Market Overview

The Global Healthcare Data Integration Market is expected to value

USD 28.5 billion in 2025 and is expected to grow to

USD 100.7 billion by 2034, registering a compound annual growth rate

(CAGR) of 15.0% from 2025 to 2034.

Healthcare data integration refers to the process of combining data from various healthcare systems, applications, and sources to create a unified and accurate dataset. This integration enables seamless data sharing across hospitals, clinics, and research institutions, improving patient care, operational efficiency, and decision-making. With the rise of electronic health records (EHRs), wearable health devices, and telemedicine, data integration has become crucial.

Advanced technologies such as AI, cloud computing, and blockchain are enhancing interoperability, security, and real-time data access. Healthcare data integration helps reduce medical errors, improve diagnosis accuracy, and support personalized treatment plans for better health outcomes.

The healthcare data integration market is driven by the increasing adoption of electronic health records (EHRs) and the need for interoperability among healthcare systems. Regulatory mandates for data standardization and patient-centric care models are pushing healthcare providers to integrate their systems. The rising prevalence of chronic diseases and the growing volume of healthcare data generated from diagnostic tools, wearable devices, and remote monitoring systems further fuel the demand for efficient data integration. Additionally, advancements in AI,

big data analytics, and cloud computing have made data integration more scalable, secure, and cost-effective.

The healthcare data integration market presents vast opportunities, especially with the expansion of digital health initiatives. The increasing use of blockchain for secure patient data exchange and the adoption of IoT-based healthcare solutions create new growth avenues. Emerging markets in Asia-Pacific and Latin America offer significant potential due to rising healthcare digitization and government support for health IT solutions.

Moreover, collaborations between healthcare providers and tech firms are driving innovation, leading to enhanced patient care and predictive analytics applications.

The demand for healthcare data integration is escalating as hospitals, pharmaceutical firms, and insurance providers seek real-time insights for informed decision-making. The shift toward value-based care, personalized medicine, and population health management is increasing reliance on integrated data platforms.

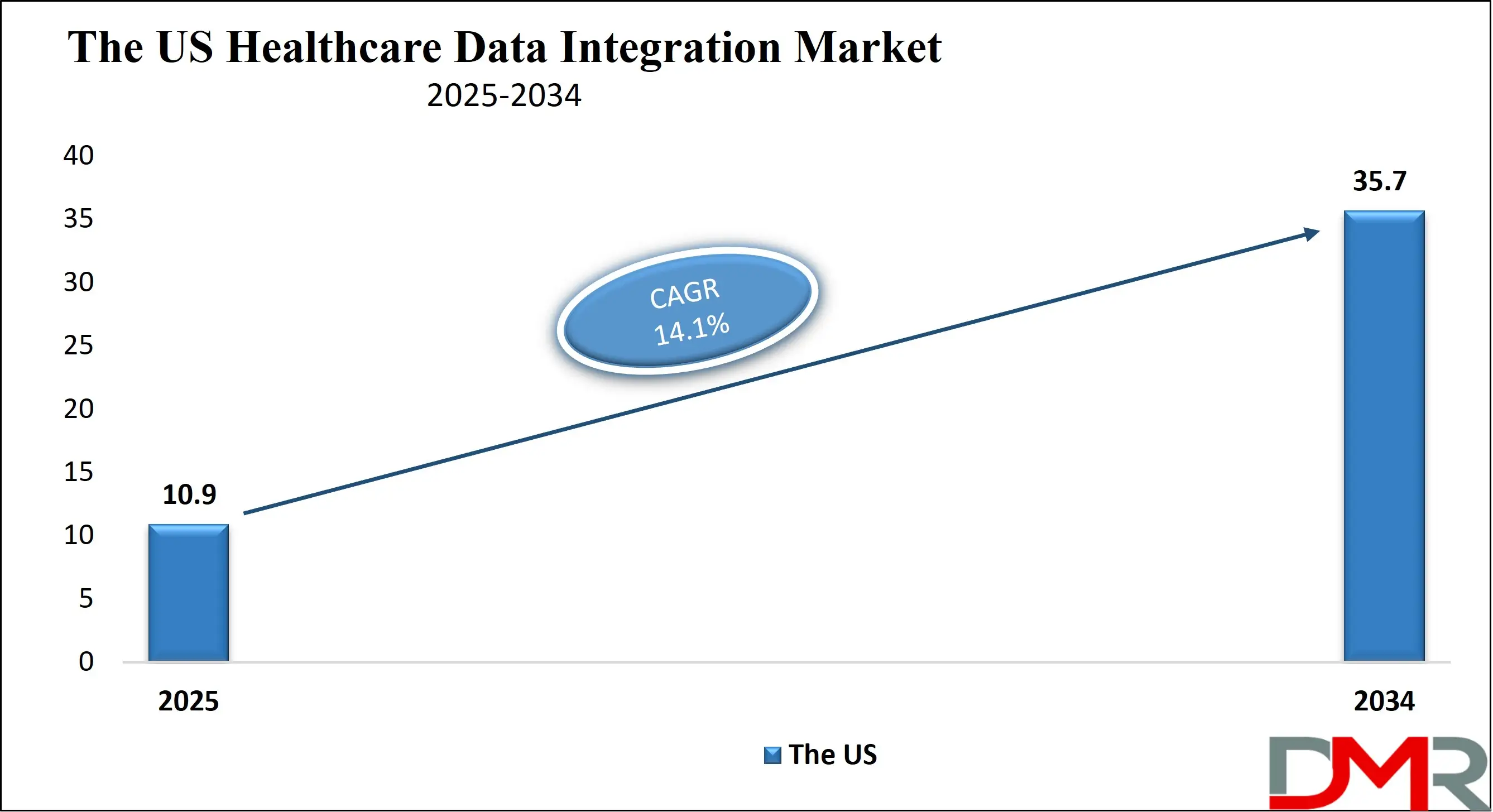

The US Healthcare Data Integration Market

The US Healthcare Data Integration Market is projected to be valued at USD 10.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 35.7 billion in 2034 at a CAGR of 14.1%.

The US healthcare data integration market is driven by increasing demand for interoperability, regulatory compliance, and value-based care models. Government initiatives like the 21st Century Cures Act and FHIR (Fast Healthcare Interoperability Resources) standards push for seamless data exchange. The rise of electronic health records (EHRs), the need for real-time patient insights, and AI-driven analytics fuel integration demand. Additionally, the growing adoption of cloud-based solutions, population health management, and telehealth expansion further accelerate market growth.

API-based integrations are becoming more prevalent, enabling seamless data exchange between healthcare systems. AI-driven analytics and

machine learning are enhancing clinical decision-making, while blockchain technology is gaining attention for secure patient data management. The adoption of cloud-based interoperability solutions is on the rise, improving scalability and real-time access to patient information. Additionally, the integration of wearable and IoT-generated health data supports

remote patient monitoring and personalized care.

Healthcare Data Integration Market: Key Takeaways

- Market Growth: The global healthcare data integration market is valued at USD 28.5 billion in 2025 and is projected to reach USD 100.7 billion by 2034, growing at a CAGR of 15.0%.

- Tools Lead Market: Tools are predicted to dominate with a 73.2% share in 2025 as healthcare providers prioritize data accuracy, interoperability, and efficiency. The services segment grows due to rising complexity.

- On-Premises Preference: The on-premises segment is expected to hold a 65.3% market share by 2025, driven by security, compliance, and performance concerns.

- Large Organizations Dominate: Large organizations will dominate the market with a 71.4% share in 2025, driven by extensive data integration needs, regulatory compliance, and interoperability requirements.

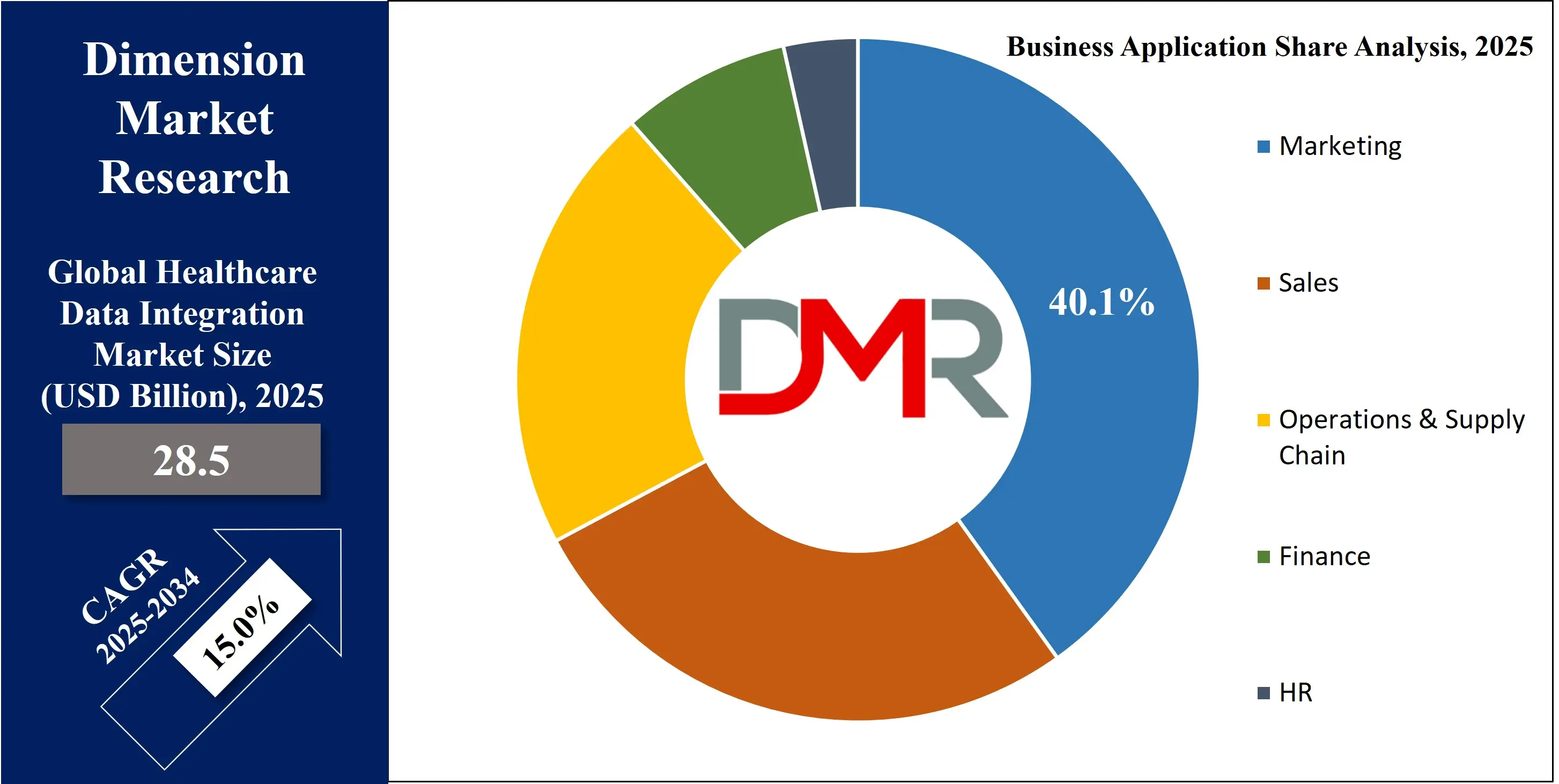

- Marketing Leads Business Application: The marketing segment is projected to lead the business application category with a 40.1% share in 2025, as data integration enhances audience targeting, segmentation, and ROI measurement.

- Hospitals Drive Demand: Hospitals are anticipated to drive demand with a 54.1% market share in 2025, leveraging data integration for EHRs, billing, and patient care efficiency.

- US Market: The U.S. healthcare data integration market is valued at USD 10.9 billion in 2025 and is projected to reach USD 35.7 billion by 2034, growing at a CAGR of 14.1%.

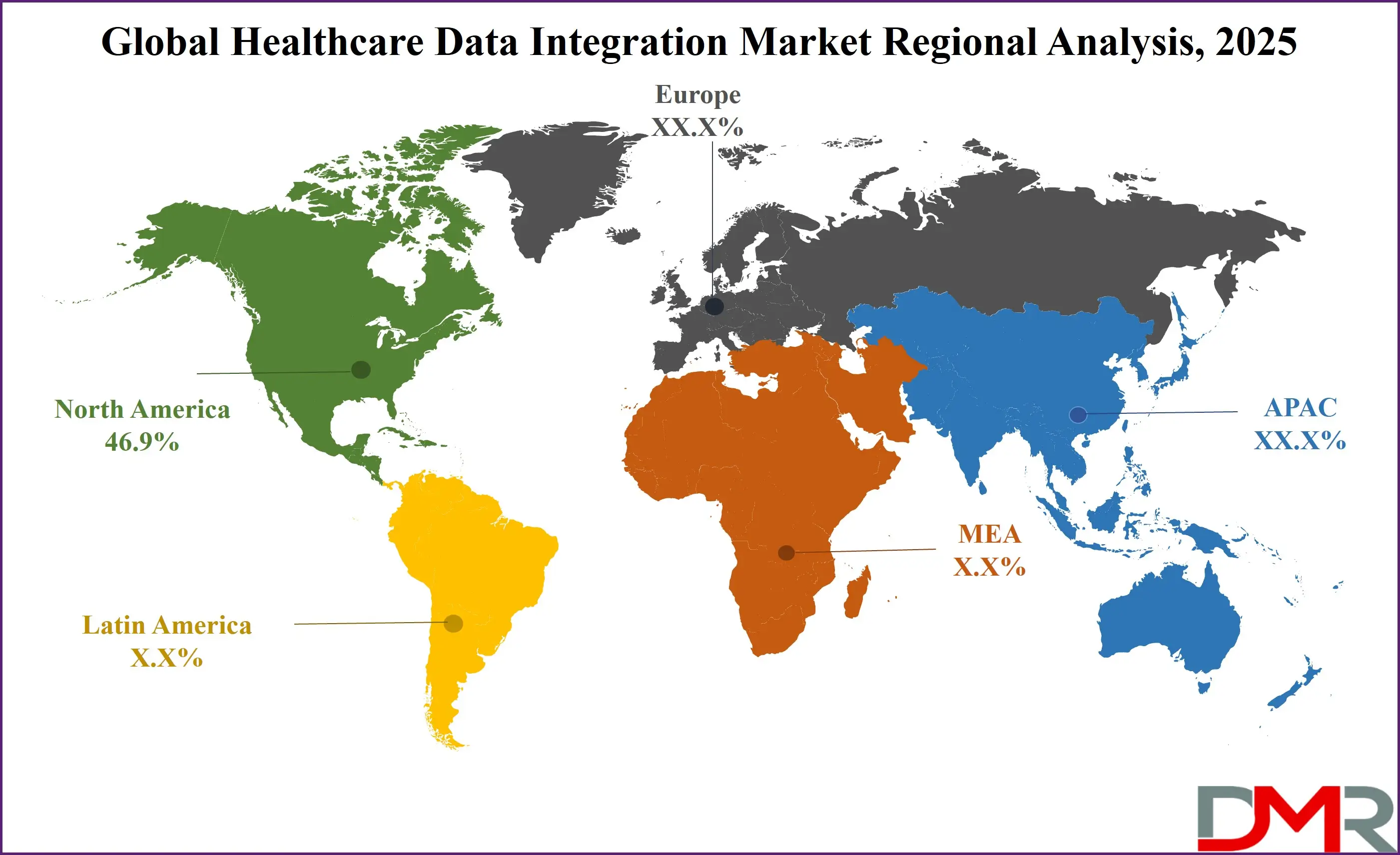

- North America Leads: North America is expected to lead the global market with a 46.9% share by 2025, driven by early adoption of digital health technologies, regulatory incentives, and the shift toward value-based care models.

- Asia Pacific Fastest Growth: Highest CAGR, fueled by population growth, chronic disease prevalence, digital transformation, and government healthcare IT initiatives.

- Key Players: Cerner, IBM, McKesson, and others dominate the market through technological advancements, interoperability solutions, and strategic partnerships.

Healthcare Data Integration Market: Use Cases

- Collaboration Among Healthcare Providers: Healthcare data integration enables seamless exchange of medical records through HIE systems, ensuring that care providers have access to a comprehensive patient history. This improves the quality of care and supports more effective public health management by aggregating data from multiple sources.

- Clinical Decision Support: By leveraging integrated healthcare data, AI-driven Clinical Decision Support Systems (CDSSs) assist physicians in diagnosing and treating patients. These systems help evaluate all health factors, minimize medical errors, detect early signs of diseases, and guide accurate care decisions.

- Personal Health Records Management: When patients have easy access to their health records, they become more engaged in their well-being. This encourages them to adhere to treatment plans and take a proactive approach to monitoring their health.

- Reporting and Analytics: Integrating data across a healthcare organization simplifies reporting by reducing the need for manual data collection. It also enables real-time analysis of healthcare outcomes, performance indicators, and financial metrics, allowing for quicker identification and resolution of operational challenges.

Healthcare Data Integration Market: Stats & Facts

- Adoption of Cloud-Based Solutions and APIs: 81% of healthcare providers have implemented cloud solutions, enhancing data access for medical professionals. API-driven medical apps promote seamless data integration, increasing the demand for organization-wide healthcare connectivity. (Source: PwC, Innowise)

- Better Patient Outcomes: 25% of clinicians acknowledge that integrated data platforms improve decision-making. Real-time access to comprehensive patient records enhances diagnostics and treatment choices, ultimately leading to better health outcomes. (Source: Innowise)

- Improved Operational Efficiency: Healthcare data integration streamlines administrative processes, reducing time spent on manual data entry, compliance, and reporting. This allows physicians to focus more on patient care, improving overall efficiency. (Source: Innowise)

- Reduced Costs: 30% of healthcare providers report that data integration leads to significant cost savings by optimizing resource allocation and workforce management, ultimately lowering operational expenses. (Source: Innowise)

- Better Coordination across Healthcare Providers: Health Information Exchange (HIE) adoption allows different healthcare providers to access complete patient records. This facilitates informed decision-making and helps avoid redundant medical procedures. (Source: Innowise)

- Reduced Medical Errors: Automated data exchange minimizes errors and prevents data duplication compared to manual entry. This enhances data accuracy, reducing the risk of medical mistakes. (Source: Innowise)

- Accelerated Clinical Research and Trials: Integrated databases with anonymized patient records support clinical research on disease patterns, medication side effects, treatment effectiveness, and population health management. (Source: Innowise)

- Enhanced Patient Engagement in Care: 84% of patients believe that having online access to their health records improves communication with providers. Real-time access to consolidated records encourages patient involvement in their treatment. (Source: Innowise)

Healthcare Data Integration Market: Market Dynamic

Driving Factors in the Healthcare Data Integration Market

Expansion of Telehealth and Remote Patient Monitoring

Telehealth services and remote patient monitoring are some of the biggest drivers of healthcare data integration market growth. As virtual consultations and home healthcare become a regular feature of care delivery, patients, providers, medical systems, wearable devices, and monitoring tools all need seamless data exchange among themselves and medical systems, cloud-based integration platforms enable real-time sharing between wearable devices, mobile health applications, and remote monitoring tools allowing continuous patient monitoring while decreasing hospital readmission rates as well as overall healthcare costs; consequently leading to robust data integration solutions being sought ever more often by providers as telemedicine becomes part of daily healthcare delivery.

Growing Adoption of Electronic Health Records (EHRs)

As electronic health records (EHRs) become a more widely adopted solution, their widespread implementation is spurring greater demand for efficient data integration solutions within healthcare. EHRs store vast quantities of patient data that must be integrated across healthcare systems for effective care coordination.

Cloud-based integration platforms facilitate seamless interoperability among various EHR systems, providing healthcare providers access to complete patient records for improved clinical decision-making, decreased medical errors, and enhanced patient outcomes. Government mandates and financial incentives encourage EHR adoption further speeding data integration solutions forward making them indispensable solutions in modern healthcare ecosystems.

Restraints in the Healthcare Data Integration Market

Data Security and Privacy Concerns

One of the major challenges of the global healthcare data integration market lies in assuring data security and privacy. Healthcare data is highly confidential, with any breach having potentially severe legal and financial ramifications. Ransomware attacks, unauthorized accesses, compliance regulations like HIPAA (Health Insurance Portability and Accountability Act in the US) or GDPR (General Data Protection Regulation in Europe), compliance efforts further compound data integration efforts while addressing security concerns requires robust encryption, access controls, and continuous monitoring; which often prove cost prohibitive or resource intensive.

High Implementation Costs and Technical Complexity

Integrating healthcare data across diverse systems and platforms requires substantial investments in infrastructure, software, and training. Many healthcare organizations, particularly smaller providers, struggle with the high costs associated with implementing advanced data integration solutions. Integrating legacy healthcare IT systems with modern cloud platforms can be technically complex, necessitating special expertise.

Compatibility issues between different EHR systems and interoperability challenges prevent seamless data exchange; without sufficient financial and technical resources available to them many healthcare providers experience difficulty adopting comprehensive data integration solutions that promote market expansion.

Opportunities in the Healthcare Data Integration Market

Integration of Artificial Intelligence (AI) and Predictive Analytics

AI and predictive analytics represent an exciting new frontier in the healthcare data integration market. AI-powered solutions can analyze vast amounts of healthcare data to spot patterns, predict patient risks, and recommend tailored treatments which improve decision-making processes while early disease detection improves.

Furthermore, fraud detection systems powered by AI reduce fraudulent activities in billing or insurance claims processes reducing overall healthcare outcomes over time. As AI technologies advance further their application will only continue growing within the healthcare data integration market boosting innovation while furthering overall healthcare outcomes.

Rising Demand for Interoperability and Value-Based Care

As healthcare systems transition from fee-for-service models to value-based care, the need for seamless data interoperability is increasing. Value-based care emphasizes improved patient outcomes, cost reduction, and coordinated care, all of which require efficient data sharing between hospitals, clinics, and insurance providers.

Cloud-based data integration solutions facilitate interoperability, enabling healthcare organizations to achieve a unified view of patient data. It not only enhances patient-centered care but also improves operational efficiency and regulatory compliance. The ongoing push for interoperability, driven by regulatory mandates and industry demand, presents a lucrative opportunity for the growth of data integration solutions.

Trends in the Healthcare Data Integration Market

Increased Adoption of Cloud-Based Healthcare Integration

Healthcare industries are quickly adopting cloud-based data integration solutions for better patient records access. Cloud technology enables seamless exchange, scaling, and real-time accessibility across various healthcare systems. As healthcare providers prioritize interoperability and digital transformation, cloud-based integration platforms have become essential in improving collaboration among hospitals, clinics, and research institutions.

Cloud solutions have long been seen as a cost-cutting measure, improving infrastructure costs while increasing security which is preferred by healthcare organizations. Now with increased cybersecurity protocols and global regulations taking effect, it seems likely that adoption of cloud healthcare integration will accelerate in the coming years.

Growing Use of AI and Big Data Analytics in Healthcare Integration

Artificial Intelligence (AI) and big data analytics in healthcare data integration are revolutionizing the industry. AI-powered analytics can process vast quantities of patient information quickly, identify patterns quickly, and offer predictive insights that enhance clinical decision-making.

Healthcare organizations use machine learning algorithms for early disease detection, risk evaluation, and treatment personalization while AI automation reduces administrative burden and enhances efficiency - these technologies will play a pivotal role in improving healthcare data management while driving improved patient outcomes and streamlining operations further into the future.

Healthcare Data Integration Market: Research Scope and Analysis

By Component Analysis

Tools are expected to maintain their dominant market position through 2025, reaching an estimated revenue share of 73.2% due to healthcare organizations' growing reliance on data integration tools for improving data accuracy, informing decision-making processes, and streamlining operations. As healthcare data from multiple sources continues to multiply exponentially, advanced integration solutions must also increase efficiency while simultaneously cutting costs increasing patient care expectations as well as regulatory compliance requirements further underline demand for this segment of tools, consolidating market leadership as healthcare providers prioritize seamless data management and interoperability solutions for healthcare provider priority as data integration tools play an integral part in providing accurate data management that allows healthcare organizations.

The services segment is anticipated to experience robust growth due to the increasing complexity of healthcare data integration and the need for specialized expertise. Organizations are increasingly turning to managed and cloud-based services to effectively implement and maintain integration solutions. Small and medium-sized healthcare providers, in particular, are driving demand, seeking cost-effective, scalable services to enhance operational efficiency.

Additionally, the shift toward value-based care and interoperability requirements fuel investment in tailored data integration services. As healthcare IT landscapes evolve, service providers offering customized solutions and ongoing support will experience accelerated growth, resulting in a high CAGR for the segment.

By Deployment Analysis

The on-premises segment is anticipated to maintain supremacy with a 65.3% revenue share by 2025 due to its superior control, security, and compliance. Healthcare organizations accord top priority to stringent data security and privacy protocols, and on-premises solutions are thus the favored choice.

The solutions also provide consistent performance for real-time data processing and seamless integration with existing systems. Customization also caters to the complex needs of healthcare providers, thus guaranteeing operational efficacy. Amidst the increasing data sensitivity and regulatory requirements in healthcare, organizations continue to rely on on-premises infrastructure, which cements its market leadership despite the growing adoption of cloud-based alternatives.

The cloud segment is expected to record a high CAGR due to the increasing uptake of cloud computing in healthcare. Cloud-based data integration solutions offer flexibility, scalability, and cost-effectiveness that render them attractive for healthcare organizations that manage large amounts of data from EHRs, patient portals, and wearable devices.

Cloud-based solutions facilitate seamless data access and interoperability, enhancing data-driven decision-making and patient care. Additionally, cloud deployment reduces infrastructure costs and shortens implementation time, leading to widespread adoption. As healthcare providers seek agile and cost-effective data management solutions, the cloud segment will witness high growth in the coming years.

By Organization Size Analysis

Large organizations will continue to maintain market control, achieving a 71.4% revenue share by 2025, owing to their extensive data integration demands and deep pockets. These organizations deal with massive volumes of healthcare data and require advanced integration solutions to connect EHRs with heterogeneous systems like laboratory and radiology databases.

Additionally, the value-based care imperative still drives investments in data-driven decision-making to improve patient outcomes and cost-effectiveness. With their complexity, regulatory compliance imperatives, and need for impeccable interoperability, large organizations will continue to prioritize extensive data integration solutions, consolidating their market control.

SMEs are poised to experience high growth due to the increasing adoption of cloud-based data integration solutions that provide cost-effective, scalable, and user-friendly options. Faced with pressure to enhance efficiency and reduce operational costs, SMEs are leveraging automation to minimize data entry and consolidate disparate data sources.

Further, stringent regulatory requirements, such as HIPAA and GDPR, are compelling SMEs to invest in data integration for compliant and secure data management. With companies requiring enhanced decision-making and operational agility, the segment is expected to experience high CAGR led by the need for cost-effective, automated, and regulatory-compliant data integration solutions.

By Business Application Analysis

The marketing segment is projected to maintain its dominance, reaching a 40.1% revenue share by 2025. This growth is fueled by the increasing adoption of data-driven strategies that enhance audience targeting and campaign effectiveness. Healthcare data integration solutions allow marketing teams to consolidate insights from EHRs, CRM systems, and social media, enabling highly personalized campaigns.

Additionally, these tools support precise audience segmentation based on demographics and health history, leading to more impactful messaging and improved ROI measurement. As organizations prioritize optimized marketing spending and refined engagement strategies, data integration solutions will remain essential for sustained competitive advantage.

The HR segment is expected to experience substantial growth, driven by healthcare organizations’ growing reliance on data-driven decision-making in recruitment, training, and performance management. Data integration solutions enable HR teams to centralize information from various systems, creating a holistic employee view for better workforce planning.

Additionally, compliance with complex and evolving HR regulations necessitates robust data management, making integration solutions indispensable. As organizations strive to enhance operational efficiency and workforce engagement, the demand for seamless HR data consolidation will continue to rise, fueling the segment's high CAGR in the coming years.

By End User Analysis

The hospital segment is projected to maintain its dominance, reaching a 54.1% revenue share by 2025, due to its extensive reliance on healthcare data integration. Hospitals manage vast amounts of patient information from EHRs, billing systems, and patient portals, making seamless data integration essential for improving patient care and operational efficiency.

Automating administrative tasks like billing and insurance claims reduces costs while minimizing manual data entry and allows staff to prioritize patient care. Additionally, with the growing emphasis on interoperability and real-time data access, hospitals increasingly adopt advanced integration solutions, further solidifying their market leadership.

The laboratories segment is expected to experience substantial growth, driven by the increasing complexity and volume of diagnostic data. Advancements in testing technologies, coupled with the rising prevalence of chronic diseases, necessitate efficient data management solutions. Integration platforms enhance laboratory efficiency by automating workflows, streamlining communication, and reducing turnaround times. Additionally, with the shift towards value-based care models, laboratories must analyze large datasets to enhance service quality and improve patient outcomes. The rising demand for precision medicine and real-time data sharing further accelerates adoption, making data integration a crucial factor in the segment’s rapid expansion.

The Healthcare Data Integration Market Report is segmented on the basis of the following:

By Component

By Deployment

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Business Application

- Marketing

- Sales

- Operations & Supply Chain

- Finance

- HR

By End User

- Hospital

- Clinics

- Laboratories

- Others

Regional Analysis

Region with the largest Revenue Share

North America is projected to dominate the healthcare data integration market with a revenue share of

46.9% by the end of 2025, due to its early adoption of digital health technologies such as EHRs, CDSSs, and telemedicine. These technologies generate vast amounts of data, necessitating efficient integration solutions.

Additionally, government regulations and financial incentives encourage healthcare providers to implement IT-driven solutions. The region’s shift towards value-based care, which prioritizes improved patient outcomes and cost reduction, further fuels demand for healthcare data integration. Strong infrastructure, technological advancements, and strategic investments by key industry players solidify North America’s position as the leading market for healthcare data integration.

Region with Highest CAGR

Asia Pacific is anticipated to experience the highest CAGR in the healthcare data integration market due to its growing population and rising prevalence of chronic diseases, which increase the need for efficient healthcare solutions. The region's healthcare sector is investing heavily in digital transformation, emphasizing affordability and accessibility. Key industry players are expanding their product offerings and forming strategic partnerships to cater to the rising demand.

Additionally, government initiatives supporting healthcare IT adoption contribute to the region’s rapid market expansion. The combination of these factors positions Asia Pacific as a high-growth region in healthcare data integration.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The healthcare data integration market is characterized by intense competition, with key players striving to expand their market share through strategic initiatives. Major companies are leveraging both organic and inorganic growth strategies, including product enhancements, partnerships, acquisitions, and technological advancements. These strategies are helping organizations strengthen their foothold in a rapidly evolving market driven by the increasing demand for seamless data interoperability in healthcare systems.

Strategic partnerships and collaborations play a crucial role in the competitive landscape. Leading firms are actively forming alliances with healthcare providers, IT solution vendors, and regulatory bodies to improve data integration capabilities. These collaborations allow companies to enhance their technological offerings, ensuring compliance with industry standards and improving patient care outcomes.

The market is also witnessing a surge in mergers and acquisitions, as companies seek to expand their geographical presence and technological expertise. Larger corporations are acquiring smaller, specialized firms to integrate innovative solutions into their existing portfolios. These acquisitions enable businesses to offer end-to-end data integration solutions, addressing critical challenges such as data silos and interoperability issues.

Innovation and technological advancements are key differentiators among competitors. Companies are investing heavily in artificial intelligence (AI), machine learning (ML), and cloud-based solutions to enhance data processing and analytics capabilities. These technologies enable real-time data sharing, predictive analytics, and improved decision-making, further driving competition in the market.

Some of the prominent players in the global Healthcare Data Integration Market are:

- Astera Software

- Cloud Software Group, Inc.

- Denodo Technologies

- Innovaccer, Inc.

- Microsoft

- Oracle

- QlikTech International AB

- Talend

- Ursa Health LLC

- Vorro

- Cerner

- SAP SE

- IBM Corporation

- Allscripts Healthcare Solutions

- GE Healthcare

- Siemens Healthineers

- Epic Systems

- Dell Technologies

- Philips Healthcare

- Amazon Web Services

- Oracle Corporation

- McKesson Corporation

- NextGen Healthcare Information System

- Other Key Players

Recent Developments

- In February 2025, Innovaccer Inc. announced an enhanced integration with athenahealth through the company’s Marketplace program. This improvement simplifies access to critical analytics for joint customers while optimizing clinical workflows and accelerating value realization. With Innovaccer’s integration into Athenahealth’s Data View solution and EHR write-back functionality, healthcare organizations can efficiently access clinical, financial, and scheduling data while minimizing administrative workload.

- In August 2024, Oracle announced the release of the Oracle Integration Cloud (OIC) Healthcare Edition. Beginning with OIC version 24.08, organizations now can deploy a healthcare-specific edition of Oracle Integration. This edition provides a comprehensive integration and business automation solution, enabling businesses to seamlessly connect and manage both operational and healthcare data within a unified enterprise automation and connectivity platform.

- In June 2023, CipherHealth collaborated with the SADA, to improve patient care by integrating social determinants of health (SDOH) data. This partnership aims to simplify the accessibility and usability of SDOH data for healthcare providers, fostering a more fair and efficient healthcare system.

- In October 2023, Productive Edge, collaborated with Redox, to tackle critical issues in healthcare, such as fragmented health data, real-time analytics, and compliance.

- In August 2022, Indonesia launched SATUSEHAT, a healthcare data integration platform, which translates to "ONEHEALTHY" in Indonesian.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 28.5 Bn |

| Forecast Value (2034) |

USD 100.7 Bn |

| CAGR (2025–2034) |

15.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 10.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Tools, and Services), By Deployment (On-premises, and Cloud), By Organization Size (Large Enterprises, and Small & Medium Enterprises), By Business Application (Marketing, Sales, Operations & Supply Chain, Finance, and HR), By End User (Hospital, Clinics, Laboratories, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Astera Software, Cloud Software Group, Inc., Denodo Technologies, Innovaccer Inc., Microsoft, Oracle, QlikTech International AB, Talend, Ursa Health LLC., Vorro, Cerner, SAP SE, IBM Corporation, Allscripts Healthcare Solutions, GE Healthcare, Siemens Healthineers, Epic Systems, Dell Technologies, Philips Healthcare, Amazon Web Services, Oracle Corporation, McKesson Corporation, NextGen Healthcare Information System, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Healthcare Data Integration Market size is estimated to have a value of USD 28.5 billion in 2025 and is expected to reach USD 100.7 billion by the end of 2034.

North America is expected to be the largest market share for the Global Healthcare Data Integration Market with a share of about 46.9% in 2025.

Some of the major key players in the Global Healthcare Data Integration Market are Cerner Corporation, IBM Corporation, McKesson Corporation, and many others.

The market is growing at a CAGR of 15.0 percent over the forecasted period.

The US Healthcare Data Integration Market size is estimated to have a value of USD 10.9 billion in 2025 and is expected to reach USD 35.7 billion by the end of 2034.