Market Overview

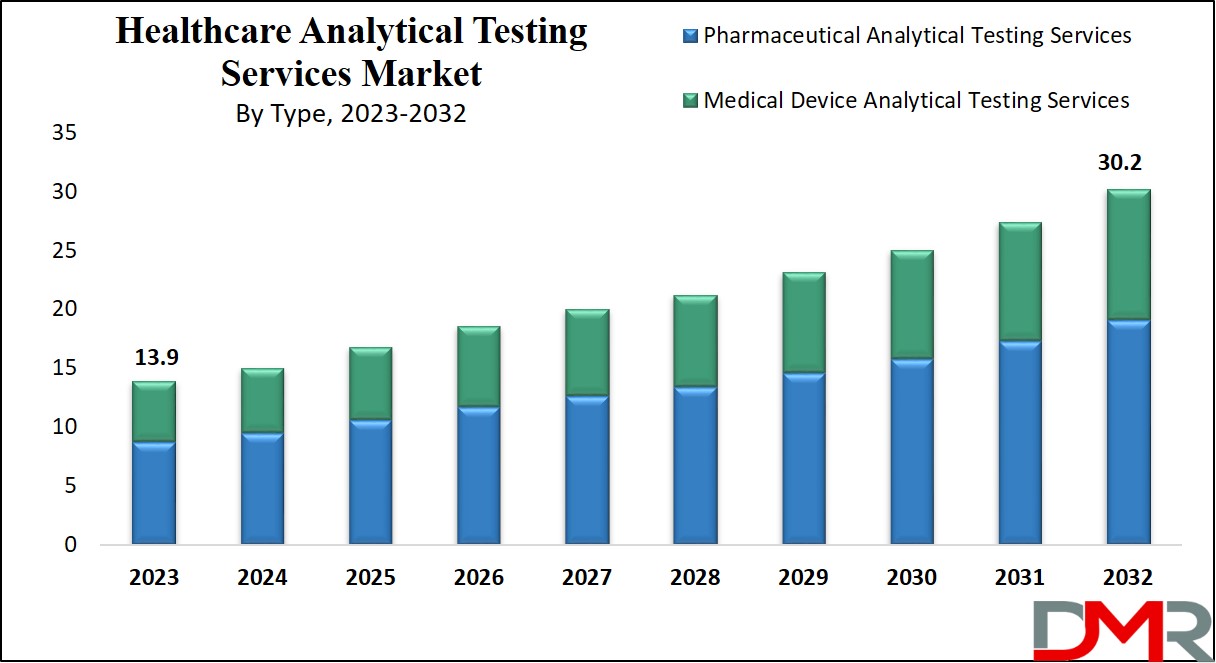

The Global Healthcare Analytics Testing Service Market will grow to USD 13.9 billion in 2023 and is predicted to show subsequent growth with a market value of USD 30.2 billion by the end of 2032 at a CAGR of 9.0%.

The term international healthcare analytics testing service market refers to the systematic use of facts and quantitative techniques, called healthcare analytics, to advantage insights into healthcare transport and machine performance. Testing offerings within this context represent the analytical and diagnostic offerings making sure the first-class, protection, and efficacy of healthcare products, along with prescribed drugs and clinical devices.

In other phrases, the global healthcare analytics checking out provider market is a dynamic region this is critical for informing selection-making, improving affected person care, and ensuring the safety and compliance of healthcare products on a global level.

Key drivers in the analytical testing offerings industry consist of a surge in pharmaceutical businesses outsourcing those services, a developing range of scientific trials necessitating analytical checking out, and an expanded consciousness of biosimilars.

Analytical testing plays a crucial role in establishing the physicochemical characterization necessary to demonstrate the “sameness” of biosimilars to their reference molecules during development. This critical function is expected to drive the demand for healthcare analytical testing services in the coming years.

For example, in March 2024, LGM Pharma announced a significant enhancement of its analytical testing services. The company expanded its capacity for CDMO by 50% and invested USD 2 million to advance its offerings. This initiative includes introducing new suppository manufacturing expertise, which is anticipated to bolster the market and meet the growing demand for comprehensive testing solutions.

Key Takeaways

- Strong Market Growth: The Global Healthcare Analytics Testing Service Market reached USD 13.9 billion in 2023 and is projected to grow to USD 30.2 billion by 2032, expanding at a CAGR of 9.0% driven by the rising adoption of data-driven decision-making and advanced healthcare solutions.

- Dominant Segment – Pharmaceutical Testing: Pharmaceutical analytical testing services accounted for 63.1% market share in 2023, supported by increasing drug development, biosimilars, and stringent quality and safety regulations, making this the largest and fastest-growing segment.

- Key Growth Drivers: Outsourcing by pharmaceutical companies, increasing clinical trials, demand for biosimilar testing, adoption of electronic health records (EHRs), and the integration of AI and machine learning into analytics are fueling market expansion.

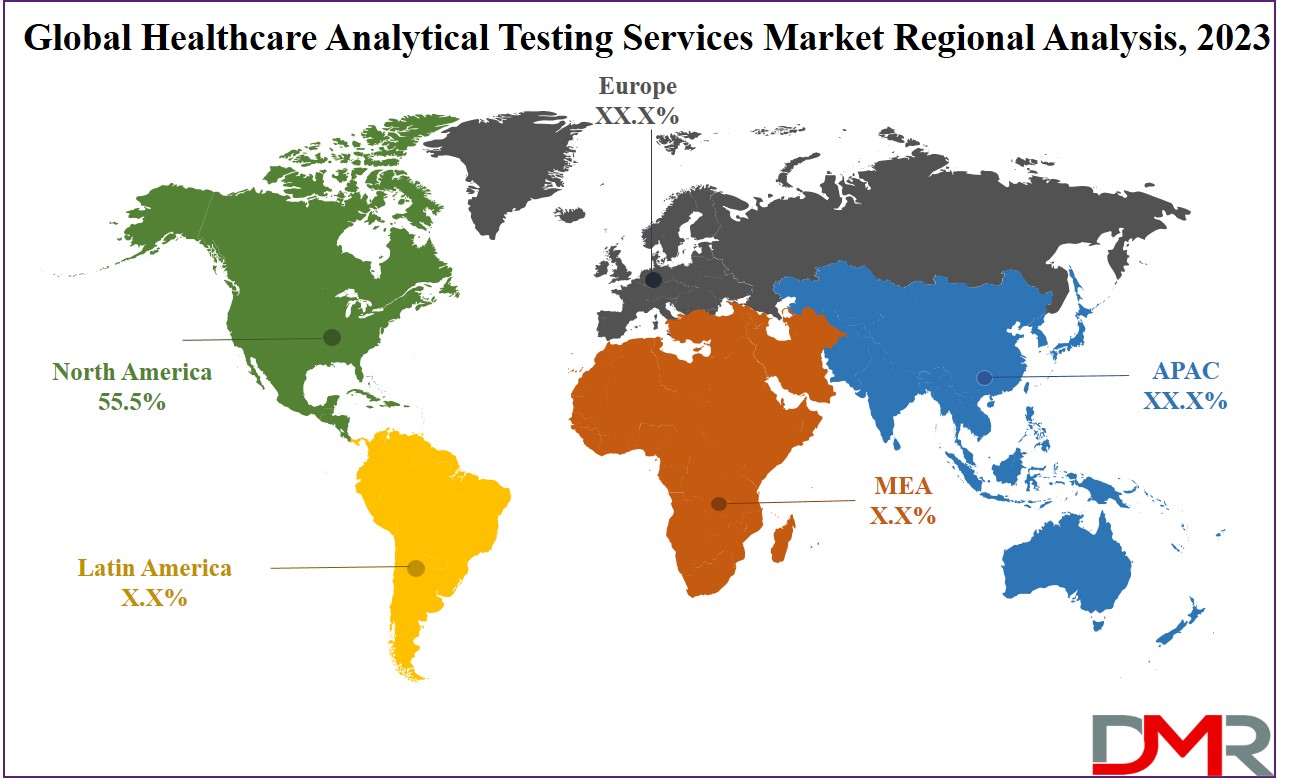

- Regional Leadership – North America: North America led the market with 55.5% share in 2023, supported by advanced healthcare infrastructure, strong R&D activity, and strategic collaborations between testing service providers and pharmaceutical/biotech firms.

- Emerging Opportunities: Expanding telehealth, remote patient monitoring, precision medicine, and interoperability initiatives present significant opportunities for testing services, especially in Asia-Pacific and other emerging healthcare markets.

Use Cases

- Biosimilar Development: Analytical testing services are essential in demonstrating the similarity of biosimilars to reference drugs by providing detailed physicochemical characterization, ensuring safety, efficacy, and regulatory compliance.

- Clinical Trial Support: Healthcare analytics testing enables accurate bioanalytical testing during clinical trials, helping pharmaceutical companies validate new drugs, monitor patient responses, and meet international approval standards.

- Medical Device Validation: Testing services such as extractables & leachables, sterility, and bioburden testing ensure that medical devices meet safety, durability, and regulatory requirements before entering the market.

- Population Health Management: By leveraging analytics testing, healthcare providers can identify disease trends, evaluate treatment outcomes, and design targeted interventions, improving patient care while reducing costs.

- Precision Medicine & Genomics: Advanced analytics testing supports personalized treatment strategies by validating genomic data, enabling accurate diagnostics, and guiding the development of tailored therapies.

Market Dynamic

The global healthcare analytics checking-out market is characterized through numerous dynamic elements that considerably have an effect on its boom which includes the growing emphasis on statistics-driven decision-making in healthcare companies, pushed by way of the combination of analytics testing for extracting significant insights. The sizeable adoption of digital fitness data contributes to market increase, allowing vendors to research patient facts for greater knowledge of healthcare transport.

The growing cognizance of populace fitness management drives the call for analytics testing to identify tendencies and put into effect focused interventions. Real-time analytics trying out is at the upward thrust, enabling timely decision-making and tracking of affected person situations.

The complexity of healthcare records, integration of

artificial intelligence and system studying, and regulatory pressures, which include compliance with records privacy rules, shape the marketplace landscape. The shift in the direction of price-based care fashions emphasizes the role of analytics testing in measuring and improving care exceptional.

The call for trying out services is immediately correlated with the upward thrust in improvements and the development of the latest merchandise. Outsourcing has seen an uptick due to concerns related to pricing, time-to-market efficiency, and competitive pressures within the pharmaceutical area. The development of biosimilars, combination products, and other modern drugs has similarly amplified the need for particular styles of exams.

This industry's momentum is fashioned with the aid of these elements, reflecting the dynamic landscape driven by the pharmaceutical area's evolving demands and the vital for efficient and specialized analytical checking out offerings.

Driving Factors

The primary factor driving the Healthcare Analytics Testing Service Market is increasing adoption of data-driven decision making in healthcare. As pressure to improve patient outcomes and operational efficiencies grows, healthcare providers are turning to advanced analytics to gain actionable insights and uncover meaningful findings.

As chronic diseases &

chronic disease management increase and value-based care models become more widely adopted, predictive and prescriptive analytics become ever more essential. Government mandates encouraging electronic health records (EHRs) have produced vast quantities of data, further driving demand for analytics services. All these factors combined have resulted in the rapid expansion of testing services to verify and ensure accuracy and efficacy in healthcare analytics solutions.

Trending Factors

A prominent trend in the Healthcare Analytics Testing Service Market is the increasing usage of artificial intelligence (AI) and

machine learning (ML) technologies. AI-powered analytics tools are helping healthcare organizations process and interpret complex healthcare data more quickly and accurately for personalized care and early diagnosis, with real time insights for personalized care or early diagnosis available real time.

Furthermore, interoperability initiatives have resulted in the creation of analytics platforms which seamlessly connect to various healthcare systems while blockchain technology's ability to ensure data security and transparency is gaining traction changing how healthcare organizations test, validate, deploy solutions in order to achieve improved patient outcomes.

Restraining Factors

One major barrier in Healthcare Analytics Testing Service Market is the high costs associated with implementing and maintaining advanced analytics solutions. Small- and mid-sized healthcare providers frequently face budgetary constraints that impede their ability to utilize testing services. Furthermore, data privacy and security issues present additional difficulties, given the stringent compliance standards in healthcare.

Resistance from healthcare professionals unfamiliar with analytics solutions further limits adoption, while legacy system integration issues create further obstacles to widespread implementation of testing services in healthcare analytics domain.

Opportunity

The Healthcare Analytics Testing Service Market presents numerous opportunities in terms of expanding telehealth and remote patient monitoring systems. As virtual care becomes an essential component of modern healthcare, analytics solutions can optimize remote diagnostics and patient engagement strategies. Emerging healthcare markets with expanding infrastructure hold immense promise, as healthcare providers adopt analytics solutions to overcome resource limitations.

As genomic and precision medicine continue to expand, analytics testing services present opportunities to support personalized treatment plans. Collaborations between analytics providers and healthcare organizations to co-develop tailored solutions further extend growth potential in this ever-evolving market.

Research Scope and Analysis

By Type

In terms of type, pharmaceutical analytical testing services dominate this section because it holds 63.1% in 2023 and is projected to show subsequent growth in the upcoming period of 2023 to 2032. Pharmaceutical analytical testing services' dominance in this segment can be attributed to their importance for ensuring the excellent, protection, and efficacy of pharmaceutical products for the duration of their shelf life.

Bioanalytical testing includes quantifying capsules and their metabolites in organic matrices to understand pharmacokinetics and pharmacodynamics. Method development and validation establish analytical techniques for assessing product excellent and determining their attention, purity, and stability. Stability checking out evaluates merchandise underneath extraordinary situations, guiding shelf life and garage pointers.

The expanding pharmaceutical enterprise heightens the need for analytical testing offerings from uncooked fabric suppliers to manufacturers, making sure pleasant and compliant throughout the supply chain. Ongoing improvements in drug improvement, biopharmaceuticals, and formulations create a non-stop demand for analytical testing offerings, as each new product has to undergo rigorous testing to fulfill regulatory standards and ensure patient safety.

The market is shaped through stringent regulatory requirements, specifically from groups like the FDA and EMA, emphasizing the need for sturdy analytical checking out to satisfy protection and efficacy standards. Outsourcing analytical testing is a prominent fashion, permitting pharmaceutical corporations to attention to middle talents.

Technological improvements, which include excessive-performance liquid chromatography and mass spectrometry, decorate precision. Globalization of clinical trials will increase the call for standardized checking-out services with a global presence. Data integrity, accuracy, and traceability are paramount, ensuring reproducibility in pharmaceutical studies.

The Healthcare Analytical Testing Services Market Report is segmented on the basis of the following

By Type

Pharmaceutical Analytical Testing Services

- Bioanalytical Testing

- Method Development & Validation

- Stability Testing

- Others

Medical Device Analytical Testing Services

- Extractables & Leachable

- Material characterization

- Physical Testing

- Bioburden Testing

- Sterility Testing

- Others

Regional Analysis

North America has historically held a prominent position in the healthcare analytical testing services market as it

holds 55.5% of the market share in 2023 and is expected to show subsequent growth in the forthcoming period of 2023 to 2032.

The growth in this market is driven by several factors driven by several key factors. In this vicinity, especially the US and Canada, benefit from their nicely evolved and superior healthcare infrastructure, fostering a strong call for analytical testing services. The area's ideal surroundings as a studies and development hub contribute to its continuous innovation in drugs, biologics, and scientific gadgets, riding the demand for analytical checking out offerings to evaluate product pleasant and safety.

Strategic alliances and partnerships between North American analytical trying out carrier carriers and pharmaceutical or biotechnology companies play a pivotal position in increasing provider offerings and geographic attain.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The worldwide healthcare analytical testing services market features an aggressive landscape characterized by key gamers including Eurofins Scientific, SGS SA, Charles River Laboratories International, WuXi AppTec, and Laboratory Corporation of America Holdings (LabCorp). These organizations provide a huge variety of checking out answers for the pharmaceutical and healthcare sectors. Contract Research Organizations (CROs) are critical individuals to this market as they're offering bioanalytical testing, scientific trials, and regulatory guides.

The aggressive scenario is marked by the sizeable worldwide presence of key players, emphasizing the global scale of healthcare analytical testing services. Strategic collaborations and acquisitions are everyday techniques hired by market contributors to decorate carrier portfolios, amplify geographic attain, and bolster technical abilities.

Innovations in analytical technologies and methodologies are the main target of companies that seek to retain a competitive market, as innovations help improve testing service effectiveness by increasing their accuracy. In this highly-regulated sector, regulatory compliance is of critical importance and strict adherence to standards represents a measure of competitiveness.

Some of the prominent players in the Global Healthcare Analytical Testing Market are

- Element Materials Technology

- Eurofins Scientific

- PPD Inc.

- Source BioScience

- Intertek Group plc

- Laboratory Corporation of America Holdings

- Charles River Laboratories

- Medpace

- WuXi AppTec

- IQVIA

- SGS Société Générale de Surveillance SA

- Intertek Group plc

- Syneos Health.

- ICON plc

- PPD Inc.

- Other Key Players

Recent Development

- In July 2022, LabCorp that's a US-primarily based enterprise formed a partnership with MD Anderson Cancer Center Foundation to accelerate discoveries and improvement of cancer treatments globally. This is likewise aimed at fulfilling the developing demand for and getting entry to early-segment oncology medical trials in the course of Spain.

- In March 2022, WuXi Advanced Therapies launched Tetracycline-Enabled Self-Silencing Adenovirus (TESSA) to ensure stable gene therapy production is integrated with intricate testing capabilities to develop more advanced testing methods.

- In July 2022, Silver State Analytical & Excelchem acquired SGS for the expansion of their environmental testing capabilities in the United States.

- In March 2022, Symphogen formed a collaboration with Thermo Fisher for development and advancements in biopharmaceutical discovery with innovative tools.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 13.9 Bn |

| Forecast Value (2032) |

USD 30.2 Bn |

| CAGR (2023-2032) |

9.0% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Pharmaceutical Analytical Testing Services and Medical Device Analytical Testing Services) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Element Materials Technology, Eurofins Scientific, PPD Inc., Source BioScience, Intertek Group plc, Laboratory Corporation of America Holdings, Charles River Laboratories, Medpace, WuXi AppTec, IQVIA, SGS Société Générale de Surveillance SA, Intertek Group plc, Syneos Health., ICON plc, PPD Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global healthcare analytical testing services market size accounted for USD 114.8 billion in 2023 and

it is expected to reach around USD 204.8 billion by 2032.

The CAGR of the global healthcare analytical testing services market is 9.0%.

The prominent players operating in the global healthcare analytical testing services market are Element

Materials Technology, Eurofins Scientific, PPD Inc., Source BioScience and others.

North America will lead the global healthcare analytical testing services market as it holds 55.5% of the

market share in 2023.