Market Overview

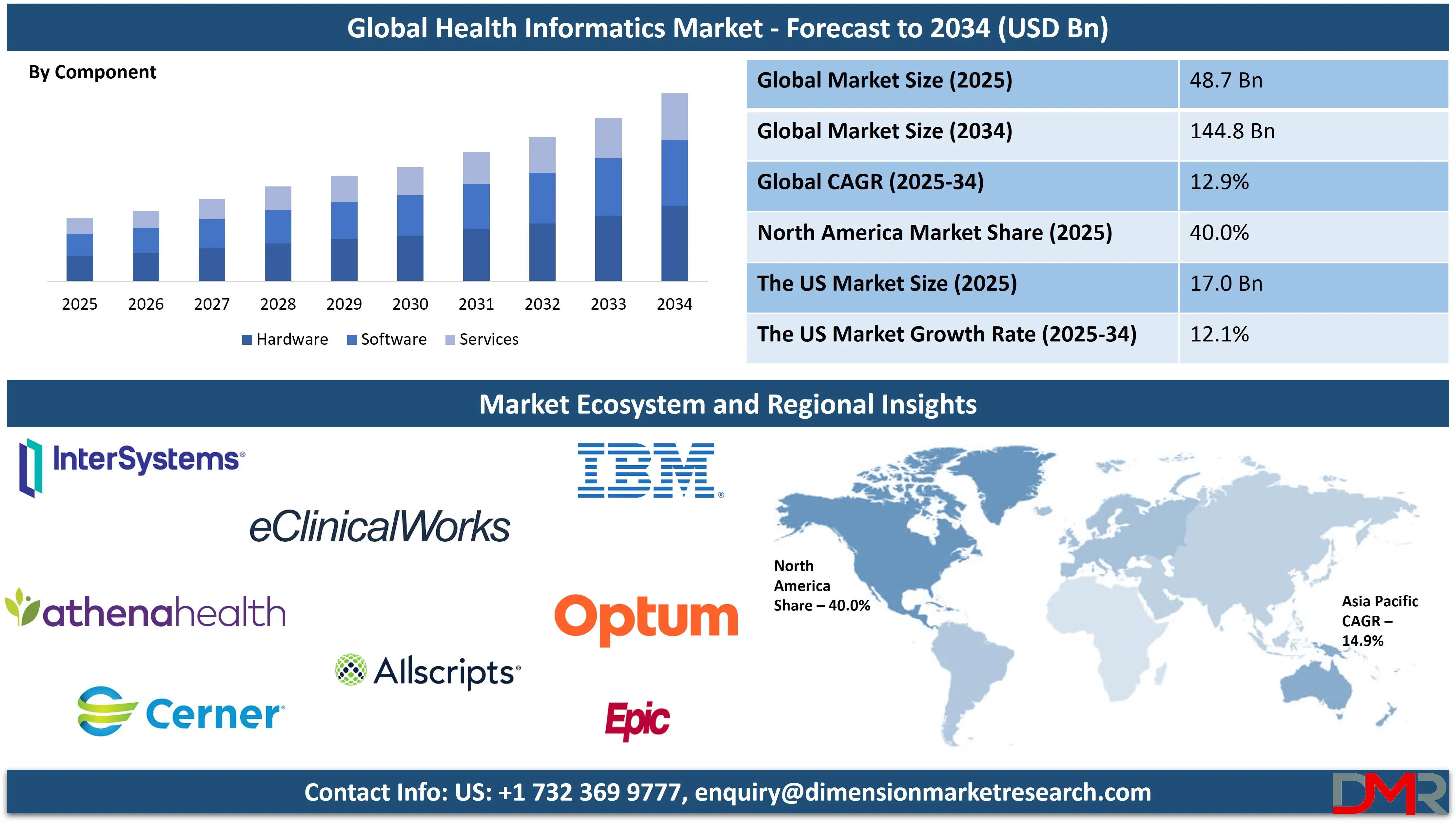

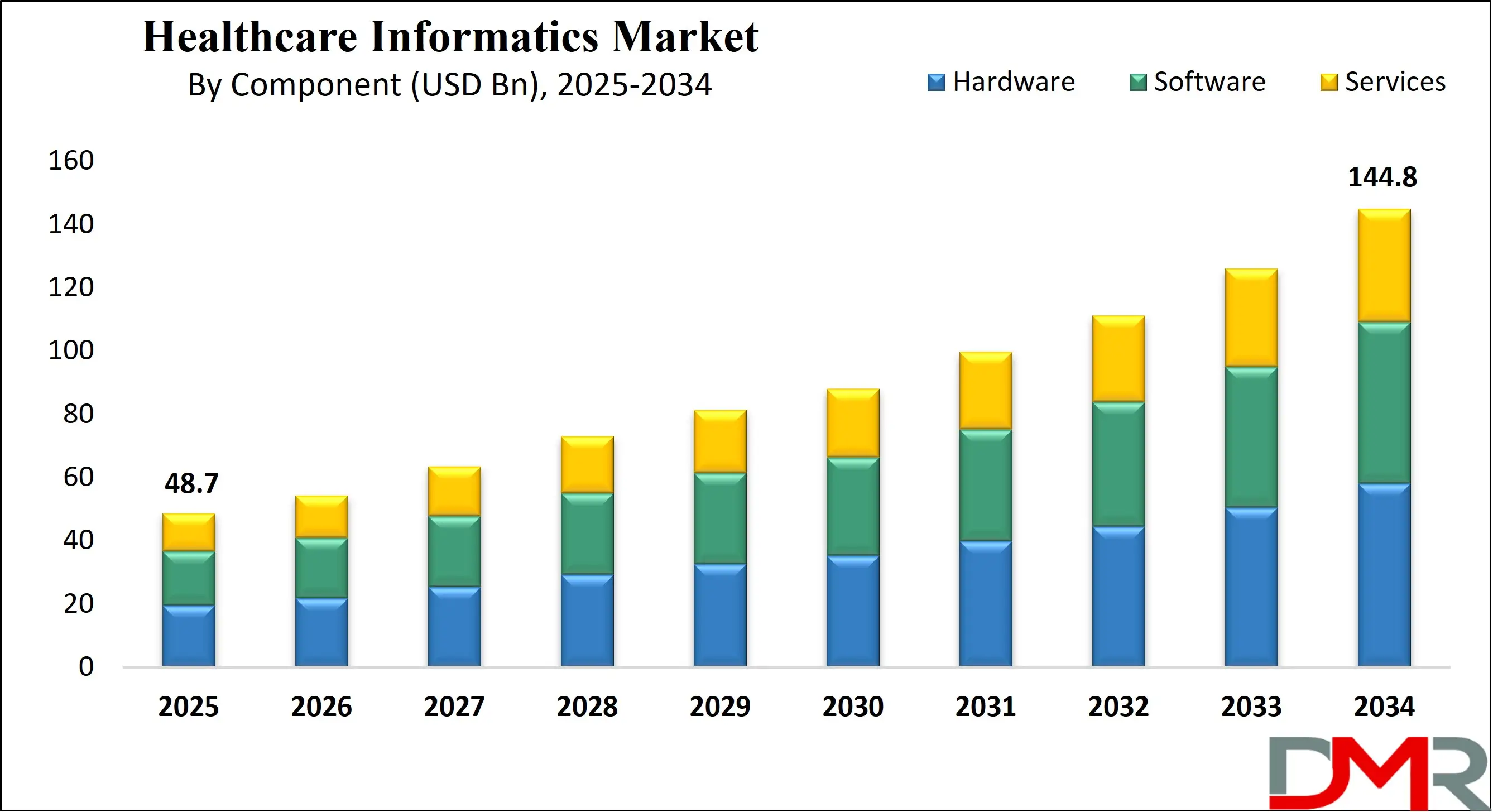

The Global Health Informatics Market size is projected to reach USD 48.7 billion in 2025 and grow at a compound annual growth rate of 12.9% to reach a value of USD 144.8 billion in 2034.

The Health Informatics market encompasses the use of information technology and data analytics in healthcare to improve patient care, operational efficiency, and decision-making. It integrates hardware (like medical devices and storage systems), software (such as EHRs and analytics tools), and services (including consulting and integration) to create cohesive digital health solutions.

Over the years, the market has gained momentum due to the global push for digital healthcare transformation. Key drivers include aging populations, rising chronic diseases, and the need to contain healthcare costs. Health informatics systems help providers collect, store, share, and analyze patient information, enabling better care coordination, preventive care, and personalized medicine.

