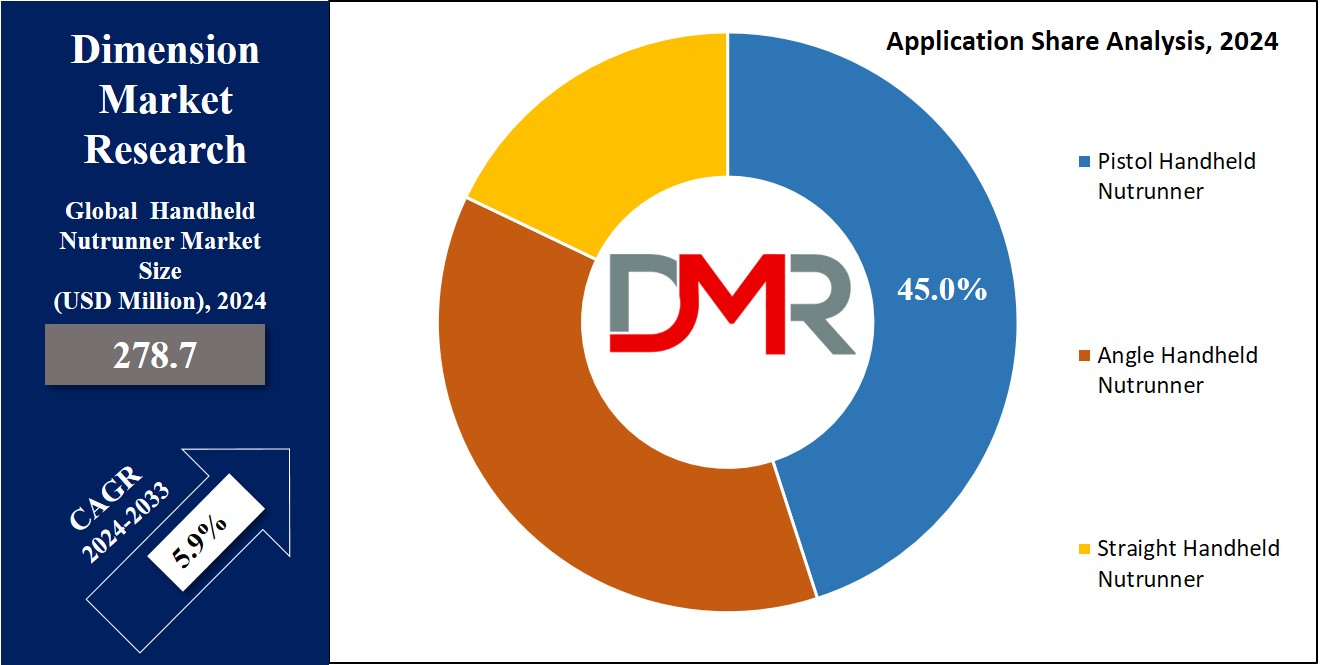

- Market Growth Forecast: The world market for Handheld Nutrunner is estimated to increase from USD 278.7 million in 2024 to USD 467.7 million by the end of 2033, with a noteworthy CAGR of 5.9%.

- Primary Product Type: During 2023, the market share captured by Pistol Handheld Nutrunners was 45%, owing to their ergonomics and high precision which drive the demand from automotive and electronics industries for final assembly.

- Leading Application Sector: The automotive sector is the most important application sector, holding a share of around 50% because hand-held nutrunners are widely used for high-productivity assembly lines and in-process quality control inspections.

- Regional Dominance: The leader in North America, with a share of 35% in the global market for these reasons: highly developed manufacturing infrastructures and extensive use of automation technologies in end-user industries such as automotive, aerospace, and general engineering.

- Key Technological Trends: The market is witnessing significant advancements in digital torque control, wireless connectivity, and integrated sensor technologies, enhancing the capabilities of handheld nutrunners

Use Cases

- Automotive Manufacturing: To enable a precise fitting within automotive assembly lines, hand-held nutrunners guarantee high-quality fastening and the proper functioning of operations to the most demanding of industry criteria.

- Aerospace: Essential in putting together intricate aerospace parts, these tools guarantee the right torque control and reliability— in a context where safety and performance are critical.

- Electric Vehicle Production: With an increase in EV production, hand-held nutrunners play a critical role in ensuring proper torque specifications with manufacturing precision as well as quality standards to staunchly back this growing field.

- Construction and Machinery: Used for heavy-duty assembly tasks, handheld nutrunners improve efficiency and reliability in construction and machinery production furthering automation.

