Healthcare Software as a Service Market Overview

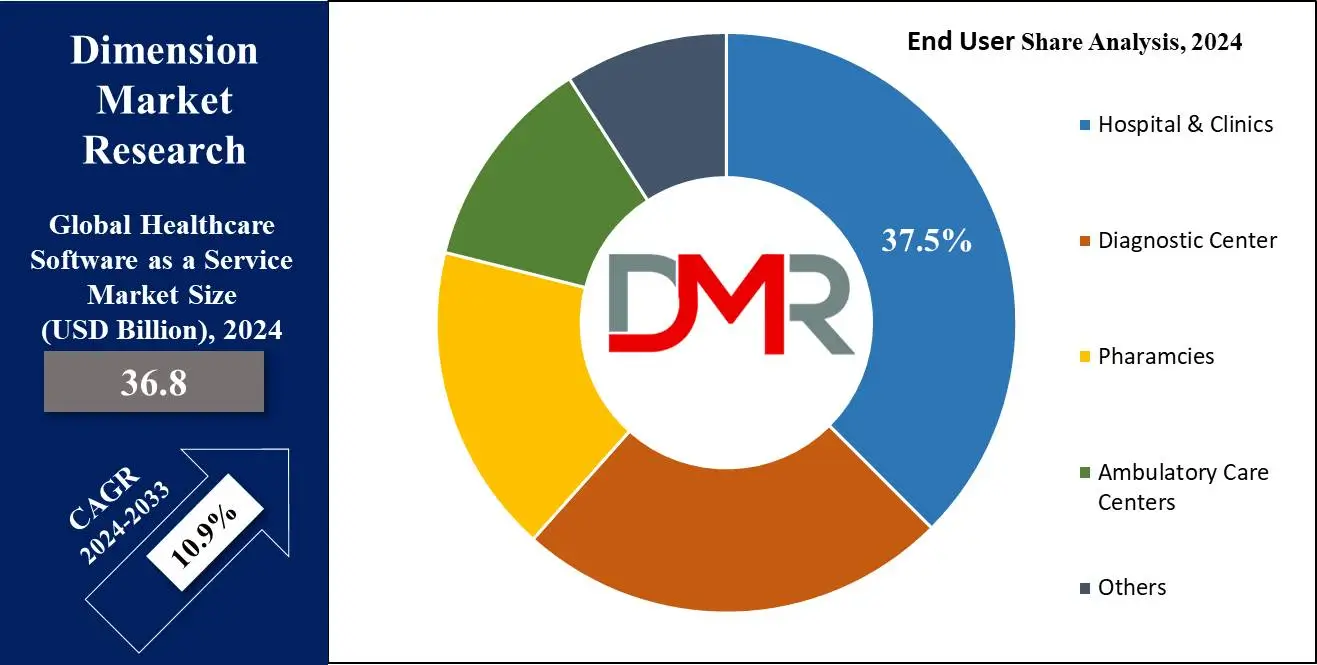

The Global

Healthcare Software as a Service Market is projected to reach

USD 36.8 billion in 2024 and grow at a compound annual

growth rate of 10.9% from there until 2033 to reach a

value of USD 93.4 billion.

Healthcare companies are accepting SaaS for cost benefits, security, ease of use, ease of integration, customer support, better administration and management capabilities, uptime guarantee, scalability, customizability, data center infrastructure, disaster recovery plan, and reporting. SaaS finds numerous applications, like websites, emails, communications, mobile services, customer relationship management, mobile services, productivity apps, ERP, data analytics, document management, and database servers.

The global healthcare landscape is experiencing rapid digital disruption due to increased adoption of cloud computing and wireless technologies, driving significant growth of healthcare software as a service (SaaS) solutions. Healthcare facilities have played a critical role in this transformation by adopting advanced software systems into their operations which promises increased overall efficiency and better patient care outcomes.

Research indicates that 23% of organizations plan to implement cloud based systems in the near future, signaling significant growth for this industry. Furthermore, 94% of healthcare centers already utilise SaaS solutions within their operations, showing widespread acceptance for these technologies.

The US Healthcare Software as a Service Market

The US Healthcare Software as a Service Market is projected to reach USD 15.8 billion in 2024 at a compound annual growth rate of 10.2% over its forecast period.

The healthcare SaaS market in the US provides growth opportunities through increasing demand for telehealth, electronic health records (EHR), and patient engagement tools. The increase in healthcare costs and regulatory pressure to enhance care quality drive the adoption of cloud-based solutions. In addition, the development of AI and data analytics within SaaS platforms provides opportunities for personalized care, predictive health management, and operational efficiency improvements.

Further, a major growth driver for the market is the rising adoption of cloud technologies,

telehealth, and EHR systems, driven by regulatory mandates and the need for effective care delivery. However, a major restraint is data privacy concerns and strict compliance requirements, like HIPAA, which can slow adoption as healthcare providers prioritize security and regulatory compliance.

Healthcare Software as a Service Market Key Takeaways

- Market Growth: The Healthcare Software as a Service Market size is expected to grow by 53.0 billion, at a CAGR of 10.9% during the forecasted period of 2025 to 2033.

- By Deployment Mode: The cloud segment is anticipated to get the majority share of the Healthcare Software as a Service Market in 2024.

- By Application: The patient portal segment is expected to be leading the market in 2024

- By End User: The hospital & clinics segment is expected to get the largest revenue share in 2024 in the Healthcare Software as a Service Market.

- Regional Insight: North America is expected to hold a 49.2% share of revenue in the Global Healthcare Software as a Service Market in 2024.

- Use Cases: Some of the use cases of Healthcare Software as a Service include telemedicine platforms, health analytics & predictive tools, and more.

Healthcare Software as a Service Market Use Cases

- Patient Management System: Easy patient registration, scheduling, and medical history tracking, enhancing healthcare providers' efficiency and reducing wait times.

- Telemedicine Platform: Allowing remote consultations through video calls, secure messaging, and e-prescriptions, expanding healthcare access to patients in remote areas.

- Electronic Health Records (EHR) Solutions: Provides cloud-based access to patient data across facilities, ensuring easy care coordination and reducing administrative overhead.

- Health Analytics & Predictive Tools: Uses patient data and AI to predict health trends, enhance diagnostics, and optimize treatment plans, fostering proactive care delivery.

Healthcare Software as a Service Market Dynamic

Driving Factors

Increasing Demand for Remote Healthcare ServicesThe COVID-19 pandemic expanded the adoption of telehealth and remote monitoring solutions, driving healthcare providers to invest in SaaS platforms. As patients constantly look for convenient and flexible care options, the need for these services is expected to grow, driving SaaS providers to innovate and expand their offerings to improve user experiences and care delivery.

Rising Adoption of Electronic Health Records (EHR)

The transition from paper-based to digital formats has created a major demand for EHR SaaS solutions. Governments & regulatory bodies are promoting EHR adoption through incentives and compliance requirements, leading healthcare organizations to adopt cloud-based systems that improve interoperability, data sharing, and overall patient care efficiency.

Restraints

Data Security and Privacy Concerns

The sensitive nature of healthcare data makes it a major target for cyberattacks, leading to growing concerns regarding data breaches and compliance with regulations like HIPAA. Healthcare organizations may be concerned about completely embracing SaaS solutions due to fears of unauthorized access & potential penalties for non-compliance, slowing the adoption of these technologies.

Integration Challenges with Legacy SystemsMany healthcare providers still depend on outdated legacy systems that may not easily incorporate modern SaaS solutions. These systems can create operational inefficiencies and raise the overall cost of transitioning new technologies, making organizations resist adopting cloud-based solutions despite their potential benefits.

Opportunities

Expansion of AI and Machine Learning ApplicationsThe incorporation of AI and

machine learning into healthcare SaaS solutions provides significant opportunities for innovation. These technologies can improve diagnostic accuracy, personalize treatment plans, and simplify administrative processes, allowing providers to deliver higher-quality care while reducing costs. As healthcare organizations look to improve patient outcomes, the demand for AI-driven SaaS solutions is expected to rise.

Growth of Value-Based Care Models

The transformation from fee-for-service to value-based care is developing a demand for SaaS solutions that can support healthcare providers track patient outcomes, managing costs, and ensuring quality care. These systems can provide better data analysis and reporting, allowing organizations to demonstrate their effectiveness in enhancing patient health. As this trend continues, SaaS providers that offer better tools for managing value-based care will find significant growth opportunities in the market.

Trends

Rise of Patient-Centric Solutions

There is a prominent trend toward developing healthcare SaaS platforms that prioritize patient engagement & experience. Solutions that allow patients to access their health records, schedule appointments, and communicate with providers through user-friendly interfaces are gaining popularity, which focuses on the importance of empowering patients in their healthcare journey, leading to better compliance with treatment plans and better health outcomes.

Integration of Wearable Technology

The growing utilization of wearable devices for health monitoring is influencing the healthcare SaaS market. Many SaaS providers are integrating data from wearables into their platforms to provide real-time health insights, remote patient monitoring, and personalized health recommendations, which not only improve patient engagement but also support proactive health management, allowing providers to intervene early and minimize hospitalizations.

Healthcare Software as a Service Market Research Scope and Analysis

By Solution

Electronic Health Records (EHR) solutions are a major driver of growth in the healthcare SaaS market and are expected to lead in 2024 by allowing healthcare providers to store, access, and share patient information easily. Cloud-based EHR systems enhance care coordination by giving doctors and specialists real-time access to medical histories, lab results, and treatment plans.

These solutions support reducing paperwork, minimizing errors, and enhancing decision-making, leading to better patient outcomes. EHR platforms also support regulatory compliance by providing built-in tools for secure data management and reporting. As healthcare transforms towards digital transformation and value-based care, the adoption of EHR solutions constantly expands, driving the SaaS market forward.

Further, telehealth solutions play an important role in driving the healthcare SaaS market by allowing remote care through virtual consultations, video calls, and secure messaging. These platforms make healthcare more accessible, mainly for patients in remote areas or those seeking convenient care options. Telehealth SaaS solutions reduce the burden on hospitals by lowering in-person visits while maintaining quality care.

They also help remote patient monitoring, helping providers track chronic conditions and intervene early. As the need for virtual care grows post-COVID-19, telehealth adoption continues to expand, driving further growth in the SaaS market.

By Deployment Mode

Cloud deployment is expected to lead the healthcare SaaS market in 2024, as it plays a major role in the growth by providing flexibility, scalability, and cost-efficiency. It allows healthcare providers to access software solutions without requiring expensive on-site infrastructure, making it easier to adopt new technologies. Cloud-based platforms allow smooth data sharing between providers, enhancing care coordination and patient outcomes. They also promote remote access, empowering healthcare professionals and patients to stay connected through telehealth and patient portals.

In addition, cloud solutions are easily upgradable, making providers to stay current with the latest features and security protocols. As healthcare organizations look to reduce costs and improve operational efficiency, cloud adoption continues to drive the expansion of SaaS solutions in the industry. Further, on-premise deployment plays a major role in the growth of the healthcare SaaS market by providing healthcare organizations with greater control over their data and IT infrastructure.

Many providers prefer on-premise solutions to ensure strict compliance with privacy regulations and to minimize the risks linked with external data storage, which is particularly useful for large hospitals and institutions with complex workflows, providing customized software setups personalized to their specific needs. On-premise systems also provide better security since data remains within the organization’s servers. While cloud adoption is rising, on-premise deployment remains relevant for institutions prioritizing control, security, and regulatory compliance.

By Application

The patient portal segment as an application is expected to generate the highest revenue within the healthcare SaaS market in 2024. The growing use of patient portal software and the availability of many such platforms are major factors behind this growth. More healthcare providers are turning to these portals to enhance patient engagement, giving individuals easy access to their medical records, appointments, and communication with doctors.

As the need for digital tools that improve patient interaction grows, the adoption of patient portals is likely to rise further, boosting the segment’s revenue share. Further, the telemedicine segment is expected to grow at the fastest rate in the coming years, due to its quick adoption following the COVID-19 pandemic. Telemedicine has become a major option for many patients and healthcare providers due to its convenience and accessibility.

Higher investments and funding in telemedicine platforms, along with an increase in their adoption by health insurers, are major drivers fueling this expansion. With more insurers getting virtual consultations and a transformation towards remote care, the segment is expected to experience significant growth in the future.

By End User

Hospitals and clinics are set to drive the growth of the healthcare SaaS market throughout the forecast period by adopting digital solutions to enhance patient care, ease operations, and lower costs. These institutions highly depend on SaaS platforms for electronic health records (EHR), appointment scheduling, billing, and patient management systems. The need for real-time access to patient data across departments encourages the usage of cloud-based solutions, improving care coordination and decision-making.

In addition, as patient expectations for digital engagement grow, hospitals and clinics are implementing telemedicine platforms and patient portals to provide remote care and improve patient interaction. Their shift toward value-based care further boosts SaaS adoption, ensuring efficient operations and better health outcomes. Further, pharmacies are also expected to contribute significantly to the growth of the healthcare SaaS market by adopting digital platforms to manage prescriptions, inventory, and customer interactions efficiently.

SaaS solutions help pharmacies simplify operations, automate prescription refills, and ensure accurate inventory tracking, reducing the risk of medication shortages. With the rising demand for e-prescriptions and online medicine orders, pharmacies are highly using SaaS tools for smooth coordination with healthcare providers and patients.

These platforms also allow better regulations with regulatory requirements through automated reporting and tracking features. As the trend toward digital healthcare expands, pharmacies play a crucial role in driving the adoption of SaaS solutions.

The Healthcare Software as a Service Market Report is segmented on the basis of the following

By Solution

- Electronic Health Records

- Practice Management Systems

- Revenue Cycle Management

- Telehealth Solutions

- Others

By Deployment Mode

- Cloud

- Public Cloud

- Hybrid Cloud

- Private Cloud

- On-Premise

By Application

- Telemedicine

- Medical Billing

- Mobile Communication

- Patient Portal

- e Prescribing

- EHR Systems

- ERP & HR Portal

- Others

By End User

- Hospital & Clinics

- Diagnostic Center

- Pharmacies

- Ambulatory Care Centers

- Others

How Does Artificial Intelligence Contribute To Healthcare Software as a Service Market ?

- Advanced Data Analytics:AI-powered analytics systems process large volumes of patient data in real time, providing actionable insights for clinical decision-making. Predictive analytics identifies at-risk patients, enabling early intervention and reducing hospital readmissions.

- Personalized Patient Care: AI enables SaaS platforms to offer tailored healthcare services. By analyzing patient history, genetic data, and real-time health metrics, AI helps design personalized treatment plans and improve care delivery.

- Automation of Administrative Tasks: AI streamlines administrative processes such as billing, appointment scheduling, and insurance claims. This reduces errors, saves time, and allows healthcare professionals to focus more on patient care.

- Telehealth Enhancement:AI improves telehealth services by integrating natural language processing (NLP) for virtual consultations, enabling accurate symptom analysis, and ensuring efficient remote patient monitoring through AI-driven wearable devices.

- Fraud Detection and Cybersecurity: AI algorithms detect unusual patterns in financial transactions and unauthorized access attempts, enhancing cybersecurity in SaaS platforms and minimizing risks of fraud.

- Improved Clinical Operations:AI optimizes workflows, resource allocation, and equipment usage in healthcare facilities. For example, AI-assisted tools ensure efficient staff scheduling and equipment maintenance, reducing operational costs.

- Drug Discovery and Research Support: AI integrated into SaaS platforms accelerates drug discovery and clinical trials by analyzing massive datasets for potential drug interactions, outcomes, and efficacy predictions.

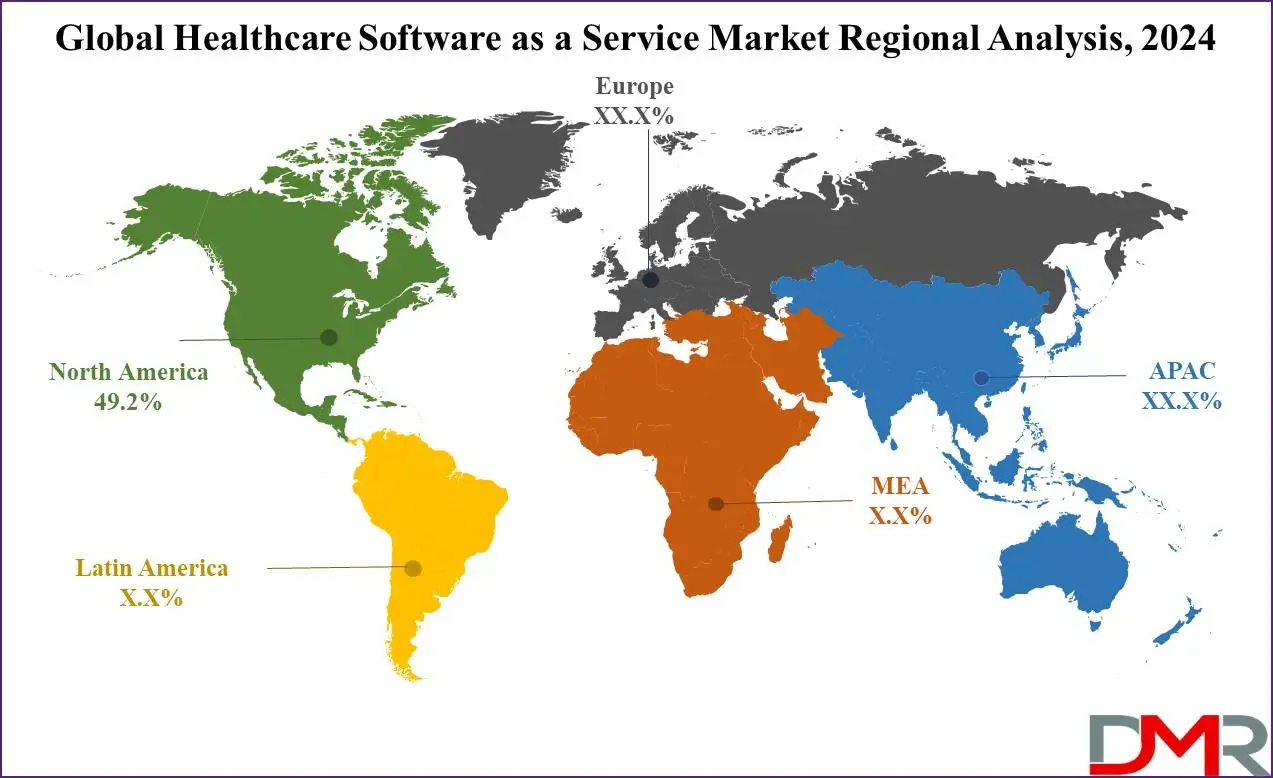

Healthcare Software as a Service Market Regional Analysis

North America is anticipated to have the largest revenue share of

49.2% in 2024 within the healthcare SaaS market. A major reason for this dominance is the presence of major technology companies like Google, IBM, SAP, and Microsoft in the US and Canada, which boosts innovation and adoption. In addition, there is a significant awareness of cloud-based solutions, with quick uptake of technologies like SaaS in healthcare settings.

The increase in demand for high-quality care, along with strict regulatory requirements focused on lowering healthcare costs, is promoting providers to invest in digital healthcare solutions, which is boosting the overall growth of the market in the region. Further, the Asia Pacific region is anticipated to achieve the fastest growth rate over the coming years, driven by numerous initiatives from governments and private stakeholders.

The growing adoption of mobile health solutions, telemedicine platforms, and other digital tools is playing a major role in expanding the market. The growth toward digitalization across healthcare systems, like efforts to modernize infrastructure, is further expanding the growth. As more healthcare providers in countries like China, India, and Japan adopt telehealth services and mobile health applications, the region is becoming a major area for future market expansion.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Healthcare Software as a Service Market Competitive Landscape

The competitive landscape of the healthcare SaaS market is shaped by the presence of both major tech giants and specialized healthcare software providers. Companies like IBM, Google, and SAP dominate with their advanced cloud infrastructure and large customer bases, providing scalable solutions. Further, healthcare-focused SaaS providers like Cerner and Athenahealth meets specific needs like electronic health records, patient management, and telehealth.

Intense competition drives constant innovation, with players focusing on improving data security, interoperability, and user experience. Mergers, partnerships, and investments are also common strategies to expand market reach and stay ahead in this dynamic space.

Some of the prominent players in the Global Healthcare Software as a Service are

Healthcare Software as a Service Market Recent Developments

- In October 2024, Microsoft announced new healthcare data and artificial intelligence tools, like a combination of a healthcare agent service, medical imaging models, and an automated documentation solution for nurses, which focuses on helping healthcare organizations build AI applications quicker and save clinicians time on administrative tasks, a major cause of industry burnout.

- In August 2024, Pfizer Inc. introduced PfizerForAll, a user-friendly digital platform designed to make access to healthcare and managing health & wellness easier for people across the US, as it would support the millions of Americans affected annually by common illnesses like migraine or flu and those looking to protect themselves with adult vaccinations.

- In August 2024, VSee Health, Inc. in partnership with Stand Together launched its Aimee telehealth service in Wichita, Kansas, to expand access to affordable care, initially in Wichita. Further, its telehealth software that powers Aimee is strand modular in a way that easily integrates with local community centers and empowers their members to take charge of their health.

- In March 2024, Informatica announced that Pharmarack, India’s largest selected Informatica’s intelligent Master Data Management (MDM) on Amazon Web Services (AWS), which is part of its AI-powered Intelligent Data Management Cloud (IDMC) and focuses on assisting Pharmarack in its mission to digitize the pharma ecosystem in India and highly improve the ease of transactions between stockists.

- In December 2023, Caresyntax announced its collaboration with The Applied AI Company (AAICO), a leading AI technology company, to distribute new software and artificial intelligence solutions throughout the UAE, US, and Europe, as it will allow the companies to combine their healthcare datasets and delivery resources to provide bundled software and services solutions to healthcare companies and insurance companies in these markets, as they will be used to build new AI-based applications to improve the entire surgical continuum, like medical billing, patient pathway management, and revenue assurance.

Healthcare Software as a Service Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 36.8 Bn |

| Forecast Value (2033) |

USD 93.4 Bn |

| CAGR (2024-2033) |

10.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 15.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Solution (Electronic Health Records, Practice Management Systems, Revenue Cycle Management, Telehealth Solutions, and Others), By Deployment Mode (Cloud and On-Premise), By Application(Telemedicine, Medical Billing, Mobile Communication, Patient Portal, e Prescribing, EHR Systems, ERP & HR Portal, and Others), By End User (Hospital & Clinics, Diagnostic Center, Pharmacies, Ambulatory Care Centers, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

IBM, eClinicalWorks Inc, Athenahealth Inc, Cerner Corp, NextGen Healthcare, Practice Fusion Inc, McKesson Corp, Google, Cisco, SAP, Optum Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Healthcare Software as a Service Market size is expected to reach a value of USD 36.8 billion in 2024 and is expected to reach USD 93.4 billion by the end of 2033.

North America is expected to have the largest market share in the Global Healthcare Software as a Service Market with a share of about 49.2% in 2024.

The Healthcare Software as a Service Market in the US is expected to reach USD 15.8 billion in 2024.

Some of the major key players in the Global Healthcare Software as a Service Market are IBM, eClinicalWorks Inc, Athenahealth Inc, and others

The market is growing at a CAGR of 10.9 percent over the forecasted period.