Market Overview

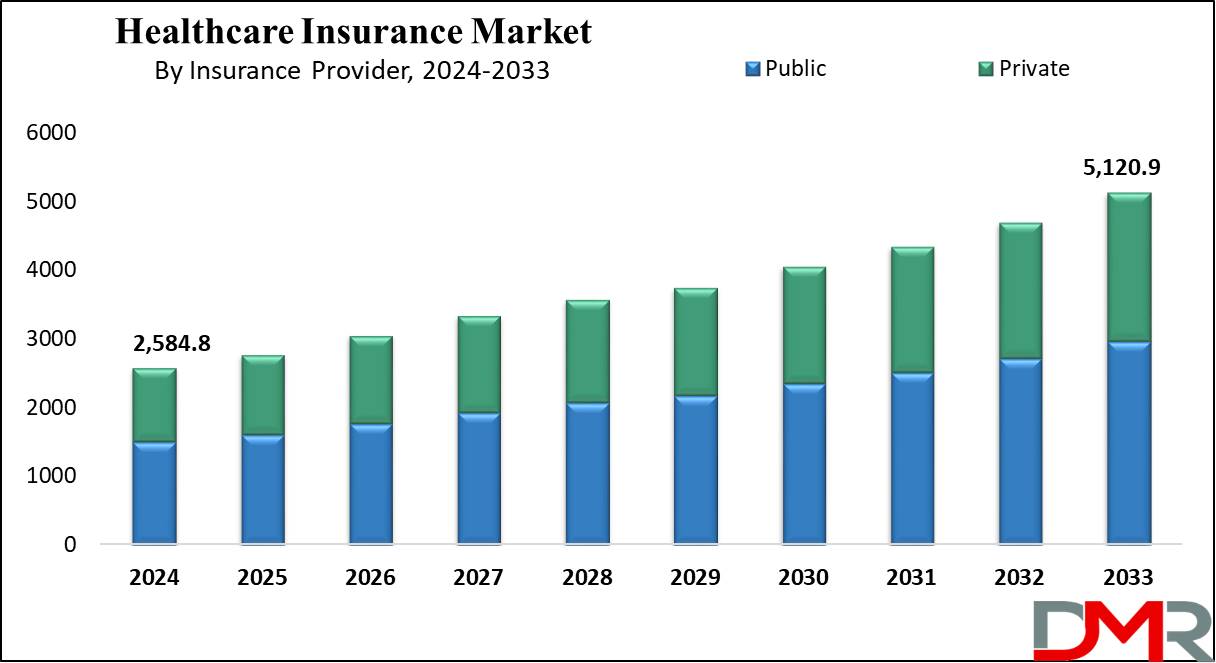

The Global Healthcare Insurance Market is expected to project a market value of USD 2,584.8 billion in 2024 which will further reach USD 5,120.9 billion in 2033 at a CAGR of 7.9%.

The Global Healthcare Insurance Market represents a wide range of health insurance products that are used to finance medical expenses and numerous health services. It works on a global scale, safeguarding the monetary expenses in the sphere of healthcare offerings, treatments, and medicines of individuals and agencies. This market incorporates numerous varieties of coverage plans, along with medical health insurance, organization health insurance, and authorities-sponsored medical health insurance programs.

Cigna and Humana have resumed merger talks, potentially creating a major health insurance entity worth nearly $140 billion. This move could reshape the competitive landscape, though regulatory challenges are expected. Meanwhile, healthcare conferences like AHIP 2024 focus on Medicare Advantage trends and policy impacts, reflecting growing industry attention to these programs. Recent surveys highlight consumer concerns over rising premiums, emphasizing the demand for affordable options amidst ongoing market consolidations.

One of the global healthcare developments in recent years is the pointy upward push in demand for healthcare insurance, and that is due to growing stress on healthcare budgets globally as well as elements such as increasing medical inflation, growing older populations, and enormous continual illnesses. Insurance providers are also leveraging Healthcare Analytics to better predict costs, detect fraud, and enhance customer experiences across products, from health to

Cyber Insurance and beyond.

The insurance enterprise is marked by cutthroat competition among extraordinary insurers which drives product innovation and pricing strategies. Similarly, the regulatory surroundings and government guidelines also have a big effect on how this market is being operated.

As per Forbes Advisor, the healthcare insurance market in 2023 showcased significant coverage, with 89.1% of U.S. adults aged 18-64 insured at some point, though 7.6% of Americans across all age groups remained uninsured. Texas recorded the highest uninsured rate for nonelderly adults at 18.9%, while Massachusetts had the lowest at 2.8%.

Medical debt remains a concern, with 41% of adults carrying unpaid bills. Cost pressures led 35% of adults to delay dental care, 25% vision services, and 24% doctor visits. Notably, Medicaid covered 41% of U.S. births as of mid-2023, underscoring its critical role in public healthcare financing.

Key Takeaways

- Market Value: The market size is projected to reach a market value of USD 2,767.7 billion in 2025, in comparison to USD 5,120.9 billion in 2033 at a CAGR of 7.9%.

- Market Definition: Healthcare coverage offers monetary coverage for medical prices, treatment, and services. It gives individuals and organizations protection against the high expenses associated with healthcare through diverse insurance plans. Increasingly, insurers are integrating Digital Insurance Platforms to streamline services and using Healthcare Analytics to personalize healthcare offerings and manage risks more effectively.

- Insurance Provider Segment Analysis: Public insurance providers are projected to exert their prominence in the insurance provider segment with 57.9% of the market share in 2024.

- Service Segment Analysis: Impatient treatment is projected to command the healthcare insurance market with the highest market value in 2024.

- Level of Coverage Segment Analysis: Silver levels are projected to exert prominence in the coverage level segment with the highest market share in 2024.

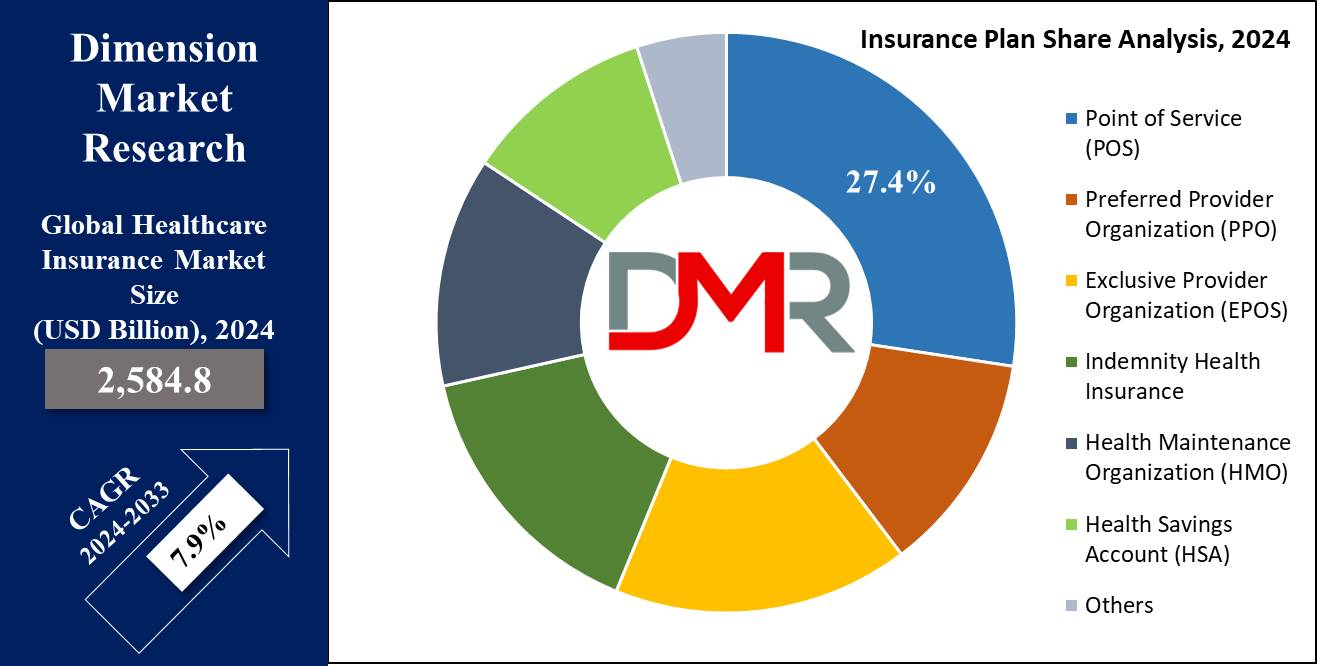

- Insurance Plan Segment Analysis: Point of service (POS) is projected to command the healthcare insurance market with 27.4% of market share in 2024.

- End User Segment Analysis: Individuals are expected to dominate this market with the highest market share in 2024.

- Regional Analysis: North America is predicted to dominate the healthcare insurance market with 43.3% of the market share in 2024.

Use Cases

- Preventive Care Coverage: Healthcare insurance regularly covers preventive offerings like vaccinations, screenings, and regular checkups, promoting early detection and disease prevention.

- Treatment Expenses: Insurance assists in overlaying the expenses of hospitalizations, surgical procedures, medicinal drugs, and treatment, making sure the patient has access to vital scientific treatments without extensive financial pressure.

- Chronic Disease Management: Insurance supports ongoing control of persistent situations such as diabetes or coronary heart disease, covering consultations, medicinal drugs, and specialized treatments to maintain health and quality of life. Healthcare Analytics is increasingly crucial for managing chronic conditions, allowing insurers to design more effective and personalized treatment pathways.

- Emergency Care: In instances of injuries or sudden ailments, insurance presents coverage for emergency room visits, ambulance services, and urgent clinical interventions.

- Maternity and Childbirth Services: Healthcare coverage often consists of insurance for prenatal care, childbirth, and postnatal services, easing the monetary burden related to being pregnant-associated medical expenses for expectant parents.

Market Dynamic

The Healthcare Insurance Market is characterized by elements such as evolving healthcare needs, regulatory changes, technological advancements, and economic developments. Consumer demographics, together with the rising older populations and increasing continual disease occurrence, drive the need for insurance products.

Rising healthcare charges pushed by factors like scientific inflation and technological improvements, influence pricing techniques and product innovation within the market. Additionally, transferring regulatory landscapes, which include healthcare reforms and modifications in coverage mandates, impact marketplace dynamics by way of influencing coverage requirements and administrative procedures.

Technological advancements, such as telemedicine and digital fitness programs, are reshaping the manner healthcare services are brought and accessed, influencing insurance services and distribution channels. Market competition intensifies as insurers attempt to distinguish themselves via value-added services, network partnerships, and customized health management programs. Mergers and acquisitions are common techniques among insurers looking to enlarge market share and improve service competencies.

Moreover, financial elements like unemployment rates and income level influence insurance enrollment and affordability, affecting market penetration and consumer retention. Overall, the Healthcare Insurance Market is a dynamic environment where insurers constantly adapt to satisfy evolving consumer needs, while navigating complex financial and competitive landscapes.

In the health insurance market, the mandatory provision of health insurance ensures broad coverage for individuals against medical expenses arising from diseases. Health insurance companies like Cigna operate within this scope, agreeing to provide comprehensive coverages encompassing various conditions outlined in the insurance plan. Such agreements positively impact the market by offering peace of mind to consumers, knowing they are protected financially in times of need. This trend mirrors developments in other sectors, such as Cyber Insurance and

Term Insurance, where tailored solutions address specific consumer risks and preferences.

Consumers are increasingly aware of the benefits of health insurance, recognizing its importance in mitigating healthcare costs. The comprehensive coverages included in health insurance plans cater to a wide range of medical needs, ensuring individuals have access to necessary treatments and services. As players in the health insurance market continue to innovate and expand their offerings, the scope of health insurance is expected to grow, further enhancing its value proposition for consumers and contributing to the overall well-being of society.

Research Scope and Analysis

By Insurance Provider

Public insurance providers are expected to show their prominence in the insurance provider segment as they hold 57.9% of the market share in 2024. Public insurance provider dominates the healthcare insurance market because they've strong authority support, which makes individual beings consider them, especially during tough economic times or health crises. They can negotiate better offers with hospitals and drug companies due to the fact they cover a lot of people. This allows them to offer good insurance plans at a lower cost, which is attractive to many, particularly those with low incomes or middle-class families.

Moreover, governments often mandate or assist fund public insurance to ensure everybody can get healthcare. This makes them even more famous. Public insurers cover a wide variety of plans, along with people who may also have trouble getting insurance in some other place, which gives them a large benefit.

Also, due to the fact they cover so many people, public insurers can save cash by doing things efficiently. They have fewer administrative costs and can manage their resources better. This efficiency facilitates them to keep prices down and offer better services. Overall, public insurance companies are important because they ensure everybody can get healthcare benefits when they need it, making them a key part of the healthcare system.

By Services

Inpatient treatment is projected to dominate the service segment with the highest market share in 2024. Inpatient treatment dominates the healthcare insurance market phase due to its considerable effect on usual healthcare costs and the crucial nature of services supplied. Inpatient treatment involves care that requires admission to a health center or medical facility, typically for surgical procedures, complicated medical techniques, or severe illnesses that necessitate non-stop monitoring and specialized care.

Insurance coverage for inpatient treatment is critical as it addresses the high prices associated with hospital stays, which include room prices, surgical procedures, diagnostic tests, medications, and professional clinical services. These expenses can speedily rise, placing a huge monetary burden on people and households without good enough insurance coverage.

Moreover, inpatient treatment often involves emergency conditions or acute medical conditions that require immediate attention, making it a concern for insurance coverage. Given the unpredictable nature of healthcare needs, individuals are trying to find assurance that they'll be financially included in the event of hospitalization or serious illness, underscoring the importance of inpatient treatment insurance within healthcare coverage plans.

By Level of Coverage

In the hierarchy of coverage levels within this market, the silver tier is projected to exert its dominance because of its balanced mixture of affordability and comprehensive benefits. silver plans commonly strike a middle ground between the lower premiums of bronze plans and the better coverage ranges of gold and platinum plans.

silver plans offer a competitive mix of premium fees and out-of-pocket expenses, making them appealing to a broad spectrum of customers. while bronze plans may have lower charges, they regularly include better deductibles and copayments. on the other hand, gold and platinum plans, at the same time as offering greater comprehensive insurance, frequently come with notably higher charges, making them much less reachable to fee-aware clients.

The silver tier offers an inexpensive compromise, imparting moderate rates in conjunction with a balance of coverage for critical healthcare services, medicinal drugs, and preventive care. additionally, silver plans regularly qualify for value-sharing reductions for eligible people. further enhancing their affordability and value proposition.

moreover, below the Affordable Care Act (ACA), silver plans are pivotal as they serve as the benchmark for determining premium subsidies, making them a popular choice among customers searching for financial help to reduce insurance costs. overall, the dominance of silver plans reflects as a practical choice for individuals looking for complete coverage without breaking the bank.

By Demographics

In the segmentation of the healthcare insurance market through demographics, adults often dominate because of their substantial representation in the working-age population and their various healthcare needs.

Adults typically constitute the largest demographic group, encompassing people aged 18 to 64, who're often in their prime working years and may have dependents counting on them for healthcare coverage. Adults face a myriad of healthcare needs, consisting of preventive care, persistent disorder control, reproductive health services, and low acute medical issues. As a result, they are seeking comprehensive insurance coverage that addresses a wide range of health concerns at the same time as remaining low-cost and handy.

Moreover, adults are frequently the primary breadwinners or decision-makers within families, making healthcare coverage a priority for financial planning and risk control. They value insurance plans that provide a balance between insurance breadth and affordability, ensuring they can get entry to necessary medical care without incurring sizable out-of-pocket expenses.

By Insurance Plan

Point of Service (POS) plans are anticipated to dominate the healthcare insurance market with 27.4% of the market share in this segment because of their flexibility and comprehensive insurance alternatives, combining elements of each Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans. POS plans to offer a hybrid approach that allows policyholders to choose healthcare companies from within a community (similar to HMOs) even as additionally offering the option to seek care outdoor the network (just like PPOs).

This flexibility is in particular appealing to consumers who value preference and autonomy in healthcare decision-making. POS plans usually feature a primary care physician (PCP) who serves as a significant point of contact for coordinating care and referrals in the network. However, policyholders have the liberty to look for professionals or are seeking care outside the community without a referral, albeit at a higher out-of-pocket cost.

Moreover, POS plans frequently provide complete coverage for preventive care, clinical services, and prescribed drugs, making them attractive to individuals and families in search of complete insurance protection. The potential to get entry to an extensive range of healthcare companies coupled with the freedom to look for care outdoor the network important positions POS plans as a versatile and famous desire inside the healthcare insurance market phase.

By End User

Individuals are projected to dominate the healthcare insurance market in this segment with the highest market share in 2024 because of numerous key elements that highlight their sizable role as end users. Firstly, individuals contain the largest demographic group within the populace, encompassing people of every age and socioeconomic background. As such, they constitute a numerous variety of healthcare needs and alternatives, driving demand for a whole lot of coverage merchandise tailor-made to their unique necessities.

Secondly, individuals have specific healthcare issues and ranging levels of risk tolerance, influencing their coverage purchasing decisions. They are seeking insurance that aligns with their lifestyle, health status, and financial skills, whether or not it is fundamental insurance for routine medical expenses or more broad plans for unforeseen emergencies or persistent conditions.

Overall, the dominance of individuals as end-users underscores their pivotal function in driving the demand and shaping the dynamics of the healthcare insurance market segment, reflecting their numerous healthcare needs and preferences. Health insurance comprehensive coverages a variety of insurance like medical insurance policies which is driving the market growth.

The Healthcare Insurance Market Report is segmented on the basis of the following:

By Insurance Provider

By Services

- Inpatient Treatment

- Outpatient Treatment

- Medical Assurance

- Others

By Level of Coverage

- Bronze

- Silver

- Gold

- Platinum

By Demographics

- Minor

- Adults

- Senior Citizen

By Insurance Plan

- Point of Service (POS)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPOS)

- Indemnity Health Insurance

- Health Maintenance Organization (HMO)

- Health Savings Account (HSA)

- Others

By End User

Regional Analysis

North America is projected to dominate the global healthcare insurance market

with 43.3% of the market share in 2024. North America commands dominance in the healthcare insurance market for several interconnected reasons. Firstly, the area benefits from a nicely-established healthcare infrastructure and technological advancements, ensuring the delivery of first-rate medical services. This infrastructure supports a robust insurance market by means of providing a framework for complete insurance options and facilitating access to a wide array of healthcare providers.

North America also possesses a sizable and prosperous population with tremendously excessive healthcare expenditure levels, using massive demand for insurance products. Moreover, the area hosts a wide range of insurance groups, both public and private, providing widespread networks and innovative product portfolios tailor-made to meet varying client needs. Additionally, authorities' interventions, along with the Affordable Care Act (ACA) in the United States, have increased coverage insurance and advocated market increase, further consolidating North America's dominance.

Furthermore, the regulatory surroundings in North America foster stability, customer safety, and competition, contributing to the attractiveness of the region for insurers and investors alike. Lastly, the location's sturdy financial system and consumer-driven healthcare system incentivize non-stop innovation and investment, solidifying North America's position as a pacesetter in the worldwide healthcare insurance market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive panorama of the healthcare insurance market is characterized by means of a wide array of players, which includes large multinational insurance groups, regional insurers, authorities-subsidized entities, and rising startups. Established insurers consisting of UnitedHealth Group, Anthem, and Aetna dominate the marketplace with extensive networks, diverse product services, and strong brand popularity.

