Market Overview

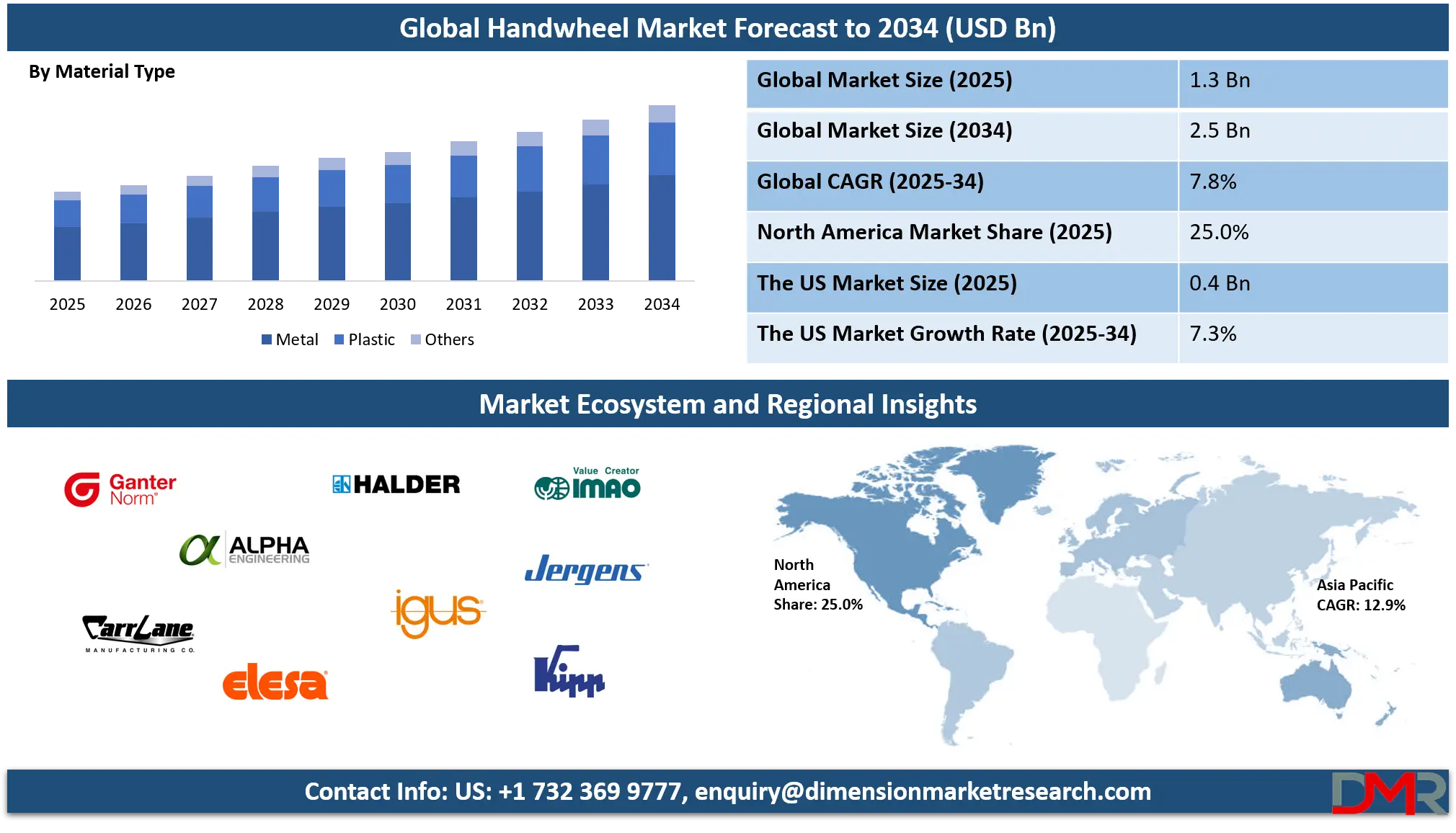

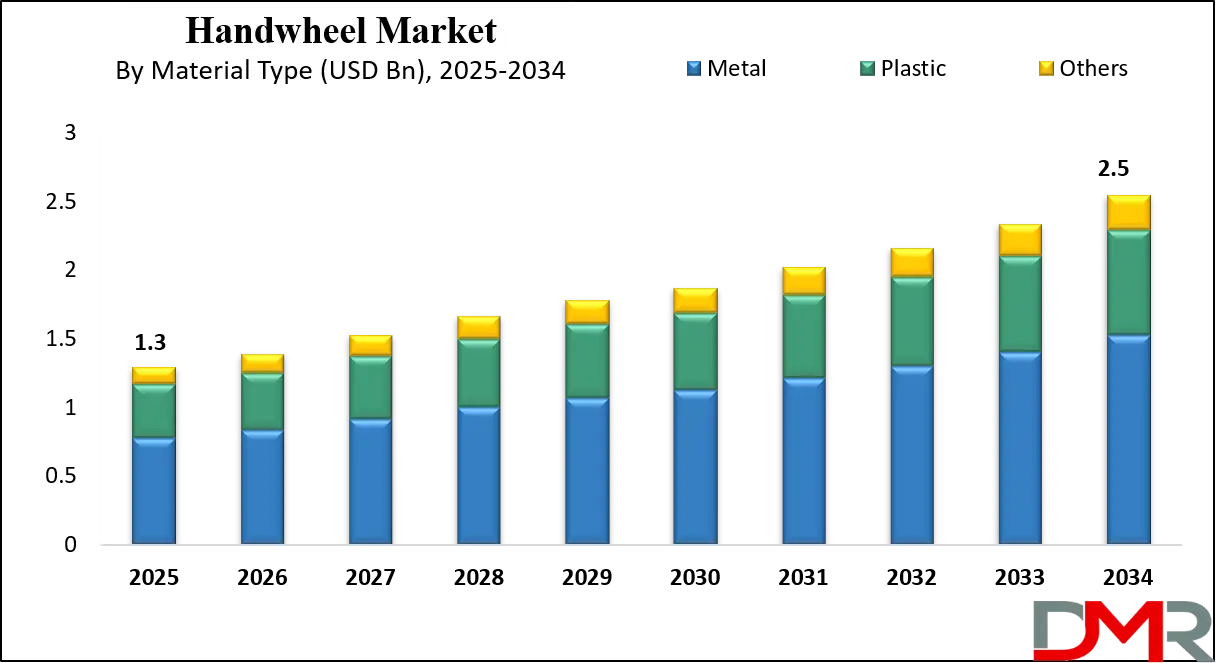

The global handwheel market is projected to grow from USD 1.3 billion in 2025 to USD 2.5 billion by 2034, expanding at a CAGR of 7.8%. Rising demand for industrial machinery components, valve control systems, and precision equipment across manufacturing, automotive, oil and gas, and construction sectors is driving market growth, with increased adoption of ergonomic and durable handwheels supporting operational efficiency and reliability globally.

A handwheel is a mechanical component designed to manually control the movement or operation of machinery and equipment. It typically consists of a circular wheel attached to a shaft, allowing an operator to rotate it with precision and ease. Handwheels are commonly used in various industrial applications including valve operation, machine tools, and automated systems, providing reliable and accurate adjustments. They are available in different designs such as spoked, flat, and offset types, and can be constructed from materials like metal, plastic, or composite alloys to suit specific durability, strength, and corrosion resistance requirements. Their ergonomic design ensures safe handling and improved operational efficiency, making them an essential tool for industries requiring precise mechanical control.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global handwheel market encompasses the manufacturing, distribution, and application of these components across a variety of industrial sectors. It includes end-use industries such as automotive, oil and gas, food and beverage, construction, and general manufacturing, where handwheels are critical for controlling valves, machinery, and equipment adjustments. Market growth is driven by growing industrial automation, demand for precision mechanical operations, and the need for reliable components in critical industrial processes. Technological advancements in materials and ergonomic design are further enhancing the adoption of handwheels in both traditional and modern manufacturing setups, supporting improved productivity and operational safety.

The market is characterized by a competitive landscape featuring established manufacturers and emerging players focusing on innovation, quality, and customization of products. Regional developments, especially in Asia-Pacific, North America, and Europe, are shaping market trends, with Asia-Pacific leading due to extensive industrial growth and manufacturing capabilities. The rising demand for efficient mechanical solutions in industrial applications combined with expanding infrastructure projects globally is expected to sustain market growth. As industries continue to modernize and implement precision equipment, the global handwheel market is poised to experience steady expansion driven by both functional necessity and technological improvements in industrial machinery components.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Handwheel Market

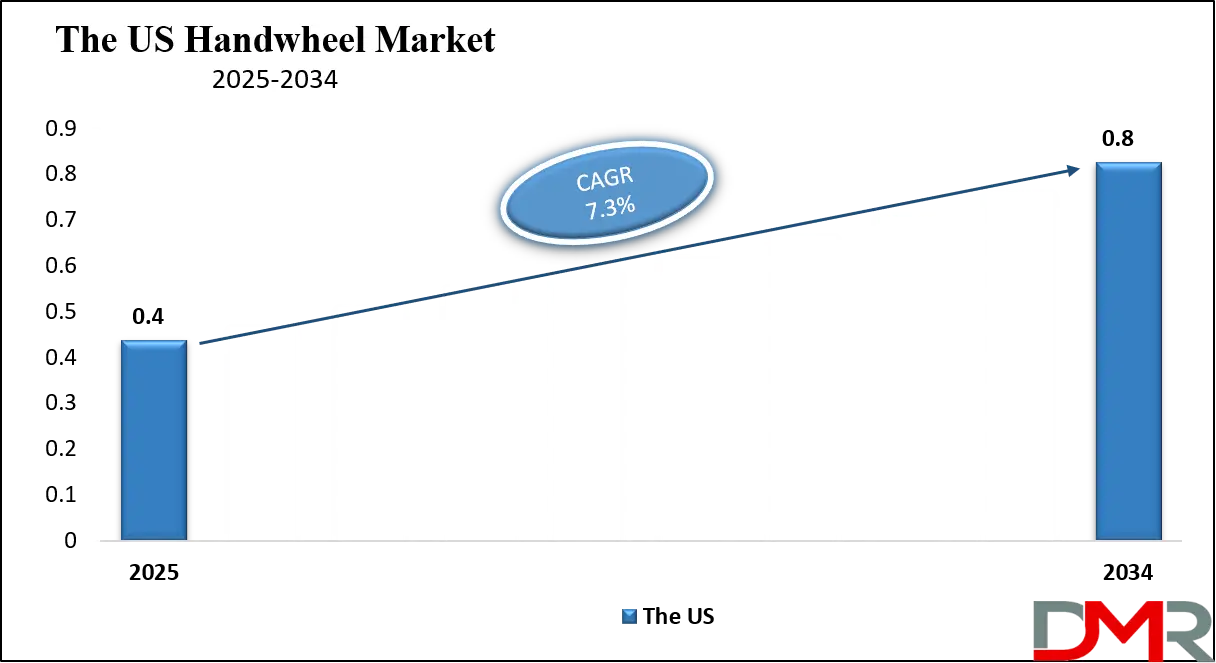

The U.S. Handwheel market size is projected to be valued at USD 400 million by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 800 million in 2034 at a CAGR of 7.3%.

The United States handwheel market is a significant segment of the North American industrial components landscape, driven by the country’s advanced manufacturing, automotive, and oil and gas sectors. In the US, handwheels are extensively used in machine tools, valve operations, industrial automation systems, and precision equipment, where reliable and ergonomic components are essential for operational efficiency.

The market benefits from the presence of established manufacturers offering spoked, flat, and offset handwheels made from durable materials such as metals and engineering plastics. Rising industrial automation and modernization of production facilities have further increased the demand for high-quality handwheels, with a focus on safety, precision control, and resistance to wear and corrosion in critical industrial processes.

Additionally, the US market is influenced by technological innovations and stringent quality standards that emphasize ergonomic design and material performance in handwheel production. Growth in sectors such as aerospace, food and beverage processing, and construction equipment is contributing to increased adoption of advanced handwheel solutions capable of handling high loads and frequent usage.

Key market drivers include the need for precise mechanical adjustments, efficiency in valve and machinery operations, and maintenance reduction in industrial equipment. Regional manufacturing hubs in the Midwest and Southeast are witnessing increased demand, with domestic and international suppliers competing to provide customized solutions that meet the evolving requirements of automated production and modern industrial operations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Handwheel Market

The European handwheel market is projected to reach approximately USD 370 million in 2025, reflecting its significant contribution to the global market. This strong position is primarily driven by the region’s well-established industrial base, including advanced manufacturing, automotive, aerospace, and machinery sectors. Handwheels are widely utilized in these industries for precise mechanical control, valve operation, and adjustments in industrial equipment. The preference for durable metal handwheels, ergonomic designs, and high-quality components supports consistent demand across Europe.

Additionally, manufacturers in the region focus on product innovation and customization, catering to the specific operational requirements of various industrial applications, which further strengthens the market share.

The market in Europe is expected to grow at a compound annual growth rate of 4.7% during the forecast period. This moderate growth is supported by ongoing investments in automation, industrial modernization, and infrastructure development. Companies are increasingly adopting advanced handwheel solutions integrated with smart machinery and automated systems, enhancing operational efficiency and safety.

Moreover, stringent quality standards and the emphasis on energy-efficient and reliable industrial components are driving demand for high-performance handwheels. As industries in Germany, France, Italy, and other European nations continue to expand and modernize, the handwheel market is poised for steady growth, maintaining its prominent position in the global landscape.

Japan Handwheel Market

The Japanese handwheel market is projected to reach approximately USD 160 million in 2025, reflecting a significant share of the global market. This strong position is driven by Japan’s advanced manufacturing and industrial sectors, including automotive, electronics, aerospace, and precision machinery. Handwheels are widely used in these industries for accurate mechanical adjustments, valve operations, and control of industrial equipment. The demand for high-quality, durable, and ergonomically designed handwheels supports consistent adoption across various applications. Japanese manufacturers emphasize innovation and precision engineering, offering products that meet the rigorous standards required for high-performance industrial operations.

The market in Japan is expected to grow at a compound annual growth rate of 6.4% during the forecast period. This growth is fueled by growing investments in industrial automation, smart manufacturing systems, and modernized production facilities. The rising adoption of IoT-enabled machinery and precision equipment further enhances the need for reliable handwheel components.

Additionally, the focus on operational efficiency, safety, and maintenance reduction in industrial processes is driving demand for durable and technologically advanced handwheels. With the rapid integration of industrial robotics, these components are increasingly being designed to interface seamlessly with automated systems, enhancing precision, control, and productivity in manufacturing environments. As industries continue to innovate and expand, Japan’s handwheel market is poised for robust growth, strengthening its position in the global industrial components landscape

Global Handwheel Market: Key Takeaways

- Market Value: The global Handwheel market size is expected to reach a value of USD 2.5 billion by 2034 from a base value of USD 1.3 billion in 2025 at a CAGR of 7.8%.

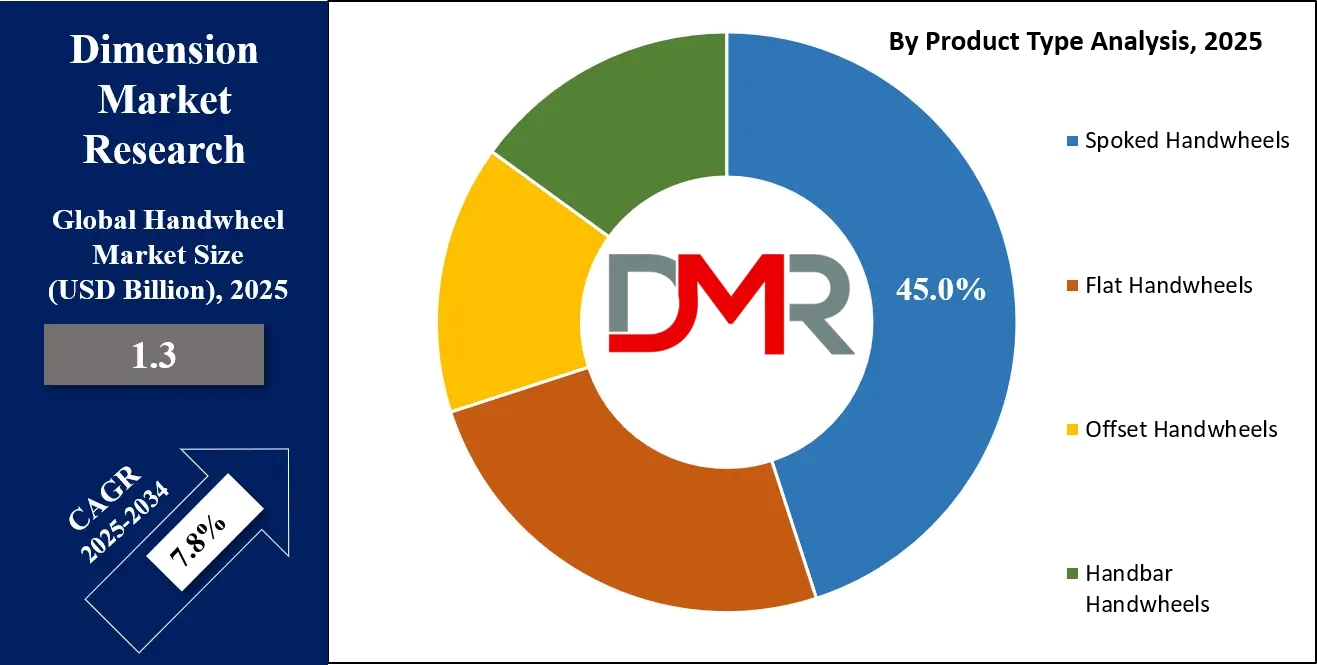

- By Product Type Analysis: Spoked Handwheels are anticipated to dominate the product type segment, capturing 45.0% of the total market share in 2025.

- By Material Type Segment Analysis: Metals are expected to maintain their dominance in the material type segment, capturing 60.0% of the total market share in 2025.

- By Grip Type Segment Analysis: Fixed Grip will dominate the grip type segment, capturing 70.0% of the market share in 2025.

- By End-Use Industry Segment Analysis: Manufacturing will account for the maximum share in the end-use industry segment, capturing 40.0% of the total market value.

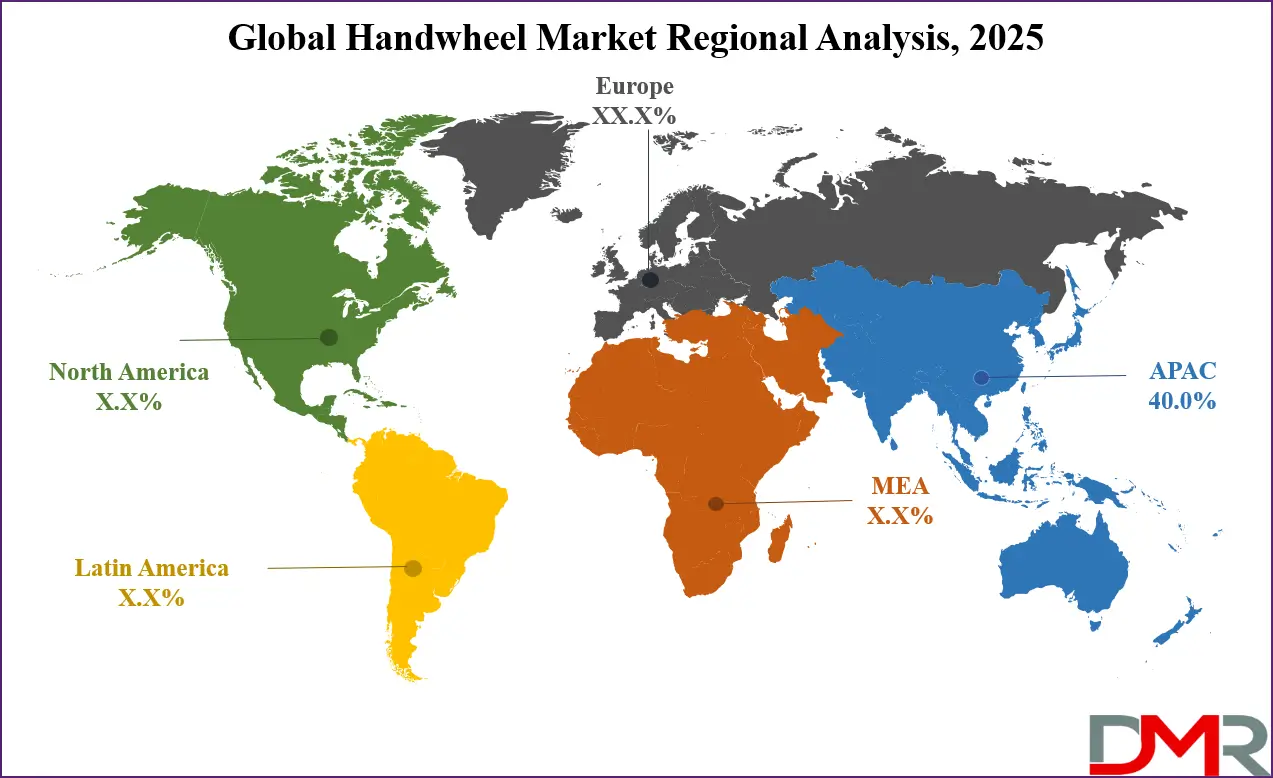

- Regional Analysis: Asia Pacific is anticipated to lead the global Handwheel market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Handwheel market include Otto Ganter GmbH & Co. KG, Alpha Engineering Co., Carr Lane Manufacturing Co., Dandong Foundry, ELESA S.p.A., Erwin Halder KG, igus GmbH, IMAO CORPORATION, Jergens, Inc., HEINRICH KIPP WERK GmbH & Co. KG, MISUMI Corporation, norelem Normelemente GmbH & Co. KG, OneMonroe (Monroe Engineering), Steel-Smith, Trumbull Manufacturing, and Others.

Global Handwheel Market: Use Cases

- Industrial Machinery Control: Handwheels are extensively used in industrial machinery for precise mechanical adjustments and operational control. They enable operators to manually control machine tools, lathes, milling machines, and presses with accuracy. By providing ergonomic handling and smooth rotation, handwheels enhance efficiency in manufacturing processes, reduce operational errors, and ensure consistent output quality. Their application in heavy-duty machinery also supports durability and reliability under high-load conditions, making them an essential component in modern industrial operations.

- Valve and Pipeline Operations: In the oil and gas, chemical, and water treatment industries, handwheels are critical for valve operation and pipeline control. They allow precise opening, closing, and regulation of valves, ensuring safe and efficient flow of liquids and gases. Durable materials like stainless steel and corrosion-resistant alloys enhance their performance in harsh industrial environments. Handwheels improve operational safety, reduce maintenance requirements, and provide consistent control, making them indispensable in fluid management systems.

- Automotive and Aerospace Equipment: Handwheels find applications in automotive manufacturing lines and aerospace assembly for adjusting machinery, fixtures, and specialized tools. Their precision enables accurate alignment, calibration, and positioning of components during production. Lightweight and ergonomic designs are especially valued in aerospace applications, where safety, reliability, and repetitive control are crucial. The adoption of advanced handwheel solutions supports high-quality production, reduces downtime, and improves operational efficiency across these sectors.

- Food and Beverage Processing: Handwheels are widely employed in food and beverage processing machinery for controlling mixers, conveyors, packaging equipment, and filling systems. They allow operators to make precise adjustments for batch consistency, machine speed, and material flow. Hygienic materials like food-grade plastics and stainless steel ensure compliance with industry standards and reduce contamination risks. Handwheels in this sector enhance production reliability, streamline operations, and support safe and efficient processing in large-scale food manufacturing facilities.

Impact of Artificial Intelligence on the global Handwheel market

Artificial Intelligence is increasingly influencing the global handwheel market by enhancing the design, functionality, and integration of these mechanical components into automated systems. AI-powered predictive maintenance and smart monitoring systems allow manufacturers to optimize handwheel performance, reduce operational downtime, and improve precision in industrial machinery and valve control applications.

Additionally, AI-driven design tools enable the development of ergonomically optimized and highly durable handwheels tailored for specific industrial needs, while integration with robotics, swarm robotics, and automated production lines expands their use in advanced manufacturing, automotive, and aerospace sectors. This convergence of AI, swarm robotics, and mechanical components is driving efficiency, reliability, and innovation across the handwheel market globally.

Global Handwheel Market: Market Dynamics

Global Handwheel Market: Driving Factors

Growing Industrial Automation

The rising adoption of industrial automation and smart manufacturing solutions is a major driving factor for the handwheel market. Handwheels are essential components in machine tools, precision equipment, and automated control systems, providing operators with reliable manual overrides and fine adjustments. Industries such as automotive, aerospace, and heavy machinery are increasingly integrating handwheels with automated systems to enhance operational efficiency and accuracy, supporting consistent production quality and reducing human error.

Increasing Demand for Durable and Ergonomic Components

Industries are focusing on operational safety and efficiency, creating a demand for handwheels made from durable metals and corrosion-resistant materials. Ergonomic designs improve operator comfort and reduce fatigue during repetitive tasks in manufacturing, oil and gas, and food processing sectors. This growing emphasis on high-performance components drives market growth as companies seek long-lasting, reliable handwheels that can withstand heavy usage and harsh industrial environments.

Global Handwheel Market: Restraints

High Initial Cost of Premium Handwheels

The cost of high-quality, precision-engineered handwheels can be a restraint for small and medium-scale manufacturers. While these components offer durability and advanced features, the initial investment may limit adoption in cost-sensitive industries. Companies often need to balance performance requirements with budget constraints, which can slow market penetration for premium handwheel products.

Competition from Automated Control Systems

The growing use of fully automated control systems and robotics reduces reliance on manual mechanical components such as handwheels. In highly automated industries, handwheels are sometimes replaced by digital controls or servo-driven mechanisms, which can limit market growth, particularly in advanced manufacturing facilities with minimal manual intervention.

Global Handwheel Market: Opportunities

Expansion in Emerging Industrial Regions

Rapid industrialization in Asia-Pacific, Latin America, and the Middle East presents significant opportunities for handwheel manufacturers. Growing infrastructure projects, automotive assembly plants, and machinery production in these regions drive demand for reliable mechanical components, including spoked, flat, and offset handwheels. Companies can capitalize on this growth by offering region-specific solutions and establishing local distribution networks.

Integration with Smart and IoT-enabled Systems

The rise of smart factories and Industrial Internet of Things applications creates opportunities for intelligent handwheel solutions. Embedding sensors or IoT-compatible designs in handwheels allows real-time monitoring of mechanical adjustments, predictive maintenance, and enhanced operational control. Such innovations can expand adoption in advanced manufacturing, aerospace, and oil and gas sectors seeking efficient and connected equipment.

Global Handwheel Market: Trends

Focus on Lightweight and Corrosion-Resistant Materials

There is a growing trend toward handwheels made from lightweight metals, composites, and high-grade plastics that offer corrosion resistance and long-term durability. These materials not only reduce operational fatigue but also extend the lifespan of machinery in harsh industrial environments. Companies are investing in material innovations to meet the evolving requirements of manufacturing, chemical processing, and food and beverage industries.

Customization and Ergonomic Design

Manufacturers are increasingly offering customized handwheel solutions with ergonomic features to suit specific industrial applications. Tailored designs for size, grip type, and material ensure optimal control, safety, and efficiency. This trend is particularly prominent in sectors requiring precise adjustments such as medical equipment, aerospace, and high-precision machine tools, helping manufacturers differentiate their products and enhance user experience.

Global Handwheel Market: Research Scope and Analysis

By Product Type Analysis

Spoked handwheels are expected to lead the product type segment of the global handwheel market, accounting for approximately 45.0% of the total market share in 2025. Their dominance can be attributed to their robust design and versatility, making them suitable for a wide range of industrial applications such as machine tools, valve operations, and precision equipment. The open spoke structure allows for better grip and ergonomic handling, which reduces operator fatigue during repetitive manual adjustments.

Additionally, spoked handwheels are preferred in heavy-duty machinery where durability, strength, and reliable mechanical control are critical, supporting consistent performance even under high-load conditions.

Flat handwheels, on the other hand, represent another important segment in the market due to their compact and simple design. They are commonly used in applications where space constraints exist or where lighter-duty control is sufficient. Flat handwheels offer ease of operation and can be constructed from both metal and high-grade plastic materials, making them suitable for industries such as food and beverage processing, automotive assembly, and general manufacturing. While their market share is smaller compared to spoked handwheels, flat handwheels are valued for their cost-effectiveness, ergonomic usability, and adaptability across a variety of industrial machinery setups.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Material Type Analysis

Metals are expected to dominate the material type segment of the global handwheel market, capturing around 60.0% of the total market share in 2025. The preference for metal handwheels stems from their superior strength, durability, and resistance to wear, making them suitable for heavy-duty industrial applications such as machine tools, valve operations, and automated equipment. Metals like stainless steel, cast iron, and aluminum provide reliable mechanical performance even under high stress, harsh environmental conditions, or continuous operation. Their robustness ensures long service life, reduces maintenance requirements, and supports precise control in critical industrial processes, which is why metal handwheels remain the preferred choice across sectors like manufacturing, oil and gas, and construction.

Plastic handwheels, while less dominant, are an important part of the market due to their lightweight nature and resistance to corrosion. They are widely used in applications where reduced weight, ease of handling, and cost-effectiveness are key considerations. Industries such as food and beverage, pharmaceuticals, and light machinery benefit from plastic handwheels as they offer ergonomic handling and can be designed to meet hygiene standards or chemical resistance requirements. Although their market share is smaller compared to metals, plastic handwheels provide flexibility in design, lower manufacturing costs, and suitability for environments where metal components may be prone to corrosion or require additional maintenance.

By Grip Type Analysis

Fixed grip handwheels are expected to dominate the grip type segment of the global handwheel market, accounting for approximately 70.0% of the market share in 2025. Their widespread adoption is due to the stable and secure control they provide, which is essential for precision operations in industrial machinery, valve control, and manufacturing equipment. Fixed grip handwheels allow operators to exert consistent force with minimal slippage, ensuring accurate adjustments and enhancing operational safety. Their simple yet robust design makes them suitable for heavy-duty applications across industries such as automotive, oil and gas, construction, and general manufacturing, where reliability and durability are critical for continuous operations.

Revolving grip handwheels, while less dominant, serve a specific niche in the market where rotational flexibility and continuous motion are required. They are often used in applications that demand repetitive turning or fine-tuned adjustments without the need to constantly reposition the operator’s hand constantly. Revolving grip designs are appreciated in sectors such as precision machine tools, laboratory equipment, and automated assembly lines, where controlled rotation and smooth motion improve operational efficiency. Although their market share is smaller compared to fixed grip handwheels, revolving grip variants provide ergonomic benefits and specialized functionality for industries that require high-frequency or continuous manual control.

By End-Use Industry Analysis

The manufacturing sector is expected to account for the largest share in the end-use industry segment of the global handwheel market, capturing around 40.0% of the total market value. This dominance is driven by the extensive use of handwheels in machine tools, presses, and industrial equipment where precise manual adjustments are essential. Manufacturing processes demand reliable and durable components that can withstand continuous operation and high mechanical loads. Handwheels in this sector provide operators with ergonomic control, reduce operational errors, and enhance production efficiency, making them an integral part of both traditional and automated industrial setups.

The automotive industry also represents a significant segment of the handwheel market, though with a smaller share compared to manufacturing. In automotive production, handwheels are used in assembly lines, machinery adjustments, and quality control processes where precise positioning and mechanical control are critical. They facilitate accurate calibration of components and support ergonomic operation for workers, particularly in valve control systems and specialized equipment. While the automotive segment’s market share is lower, the demand for durable, high-quality handwheels continues to grow due to the industry’s focus on efficiency, safety, and precision in vehicle manufacturing.

The Handwheel Market Report is segmented on the basis of the following:

By Product Type

- Spoked Handwheels

- Flat Handwheels

- Offset Handwheels

- Handbar Handwheels

By Material Type

By Grip Type

- Fixed Grip

- Revolving Grip

By End-Use Industry

- Manufacturing

- Automotive

- Oil & Gas

- Food & Beverage

- Construction

- Others

Global Handwheel Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global handwheel market, capturing approximately 40.0% of the total market revenue in 2025. The region’s dominance is driven by rapid industrialization, expanding manufacturing hubs, and growing demand for machinery components across countries such as China, India, and Japan. High adoption of handwheels in sectors like automotive, construction, oil and gas, and food processing supports market growth, while competitive production costs and growing infrastructure development further enhance regional market opportunities.

Additionally, the presence of key domestic and international manufacturers and rising investments in industrial automation contribute to Asia Pacific’s position as the largest and fastest-growing handwheel market globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East and Africa region is witnessing significant growth in the handwheel market, driven by growing investments in oil and gas infrastructure, construction projects, and industrial automation. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are expanding their manufacturing and energy sectors, creating demand for durable and reliable mechanical components like handwheels. The growing adoption of advanced machinery and equipment, integrated with rising industrialization and modernization efforts, is fueling market expansion.

Additionally, government initiatives supporting infrastructure development and technological upgrades in industrial processes are expected to sustain long-term growth in this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Handwheel Market: Competitive Landscape

The global handwheel market is characterized by a competitive landscape comprising established multinational corporations, regional manufacturers, and specialized suppliers. Leading companies such as Otto Ganter GmbH & Co. KG, ELESA S.p.A., Erwin Halder KG, igus GmbH, and J.W. Winco dominate the market, offering a diverse range of handwheel designs, including spoked, flat, and offset types, to cater to various industrial applications.

These industry leaders focus on product innovation, ergonomic design, and material durability to meet the evolving demands of sectors like manufacturing, automotive, aerospace, and energy. Additionally, companies like Carr Lane Manufacturing Co., Dandong Foundry, and Trumbull Manufacturing contribute to the market by providing specialized solutions and customized handwheel components, further enhancing the industry's competitiveness. The presence of both global and regional players fosters a dynamic market environment, driving continuous advancements in handwheel technology and expanding their applications across different industries.

Some of the prominent players in the global Handwheel market are:

- Otto Ganter GmbH & Co. KG

- Alpha Engineering Co.

- Carr Lane Manufacturing Co.

- Dandong Foundry

- ELESA S.p.A.

- Erwin Halder KG

- igus GmbH

- IMAO CORPORATION

- Jergens, Inc.

- HEINRICH KIPP WERK GmbH & Co. KG

- MISUMI Corporation

- norelem Normelemente GmbH & Co. KG

- OneMonroe (Monroe Engineering)

- Steel-Smith

- Trumbull Manufacturing

- GAMM

- J.W. Winco

- Essentra Components

- Vital Parts Ltd.

- WDS Component Parts Ltd.

- Other Key Players

Global Handwheel Market: Recent Developments

- January 2025: Otto Ganter GmbH & Co. KG introduced a new product family, expanding their offerings to include various casters and wheels, complementing their existing handwheel range.

- November 2024: Elesa S.p.A. announced the acquisition of a controlling stake in Tellure Rôta, a move aimed at enhancing their portfolio in industrial castors and wheels.

- October 2024: Elesa S.p.A. announced the completion of their acquisition of FM Partec S.p.A., a move that is expected to optimize synergies and enhance their technical capabilities.

- October 2024: Carr Lane Manufacturing Co. received a contract award, indicating continued investment and growth in their operations.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.3 Bn |

| Forecast Value (2034) |

USD 2.5 Bn |

| CAGR (2025–2034) |

7.8% |

| The US Market Size (2025) |

USD 400 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Spoked Handwheels, Flat Handwheels, Offset Handwheels, Handbar Handwheels), By Material Type (Metal, Plastic, Others), By Grip Type (Fixed Grip, Revolving Grip), and By End-Use Industry (Manufacturing, Automotive, Oil & Gas, Food & Beverage, Construction, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Otto Ganter GmbH & Co. KG, Alpha Engineering Co., Carr Lane Manufacturing Co., Dandong Foundry, ELESA S.p.A., Erwin Halder KG, igus GmbH, IMAO CORPORATION, Jergens, Inc., HEINRICH KIPP WERK GmbH & Co. KG, MISUMI Corporation, norelem Normelemente GmbH & Co. KG, OneMonroe (Monroe Engineering), Steel-Smith, Trumbull Manufacturing, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |