Market Overview

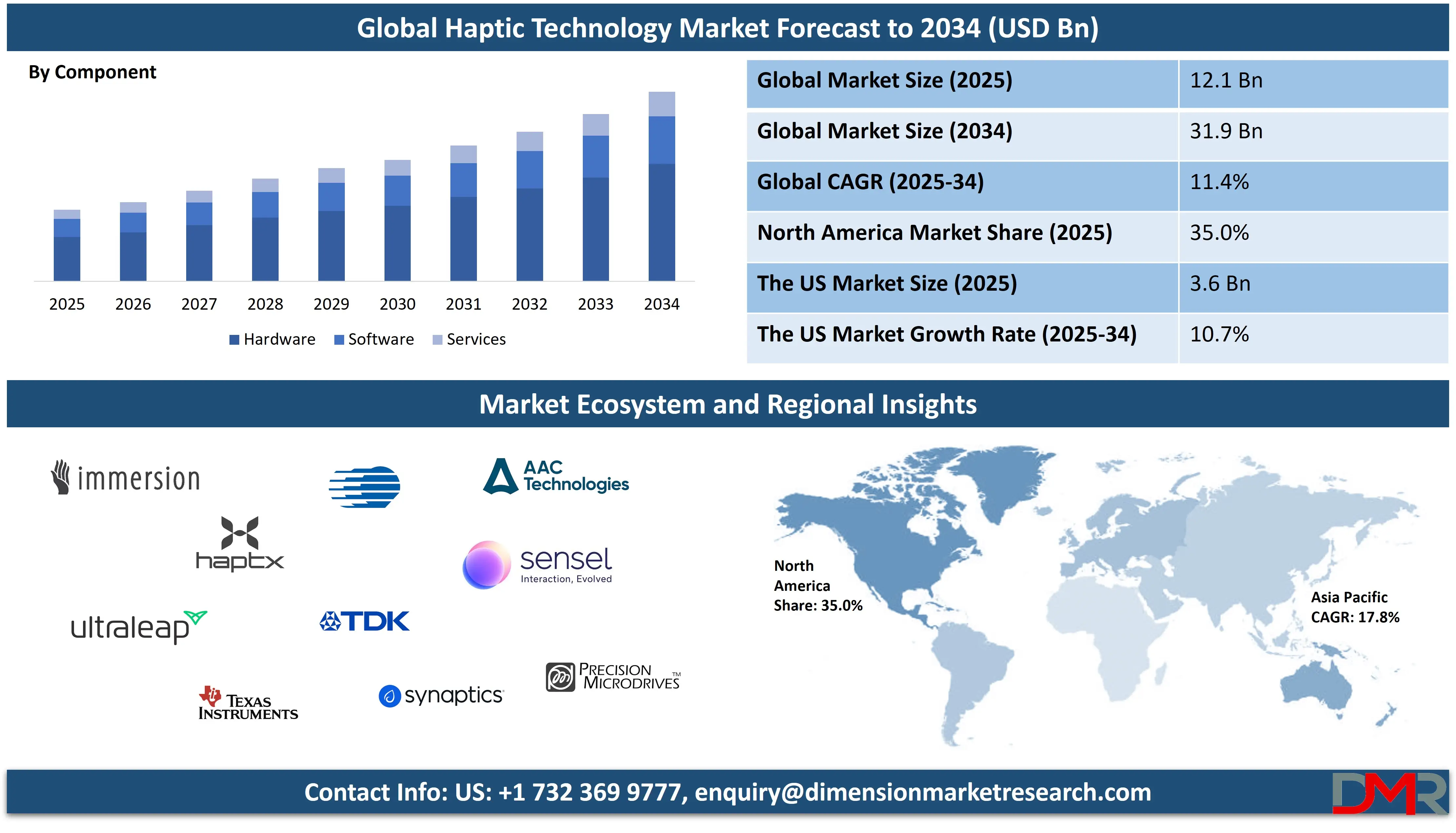

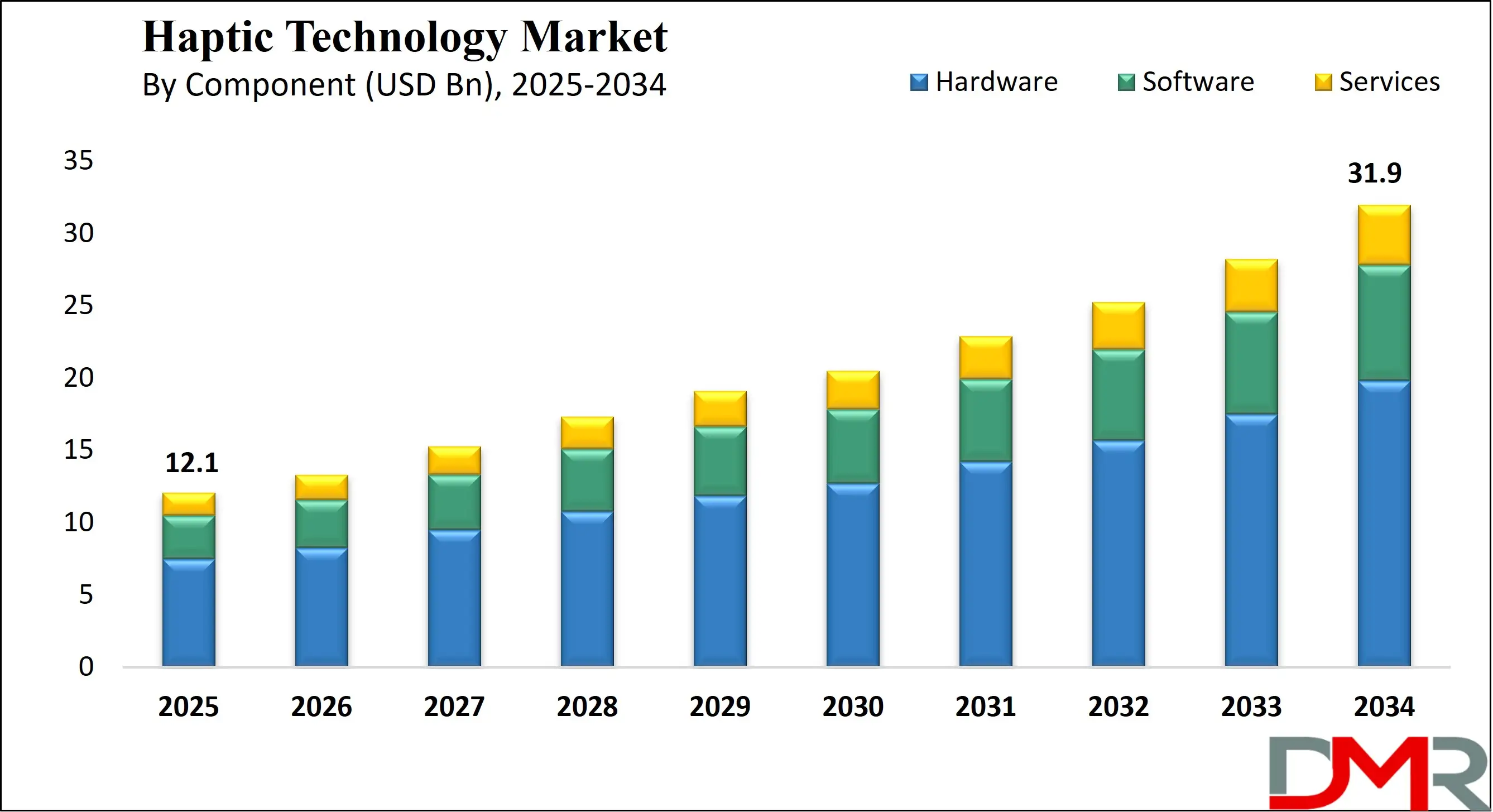

The global haptic technology market is projected to reach USD 12.1 billion in 2025 and is expected to grow to USD 31.9 billion by 2034, reflecting a CAGR of 11.4%. This growth underscores rising adoption of advanced tactile feedback systems, force feedback solutions, and immersive haptic interfaces across consumer electronics, automotive applications, extended reality, medical simulation, and industrial automation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Haptic technology refers to the science and engineering of creating tactile sensations that allow users to physically feel digital interactions through vibration, force, motion, or other touch-based stimuli. It enhances human computer interaction by simulating realistic textures, pressure, resistance, and movement, making digital environments more immersive and intuitive. This technology relies on actuators, sensors, controllers, and software algorithms that translate digital signals into precise touch responses. By enabling a sense of physical presence in virtual and augmented environments, haptic systems improve accuracy, engagement, and emotional connection across applications such as mobile devices, gaming, robotics, automotive interfaces, and medical simulation.

The global haptic technology market represents the worldwide industry that enables touch based digital experiences across consumer electronics, automotive systems, extended reality platforms, and industrial applications. The market is driven by rapid advancements in tactile feedback systems, increasing integration of high fidelity actuators in smartphones and wearables, and the growing use of immersive solutions in virtual reality and augmented reality. Rising demand for intuitive human machine interfaces in vehicles, along with expanding applications in medical training, teleoperation, and robotics, further accelerates commercial adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

As more industries adopt vibrotactile technology, force feedback solutions, and advanced surface haptics, the market continues to evolve toward multisensory user experiences. Companies are increasingly investing in precision micro actuators, AI enhanced haptic engines, and cloud based haptic delivery to improve immersion and reduce latency. The expansion of 3D touch, mid air haptics, and electrotactile interfaces is reshaping interactive design and positioning haptic systems as a core enabler of the next generation of user interfaces.