Regional insurers compete in specific geographic regions, leveraging local market knowledge and personalized services to attract clients. Government-backed entities like Medicare and Medicaid play sizeable roles, offering coverage to eligible populations and shaping market dynamics via regulatory oversight and compensation rules. Also, Allianz’s insurance expertise with UniCredit’s is going to push its market prominence in the upcoming years.

Additionally, insurtech startups are disrupting the conventional insurance model by offering progressive virtual systems, personalized coverage solution, and streamlined customer experiences. Intense opposition amongst those players drives innovation, pricing strategies, and service quality, in the long run reaping rewards for purchasers through expanding preference and driving efficiencies in the healthcare insurance market.

Some of the prominent players in the Global Healthcare Insurance Market are

- Kaiser Permanente

- Elevance Health (Anthem)

- HCSC (including BCBS plans)

- UnitedHealth Group

- Centene Corp.

- CVS Health Corp. (Aetna)

- GuideWell (Florida Blue)

- Blue Cross Blue Shield of Michigan

- Highmark

- Blue Cross of North Carolina

- Other Key Players

Recent Development

- In February 2024, Thyrocare acquired Think Health Diagnostics, expanding into home ECG services. This strategic move enhances Thyrocare's presence in pre-policy medical check-ups for the insurance market, offering comprehensive health solutions.

- In January 2024, Bajaj Finserv Health, a subsidiary of Bajaj Finserv, acquires Vidal Healthcare, a Pune-based health-tech firm, strengthening its hospitalization services with access to a vast network of healthcare providers.

- In October 2023, APRIL International expands its European presence by acquiring Belgium's Expat & Co, a leading expatriate insurance underwriter. This move enhances APRIL's offerings and strengthens its position in the market.

- In August 2023, PureHealth, UAE's leading healthcare group, acquired Circle Health Group, UK's largest private hospital operator, for USD 4.41 billion. This marks PureHealth's global expansion, emphasizing its commitment to top-quality medical care.

- In May 2023, Kaiser Permanente's subsidiary, Risant Health, acquires Geisinger Health, aiming to expand value-based care. Experts express concerns about autonomy and community impact, while predicting regulatory approval due to both entities' reputations.

- In March 2023, Acko, a retail insurance provider aiming to raise USD 150.0 million, acquires Parentlane, a digital health platform, to enhance its healthcare offerings, aligning with its strategy of expanding its healthcare product.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2,584.8 Bn |

| Forecast Value (2033) |

USD 5,120.9 Bn |

| CAGR (2023-2032) |

7.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Product, and Solutions), By Insurance Provider (Public, and Private), By Services (Inpatient Treatment, Outpatient Treatment, Medical Assurance, and Others), By Level of Coverage (Bronze, Silver, Gold, and Platinum), By Demographics (Minor, Adults, and Senior Citizen), By Insurance Plan (Point of Service (POS), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Maintenance Organization (HMO), Health Savings Account (HSA), and Others), By End User (Individuals, and Corporates) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Kaiser Permanente, Elevance Health (Anthem), UnitedHealth Group, HCSC (including BCBS plans), Centene Corp., CVS Health Corp. (Aetna), GuideWell (Florida Blue), Blue Cross Blue Shield of Michigan, Highmark, Blue Cross of North Carolina, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Healthcare Insurance Market size is estimated to have a value of USD 2,584.8 billion in 2024 and is expected to reach USD 5,120.9 billion by the end of 2033.

North America is expected to be the largest market for the Global Healthcare Insurance Market with a share of about 43.3% in 2024.

Some of the major key players in the Global Healthcare Insurance Market are UnitedHealth Group, Centene Corp., CVS Health Corp and many others.

The market is growing at a CAGR of 7.9 percent over the forecasted period.