A major development in the field has been the shift toward cloud-based platforms, allowing scalable, secure, and accessible health data storage and processing. Simultaneously, AI-powered analytics are increasingly being deployed to generate predictive insights, improve diagnostics, and reduce administrative burdens. Interoperability standards have matured, enabling disparate healthcare systems to exchange data more effectively.

Regulatory frameworks and government policies have also played a significant role. Incentives for adopting electronic health records (EHRs), investments in telehealth, and mandates for data security have encouraged healthcare providers to digitize. Meanwhile, public-private partnerships are fostering innovation, pushing for widely adopted standards and secure data-sharing tools.

The US Health Informatics Market

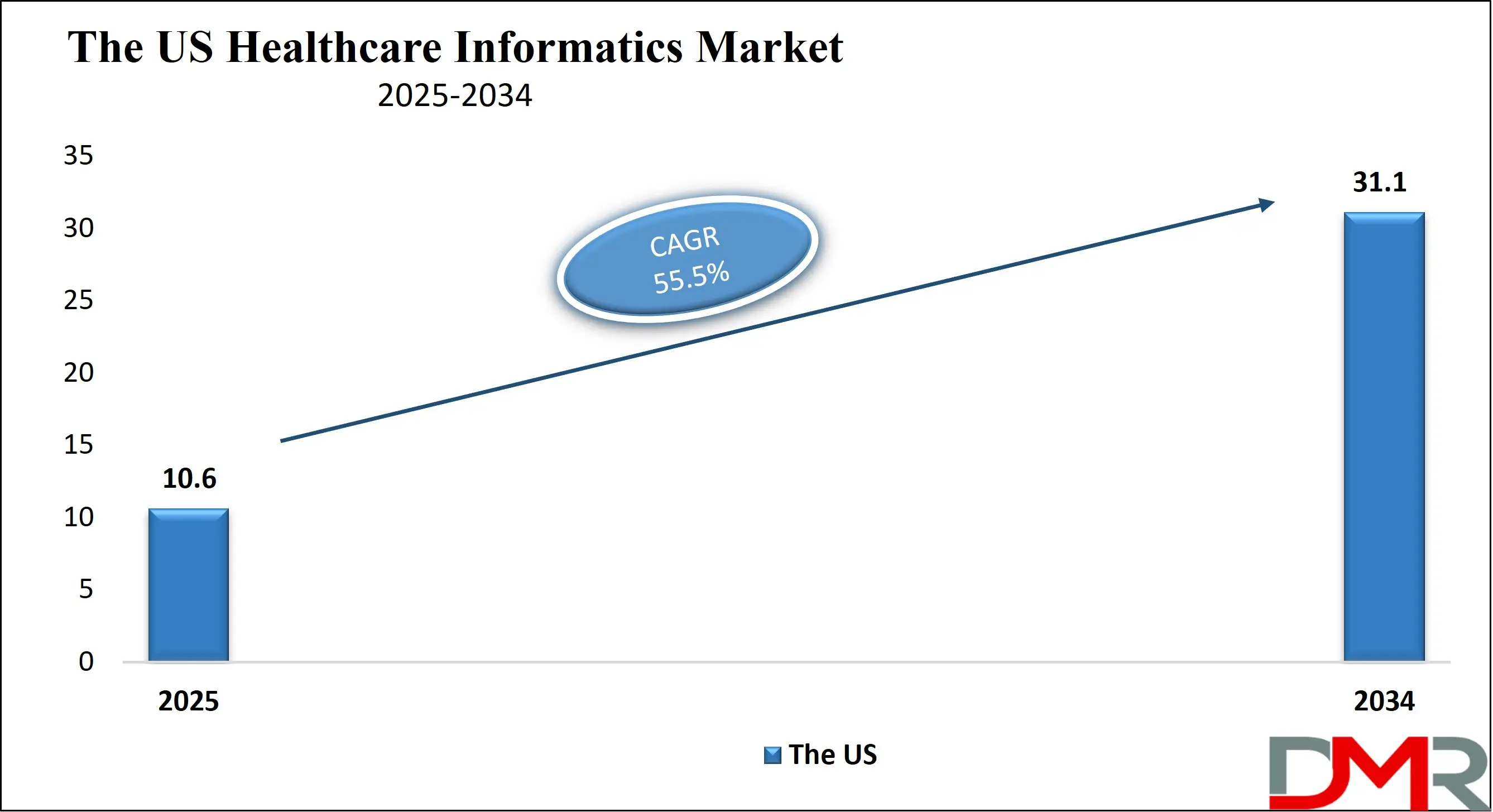

The US Health Informatics Market size is projected to reach USD 17.0 billion in 2025 at a compound annual growth rate of 12.1% over its forecast period.