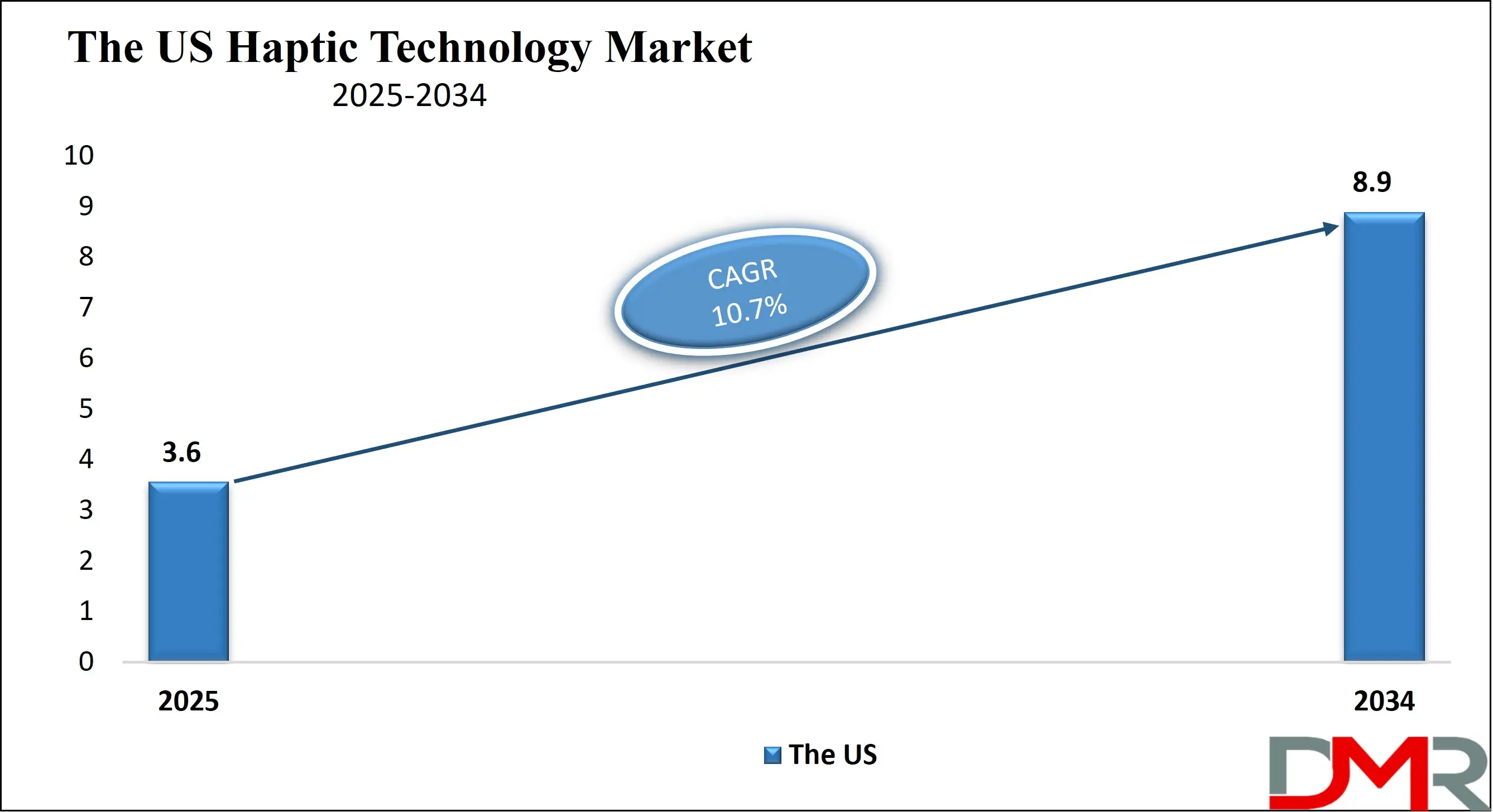

The US Haptic Technology Market

The U.S. Haptic Technology market size is projected to be valued at USD 3.6 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 8.9 billion in 2034 at a CAGR of 10.7%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US haptic technology market is expanding rapidly as demand rises for advanced tactile feedback systems across consumer electronics, automotive interfaces, gaming devices, and extended reality platforms. American manufacturers and tech companies are increasingly integrating high precision actuators, AI driven haptic engines, and vibration control systems into smartphones, wearables, AR and VR headsets, and smart devices to enhance user engagement and interaction accuracy. Growing adoption of immersive digital experiences, coupled with the country’s strong ecosystem of semiconductor developers, sensor innovators, and software vendors, continues to position the United States as a leading hub for innovation in tactile interface technology. Rising investments in surface haptics, electrotactile feedback, and localized texture rendering are further supporting market expansion.

The US market also benefits from growing applications in automotive safety systems, medical simulation, robotic teleoperation, and industrial automation, where tactile communication improves precision, training efficiency, and operator performance. Automakers are increasingly using haptic touchscreens, steering wheel feedback, and seat vibration alerts to enhance human machine interaction and driver awareness. In healthcare, haptic enabled surgical simulators and rehabilitation devices are gaining strong traction due to their ability to replicate realistic touch sensations. Meanwhile, the gaming and entertainment sector continues to drive adoption of next generation controllers, VR gloves, and full body haptic suits. With continued advancements in mid air haptics, force feedback robotics, and multisensory XR systems, the US haptic technology market is expected to maintain strong momentum over the next decade.

Europe Haptic Technology Market

The European haptic technology market is expected to reach approximately USD 2.5 billion in 2025, reflecting strong adoption across consumer electronics, automotive systems, and industrial applications. The region benefits from a well established ecosystem of electronics manufacturers, automotive OEMs, and technology developers who are integrating advanced tactile feedback systems into smartphones, wearables, gaming devices, and connected vehicles. High demand for immersive interfaces, improved human machine interaction, and force feedback solutions is driving the market, supported by ongoing research in surface haptics, electrotactile feedback, and mid-air haptic technologies.

Europe’s market growth is further fueled by increasing investments in automotive safety systems, virtual and augmented reality platforms, and industrial automation solutions. Companies are focusing on precision actuators, AI-enabled haptic engines, and multisensory interfaces to enhance user experience and performance across various sectors. With a projected CAGR of 10.4% over the coming years, the region is set to experience steady expansion as manufacturers and developers continue to deploy innovative haptic solutions in both consumer and professional applications.

Japan Haptic Technology Market

The Japanese haptic technology market is expected to reach approximately USD 1.8 billion in 2025, driven by strong adoption in consumer electronics, automotive systems, and advanced robotics. Japan’s well established electronics and automotive manufacturing sectors are increasingly integrating tactile feedback solutions such as high precision actuators, vibration motors, and force feedback systems into smartphones, gaming devices, wearables, and vehicle interfaces. These implementations enhance user interaction, provide realistic touch sensations, and enable more intuitive human machine interfaces, which are critical for the region’s technologically advanced consumer and industrial markets.

The market is projected to grow at a robust CAGR of 14.3%, fueled by rising investment in virtual and augmented reality platforms, AI enabled haptic engines, and industrial automation applications. Adoption of mid-air haptics, electrotactile systems, and advanced surface haptics is further expanding the scope of immersive tactile experiences in gaming, professional training, and teleoperation. Continuous innovation, coupled with Japan’s focus on next generation electronics and smart mobility solutions, positions the country as one of the fastest growing regions in the global haptic technology market.

Global Haptic Technology Market: Key Takeaways

- Market Value: The global Haptic Technology market size is expected to reach a value of USD 31.9 billion by 2034 from a base value of USD 12.1 billion in 2025 at a CAGR of 11.4%.

- By Component Segment Analysis: Hardware components are anticipated to dominate the component segment, capturing 62.0% of the total market share in 2025.

- By Product Category Segment Analysis: Smartphones and Tablets are expected to maintain their dominance in the product category segment, capturing 30.0% of the total market share in 2025.

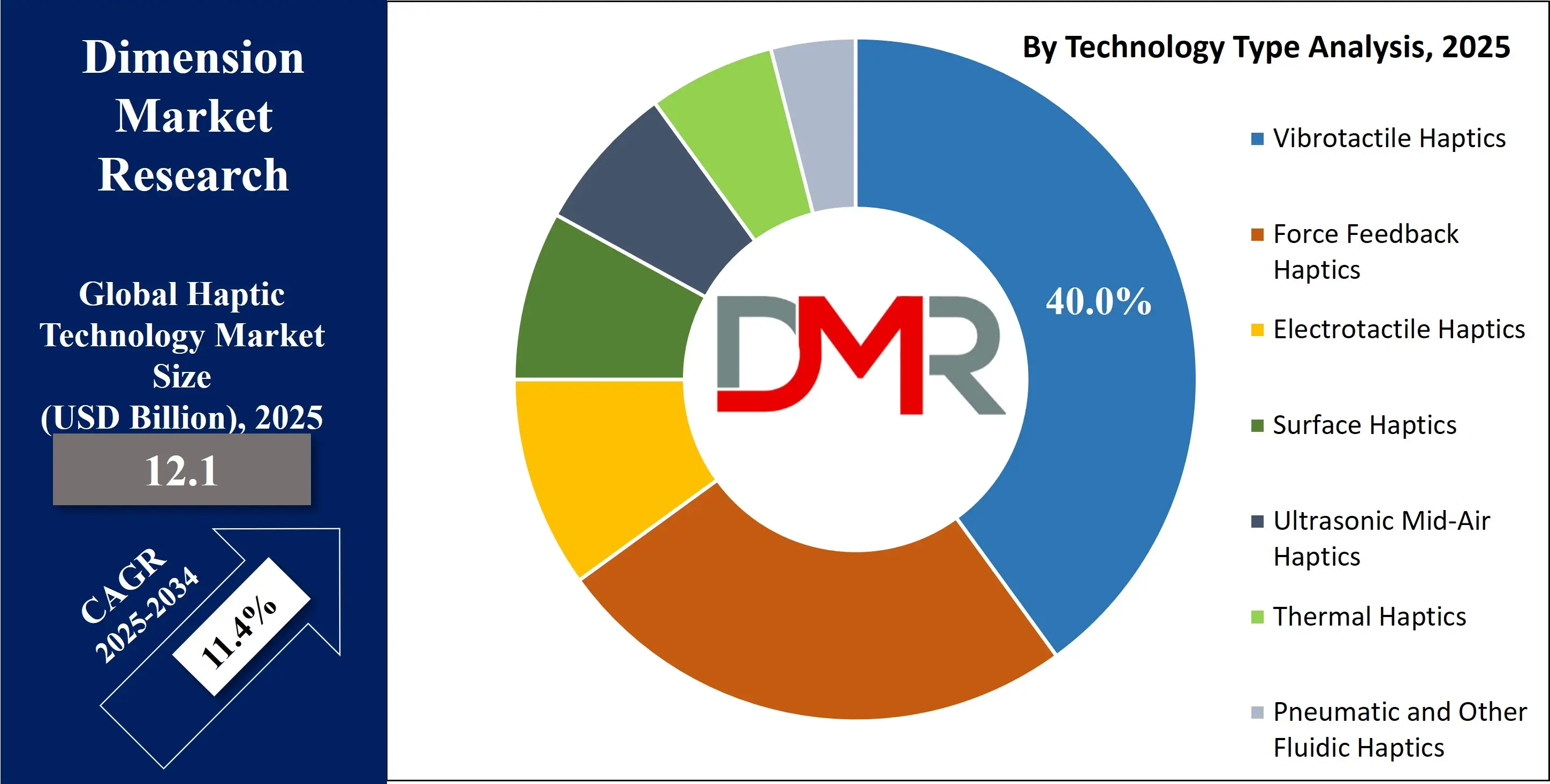

- By Technology Type Segment Analysis: Vibrotactile Haptics will dominate the technology type segment, capturing 40.0% of the market share in 2025.

- By Integration Approach Segment Analysis: Embedded Haptic Integration will account for the maximum share in the integration approach segment, capturing 65.0% of the total market value.

- By Application Area Segment Analysis: Consumer Electronics Applications will dominate the application area segment, capturing 35.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global Haptic Technology market landscape with 35.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Haptic Technology market are Immersion Corporation, HaptX Inc., Ultraleap Ltd., Texas Instruments Inc., Cirrus Logic Inc., TDK Corporation, AAC Technologies, Sensel Inc., Synaptics Incorporated, Precision Microdrives Ltd., Novasentis Inc., Force Dimension, Titan Haptics, Qualcomm Technologies Inc., Apple Inc., Sony Group Corporation, Samsung Electronics Co. Ltd, and Others.

Global Haptic Technology Market: Use Cases

- Consumer Electronics and Mobile Devices: The global haptic technology market plays a critical role in enhancing tactile feedback across smartphones, tablets, smartwatches, and other connected devices. Manufacturers integrate high precision vibration motors, linear resonant actuators, and advanced haptic engines to improve touch responsiveness, gesture control, and user experience. As demand grows for realistic textures, adaptive touch responses, and 3D touch features, haptic solutions continue to elevate interface interaction in next generation consumer electronics.

- Automotive Human Machine Interfaces: Automotive OEMs worldwide are adopting haptic feedback systems to improve driver awareness, reduce distraction, and modernize in vehicle controls. Touch based infotainment systems, steering wheel alerts, and seat vibration warnings leverage force feedback and localized tactile cues to support safer decision making. These tactile interfaces provide intuitive communication between the vehicle and driver, aligning with industry movement toward advanced driver assistance systems and intelligent cockpit technologies.

- Virtual Reality and Augmented Reality Experiences: Haptic technology strengthens immersion in AR and VR environments by delivering lifelike touch sensations through gloves, controllers, vests, and full body suits. Global adoption of extended reality in gaming, training, design, and telepresence is fueling demand for high fidelity vibrotactile and force feedback systems. These solutions replicate texture, resistance, and motion, enabling more natural and physically engaging virtual interactions across entertainment, enterprise collaboration, and simulation use cases.

- Healthcare Simulation and Medical Robotics: Medical training and telemedicine applications benefit significantly from haptic feedback solutions that replicate realistic physical sensations. Surgical simulators, rehabilitation devices, and robotic systems use precision haptic actuators to mimic tissue feel, pressure, and instrument resistance. This improves practitioner skill development, procedural accuracy, and patient outcomes. As healthcare shifts toward digital training and remote operation, haptic driven tactile interfaces continue to expand their global relevance.

Impact of Artificial Intelligence on the global Haptic Technology market

Artificial intelligence is transforming the global haptic technology market by enabling more accurate, adaptive, and context aware tactile feedback systems. AI powered algorithms optimize vibration patterns, force response, and texture rendering based on user behavior, environmental conditions, and interaction intent. This leads to more personalized haptic experiences in smartphones, AR and VR devices, wearables, and next generation user interfaces. Intelligent signal processing also improves actuator efficiency, reduces latency, and enhances the realism of touch sensations across consumer electronics and immersive platforms.

AI is further accelerating innovation in advanced haptic simulation, predictive feedback, and remote operation systems used in healthcare, automotive, robotics, and industrial environments. Machine learning models can analyze complex motion data and generate nuanced tactile cues for surgical simulators, driver assistance alerts, robotic arms, and telepresence applications. By bridging human perception with digital environments, AI driven haptics enables safer decision making, greater precision, and deeper immersion, ultimately redefining how global industries implement touch based interactions.

Global Haptic Technology Market: Stats & Facts

-

International Federation of Robotics (IFR)

- By 2023, there were approximately 4,281,585 industrial robots operating in factories worldwide, a 10% increase year-on-year.

- Global robot density (robots per 10,000 manufacturing employees) reached a record 162 units per 10,000 employees in 2023, more than double the density measured seven years earlier.

- In 2023, over 205,000 professional service robots were registered globally, with nearly 80% deployed in Asia-Pacific and a substantial portion in Europe.

- Within Europe, some countries feature robot densities as high as 219 robots per 10,000 manufacturing employees (notably Germany, Sweden, Denmark, and Slovenia).

- Japan accounted for approximately 9% of global industrial robot installations in 2023, maintaining a top-tier position.

- The top five markets for industrial robot installations globally, China, Japan, the United States, the Republic of Korea, and Germany, together accounted for 78% of global installations.

- The sustained growth of industrial robot stock worldwide (doubling over the past 7–10 years) indicates a steadily expanding base of automated manufacturing operations.

Global Haptic Technology Market: Market Dynamics

Global Haptic Technology Market: Driving Factors

Rising integration of haptics in consumer electronics

The global haptic technology market is strongly driven by the growing adoption of tactile feedback systems in smartphones, wearables, gaming devices, and extended reality platforms. Manufacturers are increasingly using advanced vibration actuators, linear resonant motors, and surface-haptic solutions to enhance user interaction, gesture control, and touchscreen responsiveness. As consumers demand more immersive and intuitive interfaces, the role of high-fidelity haptic engines continues to expand across mainstream electronic devices.

Adoption of haptics in automotive safety and infotainment systems

Automakers are embedding haptic feedback into steering wheels, dashboards, touch panels, and driver assistance systems to improve awareness and reduce road distraction. Tactile alerts help guide driver attention, complement visual signals, and support next generation cockpit design. With rising investment in connected vehicles, ADAS functions, and intelligent HMIs, automotive demand for force feedback solutions and localized vibration cues is rapidly increasing worldwide.

Global Haptic Technology Market: Restraints

High cost of advanced actuators and integration complexity

The implementation of precision haptic components such as piezo actuators, ultrasonic modules, and force feedback mechanisms often increases device production costs. Integrating these systems requires specialized firmware, haptic drivers, and mechanical design, making adoption challenging for cost sensitive devices. This pricing pressure limits penetration in low and mid tier consumer electronics and restricts scalability in certain industrial applications.

Limited standardization across hardware and software ecosystems

The lack of universal standards for tactile rendering, actuator performance, and cross-platform haptic compatibility slows market expansion. Device manufacturers, OS developers, and component suppliers often rely on proprietary technologies, creating fragmentation in the global haptic ecosystem. This inconsistency makes it difficult for developers to design uniform tactile experiences and limits seamless integration across different digital environments.

Global Haptic Technology Market: Opportunities

Expansion of haptics in healthcare simulation and medical robotics

Growing use of digital surgical simulators, rehabilitation systems, and robot-assisted procedures creates strong opportunities for advanced haptic feedback solutions. High precision tactile cues help replicate tissue feel, pressure resistance, and real world instrument interaction, improving training quality and procedural outcomes. As telemedicine and remote operation evolve, demand for intelligent, AI-enhanced haptic interfaces in the medical sector is poised to accelerate.

Growth of immersive applications in AR, VR, and metaverse platforms

The rise of virtual training, 3D design, remote collaboration, and entertainment environments fuels demand for immersive touch experiences. Haptic gloves, vests, full-body suits, and mid-air haptic systems enable realistic interaction with virtual objects and environments. As global investment in XR ecosystems increases, the market will benefit from opportunities to deliver high fidelity tactile sensations across gaming, education, enterprise simulation, and digital content creation.

Global Haptic Technology Market: Trends

Shift toward AI-driven adaptive haptic feedback

Artificial intelligence and machine learning are now used to analyze user intent, adjust vibration patterns, and generate context aware tactile cues. This trend enhances the realism of touch sensations and supports next generation interfaces in smartphones, automotive systems, robotics, and XR devices. AI-enabled haptics also improves actuator efficiency, precision, and personalization.

Emergence of mid-air and surface haptic technologies

Ultrasonic mid-air touch feedback and advanced surface haptics are gaining traction as industries explore contactless interaction and futuristic UI design. These technologies enable tactile sensations without physical touch and are being adopted in kiosks, automotive dashboards, public interfaces, and immersive VR applications. Their growing commercial maturity marks a significant evolution beyond traditional vibration based haptics.

Global Haptic Technology Market: Research Scope and Analysis

By Component Analysis

Hardware components are anticipated to dominate the component segment, capturing 62% of the total market share in 2025, primarily because they form the physical foundation of every haptic system. Actuators, controllers, drivers, and tactile sensors are essential for generating precise vibrations, force feedback, and texture simulation across smartphones, wearables, gaming devices, automotive interfaces, and extended reality platforms. As demand increases for more immersive and responsive touch experiences, manufacturers are adopting advanced linear resonant actuators, piezoelectric motors, and ultrasonic modules, reinforcing the strong market reliance on high performance hardware to deliver consistent and realistic tactile output.

Software in this market segment plays an equally important role by interpreting user input and converting digital commands into refined tactile sensations. Haptic software frameworks, control algorithms, and firmware manage actuator intensity, timing, and pattern variation to create lifelike feedback across different applications. As developers push for personalized touch responses, adaptive haptic effects, and AI enhanced interaction models, software is becoming a key enabler of advanced tactile experiences that enhance realism, improve device responsiveness, and expand the functionality of modern haptic systems.

By Product Category Analysis

Smartphones and tablets are expected to maintain their dominance in the product category segment, capturing 30% of the total market share in 2025, as these devices rely heavily on tactile feedback to enhance user interaction and overall experience. From touch typing and gesture navigation to gaming and app notifications, haptics plays a central role in improving engagement and precision. Manufacturers are continuously integrating advanced linear resonant actuators, high fidelity vibration motors, and refined haptic engines to support smoother tactile responses and realistic touch sensations. With growing demand for premium smartphones, increased usage of mobile gaming, and widespread adoption of touch driven interfaces, smartphones and tablets remain the largest contributors to haptic technology demand worldwide.

Virtual reality and augmented reality devices represent a rapidly expanding product category as immersive environments increasingly rely on realistic touch sensations to strengthen user presence and interaction accuracy. Haptic gloves, controllers, vests, and wearable components in VR and AR systems provide texture simulation, force feedback, and motion based tactile cues that make digital environments feel more lifelike. As industries adopt extended reality for training, gaming, simulation, and remote collaboration, the need for high fidelity haptic feedback continues to grow. The shift toward more immersive XR ecosystems is driving strong interest in advanced tactile technologies such as mid air haptics, electrotactile interfaces, and full body sensory systems, which enhance realism and deepen user engagement across professional and entertainment applications.

By Technology Type Analysis

Vibrotactile haptics will dominate the technology type segment, capturing 40% of the market share in 2025, mainly because this technology is widely integrated across smartphones, wearables, gaming controllers, consumer electronics, and automotive interfaces. Vibrotactile systems use compact actuators, linear resonant motors, and eccentric rotating mass units to deliver notification alerts, touch confirmations, gesture responses, and immersive interaction effects. Their low cost, energy efficiency, compact size, and ease of integration make them the preferred choice for manufacturers aiming to enhance tactile user experience without adding significant complexity. As demand grows for refined vibration patterns, high precision tactile cues, and more intuitive interaction across mainstream electronics, vibrotactile haptics continues to sustain its strong global adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Force feedback haptics plays a crucial role in applications that require deeper physical realism, resistance simulation, and motion based tactile interaction. This technology uses motors, actuators, and mechanical systems to generate controlled forces that mimic weight, pressure, and object resistance, enabling more immersive and physically accurate experiences. Force feedback is widely used in virtual reality gloves, surgical simulators, flight simulators, industrial training systems, and robotic teleoperation to enhance precision and realism. As industries increasingly adopt advanced simulators, remote operation tools, and high fidelity XR systems, force feedback haptics is gaining traction for its ability to deliver true mechanical sensation and enhance skill development in professional environments.

By Integration Approach Analysis

Embedded haptic integration will account for the maximum share in the integration approach segment, capturing 65% of the total market value, as haptic components are increasingly built directly into smartphones, tablets, wearables, gaming devices, and automotive systems. Embedding actuators, controllers, and drivers within the device architecture ensures higher precision, lower latency, and smoother tactile output. This approach also supports compact product design and energy efficiency, which are essential for modern electronics. The growing demand for seamless user interaction, advanced tactile notifications, and immersive feedback systems continues to strengthen the adoption of embedded haptics across consumer electronics, automotive interfaces, medical devices, and industrial products.

Peripheral haptic devices represent an important segment where tactile feedback is delivered through external accessories such as haptic gloves, controllers, joysticks, vests, and specialized training equipment. These devices are widely used in virtual reality, gaming, robotics, healthcare simulation, and industrial training environments where advanced tactile realism is required. Peripheral systems allow users to experience force feedback, texture simulation, and motion based haptics without altering the core device hardware. As extended reality platforms, metaverse applications, and remote operation systems expand, the demand for high fidelity peripheral haptics continues to rise, supporting more flexible and immersive interaction experiences across professional and recreational use cases.

By Application Area Analysis

Consumer electronics applications will dominate the application area segment, capturing 35% of the market share in 2025, as haptic technology is widely used to enhance user experience across smartphones, tablets, smartwatches, and wearable devices. Tactile feedback in these devices provides touch confirmation, gesture response, vibration alerts, and immersive interaction effects that improve usability and engagement. The integration of high precision actuators, vibration motors, and haptic engines enables realistic touch sensations, smooth tactile response, and adaptive feedback, making consumer electronics the largest adopter of haptics worldwide. Increasing demand for intuitive interfaces, mobile gaming, and interactive apps continues to drive growth in this application area.

Gaming and entertainment applications are a key segment where haptic technology enhances immersion, realism, and user engagement. Controllers, gloves, vests, and full body haptic suits provide vibration, force feedback, and texture simulation, allowing players to physically feel in-game actions and virtual environments. This technology is widely adopted in consoles, VR arcades, PC gaming, and extended reality platforms to create more interactive and multisensory experiences. As the global gaming industry and virtual entertainment platforms expand, demand for high fidelity tactile feedback systems continues to grow, making gaming and entertainment one of the fastest rising applications for haptic solutions.

The Haptic Technology Market Report is segmented on the basis of the following

By Component

- Hardware

- Software

- Services

By Product Category

- Smartphones and Tablets

- Virtual Reality and Augmented Reality Devices

- Wearable Devices

- Automotive Haptic Systems

- Medical and Surgical Devices

- Industrial and Robotic Equipment

- Computer Peripherals and Gaming Accessories

- Other Specialized Products

By Technology Type

- Vibrotactile Haptics

- Force Feedback Haptics

- Electrotactile Haptics

- Surface Haptics

- Ultrasonic Mid-Air Haptics

- Thermal Haptics

- Pneumatic and Other Fluidic Haptics

By Integration Approach

- Embedded Haptic Integration

- Peripheral Haptic Devices

- Cloud-Based and Software-Driven Haptics

By Application Area

- Consumer Electronics Applications

- Gaming and Entertainment Applications

- Automotive Applications

- Healthcare and Medical Applications

- Industrial and Manufacturing Applications

- Aerospace and Defense Applications

- Retail and E-Commerce Applications

- Education and Training Applications

- Other Applications

Global Haptic Technology Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global haptic technology market landscape, capturing 35% of total market revenue in 2025, driven by strong adoption of advanced consumer electronics, gaming devices, automotive systems, and extended reality platforms. The region benefits from a well established ecosystem of semiconductor manufacturers, sensor developers, software innovators, and major tech companies investing in tactile feedback solutions. High demand for immersive user experiences, AI enhanced haptic interfaces, and next generation human machine interaction across smartphones, wearables, virtual reality, and automotive applications continues to reinforce North America’s dominant position in the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the global haptic technology market over the coming years, driven by rapid adoption of smartphones, wearables, gaming devices, and automotive systems in countries such as China, Japan, and South Korea. Rising investment in extended reality platforms, increasing consumer demand for immersive tactile experiences, and the expansion of local electronics manufacturing hubs are fueling market expansion. Additionally, growing government support for digital innovation, industrial automation, and AI enabled interfaces is accelerating the deployment of advanced haptic solutions, making Asia-Pacific one of the fastest growing regions globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Haptic Technology Market: Competitive Landscape

