Market Overview

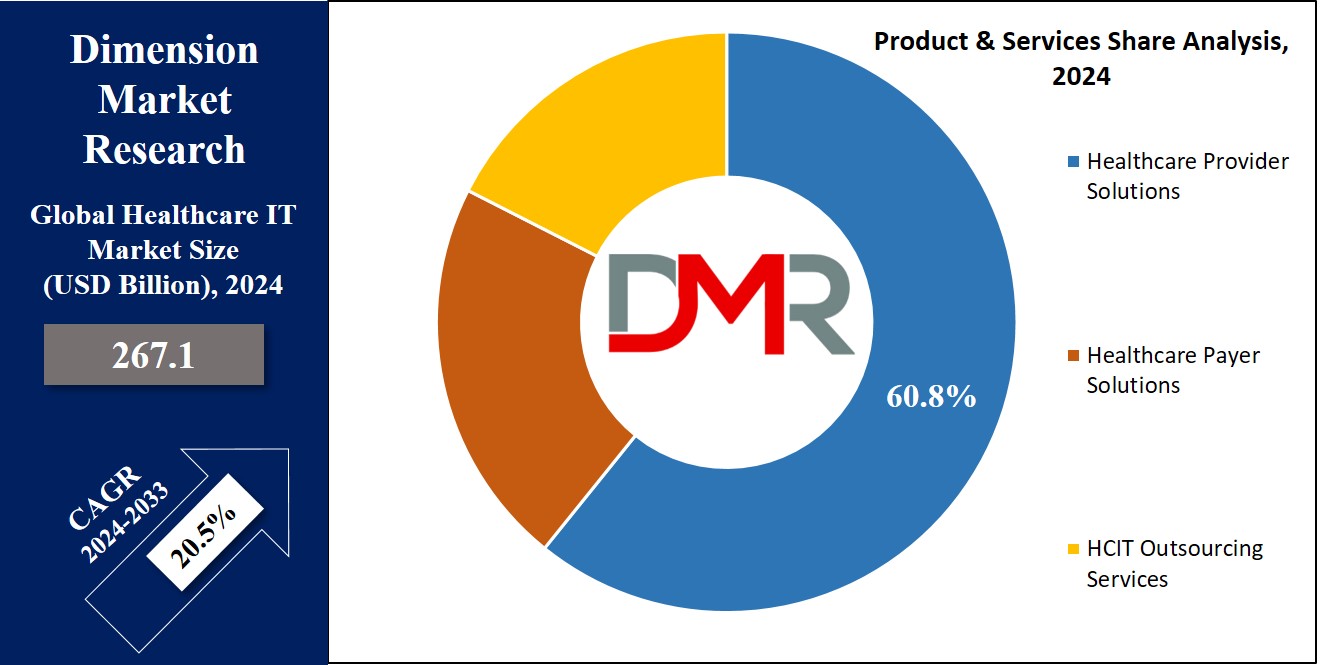

The Global

Healthcare IT Market is expected to reach a value of

USD 267.1 billion by the end of 2024, and it is further anticipated to reach a market value of

USD 1,433.2 billion by 2033 at a

CAGR of 20.5%.

Healthcare IT consists of a specialized field within IT that focuses on developing, designing, & maintaining information systems in numerous healthcare setups like clinics & hospitals. Its major goal is to improve healthcare delivery by allowing long-term data tracking, enhancing clinical outcomes, minimizing errors, improving practice efficiencies, & facilitating smooth care coordination.

The global growth of the

healthcare IT market is supported by various factors, like the broad acceptance & usage of cloud technology in healthcare IT services, an increase in desire for mHealth & telehealth solutions driven by smartphone users, the adoption of healthcare reforms like the Affordable Care Act, and the rapid growth in the old population leading to an increase in chronic diseases.

Rising smartphone penetration and internet coverage are significantly fuelling healthcare IT solutions' adoption, while mobile health (mHealth) apps have revolutionized

chronic disease management. According to a Mass Media Data report, 5.31 billion unique users were using mobile phones at the beginning of 2022; that represented more than two thirds of the global population. Internet usage has also experienced tremendous growth 4.95 billion users had online access at some point early 2022; representing 62.5 percent of people on earth at the time.

As demand for centralized medical records to enhance care delivery has grown in developed nations such as the US, it has led to greater adoption of electronic health records. This trend corresponds with value based care models and further propels market expansion.

For instance, Google Health recently collaborated with MEDITECH's Expanse EHR platform by integrating its search and summarization features for enhanced patient care through faster accessing multiple sources.

These factors collectively contribute to the global expansion of healthcare IT & improving healthcare practices globally.

Key Takeaways

- The global healthcare IT market is expected to grow by 1,166.3 billion, at a CAGR of 20.5% during the forecasted period.

- By Product & Service, healthcare provider solutions segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By End User, health care providers are expected to have lead throughout the forecasted period.

- By Application, the tele-healthcare segment is expected to take the lead & drive the market in 2024.

- North America is expected to hold a 49.9% share of revenue in the Global Healthcare IT Market in 2024.

- Some of the use cases of healthcare IT include telemedicine, mHealth apps, and more.

Use Cases

- Electronic Health Records (EHRs): EHRs assist doctors & healthcare providers keep digital records of patients' medical history, diagnoses, medications, & treatments, which allows for fast & easy access to relevant information, improving overall patient care & reducing the chances of errors.

- Telemedicine: Telemedicine uses technology to allow remote consultations between patients & healthcare professionals. Further, it's like having a virtual visit with the doctor through video calls, which is mainly useful for follow-up appointments, minor health concerns, or more.

- Healthcare Analytics: Using data analytics, healthcare professionals can analyze large sets of information to identify patterns, trends, & insights, which helps in making informed decisions, predicting disease outbreaks, optimizing resource allocation, and enhancing overall healthcare management.

- Mobile Health (mHealth) Apps: Mobile health applications provide a range of services, from tracking fitness & nutrition to monitoring chronic conditions, which empower individuals to take control of their health by providing live information, reminders for medications, and personalized health advice, as they play an important role in preventive healthcare.

Market Dynamic

The market is experiencing growth due to the increasing adaptation of preventive care, driven by high consumer demand & rising funding for several mobile health startups. Further, improvements in network infrastructure & expanded network coverage contribute to this growth.

Also, technological developments & advancements, mainly in healthcare IT infrastructure including IoT & AI implementation, play a major role in driving the expansion of the market, as nations like India have made significant efforts in digitalization, exemplified by initiatives like the Pradhan Mantri Digital Health Mission introduced by the Indian PM in recent past.

Which aims to create a secure digital healthcare system, that enable individuals to access, store, & authorize the sharing of their health records. The economical nature, ease of use & time efficiency are key drivers behind the acceptance of healthcare IT in hospitals.

Moreover, the growth of the market is driven by constant enhancement in the services provided by industry participants to cater to changing consumer needs. Also, the growing interest in better-quality healthcare solutions, the adoption of telemedicine & mobile health technologies, and enhanced government efforts to boost healthcare IT continue to propel the market's growth.

However, challenges grow because of concerns regarding the security & safety of patient data, mainly due to the rising cases of cyber-attacks worldwide. Ensuring the confidentiality of patient information remains a major challenge for key industry players.

Driver

Electronic Health Records (EHRs) and Telemedicine solutions have become an essential factor for healthcare IT market growth in recent years. Governments and healthcare organizations alike are investing heavily in digital infrastructure to streamline patient data management, reduce medical errors, and optimize healthcare delivery efficiency.

Due to an aging population and rising chronic disease prevalence,

remote patient monitoring services are being increasingly adopted by healthcare providers. With advances in cloud computing, artificial intelligence, and data analytics supporting healthcare providers with making informed clinical decisions while streamlining workflows and improving patient care creating rapid growth of the Healthcare IT Market.

Trend

One noteworthy trend in the Healthcare IT Market is the rising use of artificial intelligence (AI) and machine learning (ML) technologies, which improve diagnostics, predictive analytics, personalized medicine by analyzing large amounts of patient data. Cloud based healthcare solutions have seen increasing adoption due to their cost effective, scalable, and secure platforms for managing data.

Wearable health devices and Internet of Things (IoT) technology have allowed for real time collection and transmission of patient data, and advanced cybersecurity measures to protect this sensitive health data is another trend shaping the market to ensure compliance with data protection regulations.

Restraints

While its potential is immense, Healthcare IT Market faces obstacles such as high implementation costs and interoperability issues that impede its progress. Small and mid sized healthcare facilities in developing regions often find it hard to justify making the initial investments required for deploying IT solutions.

Adopting new technologies among healthcare professionals may be hindered by complex systems with steep learning curves, fragmented healthcare systems, data security breaches, unauthorized access to patient records, and concerns over data reliability all factors which inhibit market expansion.

Opportunity

The Healthcare IT Market presents ample opportunities, driven by technological advancements and growing demand for personalized care. Telehealth platforms in particular present an exciting prospect for remote consultations and monitoring, which have become particularly essential post pandemic.

Emerging markets across Asia Pacific, Latin America and the Middle East represent unrealized potential as governments work toward improving healthcare infrastructure and IT integration. As patient centric care and value based healthcare models become more prominent, opportunities exist for IT solutions that improve operational efficiency and patient outcomes. Furthermore, integrating AI, blockchain and big data analytics creates opportunities for smarter healthcare systems globally.

Research Scope and Analysis

By Product & Services

The healthcare provider solutions segment is expected to lead the market in 2024, holding a maximum share, which is expected to persist because of the growing desire for patient safety & care. Further, the healthcare payer solutions segment is expected to have significant growth during the anticipated period, driven by payers' rise in requirement for patient documentation & billing services.

Also, the healthcare provider solutions segment is expected to experience the highest growth, due to the rising acceptance of EHR (electronic health records) & other healthcare information systems by providers, which is fueled by the need for quality healthcare services.

Further the growing adoption of mHealth & telehealth practices, increased government initiatives to promote healthcare IT, & the widespread acceptance of cloud technology in the sector of healthcare.

By End User

Based on End User, the Global Healthcare IT Market is consists of healthcare providers & healthcare payers. Within the healthcare provider segment, there are subdivisions like mobile care centers, pharmacies, hospitals, individual & imaging centers, and other facilities. The healthcare payer segment is also classified into public payers & private payers.

During the forecast period, the healthcare provider segment is expected to dominate the market with a maximum share in 2024 and is anticipated to experience significant growth in coming years as well, with hospitals being the largest segment within healthcare IT requests, which is attributed to the hospitals' need for a variety of healthcare IT solutions to smoothly deal with the rising challenges of managing patient information within their facilities. Further, the healthcare payers’ domain is expected to maintain a high growth rate in the coming years.

By Application

The tele-healthcare sector is expected to lead the market in 2024, driven by a demand for effective electronic healthcare systems & advancements in healthcare IT, which is fueled by the growing awareness of streamlined healthcare processes & the necessity for technology-integrated solutions. Further, the tele-healthcare is divided into tele-care and

telehealth, responding to the growth in health consciousness, a need for cost-effective care, and the expanding geriatric population.

Moreover, the electronic prescribing system segment is expected to see rapid growth in the coming years, as the adoption of e-prescribing systems is growing due to increased awareness of their benefits.

Moreover, the medical imaging information systems segment, including monitoring analysis software, radiology information systems, and PACS, is expected to experience substantial growth due to the demand for streamlined healthcare operations &the awareness of their applications in tracking billing information and radiology imaging orders, mainly during the global increase in chronic diseases.

The Healthcare IT Market Report is segmented on the basis of the following:

By Product & Services

Healthcare Provider Solutions

- Clinical Solutions

- Non-Clinical Healthcare IT Solutions

Healthcare Payer Solutions

- Claims Management Solutions

- Population Health Management Solutions

- Pharmacy Audit & Analysis Solutions

- Payment Management Solutions

- Customer Relationship Management Solutions

- Member Eligibility Management Solutions

- Fraud Analytics Solutions

- Provider Network Management Solutions

HCIT Outsourcing Services

- IT Infrastructure Management Services

- Payer HCIT Outsourcing Services

- Provider HCIT Outsourcing Services

- Operational HCIT Outsourcing Services

By End User

Healthcare Providers

- Hospitals

- Ambulatory Care Centers

- Diagnostics & Imaging Centers

- Pharmacies

- Others

Healthcare Payers

- Private Payers

- Public Payers

By Application

- Electronic Health Records

- Computerized Provider Order Entry Systems

- Electronic Prescribing Systems

- Laboratory Informatics

- Clinical Information Systems

- Medical Imaging Information Systems

- Radiology Information Systems

- Monitoring Analysis Software

- Picture Archiving and Communication Systems

Tele-healthcare

Regional Analysis

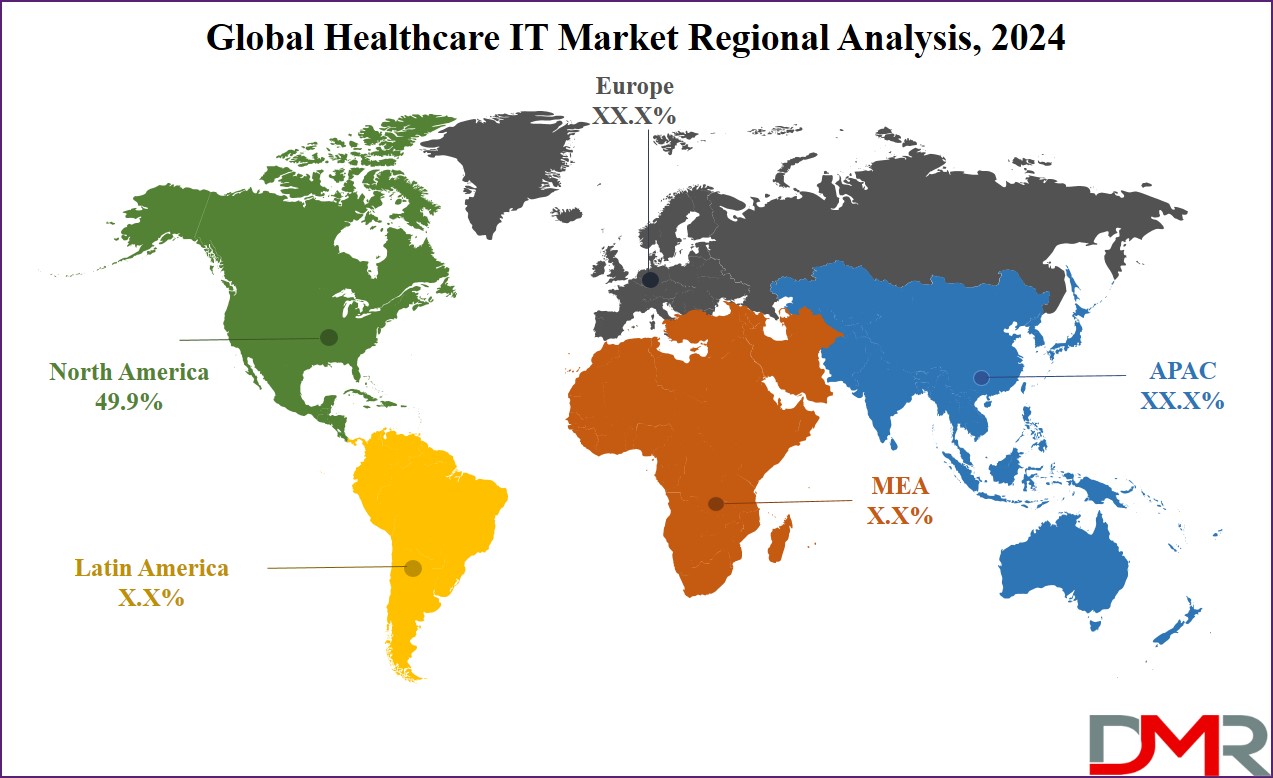

North America stands out as a major force in the market and is expected to have the maximum revenue share at

49.9% in 2024. The region's market prominence can be accredited to the broad usage of healthcare IT solutions & services, mainly in the US. Providers in this region are constantly integrating IT solutions to improve patient care quality & reduce operational costs.

The adoption rates of healthcare IT solutions vary among providers & are influenced by diverse factors. For instance, HER (Electronic Health Records) adoption in Oregon highlights varying rates among healthcare providers, showcasing distinct digital disparities. Further, the acceptance of electronic health records in the US has experienced a significant increase, as around nearly 9 out of 10 physicians based in the US have accepted EHR systems.

By Region

North America

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The key players in the market are opting for various strategies, like the development of new products, partnerships, & collaborations, to increase their presence in the sector. For instance, Athenahealth made a major announcement regarding its integrated medical billing, cloud-based EHR, & patient engagement solution called 'athenaOne', which along with 'athenaOne Dental', was selected by LCH Health & Community Services to enhance both provider & patient experiences.

While focusing on its growth objectives. Moreover, the market is highly competitive, providing a broad range of applications like EHR & e-prescribing, with several vendors offering customized solutions.

Some of the prominent players in the global Healthcare IT Market are

Recent Developments

- In January 2024, Eli Lilly and Company announced LillyDirect, a new digital healthcare experience for patients in the US. living with obesity, migraine, and diabetes, as it provides disease management resources, like access to independent healthcare providers, customized support, & direct home delivery of select Lilly medicines via third-party pharmacy dispensing services.

- In December 2023, Healthix announced that the company has launched Individual Access Services to allow consumers free, easy, & secure access to their healthcare data from over 8,000 health facilities across New York State in a single portal.

- In July 2023, EVYD Technology & the Agency for Science, Technology & Research, Singapore's lead R&D agency launched a joint AI research lab aimed at population health & digital health, along with it they announced a USD 7.5 million project under the joint lab to support multi-institutional, cross-border collaborations in digital health.

- In March 2023, Fujitsu launched a new cloud-based platform that allows users to securely collect & leverage health-related data to support digital transformation in the medical field. Further, the new offering provides a part of Fujitsu’s ongoing efforts to contribute to the creation of a healthy society as part of its vision for “Healthy Living” under Fujitsu's Uvance to create a sustainable world.

- In March 2023, Nuance Communications, Inc., announced Dragon Ambient eXperience (DAX) Express, a workflow-integrated, fully automated clinical documentation application that integrates proven conversational & ambient AI with OpenAI's newest & most capable model, GPT-4. E

Regional Analysis

| Report Characteristics |

| Market Size (2023) |

USD 267.1 Bn |

| Forecast Value (2032) |

USD 1,433.4 Bn |

| CAGR (2023-2032) |

20.5% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product & Services (Healthcare Provider Solutions,

Healthcare Payer Solutions, and HCIT Outsourcing

Services), By End User (Healthcare Providers and

Healthcare Payers), By Application (Electronic Health

Records, Computerized Provider Order Entry

Systems, Electronic Prescribing Systems, Laboratory

Informatics, Clinical Information Systems, Medical

Imaging Information Systems, and Tele-healthcare) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Allscripts Healthcare Solutions Inc., eMDs, Inc.,

Cerner corporation, Epic system corporation, General

Electric company, Infor, inc., SAP, Siemens

Healthineers, GE Healthcare, Oracle Corporation, and

Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Healthcare IT Market size is estimated to have a value of USD 267.1 billion in 2024 and is

expected to reach USD 1,433.4 billion by the end of 2033.

North America is expected to have the largest market share in the Global Healthcare IT Market with a

share of about 49.9% in 2024.

Some of the major key players in the Global Healthcare IT Market are Allscripts Healthcare Solutions

Inc., eMDs, Inc., Cerner Corporation, and many others.

The Healthcare IT market is growing at a CAGR of 20.5 percent over the forecasted period.