- Consumer Electronics: Ideal for assembling intricate electronic devices, these tools offer precision and ergonomic features to ensure high-quality production and reduce assembly errors.

Driving Factors

As components and assemblies become more sophisticated

Handheld Nutrunner Market growth has been propelled by an ever-increasing array of complex components and assemblies. As industries such as automotive, aerospace, and electronics grow more complex, the precision required for fastening components has only grown more important. Modern assemblies often involve intricate designs with tight tolerances that necessitate sophisticated tools capable of consistently and accurately applying torque. Handheld nutrunners equipped with digital torque controls and high-precision sensors are essential tools for meeting these demands. Demand for advanced tools is underscored by rising consumer demands for high-quality, reliable products, prompting manufacturers to adopt handheld nutrunners capable of managing complex fastening tasks effectively. Market reports reveal an unprecedented surge in precision tool demand as manufacturers work toward meeting increasingly stringent assembly standards.

Cost-Effective and Improved Quality Solutions

Handheld nutrunners have quickly become a go-to solution due to their cost-efficiency and quality improvement capabilities. They offer numerous advantages over manual methods, such as lower labor costs, fewer errors, and increased productivity. Handheld nutrunners provide precise torque control, helping ensure product quality and durability while minimizing costly rework or defects. Furthermore, by streamlining fastening processes these tools contribute to lower production costs overall. According to industry analyses, manufacturers who adopt advanced handheld nutrunners report improvements in operational efficiency and product quality - driving market growth as companies seek to optimize production lines while maintaining competitive advantage.

Automation Trend in Manufacturing Processes

Automation in manufacturing processes has been one of the primary factors driving growth of the handheld nutrunner market. As more manufacturing facilities incorporate automated systems, there is a rising need for advanced tools that seamlessly fit into these environments. Handheld nutrunners provide accurate torque levels that complement automated processes by guaranteeing each fastening operation meets specific standards. With smart manufacturing and Industry 4.0 initiatives becoming more prevalent, manufacturers are seeking tools that not only boost automation but also enhance overall process efficiency. Statistics reveal that sectors investing in automation are also increasing spending on high-tech fastening solutions, illustrating their interdependency and underscoring the essential role handheld nutrunners play in modern manufacturing ecosystems.

Growth Opportunities

Develop Smart Handheld Nutrunters

2023 is set to bring transformational opportunities for the global Handheld Nutrunner Market as new smart handheld nutrunners are introduced onto the market. Integration of advanced technologies such as IoT connectivity, digital torque control, and real-time data analytics is becoming ever more critical. These smart tools enhance precision, offer predictive maintenance capabilities, and facilitate seamless integration into automated manufacturing systems. This shift towards smarter, data-driven solutions fits with the wider trend of digitization in manufacturing, offering significant gains in operational efficiency and quality. Companies investing in smart nutrunners may lead their markets by satisfying increased demands for technologically advanced and connected tools.

Targeting the Electric Vehicle Manufacturing Industry

As electric vehicle (EV) production increases, so too does the need for precise and reliable fastening solutions. Handheld nutrunners play an essential role in assuring complex components meet strict torque specifications - handheld nutrunners play an instrumental role here! Manufacturers that focus their production efforts on serving this fast-growing sector can tap into a high-growth market that has specific fastening needs; taking this strategic approach allows companies to capitalize on demand growth for EVs while opening up new revenue streams while expanding market presence within an expanding industry.

Training and Support Services Provided for Successful Operations

As handheld nutrunners become more advanced, providing end users with effective training is increasingly critical to maximizing the full capabilities of their equipment. Furthermore, support services that include maintenance, troubleshooting, and operational guidance can greatly enhance customer satisfaction and tool performance - not to mention long-term customer relationships and brand loyalty that distinguish companies in an otherwise competitive market. By investing in these services, companies not only improve user experience but can also build long-term customer relationships while adding value to product offerings and differentiating themselves from the competition.

Key Trends

Trend toward Integrated Solutions

2023 will see an increasingly prominent trend within the global Handheld Nutrunner Market: integration solutions. This trend echoes a wider shift within manufacturing towards cohesive systems that combine several functionalities into a single tool, rather than having separate solutions designed specifically to cover one function at once. Modern handheld nutrunners are increasingly being designed to work seamlessly with other manufacturing technologies, including automated assembly lines and real-time quality monitoring systems. Integration not only enhances operational efficiency but also provides users with a single platform for fastening tasks. As industries seek more seamless solutions, demand for these integrated tools should continue to rise driving market expansion and innovation.

Advancements in Torque Monitoring Capabilities

Advanced torque control and data monitoring features represent a notable trend reshaping the handheld nutrunner market. Newer models feature sophisticated torque management mechanisms as well as data analytics features for consistent, precise performance. Real-time monitoring and feedback allow operators to ensure fastening processes meet exact specifications, thus minimizing errors and improving product quality. These advances reflect an industry trend towards precision and data-driven decision-making, improving manufacturing operations. As these technologies advance further they could potentially fuel substantial market expansion by drawing users seeking high-performance fastening solutions that deliver reliable performance.

Ergonomics and Worker Safety Gain Priority

Another significant trend in handheld nutrunner design is an increasing emphasis on ergonomics and worker safety. As manufacturing environments become more demanding, attention has turned toward developing tools that prioritize user comfort while mitigating injury risk. Ergonomic designs that reduce strain and fatigue combined with safety features such as torque overload protection and non-slip grips have become standard practices - this trend being driven both by regulatory requirements as well as commitments made towards employee wellbeing; by meeting such needs manufacturers can not only comply with safety standards more easily but also enhance productivity, job satisfaction levels while creating more positive work environments overall.

Restraining Factors

Maintenance and Calibration Costs

One of the primary impediments to growth for the Handheld Nutrunner Market is the high costs associated with maintenance and calibration. Handheld nutrunners with advanced torque control and data monitoring features require regular upkeep to operate optimally, including periodic calibration to maintain precision and avoid errors. Cost can be a substantial barrier for manufacturers, particularly smaller or budget-constrained operations. Maintenance expenses may discourage firms from investing in advanced tools if their return on investment remains unclear, hindering market expansion by deterring the adoption of cost-sensitive technologies and slowing growth in those segments.

Dependency on Specific Industries

Handheld nutrunners are used extensively within certain industries such as automotive, aerospace, and electronics due to their special requirements for precision and efficiency. The fluctuating nature and fluctuating demands of certain industries can directly impact the market for handheld nutrunners. For instance, downturns in automotive production or aerospace contracts could reduce fastening tool demand, creating market instability. Such dependencies increase vulnerability as their performance and growth rely heavily on certain key sectors; such reliance could limit overall expansion potential as well as make the overall market susceptible to sector-specific economic shifts.

Technological Complexity

Technological complexity also presents a barrier to market growth. Advanced handheld nutrunners equipped with features like digital torque control and data analytics require high levels of technical expertise both for use and maintenance purposes. Complexity can impede entry for companies that lack the required technical resources and skills. Furthermore, technology progress is constantly accelerating meaning companies must invest in training and updates to keep pace with any developments that arise. Complex systems can be complex and resource-intensive, which may discourage widespread adoption by smaller firms or those without enough technical know-how. Their complexity restricts market expansion by favoring users with advanced technological knowledge and more financial capability.

Research Scope Analysis

By Type

Pistol Nutrunner was the undisputed market leader in 2023 for the Product Type segment of the Handheld Nutrunner Market with an approximate share of approximately 45%. This dominance can be attributed to its ergonomic design and ease of use which made it especially suitable for tasks requiring high precision and control, providing comfortable gripping features to reduce operator fatigue thereby leading to widespread adoption across different industries including automotive and electronics industries.

Following closely, Angle Handheld Nutrunners made up approximately 30% of the market share. Their unique design enables easy maneuverability in tight spaces - ideal for applications involving complex or constrained assembly environments. This segment benefits from increased demand for tools capable of accommodating intricate assembly tasks while increasing accessibility during challenging work conditions.

Straight Handheld Nutrunners hold approximately 25% market share but remain an integral component. Their simple and reliable linear fastening applications make them a staple tool across various industrial environments.

By Application

The automotive sector held a commanding market position within the End-Use segment of the Handheld Nutrunner Market with approximately 50% market share in 2023, This trend can be explained by their extensive use of handheld nutrunners for precise assembly and quality control; as well as high-performance standards and efficient production processes that emphasize their vital role in reliable fastening on vehicle assembly lines.

Transportation industry applications including rail, aerospace, and marine applications made up roughly 25% of the market share in 2016. Handheld nutrunners played a pivotal role in meeting its demanding assembly requirements and stringent safety standards, as they provide fastening solutions that could withstand high-stress environments with differing environmental conditions. The sector relied heavily on this tool.

Machinery Manufacturing was estimated to represent roughly 20% of the market. Handheld nutrunners are an essential tool in this segment for assembling an array of machinery and equipment. Their usage stems from precision in the assembly of complex machinery components as well as increased focus on automation and efficiency in manufacturing processes.

The Handheld Nutrunner Market Report is segmented based on the following:

By Type

- Pistol Handheld Nutrunner

- Angle Handheld Nutrunner

- Straight Handheld Nutrunner

By Application

- Automotive

- Transportation

- Machinery Manufacturing

Regional Analysis

North America became the dominant region in terms of market share, accounting for 35%. This can be attributed to North America's advanced manufacturing infrastructure, high adoption rates of automation technologies, and strong focus on precision engineering. Furthermore, automotive and aerospace industries in this region drive demand for handheld nutrunners as essential tools for maintaining strict quality standards while simultaneously increasing production efficiencies.

Europe accounted for around 30% of the market.

Europe has an active industrial base and strong technological advances; as well as stringent regulations regarding product quality and safety such as automotive manufacturing. Furthermore, Europe's focus on more sustainable manufacturing practices helped drive its continued development of this market segment.

Asia Pacific held approximately 25% of the global fastener market share in 2017, driven by rapid industrialization and an expansive manufacturing sector. Major investments in infrastructure development in countries like China and India helped the region capture this market share; automotive and electronics manufacturing also played a part. Asia Pacific became a key player in the global fastening tool sales market as their industries expanded further.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023 will see a significant advancement in the global Handheld Nutrunner Market from several key players who are driving innovation and setting industry standards. Atlas Copco continues to dominate this space with their wide variety of high-quality handheld nutrunners known for their durability and precision; thanks to decades of industry experience they're widely utilized across automotive, aerospace, and heavy machinery applications; their focus on technological advancement and reliability ensure their place as industry leaders.

Bosch Rexroth and Apex Tool Group are also key contributors to the market, with Bosch Rexroth's incorporation of smart technologies and automation into their handheld nutrunners highlighting an industry trend toward digitalization and operational efficiencies. Meanwhile, Apex Tool Group boasts a diverse tool portfolio designed for precision and ergonomic comfort to make it the first choice among various industrial applications. Both companies continue to be at the forefront of offering features tailored specifically towards modern manufacturing environments.

STANLEY Engineered Fastening, ESTIC Corporation, and Ingersoll Rand are three brands that help strengthen the market with specialized offerings.

STANLEY Engineered Fastening stands out due to its commitment to innovation and high-performance tools that support its position within the automotive and aerospace industries. ESTIC Corporation and Ingersoll Rand both contribute with advanced torque control technologies that ensure high precision and dependability under demanding conditions. ALFING Montagetechnik GmbH, Dai-ichi Dentsu Ltd, Sanyo Machine Works, and Maschinenfabrik Wagner play key roles by offering solutions tailored to specific industrial needs. Together, these key players fuel market growth through continuous innovations that meet global manufacturing industry requirements.

Some of the prominent players in the Global Handheld Nutrunner Market are:

- Atlas Copco

- Bosch Rexroth

- Apex Tool Group

- STANLEY Engineered Fastening

- ESTIC Corporation

- Ingersoll Rand

- ALFING Montagetechnik GmbH

- Dai-ichi Dentsu Ltd

- Sanyo Machine Works

- Maschinenfabrik Wagner

Recent developments

- In 2024 the market has seen a significant increase in demand for battery-powered models, driven by advancements in battery technology that enhance portability and operational efficiency.

- In 2023, November Smart handheld nutrunners with IoT connectivity and real-time data analytics were introduced, providing improved precision and predictive maintenance features.

- In 2023, July New ergonomic designs have been launched, featuring improved grip and reduced weight to enhance operator comfort and safety in demanding work environments.

- In 2023, March Advancements in torque monitoring capabilities have been implemented, with new models offering sophisticated data analytics for greater accuracy and consistency in fastening processes.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 278.7 million |

| Forecast Value (2032) |

USD 467.7 million |

| CAGR (2023-2032) |

5.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Pistol Handheld Nutrunner, Angle Handheld Nutrunner, Straight Handheld Nutrunner), By Application (Automotive, Transportation, Machinery Manufacturing) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Atlas Copco, Bosch Rexroth, Apex Tool Group, STANLEY Engineered Fastening, ESTIC Corporation, Ingersoll Rand, ALFING Montagetechnik GmbH, Dai-ichi Dentsu Ltd, Sanyo Machine Works, Maschinenfabrik Wagner |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |