Market Overview

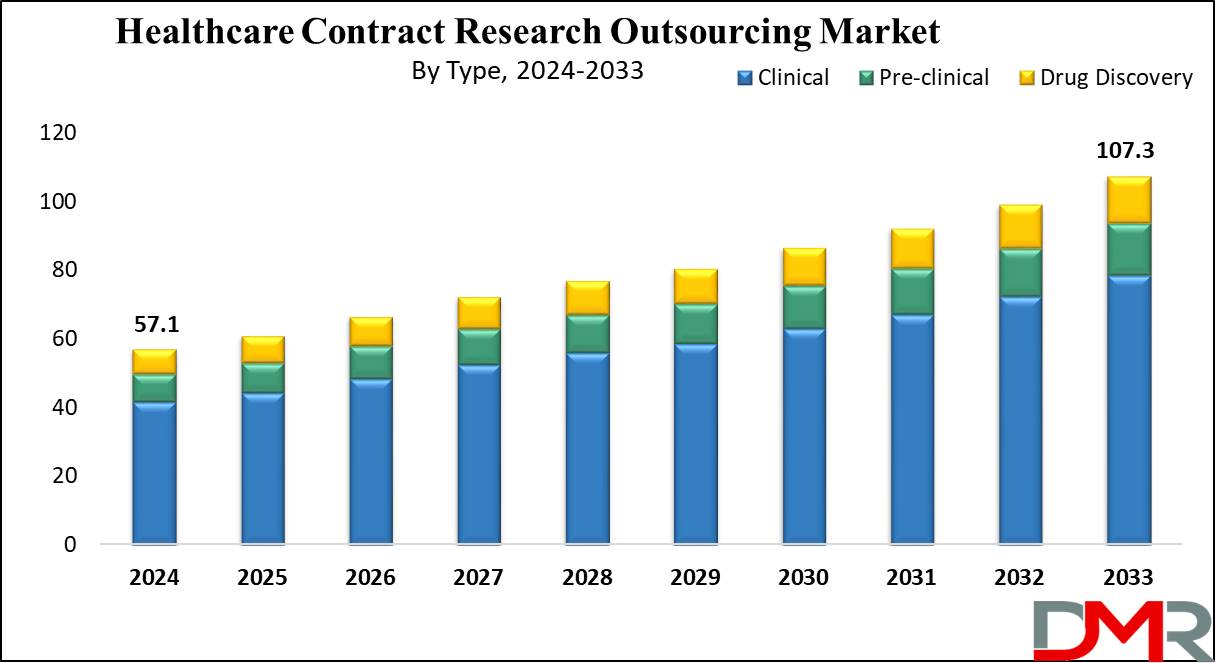

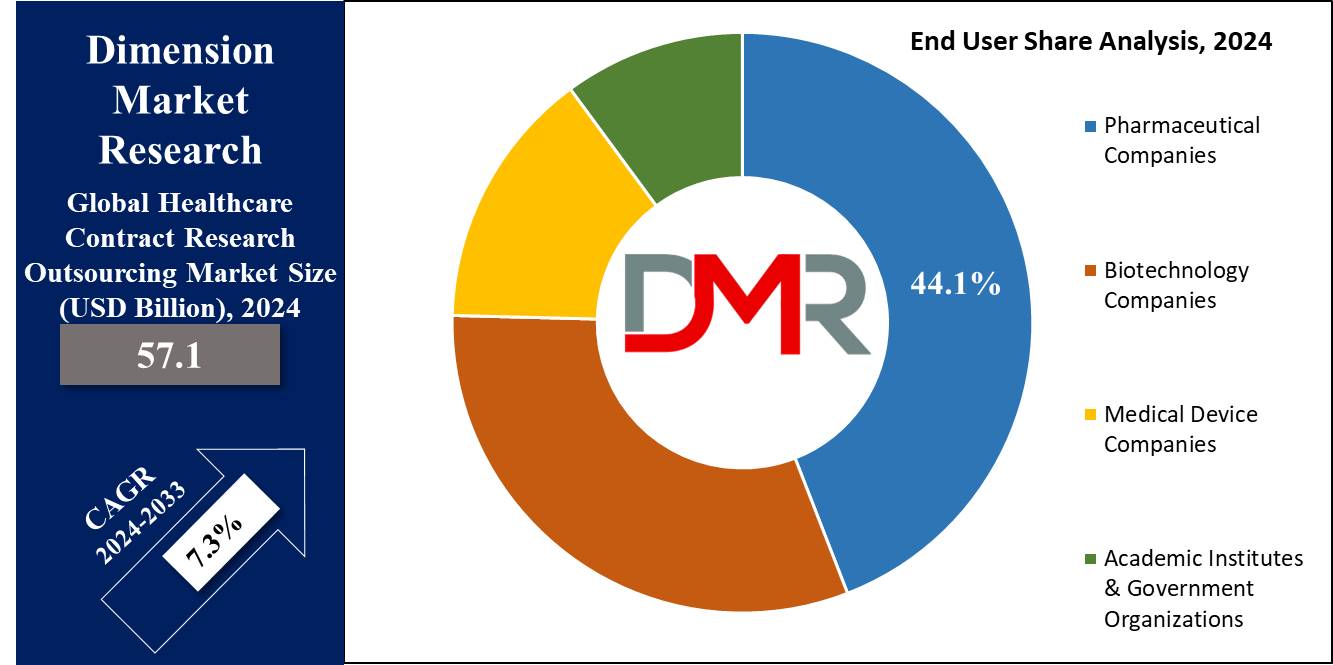

The Global Healthcare Contract Research Outsourcing Market is expected to reach a value of USD 57.1 billion by the end of 2024, and it is further anticipated to reach a market value of USD 107.3 billion by 2033 at a CAGR of 7.3%.

A Contract Research Organization or CRO assists pharmaceutical, biotech, and medical device industries by redistributing research services. CROs focus on reducing costs in drug development for specialized markets, providing solutions like biopharmaceutical development, clinical trials, &pharmacovigilance.

Further, they fund foundations & universities and support government agencies. CROs conduct clinical research & trials for medications and medical devices to benefit the healthcare industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

As per Microsourcing, the Healthcare Contract Research Outsourcing market is witnessing substantial growth, driven by the increasing reliance on third-party vendors to address operational challenges and financial inefficiencies. Over 90% of health executives are exploring cost-saving measures through outsourcing, while 98% of C-level executives are actively adopting or considering such strategies. Billing errors, which cost the sector approximately $20 billion annually, highlight the need for more efficient processes, leading 54% of health CFOs to believe outsourcing can enhance financial health.

Nearly 68% of physician groups with 10 or more practitioners outsource collections and claims management, while over 90% of U.S. hospitals outsource at least one process, with 75% of hospitals exceeding 300 beds outsourcing IT services. Amid growing talent shortages, with 71% of financial leaders citing staffing challenges and 40% of nurses planning to leave their roles, outsourcing offers a critical solution to maintain operational continuity and mitigate workforce constraints.

Key Takeaways

- The Global Healthcare Contract Research Outsourcing Market is expected to grow by 50.2 billion, at a CAGR of 7.3% during the forecasted period.

- By Service, the clinical monitoring segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Type, the clinical segment is expected to have a lead throughout the forecasted period.

- By End User, Pharmaceutical companies are expected to be the dominant driver of the growth of the market in forecasted years.

- Asia Pacific is expected to hold a 46.1% share of revenue in the Global Healthcare Contract Research Outsourcing Market in 2024.

- Some of the use cases of Healthcare Contract Research Outsourcing include Clinical Trial Management, Regulatory Affairs Support, and more.

Use Cases

- Clinical Trial Management: Healthcare contract research outsourcing firms effectively trial processes, from protocol development to regulatory compliance, enhancing drug development timelines.

- Regulatory Affairs Support: These firms create regulatory compliance by expertly preparing and submitting applications, and promoting approvals for new drugs & medical devices.

- Pharmacovigilance and Drug Safety Monitoring: They also monitor post-market safety data, detecting unfortunate events and reducing risks to ensure product safety.

- Health Economics and Outcomes Research (HEOR): They conduct studies to assess economic & clinical outcomes, supporting stakeholders in informed decision-making on resource allocation and payment strategies.

Market Dynamic

Personalized medicine is gaining importance in healthcare as the focus shifts towards prevention rather than just treatment. Due to the high costs of traditional treatments, personalized medicine is becoming important for low-cost therapeutic approaches.

Many CROs are now giving importance to personalized medicine to streamline drug development and minimize expenses. In China, the market is expected to grow rapidly due to the occurrence of chronic diseases, diverse populations, and favorable regulatory norms, supported by investments in infrastructure & better healthcare services.

However, challenges like lack of expertise, regulatory differences between countries, & shortage of skilled personnel restrain industry growth. While outsourcing research can cut costs, securing quality remains paramount, mainly for activities like clinical studies & medical writing. Some sectors remain certain of outsourcing due to concerns about maintaining necessary standards.

Driving Factors

Pharmaceutical and biotechnology companies increasingly rely on CROs as cost cutting measures during drug development and clinical trials, streamlining operations and shortening time to market while cutting R&D expenses. Due to the increasing complexity of clinical trials combined with stringent regulatory requirements, outsourcing has become more prevalent.

Firms specializing in global compliance standards may provide assistance. Increased prevalence of chronic diseases, rare disorders and personalized medicine has led to an upsurge in demand for CROs to manage diverse and niche trials this trend being further strengthened by advances in technology that enable efficient data management and real time monitoring capabilities.

Trending Factors

Technology advances are revolutionizing the Healthcare CRO Market, with an increasing focus on digitalization and data driven processes.

Artificial Intelligence and

Machine Learning technologies are being implemented into

clinical trial designs, patient recruitment efforts and data analysis in order to increase efficiency and accuracy. Decentralized clinical trials (DCTs) are becoming more and more popular, using technology such as

telehealth, wearable devices and remote monitoring to facilitate patient participation and data collection.

Blockchain technology ensures data transparency and security; real world evidence (RWE) for regulatory approvals and post market surveillance further fuel innovation making CROs key players in adopting and implementing these cutting edge trends in healthcare research.

Restraining Factors

The Healthcare CRO Market faces mounting competition and regulatory complexities that vary between regions, requiring CROs to maintain extensive expertise on global regulations to remain compliant and expedite trial processes. Small and mid sized CROs often face high operational costs and the requirement of skilled professionals as additional obstacles to their operations, and issues related to intellectual property rights or data privacy could hinder collaboration between sponsors and CROs.

Relying on third party outsourcing increases risks associated with inconsistent quality or delays in deliverables, necessitating robust risk management strategies, investments in advanced technologies and creating trust between stakeholders.

Opportunity

The Healthcare CRO Market presents unique opportunities with the rise of emerging markets and increased focus on niche therapeutic areas. Asia Pacific and Latin American regions' expanding healthcare infrastructure present untapped potential for outsourcing clinical trials. As more money is poured into personalized medicine, rare disease research, and biologics, more CRO services are needed to accommodate growing investments in personalized medicine, rare disease research, and biologics.

Technological innovations like AI driven analytics and decentralized trial models allow CROs to deliver innovative yet scalable solutions. Furthermore, strategic alliances between pharmaceutical companies, research institutes and CROs open doors for long term partnerships that foster innovation and efficiency within healthcare research & development.

Research Scope and Analysis

By Service

The clinical monitoring segment is expected to lead the healthcare contract research organization (CRO) market in 2024, holding the largest revenue share, which is driven by an increasing number of clinical trials & the demand for effective monitoring services. Over the past decade, clinical research has been highly outsourced to CROs due to their low cost and technical expertise.

The integration of smart analytics & live data acquisition devices is expected to enhance clinical monitoring data quality in the healthcare sector, allowing early detection of trial errors and assisting fast corrections.

Further, the regulatory/medical affairs segment is anticipated to experience rapid growth, fueled by the increase in outsourcing of regulatory affairs services, which is due to the rising R&D activities, clinical trial applications, and product registrations. In addition, the demand for new product approvals & compliance maintenance is expected to drive segment growth, allowing CROs to focus on expansion strategies to enhance their market presence.

By Type

The clinical segment is expected to lead in revenue share in 2024, driven by several factors like a rise in biologics, and demand for new treatments driven by the necessity for personalized and orphan drugs. In addition, the chase for advanced technologies plays a role in this growth, along with the evolution of technology, globalization of clinical trials, and the increasing reliance on contract research organizations for trial conduct.

Simultaneously, the preclinical studies segment is expected to experience rapid expansion during the projected period. This surge is attributed to a global increase in preclinical trials and the need to control R&D costs, leading to an increase in demand for high-quality preclinical CRO services. Furthermore, the growing outlet of innovative therapeutics further fuels the high growth of preclinical services.

By End User

Pharmaceutical companies are projected to lead the market in 2024, as they are prioritizing the development of safer & more effective technologies. The rising R&D investment is expected to help biopharmaceutical companies increase their earnings. To cut costs associated with internal testing platforms, pharmaceutical companies are majorly outsourcing R&D to Contract Research Organizations (CROs).

Further, small pharmaceutical companies are turning to CRO technologies for product design development, driven by a growth in the market for innovative designs & expiring copyrights. Due to the complexity of drug development, the need for faster discovery timelines, low cost, and access to expert medicinal knowledge, pharmaceutical companies hold a major portion of the global healthcare contract research outsourcing industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Healthcare Contract Research Outsourcing Market Report is segmented on the basis of the following

By Service

• Clinical Monitoring

• Regulatory Services

• Clinical Data Management & Biometrics

- Electronic Data Capture

- Electronic Patient Recorded Outcomes

- Others

• Medical Writing

• Pharmacovigilance

• Site Management Protocol

• Others

By Type

• Drug Discovery

- Target Validation

- Lead Identification

- Lead Optimization

• Pre-Clinical

• Clinical

- Phase I Trial Services

- Phase II Trial Services

- Phase III Trial Services

- Phase IV Trial Services

By End User

• Pharmaceutical Companies

• Biotechnology Companies

• Medical Device Companies

• Academic Institutes & Government Organizations

Regional Analysis

Asia Pacific is expected to dominate the healthcare contract research organizations market, holding

46.1% of the revenue share in 2024, which is driven by factors like an increasing chronic illness, diverse populations, and simplified regulations, along with efforts by public organizations to set up drug approval processes. The region is anticipated for rapid expansion due to these favorable conditions.

Further, North America's healthcare contract research organizations market anticipates steady growth, driven by the region's increasing trials & higher government support for R&D. Particularly, the US market is predicted to be productive in 2024, driven by growth in R&D activities and a strong biosimilars & biologics industry. Despite the considerable expense & time required to develop new drugs, the US maintains its status as a pharmaceutical powerhouse, with research companies investing heavily in R&D activities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global healthcare contract research outsourcing market consists of a competitive landscape with many players providing services like clinical trial management, regulatory affairs support, & pharmacovigilance. These firms compete on factors like expertise, reputation, and affordability.

The market is characterized by current partnerships, mergers, and acquisitions focused on expanding service offerings & geographic reach. In addition, emerging trends like the adoption of advanced technologies & the increase in demand for personalized medicine further strengthen competition in the industry.

Some of the prominent players in the global Healthcare Contract Research Outsourcing Market are

Recent Developments

- In December 2023, Atlas Clinical Research unveiled the acquisition of Suncoast Clinical Research, Inc., a multi-therapeutic, community-based research facility with two locations in New Port Richey & Palm Harbor, Florida. Suncoast conducts Phase II-IV clinical research from its sites and has conducted numerous clinical research studies since its stat rand created strong relationships with local communities, sponsors, and CROs as a go-to site for clinical research in the key therapeutic areas of CNS and Metabolic Disorders.

- In September 2023, Curavit Clinical Research announced that the company has been chosen as the VCRO for a study on MR-001, MedRhythms' neurorehabilitation system for chronic stroke walking impairments. The study focuses on assessing MR-001's long-term economic & clinical benefits, patient engagement, and therapeutic response durability.

- In June 2023, ITOCHU Corporation announced that its subsidiary A2 Healthcare Corporation made the first partnership agreement with NRG Oncology-Japan as a CRO*1 in Japan. NRGJ supports multicenter joint clinical research within Japan as a joint of the National Cancer Institute. Based on the agreement, A2 Healthcare would constantly engage in the clinical trial support business for drugs that have not yet been approved in Japan to address drug lag and drug loss, which are recent social issues.

- In May 2023, Abbott announced that the company plans to expand its Diversity in Clinical Trials initiative, introducing partnerships with Norton Healthcare Foundation & Barnett International. In addition, the company also established a Diversity in Research Office to ensure diverse representation in clinical trials, enhancing care among under-represented populations.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 8.5 Bn |

| Forecast Value (2033) |

USD 15.7 Bn |

| CAGR (2023-2032) |

7.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Function (Supply Chain & Logistics, Finance & Billing, Inventory Management, Patient Relationship Management, and Others), By Deployment (On- Premise and Cloud), By End User (Hospitals, Clinics, Nursing Homes, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Infor, Microsoft, Oracle, SAP, Aptean, Sage Group, McKesson Corp, Odoo, Epicor Software Corp, QAD Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Healthcare Contract Research Outsourcing Market?

▾ The Global Healthcare Contract Research Outsourcing Market size is estimated to have a value of USD

57.1 billion in 2024 and is expected to reach USD 107.3 billion by the end of 2033.

Which region accounted for the largest Global Healthcare Contract Research Outsourcing Market?

▾ Asia Pacific is expected to have the largest market share in the Global Healthcare Contract Research

Outsourcing Market with a share of about 46.1% in 2024.

Who are the key players in the Global Healthcare Contract Research Outsourcing Market?

▾ Some of the major key players in the Global Healthcare Contract Research Outsourcing Market are SGS

SA, KCR SA, ICON Plc, and many others.

What is the growth rate in the Global Healthcare Contract Research Outsourcing Market?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period.