The United States holds a dominant position in the Health Informatics market, primarily driven by the adoption of digital health technologies and the government's push for healthcare digitalization. With a robust healthcare system, the US continues to lead in the development and implementation of health informatics solutions, such as EHRs and telehealth services. Additionally, the demand for data-driven decision-making in clinical settings has resulted in rapid investments in AI and machine learning applications to enhance healthcare delivery. The US market’s growth is further supported by increased healthcare expenditure and a well-established regulatory framework.

Europe Health Informatics Market

Europe Health Informatics Market size is projected to reach USD 15.6 billion in 2025 at a compound annual growth rate of 12.4% over its forecast period.

Europe's Health Informatics market is characterized by diverse healthcare systems across countries, each adopting digital solutions at varying rates. However, there is a strong emphasis on interoperability, data security, and patient privacy, particularly with the implementation of GDPR. The EU’s commitment to digital health initiatives, such as the European Health Data Space, is likely to boost the adoption of health informatics solutions. The market also benefits from high healthcare standards and government initiatives promoting the use of telemedicine, digital health records, and healthcare analytics, resulting in steady growth.

Japan Health Informatics Market

Japan Health Informatics Market size is projected to reach USD 2.4 billion in 2025 at a compound annual growth rate of 13.0% over its forecast period.

Japan’s Health Informatics market is witnessing rapid growth driven by technological innovations, especially in AI, robotics, and telemedicine. The country's aging population has created a significant demand for digital healthcare solutions, particularly for remote monitoring and eldercare management. Japan's healthcare providers are increasingly integrating advanced health IT systems to improve patient care, enhance operational efficiency, and meet regulatory standards. The government’s strong focus on eHealth policies and investments in health informatics infrastructure is propelling the growth of the sector, making Japan a key player in the Asia-Pacific region.

Health Informatics Market: Key Takeaways

- Market Growth: The Health Informatics Market size is expected to grow by USD 90.5 billion, at a CAGR of 12.9%, during the forecasted period of 2026 to 2034.

- By Components: The hardware segment is anticipated to get the majority share of the Health Informatics Market in 2025.

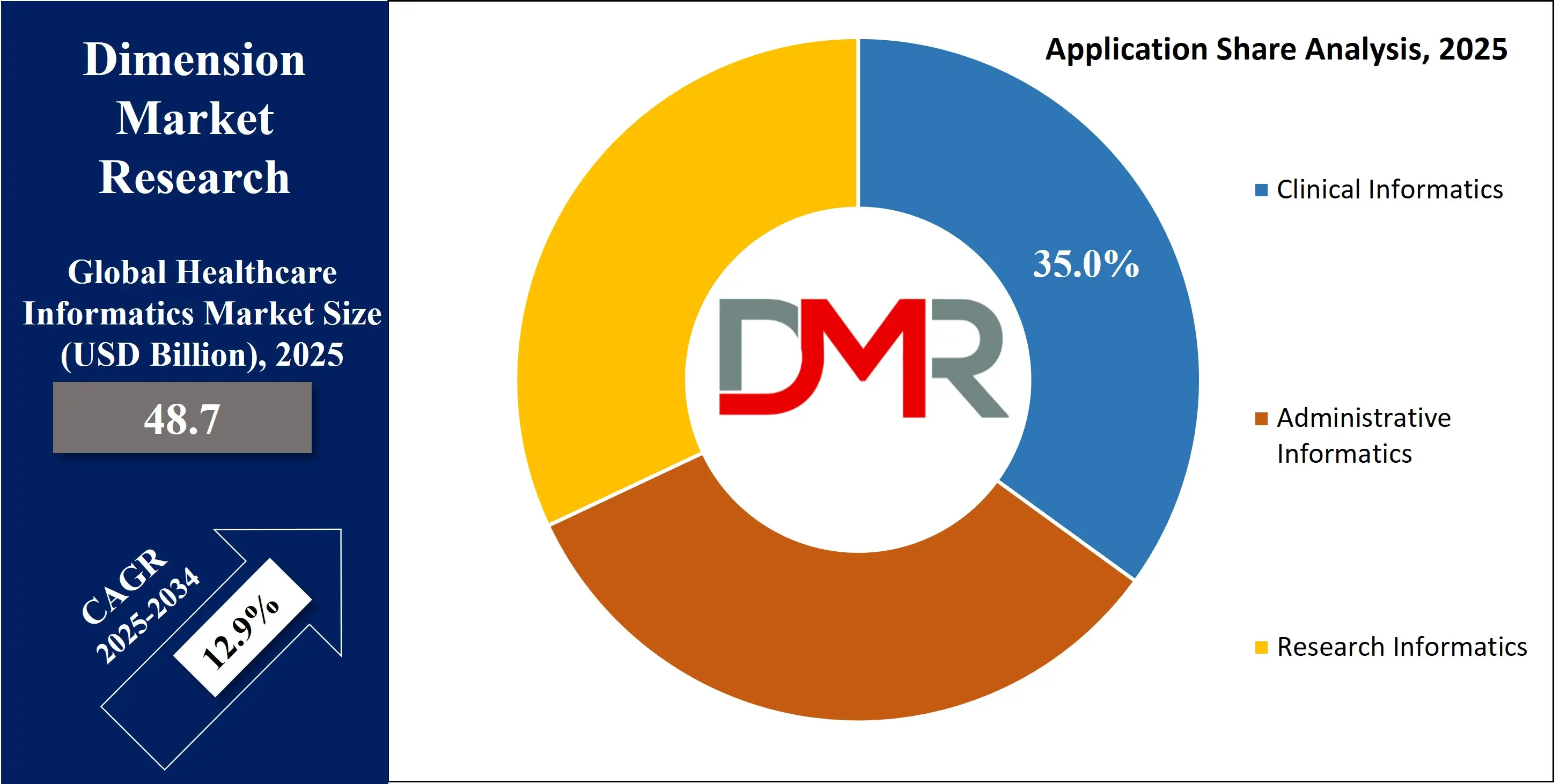

- By Application: The clinical informatics segment is expected to get the largest revenue share in 2025 in the Health Informatics Market.

- Regional Insight: North America is expected to hold a 40.0% share of revenue in the Global Health Informatics Market in 2025.

- Use Cases: Some of the use cases of Health Informatics include EHR Systems, Healthcare Analytics, and more

Health Informatics Market: Use Cases

- Clinical Decision Support: Health Informatics enables clinicians to make informed decisions by providing real-time, data-driven insights, improving patient outcomes and reducing medical errors.

- Remote Patient Monitoring: Using telehealth and wearable devices, health informatics allows for continuous monitoring of patients outside of traditional healthcare settings, enhancing chronic disease management.

- EHR Systems: Electronic Health Records (EHR) streamline patient data management, improving coordination between healthcare providers and enhancing overall care efficiency.

- Healthcare Analytics: Health informatics uses data analytics tools to analyze clinical and operational data, helping hospitals optimize processes, reduce costs, and improve patient care delivery.

Stats & Facts

- The U.S. Department of Health and Human Services reported that over 80% of hospitals in the U.S. were using EHR systems as of 2024.

- The European Commission has indicated that 75% of European healthcare organizations have adopted cloud solutions for storing patient records as of 2025.

- According to Japan’s Ministry of Health, the adoption of telemedicine services in hospitals increased by 40% in 2024, driven by advancements in digital infrastructure.

- The National Institutes of Health (NIH) reports that the use of AI in medical diagnostics has increased by 25% in clinical settings across the U.S. in the past three years.

Market Dynamic

Driving Factors in the Health Informatics Market

Government Regulations and Incentives

Government policies such as incentives for EHR adoption, data security standards, and telehealth funding have accelerated the adoption of health informatics solutions. Regulatory frameworks like the U.S. Affordable Care Act and GDPR in Europe are driving the push for data digitization, while also ensuring patient privacy and security.

Technological Advancements

The rapid advancements in artificial intelligence, machine learning, and data analytics are transforming the way healthcare providers approach diagnosis, treatment, and patient management. These technologies provide more accurate insights, improve patient care, and enhance operational efficiency.

Restraints in the Health Informatics Market

High Implementation Costs

One of the major barriers to adopting health informatics solutions is the high cost of implementation, especially for small and mid-sized healthcare providers. The cost of infrastructure, training, and maintenance of new systems can be prohibitively expensive, especially in developing countries.

Data Security and Privacy Concerns

As more healthcare data is digitized and shared across platforms, concerns regarding data security, patient privacy, and cybersecurity risks are growing. Healthcare organizations must invest heavily in robust cybersecurity measures to protect sensitive health information from breaches.

Opportunities in the Health Informatics Market

Telemedicine and Remote Healthcare

The growing demand for remote healthcare services presents significant opportunities in the health informatics market. The increasing adoption of telemedicine technologies, remote monitoring devices, and virtual consultations provides a promising avenue for market growth.

AI-Driven Healthcare Analytics

There is a growing opportunity in integrating AI into healthcare analytics for predictive diagnostics, personalized medicine, and operational improvements. The ability to predict health outcomes and optimize hospital management processes using AI presents significant growth potential.

Trends in the Health Informatics Market

Cloud-Based Solutions

The shift towards cloud-based platforms for healthcare data storage, analysis, and sharing is a key trend. Cloud technologies offer scalability, cost efficiency, and enhanced collaboration across healthcare systems, allowing for easier data access and integration.

Interoperability

As healthcare systems increasingly adopt digital tools, there is a growing focus on ensuring interoperability between disparate health IT systems. Achieving seamless data exchange between systems improves the quality of care and reduces operational inefficiencies.

Impact of Artificial Intelligence in Health Informatics Market

- Enhanced Diagnosis: AI algorithms assist in diagnosing diseases more accurately and efficiently by analyzing medical imaging, genetic data, and patient history.

- Predictive Analytics for Disease Management: AI-powered predictive models can identify potential health risks in patients, enabling early interventions and personalized treatment plans.

- Operational Efficiency: AI is automating administrative tasks like appointment scheduling, billing, and claims processing, freeing up healthcare professionals to focus on patient care.

- Telemedicine Advancements: AI-based chatbots and virtual assistants are improving patient interactions in telemedicine, offering instant responses to medical queries and enhancing the patient experience.

- Clinical Research Advancements: AI is transforming clinical research by speeding up data analysis, identifying trends, and streamlining the process of discovering new treatments.

Research Scope and Analysis

By Component Analysis

The hardware segment, comprising medical devices, networking equipment, and storage systems, is expected to hold 40% of the Health Informatics market in 2025. Its dominance is supported by the continuous need to strengthen hospital infrastructure for seamless data capture, secure storage, and rapid transmission of clinical information. As health systems scale digital operations, investments in high-capacity servers, diagnostic devices, and integrated monitoring tools are increasing. The expansion of telehealth, imaging modalities, and real-time patient monitoring further reinforces the demand for resilient hardware that ensures system stability and uninterrupted clinical workflows.

Software is projected to be the fastest-growing component and is rapidly becoming the core driver of digital transformation in healthcare. This segment includes EHRs, telehealth platforms, CDSS tools, and analytics applications that streamline operations and elevate clinical decision-making. Providers are prioritizing software solutions to enable real-time data exchange, enhance patient engagement, and achieve better care outcomes through automation and predictive insights. The growing shift toward cloud-based and AI-enabled platforms also strengthens demand, making software essential for healthcare organizations aiming to modernize clinical and administrative processes.

By Application Analysis

Clinical informatics, which includes nursing, pharmacy, laboratory, and radiology informatics, is estimated to lead the market with a 35% share in 2025. This segment’s growth is driven by the need to reduce medical errors, standardize clinical workflows, and provide clinicians with accurate, timely data for better decision-making. Solutions such as EHRs and CDSS are being widely adopted to improve patient safety and ensure consistent documentation across care settings. As hospitals focus on improving care quality and meeting regulatory standards, clinical informatics continues to play a central role in elevating day-to-day clinical operations.

Administrative informatics is emerging as the fastest-growing application area, driven by increasing pressure on healthcare organizations to optimize workflows, reduce costs, and handle rising administrative burdens. Digital tools supporting billing, claims management, and resource allocation are becoming essential for streamlining back-office processes. The integration of automation and analytics in administrative functions is enabling faster reimbursements, improved accuracy, and better financial management. As healthcare systems transition toward value-based care, administrative informatics is gaining traction for its ability to support efficiency and transparency.

By Deployment Mode Analysis

Cloud-based deployment is expected to dominate the market with 45% share in 2025, supported by its flexibility, scalability, and cost-effectiveness. Healthcare organizations are increasingly shifting to cloud solutions to enable remote data access, improve collaboration across clinical teams, and reduce the burden of maintaining on-premise infrastructure. Cloud platforms also support seamless updates, cybersecurity enhancements, and integration with emerging technologies such as AI and IoT, making them a preferred choice for both large health systems and smaller facilities.

On-premise deployment continues to grow steadily, as many organizations still prioritize direct control over sensitive patient information and internal infrastructure. This model is favored by institutions with stringent data governance policies or limited connectivity environments. Despite the growing shift to cloud, on-premise systems remain essential for organizations requiring customized configurations, high data sovereignty, or complex legacy system integration. Its continued adoption reflects the need for hybrid approaches in diverse healthcare environments.

By End User Analysis

Hospitals and clinics are projected to account for 50% of the Health Informatics market in 2025. Their leadership is driven by increasing adoption of EHRs, telehealth platforms, and advanced analytics solutions to improve care delivery. Large hospitals are investing in comprehensive informatics systems to enhance patient flow, reduce treatment delays, and support clinical decision-making. Meanwhile, clinics are adopting streamlined, cloud-based tools to manage patient records and extend virtual care services. The sector’s emphasis on quality improvement, operational efficiency, and digital integration solidifies its central role in market demand.

Diagnostic and imaging centers represent a rapidly expanding end-user group, supported by advancements in imaging technologies, data-rich modalities, and AI-powered diagnostic tools. These centers rely heavily on informatics systems for image storage, retrieval, and integration with clinical workflows. As imaging volumes increase and precision diagnostics gain prominence, informatics solutions become essential for managing large datasets, reducing reporting turnaround times, and improving diagnostic accuracy. Growth is further enhanced by rising demand for outpatient imaging and remote radiology services.

By Function Analysis

Healthcare analytics is expected to lead this segmentation with a 38% share in 2025, reflecting the industry’s shift toward data-driven decision-making. Analytics platforms—covering descriptive, predictive, and prescriptive capabilities—enable providers to monitor performance, identify care gaps, and optimize resource usage. The focus on improving clinical outcomes, managing population health, and reducing operational inefficiencies further boosts adoption. As health systems gather increasing volumes of data, analytics becomes a crucial component of strategic planning and clinical intelligence.

Telehealth and telemedicine represent the fastest-growing function in the market, as digital-first care models continue to expand. Remote consultations, virtual triage, and continuous patient monitoring are becoming integral to modern healthcare delivery. Telehealth solutions offer improved access for rural and underserved populations, reduce hospital burden, and support chronic disease management. As consumers adopt virtual care and providers integrate remote models into standard practice, telehealth is rapidly strengthening its role in long-term healthcare strategies.

The Health Informatics Market Report is segmented on the basis of the following

By Component

- Hardware

- Medical devices

- Networking equipment

- Storage systems

- Software

- Electronic health records

- Clinical decision support systems

- Population health management platforms

- Telehealth software

- Healthcare analytics tools

- Services

- Consulting services

- Integration and implementation services

- Training and education services

- Support and maintenance services

By Application

- Clinical Informatics

- Nursing informatics

- Pharmacy informatics

- Laboratory informatics

- Radiology informatics

- Public health informatics

- Administrative Informatics

- Financial management

- Claims management

- Billing and coding

- Workflow optimization

- Research Informatics

- Clinical research data management

- Bioinformatics

- Genomic data analytics

By Deployment Mode

- On-Premise

- Cloud-Based

- Hybrid

By End User

- Hospitals & Clinics

- Large hospitals

- Ambulatory care centers

- Diagnostic & Imaging Centers

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Payers

- Private insurers

- Government health insurance bodies

By Function

- Health Information Exchange

- Data aggregation

- Patient information sharing

- Telehealth & Telemedicine

- Remote patient monitoring

- Virtual consultations

- Clinical Data Management

- Data capture

- Data integration

- Data quality management

- Healthcare Analytics

- Descriptive analytics

- Predictive analytics

- Prescriptive analytics

Regional Analysis

Leading Region in the Health Informatics Market

North America is projected to remain the leading region in the Health Informatics market by 2025, with an estimated share of 40%. The region’s dominance is anchored in its advanced healthcare infrastructure, strong government support for EHR adoption, and high investment in digital health technologies. Moreover, North America houses many of the world’s leading health informatics solution providers, and the regulatory environment (such as meaningful use incentives in the U.S.) has fostered early and deep adoption of informatics systems. These factors, combined with high healthcare spending and a strong culture of innovation, position North America as the primary driver of global market value.

Fastest Growing Region in the Health Informatics Market

The Asia-Pacific (APAC) region is expected to be the fastest growing market for Health Informatics. Rapid economic development, rising healthcare expenditure, large and aging populations, and increasing digital penetration are fueling demand. Countries like China, India, and Japan are investing heavily in health IT infrastructure, telehealth, and data analytics, making APAC a hotspot for informatics innovation and adoption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Health Informatics market is highly competitive, with major players such as Epic Systems, Cerner (Oracle Health), Allscripts, Athenahealth, and Philips driving innovation. These companies are investing in AI, cloud, and interoperability to stay ahead. Many are also forming partnerships with governments, healthcare providers, and research institutions to drive large-scale digital health deployments. In addition, new entrants—especially in the AI and analytics space—are challenging incumbents by offering more agile, data-centric solutions tailored to specific healthcare needs.

Some of the prominent players in the global Health Informatics are

- Epic Systems

- Cerner (Oracle Health)

- Allscripts (Altera Digital Health)

- Meditech

- Philips Healthcare

- GE HealthCare

- McKesson

- Optum

- IBM (Merative)

- Siemens Healthineers

- Athenahealth

- eClinicalWorks

- NextGen Healthcare

- Nuance Communications

- SAS Institute

- InterSystems

- Cognizant

- Dell Technologies

- Fujitsu

- Infosys

- Other Key Players

Recent Developments

- In June 2025, Intermountain Health made a strategic investment (via its venture arm, Intermountain Ventures) in Layer Health, a Boston-based AI company that does chart-review and clinical abstraction. Layer Health's platform uses large language models to analyze unstructured and structured clinical data from charts. Intermountain is also deploying Layer Health’s AI for registry reporting across several of its hospitals.

- In March 2025, Layer Health secured a USD 21 million Series A to expand its AI-driven chart review platform. The funding supports scaling its large-language-model technology, which interprets both structured and unstructured clinical data to automate quality reporting, registry abstraction, and research data extraction. The investment also enables broader deployment across health systems and strengthens partnerships in clinical and operational analytics.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 48.7 Bn |

| Forecast Value (2034) |

USD 144.8 Bn |

| CAGR (2025–2034) |

12.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 17.0 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Application (Clinical Informatics, Administrative Informatics, and Research Informatics), By Deployment Mode (On-Premise, Cloud-Based, and Hybrid), By End User (Hospitals & Clinics, Diagnostic & Imaging Centers, Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Payers), By Function (Health Information Exchange, Telehealth & Telemedicine, Clinical Data Management, and Healthcare Analytics) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Epic Systems, Cerner (Oracle Health), Allscripts (Altera Digital Health, Meditech, Philips Healthcare, GE HealthCare, McKesson, Optum, IBM, Siemens Healthineers, Athenahealth, eClinicalWorks, NextGen Healthcare, Nuance Communications, SAS Institute, InterSystems, Cognizant, Dell Technologies, Fujitsu, Infosys, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Health Informatics Market size is expected to reach a value of USD 48.7 billion in 2025 and is expected to reach USD 144.8 billion by the end of 2034.

North America is expected to have the largest market share in the Global Health Informatics Market, with a share of about 40.0% in 2025.

The Health Informatics Market in the US is expected to reach USD 17.0 billion in 2025.

Some of the major key players in the Global Health Informatics Market include IBM, Cerner, Epic Systems and others

The market is growing at a CAGR of 12.9 percent over the forecasted period.