The global haptic technology market is highly competitive, characterized by rapid innovation, continuous product development, and strategic collaborations across consumer electronics, automotive, healthcare, and industrial sectors. Companies are focusing on enhancing tactile feedback precision, reducing latency, and integrating AI driven haptic solutions to deliver more immersive and realistic user experiences. Investment in research and development, expansion of extended reality applications, and the introduction of advanced actuators, force feedback systems, and mid-air haptics are key strategies shaping market competition. The landscape is further driven by partnerships, technology licensing, and the push for scalable, multi-platform haptic solutions worldwide.

Some of the prominent players in the global Haptic Technology market are

- Immersion Corporation

- HaptX Inc.

- Ultraleap Ltd.

- Texas Instruments Inc.

- Cirrus Logic Inc.

- TDK Corporation

- AAC Technologies

- Sensel Inc.

- Synaptics Incorporated

- Precision Microdrives Ltd.

- Novasentis Inc.

- Force Dimension

- Titan Haptics

- Qualcomm Technologies Inc.

- Apple Inc.

- Sony Group Corporation

- Samsung Electronics Co. Ltd.

- Goertek Inc.

- Boréas Technologies

- 3D Systems Corporation

- Other Key Players

Global Haptic Technology Market: Recent Developments

- November 2025: A startup aiming to digitize touch, allowing recording, editing and streaming of realistic touch data, raised USD 1.75 million in pre‑seed funding to accelerate development of its hardware‑software haptic platform.

- October 2025: A premium external trackpad built for Windows users was launched featuring advanced piezo‑haptics and full‑force sensing, marking a notable new product introduction in the haptic market.

- January 2025: A new 3D haptic mouse designed for digital creation and immersive interaction made its debut at CES and was launched on Kickstarter, offering users tactile feedback for 3D modelling, sculpting, and virtual environments.

- September 2024: A haptic‑interface specialist secured a major funding round of USD 31.5 million to scale up its tactile‑sensing and force‑feedback products for PCs, laptops, and automotive use cases.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 12.1 Bn |

| Forecast Value (2034) |

USD 31.9 Bn |

| CAGR (2025–2034) |

11.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.6 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services); By Product Category (Smartphones and Tablets, Virtual Reality and Augmented Reality Devices, Wearable Devices, Automotive Haptic Systems, Medical and Surgical Devices, Industrial and Robotic Equipment, Computer Peripherals and Gaming Accessories, Other Specialized Products); By Technology Type (Vibrotactile Haptics, Force Feedback Haptics, Electrotactile Haptics, Surface Haptics, Ultrasonic Mid-Air Haptics, Thermal Haptics, Pneumatic and Other Fluidic Haptics); By Integration Approach (Embedded Haptic Integration, Peripheral Haptic Devices, Cloud-Based and Software-Driven Haptics); and By Application Area (Consumer Electronics Applications, Gaming and Entertainment Applications, Automotive Applications, Healthcare and Medical Applications, Industrial and Manufacturing Applications, Aerospace and Defense Applications, Retail and E-Commerce Applications, Education and Training Applications, Other Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Immersion Corporation, HaptX Inc., Ultraleap Ltd., Texas Instruments Inc., Cirrus Logic Inc., TDK Corporation, AAC Technologies, Sensel Inc., Synaptics Incorporated, Precision Microdrives Ltd., Novasentis Inc., Force Dimension, Titan Haptics, Qualcomm Technologies Inc., Apple Inc., Sony Group Corporation, Samsung Electronics Co. Ltd, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Haptic Technology market?

▾ The global Haptic Technology market size is estimated to have a value of USD 12.1 billion in 2025 and is expected to reach USD 31.9 billion by the end of 2034.

What is the size of the US Haptic Technology market?

▾ The US Haptic Technology market is projected to be valued at USD 3.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.9 billion in 2034 at a CAGR of 10.7%.

Which region accounted for the largest global Haptic Technology market?

▾ North America is expected to have the largest market share in the global Haptic Technology market, with a share of about 35.0% in 2025.

Who are the key players in the global Haptic Technology market?

▾ Some of the major key players in the global Haptic Technology market are Immersion Corporation, HaptX Inc., Ultraleap Ltd., Texas Instruments Inc., Cirrus Logic Inc., TDK Corporation, AAC Technologies, Sensel Inc., Synaptics Incorporated, Precision Microdrives Ltd., Novasentis Inc., Force Dimension, Titan Haptics, Qualcomm Technologies Inc., Apple Inc., Sony Group Corporation, Samsung Electronics Co. Ltd, and Others.

What is the growth rate of the global Haptic Technology market?

▾ The market is growing at a CAGR of 11.4 percent over the forecasted period.