Market Overview

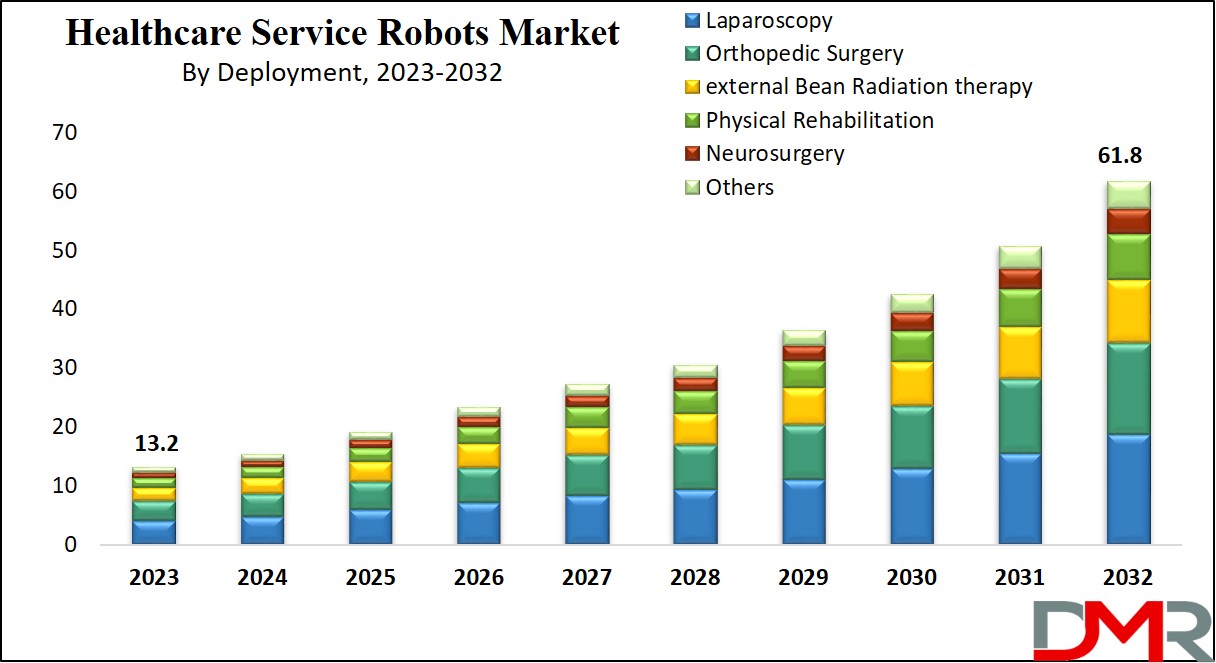

The Global Healthcare Service Robots Market is expected to reach a value of USD 13.2 billion in 2023, and it is further anticipated to reach a market value of USD 61.8 billion by 2032 at a CAGR of 18.7%.

The global healthcare service robots marketplace is a dynamic and modern zone focused on developing, generating, and deploying robot systems tailor-made to fulfill diverse desires within healthcare. These robots find packages in surgical procedures, telemedicine, rehabilitation, disinfection, and logistics, presenting numerous answers to beautify affected person care and operational efficiency.

Characterized by using continuous technological improvements, such as AI integration and advanced sensors, the market includes a wide variety of participants, from installed groups to startups. Growth within the marketplace is propelled by the growing call for automation, advancements in surgical strategies, and the vital for infection management.

Swarm robotics provide faster task completion and pathology identification with greater efficiency, while AR/VR, AI, IoT integrations, as well as 5G networks rollout are expected to foster industry growth. These advanced technologies, supported by robust network capabilities, will radically change remote patient monitoring and streamline workflow processes within the medical sector.

Robotics services play a key role in providing exceptional patient care by offering customized, frequent monitoring of individuals suffering from chronic illnesses or debilitating conditions. Furthermore, robotics enables intelligent therapeutic solutions and foster social engagement for elderly patients; providing significant improvements to both healthcare experiences and outcomes.

While challenges including ethical concerns and regulatory complexities exist, possibilities for marketplace growth lie in addressing these problems, exploring new packages, and adapting to evolving healthcare demands.

Key Takeaways

- The dominance in orthopedic surgery within the healthcare services robot market is based on offering as it holds 48.7% of the market share in 2023.

- Laparoscopy dominates the global healthcare service robots market based on deployment as they hold 30.2% of the market share in 2023.

- Security systems are integral components within the domain of healthcare service robots as they hold 26.2% of the market share in 2023.

- The dominance of disinfection robots in the healthcare service robots market based on application holds 34.9% of the market share in 2023.

- Hospitals stand as the predominant end-user segment in the healthcare service robots market as it holds 58.2% of the market share in 2023.

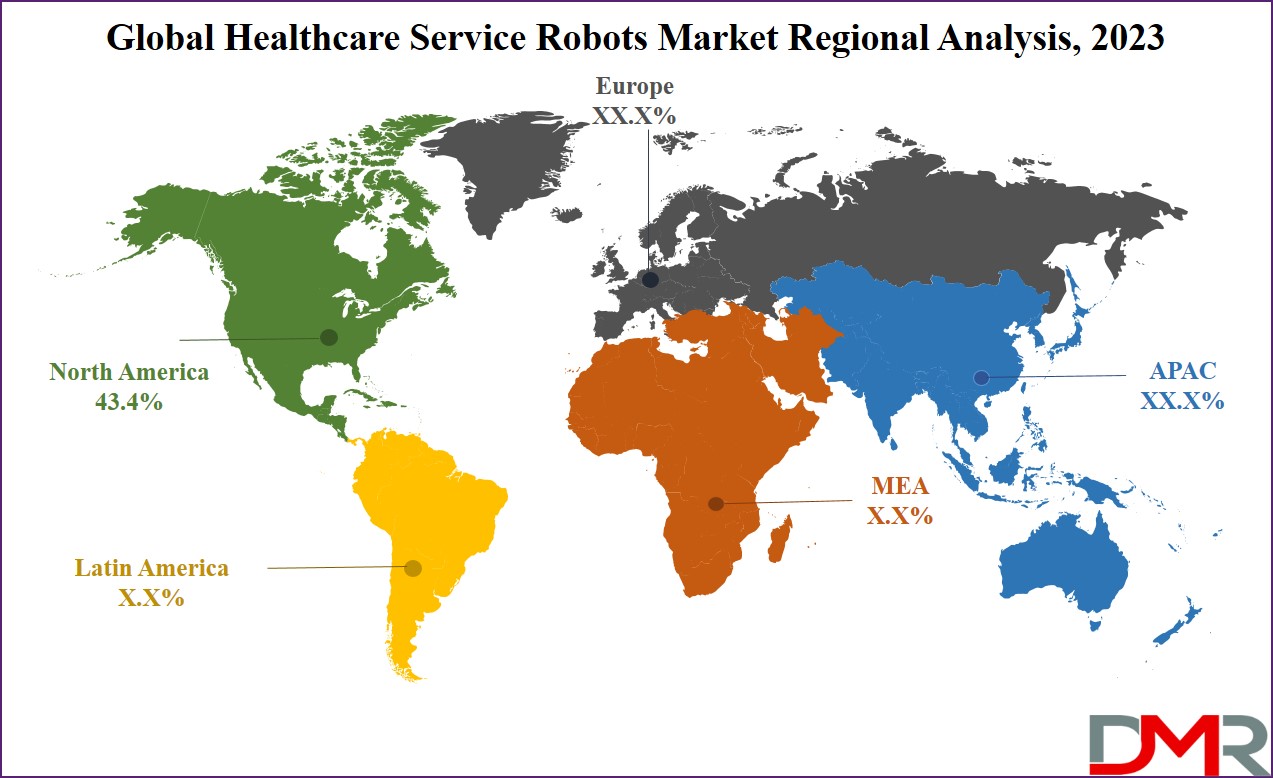

- North America dominates the global healthcare service robots market as it holds 43.4% of the market share in 2023.

Use Cases

- Remote Monitoring & Telehealth: Wearable devices and connected health apps allow continuous monitoring of vital signs (e.g., glucose, blood pressure), enabling providers to deliver timely interventions and reduce hospital visits.

- Personalized Treatment Plans: AI and big data analytics help create individualized care pathways by analyzing patient history, lifestyle, and real-time health data, improving treatment effectiveness.

- Medication Adherence Support: Smart pillboxes, mobile reminders, and automated alerts improve patient compliance with prescriptions, reducing complications from missed or incorrect dosages.

- Patient Education & Self-Management: Digital platforms provide interactive education tools, lifestyle tracking, and symptom management, empowering patients to take control of their conditions.

- Predictive Analytics for Risk Management: Advanced analytics forecast disease progression and hospitalization risks, enabling proactive care and reducing long-term treatment costs.

Market Dynamic

The global healthcare robotics market has witnessed sizable adjustments due to the growing demand for merchandise inside the healthcare area. Accelerated by the COVID-19 pandemic, there was an increasing emphasis on

telemedicine and telehealth services, with robots facilitating television and far-flung patient care. Disease control became paramount, main to the adoption of disinfection robots geared up with advanced technologies.

Continuous platform-to-platform developments such as surgical robotics, particularly the da Vinci Surgical System, have enabled increased accuracy in minimally invasive surgeries The market has been responding to the growing needs of the elderly population with robotics in rehabilitation and geriatric care.

Artificial intelligence integration, collaborative robotics, and regulatory considerations play an important role in the growth of this market, and capital investment drives the research and development of this technology Despite challenges and moral considerations, the epidemic has highlighted the resilience and readiness of healthcare robots. The global expansion of the market, focused on patient care, further explains the growth of healthcare robotics.

Driving Factors

The Healthcare Service Robots Market is driven by rising demand for automation to increase efficiency and patient outcomes, due to chronic diseases and

chronic disease management an aging population, and shortages in healthcare professionals. Robotic solutions assist with tasks including surgery, rehabilitation, patient care and disinfection - with improvements such as sensors and AI capabilities providing more precise performance than before.

In addition, COVID-19 pandemic further boosted market growth as it increased adoption of robots for tasks requiring minimal human interaction - further driving growth of this market sector.

Trending Factors

A major trend in the Healthcare Service Robots Market is the incorporation of artificial intelligence (AI) and

machine learning (ML) technologies to enhance functionality and decision-making capabilities of robots, making them increasingly capable of performing complex tasks such as early diagnosis, personalized patient care and surgical assistance with greater precision.

Cobots designed to work alongside healthcare professionals have also gained prominence, as has remote patient interaction via telepresence robots that provide remote support - all indicative of increased adoption of robotics to increase efficiency while expanding scope.

Restraining Factors

One major barrier in the Healthcare Service Robots Market is its high cost of development, implementation, and maintenance. Automated robotic systems often require significant investments for development, implementation, and maintenance restricting their adoption among smaller healthcare facilities.

Concerns regarding data privacy and security posed by AI enabled robots present further obstacles owing to stringent regulations governing them; resistance from healthcare workers unfamiliar with robotic technology hinder widespread adoption; resistance from healthcare professionals unfamiliar with its use due to job displacement fears further hinder widespread adoption.

Integrated solutions must also seamlessly fit with existing infrastructure while adhering to stringent regulatory compliance creating additional challenges faced by market participants when operating within healthcare environments where complexity reigns supreme.

Opportunity

The Healthcare Service Robots Market represents immense potential given the rise in home healthcare and personalized medicine. As our populations age and demand for remote care increases, robots designed for in-home assistance, patient monitoring and rehabilitation are becoming more widely adopted. Emerging markets with expanding healthcare infrastructure offer unrealized potential for robotic solutions. As technology evolves, more affordable and versatile robots are creating new applications.

Additionally, partnerships between robotics companies and healthcare providers to co-develop customized solutions further increase market prospects for service robots as an essential element of healthcare delivery in the future.

Research Scope and Analysis

By Offering

The dominance in orthopedic surgery within the healthcare services robot market is based on offering as it

holds 48.7% of the market share in 2023 and is projected to show subsequent growth in the upcoming period of 2023 to 2032. This dominance can be attributed to the orthopedic conditions, ranging from joint disorders to fractures, are widespread, driving a high demand for surgical interventions.

The aging global populace further amplifies the superiority of orthopedic issues, as aged people typically revel in musculoskeletal situations.

Advances in surgical techniques, specifically in minimally invasive and robot-assisted strategies, have expanded the precision and recuperation consequences of orthopedic surgeries. The continuous innovation in orthopedic technology, coupled with the vast demand for joint replacement surgeries and the high-quality impact of these interventions on sufferers' first-rate of lifestyles, underscores the uniqueness's dominance.

The integration of robotics into orthopedic approaches, collaborative efforts, and supportive compensation guidelines in addition make contributions to its prominence. As musculoskeletal situations constitute a extensive a part of the worldwide sickness burden, orthopedic surgery remains a crucial and influential thing in the broader panorama of healthcare services.

By Deployment

Laparoscopy dominates the global healthcare service robots market on the basis of deployment as they hold 30.2% of the market share in 2023 and are expected to show significant growth in the upcoming period of 2023 to 2032. The dominance of robotic systems in laparoscopy, exemplified with the aid of structures like the da Vinci Surgical System, is rooted in their precise benefits that substantially raise the capabilities of surgeons.

These structures provide unheard-of precision and dexterity, important for intricate laparoscopic strategies, at the side of 3-dimensional visualization that enhances surgical accuracy. The minimally invasive nature of laparoscopy aligns seamlessly with robotic systems, allowing for smaller incisions, decreased trauma, and faster patient recuperation.

The balance supplied with the aid of these systems, coupled with tremor reduction and an extensive range of motion, ensures managed movements in confined spaces for the duration of laparoscopic surgeries. The ability to remote surgical operations and use robot platforms for schooling purposes contribute to the great reputation and adoption of this technology.

By Component

Security systems are integral components within the domain of healthcare service robots as they hold 26.2% of the market share in 2023 and are expected to show subsequent growth in the upcoming period of 2023 to 2032. Security systems dominate this segment as they serve as vital safeguards for patient data, privacy, and the overall integrity of robotic systems in healthcare environments.

Given the sensitive nature of patient records, security measures are crucial to ensure compliance with records safety regulations, together with HIPAA, and to prevent unauthorized right of entry to each healthcare center and the robots themselves. Encryption protocols secure information transmissions, protecting against cyber threats and unauthorized intrusion. Physical protection capabilities, like obstacle detection and emergency prevention mechanisms.

Surveillance capabilities make contributions to situational awareness, and adherence to regulatory requirements ensures compliance with healthcare guidelines. Robust safety structures no longer most effectively mitigate risks and liabilities however also construct accepted as true within the use of healthcare provider robots, fostering self-belief among healthcare experts, patients, and stakeholders inside the secure deployment of these innovative technologies.

By Application

The dominance of disinfection robots in the healthcare service robots market based on application holds 34.9% of the market share in 2023 and is anticipated to show significant growth in the upcoming period of 2023 to 2032. These robots have become vital in addressing public health concerns, offering automated and effective solutions to sanitize surfaces and mitigate the risk of microbial contamination in healthcare environments.

With a focus on reducing healthcare-associated infections, disinfection robots provide unparalleled efficiency and consistency, utilizing advanced technologies such as ultraviolet light for thorough disinfection. Their ability to save time for healthcare staff, operate 24/7, adapt to diverse environments, and integrate seamlessly into existing infrastructure has propelled their widespread adoption. The remote monitoring and control capabilities, coupled with compliance with stringent infection control standards, further enhance their appeal.

By End User

Hospitals stand as the predominant end-user segment in the healthcare service robots market as it holds 58.2% of the market share in 2023 due to the versatile applications of these robotic systems. With a vast spectrum of features, along with surgical assistance, telemedicine, logistics, patient care, and disinfection, provider robots cope with the diverse wishes within hospital environments. They play a critical function in minimizing the workload on healthcare specialists through coping with repetitive or physically traumatic responsibilities.

The adoption of robots for surgical precision, telemedicine consultations, logistical efficiency, affected person assistance, and rehabilitation underscores their significance in hospitals. The heightened cognizance of infection management, particularly at some point in the COVID-19 pandemic, has further improved the position of disinfection robots in maintaining smooth health facility surroundings. Early adoption, ongoing studies tasks, and the capability for resource optimization and cost performance contribute to hospitals being key adopters.

The Healthcare Service Robots Market Report is segmented based on the following

By Offering

- Orthopedic Surgery

- Cardiology

- Neurosurgery

By Deployment

- Laparoscopy

- Orthopedic Surgery

- External Bean Radiation Therapy

- Physical Rehabilitation

- Neurosurgery

- Other

By Component

- Security Systems

- Locomotive Systems

- Interface Applications

- Software Platforms

- Power Resources

By Application

- Disinfection Robots

- E Assistance

- Delivery Robots

- Dispensing Robots

- Others

By End User

- Hospital

- Rehabilitation Centers

- Ambulatory Surgery Centers

- Others

Regional Analysis

North America dominates the global healthcare service robots market as it holds

43.4% of the market share in 2023 and is anticipated to show subsequent growth in the upcoming period of 2023 to 2032. North America, particularly the United States and Canada, has emerged as a dominant force in the healthcare service robots market due to various factors.

The region's leadership is underscored by a robust technological ecosystem, marked by continuous innovation in robotics and artificial intelligence. Strong healthcare infrastructure, characterized by the aid of superior medical centers and a willingness to embody contemporary technologies, further fuels the demand for healthcare provider robots.

The regulatory environment in North America, even making sure protection, is conducive to the improvement and adoption of rising technologies, with regulatory bodies participating with organizations to navigate approval processes. Substantial investments in research and improvement, supported with the aid of adequate undertaking capital and authority investment, facilitate innovation in healthcare robotics.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The healthcare service robots market is characterized by a dynamic competitive landscape shaped by factors such as technological advancements, regulatory considerations, and companies' ability to address healthcare challenges. Key players, along with Intuitive Surgical with its da Vinci Surgical System for robot-assisted surgical operation, iRobot Corporation diversifying into healthcare with telemedicine programs, and SoftBank Robotics exploring healthcare assistance with humanoid robot Pepper, spotlight the diversity in packages.

Companies like Ekso Bionics are cognizant of exoskeleton technology for mobility assistance, while Aethon focuses on self-sufficient cell robots for healthcare logistics. Knightscope contributes to healthcare safety with its surveillance robots, and Toyota's Human Support Robot has broader packages adaptable to healthcare settings.

The aggressive landscape remains dynamic, with ongoing advancements in AI, gadget gaining knowledge of, and sensor technology driving innovation in healthcare service robots. The potential for brand-spanking new entrants and partnerships adds to the evolving nature of the market.

Some of the prominent players in the Global Healthcare Service Robots Market are

- iRobot Corporation

- Medrobotics Corporation

- Titan Medical Inc.

- Renishaw Plc

- Health Robotics SLR

- OR Productivity plc

- Intuitive Surgical

- Mako Surgical Corp.

- Varian Medical Systems

- Stereotaxis Inc.

- Mazor Robotics

- Medtronic

- Stryker

- Zimmer Biomet

- Other Key Players

Recent Developments

- In September 2022, Titan Medical entered into a strategic agreement with Medtronic for a targeted development initiative. Within this collaboration, Medtronic will comprehensively evaluate Titan's cameras and instruments, specifically focusing on their efficacy in gynecological procedures.

- In June 2022, Intuitive, a leader in robotic surgery, receives FDA clearance to integrate mobile cone-beam CT imaging into the Ion Endoluminal System for robotic-assisted bronchoscopy, demonstrating a commitment to advancing minimally invasive surgery solutions.

- In May 2022, Johnson & Johnson's Ethicon gains FDA approval for the Monarch endourological surgery system, a flexible robotic solution unique for use in bronchoscopy and urology. Its versatility is evident in efficiently removing kidney stones, showcasing medical technology advancement.

- In January 2022, Medrobotics Corp. has received FDA clearance for its Flex Robotic System, a cutting-edge technology designed for robot-assisted visualization in general surgery, gynecology, and thoracic procedures.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 13.2 Bn |

| Forecast Value (2032) |

USD 61.8 Bn |

| CAGR (2023-2032) |

18.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Orthopedic Surgery, Cardiology, and Neurosurgery), By Deployment (Laparoscopy, Orthopedic Surgery, External Bean Radiation Therapy, Physical Rehabilitation, Neurosurgery, and Others), By Component (Security Systems, Locomotive Systems, Interface Applications, Software Platforms, and Power Resources), By Application (Disinfection Robots, E Assistance, Delivery Robots, Dispensing Robots, and Others), By End User (Hospital, Rehabilitation Centers, Ambulatory Surgery Centers, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

iRobot Corporation, Medrobotics Corporation, Titan Medical Inc., Renishaw Plc, Health Robotics SLR, OR Productivity plc, Intuitive Surgical, Mako Surgical Corp., Varian Medical Systems, Stereotaxis Inc., Mazor Robotics, Medtronic, Stryker, Zimmer Biomet, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Healthcare Service Robots Market size is estimated to have a value of USD 13.2 billion in

2023 and is expected to reach USD 61.8 billion by the end of 2032.

North America has the largest market share for the Global Healthcare Service Robots Market with a

share of about 43.4% in 2023.

Some of the major key players in the Global Healthcare Service Robots Market are iRobot Corporation,

Medrobotics Corporation, Titan Medical Inc., Renishaw Plc, and many others.

The Healthcare Service Robots market is growing at a CAGR of 18.7% over the forecasted period.