Market Overview

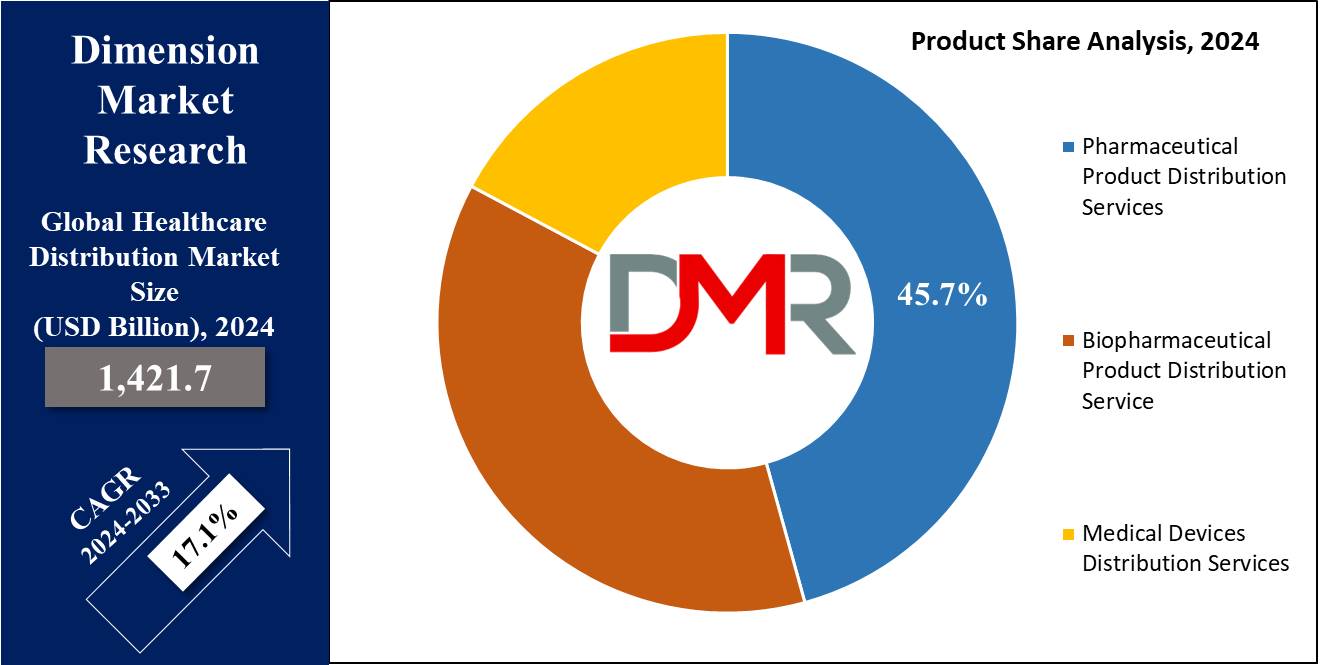

The Global Healthcare Distribution Market is expected to hold a market value of USD 1,421.7 billion in 2024 and is projected to show subsequent growth with a market value of USD 5,892.1 billion in 2033 at a CAGR of 17.1%.

Global Healthcare Distribution Market emphasizes the implementation of supply chain management to enable timely availability and expedited transport of medical products around the world.

This market is also engaged in handling inventory management, warehousing, transportation, and distribution. With the proper working of each element, the shareholders in this market which include the wholesalers, distributors, hospitals pharmacies, and clinics can facilitate the unhindered movement of pharmaceuticals, medical equipment, and supplies from the manufacturer to the end user. It therefore becomes glaringly imperative as far as satisfying the diverse and immediate healthcare needs of patients all over the world are concerned.

Key Takeaways

- In the context of product, pharmaceutical product distribution services are expected to dominate this segment as they hold 45.7% of the market share in 2024.

- Hospital pharmacies are projected to dominate the end-user segment as they hold 68.2% of the market share in 2024.

- North America is anticipated to dominate this market as it is further projected to command 39.2% of the market share in 2024.

- The Global Healthcare Distribution Market size is estimated to have a value of USD 1,421.7 billion in 2024.

- The market is growing at a CAGR of 17.1 percent over the forecasted period of 2024 to 2033.

Use Cases

- Pharmaceutical distributors play a critical role in ensuring that healthcare facilities have access to a wide range of medications to meet patient needs.

- They ensure that healthcare facilities have access to the latest medical technologies to support patient care and treatment.

- With the increasing emphasis on vaccination to prevent infectious diseases, healthcare distribution companies play a vital role in the storage, transportation, and distribution of vaccines.

- Healthcare distributors with expertise in specialty pharmaceuticals ensure safe and timely delivery to patients with complex medical needs.

- Healthcare distribution companies utilize advanced supply chain management technologies to optimize inventory management, minimize waste, and improve overall operational efficiency.

Market Dynamic

The healthcare distribution market is motivated by dynamic factors together with technological improvements, regulatory environment changes, and shifts in healthcare transport trends. Advancements like blockchain, IoT, AI, and statistics analytics beautify supply chain visibility and performance are the major factors that influence the growth of this market. Rules and regulations set for this market are one of the major factors that play a vital role in product protection and quality, impacting distribution practices and market access.

The driving shift towards value-based total care and personalized medication is transforming product distribution, emphasizing patient-centric methods and improved outcomes. In this evolving landscape, the role of the

Distribution Transformer becomes critical not only in the literal sense of managing efficient delivery systems but also as a metaphor for how distributors must transform their approaches. Distributors ought to adapt to these dynamics by leveraging technology for efficiency, navigating complex regulatory landscapes, and aligning distribution strategies with modern healthcare delivery models to meet industry demands and ensure timely, effective services reach the patient.

Research Scope and Analysis

By Product

In the context of the products, pharmaceutical product distribution services are expected to dominate this segment as

they hold 45.7% of the market share in 2024.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Pharmaceutical product distribution services lead the healthcare distribution market section due to their regulatory know-how in navigating complex necessities, offering a huge range of medicines, and retaining mounted networks with manufacturers and healthcare facilities. They invest in cold chain logistics for temperature-sensitive products, provide value-introduced offerings like inventory management, and integrate superior technologies for optimized processes.

With stringent excellent guarantee protocols, they make certain product protection and efficacy. These elements together establish pharmaceutical distributors as important partners within the healthcare enterprise, ensuring the efficient distribution of medications to assist patient care and treatment effects.

By End User

Hospital pharmacies are projected to dominate the end-user segment as they hold 68.2% of the market share in 2024. Hospital pharmacies wield massive influence within the healthcare distribution segment due to numerous key elements. Firstly, they manipulate a sizable quantity and style of medications for diverse patient needs across numerous clinic departments. Their integration into the healthcare shipping device enables close collaboration with healthcare experts, contributing to safe and powerful remedy use and enhancing patient results. Additionally, medical institution pharmacies excel in managing specialized medicines, medical offerings beyond meting out, and efficient supply chain operations within the health center.

This includes managing excessive-threat medicines and imparting medical services including therapy management and medicine reconciliation. Such abilities solidify their dominance in dispensing pharmaceutical merchandise, as they make certain the safe handling, powerful administration, and seamless integration of medicinal drugs into the treatment plan of the affected person.

The Healthcare Distribution Market Report is segmented based on the following

By Product

- Pharmaceutical Product Distribution Services

- Over the Counter Drugs

- Generic Drugs

- Branded Drugs

- Speciality Pharmaceuticals

- Controlled Substances & Narcotics

- Biopharmaceutical Product Distribution Service

- Recombinant Proteins

- Monoclonal Antibodies

- Vaccines

- Cell & Gene Therapies

- Biosimilars

- Medical Devices Distribution Services

- Diagnostic Devices

- Therapeutic Devices

- Surgical Instruments & Consumables

- Durable Medical Equipment (DME)

- Homecare & Mobility Equipment

By End User

- Hospital Pharmacies

- Retail Pharmacies

- Other

Regional Analysis

North America is anticipated to dominate the global healthcare distribution market as it is further projected to

command 39.2% of the market share by the end of 2024. This market fosters one of the largest healthcare infrastructures that is further supported by heavy investments and advanced systems. This region puts a special focus on research and development that emphasizes the development of better distribution channels. The region's focus on innovation creates a demand for distribution services, particularly in the field of pharmaceuticals, and the US is in the lead in terms of spending. A variety of distribution channels such as online and specialty pharmacies vastly pool more options to sell.

Though the regulatory conditions are very stringent in this region, they validate the product quality and safety. Mergers and acquisitions in the industry have produced big-scale distributors with multi-service offerings and large geographical coverage. Additionally, innovations in technology such as

digital health solutions and the system supply automation efficiency enhance operations and satisfy the changing customer requirements. North America's healthcare distribution market is characterized by continuous changes, as the region serves as a driving force of healthcare innovation and delivery.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global healthcare distribution segment is dominated by multinational distributors such as McKesson, AmerisourceBergen, and Cardinal Health, but also by regional players with a firm local bond. The primary function of specialty distributors is to deal with the niche markets, whereas chains like CVS and Walgreens, have more distribution networks. New initiatives currently relying on technology for supply chain optimization are influenced by some entities that model their activities to vertical integration strategies.

Consolidation through mergers and acquisitions rearranges the landscape, where regulatory compliance constitutes a major aspect. This dynamic environment requires both agility and innovation for success in an ever-changing environment of market trends and consumer demands.

Some of the prominent players in the Global Healthcare Distribution Market are

- AmerisourceBergen Corporation

- McKesson Corporation

- Medline Industries

- Cardinal Health, Inc.

- PHOENIX Group

- Shanghai Pharmaceutical Group Co., Ltd.

- Henry Schein Inc.

- Owens & Minor, Inc.

- Medline Industries

- Rochester Drug Cooperative, Inc.

- Other Key Players

Recent Development

- In February 2024, Singapore's GIC and India's PremjiInvest invested in a healthcare products distributor. GIC and PremjiInvest, active investors, join forces in this venture.

- In February 2024, NorthWest Healthcare Properties REIT declares a $0.03 per unit distribution for February 2024, reflecting its leading position in healthcare real estate infrastructure globally.

- In April 2023, Toll Group inaugurates an A$10 million healthcare distribution center in Brisbane, featuring advanced facilities for pharmaceutical storage and distribution, serving Queensland communities.

- In January 2023, Amylyx Pharmaceuticals, Inc. granted Neopharm exclusive rights to distribute AMX0035 for ALS treatment in Israel, Gaza, the West Bank, and the Palestinian Authority pending regulatory approval.

- In May 2022, AAH Pharmaceuticals, a major UK medicine wholesaler, teamed up with RELEX Solutions to optimize supply chain management where it assisted in managing over 1,000 vendors.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1,421.7 Bn |

| Forecast Value (2033) |

USD 5,892.1 Bn |

| CAGR (2023-2032) |

17.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Pharmaceutical Product Distribution Services, Biopharmaceutical Product Distribution Service, and Medical Devices Distribution Services), By End User (Hospital Pharmacies, Retail Pharmacies, and Other) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

AmerisourceBergen Corporation, McKesson Corporation, Medline Industries, Cardinal Health Inc., PHOENIX Group, Shanghai Pharmaceutical Group Co. Ltd., Henry Schein Inc., Owens & Minor Inc., Medline Industries, Rochester Drug Cooperative Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Healthcare Distribution Market?

▾ The Global Healthcare Distribution Market size is estimated to have a value of USD 1,421.7 billion in 2024 and is expected to reach USD 5,892.1 billion by the end of 2033.

Which region accounted for the largest Global Healthcare Distribution Market?

▾ North America is projected to hold the highest market share for the Global Healthcare Distribution Market with a share of about 39.2% in 2024.

Who are the key players in the Global Healthcare Distribution Market?

▾ Some of the major key players in the Global Healthcare Distribution Market are AmerisourceBergen Corporation, McKesson Corporation, Medline Industries, Cardinal Health, Inc., PHOENIX Group, and many others.

What is the growth rate in the Global Healthcare Distribution Market?

▾ The market is growing at a CAGR of 17.1 percent over the forecasted period.