Market Overview

The global healthcare asset management market is projected to reach USD 34.3 billion in 2025 and is expected to grow significantly, hitting USD 284.7 billion by 2034, registering a CAGR of 26.5%. This growth is driven by rising demand for real-time location systems (RTLS), RFID-enabled tracking solutions, and efficient medical equipment management across hospitals and healthcare facilities.

Healthcare asset management refers to the systematic approach used by healthcare organizations to monitor, track, and manage physical assets such as medical equipment, surgical tools, patient beds, and staff resources throughout their lifecycle. This involves the integration of advanced technologies like RFID, real-time location systems, IoT sensors, and barcoding systems to ensure the optimal utilization, safety, and availability of these assets.

The goal is to reduce operational inefficiencies, minimize equipment downtime, prevent loss or theft, and improve overall patient care quality. With growing pressure on healthcare facilities to streamline operations, reduce costs, and enhance patient outcomes, effective asset tracking and inventory management have become crucial components of modern healthcare systems.

The global healthcare asset management market is witnessing rapid growth due to increasing demand for real-time tracking solutions, rising cases of equipment misplacement, and the rising adoption of digital health infrastructure.

Hospitals, clinics, and pharmaceutical companies are increasingly deploying RFID-based solutions, wireless tracking technologies, and software platforms to optimize asset usage and ensure regulatory compliance. This transformation is further supported by the rise of smart hospitals, where automated systems enhance visibility and control over critical assets in real time, significantly boosting operational efficiency and patient safety.

Moreover, the market is also being driven by a surge in healthcare spending, a growing focus on reducing capital expenditure through better resource management, and the rising adoption of cloud-based asset tracking platforms.

In developing regions, especially across the Asia Pacific and Latin America, the market is experiencing accelerated adoption due to rapid healthcare infrastructure development and government investments in digital health technologies. As the complexity of healthcare systems grows, the need for integrated asset lifecycle management platforms will continue to rise, fueling sustained demand across both public and private healthcare sectors.

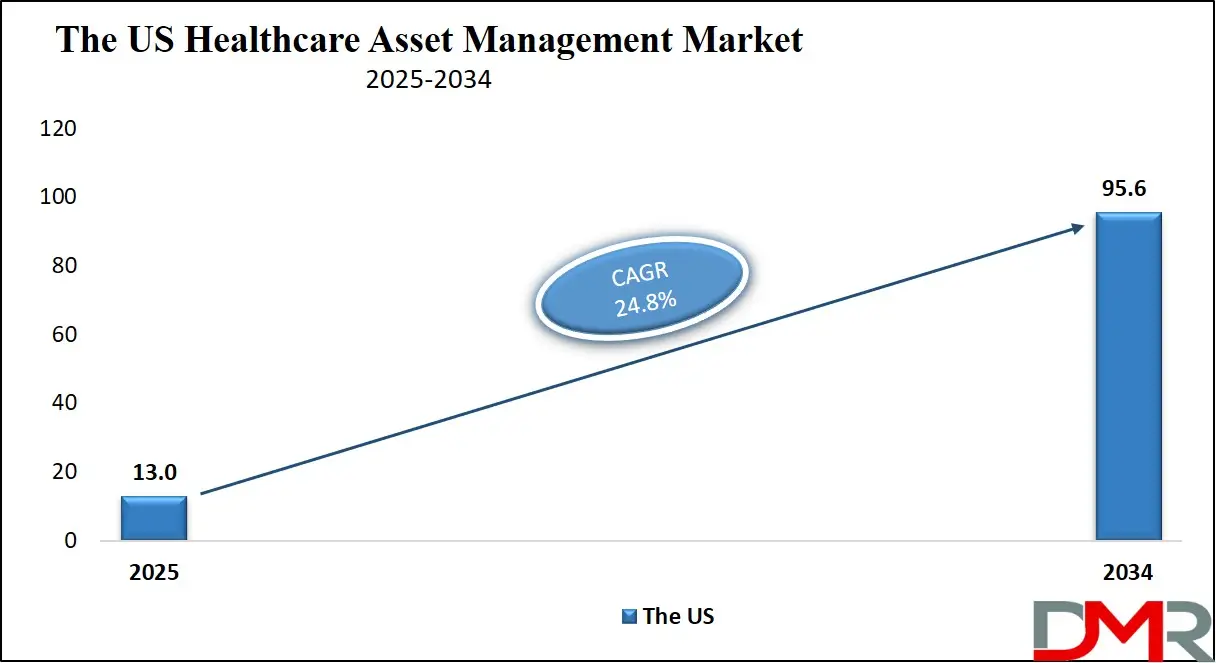

The US Healthcare Asset Management Market

The U.S. Healthcare Asset Management market size is projected to be valued at USD 13.0 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 95.6 billion in 2034 at a CAGR of 24.8%.

The US healthcare asset management market is one of the most mature and technologically advanced segments globally, driven by the increasing need to optimize hospital workflows, reduce equipment loss, and enhance patient safety. The widespread adoption of RFID systems, real-time location services (RTLS), and inventory control software in healthcare settings has transformed asset visibility and utilization in real-time.

Hospitals and large healthcare networks in the US are heavily investing in asset tracking platforms to manage high-value medical equipment, monitor patient movements, and streamline supply chain operations. These technologies not only minimize operational inefficiencies but also support regulatory compliance, improve resource allocation, and enable predictive maintenance strategies.

Additionally, the US market benefits from strong federal initiatives promoting digital health transformation and the integration of Internet of Things (IoT) technologies in clinical environments. The rise of smart hospitals, integrated with the increasing demand for centralized asset repositories and electronic health records (EHR) integration, is fueling the demand for intelligent healthcare asset management solutions.

Key players are focusing on cloud-based tracking systems, AI-driven analytics, and automation tools that support scalability and data-driven decision-making. With a high concentration of top-tier hospitals, healthcare providers, and pharmaceutical companies, the US continues to set the pace for innovation and adoption in the healthcare asset monitoring landscape.

Europe Healthcare Asset Management Market

The European healthcare asset management market is projected to reach approximately USD 7.5 billion in 2025. This growth reflects the region’s strong emphasis on healthcare digitization, patient safety, and efficient resource utilization. European healthcare providers are increasingly adopting RFID-based tracking systems and real-time location solutions (RTLS) to streamline equipment management, minimize loss or theft, and improve operational productivity.

Countries such as Germany, France, and the UK are at the forefront of deploying these technologies, driven by stringent regulatory frameworks, rising demand for quality healthcare services, and pressure to control hospital costs.

With a projected CAGR of 22.8% through 2034, Europe is poised for sustained growth in this sector. The expansion is supported by growing investments in smart hospital infrastructure, aging populations requiring more personalized care, and the integration of AI and IoT within hospital operations.

Additionally, public and private healthcare institutions are increasingly focused on automating inventory and asset workflows to enhance patient outcomes and reduce manual inefficiencies. The region’s mature healthcare ecosystem, combined with favorable government policies and funding initiatives, continues to create fertile ground for scalable and innovative asset management solutions across Europe.

Japan Healthcare Asset Management Market

Japan’s healthcare asset management market is estimated to reach USD 1.5 billion in 2025. This growth is fueled by Japan’s advanced healthcare infrastructure, widespread adoption of automation technologies, and a strong focus on operational efficiency within hospitals and eldercare facilities.

Japanese healthcare institutions are increasingly turning to RFID and RTLS systems to manage high-value medical equipment, streamline inventory control, and improve patient care workflows. The country’s rapidly aging population is placing significant pressure on healthcare resources, prompting hospitals to adopt intelligent asset tracking solutions to optimize utilization and reduce unnecessary expenditures.

With a projected CAGR of 19.5% from 2025 to 2034, Japan's healthcare asset management market is expected to expand steadily, driven by both technological innovation and demographic needs. The government’s commitment to smart hospital development and digitization of healthcare services is further accelerating the demand for real-time tracking, predictive maintenance, and automated workflow solutions.

Japanese manufacturers and tech firms are also playing a key role in shaping the local ecosystem through the development of integrated asset management platforms, tailored to the unique needs of Japan’s healthcare sector. As hospitals continue to modernize and implement IoT-enabled solutions, the market is set to witness substantial growth in both urban and regional medical institutions.

Global Healthcare Asset Management Market: Key Takeaways

- Market Value: The global healthcare asset management market size is expected to reach a value of USD 284.7 billion by 2034 from a base value of USD 34.3 billion in 2025 at a CAGR of 26.5%.

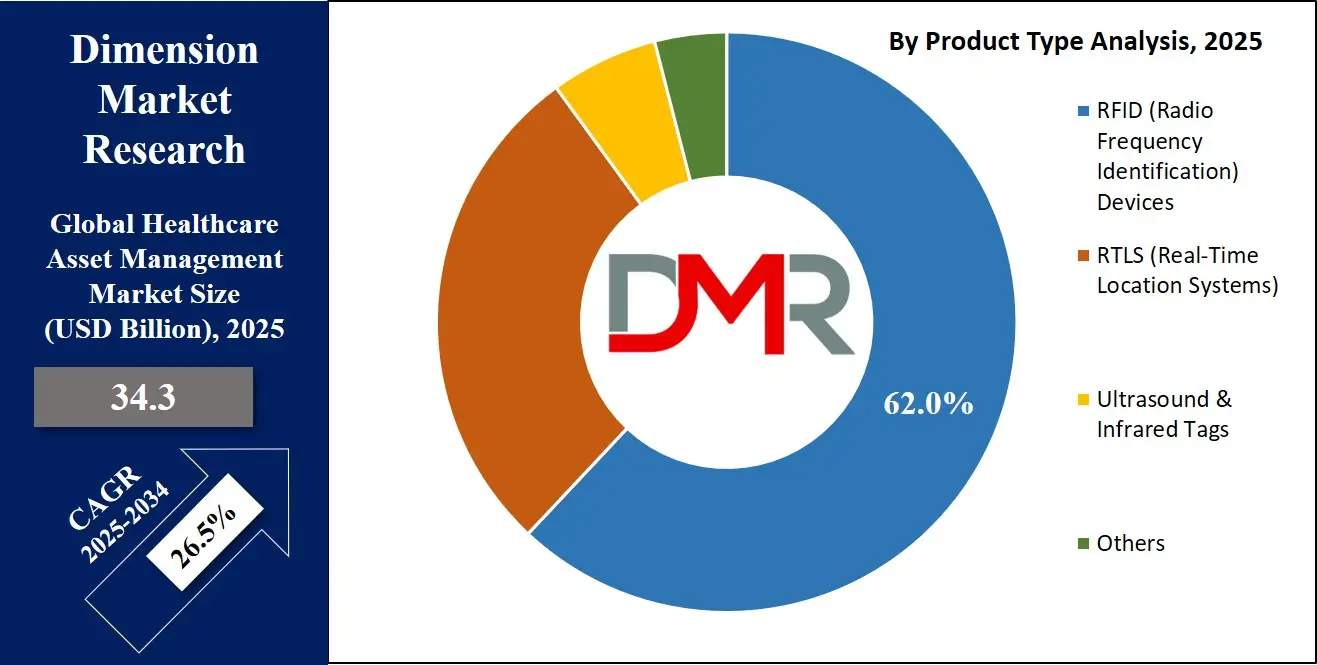

- By Product Type Segment Analysis: RFID (Radio Frequency Identification) Devices are anticipated to dominate the product type segment, capturing 62.0% of the total market share in 2025.

- By Technology Segment Analysis: RFID-Based Systems are expected to consolidate their position in the technology segment, capturing 62.0% of the market share in 2025.

- By Application Segment Analysis: Hospital Asset Tracking will account for the maximum share in the application segment, capturing 48.0% of the total market value.

- By End-User Segment Analysis: Hospitals & Clinics are expected to consolidate their dominance in the end-user segment, capturing 66.0% of the market share in 2025.

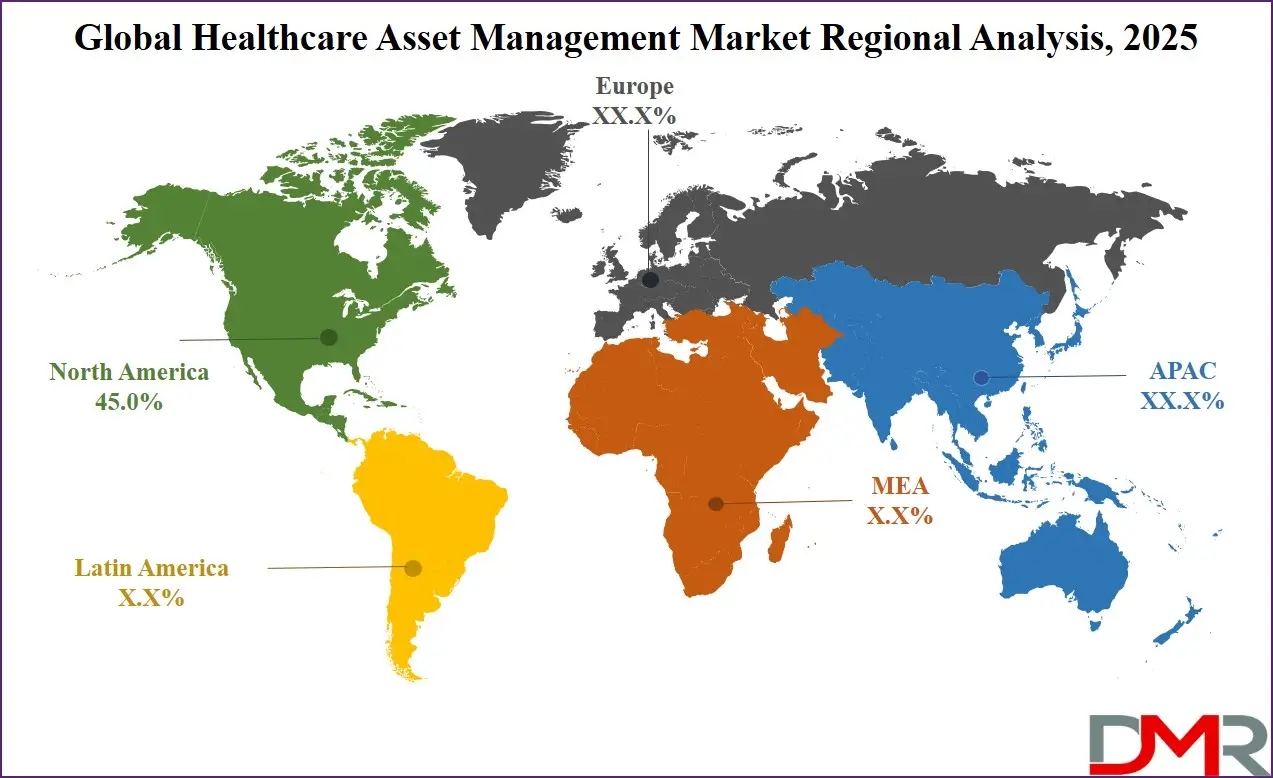

- Regional Analysis: North America is anticipated to lead the global healthcare asset management market landscape with 45.0% of total global market revenue in 2025.

- Key Players: Some key players in the global healthcare asset management market are GE HealthCare Technologies Inc., Zebra Technologies Corporation, Stanley Healthcare (Securitas AB), IBM Corporation, Oracle Corporation, Sonitor Technologies, CenTrak Inc. (Halma plc), Airista Flow Inc., Impinj Inc., STANLEY Healthcare (Stanley Black & Decker), ThingMagic (Trimble Inc.), Awarepoint Corporation, Intelligent InSites (Infor), JADAK (Novanta Inc.), Ekahau Inc., Identiv Inc., and Others.

Global Healthcare Asset Management Market: Use Cases

- Real-Time Tracking of Medical Equipment in Hospitals: One of the most prominent use cases in healthcare asset management is the real-time tracking of medical equipment such as infusion pumps, defibrillators, ventilators, and portable diagnostic devices. Using technologies like RFID tags and Real-Time Location Systems (RTLS), hospitals can monitor the precise location of these assets throughout their facilities. This significantly reduces time spent by clinical staff searching for equipment, improves asset utilization rates, and minimizes redundant purchases. Additionally, real-time equipment tracking enhances maintenance scheduling and reduces equipment downtime, leading to improved patient care delivery. As hospitals become increasingly complex, real-time visibility into medical assets is crucial for operational efficiency, patient safety, and compliance with healthcare regulations.

- Patient Flow Optimization and Safety Monitoring: Healthcare asset management platforms also play a vital role in optimizing patient flow and ensuring patient safety. By equipping patients with RFID-enabled wristbands or Bluetooth Low Energy (BLE) tags, hospitals can monitor patient movement across departments such as emergency, radiology, ICU, and operating rooms. This data allows healthcare providers to identify and eliminate workflow bottlenecks, reduce patient wait times, and enhance the coordination of care teams. In addition, patient tracking systems can help prevent incidents such as patient elopement, wandering in dementia wards, or incorrect patient routing. These tools support care quality improvement initiatives and facilitate regulatory reporting, particularly in high-acuity care settings.

- Inventory and Supply Chain Management in Pharmacies: Pharmaceutical inventory tracking is another key use case for healthcare asset management, particularly in large hospitals, retail pharmacies, and distribution centers. Using IoT-enabled sensors, barcode scanners, and RFID solutions, healthcare providers can track medications, vaccines, and medical supplies in real time. This helps ensure proper inventory levels, prevent stockouts, and minimize expired drug wastage. Automated alerts for cold chain breaches are especially valuable in vaccine management and temperature-sensitive drug storage. Moreover, integrated inventory management systems enable compliance with pharmaceutical regulations such as FDA 21 CFR Part 11 and DSCSA by providing accurate, auditable records of medication movement and access.

- Staff Location and Workflow Automation in Smart Hospitals: In modern smart hospitals, healthcare asset management platforms are also used to monitor and optimize clinical staff workflows. RTLS and BLE tags attached to staff ID badges enable the tracking of personnel movement, time spent with patients, and response times to critical alarms. This data provides actionable insights for nurse call response optimization, infection control audits, and labor resource planning. Automated workflow tools can trigger alerts when a caregiver enters or exits a patient room, document hand hygiene compliance, or manage shift transitions. In high-stress environments such as emergency departments and intensive care units, efficient staff allocation through real-time analytics significantly improves patient outcomes and reduces burnout among healthcare workers.

Impact of Artificial Intelligence on Healthcare Asset Management Market

Artificial Intelligence (AI) is significantly reshaping the healthcare asset management market by introducing intelligent automation, predictive analytics, and data-driven decision-making across asset tracking, utilization, and maintenance. Traditional systems focused primarily on locating equipment or tracking inventory, but with AI integration, healthcare organizations can now proactively manage their assets with greater precision and foresight.

AI algorithms analyze vast datasets from RFID tags, IoT sensors, and RTLS systems to forecast asset demand, detect anomalies, and recommend optimal usage patterns. This leads to improved equipment availability, reduced operational costs, and enhanced patient care outcomes.

AI also enables predictive maintenance by continuously monitoring asset performance data to anticipate failures before they occur. For instance, machine learning models can assess usage cycles, environmental conditions, and historical performance of medical devices to predict maintenance schedules, thereby avoiding unexpected downtime and costly repairs.

Furthermore, AI-powered dashboards help hospital administrators identify inefficiencies, optimize staff deployment, and streamline supply chain logistics. In high-volume environments such as emergency departments or surgical units, AI ensures critical assets are always accessible when needed.

As healthcare systems globally push toward digital transformation, the integration of AI in asset management is expected to become a key competitive differentiator, driving real-time insights, operational excellence, and patient-centric care.

Global Healthcare Asset Management Market: Stats & Facts

CMS (U.S. Centers for Medicare & Medicaid Services)

- In 2023, hospital expenditures in the U.S. reached USD 1,519.7 billion, reflecting a 10.4% rise from 2022.

- Hospital care accounted for 31% of national health spending in 2023.

- National health expenditure is projected to reach USD 7.2 trillion by 2031, growing at an average annual rate of 5.5%.

- Medicare spending is projected to grow from USD 1 trillion in 2023 to USD 1.7 trillion by 2031.

- Medicaid spending is expected to rise from USD 805 billion in 2023 to USD 1.2 trillion by 2031.

AMA (American Medical Association)

- Total U.S. healthcare spending in 2023 was USD 4.9 trillion, approximately USD 14,570 per person.

- Healthcare spending accounted for 17.6% of U.S. GDP in 2023.

- Physician services saw a 5.2% spending growth in 2023, up from 4.1% in 2022.

- Healthcare inflation remained above 3.7% in 2024, with operational costs driving digital adoption.

- Telehealth usage remained steady in 2023, with 35% of physicians integrating remote monitoring tools.

KFF (Kaiser Family Foundation)

- Hospitals remained the largest spending category, absorbing 31% of total U.S. health expenditures in 2023.

- Employer-sponsored insurance premiums grew by 7% in 2023, accelerating hospital tech adoption.

- Digital records and EHR usage were adopted by 96% of hospitals as of 2024.

- Medical device prices increased 2.1% YoY in 2024, highlighting rising cost pressures in hospital asset procurement.

U.S. National Health Spending Projections

- National healthcare spending is projected to grow at 5.6% annually from 2023 to 2032.

- Total health expenditures will exceed USD 7.1 trillion by 2032, with hospitals representing the largest share.

- From 2025 to 2030, digital transformation investments are expected to exceed USD 300 billion.

- Real-time asset tracking technologies will be installed in over 80% of hospitals by 2030.

NHS (UK National Health Service)

- The UK digital health overhaul is projected to cost £21 billion over 5 years, starting in 2025.

- As of 2023, 94% of NHS trusts had integrated digital patient records.

- Hospital IT infrastructure spending in the UK grew by 8.6% in 2024, reflecting asset modernization.

- Over 68% of NHS hospitals reported deploying RFID for internal logistics as of 2024.

- Patient waiting time reduction programs led to £1.3 billion savings in operational efficiencies in 2023–2024.

European Commission / Digital Decade Indicators

- The EU-27’s composite eHealth implementation score improved from 79% in 2023 to 83% in 2024.

- By the end of 2025, all EU citizens are expected to have cross-border access to electronic health records.

- Regulations under the European Health Data Space came into force in March 2025, pushing RFID and RTLS integration.

- Public hospitals in Europe are required to comply with mandatory asset traceability standards by 2026.

Global Healthcare Asset Management Market: Market Dynamics

Global Healthcare Asset Management Market: Driving Factors

Rising Demand for Real-Time Asset Visibility in Hospitals

The growing complexity of hospital operations has led to a surge in demand for real-time location systems (RTLS) and RFID-based tracking solutions. Hospitals face constant challenges managing a large inventory of high-value medical equipment, mobile devices, and patient-care assets. By implementing intelligent asset tracking systems, healthcare facilities can locate, allocate, and manage resources more efficiently, reducing equipment search times and improving overall clinical productivity. This need for real-time visibility is one of the most powerful drivers of asset digitization in modern healthcare systems.

Increasing Focus on Cost Containment and Operational Efficiency

With rising healthcare expenditures and shrinking margins, hospitals and health systems are under pressure to reduce unnecessary capital spending and eliminate asset redundancy. Asset management platforms using IoT sensors and data analytics allow providers to monitor asset utilization rates, avoid over-purchasing, and schedule preventative maintenance. This optimization reduces total cost of ownership (TCO) and enhances return on investment (ROI), making healthcare asset management a strategic tool for financial sustainability.

Global Healthcare Asset Management Market: Restraints

High Implementation Costs and Complex Integration

Despite the long-term benefits, the initial cost of deploying healthcare asset management solutions can be a major barrier for small to mid-sized healthcare providers. Expenses related to RFID tagging, RTLS infrastructure, software licensing, and IT integration can be substantial. Additionally, integrating asset tracking platforms with existing hospital information systems (HIS), EHRs, and inventory systems may require extensive customization and technical expertise, slowing adoption in resource-constrained settings.

Data Security and Compliance Concerns

Healthcare asset tracking involves the collection and storage of sensitive information, including equipment usage, patient movement, and staff location data. This raises serious concerns regarding data privacy and regulatory compliance, especially under standards like HIPAA, GDPR, and local healthcare regulations. Without robust cybersecurity protocols and access control systems, healthcare institutions risk breaches that could result in legal penalties and damage to their reputation.

Global Healthcare Asset Management Market: Opportunities

Expansion of Smart Hospital Projects in Emerging Markets

Countries in Asia Pacific, Latin America, and the Middle East are heavily investing in healthcare infrastructure modernization. These smart hospital initiatives create fertile ground for the adoption of intelligent asset tracking, predictive analytics, and cloud-based inventory management systems. As digital health ecosystems mature, asset management platforms can become central to hospital automation and patient safety strategies, unlocking new market growth opportunities.

Growing Demand for AI-Powered Predictive Maintenance

The integration of artificial intelligence (AI) into asset management systems opens up new possibilities for predictive maintenance and real-time performance monitoring. Machine learning algorithms can analyze asset usage data to predict equipment failures, optimize servicing schedules, and reduce unplanned downtime. Healthcare facilities can extend the lifespan of their equipment and improve uptime, especially in mission-critical departments like ICU, surgery, and emergency care.

Global Healthcare Asset Management Market: Trends

Shift Toward Cloud-Based Asset Management Platforms

There is a noticeable transition from on-premise to cloud-based asset tracking solutions across healthcare networks. Cloud platforms offer scalability, remote access, automated updates, and reduced IT overhead, making them ideal for multi-facility hospital systems. This trend also supports centralized inventory monitoring and facilitates telehealth-related logistics by enabling real-time asset coordination across various locations.

Integration with Electronic Health Records (EHR) and Workflow Automation

An emerging trend is the integration of asset management systems with EHR platforms and hospital workflow tools. This allows for intelligent automation, such as triggering alerts when a device enters a patient’s room, logging equipment usage directly into the patient’s file, or notifying maintenance teams based on usage thresholds. These integrations enhance clinical accuracy, improve staff productivity, and support better resource allocation throughout the patient care continuum.

Global Healthcare Asset Management Market: Research Scope and Analysis

By Product Type Analysis

In the healthcare asset management market, RFID (Radio Frequency Identification) devices are expected to hold a dominant position within the product type segment, accounting for approximately 62.0% of the total market share in 2025. This dominance is driven by the widespread adoption of RFID technology across hospitals, clinics, and pharmaceutical environments for real-time asset tracking, equipment tagging, and inventory management.

RFID systems offer a cost-effective and scalable solution for tracking high-value medical assets, reducing equipment loss, automating workflows, and improving overall operational efficiency. Their ability to function without direct line-of-sight, along with their integration capabilities with hospital management systems, makes them especially valuable in fast-paced healthcare environments where time and resource optimization are critical.

Real-Time Location Systems (RTLS) also play a significant role in healthcare asset management, serving as a more advanced tracking technology that provides continuous, real-time visibility into the exact location of assets, patients, and personnel within a healthcare facility. RTLS uses a combination of Wi-Fi, Bluetooth Low Energy (BLE), infrared, or ultrasound technologies to offer high-precision tracking across hospital zones.

This enables healthcare providers to improve response times, reduce patient wait times, and increase staff productivity by eliminating manual tracking processes. RTLS is particularly useful in emergency departments, intensive care units, and surgical suites, where rapid access to essential equipment and real-time coordination among care teams are crucial. While more complex and cost-intensive than RFID, RTLS is gaining popularity in large-scale smart hospital initiatives aiming for complete digitization and workflow automation.

By Technology Analysis

RFID-based systems are projected to solidify their leadership in the technology segment of the healthcare asset management market, capturing around 62.0% of the total share in 2025. These systems are widely adopted due to their affordability, scalability, and ease of integration into existing hospital infrastructures. RFID technology enables healthcare providers to automate asset identification, monitor inventory levels, and track the movement of equipment and supplies without the need for direct human intervention.

The ability to read multiple tags simultaneously and without line-of-sight significantly improves efficiency in high-traffic healthcare environments. Hospitals and clinics rely on RFID systems to reduce equipment loss, prevent theft, and maintain real-time visibility into critical assets, contributing to better operational control and reduced overhead costs.

Wi-Fi-based Real-Time Location Systems (RTLS), on the other hand, are emerging as a valuable complement within the technology segment. These systems utilize a facility’s existing Wi-Fi network to track and locate tagged assets, staff, and even patients in real time. Wi-Fi RTLS is particularly advantageous in large hospitals and multi-facility healthcare networks where building an entirely new tracking infrastructure can be cost-prohibitive.

It enables precise location tracking, supports workflow automation, and enhances response times in critical departments such as emergency rooms and operating theaters. Although Wi-Fi RTLS may face limitations in signal interference and location accuracy compared to other RTLS technologies like ultrasound or infrared, its compatibility with existing IT infrastructure makes it an attractive option for healthcare providers seeking to modernize asset management without heavy capital investment.

By Application Analysis

Hospital asset tracking is expected to lead the application segment in the healthcare asset management market, capturing approximately 48.0% of the total market value in 2025. This dominance stems from the pressing need among hospitals to efficiently manage a wide range of physical assets, including surgical tools, diagnostic machines, wheelchairs, IV pumps, and mobile workstations.

By using technologies such as RFID tags and real-time location systems, hospitals can monitor the movement and availability of these assets in real time, reduce equipment misplacement, prevent loss, and enhance resource utilization.

The ability to locate essential medical equipment quickly not only saves valuable staff time but also improves patient care by ensuring timely access to critical tools. In high-pressure environments like emergency departments and intensive care units, asset tracking is crucial for maintaining operational continuity and reducing delays in treatment delivery.

Patient tracking is another important application within this market, providing healthcare providers with the ability to monitor the real-time location and status of patients throughout their care journey.

Using wearable RFID wristbands or Bluetooth tags, hospitals can follow patient movements from admission to discharge, helping to optimize room assignments, reduce wait times, and prevent unauthorized departures or elopement, especially in high-risk units such as behavioral health wards or neonatal care.

Patient tracking also supports infection control efforts by recording patient interactions and movement paths, which can be vital during disease outbreaks. In addition, it enables seamless coordination between departments, reducing transfer delays and improving overall care efficiency. As patient safety and care personalization become higher priorities, adoption of intelligent tracking solutions is expected to rise steadily.

By End User Analysis

Hospitals and clinics are projected to dominate the end-user segment of the healthcare asset management market, accounting for nearly 66.0% of the total market share in 2025. This strong position is attributed to the high volume and variety of assets managed within hospital environments, including medical devices, surgical instruments, patient beds, and mobile diagnostic tools.

Healthcare providers face increasing pressure to enhance operational efficiency, minimize equipment downtime, and improve patient care outcomes, all of which drive the adoption of RFID and RTLS-based asset tracking systems. These technologies enable real-time visibility of assets, reduce capital expenditures by avoiding unnecessary purchases, and streamline maintenance processes.

In addition, hospitals benefit from enhanced regulatory compliance, improved inventory control, and better allocation of clinical resources, especially in high-acuity departments like ICUs, operating rooms, and emergency units.

Pharmaceutical companies also represent a growing end-user segment within the healthcare asset management market. These organizations rely on advanced asset tracking solutions to monitor and manage valuable resources across R&D labs, manufacturing plants, and distribution centers. Asset management systems are used to track laboratory equipment, monitor temperature-sensitive drug inventories, and ensure chain-of-custody for high-value pharmaceuticals.

Compliance with stringent regulatory frameworks such as FDA and EMA guidelines necessitates accurate documentation and real-time tracking of raw materials and finished goods. RFID and IoT-enabled sensors also support cold chain monitoring for biologics and vaccines, helping to maintain product integrity from production to delivery. As pharmaceutical operations grow in scale and complexity, the demand for intelligent asset management solutions that ensure safety, traceability, and efficiency is expected to accelerate.

The Healthcare Asset Management Market Report is segmented based on the following:

By Product Type

- RFID (Radio Frequency Identification) Devices

- RTLS (Real-Time Location Systems)

- Ultrasound & Infrared Tags

- Others

By Technology

- RFID-Based Systems

- Wi-Fi-Based RTLS

- Bluetooth Low Energy (BLE)

- Ultrasound & Infrared

- ZigBee, GPS & Others

By Application

- Hospital Asset Tracking

- Patient Tracking

- Pharmaceutical Tracking

- Staff Tracking

- Others

By End User

- Hospitals & Clinics

- Pharmaceutical Companies

- Biotechnology Firms

- Ambulatory Surgical Centers

- Others

Global Healthcare Asset Management Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominate the global healthcare asset management market in 2025, accounting for approximately 45.0% of total market revenue. This leadership is driven by the region’s advanced healthcare infrastructure, widespread adoption of RFID and real-time location systems, and strong regulatory frameworks supporting digital transformation in healthcare.

Hospitals and health systems in the United States and Canada are early adopters of asset tracking technologies aimed at improving operational efficiency, reducing equipment loss, and enhancing patient care. Additionally, the presence of leading technology providers, significant healthcare spending, and continuous investments in smart hospital initiatives further strengthen North America's position as the primary contributor to global market growth.

Region with significant growth

The Asia Pacific region is expected to witness the most significant growth in the healthcare asset management market over the coming years, driven by rapid healthcare infrastructure development, increasing investments in smart hospital projects, and rising demand for advanced medical technologies across emerging economies like China, India, and Southeast Asia.

Governments in the region are prioritizing healthcare modernization, leading to higher adoption of RFID, IoT-based asset tracking, and real-time location systems in both public and private healthcare facilities.

Additionally, a growing middle-class population, rising healthcare expenditure, and the expansion of private hospital chains are creating favorable conditions for the widespread deployment of asset management solutions. As cost-effective technologies become more accessible, Asia Pacific is poised to become a key growth engine for the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Healthcare Asset Management Market: Competitive Landscape

The global competitive landscape of the healthcare asset management market is characterized by the presence of several well-established players alongside a growing number of innovative startups, all striving to capture market share through technological advancements and strategic partnerships.

Key companies such as GE HealthCare, Zebra Technologies, IBM, Oracle, CenTrak, and Stanley Healthcare are leading the market with comprehensive RFID and RTLS-based solutions tailored for hospitals, pharmaceutical companies, and laboratories.

These players are focused on integrating AI, cloud computing, and IoT into their platforms to enhance real-time tracking, predictive maintenance, and workflow automation. At the same time, emerging vendors are introducing niche, cost-effective solutions to cater to small- and mid-sized healthcare providers.

Mergers, acquisitions, and regional expansions are also shaping the competitive dynamics, with firms aiming to strengthen their global footprint and meet the rising demand for smart asset tracking technologies across diverse healthcare settings.

Some of the prominent players in the global healthcare asset management market are:

- GE HealthCare Technologies Inc.

- Zebra Technologies Corporation

- Stanley Healthcare (Securitas AB)

- IBM Corporation

- Oracle Corporation

- Sonitor Technologies

- CenTrak Inc. (Halma plc)

- Airista Flow, Inc.

- Impinj, Inc.

- STANLEY Healthcare (a division of Stanley Black & Decker)

- ThingMagic (Trimble Inc.)

- Awarepoint Corporation

- Intelligent InSites (now part of Infor)

- JADAK (Novanta Inc.)

- Ekahau Inc.

- Identiv, Inc.

- Terso Solutions, Inc.

- RF Technologies, Inc.

- Elpas (Tyco International)

- Wavemark (Cardinal Health

- Other Key Players

Global Healthcare Asset Management Market: Recent Developments

- July 2025: W Health Ventures announced plans to raise USD 70 million for its second healthcare-focused fund targeting Indian startups, signaling increased investment appetite in healthtech innovation.

- June 2025: H.I.G. Capital’s portfolio company GetixHealth completed the acquisition of Americollect, strengthening its patient engagement and billing ecosystem and enhancing integrated asset and patient data management.

- January 2025: Hildred Capital Management raised a USD 810 million fund (Hildred Equity Partners III) to invest across healthcare subsectors, reflecting continued growth in healthcare-focused private equity capital.

- October 2024: Kontakt.io rolled out new mobile applications designed to enhance hospital asset tracking and staff duress response via AI, IoT, and RTLS integration for smarter healthcare operations.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 34.3 Bn |

| Forecast Value (2034) |

USD 284.7 Bn |

| CAGR (2025–2034) |

26.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 13.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (RFID Devices, RTLS, Ultrasound & Infrared Tags, and Others), By Technology (RFID-Based Systems, Wi-Fi Based RTLS, Bluetooth Low Energy, Ultrasound & Infrared, ZigBee, GPS & Others), By Application (Hospital Asset Tracking, Patient Tracking, Pharmaceutical Tracking, Staff Tracking, and Others), By End User (Hospitals & Clinics, Pharmaceutical Companies, Biotechnology Firms, Ambulatory Surgical Centers, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

GE HealthCare Technologies Inc., Zebra Technologies Corporation, Stanley Healthcare (Securitas AB), IBM Corporation, Oracle Corporation, Sonitor Technologies, CenTrak Inc. (Halma plc), Airista Flow Inc., Impinj Inc., STANLEY Healthcare (Stanley Black & Decker), ThingMagic (Trimble Inc.), Awarepoint Corporation, Intelligent InSites (Infor), JADAK (Novanta Inc.), Ekahau Inc., Identiv Inc., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |