Market Overview

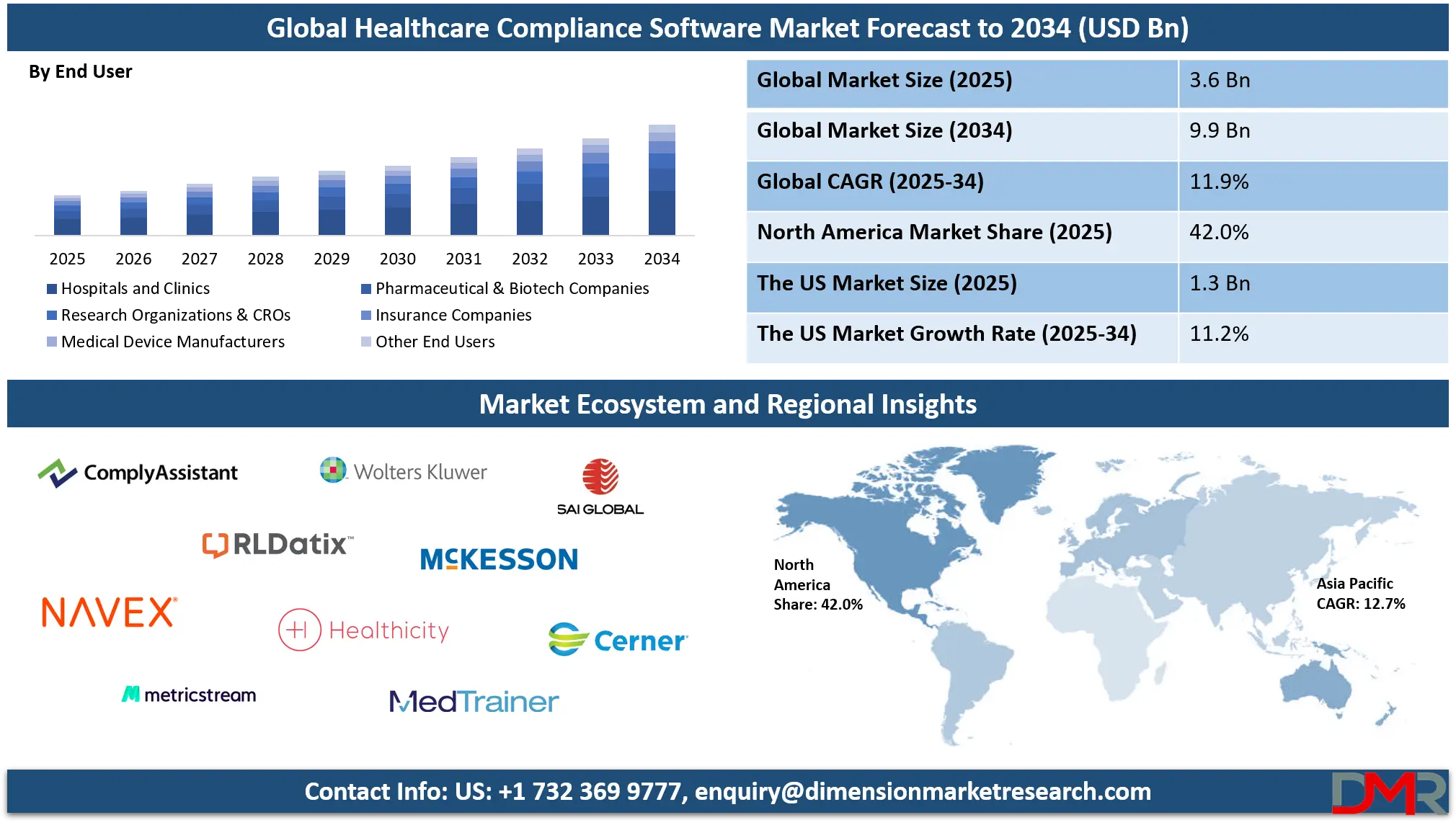

The global healthcare compliance software market is projected to grow from USD 3.6 billion in 2025 to USD 9.9 billion by 2034, expanding at a CAGR of 11.9%. This growth is fueled by rising regulatory complexities, increasing adoption of healthcare IT solutions, and the need for robust data privacy and compliance management across hospitals, pharmaceutical firms, and clinical research organizations.

Healthcare compliance software is a specialized digital solution designed to help healthcare organizations adhere to regulatory, legal, and ethical standards within their operations. These platforms streamline the management of compliance-related activities, such as tracking HIPAA requirements, managing audit trails, automating policy and procedure updates, and ensuring accurate medical coding and billing.

The software reduces the risk of legal penalties and data breaches by offering centralized tools for monitoring employee training, regulatory reporting, and documentation. It supports hospitals, clinics, pharmaceutical companies, and insurance providers in maintaining operational transparency while enhancing patient data security and minimizing manual errors.

The global healthcare compliance software market has witnessed rapid expansion in recent years, driven by the growing complexity of healthcare regulations and the increasing need for automation in compliance management. With the proliferation of electronic health records, telehealth services, and cross-border clinical trials, the demand for robust compliance tracking tools has surged.

Software providers are offering cloud-based platforms integrated with real-time reporting, audit management, and risk assessment modules tailored for health systems, biotech firms, and clinical research organizations. The rise in data privacy laws, such as GDPR and HIPAA, along with stricter FDA and EMA guidelines, is pushing healthcare entities to adopt dedicated compliance software for effective governance.

Additionally, the market is experiencing strong momentum due to increased healthcare digitization and heightened awareness regarding patient safety and institutional accountability. As healthcare providers strive to minimize fraud, reduce claim denials, and align with evolving global standards, compliance solutions are becoming integral to operational infrastructure.

The growing reliance on AI-powered analytics, automated alerts, and customizable dashboards further enhances software usability and ROI. Emerging markets are also showing traction as hospitals and pharmaceutical manufacturers in Asia-Pacific and Latin America embrace digital compliance systems to keep up with international regulatory expectations.

The US Healthcare Compliance Software Market

The U.S. Healthcare Compliance Software market size is projected to be valued at USD 1.3 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3.3 billion in 2034 at a CAGR of 11.2%.

The United States healthcare compliance landscape is one of the most stringent and well-regulated globally, driven by comprehensive frameworks such as HIPAA, HITECH, and the Affordable Care Act. These regulations mandate healthcare providers, payers, and associated vendors to implement strict protocols for data privacy, billing accuracy, patient consent, and risk mitigation. In this environment, healthcare compliance software plays a vital role in streamlining regulatory reporting, automating policy management, and tracking workforce training and audit trails.

Hospitals, private practices, and integrated health systems increasingly rely on these platforms to manage internal audits, ensure coding compliance, and prevent healthcare fraud or reimbursement denials. The growing volume of electronic health records and digital patient data has further heightened the need for scalable, cloud-based compliance management systems equipped with encryption, access controls, and real-time monitoring capabilities.

Moreover, the US healthcare sector has witnessed a surge in compliance complexity due to the increasing use of telehealth, mobile health apps, and cross-state clinical collaborations, which require strict adherence to both federal and state-level regulations. Healthcare compliance solutions in the US are evolving to support enterprise-wide governance, risk, and compliance (GRC) frameworks, often integrating with EHR systems, claims management tools, and regulatory reporting software.

The demand is especially high among hospitals, health insurers, and life sciences companies aiming to meet FDA, CMS, and OIG requirements efficiently. Additionally, the rise in data breach incidents and cybersecurity threats is compelling providers to adopt advanced compliance analytics and audit automation to safeguard patient information and maintain institutional integrity. As regulatory enforcement becomes more data-driven, US healthcare entities are investing heavily in software platforms that offer proactive risk identification, audit readiness, and real-time compliance dashboards.

Europe Healthcare Compliance Software Market

The European healthcare compliance software market is estimated to reach approximately USD 900 million in 2025, reflecting its substantial contribution to the global market landscape. This strong position is primarily driven by stringent regulatory frameworks such as the General Data Protection Regulation (GDPR), the EU Medical Device Regulation (MDR), and increasing demand for centralized compliance oversight across hospitals, pharmaceutical companies, and research institutions.

European countries like Germany, the United Kingdom, and France are leading in the adoption of healthcare IT and compliance automation tools, especially in areas involving patient data privacy, audit trail documentation, and digital policy management. The region's advanced healthcare infrastructure, along with ongoing investment in digital transformation and clinical governance, continues to support robust demand for scalable and cloud-based compliance platforms.

With a projected compound annual growth rate (CAGR) of 10.5% from 2025 to 2034, Europe’s healthcare compliance software market is poised for steady expansion. This growth is fueled by the rising complexity of healthcare operations, increased cross-border research collaborations, and the need for real-time regulatory reporting tools.

Additionally, the expanding use of electronic health records, AI in clinical workflows, and cloud-enabled telehealth solutions is accelerating the need for integrated compliance systems that can manage diverse regulations across multiple jurisdictions. The focus on reducing administrative burdens, improving transparency, and avoiding penalties is also encouraging small and medium-sized healthcare providers to invest in compliance automation solutions, further driving market growth across the region.

Japan Healthcare Compliance Software Market

The healthcare compliance software market in Japan is estimated to reach approximately USD 200 million in 2025, reflecting a growing emphasis on regulatory modernization and digital transformation in the country’s healthcare sector. Japan's healthcare system, known for its universal coverage and high standards, is increasingly adopting IT solutions to manage the rising complexity of data privacy, billing regulations, and clinical documentation.

Government-led initiatives such as the “Digital Health Reform Roadmap” and growing pressure to comply with international standards like ISO 13485 and GxP are pushing hospitals, pharmaceutical firms, and clinical research organizations to invest in automated compliance platforms. Additionally, the expansion of electronic medical records, along with increased participation in global clinical trials, is creating a need for robust software tools that ensure accurate reporting and regulatory transparency.

With a projected compound annual growth rate (CAGR) of 9.2% between 2025 and 2034, Japan’s healthcare compliance software market is expected to grow steadily, though at a more measured pace compared to Western markets. This growth is driven by factors such as the aging population, the rising demand for long-term care services, and the increasing use of telemedicine and home healthcare technologies, all of which introduce new layers of regulatory responsibility. Healthcare institutions are now prioritizing compliance to minimize legal risks, ensure patient data security, and align with evolving reimbursement models. Moreover, the integration of AI and cloud-based systems into compliance platforms is gaining traction in Japan, helping providers automate tasks like audit tracking, workforce training, and clinical risk monitoring, which further fuels the market's long-term potential.

Global Healthcare Compliance Software Market: Key Takeaways

- Market Value: The global healthcare compliance software market size is expected to reach a value of USD 9.9 billion by 2034 from a base value of USD 3.6 billion in 2025 at a CAGR of 11.9%.

- By Component Segment Analysis: Software components are anticipated to dominate the component segment, capturing 70.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based deployment mode is expected to maintain its dominance in the deployment mode segment, capturing 62.0% of the total market share in 2025.

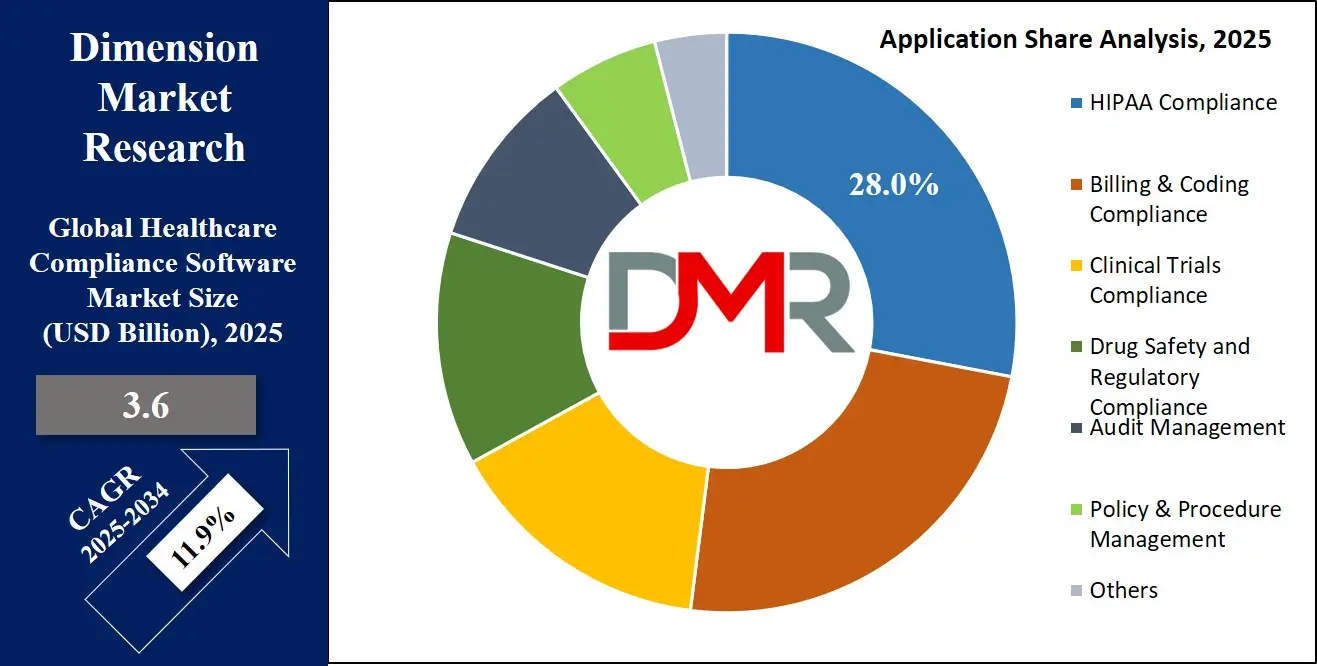

- By Application Segment Analysis: HIPAA Compliance applications will account for the maximum share in the application segment, capturing 28.0% of the total market value.

- By End-User Segment Analysis: Hospitals and Clinics are expected to consolidate their dominance in the end-user segment, capturing 40.0% of the market share in 2025.

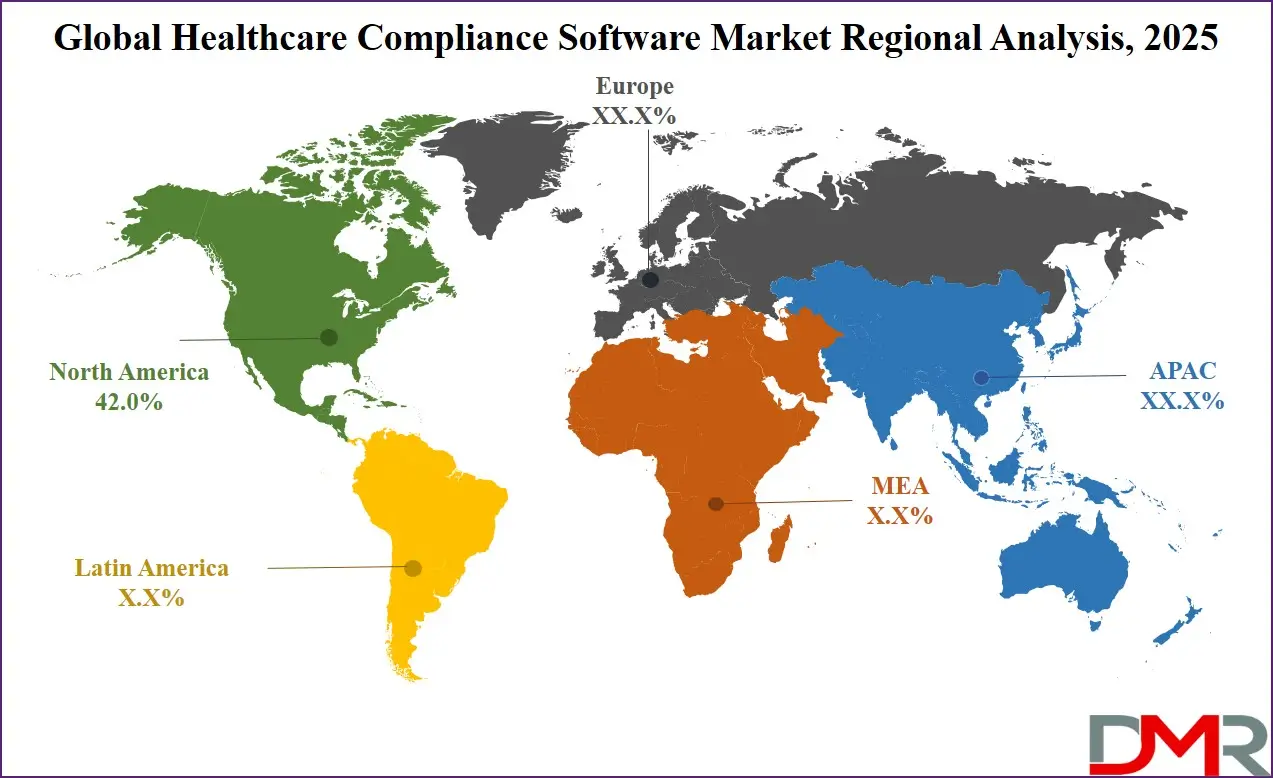

- Regional Analysis: North America is anticipated to lead the global healthcare compliance software market landscape with 42.0% of total global market revenue in 2025.

- Key Players: Some key players in the global healthcare compliance software market are ComplyAssistant, RLDatix, NAVEX Global, MetricStream, Wolters Kluwer, Healthicity, Medtrainer, SAI Global, McKesson Corporation, Cerner Corporation, IBM Watson Health, Verge Health, Symplr, SAP SE, Medtech Global, Smartgate Solutions, and Others.

Global Healthcare Compliance Software Market: Use Cases

- Automated HIPAA Compliance Management in Hospitals: Large hospitals and integrated health systems must comply with the Health Insurance Portability and Accountability Act (HIPAA), which mandates secure handling of Protected Health Information (PHI). Healthcare compliance software automates policy enforcement, employee training, data access control, and breach reporting, reducing manual errors and increasing regulatory adherence. These platforms provide real-time alerts for non-compliance risks, maintain digital audit trails, and ensure encrypted data sharing between departments. As hospitals manage growing volumes of electronic health records (EHRs), compliance systems are critical in avoiding costly penalties while ensuring patient data privacy and operational integrity.

- Clinical Trial Compliance for Pharmaceutical Companies: Pharmaceutical firms conducting multi-regional clinical trials face complex regulatory requirements from entities like the FDA, EMA, and MHRA. Compliance software enables standardized tracking of informed consent, adverse event reporting, protocol adherence, and regulatory submissions. With built-in workflows and role-based access, companies can streamline their global clinical governance while maintaining transparency. These platforms also support real-time documentation, GxP compliance, and integration with trial management systems, minimizing the risk of delays or trial disqualification due to regulatory missteps.

- Billing and Coding Accuracy in Healthcare Revenue Cycle Management: Medical billing errors and incorrect coding can lead to claim denials, revenue loss, or fraud investigations. Healthcare compliance software assists clinics and insurance companies by automating coding validation, updating CPT/ICD codes in real time, and aligning documentation with CMS and payer guidelines. The software offers audit-ready logs, reimbursement tracking, and workflow automation that improve operational efficiency. In value-based care environments, it ensures that coding practices remain accurate, transparent, and compliant, thereby reducing audit risk and enhancing financial performance.

- Workforce Training and Policy Acknowledgment in Multi-Site Health Networks: Large health networks with multiple facilities often struggle to standardize compliance training and policy acknowledgment across sites. Healthcare compliance platforms centralize these functions by delivering customized training modules, tracking completion rates, and issuing digital certificates of compliance. These systems also automate policy updates, require electronic sign-offs, and generate compliance scorecards for leadership review. This ensures every staff member, from physicians to administrative personnel, adheres to the latest regulatory standards, improving internal governance and reducing liability risks.

Impact of Artificial Intelligence on Healthcare Compliance Software Market

Artificial Intelligence (AI) is reshaping the healthcare compliance software market by enhancing automation, accuracy, and decision-making in regulatory and governance processes. As compliance requirements grow more complex with evolving data privacy laws and clinical safety standards, AI-driven solutions offer advanced capabilities for risk prediction, real-time monitoring, and smart documentation.

These intelligent systems can identify compliance gaps, recommend corrective actions, and detect anomalies in vast healthcare datasets with minimal human intervention. This significantly reduces the burden on compliance officers while improving audit preparedness and organizational accountability.

AI also plays a critical role in automating routine compliance tasks such as claims auditing, medical coding validation, and consent form verification, which traditionally required manual oversight. Through machine learning and natural language processing (NLP), AI tools can scan large volumes of clinical and administrative records to ensure policy alignment, detect potential fraud, and flag coding errors in real time.

Additionally, predictive analytics in AI-driven compliance platforms enables proactive risk management by forecasting potential violations before they escalate. This shift towards intelligent compliance ecosystems not only ensures regulatory adherence but also drives efficiency, cost savings, and scalability across hospitals, pharma firms, and insurance providers. As AI continues to evolve, its integration into healthcare compliance software is expected to become a core differentiator in the global market.

Global Healthcare Compliance Software Market: Stats & Facts

- European Commission (Digital Decade 2024 eHealth Indicator Study)

- EU‑27 average eHealth maturity composite score rose from 72 % in 2023 to 79 % in 2024, indicating improved access to electronic health records and digital infrastructure across member states.

- European Health Data Space Regulation (EU Regulation 2025/327)

- The EHDS entered into force on 26 March 2025, establishing binding legal frameworks for cross‑border electronic health record exchange and secondary use of health data across all EU member countries.

- OECD / European Observatory (State of Health in the EU: Synthesis Report 2023)

- The 2023 synthesis report emphasized strengthened national frameworks for digital health data collection, increased use of structured EHRs, and improved health information interoperability across European healthcare systems.

- Japan Government Progress on Digital Health (Chambers Global Practice Guide)

- By 2025, Japan expanded its national eHealth initiatives, increasing telemedicine use and driving standardization of electronic medical records through its Digital Health Reform Roadmap. It also advanced interoperability and privacy controls for regulated compliance frameworks.

- Japan Regulatory Reform (Financial Times, public reporting of policy changes)

- As of May 2025, Japan implemented reforms allowing pseudonymized patient data to be reused for AI-driven compliance tools, regulatory audits, and diagnostic model training, under stricter privacy laws aligned with international data protection standards.

Global Healthcare Compliance Software Market: Market Dynamics

Global Healthcare Compliance Software Market: Driving Factors

Rising Regulatory Complexity and Enforcement Actions

The continuous evolution of healthcare regulations such as HIPAA, HITECH, GDPR, and GxP has increased the pressure on healthcare providers and pharmaceutical companies to maintain stringent compliance. Government agencies are actively monitoring data protection and billing practices, issuing heavy penalties for non-compliance. Healthcare compliance software helps organizations automate policy enforcement, track regulatory changes, and maintain audit-ready records, thereby ensuring consistent regulatory alignment and operational integrity.

Rapid Growth of Digital Health Ecosystems

The surge in electronic health records adoption, telehealth expansion, and digital diagnostics has made regulatory compliance more multifaceted. As clinical and administrative data volumes grow, healthcare compliance platforms are essential for automating documentation workflows, protecting patient data, and ensuring policy adherence across cloud-based systems. This trend is accelerating the demand for scalable compliance tools that can integrate with hospital information systems, enhancing both efficiency and data security.

Global Healthcare Compliance Software Market: Restraints

High Implementation and Maintenance Costs

Despite the long-term benefits, many small and mid-sized healthcare facilities hesitate to invest in healthcare compliance software due to high initial costs and ongoing maintenance expenses. The need for staff training, IT infrastructure upgrades, and frequent system updates often acts as a financial barrier. This limits adoption, especially in resource-constrained settings where manual processes are still dominant.

Integration Challenges with Legacy Systems

Many healthcare institutions still rely on outdated electronic medical record platforms and siloed data systems. Integrating modern compliance solutions with these legacy infrastructures can be technically complex and time-consuming. Incompatibility issues may hinder real-time monitoring and automated reporting, reducing the overall effectiveness of the compliance software.

Global Healthcare Compliance Software Market: Opportunities

Artificial Intelligence and Predictive Compliance Tools

AI and machine learning technologies are creating new opportunities in healthcare compliance by enabling predictive risk analytics, automated coding audits, and intelligent policy management. These tools help organizations proactively detect compliance gaps, reduce errors, and make data-driven decisions. Vendors are increasingly incorporating AI capabilities into their platforms to support smarter compliance tracking and enhanced regulatory foresight.

Emerging Markets and Telehealth Expansion

Developing countries in Asia-Pacific, Latin America, and the Middle East are witnessing rapid healthcare digitalization, supported by government reforms and infrastructure investments. As telemedicine and cross-border clinical trials become more common, healthcare organizations in these regions are looking for software that ensures international compliance standards. This creates a promising market for vendors offering localized, cloud-based compliance solutions tailored for regional regulations.

Global Healthcare Compliance Software Market: Trends

Shift Toward Cloud-Based and SaaS Compliance Platforms

Healthcare providers are increasingly transitioning from on-premise systems to cloud-based compliance platforms due to their scalability, lower capital expenditure, and ease of remote access. Software-as-a-Service models offer real-time updates, improved data backup, and centralized compliance management across multi-site health systems. This trend is particularly prevalent among hospitals and health insurers seeking agile solutions.

Integration with EHR and Clinical Decision Support Systems

Modern compliance software is evolving to seamlessly integrate with EHR systems and clinical decision support tools. This interoperability enables automated capture of clinical data, real-time alerts for policy violations, and streamlined audit processes. Such integration not only improves operational efficiency but also enhances patient safety and institutional accountability in healthcare settings.

Global Healthcare Compliance Software Market: Research Scope and Analysis

By Component Analysis

In the component segment of the global healthcare compliance software market, software is projected to hold a dominant position, capturing approximately 70.0% of the total market share in 2025. This dominance is primarily driven by the growing need for automation in regulatory workflows and the rising adoption of digital health solutions across hospitals, clinics, and pharmaceutical firms. Software platforms are being increasingly used to streamline key compliance processes such as HIPAA adherence, billing accuracy, clinical trial documentation, and internal auditing.

These solutions often integrate with existing health IT infrastructure like EHR systems, providing real-time alerts, centralized dashboards, and automated compliance tracking. The scalability and flexibility of cloud-based compliance platforms further contribute to their widespread adoption, especially among large healthcare networks and research institutions managing complex regulatory environments.

Alongside software, services form a crucial part of the healthcare compliance ecosystem. These services typically include implementation support, software customization, training, ongoing technical support, auditing assistance, and regulatory consulting. As compliance requirements differ significantly by geography and institution type, tailored services are essential to ensure that healthcare organizations can fully utilize the software's capabilities and maintain continuous adherence to ever-evolving regulations.

Additionally, service providers play a key role in helping institutions transition from legacy systems to modern compliance platforms, offering expertise in data migration, system integration, and change management. With growing demand for third-party guidance in compliance strategy and operational improvement, the services segment is expected to witness steady growth, especially among mid-sized and resource-constrained healthcare facilities.

By Deployment Mode Analysis

In the deployment mode segment of the global healthcare compliance software market, cloud-based solutions are expected to dominate, capturing 62.0% of the total market share in 2025. This trend reflects the growing preference for scalable, flexible, and cost-efficient platforms that can be accessed remotely and updated in real time. Cloud-based compliance software offers several advantages, including lower upfront capital investment, easier maintenance, automatic regulatory updates, and enhanced data recovery options.

These solutions are particularly valuable for healthcare organizations operating across multiple locations, as they allow centralized management of compliance activities such as policy distribution, staff training, audit preparation, and risk assessment. With increasing adoption of electronic health records and the rise of virtual care models, cloud deployment is becoming the go-to choice for healthcare providers seeking operational efficiency, security, and compliance continuity.

On the other hand, on-premise deployment continues to serve a significant portion of the market, especially among large hospitals, government health institutions, and pharmaceutical companies with strict data security and internal control policies. These organizations often prefer on-premise solutions because they allow complete ownership and customization of the compliance system within their internal IT environment. While implementation and maintenance costs tend to be higher, on-premise models offer greater control over sensitive patient data, which is critical in highly regulated settings.

Furthermore, institutions dealing with limited internet access or specific regional compliance laws may find on-premise deployment more practical. Despite the growing dominance of cloud platforms, on-premise solutions remain relevant for organizations with complex infrastructure needs and strict regulatory oversight.

By Application Analysis

In the application segment of the global healthcare compliance software market, HIPAA compliance is anticipated to hold the largest share, capturing 28.0% of the total market value. This strong position is largely attributed to the strict enforcement of patient data protection regulations in the United States and the increasing volume of digital health information being managed across hospitals, clinics, and telehealth platforms. Healthcare compliance software designed for HIPAA adherence helps institutions ensure the confidentiality, integrity, and availability of protected health information.

It automates tasks such as access control, breach reporting, audit trail documentation, and staff training on privacy policies. As healthcare organizations continue to expand their use of electronic health records, mobile health applications, and cloud-based platforms, the need for robust HIPAA compliance tools has become more critical than ever. These solutions play a key role in avoiding costly legal penalties, protecting patient trust, and maintaining institutional accreditation.

Billing and coding compliance is another vital application area within the market, gaining momentum due to the increasing scrutiny over healthcare reimbursements and fraud prevention. Compliance software in this domain helps ensure that medical coding and billing procedures align with national and private payer guidelines such as ICD, CPT, and CMS rules. The software supports automated claim validation, real-time error detection, and audit preparation, minimizing the risk of denied claims or overbilling.

Accurate billing and coding are essential not only for securing proper reimbursement but also for maintaining transparency in the healthcare revenue cycle. Hospitals, physician groups, and insurance providers use these systems to ensure documentation accuracy, streamline workflows, and comply with payer-specific policies, which ultimately enhances financial performance and reduces regulatory risk.

By End User Analysis

In the end-user segment of the global healthcare compliance software market, hospitals and clinics are expected to maintain their dominance, accounting for 40.0% of the total market share in 2025. This leading position is driven by the complex regulatory responsibilities hospitals face in managing patient data, clinical procedures, billing practices, and workforce training. These healthcare institutions are under constant pressure to comply with frameworks like HIPAA, HITECH, OSHA, and CMS standards, which makes the adoption of specialized compliance software essential.

The software supports these facilities by automating policy distribution, tracking employee certifications, monitoring data access, and maintaining detailed audit logs. As hospitals increasingly digitize their operations and adopt cloud-based health information systems, the demand for integrated compliance platforms that can work alongside EHRs and revenue cycle management tools continues to grow. The software not only reduces the administrative burden but also helps improve operational transparency, reduce legal liabilities, and enhance patient trust.

Pharmaceutical and biotech companies also represent a significant and growing end-user segment within this market, as they face strict regulatory oversight throughout the drug development and commercialization process. Compliance software is vital in ensuring adherence to Good Clinical Practice, FDA 21 CFR Part 11, pharmacovigilance guidelines, and other international regulatory standards.

These platforms help manage documentation, control access to sensitive data, track clinical trial protocols, and automate audit processes. As these companies operate in a global and highly scrutinized environment, having robust systems in place for regulatory compliance, adverse event reporting, and data integrity is critical. With the increasing volume of clinical trials, product approvals, and market expansions, the need for scalable compliance management tools in the pharmaceutical and biotech sectors is expected to continue rising steadily.

The Healthcare Compliance Software Market Report is segmented on the basis of the following:

By Component

By Deployment Mode

By Application

- HIPAA Compliance

- Billing & Coding Compliance

- Clinical Trials Compliance

- Drug Safety and Regulatory Compliance

- Audit Management

- Policy & Procedure

- Others

By End User

- Hospitals and Clinics

- Pharmaceutical & Biotech Companies

- Research Organization & CROs

- Insurance Companies

- Medical Device Manufacturers

- Other End Users

Global Healthcare Compliance Software Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global healthcare compliance software market in 2025, accounting for 42.0% of total market revenue. This dominance is largely driven by the region’s well-established regulatory environment, widespread adoption of electronic health records, and strong enforcement of data privacy laws such as HIPAA and HITECH.

Healthcare providers, insurers, and life sciences companies in the United States and Canada are increasingly investing in advanced compliance solutions to navigate complex legal frameworks, manage audit readiness, and ensure secure handling of protected health information. The presence of key market players, rapid digital transformation in healthcare, and continued growth in telemedicine and remote care models further strengthen North America's leadership position in the global landscape.

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the healthcare compliance software market over the coming years, driven by the rapid digital transformation of healthcare systems, rising adoption of electronic health records, and increasing focus on regulatory standardization across emerging economies. Countries such as India, China, and Singapore are investing heavily in healthcare IT infrastructure, supported by government-led digital health initiatives and policy reforms aimed at improving data security and clinical governance.

As the region experiences a surge in medical tourism, clinical trials, and cross-border health services, the demand for robust compliance management tools is accelerating. Additionally, growing awareness of international regulations such as GDPR and GxP is prompting healthcare providers and pharmaceutical companies to adopt scalable and cloud-based compliance software, making Asia-Pacific one of the fastest-growing markets globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Healthcare Compliance Software Market: Competitive Landscape

The global competitive landscape of the healthcare compliance software market is characterized by a mix of established technology providers, specialized compliance solution vendors, and emerging startups focused on cloud-based and AI-driven platforms. Major players such as IBM Watson Health, Cerner Corporation, Wolters Kluwer, NAVEX Global, and RLDatix lead the market with comprehensive compliance suites that integrate seamlessly with broader healthcare IT ecosystems.

These companies compete on the basis of product scalability, regulatory coverage, analytics capabilities, and customer support. Meanwhile, niche firms like Healthicity, Medtrainer, and ComplyAssistant are gaining traction by offering tailored, user-friendly solutions for smaller healthcare organizations and specific regulatory needs.

Strategic partnerships, mergers, and investments in AI and machine learning are shaping the competitive dynamics, enabling companies to expand their portfolios and address emerging compliance challenges such as real-time risk prediction and automated audit management. The market is also seeing growing interest from global software providers entering developing regions, intensifying competition and accelerating innovation across the sector.

Some of the prominent players in the global healthcare compliance software market are:

- ComplyAssistant

- RLDatix

- NAVEX Global

- MetricStream

- Wolters Kluwer

- Healthicity

- Medtrainer

- SAI Global

- McKesson Corporation

- Cerner Corporation

- IBM Watson Health

- Verge Health

- Symplr

- SAP SE

- Medtech Global

- Smartgate Solutions

- ConvergePoint

- OneTrust

- LogicManager

- GreenLight Medical

- Other Key Players

Global Healthcare Compliance Software Market: Recent Developments

- July 2025: Waystar announced a definitive acquisition of Iodine Software for US$1.25 billion (including debt), integrating Iodine’s AI-driven clinical documentation and reimbursement tools to strengthen healthcare payments compliance.

- June 2025: Baker Tilly and MediSpend expanded their complianceNOW suite by introducing stewardshipNOW, a life sciences compliance platform that automates external funding workflows from grants to sponsorships with built-in regulatory oversight.

- May 2025: Foxit Software rolled out its Smart Redact Server, an AI-driven redaction solution tailored for industries managing sensitive data, including healthcare, automating the identification and removal of protected health information in compliance with HIPAA, GDPR, and CCPA.

- April 2025: Reveleer acquired Novillus, enhancing its clinical intelligence and care gap management capabilities, thereby advancing its compliance and risk adjustment offerings in value-based care.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.6 Bn |

| Forecast Value (2034) |

USD 9.9 Bn |

| CAGR (2025–2034) |

11.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software and Services), By Deployment Mode (Cloud-Based and On-Premise), By Application (HIPAA Compliance, Billing & Coding Compliance, Clinical Trials Compliance, Drug Safety and Regulatory Compliance, Audit Management, Policy & Procedure, and Others), and By End User (Hospitals and Clinics, Pharmaceutical & Biotech Companies, Research Organizations & CROs, Insurance Companies, Medical Device Manufacturers, and Other End Users) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Comply Assistant, RLDatix, NAVEX Global, MetricStream, Wolters Kluwer, Healthicity, Medtrainer, SAI Global, McKesson Corporation, Cerner Corporation, IBM Watson Health, Verge Health, Symplr, SAP SE, Medtech Global, Smartgate Solutions, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global healthcare compliance software market size is estimated to have a value of USD 3.6 billion in 2025 and is expected to reach USD 9.9 billion by the end of 2034.

The US healthcare compliance software market is projected to be valued at USD 1.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.3 billion in 2034 at a CAGR of 11.2%.

North America is expected to have the largest market share in the global healthcare compliance software market, with a share of about 42.0% in 2025.

Some of the major key players in the global healthcare compliance software market are ComplyAssistant, RLDatix, NAVEX Global, MetricStream, Wolters Kluwer, Healthicity, Medtrainer, SAI Global, McKesson Corporation, Cerner Corporation, IBM Watson Health, Verge Health, Symplr, SAP SE, Medtech Global, Smartgate Solutions, and Others.

The market is growing at a CAGR of 11.9 percent over the forecasted period.