Healthcare fabrics are tailored specifically for use within the healthcare sector, providing medical and hygiene benefits in healthcare environments. Crafted using fibers such as polypropylene, polyester, cotton viscose polyamide or others; each chosen for its individual properties healthcare fabrics provide essential safety, comfort and functionality in healthcare settings. These innovations reflect the growth of the medical textiles industry, which continuously integrates performance-driven fabrics to meet stringent clinical requirements.

To meet stringent healthcare requirements, these fabrics are engineered with antimicrobial, fireproofing, non allergic and non carcinogenic features to make them safe for medical settings. A variety of production technologies such as weaving, non weaving and knitting are employed for optimal performance, durability and versatility.

Healthcare fabrics with improved quality and growing consumer awareness about infection control and hygiene have seen exponential demand since their introduction into use, such as surgical drapes, bed linens, patient gowns and masks, disposable medical products such as masks or even surgical drapes. With healthcare expanding into emerging economies the demand for high-performance healthcare fabrics continues to expand exponentially. This growth is further supported by emerging

Telemedicine applications where hygiene and protection are paramount, particularly in remote consultation and home-care environments.

Key Takeaways

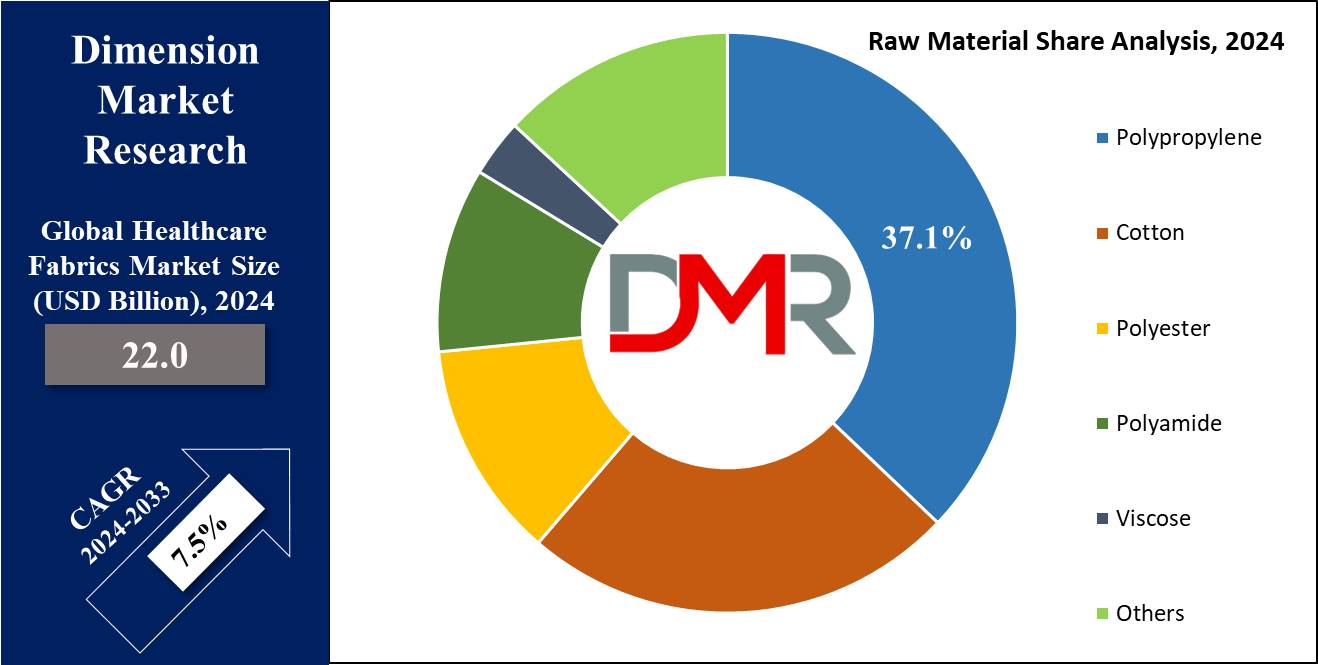

- The Global Healthcare Fabrics Market is expected to grow by 20.0 billion, at a CAGR of 7.5% during the forecasted period.

- By Fabric Type, the non-woven segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Raw Material, Polypropylene is expected to have a lead throughout the forecasted period.

- By Application, hygiene products are expected to be the dominant driver of the growth of the market in forecasted years.

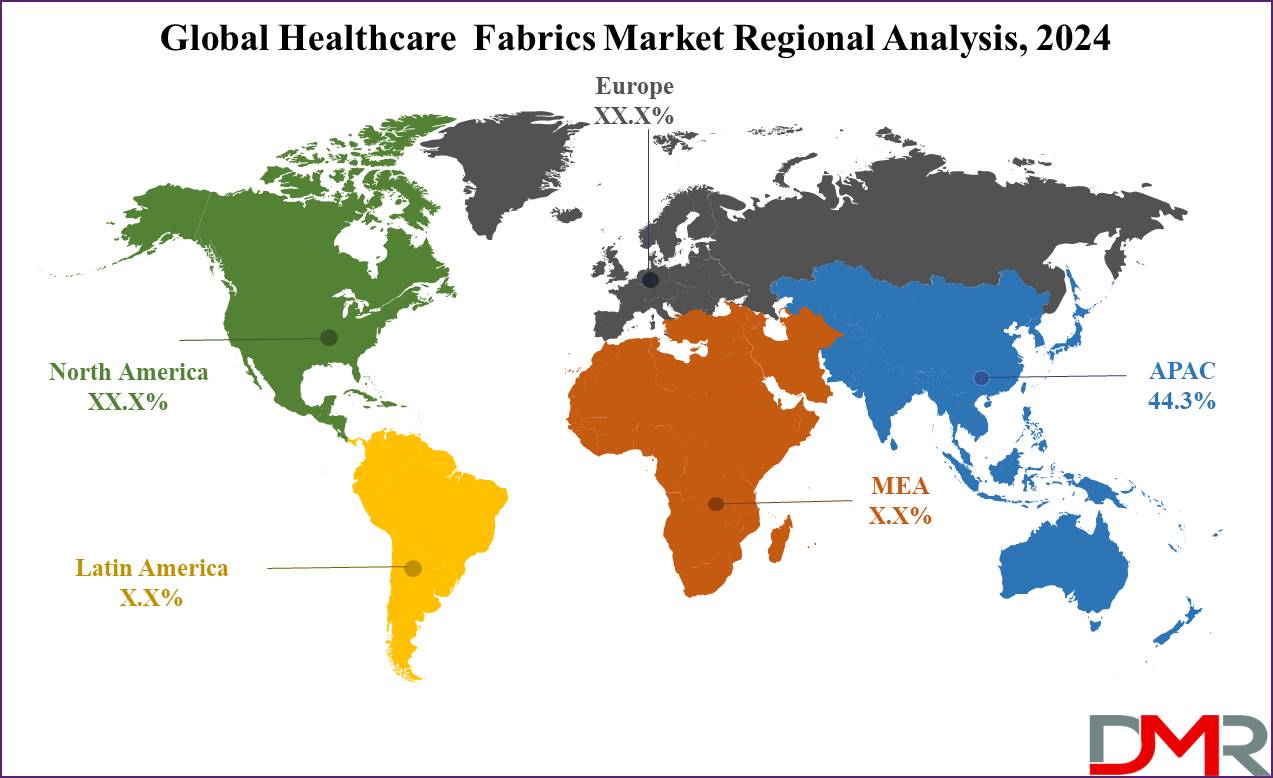

- Asia Pacific is expected to hold a 44.3% share of revenue in the Global Healthcare Fabrics Market in 2024.

- Some of the use cases of healthcare fabrics include antimicrobial fabrics, temperature-regulating fabrics, and more.

Use Cases

- Antimicrobial Fabrics: Healthcare fabrics are designed with antimicrobial properties that are important in reducing the spread of infections in medical environments. These fabrics reduce the growth of microorganisms, like bacteria and fungi, thereby improving hygiene & reducing the risk of hospital-acquired infections.

- Moisture Management Fabrics: Moisture-wicking fabrics play a major role in medical garments & linens by effectively managing perspiration & bodily fluids. These fabrics keep patients & healthcare professionals dry and comfortable, which is crucial for preventing skin irritations & maintaining hygiene standards.

- Barrier Fabrics for Personal Protective Equipment (PPE): Having barrier properties, these are fundamental components of PPE, like surgical gowns, masks, and drapes, as they act as a protective barrier against contaminants, like blood, bodily fluids, and pathogens, protecting both healthcare workers and patients during medical procedures.

- Temperature-Regulating Fabrics: Temperature-regulating fabrics are created to provide thermal comfort in healthcare settings, making sure that patients remain at optimal temperatures during recovery or treatment. These fabrics help avoid overheating or chilling, contributing to the complete well-being and comfort of patients in hospitals and other medical facilities.

Market Dynamic

The global healthcare fabric market is anticipated to grow, driven by a rise in the number of hospitalizations due to the increase in the burden of chronic ailments. As hospitals look to contain bacterial infections, the need for healthcare fabrics rises. Government initiatives globally, like India's Total Sanitation Campaign, support awareness of hygiene products, mainly antibacterial textiles.

Further, non-woven fabrics, renowned for their durability & versatility, are largely used in medical garments due to their exceptional properties like moisture resistance and low cost, promising sustained market growth. Advanced technologies in

Quantum Computing also support research in fabric properties, enabling better design of antimicrobial and performance textiles.

However, the market may experience challenges coming from the environmental impact of female hygiene products. The broad use of non-biodegradable sanitary napkins contributes highly to carbon footprint, with a single napkin taking centuries to decompose, which highlights the need for sustainable alternatives & creates a challenge to the growth of the healthcare fabrics market.

Driving Factor

Demand for infection control and hygiene has propelled the Healthcare Fabric Market forward. As awareness about healthcare associated infections (HAIs) has increased, antimicrobial and fluid repellent fabrics have become more commonly adopted within hospitals and clinics for infection control purposes. Healthcare infrastructure expansion, particularly in emerging economies, contributes significantly to market expansion.

Furthermore, an aging population and prevalence of chronic conditions has seen healthcare fabrics used more commonly for bedding, surgical drapes, patient apparel, etc. Additionally, advances in fabric technology providing durability, comfort, and protection help meet evolving healthcare sector requirements. Healthcare fabrics are also being considered in supportive roles for

Mental Health facilities, such as comfortable patient bedding and therapeutic textiles in care centers.

Trending Factors

Sustainable and eco friendly fabrics are an emerging trend in the Healthcare Fabric Market. In light of rising environmental concerns, manufacturers have begun producing biodegradable and recyclable materials without compromising on performance and quality.

Integration of advanced technologies such as smart textiles equipped with antimicrobial or moisture wicking properties has gained momentum, as are customization of healthcare fabrics to meet specific requirements such as flame resistance or allergen reduction. Adoption of nonwoven fabrics has increased dramatically during public health emergencies like COVID 19 pandemic.

Increasing adoption of fabrics compatible with

Electric Vehicle medical transport systems and wearable diagnostic devices is also expected to enhance the market, highlighting cross-industry applications.

Restraining Factors

The high cost of advanced healthcare fabrics presents a serious obstacle to market expansion. Healthcare providers in developing regions, especially, often encounter budget restrictions that prevent them from purchasing specialized, high quality fabric options.

Fabric production lacks standardization and regulatory requirements differ across regions, making market penetration more complex. Environmental impact concerns over synthetic healthcare fabrics (which are not biodegradable) also present difficulties to market penetration. Finally, limited awareness about advanced healthcare fabrics in low income countries acts as another roadblock preventing widespread adoption and unlocking their full potential within this market.

Opportunity

The Healthcare Fabric Market presents significant growth potential due to rising investments in research and development of innovative solutions, as well as increasing healthcare infrastructure development in emerging economies which present untapped market penetration potential. Home healthcare and long term care facilities present opportunities for bedding and wearable fabrics manufacturers to sell products such as these.

Collaboration between fabric manufacturers and healthcare providers to develop customized solutions tailored to specific medical needs can fuel innovation and market expansion. Furthermore, with growing emphasis placed on eco friendly products comes opportunities for fabric manufacturers to produce biodegradable healthcare fabrics in line with global trends.

Research Scope and Analysis

By Fabric Type

The non-woven segment is predicted to lead the healthcare fabrics market in 2024, as it has seen an increase in demand since the COVID-19 pandemic. Products such as face masks, personal protective equipment, and gowns have experienced an increase in use for protection against the coronavirus. Also, strict government regulations across the globe mandating the use of such items have supported the segment's growth significantly.

Further, the knitted segment is expected to experience notable growth throughout the forecast period. Knitted healthcare fabrics, are known for their effectiveness & efficiency, which is supported by ongoing R&D attempts focused on improving the capabilities & applications of knitted healthcare fabrics.

By Raw Material

Polypropylene as a raw material is expected to lead the healthcare fabrics market in 2024, benefitting from development in medical techniques & textile technology. Polypropylene's dominance is driven by its broad use in disposable non-woven materials, mainly in hygiene and medical applications like protective clothing for patients and sterile surgical drapes.

Further, the cotton segment is expected to witness rapid growth due to its inherent qualities suited for healthcare settings. Cotton's absorbency, softness, and compatibility with sterilization methods like steam, ethylene oxide, & gamma radiation make it highly desirable. Whether used in its pure form or blended with other fibers, cotton is highly used in healthcare fabrics, reflecting its versatility & broader adoption in the industry.

By Application

The hygiene products segment is expected to dominate the healthcare fabrics market in 2024, including a range of items like gowns, caps, face masks, pads, and sanitary napkins. Both developed & developing regions are investing significantly in healthcare infrastructure, directly driving the need for hygiene products in the global market.

Further, the dressing products expected are projected to experience fast growth during the forecast period, as the growth in demand for dressing products is due to increasing instances of accidents. These products play a major role in safeguarding stitches & wounds, while also helping in minimizing swelling & reducing pain in the affected areas of the body, which showcases the essential role dressing products play in patient care & recovery.

The Healthcare Fabrics Market Report is segmented on the basis of the following

By Fabric Type

By Raw Material

- Polypropylene

- Cotton

- Polyester

- Viscose

- Polyamide

- Others

By Application

- Hygiene Products

- Sanitary Napkins

- Baby Diapers

- Adult Diapers

- Dressing Products

- Clothing

- Blanket & Bedding

- Upholstery

- Privacy Curtains

- Others

Regional Analysis

Asia-Pacific is projected to lead the healthcare fabrics market, holding a significant venue

share of 44.3% in 2024. Key markets in this region include India & China, which have a major presence in the healthcare fabrics market. The growth in Asia-Pacific is driven by the broad adoption of feminine hygiene products &supported by favorable government regulations and technological development.

Further, Europe is expected to experience the fastest development during the forecast period.

Leading the growth are countries like Germany, the UK, and France, which dominate the healthcare fabric market in this region. Also, factors like the expansion of the healthcare industry, the growth in cosmetic surgeries, and the rise in the geriatric population contribute to the current and future demand for healthcare fabrics in Europe.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Due to the growing demand for healthcare fabrics, the global market has become strongly competitive. To stay ahead, companies are strategically using innovative products that focus on novelty highlighting the dynamic nature of the industry, where players constantly look to meet changing needs & standards in healthcare fabric applications, driving competition & development in the market.

Some of the prominent players in the global Healthcare Fabrics Market are

Recent Developments

- In February 2024, DuPont unveiled that the company launched a new program called the Tyvek Sustainable Healthcare Packaging Awards, which is designed to recognize leaders across the healthcare industry who are adopting & driving sustainability throughout the packaging lifecycle.

- In December 2023, PlumCare RWE & Fabric Genomics announced a partnership to integrate the Fabric AI platform into the PlumCare RWE FirstSteps newborn genome screening program in Greece which would focus on screening every newborn in Greece within five years using whole genome sequencing, facilitated by the Fabric AI platform.

- In June 2023, Modern Meadow made a strategic alliance with Navis TubeTex, a leading provider of textile finishing machinery, as the collaboration looks to innovate the dyeing, finishing, and coating equipment sector by using Modern Meadow's Bio-Alloy technology with Navis TubeTex's advanced foam technology equipment, aiming to advance sustainability in manufacturing.

- In April 2023, The Textile Ministry of India introduced two Quality Control Orders (QCOs) for 31 items consisting of 19 geotextiles and 12 protective textiles to improve product quality & ensure compliance with global standards. Protective textiles include various items such as curtains, drapes, & protective clothing, while geotextiles include products like HDPE laminates and non-woven bags.

- In April 2023, Trelleborg Engineered Coated Fabrics operation announced an agreement with MMI Textiles for TACTWEAR High Abrasion Neoprene Kevlar, as MMI Textiles will directly offer TACTWEAR HANK in many weights, colors, & quantities, which enhances Trelleborg's ability to meet the number of needs of customers.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 22.0 Bn |

| Forecast Value (2033) |

USD 42.0 Bn |

| CAGR (2023-2032) |

7.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Fabric Type (Non-woven, Woven, and Knitted), By Raw Material (Polypropylene, Cotton, Polyester, Viscose, Polyamide, and Others), By Application (Hygiene Products, Dressing Products, Clothing, Blanket & Bedding, Upholstery, Privacy Curtains, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Knoll Inc, Eximus Corp, Avgol Industries, Berry Global Group, Herculite, Designtex, DuPont de Nemours Inc, Maharam, Brentano, Carnegie Fabrics, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |