As per Experian, 70% of healthcare providers cite staff shortages as a critical obstacle to payer reimbursement, while 83% face growing difficulties in managing late payments and assisting financially challenged patients. The State of Patient Access, 2023 survey highlights that 87% of providers report worsening healthcare access due to staffing shortages.

Claim denials cost hospitals $5 million annually, with 38% of providers experiencing denial rates above 10%. According to the American Hospital Association, Medicare Advantage payment denials rose by 56% from January 2022 to June 2023, reducing cash reserves by 28% as maintenance costs soared by 90% and operational expenses increased by 35%.

Healthcare reimbursement remains a critical focus, with value-based care driving innovation. Recent mergers, such as CVS Health's acquisition of Oak Street Health, highlight the industry's consolidation trend to streamline services and improve patient outcomes. Opportunities abound in telehealth, AI-driven solutions, and alternative payment models as insurers and providers seek efficiency. Collaborations with

Healthcare Consulting Services are increasingly supporting providers to navigate complex reimbursement regulations and optimize revenue cycles.

Conferences like the Healthcare Financial Management Association (HFMA) Annual Conference provide insights into regulatory changes and reimbursement strategies. News of policy shifts, including Medicare expansion and price transparency regulations, continues to shape the landscape. Staying informed on these developments is key to identifying growth and partnership opportunities in healthcare.

Key Takeaways

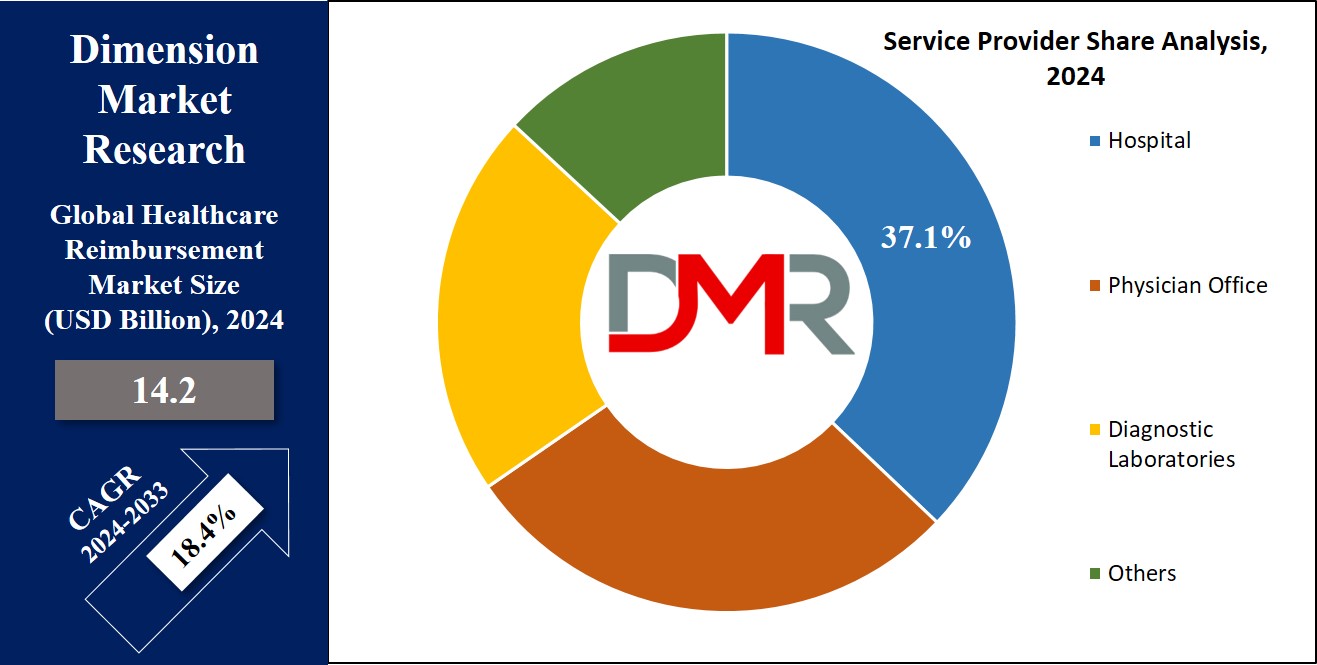

- The Global Healthcare Reimbursement Market is anticipated to dominate with USD 14.2 billion in 2024 and is anticipated to grow to USD 64.5 billion by 2033 at a CAGR of 18.4%.

- The underpaid segment is predicted to account for the revenue share of 53.1% in 2024.

- Based on payers, private are expected to dominate the market with the largest revenue share in 2024.

- The hospital segment is anticipated to emerge as the largest revenue share of 37.1% in 2024.

- North America is predicted to dominate the market with a revenue share of 34.1% in 2024.

Use Cases

- Healthcare providers receive payment for each service they perform for patients under this approach as the rates are typically fixed by the payer and provider after discussion.

- Diagnosis reimbursement is used for patients who are already staying in the hospital where the service provider receives fixed payment based on the severity of the patient's condition.

- Capitation is a service provided by healthcare organizations in which providers receive a fixed monthly payment per patient enrolled in their plan, regardless of the services rendered which is managed by Health Maintenance Organizations and Accountable Care Organizations.

- Healthcare providers are rewarded for achieving certain performance metrics, such as improving patient outcomes, reducing hospital readmissions, or enhancing patient satisfaction which aims to promote higher quality, more efficient care delivery.

Market Dynamic

The market dynamic is influenced by the increasing cost of healthcare services and government programs, which drive the growth of this market. The growing occurrence of chronic disease requires continuous medical care, and treatment like doctor visits, and medication besides that, the demand for this disease is rising continually which consequently results in the rise of health spending, thus accelerating the market growth, too. Moreover, the rise in the cost of prescription medicine alongside growing patient numbers will lead to a burden on patients, hence the growth potential of the market is improved. The stakeholders are also, increasingly involved in payment, because of high medical costs.

However, low quality of care, high cost of treatment, and similar administrative load are keeping this market from doing accomplishments.

Research Scope and Analysis

By Claim

The underpaid segment is expected to account for the revenue share of 53.1% in 2024 due to the rising number of false claims and unnecessary utilization of healthcare services resulting in underpaid settlements. Also, there are many cases of people and companies scamming federal and state healthcare systems.

This segment includes placing a claim for medicines, medical equipment, services, and treatment that was never given. Further, consumers are not paying the entire cost of services, they are more inclined to use them, which fuels the market. Some intentionally utilize medical services that are not necessary for their health.

Full-paid claims are processed where the payer has reimbursed the provider according to the contracted rates or fee schedules without any discrepancies or underpayments.

By Payers

Based on payers, the market is divided into private and public payers, private payers are expected to dominate the market with the largest revenue share in 2024 due to the presence of a large number of private organizations in the market. These are insurance companies that are privately owned and operated and provide health insurance plans to individuals and groups, such as employers or associations.

Half of the American population is insured which provides private health coverage.

Growing policies and acts regarding healthcare services increase the size of the private insurance market. This segment forces those who are not covered by company insurance programs to acquire private health insurance and creates incentives for employers to offer insurance.

These are elements responsible for the segment's expansion. Furthermore, the public segment is growing due to government-funded healthcare programs that provide coverage to eligible individuals.

By Providers

The hospital segment is expected to grow with the largest revenue share of 37.1% in 2024 due to the increasing old population along with a rising number of surgeries as these are medical facilities that provide several healthcare services, including emergency care, surgery, inpatient care, and more which are based on their size, scope of services, and ownership.

Reimbursement in this segment involves a complex system of payments based on diagnosis-related groups for inpatient care, fee-for-service payments for outpatient services, or bundled payments for episodes of care. The physician offices segment is predicted to dominate the market due to reimbursement based on fee-for-service payments, where healthcare providers are reimbursed based on the services they offer, like office visits, consultations, procedures, and tests.

Furthermore, the diagnostic laboratory segment is expected to experience significant expansion in the foreseeable future due to a rising number of patients and government initiatives aimed at embracing advanced healthcare infrastructure.

The Healthcare Reimbursement Market Report is segmented based on the following

By Claim

By Payers

- Private Payers

- Public Payers

By Providers

- Hospitals

- Physician office

- Diagnostic Laboratories

- Others

Regional Analysis

North America is expected to rule with a

revenue of 34.1% by 2024 due to the presence of smooth policies and government linkage with the insurance sector. Additionally, compulsory health insurance in the US is another fact that driving the growth of this market as the federal government can punish the states that neglect the rules leading to the expansion of the marketplace in this region.

The specialization in this health region is highly affected by the established health system and advanced medical technology, which results in a higher demand for reimbursement services.

Europe, the second largest market after North America, is expected to be driven by an older population and the occurrence of diseases like atherosclerosis, respiratory problems, and cardiovascular diseases. Healthcare systems in this region are shifting fast, with performance-based payment implementation being the main goal.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Companies are teaming up with the government in the creation of this reimbursement market by the governments have been forming regulations and policies to improve healthcare quality and affordability.

Besides, startups and tech companies are crossing into the reimbursement landscape offering innovative solutions that aim to replace and disrupt the traditional models.

A strategic choice of major players is the adoption of product launches, acquisitions, and collaborations to enrich their healthcare reimbursement portfolio. Many players still compete and this results in the whole dynamic scenario being formed to provide to the many faces of patients, providers, and payers.

Some of the prominent players in the global healthcare reimbursement market are

- UnitedHealth Group

- Aviva

- Allianz

- CVS Health,

- BNP Paribas

- Aetna

- Nippon Life Insurance

- WellCare Health Plans

- AgileHealthInsurance

- The Blue Cross Blue Shield Association

- Others

Recent Development

- In January 2024, Mastercard announced a medical claims payment partnership in India using its virtual card technology.

- In January 2024, the General Insurance Council announced that hospitals with 15 beds, and registered with the respective state health authorities under the Clinical Establishment Act can offer cashless hospitalization aimed to make it available for policyholders.

- In December 2023, the Centers for Medicare and Medicaid Services aims to have all traditional Medicare beneficiaries under a value-based care model that can successfully use electronic health records for documentation and reporting.

- In October 2023, the National Health Claims Exchange is a digital deliverance of sorts that could sharply cut down both the time spent on and the cost incurred in insurance claims processing.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 14.2 Bn |

| Forecast Value (2033) |

USD 64.5 Bn |

| CAGR (2023-2032) |

18.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Claim (Underpaid, Full Paid), By Payers (Private Payers, Public Payers), By Providers (Hospitals, Physician offices, Diagnostic Laboratories, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

UnitedHealth Group, Aviva, Allianz, CVS Health, BNP Paribas, Aetna, Nippon Life Insurance, WellCare Health Plans, AgileHealthInsurance, The Blue Cross Blue Shield Association, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |