from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Healthcare cybersecurity is becoming increasingly crucial as the industry undergoes rapid digital transformation. The rising adoption of electronic health records (EHRs), telemedicine, and connected medical devices has exposed the sector to cyber threats, driving the demand for robust cybersecurity solutions. Cyberattacks, such as ransomware and data breaches, pose significant risks, compromising sensitive patient data and disrupting healthcare operations.

A key driving factor of the healthcare cybersecurity market is the growing number of cyber threats targeting hospitals, pharmaceutical companies, and research institutions. Regulatory compliance, such as HIPAA in the U.S. and GDPR in Europe, further accelerates investment in cybersecurity solutions. Additionally, the increasing use of cloud-based healthcare solutions and the Internet of Medical Things (IoMT) necessitate enhanced security frameworks, including modern approaches such as

Cybersecurity Mesh architectures that provide flexible, scalable protection across distributed networks.

Opportunities in this market include advancements in artificial intelligence (AI) and machine learning (ML) for threat detection, blockchain for secure data sharing, and zero-trust security models. The growing awareness of cybersecurity risks among healthcare organizations and rising government initiatives also fuel market expansion. With the demand for secure digital healthcare services rising, cybersecurity will remain a top priority for healthcare providers, insurers, and tech companies, driving continuous innovation in the industry.

The US Healthcare Cybersecurity Market

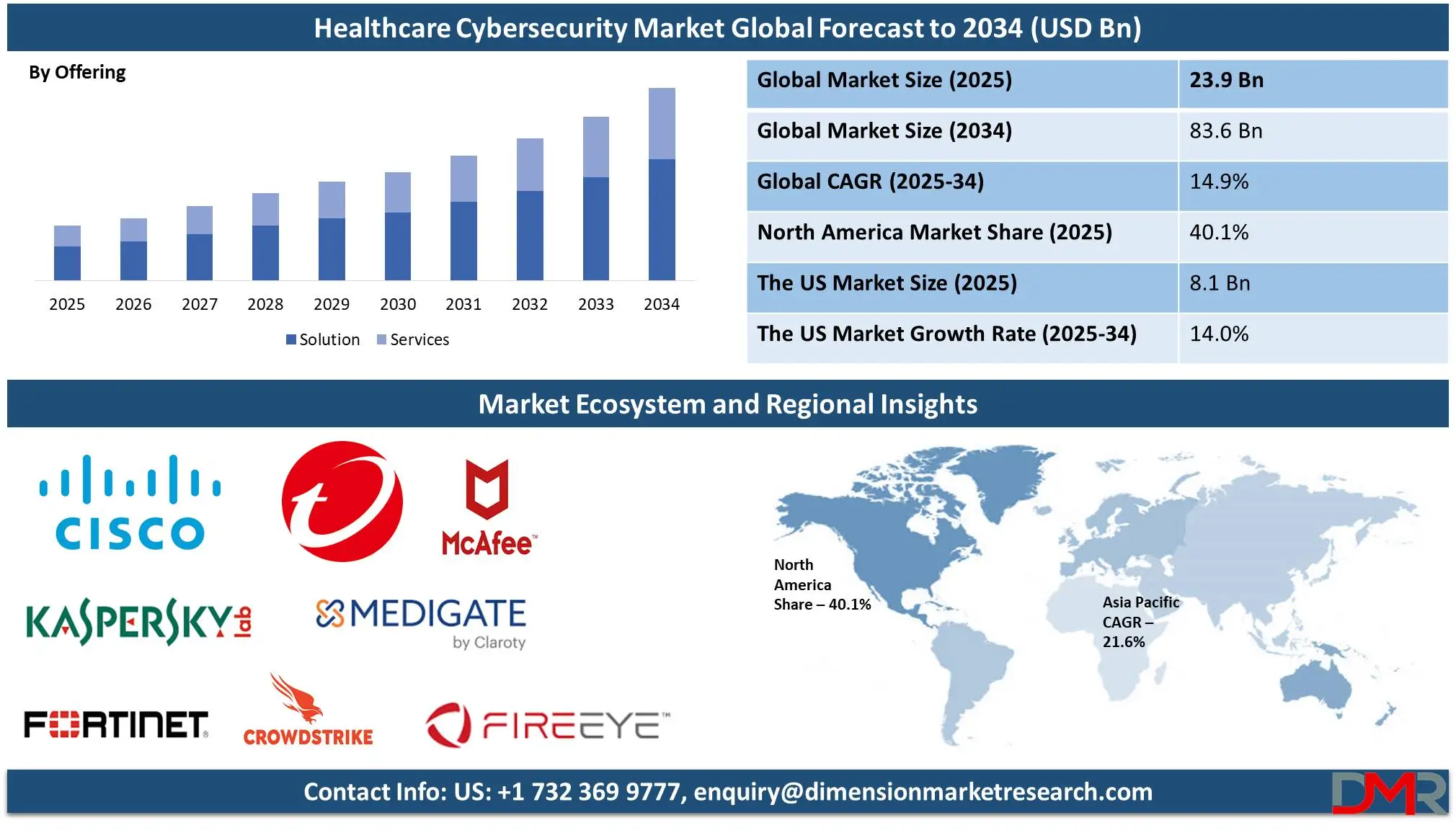

The US Healthcare Cybersecurity market is projected to be valued at USD 8.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 26.2 billion in 2034 at a CAGR of 14.0%.

The U.S. healthcare cybersecurity market is driven by the rising frequency and sophistication of cyber threats, including ransomware attacks and data breaches targeting sensitive patient information. Regulatory frameworks like HIPAA and the HITECH Act mandate strict compliance, pushing healthcare organizations to strengthen their cybersecurity measures. The growing adoption of digital health technologies, such as electronic health records (EHRs) and telemedicine, increases vulnerability, necessitating advanced security solutions.

Key trends in the U.S. healthcare cybersecurity market include the adoption of AI and machine learning for threat detection and response. Zero Trust security models are gaining traction to minimize unauthorized access. The rise of cloud-based security solutions is improving scalability and efficiency. Additionally, healthcare organizations are increasingly investing in blockchain for secure patient data exchange. Cybersecurity awareness training for healthcare staff is also becoming a priority to mitigate risks associated with human error and phishing attacks.

Healthcare Cybersecurity Market: Key Takeaways

- Market Growth: The Global Healthcare Cybersecurity Market is anticipated to expand by USD 56.5 billion, achieving a CAGR of 14.9% from 2025 to 2034.

- Offering Segment Analysis: Solution revenue is likely to account for 60.0% of the revenue share of the global market revenue share by 2025.

- Threat Type Segment Analysis: Malware is expected to dominate in global market with a revenue share of 34.5% by the end of 2025.

- Security Type Segment Analysis: Public health insurance is expected to dominate the Global Market with a revenue share of 44.9% by the end of 2025.

- End User Segment Analysis: Hospitals and healthcare facilities are predicted to dominate the healthcare cybersecurity market with a revenue share of 36.3% in 2025.

- Regional Analysis: North America is predicted to lead the global Healthcare Cybersecurity Market with a revenue share of 40.1% in 2025.

- Prominent Players: Some of the major key players in the Global Healthcare Cybersecurity Market are CrowdStrike, Trend Micro, McAfee, and many others.

Healthcare Cybersecurity Market: Use Cases

- Protecting Patient Data from Breaches: Cybersecurity safeguards electronic health records (EHRs) by preventing unauthorized access, data breaches, and leaks. Strong encryption, access controls, and regular security audits help ensure that sensitive patient information remains confidential and secure.

- Preventing Ransomware Attacks: Healthcare organizations are frequent targets of ransomware attacks, where hackers encrypt critical data and demand payment for its release. Implementing robust cybersecurity measures, such as network segmentation, intrusion detection systems, and regular data backups, helps mitigate the risk of such attacks and ensures business continuity. AI in Cybersecurity is proving invaluable in identifying ransomware signatures earlier and automating responses to contain threats quickly.

- Securing Connected Medical Devices (IoT Security): Many modern medical devices, such as pacemakers, insulin pumps, and imaging systems, are connected to networks and the internet. Cybersecurity measures like device authentication, regular software updates, and network monitoring help prevent cyber threats that could compromise patient safety.

- Ensuring Compliance with Regulatory Standards: Healthcare organizations must comply with regulations like the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR). Cybersecurity frameworks ensure adherence to these regulations by implementing secure access controls, encryption protocols, and continuous monitoring to protect patient privacy and avoid legal penalties. In regions like The Kingdom of Saudi Arabia (KSA) Cybersecurity regulations are evolving rapidly to align with global standards, ensuring that healthcare institutions operate with secure data practices.

Healthcare Cybersecurity Market: Stats & Facts

Rising Cybersecurity Vulnerabilities in Healthcare

- The healthcare sector remains the most expensive industry for addressing and recovering from data breaches, a position it has held for over a decade due to its vast collection of sensitive patient data and interconnected technologies.

- The rise of ransomware and hacking incidents is attributed to outdated software, dispersed systems with multiple endpoints, and limited security resources in hospitals and healthcare organizations.

- According to the HHS Office for Civil Rights (OCR) update from December 2023, cyber incidents in the U.S. healthcare sector are becoming more frequent. Between 2018 and 2022, the number of major breaches reported to OCR rose by 93.0%, climbing from 369 to 712. Notably, large breaches involving ransomware saw an alarming 278.0% surge.

- General Cybersecurity Statistics

- The UnitedHealth cyberattack in February 2024 became the largest breach of protected health information (PHI), compromising the data of at least 100 million individuals, surpassing the 2015 Anthem Inc. breach of 78.8 million records.

- More than 100 million people were affected by healthcare cyberattacks in 2023, and in the first half of 2024, 387 breaches involving 500 or more records were reported, marking an 8.4% increase from the same period in 2023.

- The HIPAA Journal predicts that 2024 will be the worst year for breached healthcare records, with a significant rise in reported data breaches and incidents involving stolen electronic devices containing ePHI.

- Despite an increase in breach reports, HIPAA reports that healthcare data breaches in the U.S. have decreased by 48% due to improved security measures and stricter regulatory compliance.

- Healthcare data breaches cost an average of $408 per record, which is three times higher than the cross-industry average of USD 148 per record, making it the costliest sector for data breaches.

- The average cost of a healthcare data breach fell by 10.6% in 2024, reaching $9.8 million, but for the 14th consecutive year, healthcare remains the most expensive industry for breach recovery.

- Internal issues such as human error (26.0%) and IT failures (22.0%) contributed to healthcare attacks, while 52.0% of breaches were caused by malicious actors exploiting vulnerabilities in security systems.

- More than 90.0% of healthcare organizations experience at least one security breach, with 30% of these breaches occurring in large hospitals, emphasizing the urgent need for stronger cybersecurity measures.

Top Healthcare Data Breaches by Records

- The largest healthcare breach in history occurred in 2024 when Change Healthcare Inc. reported 100 million records compromised due to a hacking incident.

- Other notable breaches include the 2015 Anthem Inc. breach (78.8 million records), the 2023 Welltok, Inc. breach (14.7 million records), and the 2024 Kaiser Foundation Health Plan breach (13.4 million records).

- Several health plans, business associates, and healthcare providers have been targeted over the years, with hacking and unauthorized access being the most common causes of these incidents.

- Ransomware and Phishing Cybersecurity Statistics

- Ransomware attacks on healthcare facilities resulted in increased medical complications in 36% of cases, demonstrating the critical impact cyber threats have on patient care and hospital operations.

- 74.0% of ransomware attacks in 2024 targeted hospitals, while 26.0% affected secondary institutions such as dental services and nursing homes, showing that all healthcare sectors are at risk.

- 88% of healthcare employees opened phishing emails in 2024, highlighting the need for stronger cybersecurity training and awareness programs within healthcare institutions.

- More than 90.0% of cyberattacks against healthcare organizations originate from phishing scams, emphasizing the importance of educating staff on detecting and avoiding phishing attempts.

Third-Party Breach Statistics

- In 2023, 58.0% of the 77.3 million individuals affected by data breaches were impacted due to attacks on third-party healthcare vendors, a staggering 287.0% increase from 2022.

- The healthcare sector experienced the highest number of third-party breaches, followed by financial services, as reliance on external vendors increased exposure to security risks.

- 35% of all reported healthcare data breaches occurred at third-party providers, demonstrating the need for stricter security protocols when working with external partners.

Regulation Changes

- In 2024, the European Parliament and Council introduced the EU Artificial Intelligence Act (EU AI Act), imposing strict AI regulations with non-compliance penalties of up to $38 million or 7% of a company’s gross revenue.

- The U.S. government proposed new security requirements for healthcare organizations receiving Medicare and Medicaid reimbursements, ensuring stronger cybersecurity frameworks in federally funded institutions.

- The Australian government allocated USD 4.2 million to establish an information-sharing network for cyber threats in the healthcare sector, aiming to enhance security across healthcare organizations.

- Proposed U.S. legislation seeks to accelerate payments for healthcare providers impacted by cyberattacks, provided they meet baseline cybersecurity standards, encouraging stronger defense measures.

- The Biden administration requested $800 million in its proposed 2025 budget to provide additional cybersecurity resources to hospitals and improve national healthcare cybersecurity resilience.

Cybersecurity in Insurance

- Landmark Admin, an insurance carrier administrator, reported that hackers infiltrated its system between May and June 2024, exposing the personal data of over 800,000 individuals.

- India’s largest health insurer, Star Health, was targeted by cybercriminals, with hackers demanding USD 68,000 following a leak of customer data and medical records.

- Healthcare organizations that adopted AI and automation tools managed to detect and contain cyber incidents 98 days faster, saving an average of nearly USD 1.0 million in mitigation costs.

- Despite the rising number of ransomware incidents, only 47.0% of healthcare facilities reported that their cybersecurity insurance covered ransom payments, highlighting gaps in insurance protection.

Future Outlook and Spending on Healthcare Cybersecurity

- Cybersecurity Ventures predicts that healthcare organizations will spend over USD 125.0 billion on cybersecurity products and services between 2020 and 2025, underscoring the sector's growing investment in digital security.

- By 2025, total healthcare spending on cybersecurity is expected to reach USD 5.61 billion, with blockchain technology playing a significant role in securing patient data and reducing breach risks.

Healthcare Cybersecurity Market: Market Dynamic

Driving Factors in the Healthcare Cybersecurity Market

Rising Cyber Threats and Data Breaches

Cyberattacks in the healthcare sector have increased significantly over time, prompting an unprecedented need for cybersecurity solutions. Criminals specifically target healthcare organizations because of the vast amounts of patient data stored therein; ransomware attacks, phishing attempts, and insider threats have grown steadily more frequent leading to severe financial and reputational harm. Thus, healthcare organizations must implement robust security measures, such as encryption, multi-factor authentication, and AI threat detection to minimize security breaches while guaranteeing data protection while meeting regulatory compliance.

Growing Adoption of Digital Healthcare Technologies

Rapid digitalization in healthcare services such as telemedicine, electronic health records (EHRs), and connected medical devices has greatly increased cybersecurity risks for hospitals and clinics, including IoT-enabled devices and cloud platforms, rendering themselves even more exposed to cyber security breaches. Governments and regulatory bodies implemented stringent data protection laws which has forced healthcare organizations to establish advanced cybersecurity frameworks and secure patient information effectively. As digital technologies increase in popularity in healthcare operations, so too must their cyber defense infrastructure ensure smooth operations and privacy of patient records.

Restraints in the Healthcare Cybersecurity Market

Lack of Awareness among Healthcare Professionals

Lack of awareness among healthcare professionals regarding cybersecurity measures has severely limited the growth of the healthcare cybersecurity market. Many employees remain ignorant of cyber threats such as phishing attacks, malware infections, and security breaches which make them susceptible to being duped into providing personal or confidential data by malicious actors. Without adequate training and education in security matters, healthcare institutions struggle to effectively implement effective security strategies; raising awareness and offering regular cybersecurity training programs are therefore integral in mitigating potential attacks and protecting healthcare systems against possible attacks from the outside.

High Implementation Costs and Budget Constraints

Another significant roadblock to the growth of the healthcare cybersecurity market is its high cost. Many hospitals and clinics, particularly smaller organizations operating with tight budgets, may struggle to allocate sufficient funds for cybersecurity investments due to expenses related to security infrastructure, software updates, compliance measures, and staff training. Healthcare institutions may delay or avoid adopting essential security measures, leaving them vulnerable to cyber threats, data breaches, and potential financial losses due to cyberattacks.

Opportunities in the Healthcare Cybersecurity Market

Regulatory-Driven Cybersecurity Investments

Stringent data privacy regulations such as HIPAA and GDPR are prompting healthcare organizations to enhance their cybersecurity frameworks. Noncompliance leads to heavy fines and reputational harm for non-compliant organizations, making cybersecurity a top investment priority. As regulations continue to develop, healthcare providers will need to adopt proactive security measures such as encryption, endpoint protection, and compliance monitoring tools as preventive security measures. It creates opportunities for cybersecurity vendors who develop regulatory-compliant solutions that enable healthcare organizations to meet industry standards. It offers comprehensive security services tailored specifically towards this fast-growing sector and will gain competitive advantages.

Expansion of Cloud-Based Security Solutions

As healthcare is quickly transitioning into cloud computing, cloud-based cybersecurity solutions present an immense opportunity. Healthcare providers are moving toward cloud platforms for data storage, telehealth services, and collaboration. It requires advanced security measures to prevent unauthorized access or breaches. Cloud security solutions like secure access management, end-to-end encryption, and cloud-native threat intelligence are in high demand. Cybersecurity firms that specialize in cloud security can take advantage of this trend by providing cost-effective, scalable solutions that protect healthcare data while simultaneously offering seamless access for authorized users. Cloud-based security services present an exciting growth avenue within the healthcare cybersecurity market.

Trends in the Healthcare Cybersecurity Market

Rise of AI-Powered Threat Detection in Healthcare

The healthcare industry is increasingly leveraging artificial intelligence (AI) and machine learning (ML) to detect and respond to cyber threats in real time. AI-powered cybersecurity solutions analyze vast amounts of data to identify unusual patterns, enabling proactive threat mitigation before breaches occur. As cyber criminals adopt more sophisticated attack techniques, AI-driven security systems help healthcare organizations stay ahead by automating responses and reducing the reliance on manual threat detection. This trend is driving investment in AI-based cybersecurity tools to safeguard patient data and connected medical devices from evolving cyber threats.

Implementation of Zero Trust Security Frameworks

Healthcare organizations are adopting zero-trust security models to strengthen their defense against cyberattacks. This approach requires strict identity verification for every user and device accessing a network, ensuring that no entity is automatically trusted. With the rise of remote healthcare services and interconnected medical devices, Zero Trust architectures help mitigate risks by continuously monitoring access and enforcing stringent security policies. By implementing this framework, healthcare providers can protect sensitive patient information and medical systems from unauthorized access, reducing the likelihood of data breaches and cyber threats in an increasingly digitalized healthcare environment.

Healthcare Cybersecurity Market: Research Scope and Analysis

By Offering Analysis

Solution is likely to account for 60.0% of the revenue share of the healthcare cybersecurity market revenue share by 2025 due to increasing demands for advanced security tools that help healthcare organizations combat cyber threats such as ransomware attacks, data breaches, and phishing incidents. With healthcare organizations regularly experiencing ransomware attacks, data breaches, or phishing incidents; solutions such as identity and access management firewalls encryption SIEM solutions were essential in protecting data. Antivirus/antimalware solutions also held substantial market shares by 2023 which demonstrated their importance. Compliance regulations as well as a shift towards digital healthcare records drive demand for cybersecurity solutions further increasing market demand for these tools.

The services segment is predicted to experience the highest compound annual compound annual compound growth due to the rising adoption of professional and managed services for cybersecurity by healthcare organizations lacking internal expertise, especially as their regulatory requirements tighten further. With cyber-attacks becoming ever more sophisticated, more advanced security management expertise is becoming necessary, driving market expansion.

By Threat Type Analysis

Malware is expected to dominate in healthcare cybersecurity market with a revenue share of 34.5% by the end of 2025, as its widespread usage in cyberattacks against healthcare organizations is likely to see it lead this sector of the cybersecurity market. Malware, particularly ransomware, has become an invaluable weapon for hackers to exploit vulnerabilities in electronic health records (EHRs), medical devices, and hospital networks.

As healthcare continues to digitize and leverage interconnected systems, its attack surface increases exponentially which is becoming a prime target for malware infections. Ransomware attacks disrupt healthcare operations, compromise patient data, and demand large ransom payments which drives their popularity even further. Without strong cybersecurity measures in place to safeguard this sector from malware threats.

Advanced Persistent Threat (APT) security solutions are expected to experience high CAGR driven by sophisticated attacks targeting healthcare institutions. APTs involve prolonged, stealthy intrusions aimed at exfiltrating sensitive patient and research data from healthcare organizations using digital transformation such as cloud storage and IoT medical devices; APT attacks often come from state-backed or well-funded cybercrime groups making them hard to detect or mitigate; these attacks often remain undetected until regulatory pressure to enhance data protection forces rapid market expansion of APT-focused security solutions which contribute rapidly.

By Security Type Analysis

Cloud security is expected to dominate the healthcare cybersecurity market with a revenue share of 44.3% in 2025, due to the increasing adoption of cloud-based solutions for storing and managing patient data. With healthcare organizations transitioning to digital records, cloud security ensures data confidentiality, integrity, and compliance with strict regulations such as HIPAA. It protects critical applications, patient records, and research data from cyber threats while enabling secure communication between stakeholders. The rising adoption of telemedicine, AI-driven diagnostics, and cloud-hosted health applications further necessitates advanced cloud security solutions, making it the most dominant segment in the global healthcare cybersecurity market.

The Network Security segment is projected to experience the highest CAGR due to the increasing volume of cyberattacks targeting healthcare networks. With growing connectivity between medical devices, hospital systems, and cloud platforms, network vulnerabilities have become a primary concern. Network security solutions, including firewalls, intrusion detection systems (IDS), and secure access management, help safeguard sensitive patient data from unauthorized access. The surge in ransomware attacks, phishing incidents, and data breaches has further driven demand for robust network security, positioning it as the second most dominant segment with the highest growth rate in the global healthcare cybersecurity market.

By End User Analysis

Hospitals and healthcare facilities are predicted to dominate the healthcare cybersecurity market with a revenue share of 36.3% in 2025, due to the high volume of sensitive patient data they manage and their reliance on interconnected medical devices and systems. With increasing cyber threats like ransomware attacks and data breaches, hospitals must implement robust security solutions, including network security, endpoint protection, and identity access management.

Additionally, regulatory compliance, such as HIPAA and GDPR, mandates stringent cybersecurity measures, further driving investments. The critical nature of hospital operations makes cybersecurity essential to ensure uninterrupted patient care, making this segment the largest contributor to the healthcare cybersecurity market.

The Telehealth and Digital Health Providers segment is expected to experience the highest CAGR due to the rapid adoption of virtual healthcare services and remote patient monitoring. The increasing reliance on digital platforms for consultations, electronic health records (EHRs), and AI-driven diagnostics exposes them to cyber threats like data interception, phishing, and unauthorized access. With the expansion of digital healthcare infrastructure and regulatory mandates for securing telehealth communications, cybersecurity investments are rising. The need for encrypted data transmission, strong authentication measures, and cloud security solutions further fuels the segment's rapid growth in the healthcare cybersecurity market.

The Healthcare Cybersecurity Market Report is segmented based on the following:

By Offering

- Solutions

-

- Identity and Access Management

- Antivirus/Antimalware

- Log Management and SIEM

- Firewall

- Encryption and Tokenization

- Compliance and Policy Management

- Patch Management

- Other Solution Types

- Services

- Professional Services

- Managed Services

By Threat Type

- Phishing

- Ransomware

- Malware

- DDoS

- APT

- Other Threat Types

By Security Type

- Cloud Security

- Network Security

- Application Security

- Endpoint and IoT Security

By End User

- Hospitals and Healthcare Facilities

- Telehealth and Digital Health Providers

- Medical Device Manufacturers

- Pharmaceuticals and Biotechnology

- Health Insurance Providers and Payers

- Government Healthcare Agencies

Regional Analysis

Region with the largest Share

North America is predicted to dominate the healthcare cybersecurity market with revenue share of

40.1% in 2025, due to its strong economies, particularly in the US and Canada, enabling heavy investments in cybersecurity solutions. The region has strict data compliance regulations, such as HIPAA, driving the adoption of advanced security measures. Additionally, the rapid adoption of cloud technologies and the increased use of personal devices for healthcare operations further accelerate demand. The pandemic has heightened cybersecurity risks, prompting healthcare organizations to enhance data protection. With major cybersecurity firms offering cutting-edge solutions, North America remains at the forefront of securing healthcare systems from cyber threats.

Region with Highest CAGR

Asia Pacific is expected to experience the highest growth in the healthcare cybersecurity market due to rapid digital transformation and increasing cyber threats in healthcare. Countries like China, India, and Japan are heavily investing in healthcare IT infrastructure, boosting demand for cybersecurity solutions. The rising adoption of cloud computing, telemedicine, and IoT-driven healthcare devices has created vulnerabilities, necessitating strong security frameworks. Additionally, governments are enforcing stricter regulations to protect patient data. As cyberattacks on healthcare institutions rise and awareness about data security increases, Asia Pacific is witnessing a surge in cybersecurity investments, making it the fastest-growing market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global Healthcare Cybersecurity Market is highly competitive, driven by the increasing adoption of digital technologies and the rising number of cyber threats targeting healthcare organizations. Companies operating in this space focus on developing advanced security solutions to protect sensitive patient data and maintain regulatory compliance.

Key players in the market include SecureWorks, Palo Alto Networks, Cisco Systems, IBM Security, Symantec (Broadcom), McAfee, FireEye, and Trend Micro, among others. These firms compete by offering innovative cybersecurity solutions such as threat intelligence, endpoint protection, cloud security, and AI-driven threat detection. Strategic partnerships, mergers, and acquisitions are common as companies seek to strengthen their market position.

Regulatory frameworks such as HIPAA, GDPR, and NIST standards drive the demand for compliance-focused cybersecurity solutions. Organizations must ensure adherence to these regulations, further intensifying competition among cybersecurity providers.

Some of the prominent players in the global Healthcare Cybersecurity Market are

- Cisco Systems, Inc.

- IBM

- Marubeni Information Systems Co., Ltd.

- Symantec Corporation

- Trend Micro Incorporated

- McAfee, LLC.

- Intel Corporation

- AO Kaspersky Lab

- Lockheed Martin Corporation

- Northrop Grumman

- Imperva

- Fortinet, Inc.

- Medigate (Claroty)

- SecureWorks

- Bae Systems

- Check Point Software

- Qualys

- CrowdStrike

- FireEye

- Other Key Players

Recent Developments

- In June 2024, Microsoft Corporation introduced a new cybersecurity initiative designed to support hospitals serving over 60 million people in rural America, offering free and affordable technology services tailored to the unique needs of healthcare organizations.

- In May 2024, IBM and Palo Alto Networks expanded their partnership to deliver AI-powered security solutions, reinforcing their commitment to advancing innovation platforms and strengthening security capabilities.

- In December 2023, Cisco Systems, Inc. launched the Cisco AI Assistant for Security, marking a significant step toward integrating AI into the Security Cloud by improving decision support, enhancing tool functionality, and automating complex tasks.

- In December 2023, IBM and Palo Alto Networks broadened their strategic alliance to strengthen clients' security measures and counter emerging cyber threats. This partnership seeks to provide comprehensive solutions that enhance security resilience and help organizations navigate the ever-changing cybersecurity landscape.

- In December 2022, Palo Alto Networks (U.S.) unveiled Medical IoT Security, a solution developed to secure medical devices by eliminating implicit trust and continuously verifying each device, allowing healthcare organizations to adopt new connectivity technologies safely and efficiently.